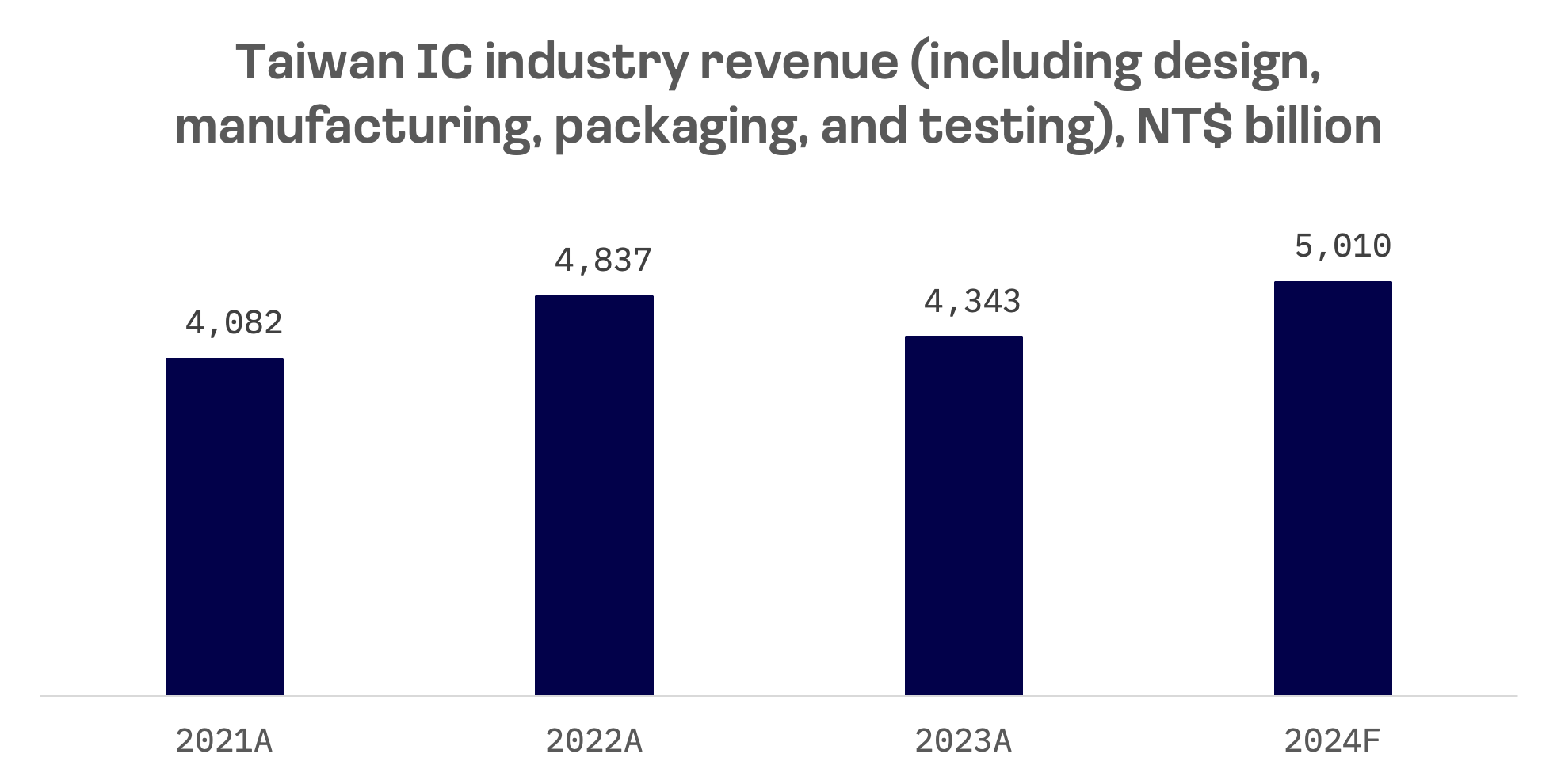

Taiwan’s semiconductor industry, a linchpin of the global technology supply chain, is poised to reach record production values in 2024, driven by robust demand for artificial intelligence and diminishing impacts from inventory adjustments. This forecast comes from the government-affiliated Industrial Technology Research Institute (ITRI).

Despite this optimistic outlook, the sector confronts a critical labour shortage, exacerbated by the nation’s low birth rate and aging population. Taiwan is currently experiencing the largest labour shortfall in its history, with the 104 Job Bank noting a striking mismatch: 1.078 million job openings released by 56,000 companies versus only 595,000 job seekers.

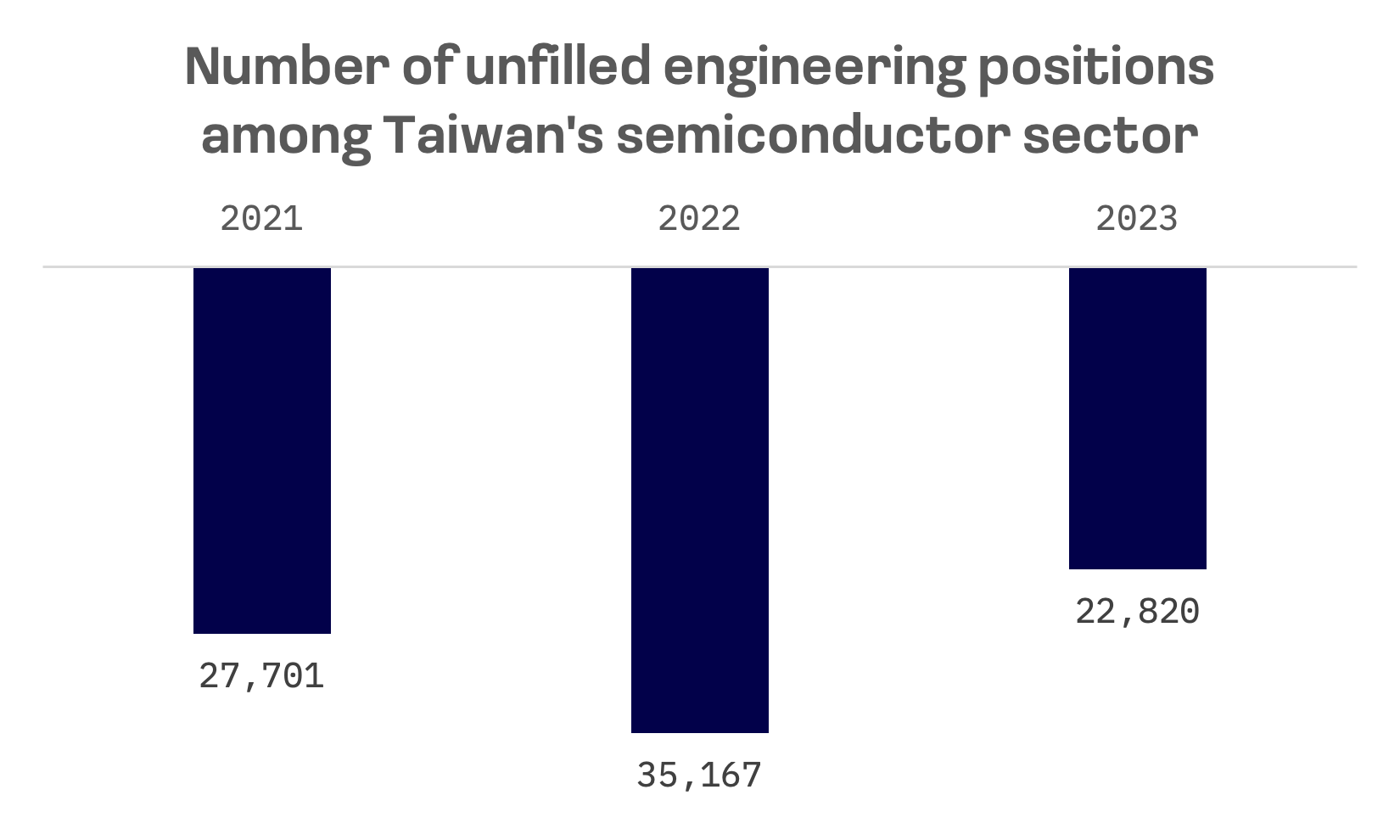

Over the past three years, Taiwan’s chip industry has consistently struggled to fill engineering positions across the supply chain. In 2021, there were 27,701 unfilled engineering roles, marking a 44% increase compared to the second quarter of 2020. The situation deteriorated further in 2022, with 35,167 unfilled positions in the first quarter, a 40% rise from the same quarter the previous year.

Despite a global market contraction for chips from the third quarter of 2022 to the second quarter of 2023, which temporarily reduced workforce demand, the talent shortage persisted. Taiwan reported 22,820 unfilled engineering positions during this period.

According to industry experts, the long hours and demanding work in the semiconductor sector are deterring the younger generation, who increasingly prefer careers that offer a better work-life balance. Chen Shu-chu, Deputy Director-General of the Hsinchu Science Park Bureau, notes, “Working in the semiconductor industry is tough because production does not stop. We do not follow office hours and often work overtime. Hence, few university graduates are willing to enter this industry.”

The semiconductor industry’s dependence on overtime work highlights the pressing need to tackle the labour shortage. In 2021, overtime hours per person per month in the manufacturing sector averaged 15 to 16 hours, with an annual increase of 2.2 hours recorded in January 2024.

These factors create a significant challenge for the Taiwanese government and tech enterprises in attracting new talent to the industry. Addressing this issue is crucial for Taiwan’s economic growth and the continued success of its semiconductor sector.

Recent government initiatives focus on recruiting foreign talent to address labour shortages:

- The Ministry of Economic Affairs (MOEA) has developed plans to recruit professionals from Southeast Asia for its semiconductor sector. These endeavors are aimed at strengthening Taiwan’s semiconductor industry by attracting talent from countries such as the Philippines, Malaysia, Indonesia and Vietnam.

- In February 2024, Taiwan and India inked a memorandum of understanding aimed at facilitating the entry of Indian migrant workers, addressing Taiwan’s labour shortage across various sectors including manufacturing, construction, and agriculture. In May, it was mutually decided that the manufacturing sector would be prioritized for recruitment efforts.

The National Science and Technology Council (NSTC) allocated 35 billion Taiwanese dollars ($1.1 billion) for the “2025 Top-Down Semiconductor Plan” in 2021, aimed at establishing various programs to support semiconductor talent. Legislative briefings in 2023 revealed that these initiatives resulted in the training of 848 master’s and 241 PhD-level students. Additionally, the NSTC-owned Taiwan Semiconductor Research Institute annually supports 2,100 high-level semiconductor talents.

Furthermore, in a significant expansion of this strategy, the Taiwanese government intensified its investment in supporting semiconductor talent. In November 2023, the Executive Yuan unveiled the “Chip-based Industrial Innovation Program (CBI).” This initiative is expected to inject NT$300 billion ($10 billion) over the next decade. The program aims to integrate generative AI and chip technologies for industrial innovation, enhance the environment for international talent, expedite industrial innovation and attract foreign investment.

Besides, experts suggest adopting strategies from Nordic countries like Sweden and Denmark, advocating for the implementation of phased retirement plans. This approach entails allowing older employees to work part-time while offering subsidies and enabling them to withdraw part of their retirement funds before reaching the age of 65. These measures aim to ensure that their income remains comparable to what they would earn if working full-time. There is significant potential in adopting such measures, particularly considering official statistics. In 2021, the labour force participation rate for individuals aged 65 and older stood at 25.6% in Japan, 36.3% in South Korea, and a mere 9.2% in Taiwan.

Semiconductor companies are also citing labour shortage as one of biggest challenges and implementing measures to address the crisis.

Lora Ho, TSMC’s senior vice president of human resources, highlighted the talent scarcity as a core challenge. With a workforce expected to grow from 77,000 to 100,000, TSMC has established the Newcomer Training Center to facilitate the onboarding and training of engineers, bolstering its global strategy. Presently, all new engineers based in Taiwan, as well as some overseas hires, are mandated to undergo an eight-week training program at the center.

Despite these measures, the underlying cause of the labour shortage — Taiwan’s low birth rate — remains a formidable obstacle. High property prices, stagnant wage growth relative to inflation and demanding work schedules discourage family planning, underscoring the need for effective governmental interventions to reverse these trends and ensure the industry’s sustainability.