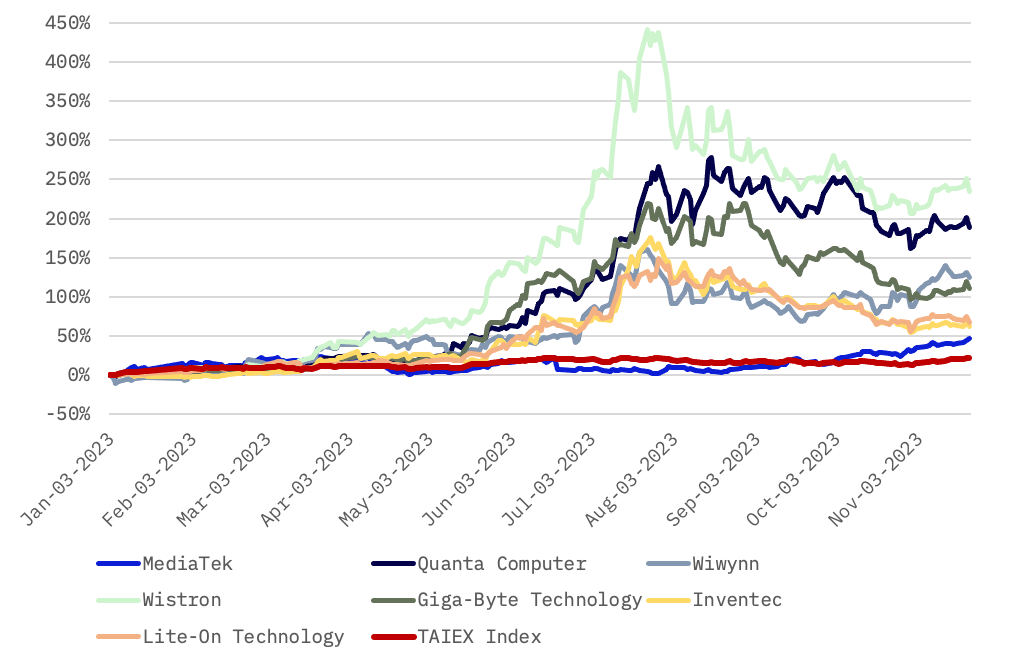

In 2023, Taiwan’s stock market has seen a significant surge, particularly in AI-related stocks, with the TAIEX index reaching its highest point since April 2022. This growth is largely driven by the burgeoning AI sector, reflecting increasing investor interest in its potential.

The AI market, driven by consumer-oriented generative AI programs such as OpenAI’s ChatGPT and Google’s Bard, is poised for exponential growth. Bloomberg Intelligence projects that generative AI will expand its impact from less than 1% to 10% by 2032, across diverse sectors including IT hardware, software services, advertising spending, and gaming market spending. This growth trajectory encompasses various facets of the hardware sector, with specific revenue projections for AI servers ($132 billion), AI storage ($93 billion), computer vision AI products ($61 billion), and conversational AI devices ($108 billion), all heavily reliant on AI chips.

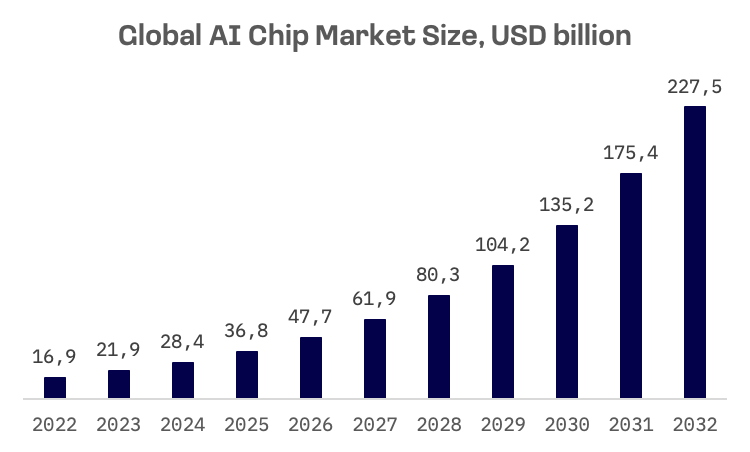

The global AI chip market, valued at $17 billion in 2022, is projected to soar to approximately $227 billion by 2032. This represents a remarkable compound annual growth rate (CAGR) of 29.72%, underscoring the accelerating demand within the AI chip sector.

Taiwan, home to some of the world’s premier semiconductor and technology companies, plays a pivotal role in the global tech supply chain and well-positioned to capitalize on the AI boom. At the forefront is Taiwan Semiconductor Manufacturing Company (TSMC), the world’s largest independent manufacturer of semiconductor chips. TSMC’s expertise in fabricating chips, which power leading-edge technologies for prominent clients such as Nvidia, positions it as a vital contributor to the advancement of generative AI.

This report, however, shines a spotlight on other key players in Taiwan’s AI sector:

| Company Name | Brief Description | Market Cap, $ mn | JAKOTA Indices Presence |

| MediaTek | AI-powered chipsets for mobile device | 47,786.0 | Blue Chip 150, Semicon 75, Tech 350 |

| Quanta Computer | AI servers | 25,610.8 | Blue Chip 150 |

| Wiwynn | AI servers | 10,168.4 | M&S Cap 2000, Tech 350 |

| Wistron | AI servers | 8,836.4 | M&S Cap 2000 |

| Lite-On Technology | Power management solutions for AI applications | 7,863.5 | M&S Cap 2000 |

| Inventec | AI servers | 4,841.6 | M&S Cap 2000 |

| Giga-Byte Technology | Graphics card for AI applications | 4,730.2 | M&S Cap 2000 |

These stocks have significantly outperformed the TAIEX index in 2023. Despite a peak in June-July, four of these companies have seen their share values increase by over 100% year-to-date. In August, there was a slowdown, with foreign investors transitioning to net sellers amid a cooling AI market.

Financially, MediaTek stands out with the highest EBITDA and EBITDA margin, despite experiencing the most substantial decline in total revenues over the past year.

| Company Name | LTM Total Revenue | LTM Total Revenues, One Year Growth % | LTM EBITDA | EBITDA margin, % | LTM EPS |

| MediaTek | 13,131.9 | -27.6% | 2,596.1 | 19.8% | 1.4 |

| Quanta Computer | 35,813.3 | -13.1% | 1,635.4 | 4.6% | 0.31 |

| Wiwynn | 8,629.4 | 3.2% | 550.9 | 6.4% | 2.26 |

| Wistron | 28,692.5 | -8.5% | 1,218.5 | 4.2% | 0.13 |

| Lite-On Technology | 4,924.1 | -11.7% | 579.5 | 11.8% | 0.21 |

| Inventec | 16,616.7 | -6.1% | 302.5 | 1.8% | 0.05 |

| Giga-Byte Technology | 3,791.5 | 8.2% | 153.1 | 4.0% | 0.23 |

In terms of the EV/Sales ratio, MediaTek is the leader. Giga-Byte Technology, the smallest in market capitalization, excels in EV/EBITDA and P/EPS metrics.

| Company Name | TEV/Total Revenues LTM | TEV/EBITDA LTM | P/EPS LTM |

| MediaTek | 3.5x | 17.3x | 21.5x |

| Quanta Computer | 0.7x | 15.1x | 21.1x |

| Wiwynn | 1.2x | 18.0x | 25.7x |

| Wistron | 0.4x | 9.5x | 23.1x |

| Lite-On Technology | 1.2x | 10.1x | 16.6x |

| Inventec | 0.3x | 17.0x | 27.5x |

| Giga-Byte Technology | 1.1x | 25.8x | 31.7x |

| MEAN | 1.2x | 16.1x | 23.9x |

| MEDIAN | 1.1x | 17.0x | 23.1x |

Established in 1986, Giga-Byte Technology primarily focuses on motherboards. However, the company is also a well-recognized brand for graphic cards utilized in AI applications and actively manufactures AI training and inference servers. Following a 12% sales downturn in 2022, Giga-Byte Technology has experienced a significant rebound, projecting a return to double-digit growth. By the end of 2023, the company is expected to achieve sales totaling 132 billion TWD, marking a substantial 23.5% increase compared to the previous year.

Giga-Byte Technology: Key financial indicators, TWD million

| For the Fiscal Period Ending | 12 months Dec-31-2020A | 12 months Dec-31-2021A | 12 months Dec-31-2022A | LTM 12 months Sep-30-2023A | 12 months Dec-31-2023E |

| Total Revenue | 84,602.8 | 121,905.4 | 107,263.6 | 118,976.8 | 132,442.7 |

| Growth Over Prior Year | 36.9% | 44.1% | (12.0%) | 8.2% | 23.47% |

| Gross Profit | 14,464.4 | 29,590.0 | 16,616.1 | 14,144.7 | – |

| Margin % | 17.1% | 24.3% | 15.5% | 11.9% | 12.82% |

| EBITDA | 4,817.5 | 15,059.4 | 6,465.1 | 4,805.2 | 6,333.14 |

| Margin % | 5.7% | 12.4% | 6.0% | 4.0% | 4.78% |

| EBIT | 4,217.8 | 14,486.5 | 5,845.2 | 4,116.8 | 5,458.79 |

| Margin % | 5.0% | 11.9% | 5.4% | 3.5% | 4.12% |

| Earnings from Cont. Ops. | 4,331.2 | 13,335.1 | 6,534.8 | 4,710.9 | – |

| Margin % | 5.1% | 10.9% | 6.1% | 4.0% | – |

| Net Income | 4,374.3 | 13,338.0 | 6,538.5 | 4,713.7 | 4,893.0 |

| Margin % | 5.2% | 10.9% | 6.1% | 4.0% | 3.69% |

| Diluted EPS Excl. Extra Items | 6.79 | 20.6 | 10.12 | 7.37 | 7.7 |

| Growth Over Prior Year | 124.8% | 203.4% | (50.9%) | (46.8%) | (25.18%) |

The surge in AI-related stocks on the Taiwan stock market is a testament to the nation’s capacity for adaptation, innovation, and success in the ever-changing global economic scene. Taiwan distinguishes itself not only as a manufacturing stronghold but also as a driving force in the next generation of technological advancements, particularly in artificial intelligence. This trend is exemplified by companies like Ever Fortune.AI (TPEX:6841), which is revolutionizing the healthcare industry with advanced digital solutions. Leveraging the latest in artificial intelligence and big data analysis, Ever Fortune.AI is committed to improving patient outcomes. With a market capitalization of approximately $200 million and not yet part of the JAKOTA indices, the company’s rapid growth in the expanding AI sector suggests its inclusion could be on the horizon.