Last week’s JAKOTA markets:

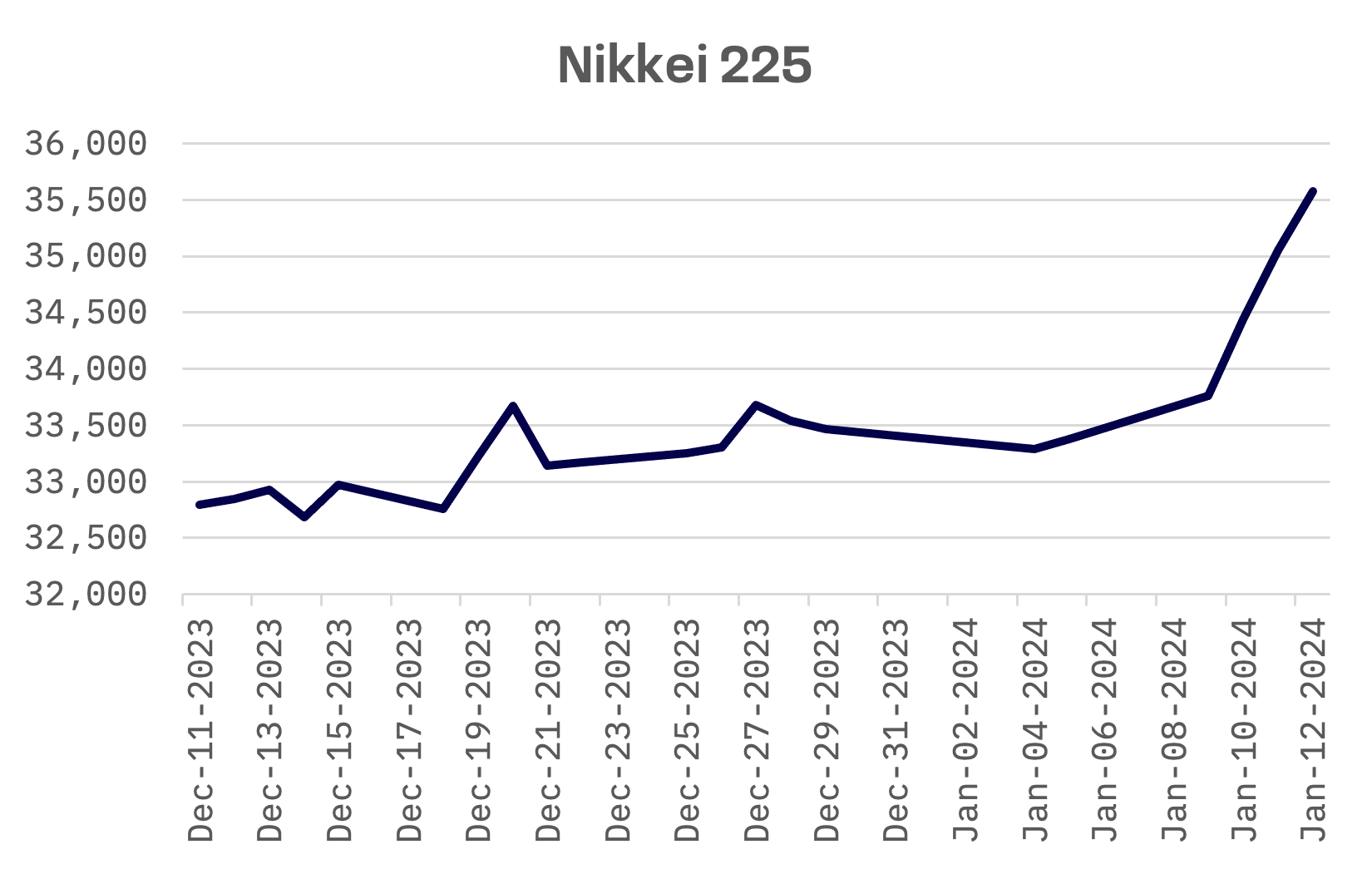

- The Nikkei 225 Index in Japan soared by 6.6%, reaching its highest level in decades, fueled by the Bank of Japan’s expansive monetary policy and a weakening yen.

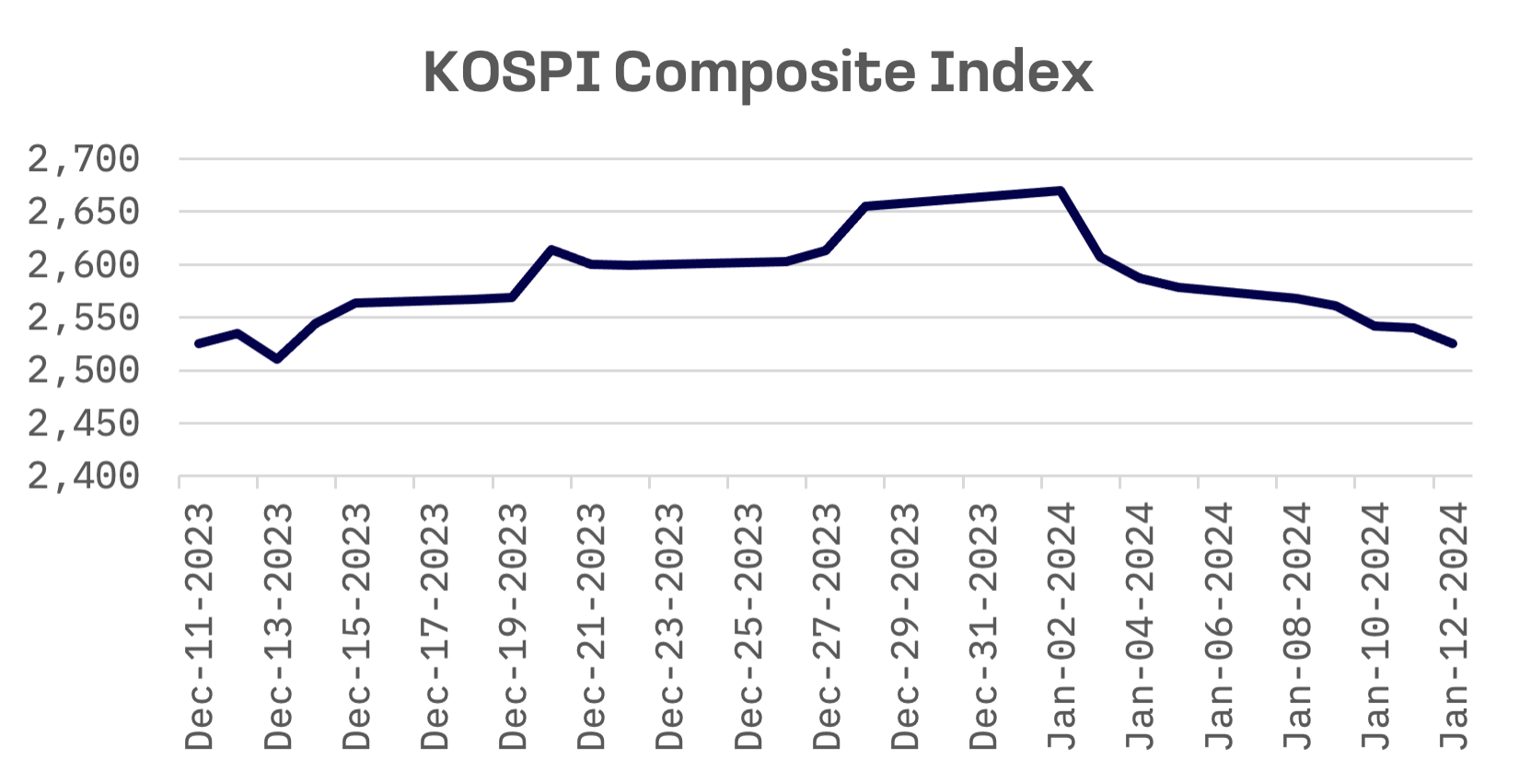

- South Korea’s KOSPI Composite Index experienced a 2.1% decline, impacted by global inflation concerns and cautious central bank policies.

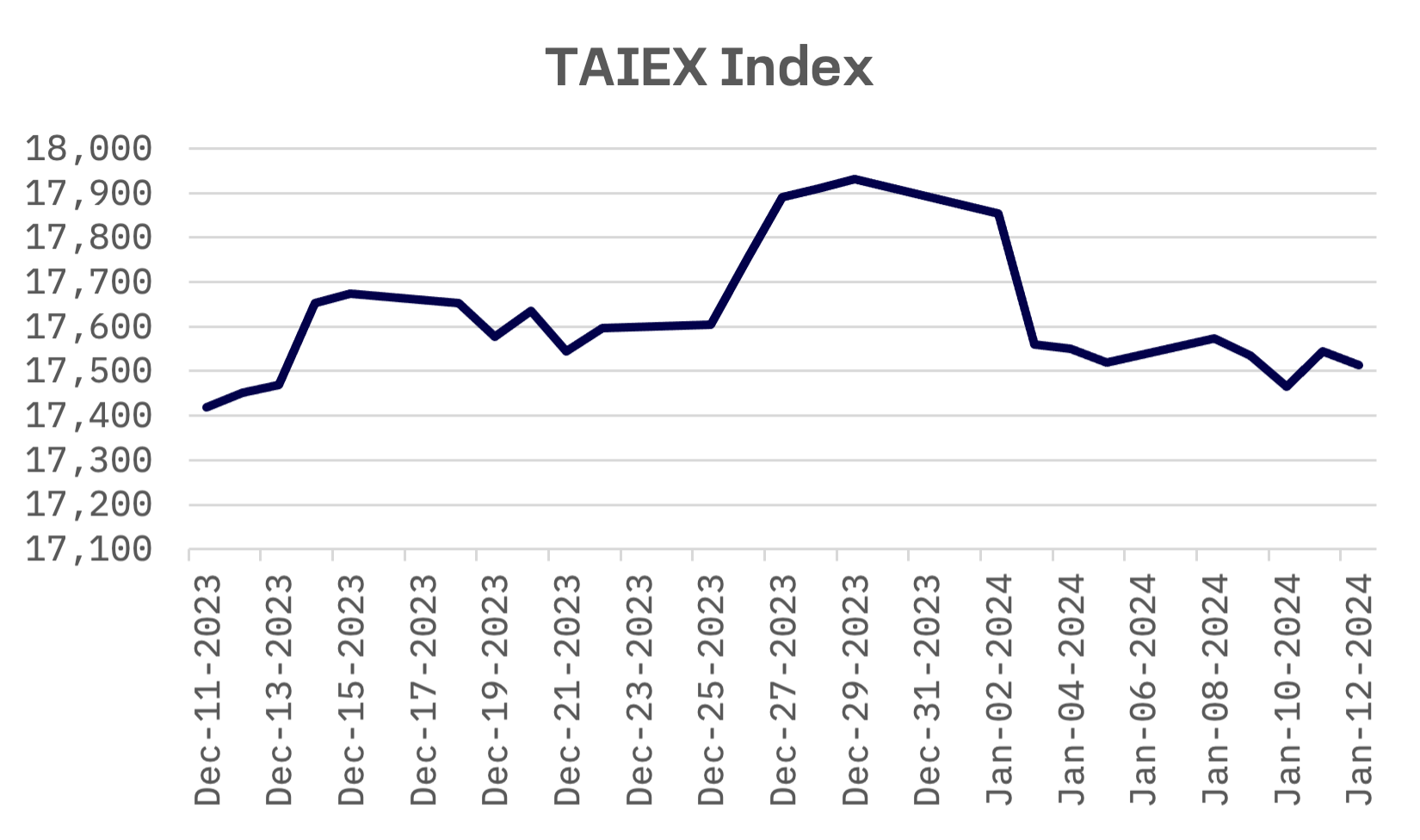

- Taiwan’s TAIEX index declined marginally, influenced by election-driven investor caution and fluctuating export figures.

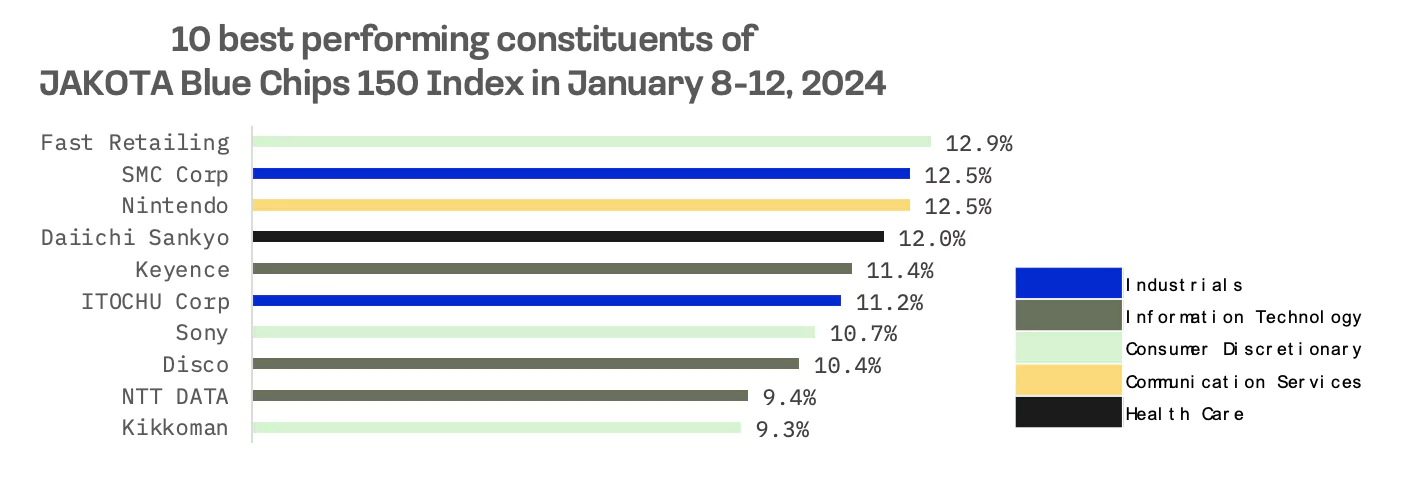

- The JAKOTA Blue Chip 150 Index rose by 2.7%, led by strong Japanese stocks, with notable performances from Fast Retailing and shifts in South Korean companies, mirroring broader market trends.

Japan

The Nikkei 225 Index in Japan showcased remarkable strength this week, surging 6.6% to its highest level in nearly 34 years. This rally was primarily driven by the ongoing expansionary monetary policy of the Bank of Japan (BoJ) and a weaker yen, which bolstered the country’s export sector.

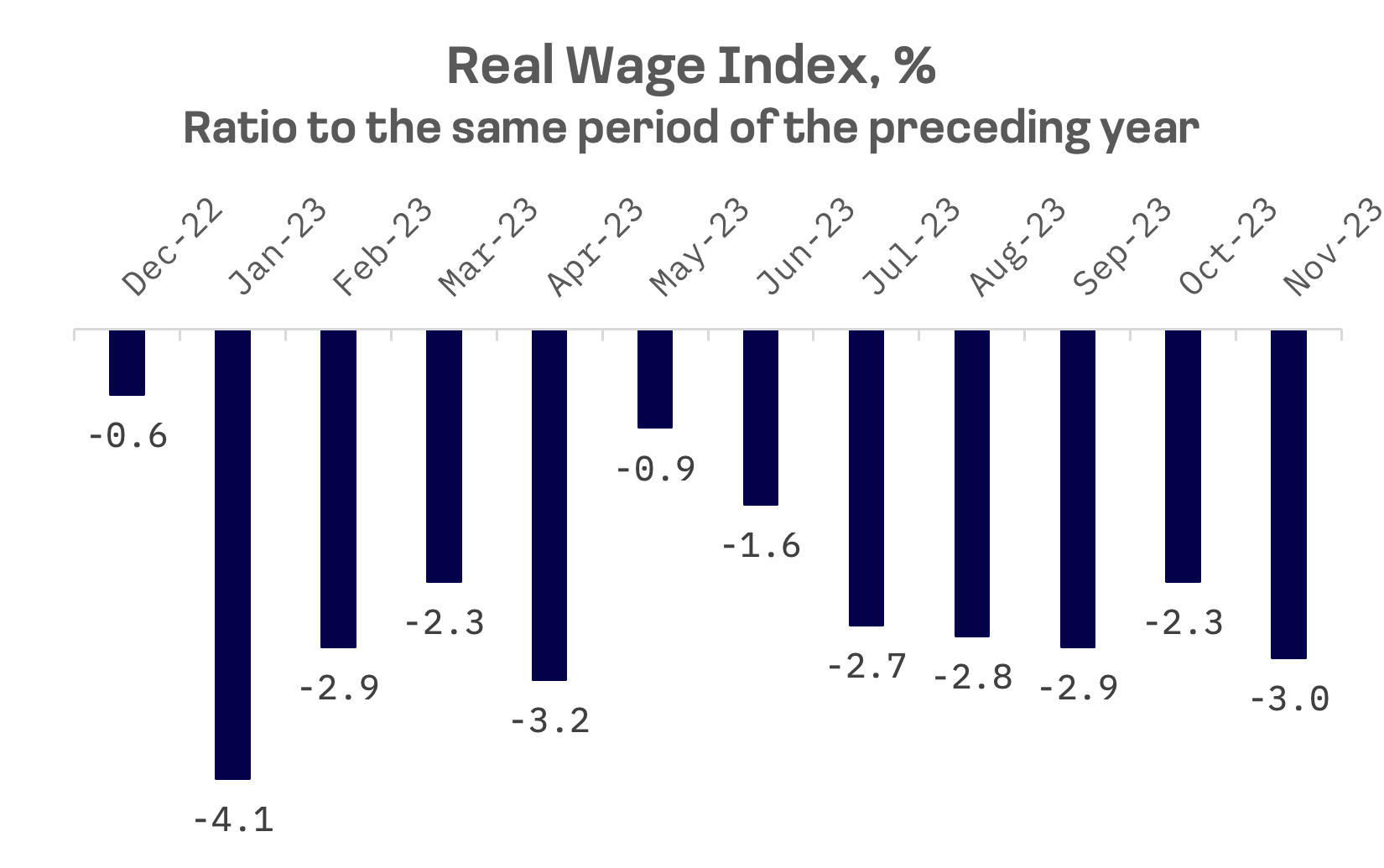

Economic data released recently underscored the likelihood of sustained monetary policy. Headline wage growth in November slowed down considerably, with real wages, adjusted for inflation, recording a significant year-on-year decline of 3.0%, steeper than October’s 2.3% decrease.

The Tokyo core consumer price index, a key measure of nationwide inflation, rose 2.1% year-on-year in December. This rate, the slowest since June 2022 and a dip from November’s 2.3%, reinforces the BoJ’s commitment to persist with an ultra-accommodative monetary policy until wage-driven sustainable inflation is evident.

Prime Minister Fumio Kishida reaffirmed the government’s resolve to utilize all policy tools to ensure disposable income growth surpasses price rises. The leader of Rengo, Japan’s largest trade union federation, emphasized the importance of securing higher wage increases in the upcoming spring shunto pay negotiations, aiming to exceed the levels achieved in 2023.

The yield on the 10-year Japanese government bond hovered around 0.6% for the week, showing no clear trend. The yen weakened to below JPY 145 against the U.S. dollar, influenced by a strong U.S. inflation report, which moderated expectations of near-term interest rate cuts by the Federal Reserve.

South Korea

The South Korean stock market faced a downturn for the second consecutive week, with the KOSPI Composite Index falling by 2.1%. Investor confidence was dented by higher-than-expected U.S. consumer price inflation in December, dampening hopes for a near-term Federal Reserve rate cut. Additionally, comments from Bank of Korea Governor Rhee Chang-yong suggesting it’s too early to discuss easing monetary policy further subdued investor sentiment.

Despite holding the policy rate steady for the eighth consecutive meeting, the Bank of Korea stopped short of indicating a shift towards a dovish policy stance, reflecting ongoing concerns about the country’s high household debt levels.

Taiwan

The Taiwanese stock market, influenced by the upcoming presidential election, saw the TAIEX index decline slightly, extending its losing streak to a second week. The approach of the presidential vote led some investors, especially foreign institutional ones, to temporarily reduce their positions.

Ministry of Finance (MOF) data released on Tuesday showed that Taiwan’s total exports for the year reached US$432.48 billion, the third-highest annual level, yet representing a 9.8% drop from 2022’s US$479.4 billion.

The MOF noted that AI-related business was instrumental in aiding Taiwanese exporters amid global demand challenges, inflation, and central banks’ aggressive interest rate hikes. The resilience in AI-related exports was a key contributor to Taiwan’s overall export performance.

JAKOTA Blue Chip 150 Index

The JAKOTA Blue Chip 150 Index climbed 2.7% in the week, driven by strong performance in Japanese stocks. Among its 150 constituents, 103 stocks posted gains.

Leading the pack was Fast Retailing, an apparel designer and retailer, which reported a significant 26.7% year-on-year increase in consolidated net profit for the first quarter of the fiscal year ending August 2024, totaling 107.8 billion yen.

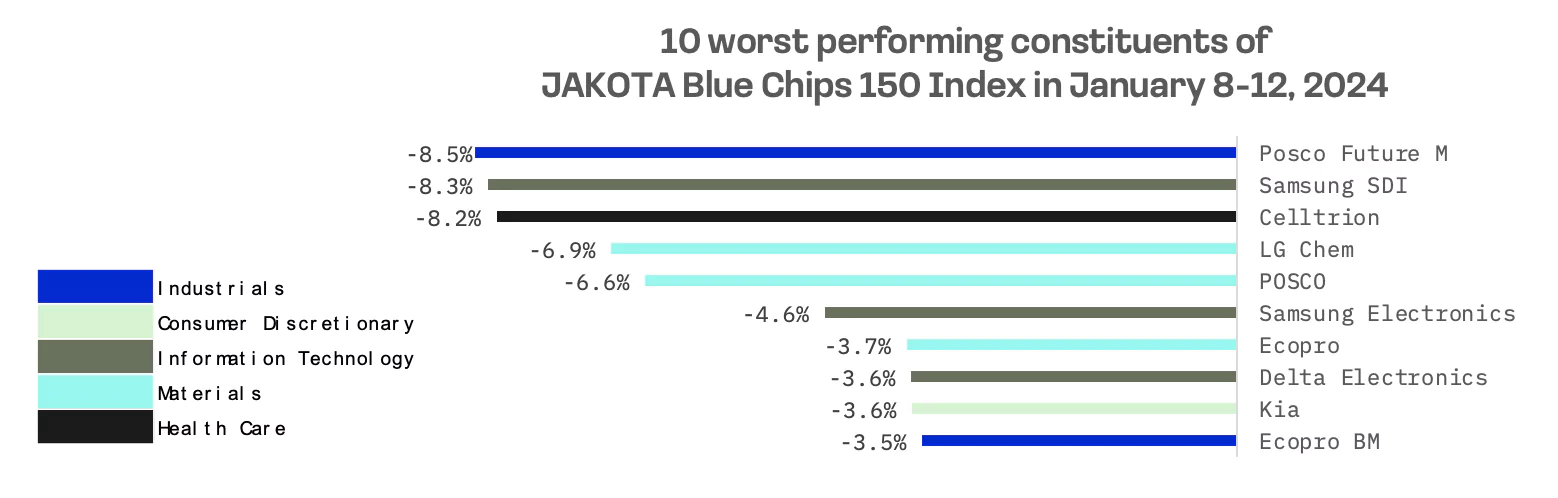

Conversely, the broader downward trend in the Korean market impacted the performance of South Korean companies in the JAKOTA Blue Chip 150 Index, with nine South Korean firms among the ten worst performers. Posco Future M led the decline, compounded by analysts’ lowered target price and reduced operating profit estimates for the current year.