Last week’s Jakota markets:

- Japan’s Nikkei 225 Index advanced 3.41%, as investor optimism grew over U.S.-Japan trade talks, despite March exports missing forecasts amid U.S. steel and aluminium tariffs

- South Korea’s KOSPI gained 2.1% on easing concerns over U.S. tariffs, though semiconductor stocks faltered after Washington’s restrictions on Nvidia’s China bound AI chip exports

- Taiwan’s TAIEX bucked the regional trend with a 0.7% decline as U.S. export restrictions on American AI companies threatened to impact Taiwanese suppliers

- The JAKOTA Blue Chip 150 Index posted a 2.4% gain, with Chugai Pharmaceutical soaring after Eli Lilly’s oral GLP-1 drug showed promising results in obesity and diabetes treatment trials

Japan

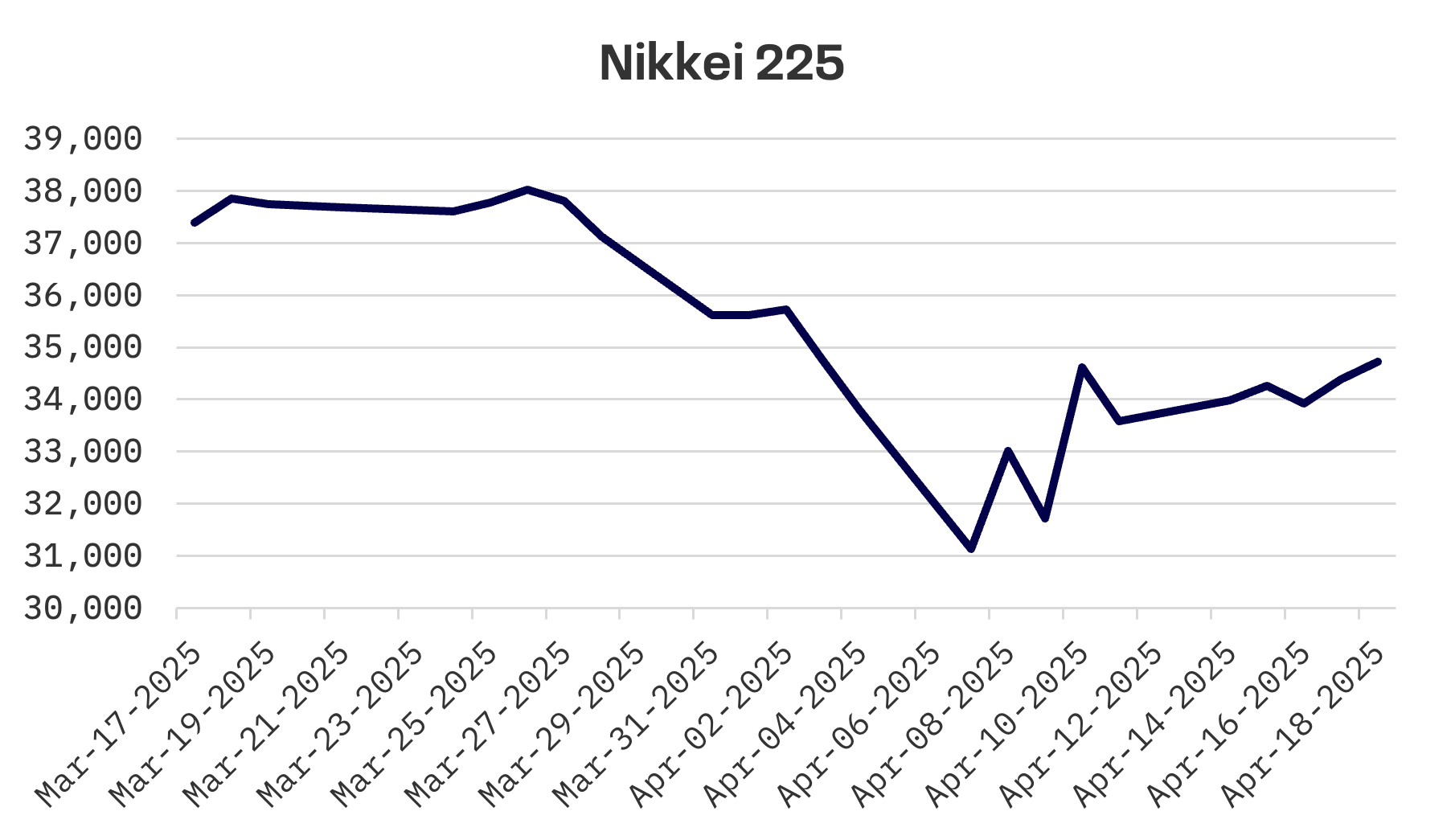

Japan’s stock market rallied this week, with the Nikkei 225 Index gaining 3.41%, as investors grew more optimistic towards the end of the period about U.S.-Japan trade negotiations. Tokyo continues pressing Washington to reconsider tariffs on Japanese imports while seeking more advantageous terms, sparking hopes for a potential breakthrough.

Investors flocked to perceived safe haven assets as signs mounted of an intensifying trade conflict between the U.S. and China. The yen strengthened to the upper end of the ¥142 range against the dollar, compared with roughly ¥143.5 at the close of the previous week. Despite growing market attention on currency fluctuations and recent yen weakness, foreign exchange matters have thus far remained excluded from U.S.-Japan trade discussions.

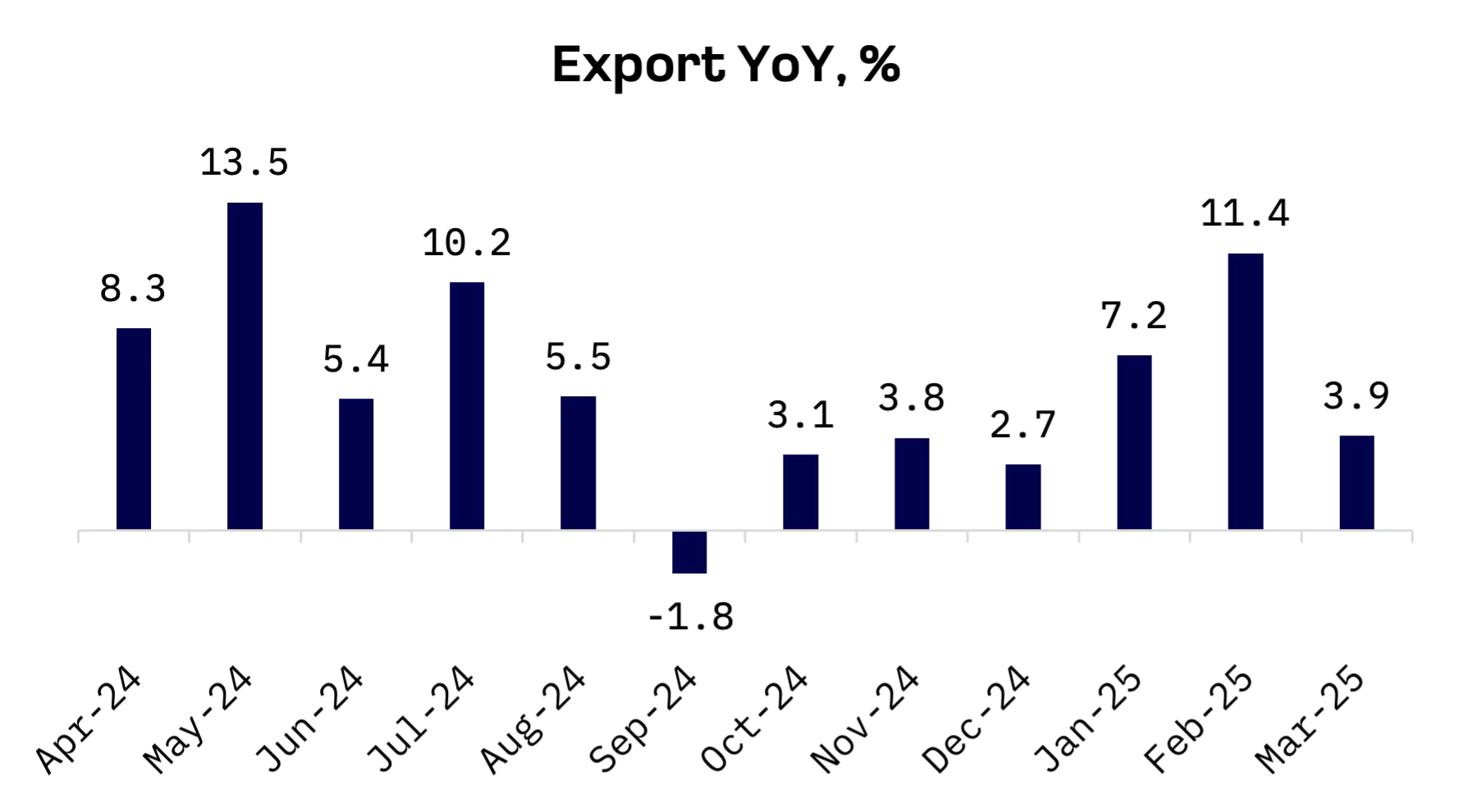

Japan’s exports increased 3.9% year-over-year in March, missing economists’ consensus forecast of 4.5% and representing a substantial deceleration from February’s 11.4% expansion. Analysts attribute the slowdown to U.S. tariffs on steel and aluminium, coupled with weakening demand from European and Chinese markets.

Recent Bank of Japan (BoJ) statements led some market participants to interpret a more cautious policy outlook, suggesting the central bank might postpone its next interest rate increase amid persistent uncertainties, including the effects of global trade frictions. Governor Kazuo Ueda indicated that policy support might be necessary and stressed that the BoJ would respond appropriately to evolving conditions. The central bank reaffirmed its position that it would continue with rate increases if economic and inflation projections are reached.

South Korea

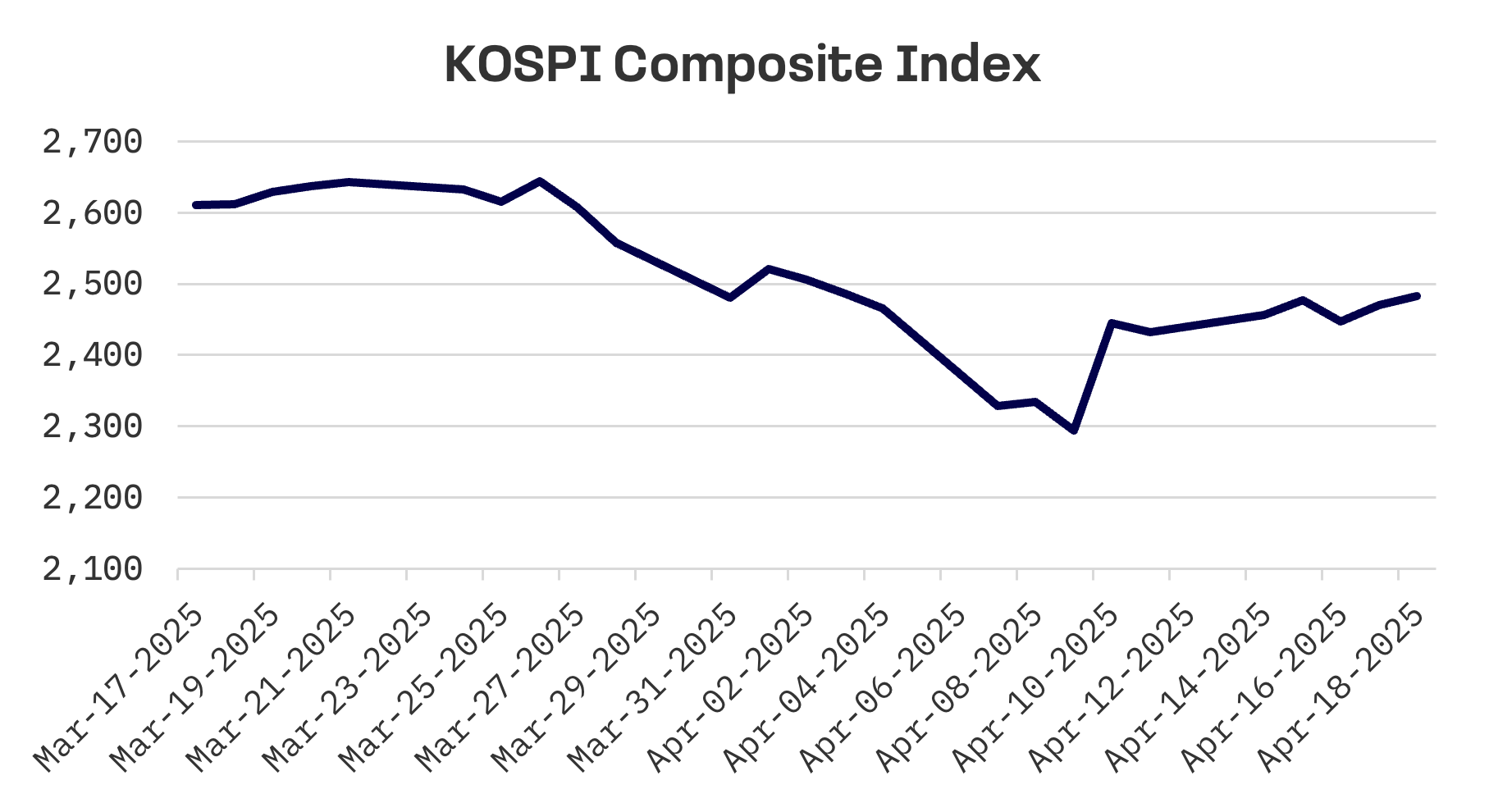

South Korean stocks advanced this week, with the KOSPI climbing 2.1% as diminishing concerns about comprehensive U.S. tariffs bolstered market sentiment. Nevertheless, semiconductor manufacturers faced headwinds midweek after the U.S. moved to limit Nvidia’s AI chip exports to China, pressuring the sector.

The Bank of Korea (BOK) maintained its benchmark interest rate at 2.75% on Thursday, with Governor Rhee Chang-yong warning that escalating global uncertainty – exacerbated by sudden shifts in U.S. trade policy – has driven the domestic economy into “a dark tunnel.”

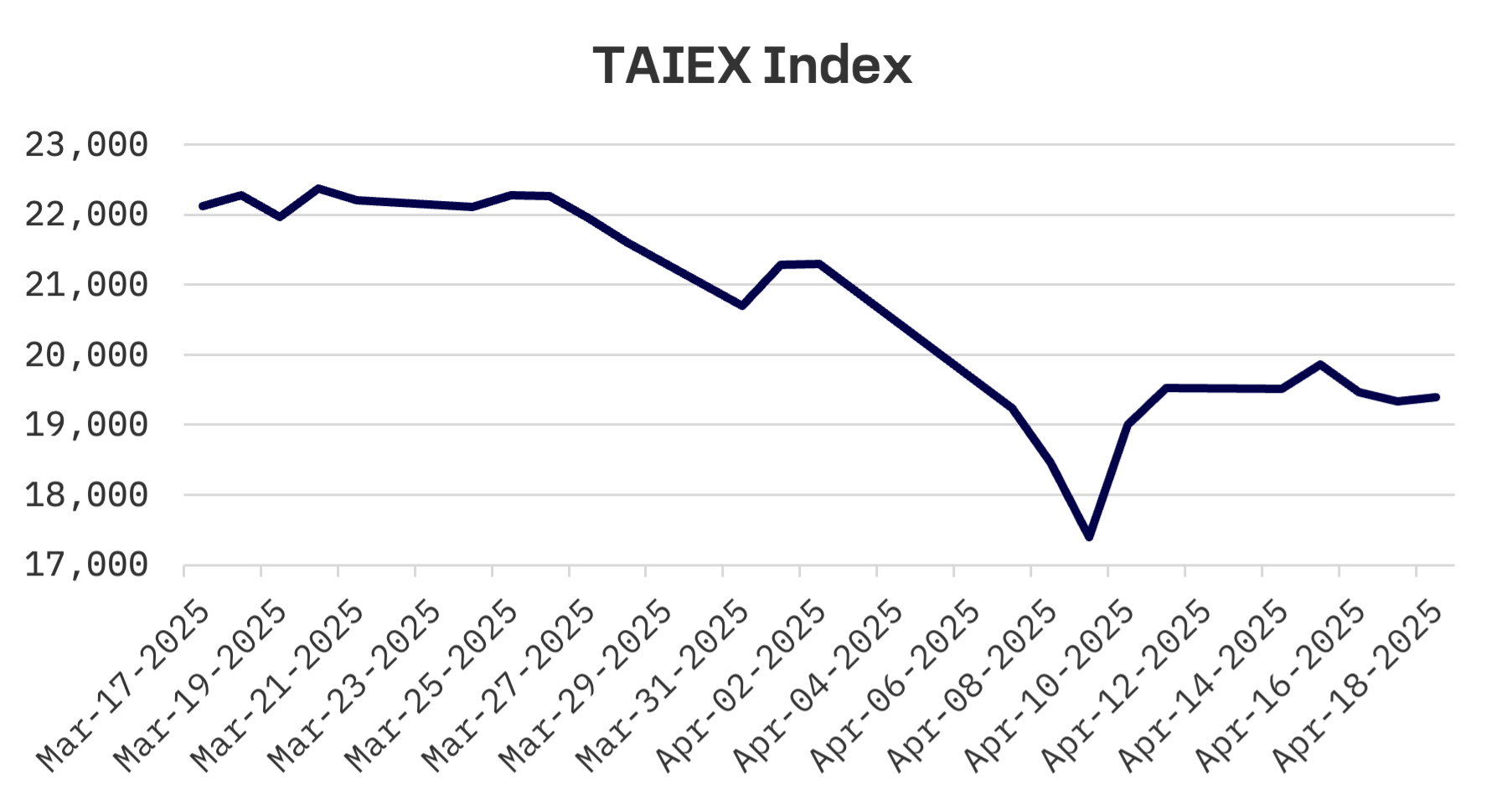

Taiwan

Unlike other Jakota markets, Taiwan’s stock market declined this week, with the TAIEX falling 0.7%. The U.S. government’s recent decision to impose additional export restrictions on exports to China by major American AI companies is expected to adversely affect their suppliers, including Taiwanese firms.

Taiwan Semiconductor (TSMC), the most heavily weighted stock in the local market, experienced selling pressure as investors remained wary ahead of Thursday’s investor conference. During the event, Chairman C.C. Wei acknowledged that recent U.S. tariff actions have introduced market uncertainties but emphasised that clients have not altered their business relationships with the company. TSMC reiterated its forecast for 2025 sales growth of 24-26% year-over-year in dollar terms. While the update alleviated some concerns, it failed to significantly revive investor enthusiasm, with shares edging up just 0.35% on Friday.

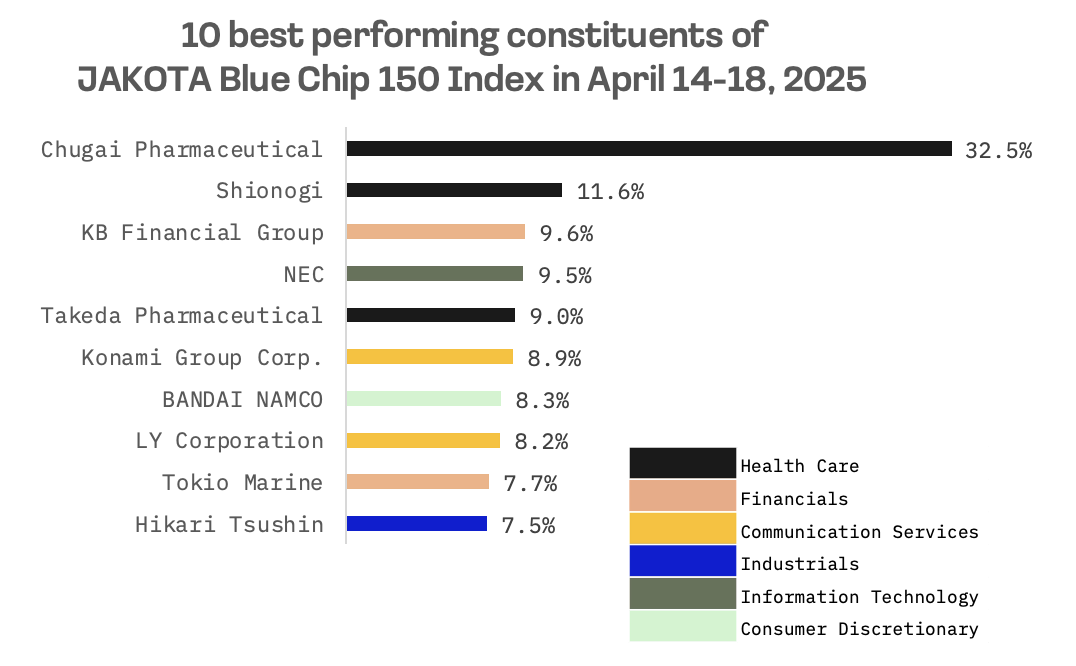

JAKOTA Blue Chip 150 Index

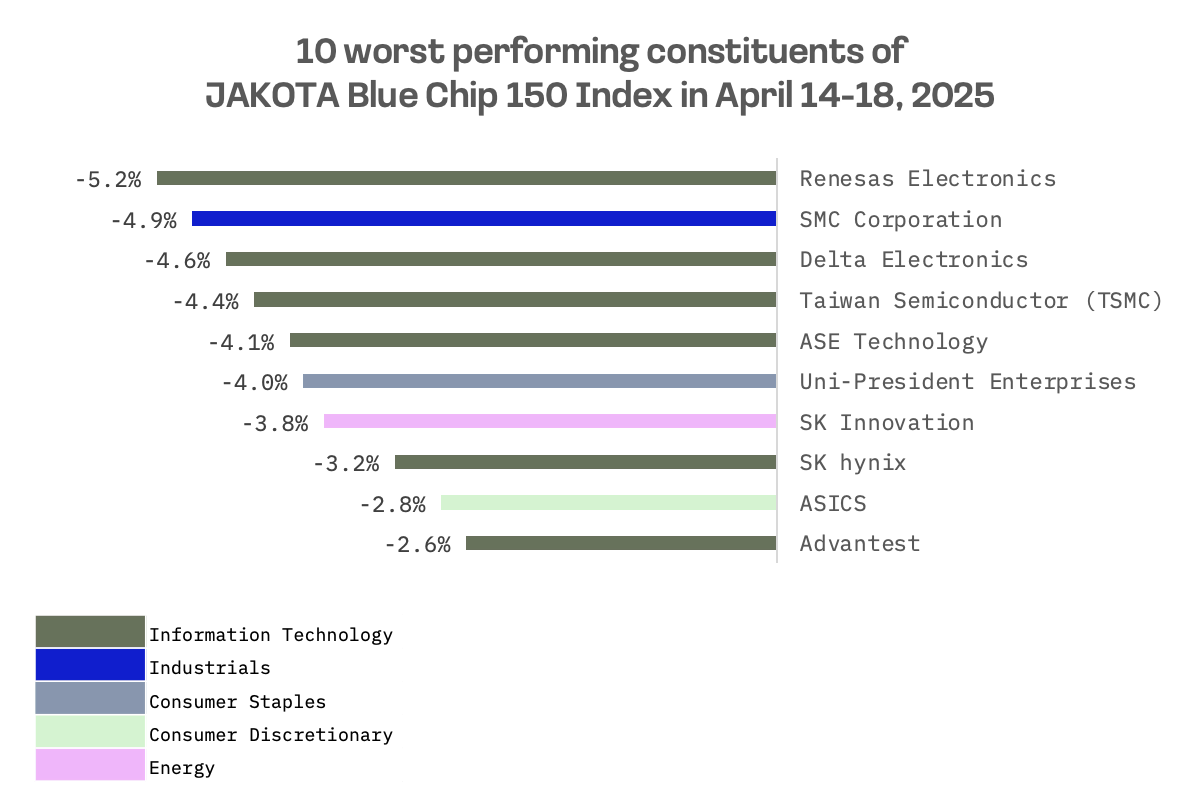

The JAKOTA Blue Chip 150 Index rose 2.4% this week, with 118 of its 150 constituent stocks recording gains.

Chugai Pharmaceutical, a Japanese drugmaker, emerged as the index’s top performer after Eli Lilly announced that orforglipron, its experimental oral GLP-1 treatment for obesity and diabetes, demonstrated efficacy comparable to Novo Nordisk’s Ozempic in clinical trials, stoking investor enthusiasm about a potential blockbuster therapy. Chugai initially discovered the compound before licensing it to Lilly in 2018.

The surge in popularity of injectable GLP-1 treatments such as Ozempic, Lilly’s Mounjaro and Zepbound has triggered intense competition to develop an oral alternative – one that offers greater convenience, scalability in production and potentially lower costs. While competitors like Pfizer have encountered obstacles, Eli Lilly’s advancement with orforglipron could strengthen its position in a market that analysts project will expand to $130 billion by 2030.

Patients in a Lilly sponsored trial shed an average of 16 pounds, representing 7.9% of body weight, over a 40 week period, exceeding weight reductions observed in earlier Ozempic studies. Participants hadn’t reached a plateau by the trial’s conclusion, suggesting potential for additional weight loss. Blood glucose levels decreased by 1.3%, slightly below results achieved with leading injectable treatments.

Japanese and Taiwanese electronics stocks, including Renesas Electronics and Delta Electronics, ranked among the week’s poorest performers, as new U.S. restrictions on China bound exports from major American AI companies intensified challenges for the region’s tech sector.