Last week’s JAKOTA markets:

- Japan’s Nikkei 225 continues its ascent towards record highs, powered by optimistic economic data and the Bank of Japan’s cautious stance on inflation

- Despite a slight weekly decline, South Korea’s KOSPI still heads up an overall growth for February, thanks to new measures aimed at enhancing corporate value and governance

- Taiwan’s TAIEX index inches up, setting a new high amidst positive business sentiment and robust demand in the semiconductor sector

- The JAKOTA Blue Chip 150 Index sees an upturn, driven by standout performances from Japanese companies and notable corporate news impacting South Korean stocks

Japan

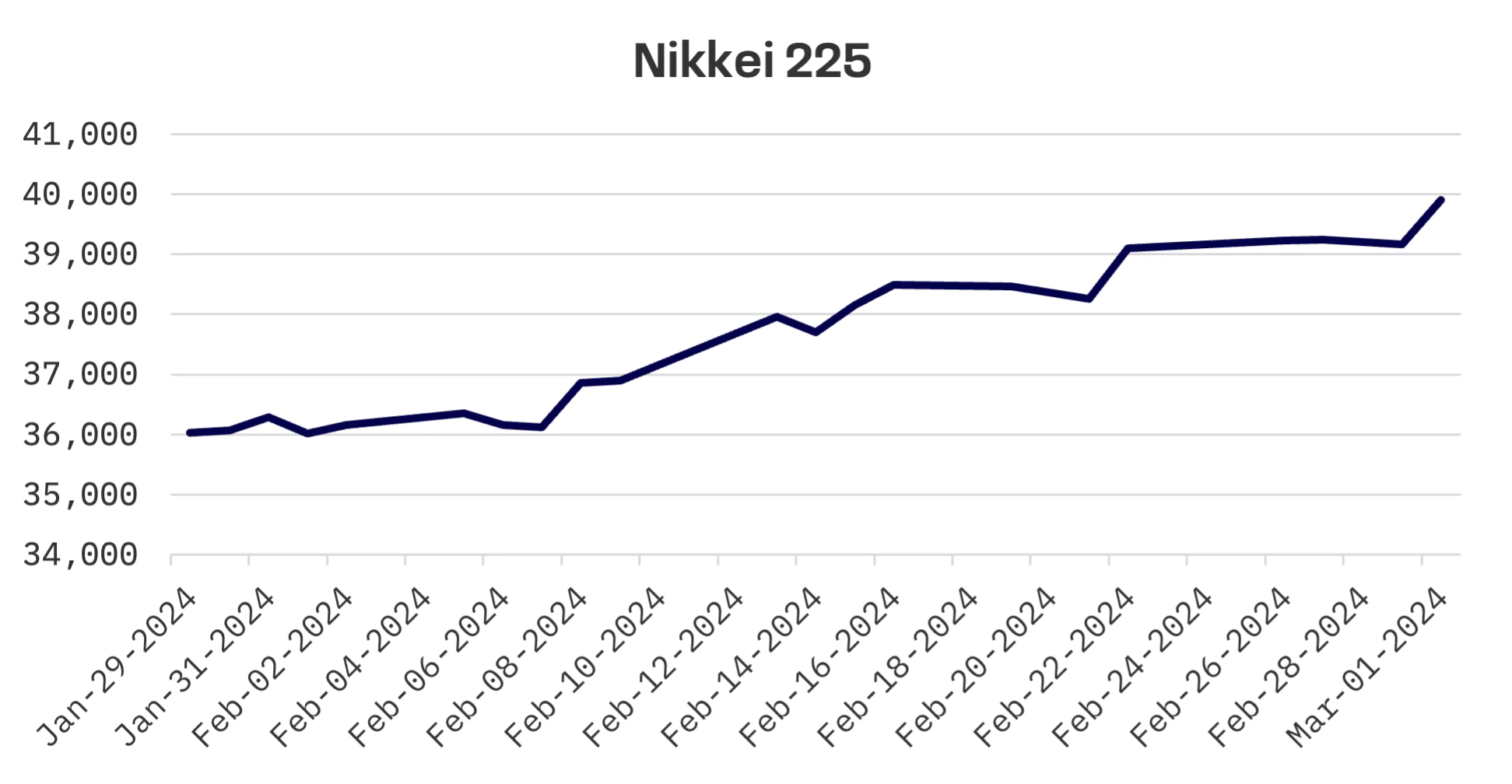

The Japanese stock market experienced a buoyant week, with the Nikkei 225 index climbing approximately 2.1%, edging closer to a new peak and marking February’s gains at around 10.0%.

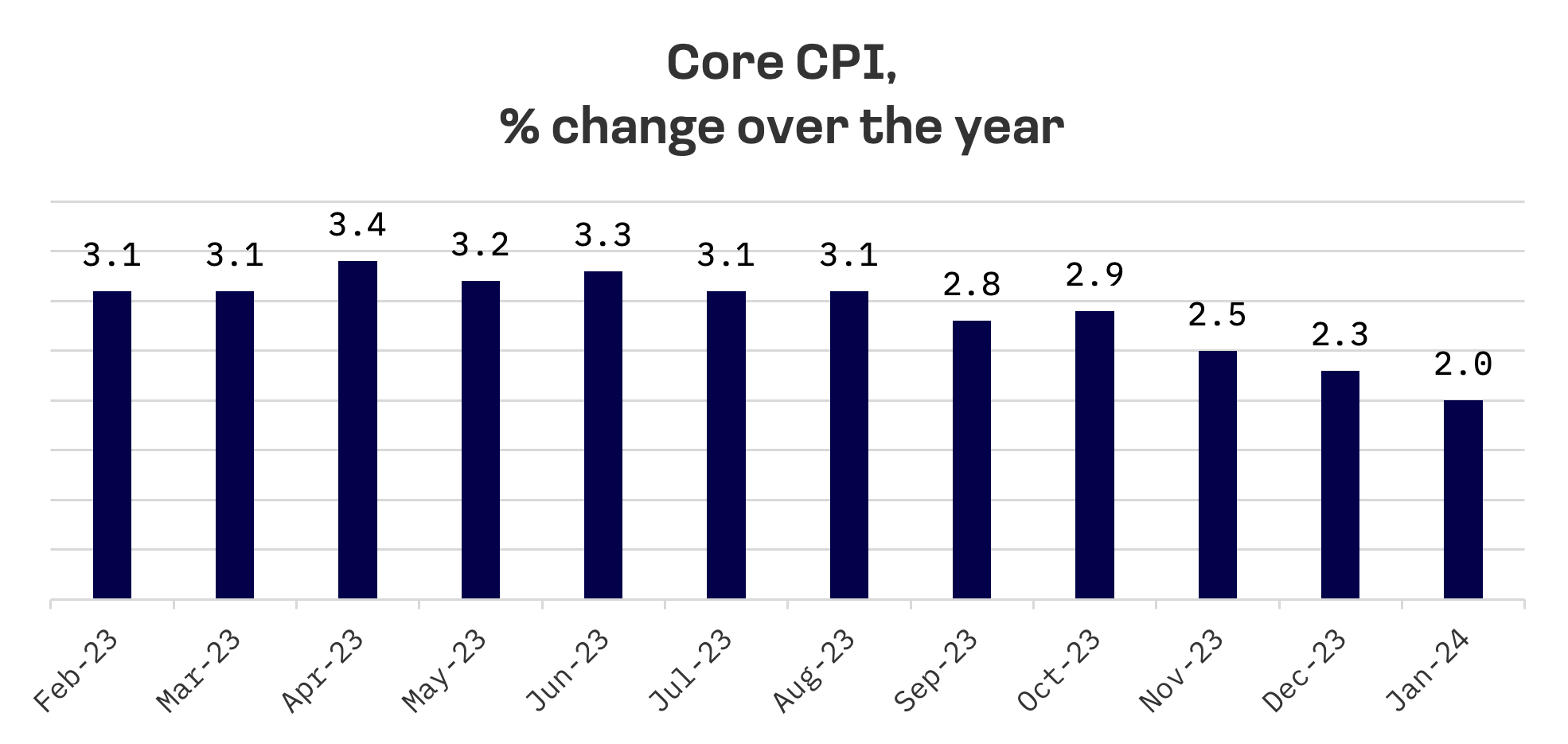

Bank of Japan Governor Kazuo Ueda’s comments underscored the central bank’s ongoing accommodative stance, noting it’s too early to declare a consistent achievement of the 2% inflation target. He stressed the importance of wage growth keeping pace with price increases before considering any policy shift. Core consumer price index data for January indicated a slowdown, growing 2.0% year-over-year, a deceleration from the previous month’s 2.3%.

Recent Purchasing Managers’ Index (PMI) figures signalled a worsening in manufacturing conditions across February, with both domestic and international demand – especially from China – showing signs of weakness. This contrasted with a more resilient services sector, underscoring its critical role in Japan’s economic landscape.

Despite fluctuations, the yen’s stability around ¥150.5 against the U.S. dollar throughout the week, coupled with its historical weakness, provided a tailwind for share prices, particularly benefiting exporters due to their significant overseas revenue.

South Korea

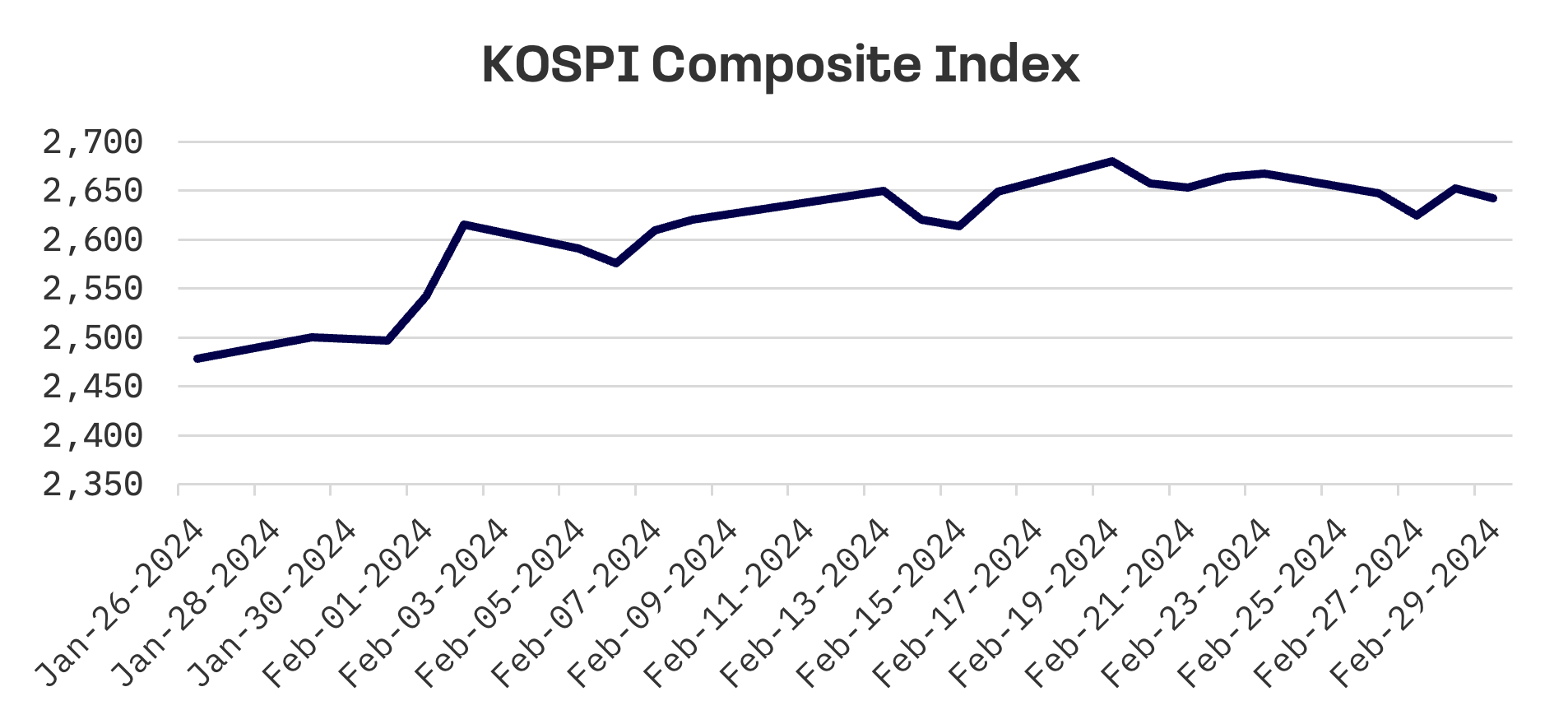

The KOSPI index in South Korea recorded a 0.9% decline in a week shortened by the Independence Movement Day holiday. Nevertheless, February witnessed a commendable 5.8% increase in the index.

On Monday, South Korea’s financial regulator introduced guidelines for a new corporate value-up programme designed to motivate listed companies to bolster their market valuation. This initiative also involves the creation of a related index and exchange-traded fund.

The government has outlined a timeline to finalise these guidelines by the end of June, incorporating tax benefits for companies undertaking value-enhancement activities, such as the retirement of treasury stocks or dividend payouts. Furthermore, the programme envisages annual recognition for companies that excel in adhering to these guidelines.

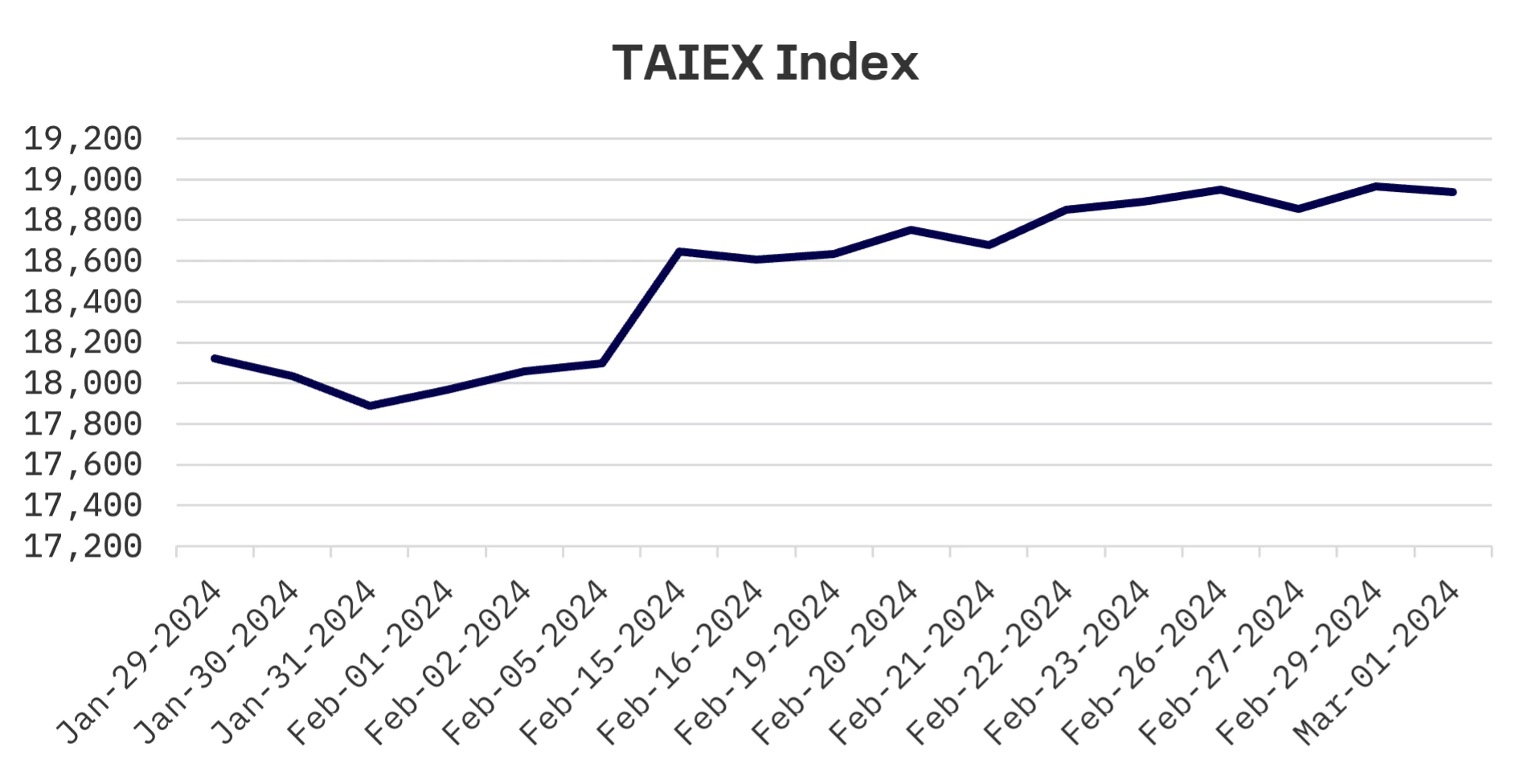

Taiwan

Taiwan’s TAIEX index modestly grew by 0.2% over the week, setting a new high despite pressure on Taiwan Semiconductor Manufacturing (TSMC) shares. Business sentiment indices for January, reported by the Taiwan Institute of Economic Research (TIER), showed improvements in both manufacturing and service sectors, hinting at a swifter economic recovery than anticipated.

Data compiled by TIER revealed that the composite index measuring business sentiment in the manufacturing sector rose by 0.99 points to 98.05 in January, marking its second month of improvement. Similarly, the services sector saw its confidence index increase by 0.75 points to 93.97, extending its growth streak to three months.

These gains reflect an optimistic outlook, largely fuelled by a reduction in semiconductor supply chain inventories and expansion in the AI chip market, which in turn has led to higher utilisation rates in advanced chip manufacturing and an increase in demand for packaging and testing services.

Additionally, the Ministry of Economic Affairs (MOEA) reported that Taiwanese companies experienced a 1.9% growth in the value of export orders in January, totaling US$48.42 billion. This increase is attributed to strong demand for AI applications and heightened stockpiling activity in anticipation of last month’s Lunar New Year holiday.

JAKOTA Blue Chip 150 Index

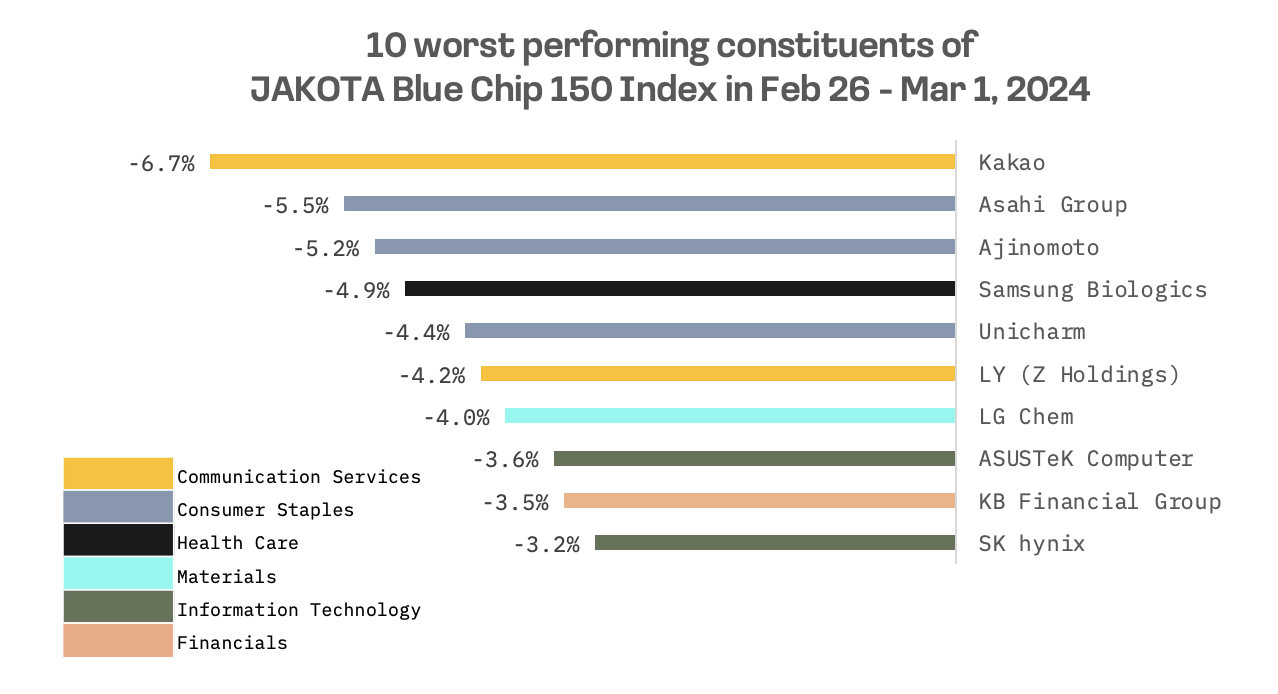

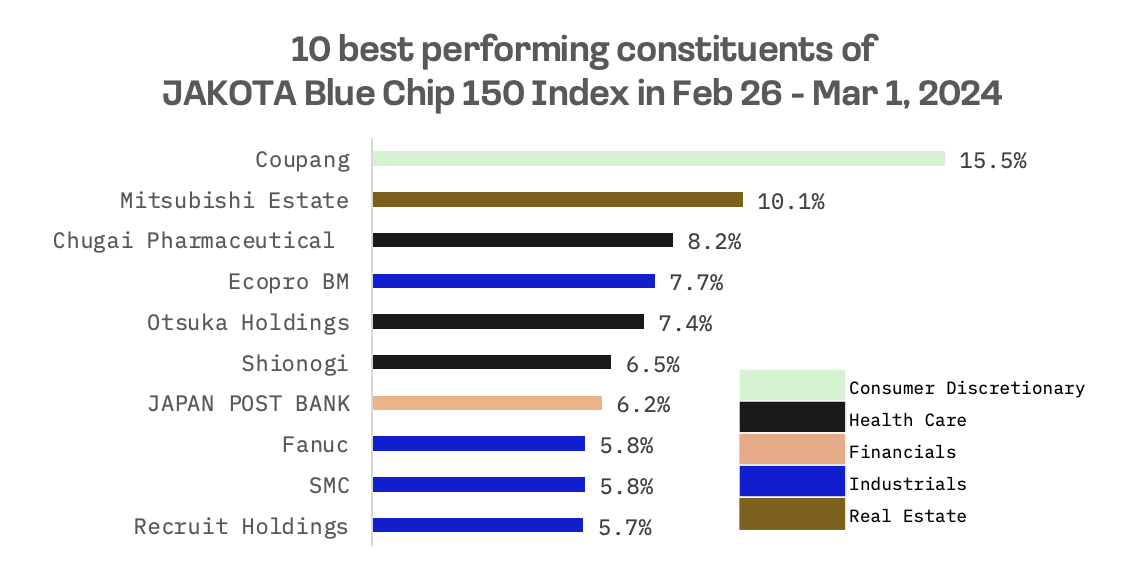

The JAKOTA Blue Chip 150 Index enjoyed a rise of 1.6% this week, largely driven by its Japanese constituents, with 97 stocks showing positive trends.

Coupang, a Korean e-commerce company, distinguished itself as this week’s top performer in the JAKOTA Blue Chip 150 Index following the announcement of its financial results for the full year 2023. The company reported a 19% increase in revenue from the previous fiscal year, alongside achieving a remarkable turnaround in net income, which soared to US$1.36 billion. This performance marked a significant improvement from the US$92.0 million loss recorded in FY 2022.

Conversely, Kakao Corp., a Korean internet company, faced a downturn, with its shares declining by 6.7%, making it the week’s worst performing stock in the JAKOTA Blue Chip 150 Index. This decline was precipitated by developments involving Stage 5, a budget-friendly mobile phone company and integral part of the Stage X consortium aimed at launching a fourth mobile carrier. On February 28, Stage 5 announced a pivotal change in ownership, with Good Plan Pin Direct Association No. 3 acquiring a 19.2% stake previously held by Kakao Investment, Kakao’s investment division.