Click to see update on recent developments on this story

Korea Zinc’s Brief Financial Overview

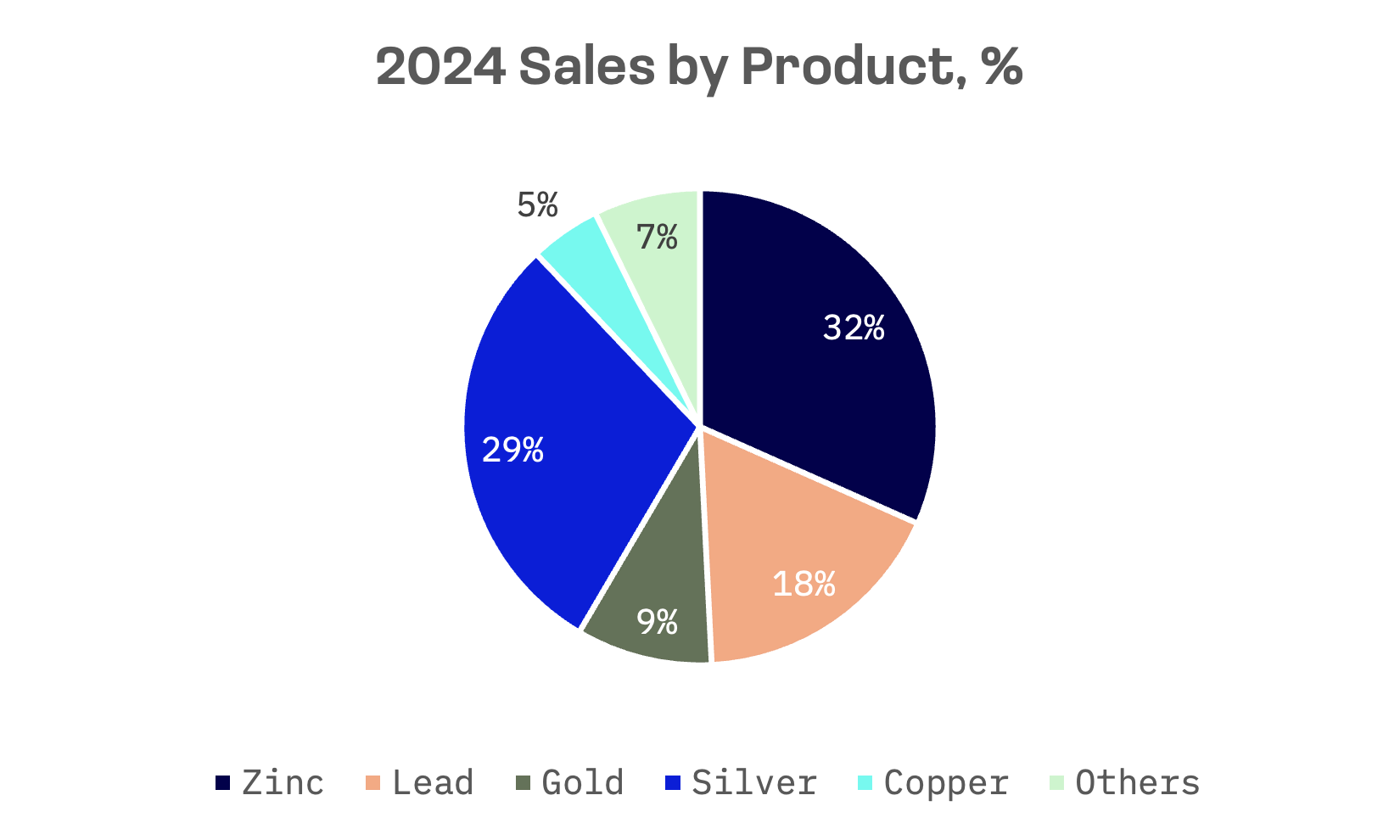

The company refines 16 metals, including zinc, lead, gold, silver, and copper, alongside rare metals like indium and gallium. As its name suggests, Korea Zinc Group’s core metal is zinc. The company produces 1.2 million tons annually, accounting for 10% of the global supply.

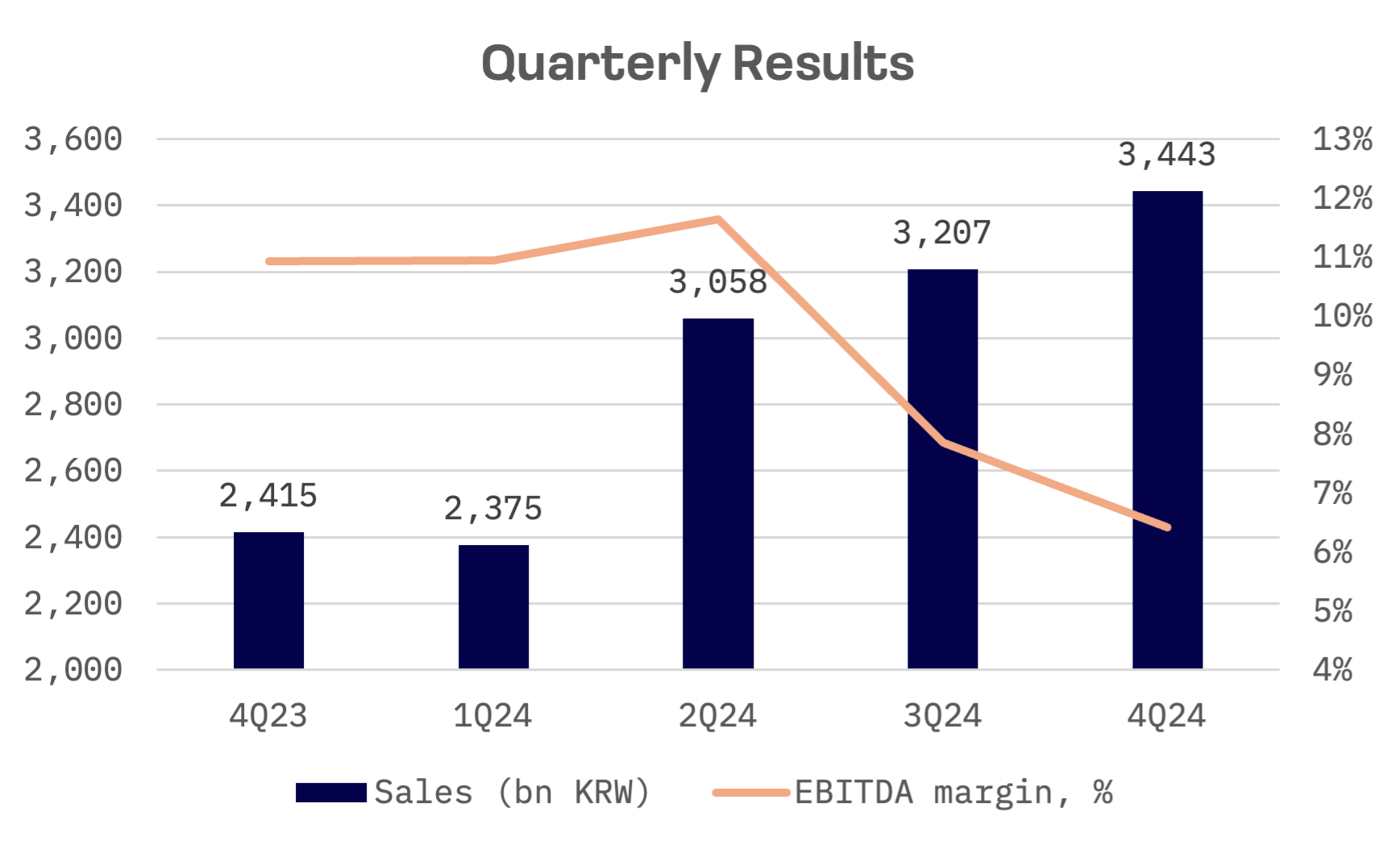

Despite rising metal prices, increased zinc and lead sales volumes and a strong dollar driving revenue growth in 2024, Korea Zinc posted a net loss of ₩225.2 billion in the fourth quarter. This marked a striking reversal from the ₩193 billion profit recorded during the same period a year earlier. The company’s fourth quarter revenue jumped 42.6% year-over-year to ₩3.44 trillion, but profitability suffered due to escalating maintenance costs and adverse foreign exchange movements.

Context of the Control Battle and Key Players

Tensions have been building as Young Poong Group’s growing influence created friction with CEO Choi Yoon-beom. The situation reached a breaking point when Korea Zinc halted the processing of sulfuric acid byproducts from Young Poong’s Seokpo smelter, citing safety concerns and cost issues. This decision catalysed the current power struggle, dividing key stakeholders into opposing camps:

- Choi Family and Current Management: Chairman Choi leads efforts to maintain the family’s historical control and strategic vision for Korea Zinc. His faction portrays the company as a national industrial champion and warns that a takeover by MBK Partners could lead to short term decision making and asset sales.

- Young Poong Group: As Korea Zinc’s largest single shareholder and former close business partner, Young Poong now seeks to reassert its influence. The group has criticised management’s operational and financial decisions while advocating for measures to enhance shareholder value.

- MBK Partners: This regional private equity firm has aligned with Young Poong to challenge the current leadership. MBK aims to revamp corporate governance and boost returns to shareholders, arguing that the existing board inadequately represents investor interests.

- Bain Capital: Emerging as the Choi family’s key ally, this global private equity firm has reinforced management’s defensive position. In October 2024, Bain Capital acquired a 1.41% stake in Korea Zinc through a public tender offer.

| Key Player | Estimated Stake | Primary Objectives | Key Tactics Used |

| Choi Family & Management | 34.35% | Maintain control, long term growth, national strategic importance | Share buybacks, cross shareholding structures, legal challenges |

| Young Poong-MBK alliance | 40.97% | Regain influence, improve financial situation, enhance shareholder returns and diversify business | Tender offers, seeking court injunctions, nominating new board members, public criticism of management |

Timeline of Key Events

Over the past year, the fight for control of Korea Zinc has unfolded in a series of swift and consequential developments, each reshaping the balance of power:

- September 2024: The Young Poong-MBK alliance escalated the conflict by launching a $1.7 billion tender offer to increase its ownership stake. Management countered with a share buyback program.

- October 2024: The alliance secured an additional 5.3% ownership through its tender offer, intensifying pressure on Chairman Choi’s team. Korea Zinc announced its own tender offer in response. Simultaneously, the Financial Supervisory Service (FSS) initiated accounting audits of both Korea Zinc and Young Poong, prompted by the dispute and allegations of potential accounting irregularities.

- November 2024: South Korea’s Supreme Court ordered the temporary closure of Young Poong’s Seokpo smelter due to unauthorised wastewater discharges, potentially weakening Young Poong’s overall position in the control battle. Meanwhile, Korea Zinc cancelled a controversial share sale amid growing scrutiny, while Choi relinquished his board chairmanship but maintained his CEO role.

- December 2024: The Young Poong-MBK alliance strengthened its position by expanding its combined stake to 40.97%.

- January 2025: South Korea’s National Pension Service reduced its Korea Zinc holdings from 7.49% to 4.51%, potentially altering voting dynamics. At an extraordinary shareholders’ meeting, Korea Zinc’s management blocked Young Poong’s voting rights by citing a newly established cross shareholding structure. Management’s board nominees were elected, though the company later indicated some willingness to negotiate.

- February 2025: The Young Poong-MBK alliance submitted formal shareholder proposals ahead of the March annual general meeting, seeking governance reforms and higher shareholder returns. The alliance urged regulatory authorities to investigate alleged illegal shareholder activities by Korea Zinc’s management. Young Poong also initiated a shareholder derivative lawsuit against top executives, alleging financial mismanagement and seeking significant damages.

- March 2025: A Seoul court overturned key resolutions from January’s extraordinary meeting, boosting the alliance’s prospects for securing board control. Korea Zinc’s Australian subsidiary, Sun Metal Holdings, responded by acquiring a 10.3% stake in Young Poong to limit its voting rights. Proxy advisory firm ISS recommended against all of Choi’s board nominees, instead supporting the Young Poong-MBK slate. This week, the U.S. State Department confirmed it is monitoring MBK Partners’ bid closely. The scrutiny follows warnings from Republican Rep. Zach Nunn, who suggested the deal could increase China’s influence over critical mineral supply chains, raising risks of economic coercion and technology leakage.

Financial Markets Implications

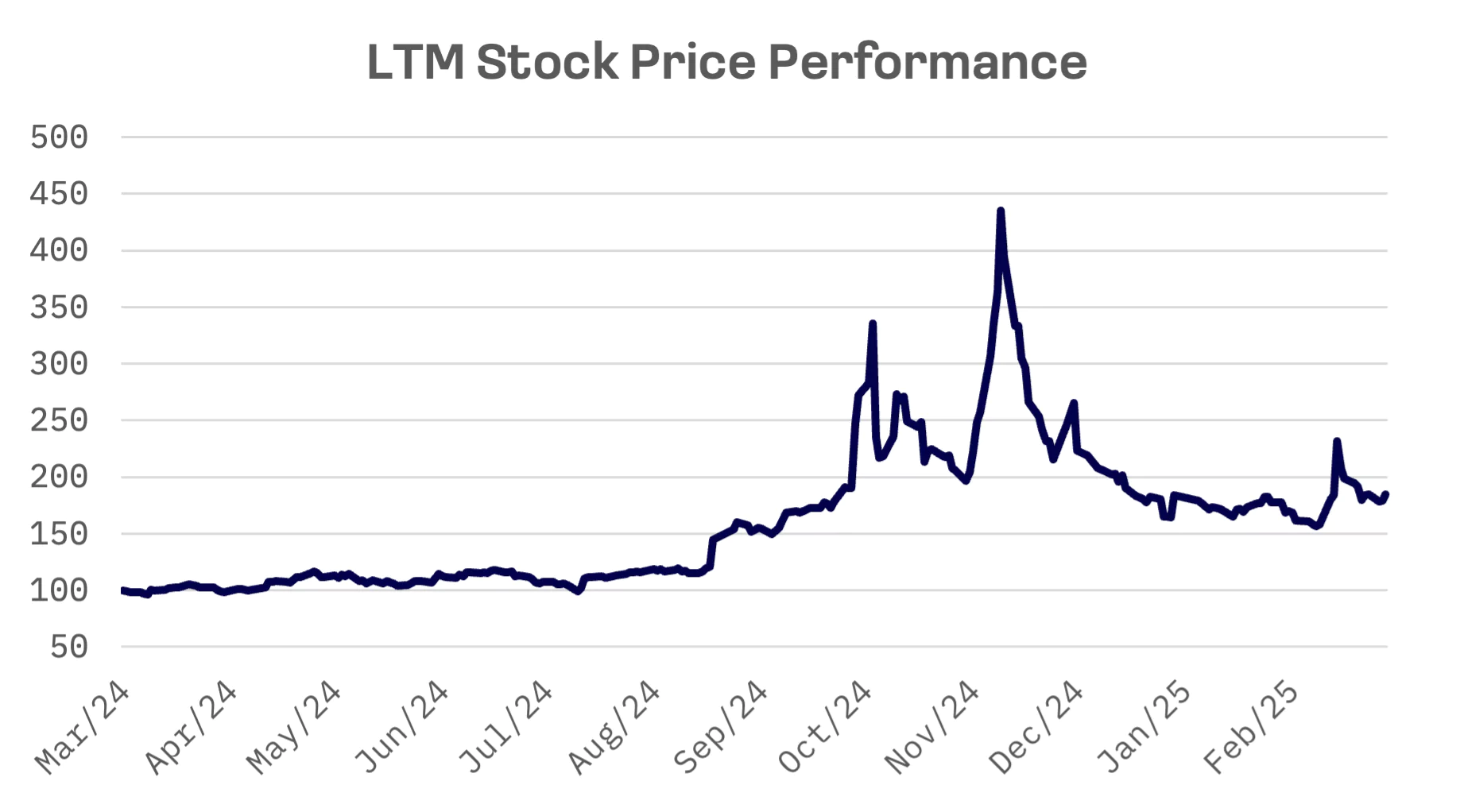

The protracted control battle has raised concerns that Korea Zinc’s aggressive share repurchases could deplete its financial resources and constrain future investments in growth initiatives and innovation. The power struggle has also triggered significant volatility in the company’s stock price, with major fluctuations corresponding to developments in the control contest.

Outlook

The battle for Korea Zinc appears to have reached a pivotal juncture. The recent Seoul court ruling has substantially undermined Choi’s position, potentially clearing a path for the Young Poong-MBK alliance to secure a board majority at the annual general meeting scheduled for March 28. The meeting agenda encompasses seven key items, including proposals to cap the number of directors, install an outside director as board chairman and implement quarterly dividend payments.

Several scenarios could emerge from the upcoming meeting:

- Alliance Victory: If Young Poong-MBK secures board control, the new leadership is expected to implement governance reforms and expand the company’s presence in the green economy.

- Management Retention: Despite recent setbacks, Choi’s team might preserve their authority, likely extending the dispute through additional legal challenges and shareholder confrontations.

- Negotiated Settlement: Though improbable given the entrenched positions and aggressive tactics displayed by both sides, a power sharing arrangement remains a remote possibility.

Even without a definitive resolution at the annual meeting, either faction could convene additional extraordinary sessions to continue the fight for control. While momentum currently favours the Young Poong-MBK alliance, Korea Zinc’s management shows no indication of conceding, suggesting a prolonged and high stakes contest. Ironically, the battle’s destructive intensity may mean that neither side emerges as a true victor, given the substantial damage already inflicted on the company’s reputation and potentially its operational capabilities.

UPDATE (as of March 29, 2025):

Choi secured approval for key proposals at the March 28 shareholder meeting, including a cap on the board’s size at 19 directors and the appointment of five new directors aligned with his faction.

Choi’s management gained a voting advantage by limiting Young Poong’s influence through a cross shareholding strategy, acquiring shares in Young Poong through its wholly owned Australian subsidiary, Sun Metals Holdings, shortly before the meeting.

Following the board reshuffle, Choi’s faction now holds 11 seats, while his rivals control four.

The seven month long dispute appears far from over, with MBK indicating plans to contest the meeting’s outcome. “We will immediately appeal and seek to suspend the results of the shareholders meeting, which we believe were distorted by limitations on Young Poong’s voting power, and will seek to rectify this in court,” the alliance said in a statement.