The transportation giant operates through three main business segments:

- Its core transportation division manages an extensive subway network primarily serving the Tokyo metropolitan area, including train operations and railroad facility maintenance.

- The real estate arm focuses on creating synergies with railroad operations, leasing office buildings and hotels – such as the Shibuya Mark City complex, situated along Tokyo Metro’s rail lines.

- A third segment handles distribution and advertising, managing commercial facilities like Echika, located in stations along Tokyo Metro’s routes; overseeing advertising within stations and trains; providing optical fibre leasing and telecommunications services.

The company’s rail network, one of the world’s most efficient subway systems, comprises nine lines extending over 195 kilometres with more than 180 stations throughout Tokyo. In the fiscal year ended March 2023, Tokyo Metro transported 2.38 billion passengers, securing its position as Japan’s second busiest rail operator after East Japan Railway.

The IPO represents the culmination of the Japanese government’s long term privatisation strategy. The transformation of the former Teito Rapid Transit Authority (TRTA) into Tokyo Metro was designed to enhance the subway system’s appeal for privatisation. Both the central government, which held a 53.4% stake, and the Tokyo Metropolitan Government, which owned 46.6%, sold half their shares in the offering.

Strong investor appetite drove pricing to ¥1,200 per share, at the upper end of the ¥1,100 to ¥1,200 provisional range. The offering’s dividend yield of 3.3%, based on a projected ¥40 per share payout for fiscal 2025, stands out among private and JR railways.

Demand proved exceptionally robust. Reuters reported the IPO was more than 15 times oversubscribed overall, with retail investors’ portion seeing 10 fold demand. The institutional tranches saw even stronger interest — domestic institutions’ 1.5% allocation was oversubscribed by more than 20 times, while foreign investors’ 20% portion saw a more than 30 fold demand.

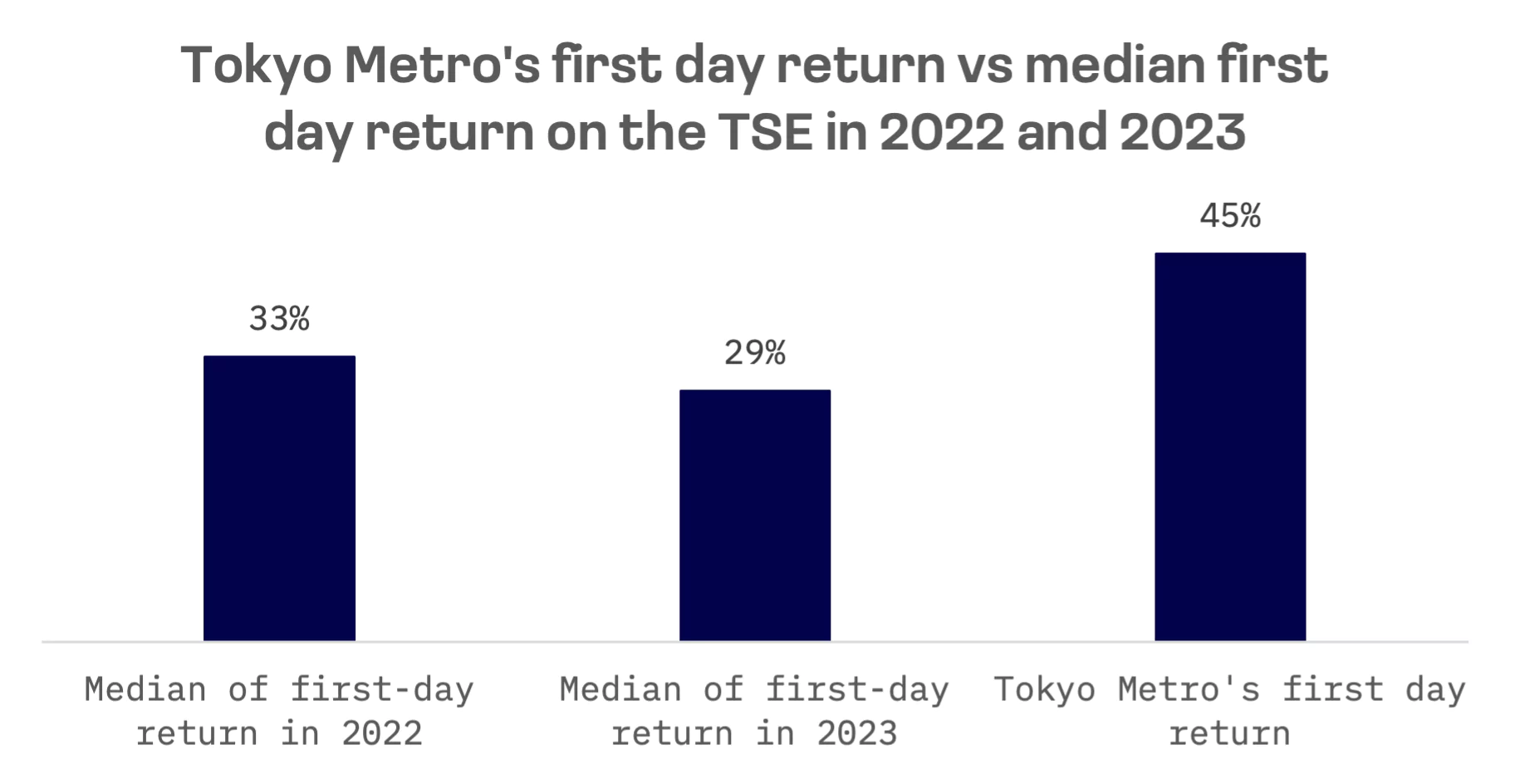

Trading under TSE:9023, Tokyo Metro shares demonstrated strong momentum on their debut, surging 45% from the initial offering price of ¥1,200 to close at ¥1,739 after opening at ¥1,630. This performance surpasses the median first day returns for Jakota market IPOs in both 2022 and 2023.

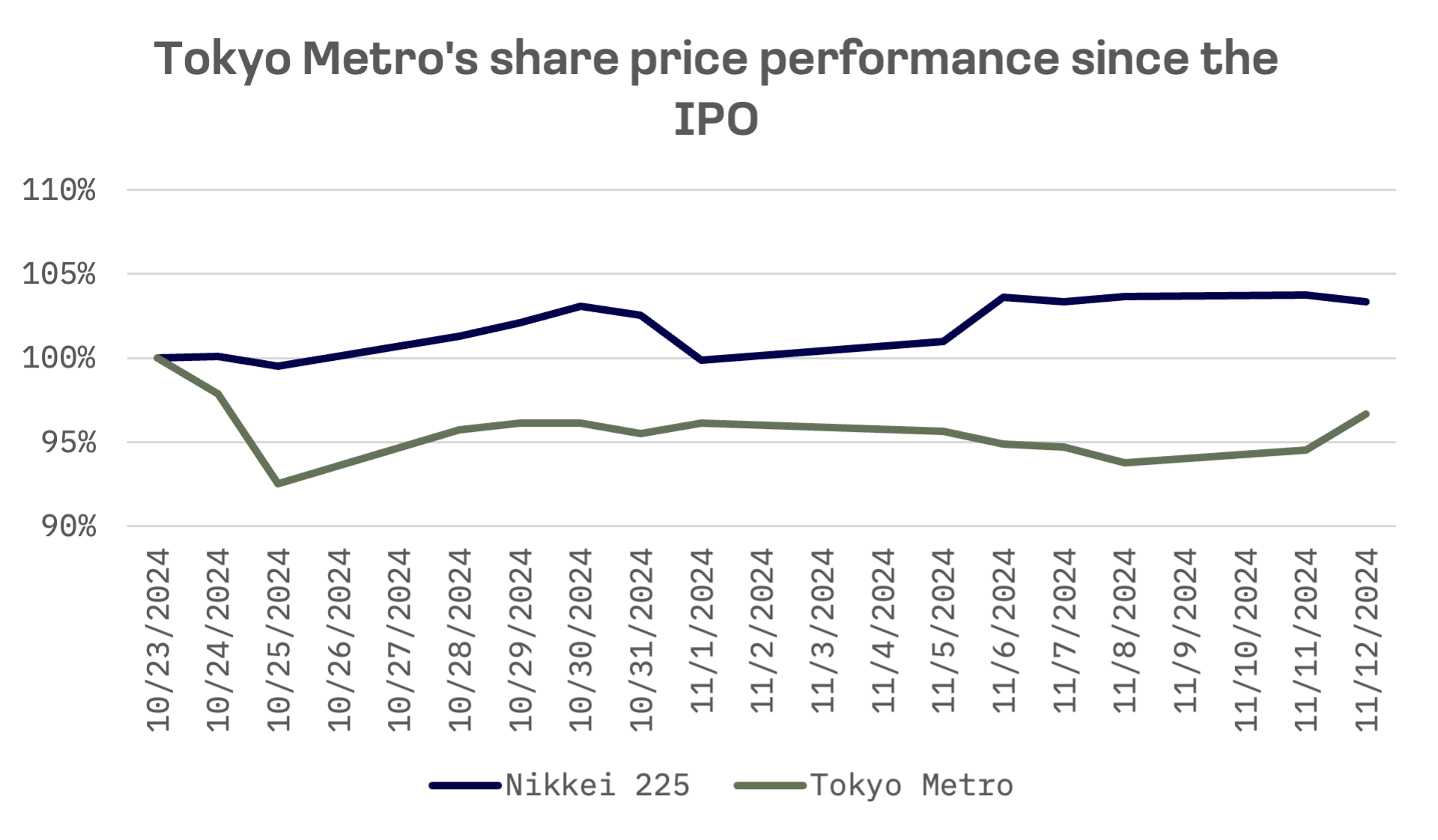

While the stock has since underperformed the Nikkei 225, it has maintained stability around ¥1,680, close to its first day closing price.

The company’s financial performance shows significant strength. Revenue grew 13% in the fiscal year ended March 2024, while operating income surged 175% to ¥76 billion.

Tokyo Metro: Key financial indicators, ¥ million

| 2023 FY ending March 31, 2023 | 2024 FY ending March 31, 2024 | LTM ending June 30, 2024 | |

| Revenue | 345,370 | 389,267 | 395,390 |

| Operating Income | 27,778 | 76,359 | 83,692 |

| EBITDA | 85,102 | 151,629 | 100,561 |

| Net Income | 27,771 | 46,262 | 51,220 |

| Basic EPS | 31.87 | 53.08 | 58.77 |

In Japan’s urban transportation sector, Tokyo Metro’s peer group includes Hankyu Hanshin Holdings and Seibu Holdings, both constituents of the JAKOTA Mid and Small Cap 2000 Index. While these companies focus more on connecting suburban and intercity areas to major urban centres, they provide relevant comparisons due to similar market capitalisations.

| Company Name | TSE Ticker | Market Cap, JPY | EV/Sales | EV/EBITDA | P/E |

| Hankyu Hanshin Holdings | 9042 | 958B | 1.98x | 21.23x | 13.07x |

| Seibu Holdings | 9024 | 994B | 3.53x | 29.88x | 32.53x |

| Tokyo Metro | 9023 | 977B | 5.10x | 23.68x | 19.07x |

| AVERAGE | 976B | 3.54x | 24.93x | 21.56x | |

| MEDIAN | 977B | 3.53x | 23.68x | 19.07x |

Despite the significant post IPO price appreciation, Tokyo Metro’s valuation metrics remain reasonable. The company’s EV/EBITDA and P/E multiples align with peer group averages, while it outperforms competitors on an EV/Sales basis.

Looking ahead, Tokyo Metro’s strategic outlook remains positive, despite potential growth constraints in its core rail and real estate businesses. The company’s strategic position in central Tokyo, where population and development are projected to expand through 2035, provides a stable demand foundation. Future growth will likely depend on the company’s ability to leverage its established rail operations to drive expansion in non rail sectors.