Asian stock markets faced a dramatic downturn today, with significant declines in Japan, South Korea, and Taiwan. The widespread sell-off was fueled by fears of a potential U.S. recession, concerns over tech sector overvaluation, and the Bank of Japan’s unexpected interest rate hike.

Japan’s Nikkei 225 index experienced its most severe two-day decline ever, falling to its lowest levels in months. Similarly, South Korea’s Kospi index suffered its steepest drop since the 2008 financial crisis. Meanwhile, Taiwan’s Taiex index recorded its largest one-day percentage loss in history.

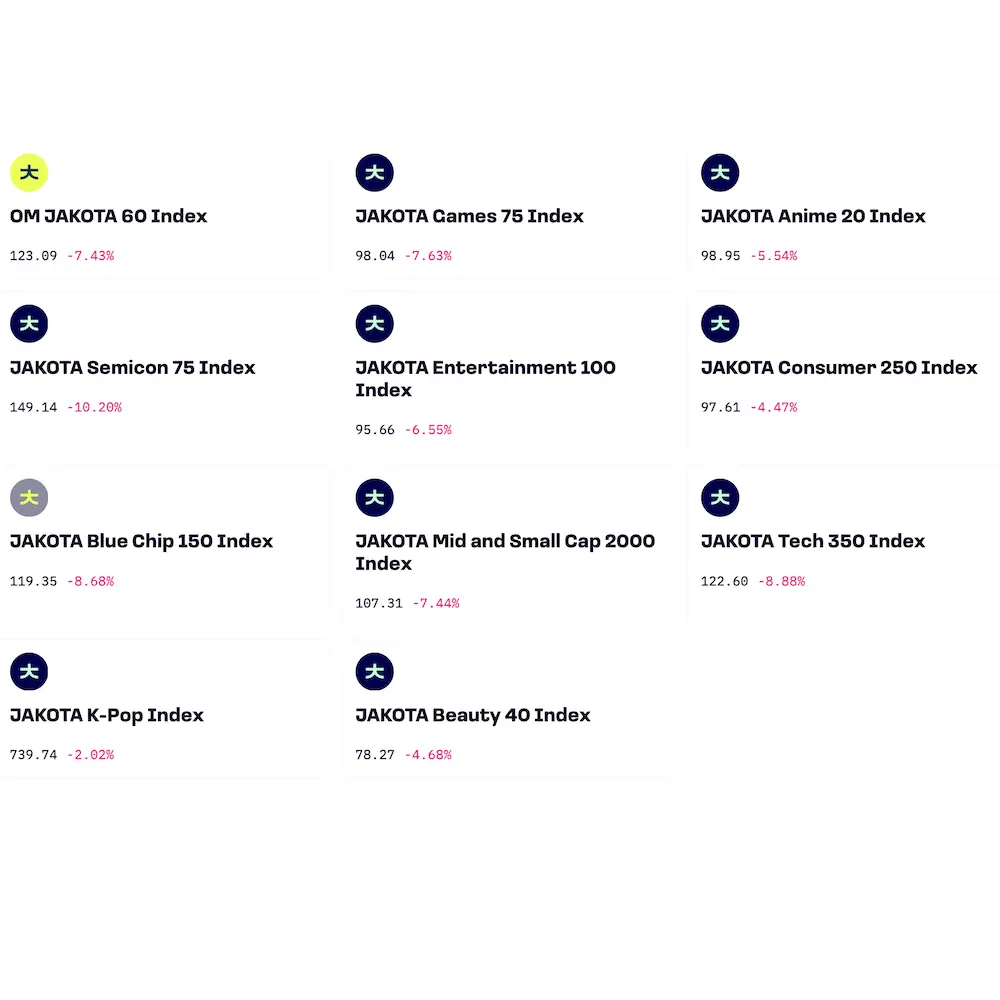

The technology sector was hit hardest, as investors reevaluated the soaring valuations of tech stocks amid the recent artificial intelligence boom. Shares of major tech companies across the region fell sharply, reflecting growing caution among investors.

The full impact of this market turbulence is still unfolding, but it underscores the global economy’s vulnerability to multiple challenges. With potential recessionary pressures and ongoing geopolitical tensions, market volatility is expected to remain high in the near term. Investors will likely stay on edge as they navigate these uncertainties, with broader implications for global economic stability.