Last week’s Jakota markets:

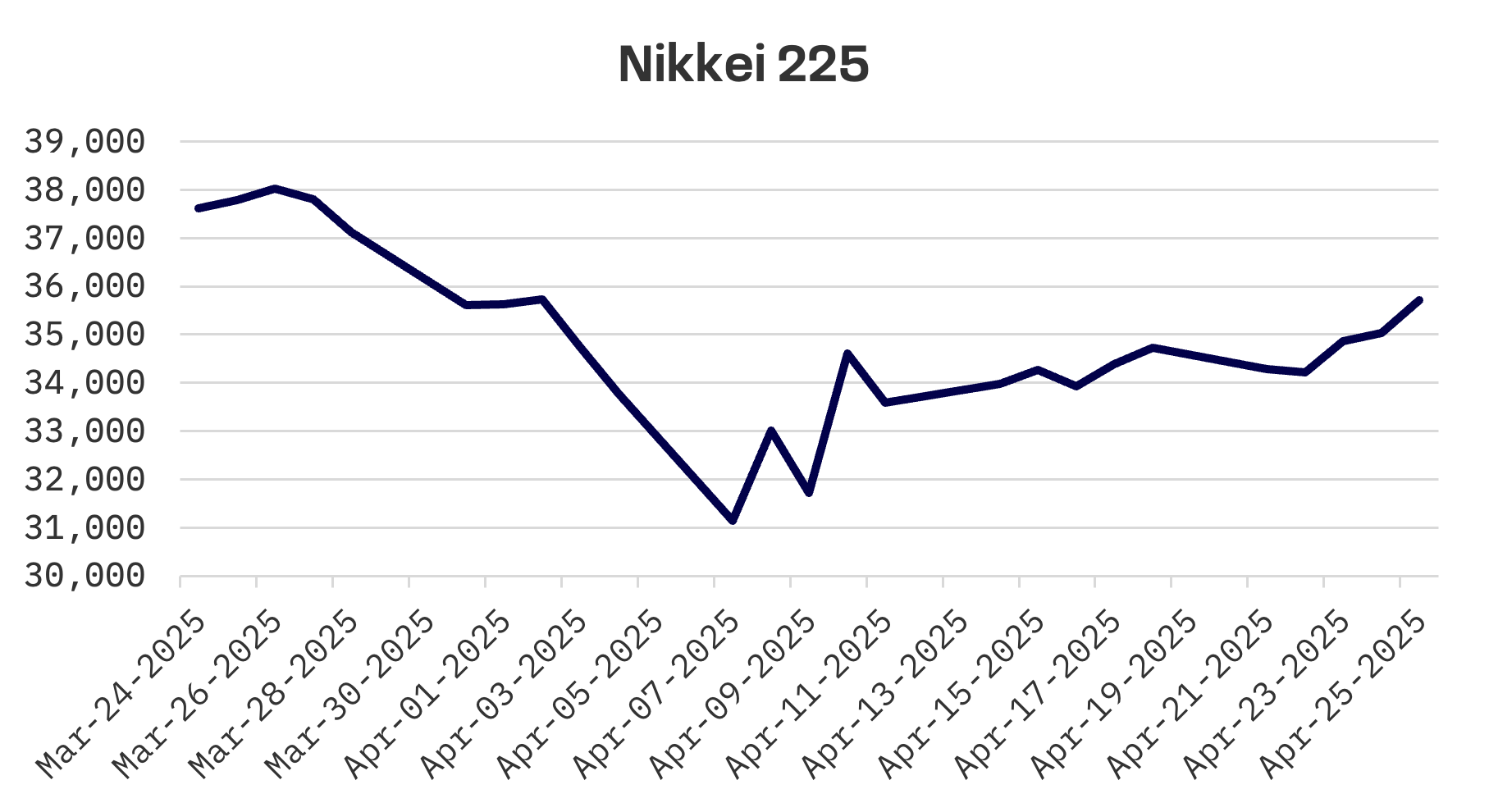

- Japan’s Nikkei 225 surged 2.8% as inflation hit a two year high, strengthening the case for BoJ policy tightening while the yen weakened to mid ¥143 against the dollar

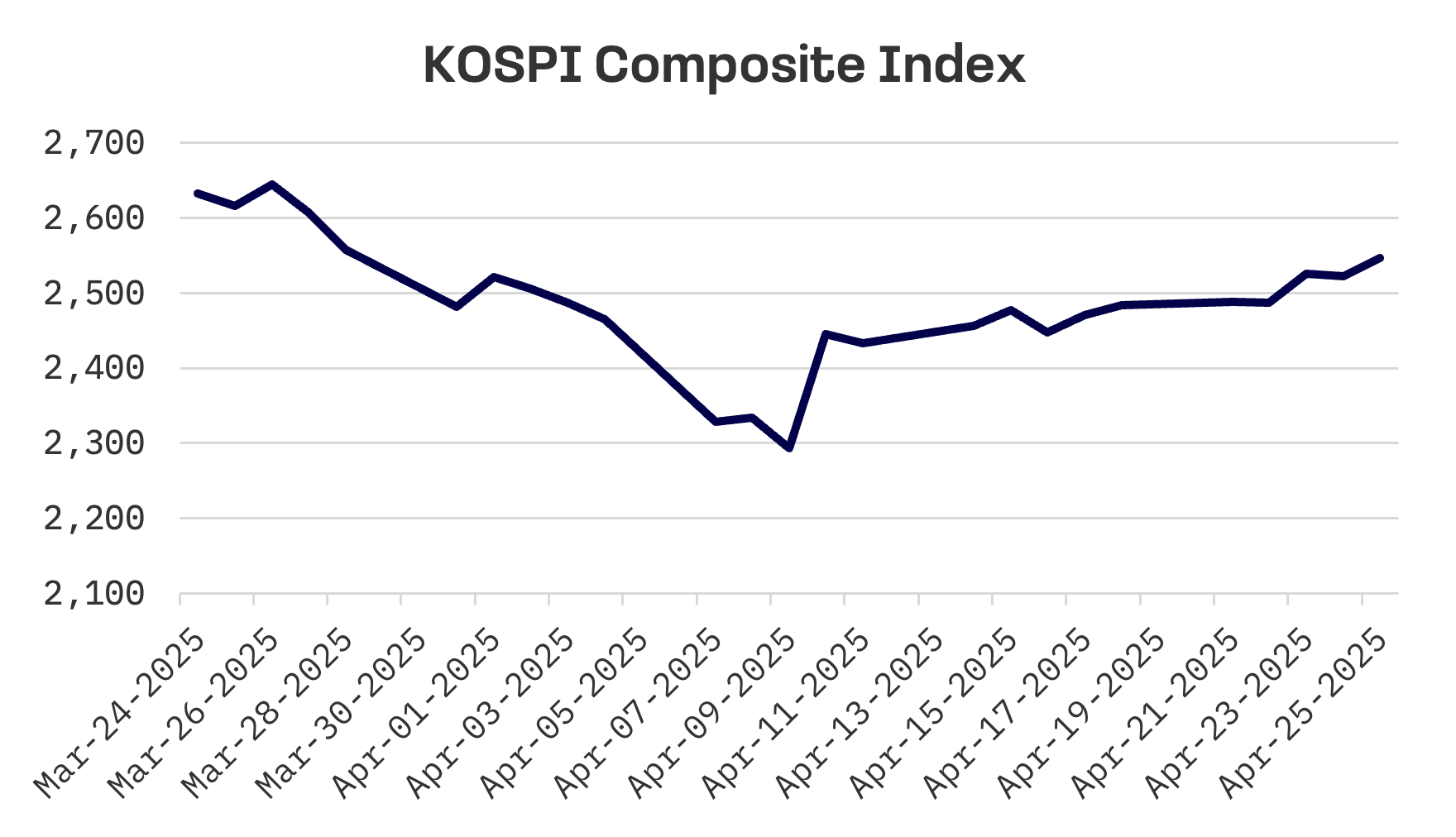

- South Korean equities gained 2.5% despite the economy’s first quarterly contraction since Q2 2024, with investors focusing on promising trade talks with Washington

- Taiwan’s market advanced 2.5% amid signs of potential easing in U.S.-China trade frictions

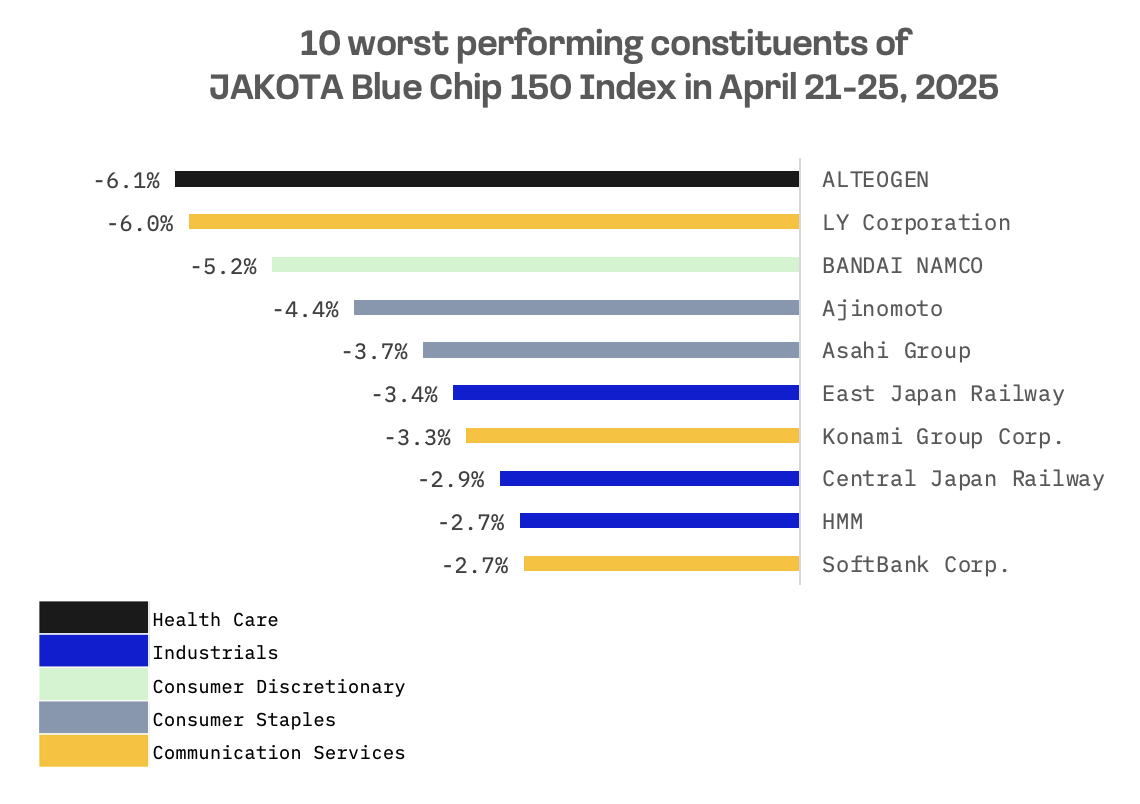

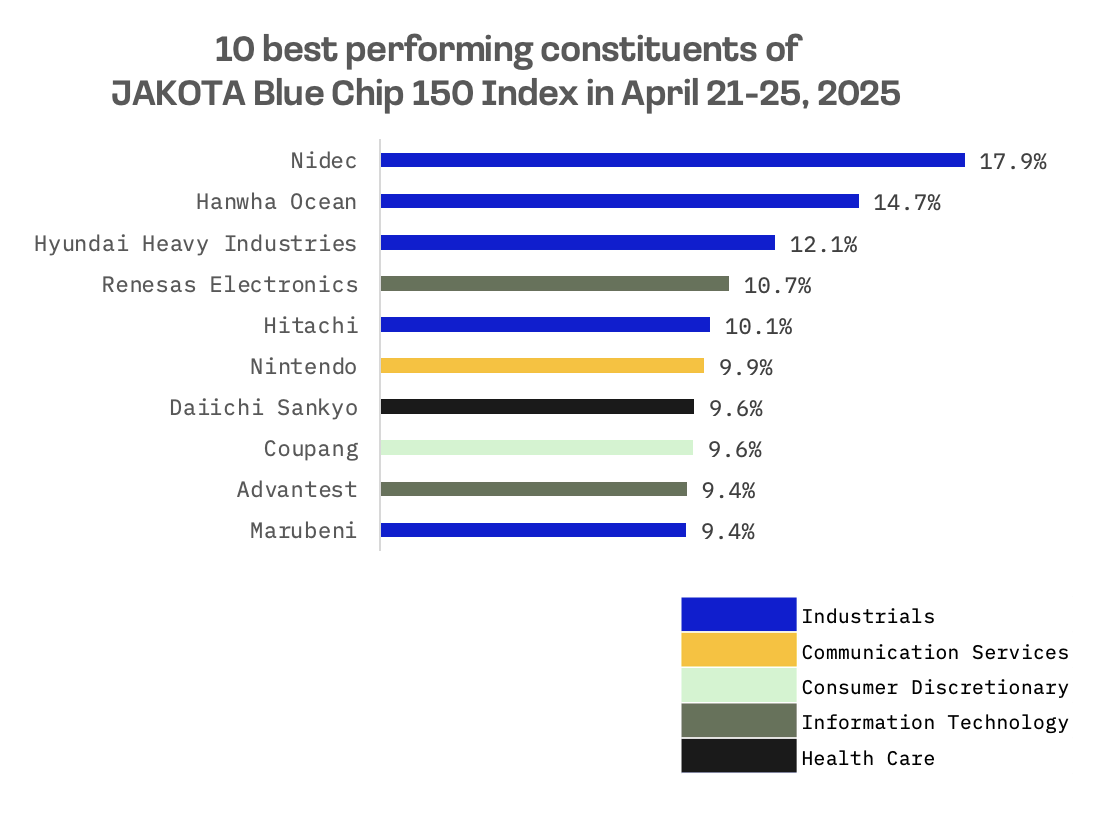

- The JAKOTA Blue Chip 150 Index added 2.5%, with Nidec leading gains after reporting record profits and Alteogen tumbling on patent litigation concerns

Japan

Japan’s stock market climbed 2.8% this week, buoyed by easing global trade tensions and inflation data that strengthened the case for additional monetary tightening. The yen weakened to the mid ¥143 range against the dollar from around ¥142 the previous week as investors moved away from haven assets. The 10 year Japanese government bond (JGB) yield increased five basis points to 1.34%.

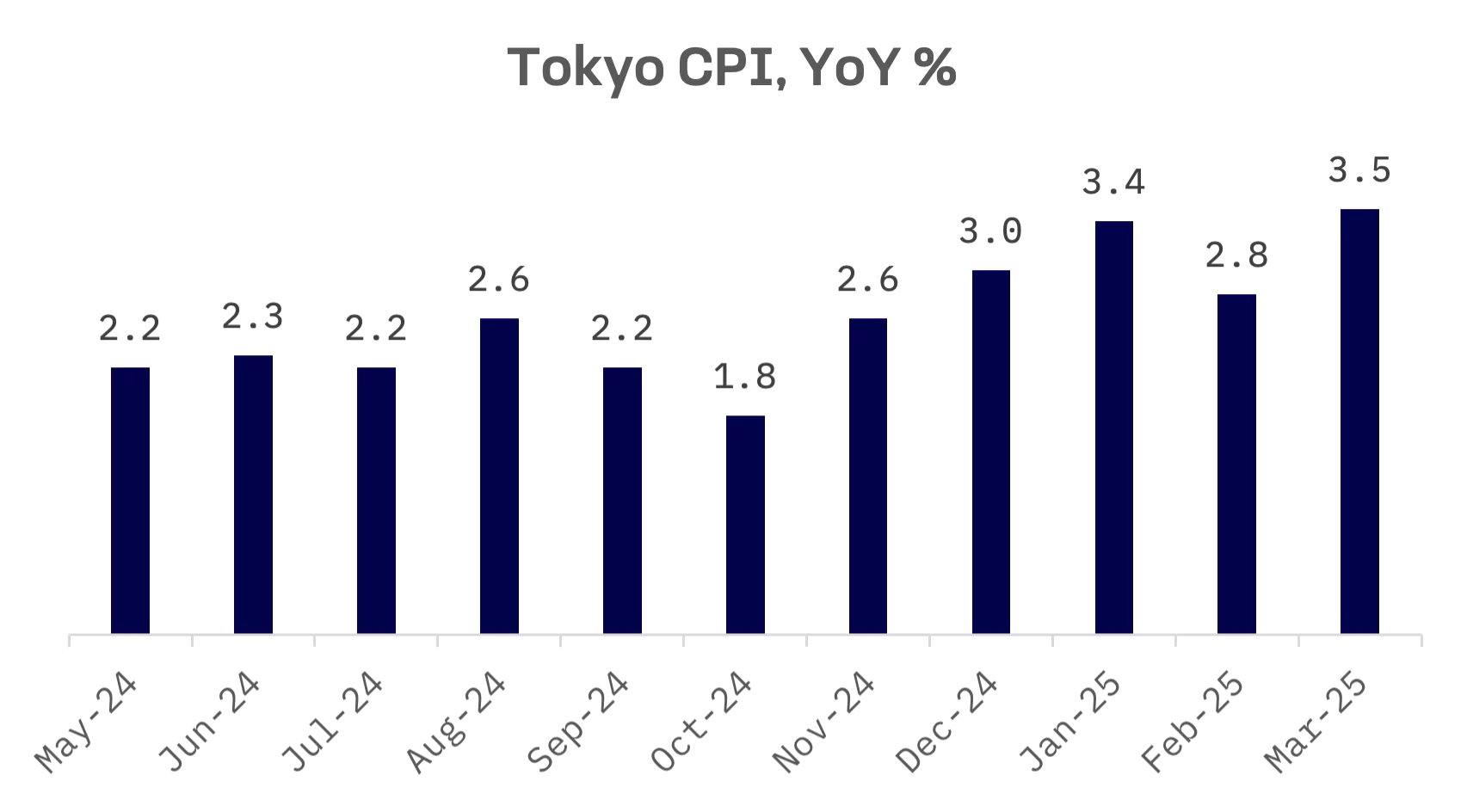

Tokyo area inflation, a bellwether for nationwide trends, jumped to a two year high, bolstering arguments for policy normalisation by the Bank of Japan (BoJ). Core consumer prices increased 3.4% in April from a year earlier, exceeding expectations and accelerating from March’s 2.4%. Rising food costs and reduced government utility subsidies drove the increase.

BoJ Governor Kazuo Ueda struck a cautious tone, reiterating that interest rate increases would depend on sustained progress towards the bank’s 2% inflation target. He emphasised the need to evaluate risks arising from U.S. tariff policies.

South Korea

South Korean stocks advanced this week, with the KOSPI gaining 2.5% amid optimism over easing tariff tensions. Investors assessed the outcome of initial trade talks between Seoul and Washington, where both sides agreed to work towards a tariff agreement before the early July expiration of the current pause on reciprocal tariffs.

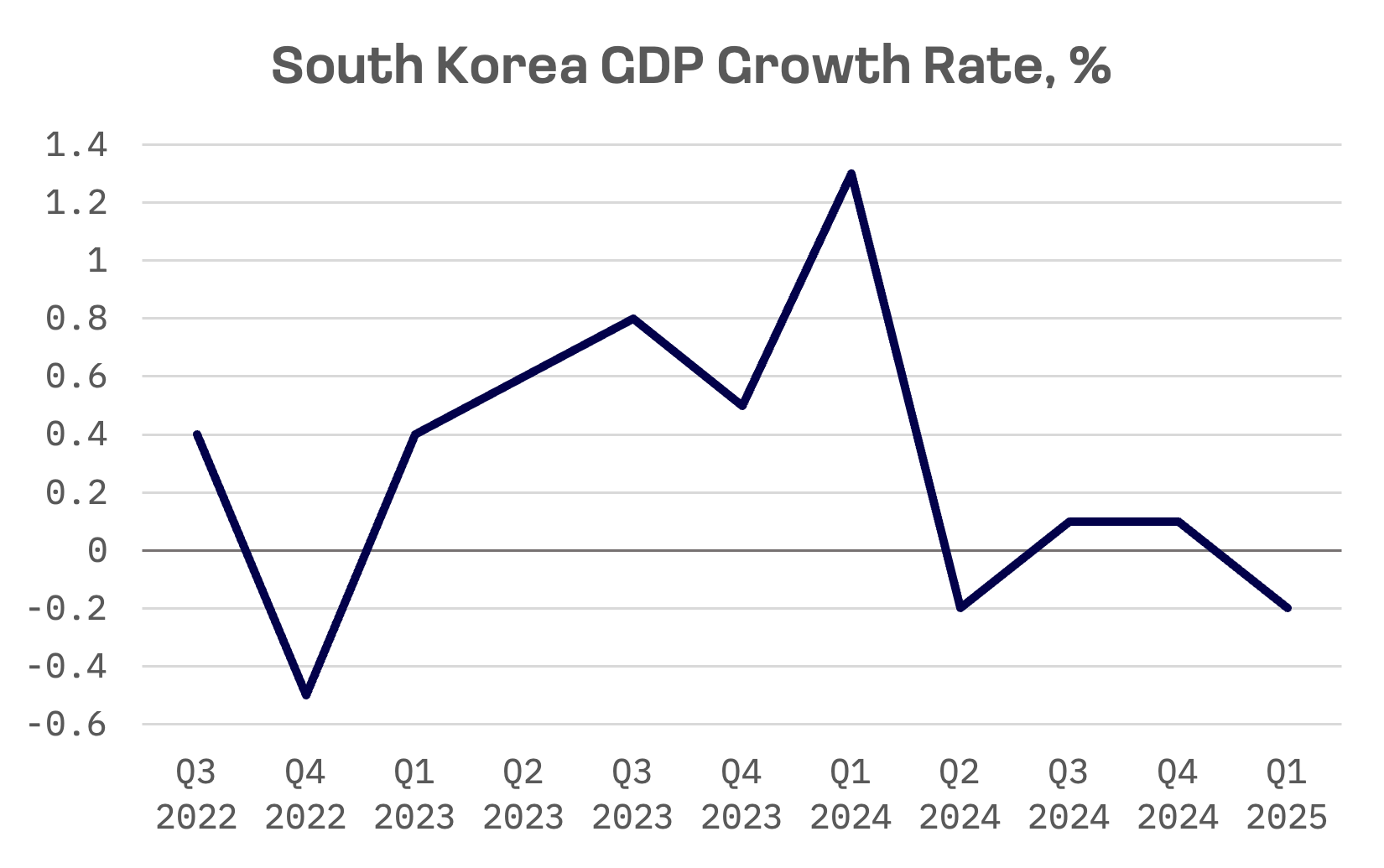

Meanwhile, South Korea’s economy unexpectedly contracted in the first quarter, hampered by weaker exports and consumption amid political uncertainty and concerns over U.S. tariffs. This decline heightened expectations for additional monetary and fiscal support.

Gross domestic product (GDP) fell 0.2% in the January-March period from the previous quarter on a seasonally adjusted basis, marking the first contraction since the second quarter of 2024, according to advance estimates from the Bank of Korea (BOK). The result missed market forecasts of 0.1% growth.

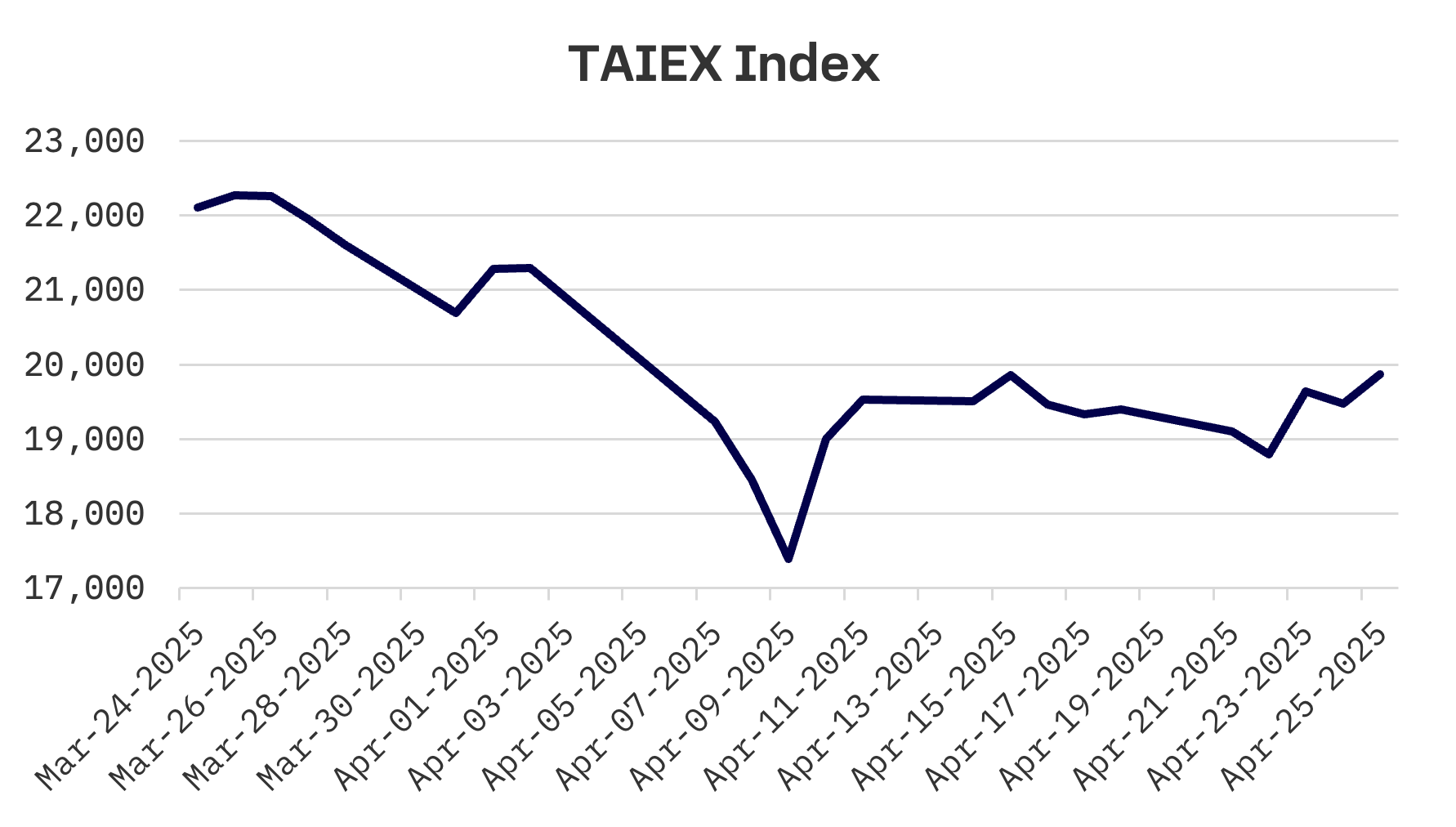

Taiwan

Taiwan’s stock market rose this week, with the TAEIX gaining 2.5% amid possible easing of trade tensions between the United States and China.

JAKOTA Blue Chip 150 Index

The JAKOTA Blue Chip 150 Index rose 2.5% this week. Of its 150 constituents, 102 stocks posted gains.

Nidec, a Japanese manufacturer of commercial and industrial motors, emerged as the top performer on the index after reporting strong financial results for the fiscal year ending March 31, 2025.

Nidec’s key highlights include:

- Record highs in full year consolidated net sales, operating profit, profit before income taxes and profit attributable to owners of the parent.

- Fourth quarter net sales and operating profit reached all time quarterly records.

- Cash flow remained at record high levels.

Alteogen, a South Korean biopharmaceutical firm specialising in novel biologics, was the week’s worst performer after facing a lawsuit over alleged patent infringement tied to Halozyme’s Merck subcutaneous injection technology.

Halozyme Therapeutics filed a patent infringement lawsuit against Merck & Co. in the U.S. District Court for New Jersey, alleging unauthorised use of its high dose subcutaneous injection technology known as MDASE. The suit seeks damages and an injunction to block commercialisation of Keytruda’s subcutaneous formulation, currently under FDA review with approval expected in September.

Halozyme contends that Merck infringed on 15 patents related to modified human hyaluronidase enzymes, critical for enabling subcutaneous drug delivery. Merck argues it leveraged Korean biotech firm Alteogen’s ATL-B4 technology – independently developed and not covered by Halozyme’s patents – to adapt Keytruda’s intravenous formulation for subcutaneous use.