Taiwan isn’t just a semiconductor powerhouse – it’s also a major force in the global footwear supply chain. The Taiwanese footwear industry launched its international expansion well before Taiwan’s now dominant semiconductor and ICT sectors achieved global prominence. Yet the transformation of Taiwan’s footwear industry from a manufacturing powerhouse into a strategic hub for sourcing, design and R&D took decades of structural adaptation.

In the 1970s and 1980s, low wages and a skilled workforce helped propel Taiwan to become the world’s second largest footwear exporter, producing 1.8 billion pairs annually by 1987. At its peak, more than 1,400 manufacturers operated there.

Rising labour costs, workforce shortages and a nearly 50% appreciation of the New Taiwan dollar between 1985 and 1989 eroded margins and forced companies to relocate production to lower cost countries. This shift ushered in a new model: while design, procurement and order management remained in Taiwan, manufacturing moved offshore to high efficiency factories. The transition cemented Taiwan’s role as a global supply chain hub and a key player in third party contract manufacturing. Today, Taiwanese firms operate as both original equipment manufacturers (OEM) and original design manufacturers (ODM), producing footwear for major global brands including Nike, Adidas, New Balance and Reebok.

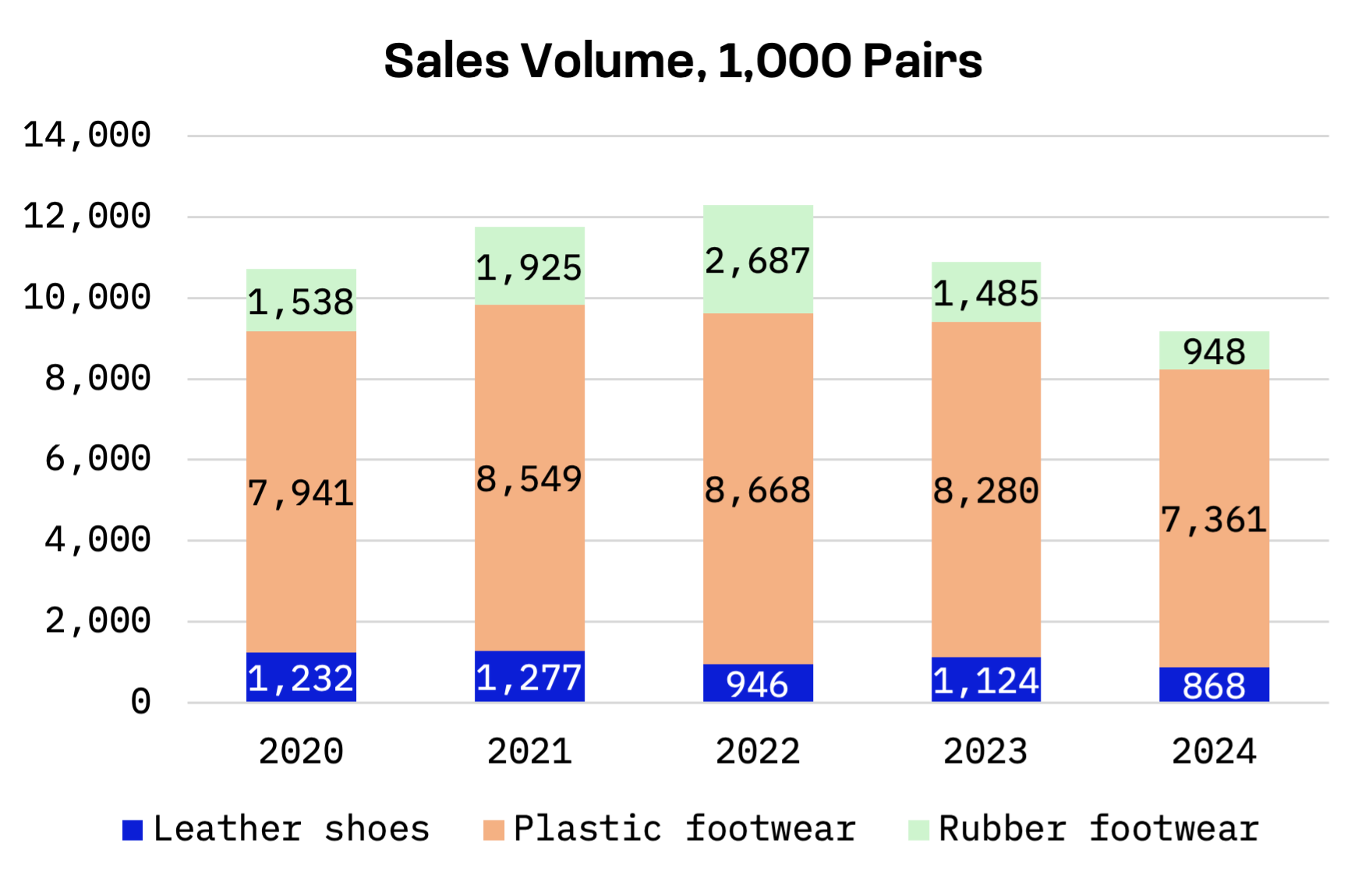

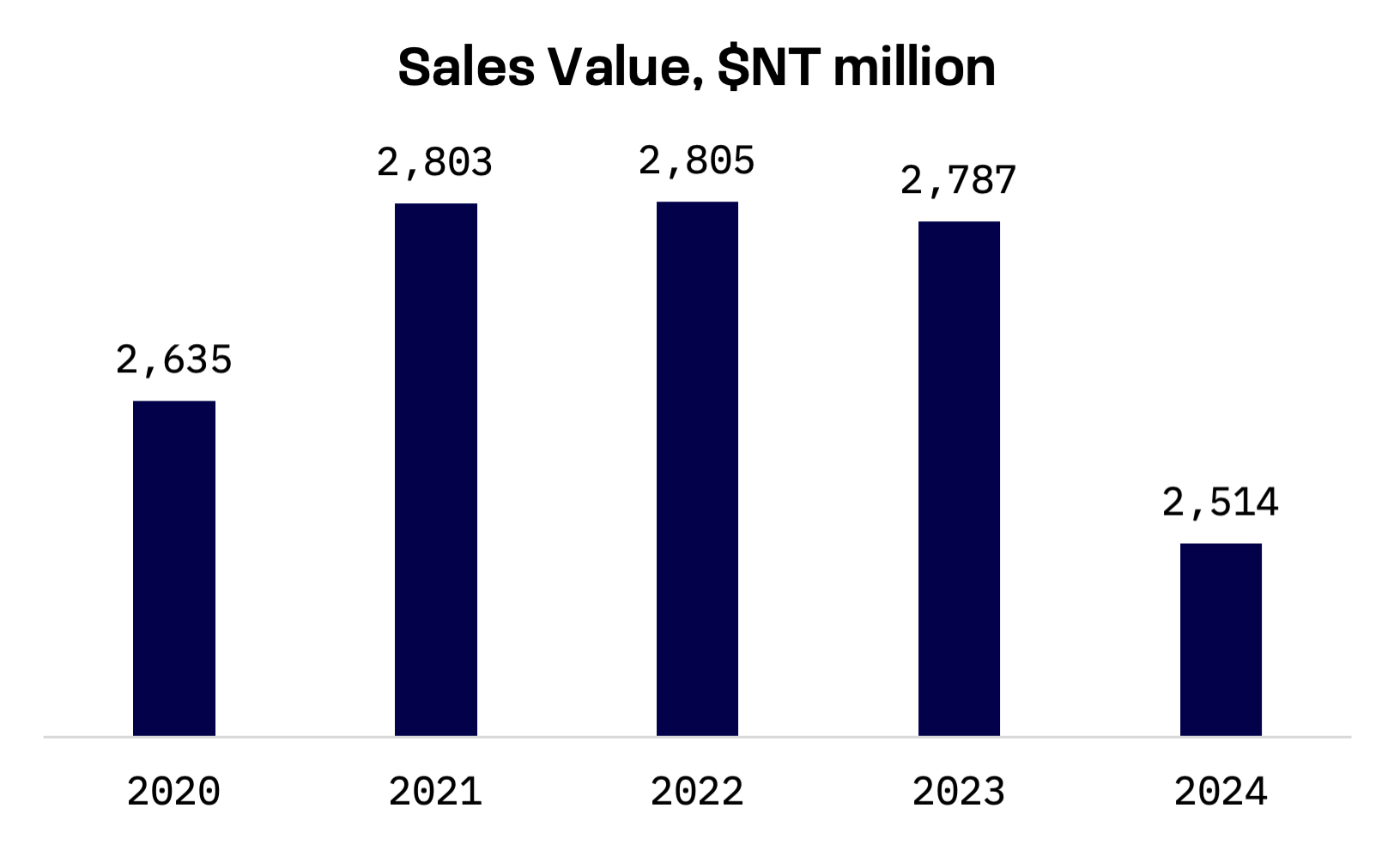

The plastic footwear segment continues to dominate Taiwan’s footwear industry, with the island maintaining its status as a key player in the global athletic footwear market, particularly in plastic based sports shoe manufacturing. However, both sales volume and value across Taiwan’s entire footwear sector declined in 2023 and 2024, driven mainly by the relocation of production to lower cost countries. The current push into India and Indonesia marks the fourth wave of overseas expansion by Taiwan’s footwear manufacturers. Every decade, Taiwan’s shoe industry has sought new production frontiers to stay ahead of margin pressure and shifting cost dynamics. In the 1980s, manufacturers expanded into Thailand and the Philippines. The 1990s brought a migration to China’s Guangdong, Guangxi and Fujian provinces as the mainland opened to foreign investment. In the 2000s, Taiwan’s footwear industry further diversified within China and made significant investments in Vietnam.

The primary destinations for Taiwan’s direct footwear exports include the U.S., Hong Kong, China, Spain and Japan.

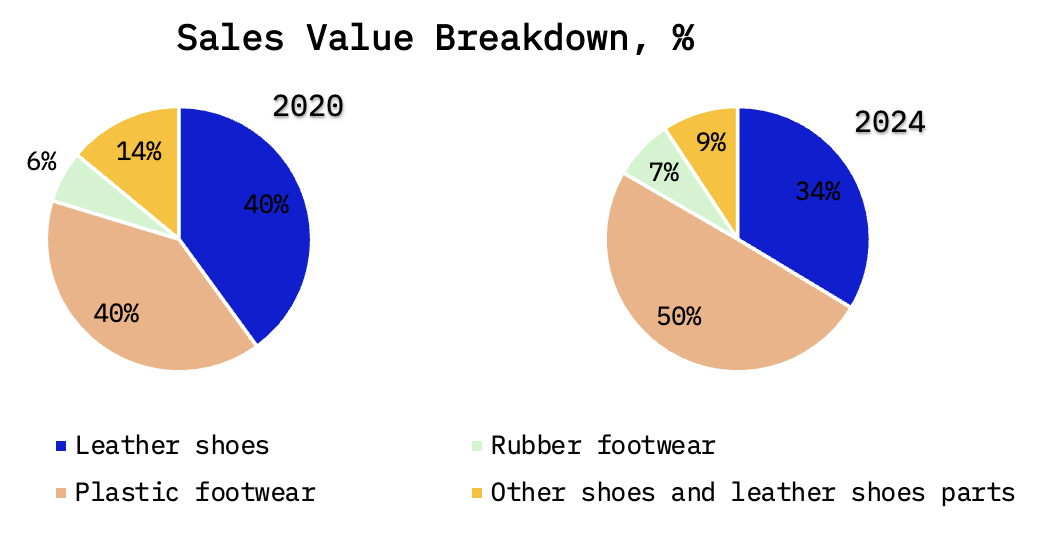

Meanwhile, the leather shoe market share has continued to erode. In 2020, leather and plastic footwear each held roughly 40% of the Taiwan footwear market, but by 2024, the plastic footwear share had risen to 50% while leather shoes slipped to 34% – ground largely ceded to the expanding plastic segment.

Pou Chen and Feng Tay Enterprises are two cornerstone players in Taiwan’s footwear industry. Pou Chen, the world’s largest manufacturer of branded athletic and casual footwear, combines extensive manufacturing capabilities with a significant sportswear retail operation, creating a diversified business model that cushions it against market volatility. Feng Tay, by contrast, pursues a strategy of focused specialisation and vertical integration, anchored by its long term, strategic partnership with Nike. The company leverages advanced R&D and automation to drive operational efficiency and boost profitability. Both companies are constituents of the JAKOTA Mid and Small Cap 2000 Index:

| Company Name | Ticker | Primary Business Focus | JAKOTA Index | Market Cap, USD |

| Feng Tay Enterprises | 9910.TW | Footwear manufacturing with specialisation in athletic brands and partnership with Nike | Mid and Small Cap 2000 | 4.02B |

| Pou Chen | 9904.TW | Diversified footwear manufacturing and sportswear retail | Mid and Small Cap 2000 | 2.82B |

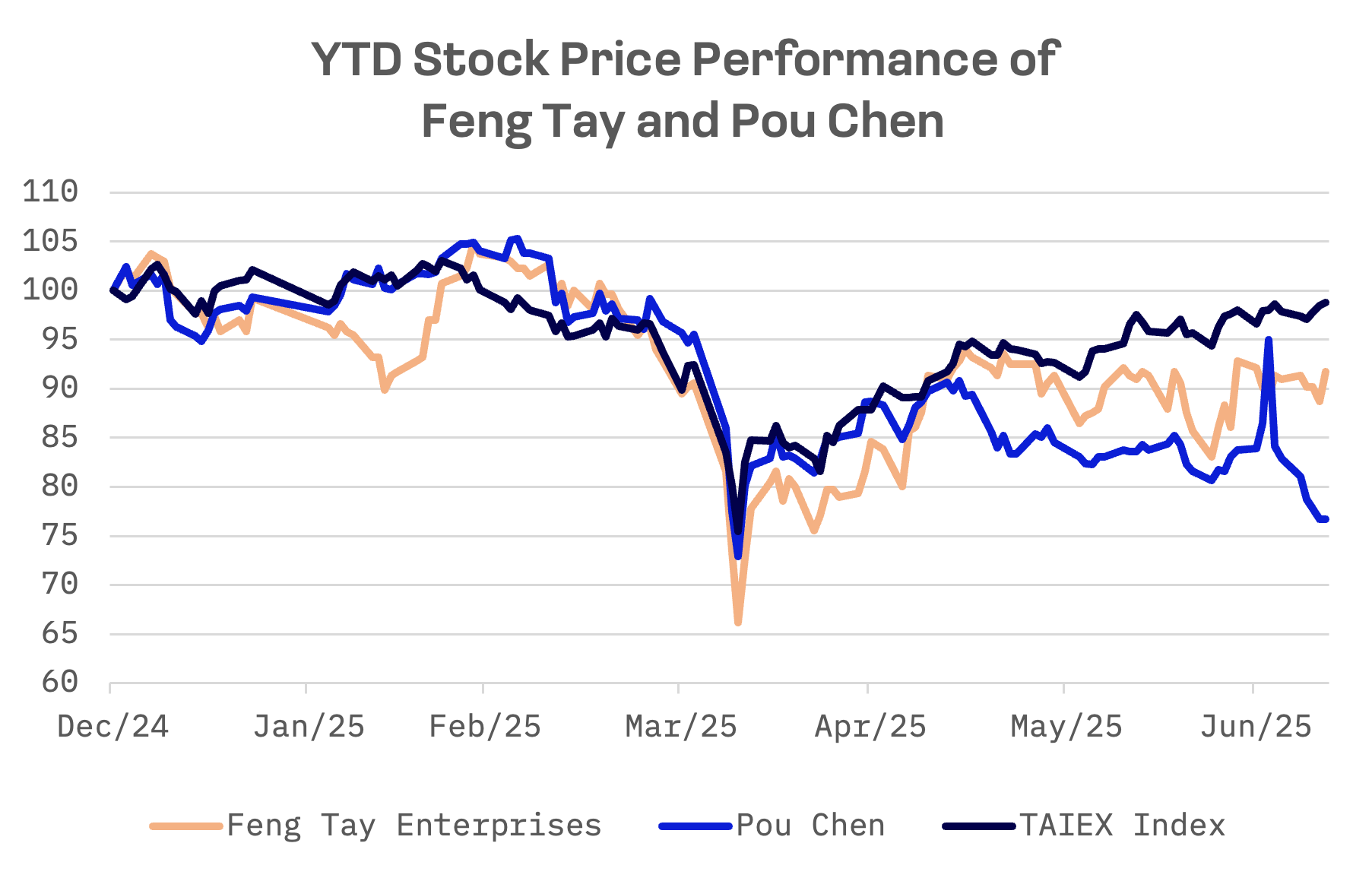

Year-to-date, both Feng Tay Enterprises and Pou Chen have underperformed the TAIEX Index, posting negative returns of 8% and 23%, respectively.

Feng Tay Enterprises trades at a premium to Pou Chen across key valuation metrics (EV/Sales, EV/EBITDA and P/E), reflecting Feng Tay’s stronger current profitability:

| Company Name | EV/Sales | EV/EBITDA | P/E |

| Feng Tay Enterprises | 1.40x | 10.16x | 20.12x |

| Pou Chen | 0.37x | 2.25x | 5.58x |

Feng Tay Enterprises

A key player in the global footwear manufacturing sector, Feng Tay is headquartered in Douliou City and specialises in the production of sports shoes, with additional involvement in casual shoes, skating shoes and snow boots.

The company’s manufacturing facilities are distributed across several key regions, including China, Indonesia, Vietnam and India.

Feng Tay Enterprises delivered mixed results for the first quarter of 2025. Revenue and EBITDA showed positive momentum, reflecting operational resilience, but net profit fell nearly 10% year-over-year, weighed down by currency fluctuations.

Feng Tay Enterprises: Key Financial Indicators, NT$ billion

| Fiscal Q1 2025 ending 03/31/25 | Y/Y change, % | |

| Revenue | 20.72 | +0.52% |

| EBITDA | 2.15 | +4.02% |

| Net income | 1.15 | -9.59% |

Pou Chen

Pou Chen, founded in 1969, began as a maker of canvas and rubber footwear before pivoting to athletic and casual shoes. The company has since transformed into a diversified industrial holding group, with core operations spanning footwear manufacturing and sportswear retail, managed primarily through its subsidiaries and affiliates under the Pou Chen Group umbrella.

Pou Chen holds the distinction of being the world’s largest manufacturer of branded athletic and casual footwear. Pou Chen operates primarily as an OEM and ODM for a broad spectrum of leading international brands, including Nike, Adidas, Asics, New Balance, Timberland and Salomon.

Pou Chen’s manufacturing footprint is geographically diverse, with factories located in countries including China, Vietnam, Indonesia, Mexico and the U.S.

Pou Chen posted a 5.9% year-over-year increase in revenue for the first quarter of 2025, but rising input and operating costs prevented the top line growth from translating into earnings. Both EBITDA and net profit registered double digit declines, underscoring the margin pressure the company faces amid escalating tariffs, currency headwinds and higher raw material prices.

Pou Chen: Key Financial Indicators, NT$ billion

| Fiscal Q1 2025 ending 03/31/25 | Y/Y change, % | |

| Revenue | 67.03 | +5.91% |

| EBITDA | 5.17 | -13.39% |

| Net income | 3.60 | -22.70% |

The global footwear industry in 2025 is grappling with major disruption following new U.S. tariffs introduced in April, which have sharply reshaped global supply chains. For Taiwanese footwear manufacturers, the landscape is particularly challenging. In addition to direct tariff exposure, the appreciation of the New Taiwan dollar against the U.S. dollar has eroded export competitiveness. Combined with rising global raw material costs, profit margins at Taiwanese footwear manufacturers are under pressure.

Taiwanese footwear manufacturers primarily operate through a vertical cooperation model that emphasises flexibility and speed rather than centralised control. This structure enables rapid decision making and cultivates a resilient entrepreneurial spirit rarely found in larger corporations, positioning them to better navigate U.S. tariff policy shifts, optimise costs, return to stable financial growth and restore investor confidence.