In the bustling JAKOTA stock markets, FADU (440110.KQ), a notable player in the JAKOTA Mid and Small Cap 2000 Index, emerged as the top decliner on November 10, 2023. This downturn, primarily driven by weaker-than-expected financial results, has caught the attention of investors and market analysts. Detailed insights into these challenges emerged from the letter to shareholders posted on the company’s official website.

FADU’s journey from its successful IPO in August to achieving the status of South Korea’s first unicorn in the chip design sector has been a blend of extraordinary highs and pressing lows. The company’s record-breaking revenues earlier in the year contrast sharply with the recent financial turbulence.

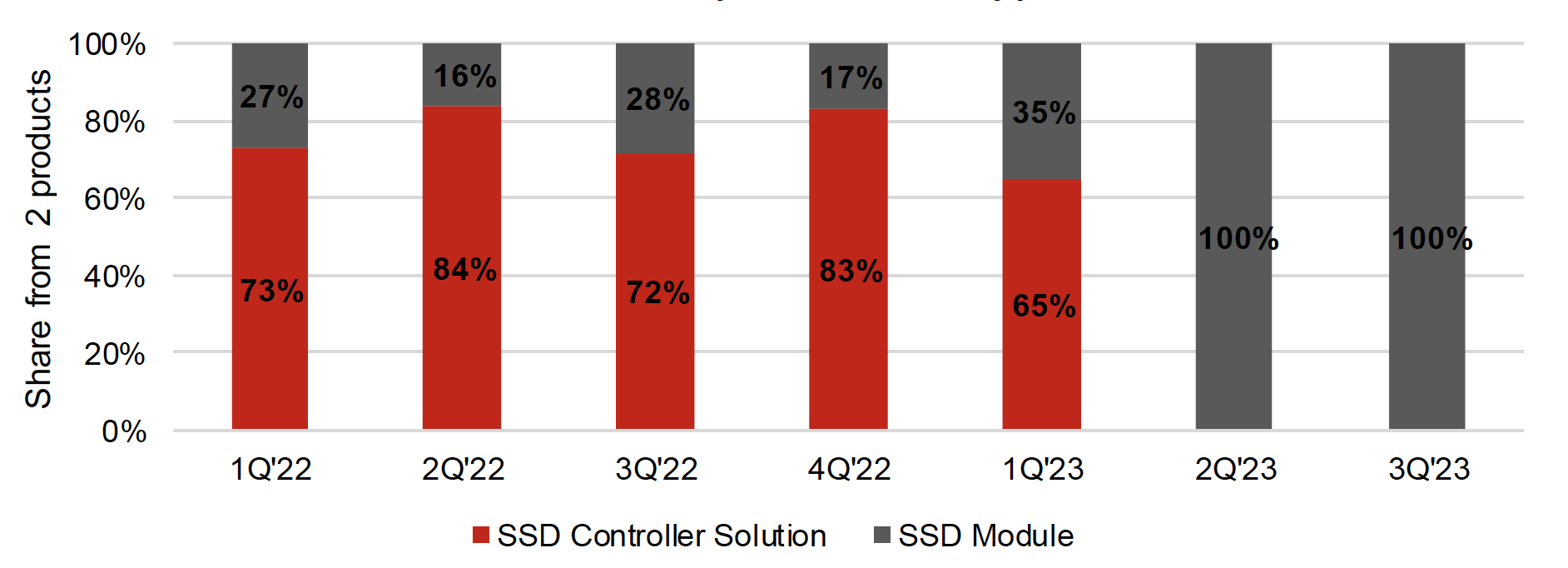

The core of FADU’s troubles lies in the NAND and SSD markets, essential to its business model. The unexpected downturn in these sectors has significantly impaired the company’s revenue streams, particularly in the SSD Controller Solution area. This scenario mirrors the company’s past struggles, notably in 2021, when it faced similar, if not more severe, financial setbacks.

FADU: Revenue by Business Type

Despite these challenges, FADU has demonstrated a remarkable capacity for recovery. In 2022 and the first quarter of 2023, the company managed to increase its revenue tenfold, showcasing resilience and strategic acumen in overcoming difficult market conditions.

Financially, FADU has navigated its challenges with a level of prudence. Despite accruing debts, the company’s past cash flow statements have not indicated alarming levels of debt. This, coupled with a substantial cash reserve from a successful IPO, positions FADU on a relatively stable financial footing. The management’s decision to maintain its workforce size and continue investing in R&D reflects a long-term vision for the company’s growth and stability.

| 2020 | 2021 | 2022 | 1Q 2023 | 2Q 2023 | 3Q 2023 | |

| Gross Profit | 394 | (1000) | 44,531 | 13,533 | (119) | (112) |

| R&D Expenses | 7,054 | 24,656 | 30,805 | 13,911 | 11,146 | 10,697 |

| Changes in Borrowings | (1,154) | 9,500 | – | – | – | 25,000 |

| Net Changes in Cash | 5,937 | 1,571 | 2,836 | – | – | 196,989 |

With the upcoming financial report, FADU’s management faces a critical juncture. They must demonstrate to investors the company’s ability to retain clients and return to previous revenue levels. Investors, having heeded the management’s call for patience, now await this report with a mix of anticipation and apprehension. This forthcoming disclosure will either reinforce investor confidence in FADU’s direction or amplify concerns about its ability to navigate an increasingly challenging market landscape.