Japan

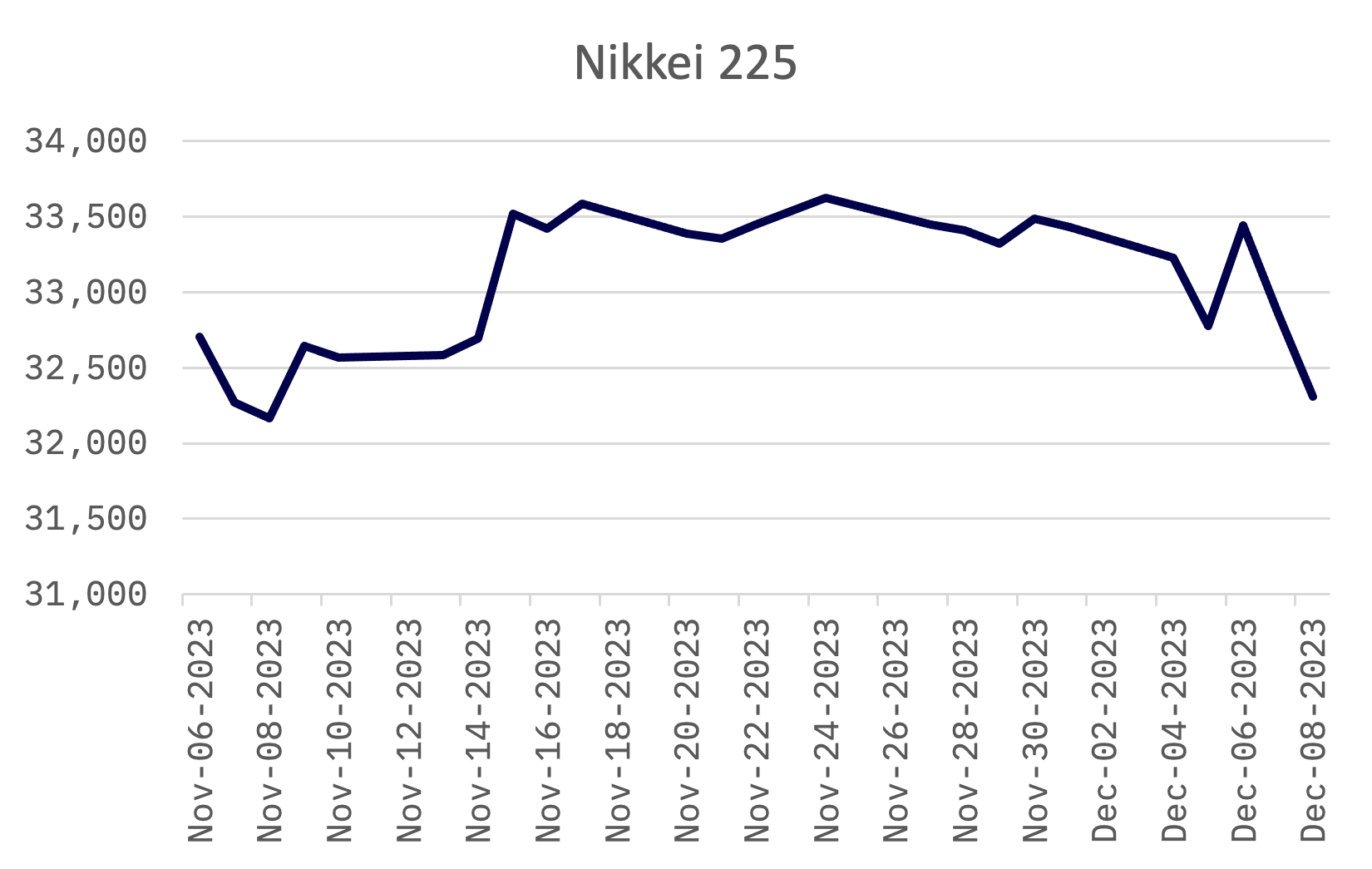

In Japan, stock markets faced a week of notable volatility, ending with a 3.4% decline in the Nikkei 225 Index. The market initially followed downward trends set by U.S. high-tech stocks and a strong yen. However, Wednesday saw a significant turnaround, swiftly replaced by intensified selling pressure on Thursday, leading to a drop of over 1,000 points in the Nikkei 225.

Comments from officials at the Bank of Japan (BoJ) sparked market speculation this week, suggesting the central bank might sooner than anticipated move away from its negative interest rate policy. This speculation exerted pressure on riskier assets, contributing to broader market volatility. Compounding these market strains, recent economic data indicated that Japan’s economy shrank more significantly in the third quarter than previously thought.

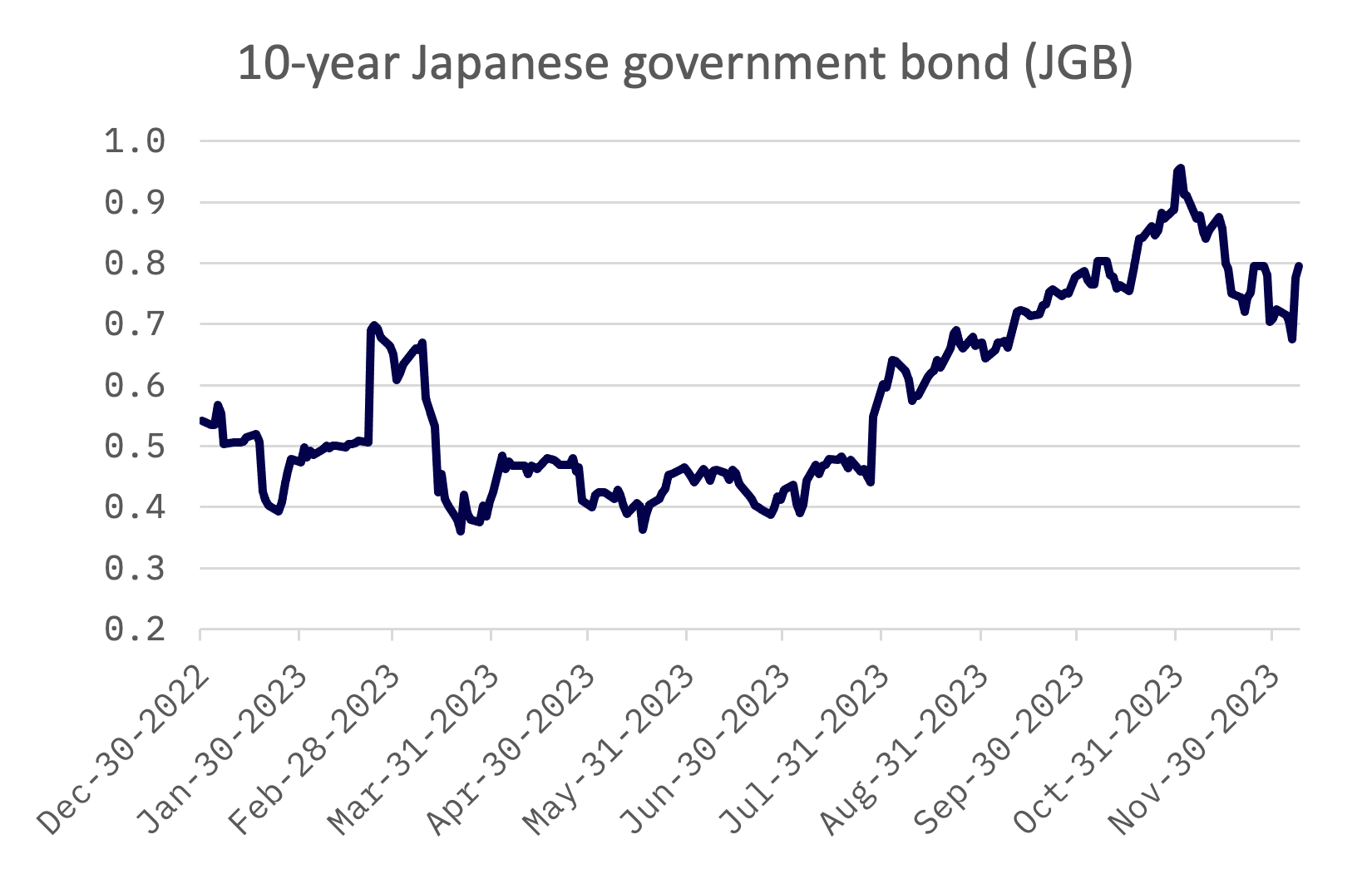

The yield on 10-year JGBs rose to 0.79%, up from 0.71%, amid expectations of a shift in the BoJ’s monetary policy.

Throughout the week, comments from Bank of Japan (BoJ) officials were interpreted by some investors as hinting at a potential acceleration in the central bank’s shift away from its highly accommodative monetary policy. There was speculation among market participants that the BoJ might soon phase out its negative interest rate policy, particularly following any adjustments to its yield curve control strategy.

In a nuanced discussion, Ryozo Himino, one of the BoJ’s Deputy Governors, posited that Japan’s economy might benefit from a gradual move away from its current ultra-loose monetary stance. He pointed out the potential positive effects on households and businesses, notably through possible increases in wages and prices. However, Himino cautioned that such a transition should be approached carefully. In a separate commentary, BoJ Governor Kazuo Ueda addressed the complexities of managing monetary policy in the approaching new year, given a challenging economic landscape. He emphasized the need for close monitoring to assess the development of a positive cycle in wages and prices.

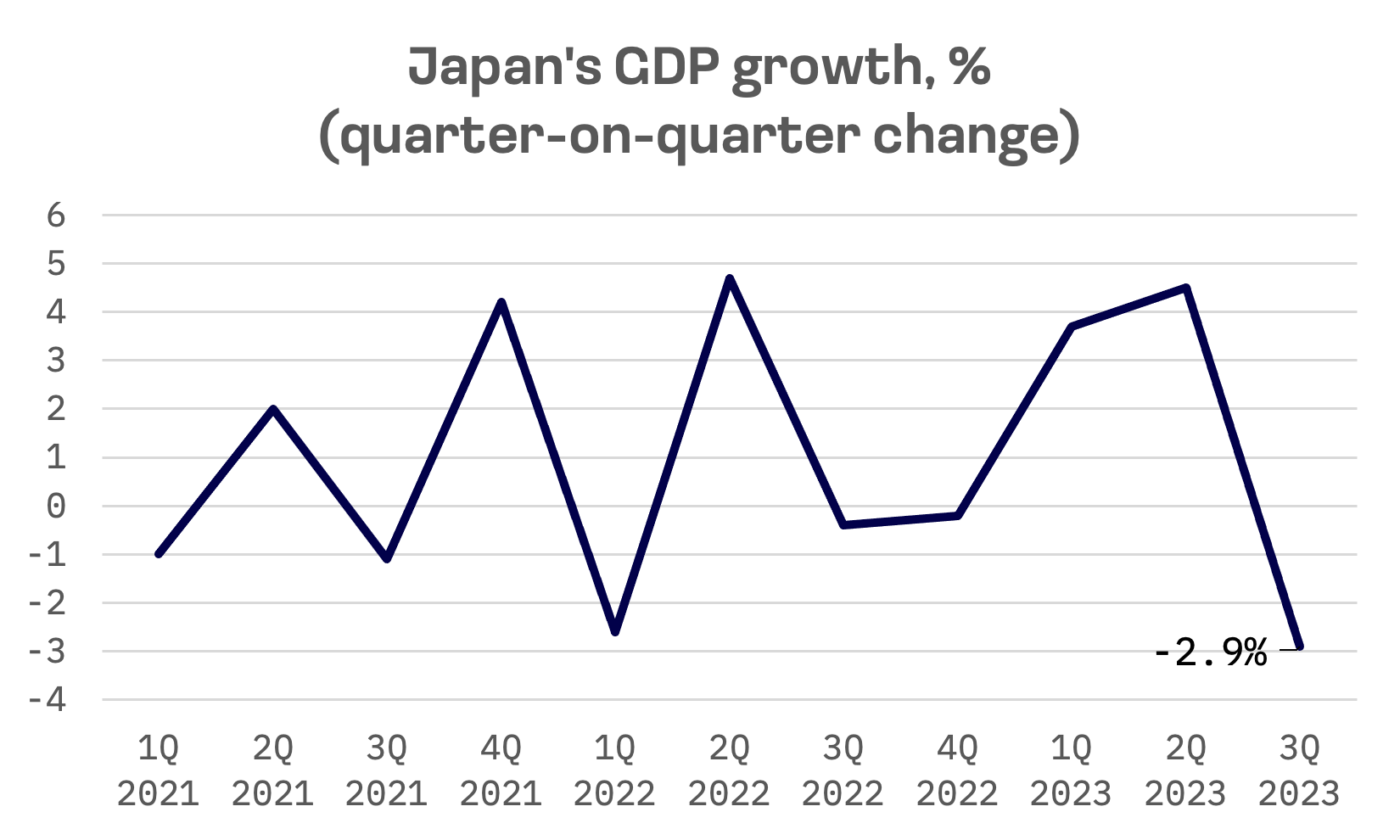

Regarding Japan’s economic performance, recent data indicated a more pronounced downturn than initially reported. The country’s gross domestic product shrank by an annualized 2.9% in the quarter ending September, a steeper decline than the previously estimated 2.1%. This revision marks the first time Japan has seen economic contraction across four consecutive quarters. Analysts attribute this downturn to the effects of inflation on private consumption and a slowdown in corporate investment.

South Korea

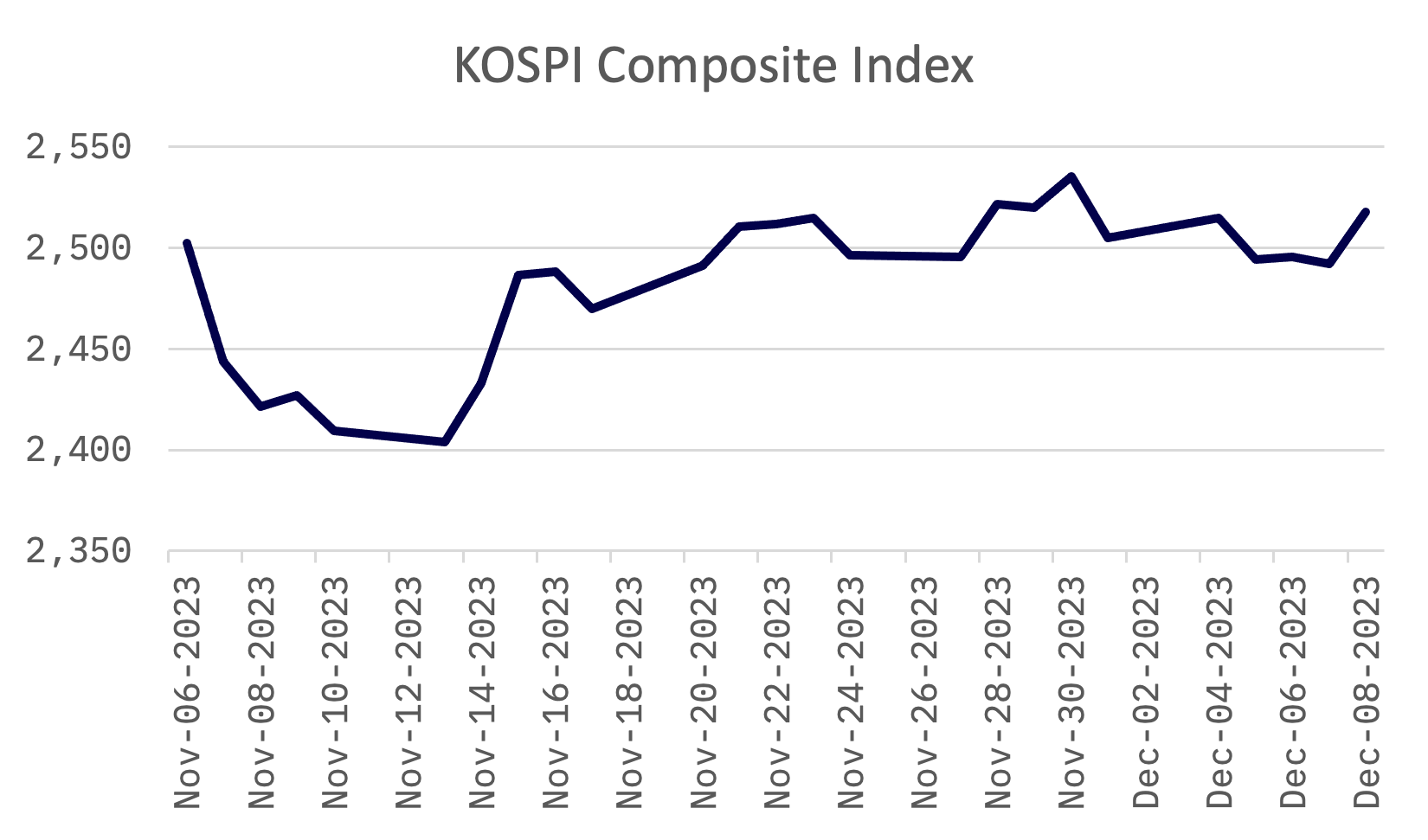

In a notable contrast to the Japanese markets, South Korea’s KOSPI Composite Index maintained its upward momentum, registering a 0.51% increase this week. This growth marks its longest winning streak since the week ending June 25, 2021, mirroring a similar six-week rise.

Throughout the week, the KOSPI showed a remarkable level of stability, with the exception of a brief dip on Tuesday. This decline was largely a response to an overnight sell-off in U.S. markets, prompting investors in South Korea to lock in recent gains. The week, however, wrapped up on a high note with a notable rally on Friday, contributing to the market’s overall modest gain. This uplift was partly driven by the growing excitement surrounding the potential of generative artificial intelligence, a factor that increasingly influences investor sentiment in the Korean market.

Additionally, the recent export data provided further impetus to the positive market outlook. South Korean exports, a crucial component of the country’s economic engine, exhibited a strong year-on-year increase of 7.8%, reaching a total of US$55.8 billion. This marks the second consecutive month of export growth, largely driven by a notable resurgence in semiconductor sales. This rebound in semiconductor exports, the first since August 2022 as per government records, indicates a potential recovery in a vital sector of the South Korean economy.

Taiwan

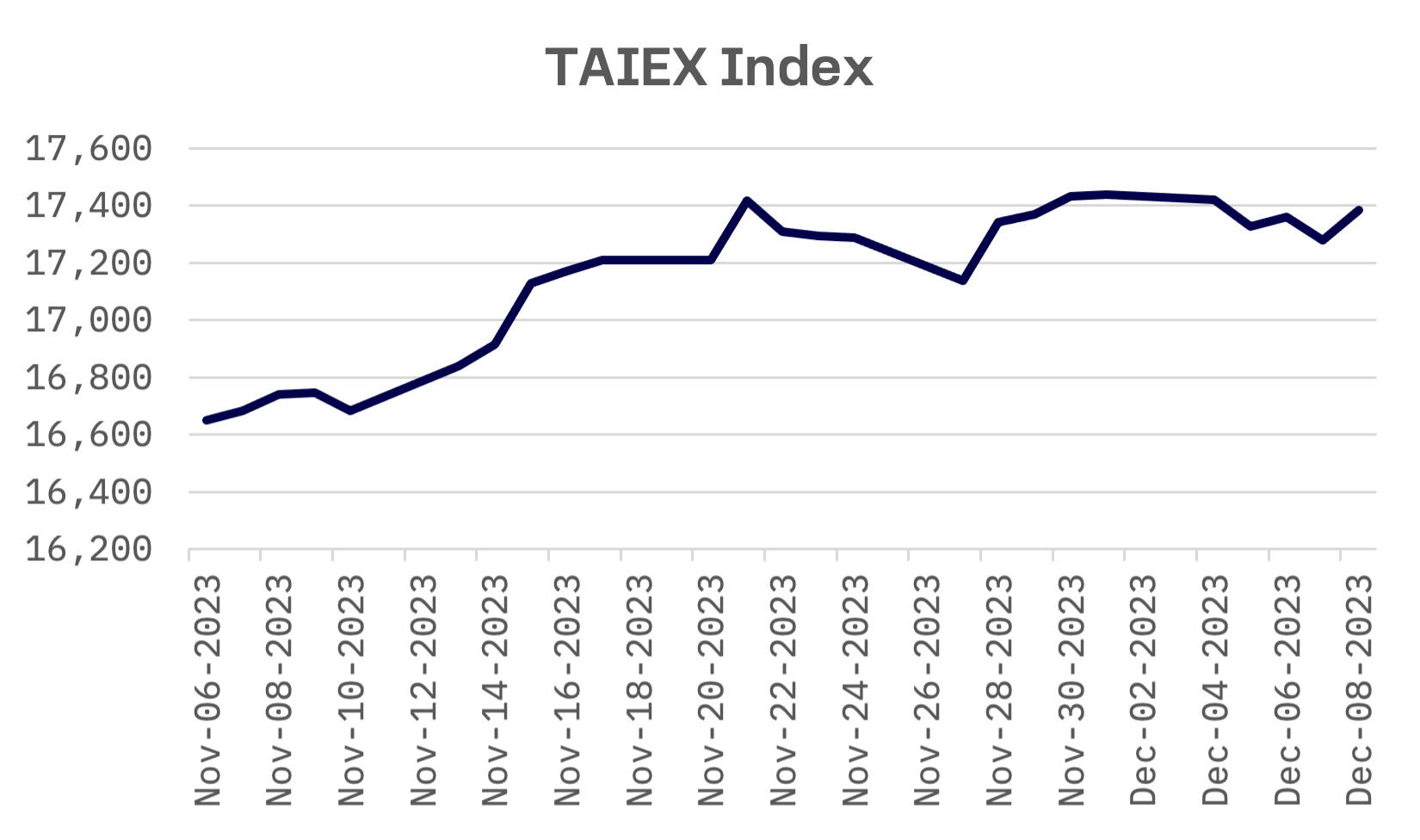

Taiwan’s stock markets saw a modest decrease this week, with the TAIEX index ending 0.31% lower, primarily due to profit-taking in the tech sector.

The market’s performance closely mirrored the fluctuations in the American stock markets, alternating between slight gains and losses. A notable rebound occurred on Friday, spurred by a surge in buying activity in large-cap semiconductor stocks. This uptick in interest was largely attributed to the announcement by U.S.-based chip designer Advanced Micro Devices (AMD) of their new artificial intelligence chips.

In terms of trade, Taiwan reported a promising rebound in exports for November, registering a 3.8% growth compared to the same period last year. The Ministry of Finance (MOF) credited this uptick to strong demand for emerging technologies, particularly in the artificial intelligence sector. Despite a sluggish global economy, Taiwan’s export growth has been resilient. According to MOF data, the total outbound sales for November amounted to US$37.47 billion, a significant improvement from the 4.5% year-on-year decline recorded in October.

JAKOTA Blue Chip 150 Index

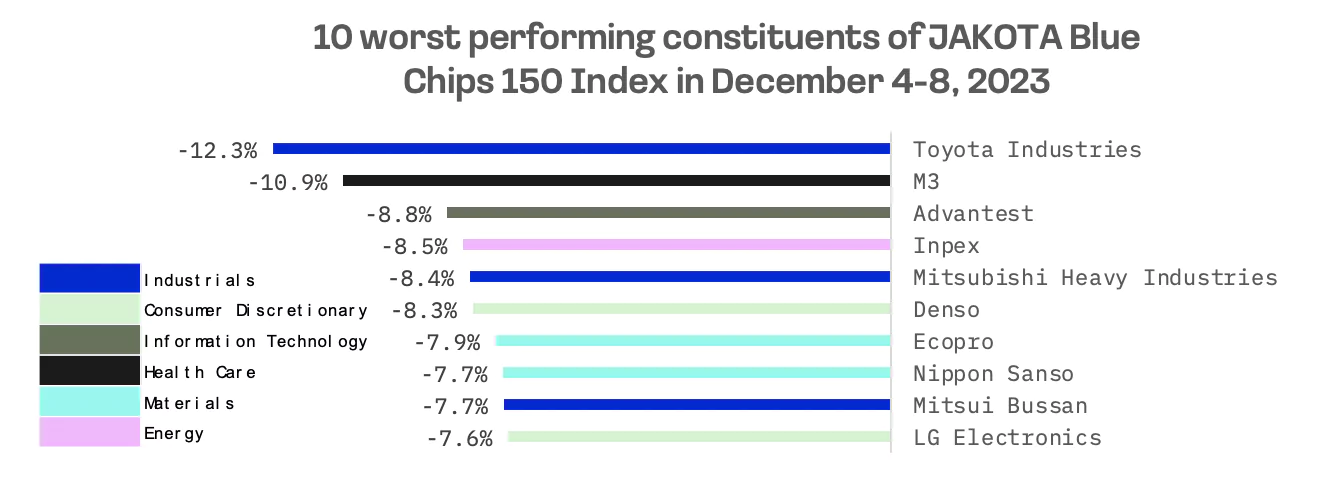

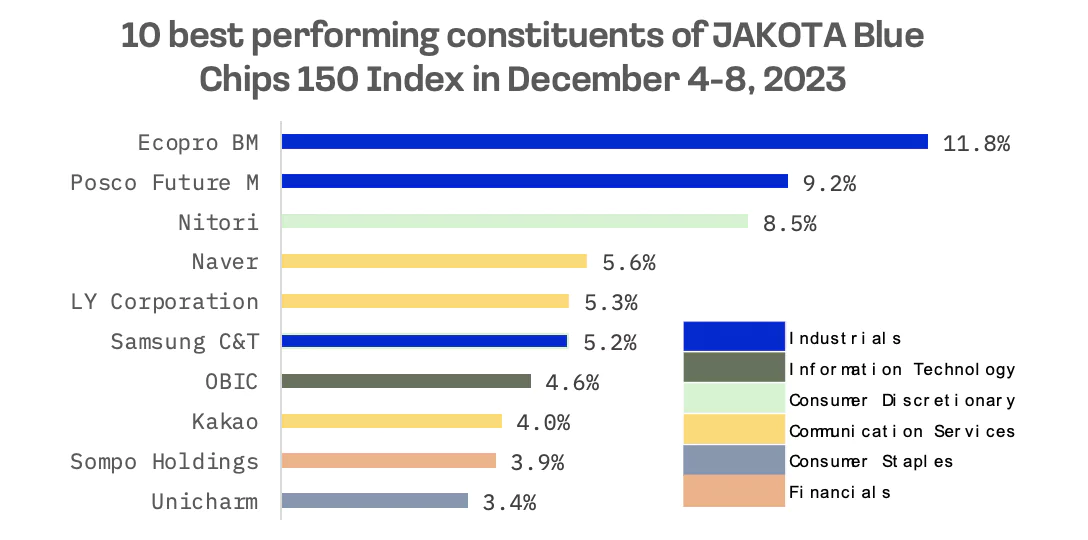

The JAKOTA Blue Chip 150 Index fell by 1.4%, with only a third of stocks showing positive trends.

Ecopro BM, a cathode materials manufacturer, stood out in the market this week, continuing its upward trajectory from the previous week. The company has clinched a substantial $34 billion deal to supply lithium nickel-cobalt-aluminum oxide (NCA) cathodes to Samsung SDI. These cathodes, essential in the manufacturing of EV batteries, are scheduled for delivery between the beginning of 2024 and the end of 2028.

The initial batch of cathodes destined for Samsung SDI next year will be produced at Ecopro BM’s facility in South Korea. From 2025 onwards, the company aims to shift production to its new plant in Hungary, which is expected to commence commercial operations that year, marking a significant expansion of Ecopro BM’s manufacturing capabilities.

Meanwhile, Toyota Industries, a machine maker, experienced a sharp decline in its stock price, dropping more than 12% after hitting an all-time high of ¥13,035 on November 30. This significant drop in share value is largely attributed to widespread profit-taking activities and a general correction in the Japanese stock market.