South Korea launched its nuclear ambitions in 1957 by joining the International Atomic Energy Agency, quickly establishing the legal and organisational foundations with the Atomic Energy Law in 1958 and the Office of Atomic Energy a year later. The nation achieved its first nuclear milestone when a small research reactor reached criticality in 1962, but commercial development took another decade to materialise with construction of Kori 1, a Westinghouse turnkey project that began commercial operation in 1978. Nuclear development then accelerated dramatically, with eight reactors under construction simultaneously in the early 1980s.

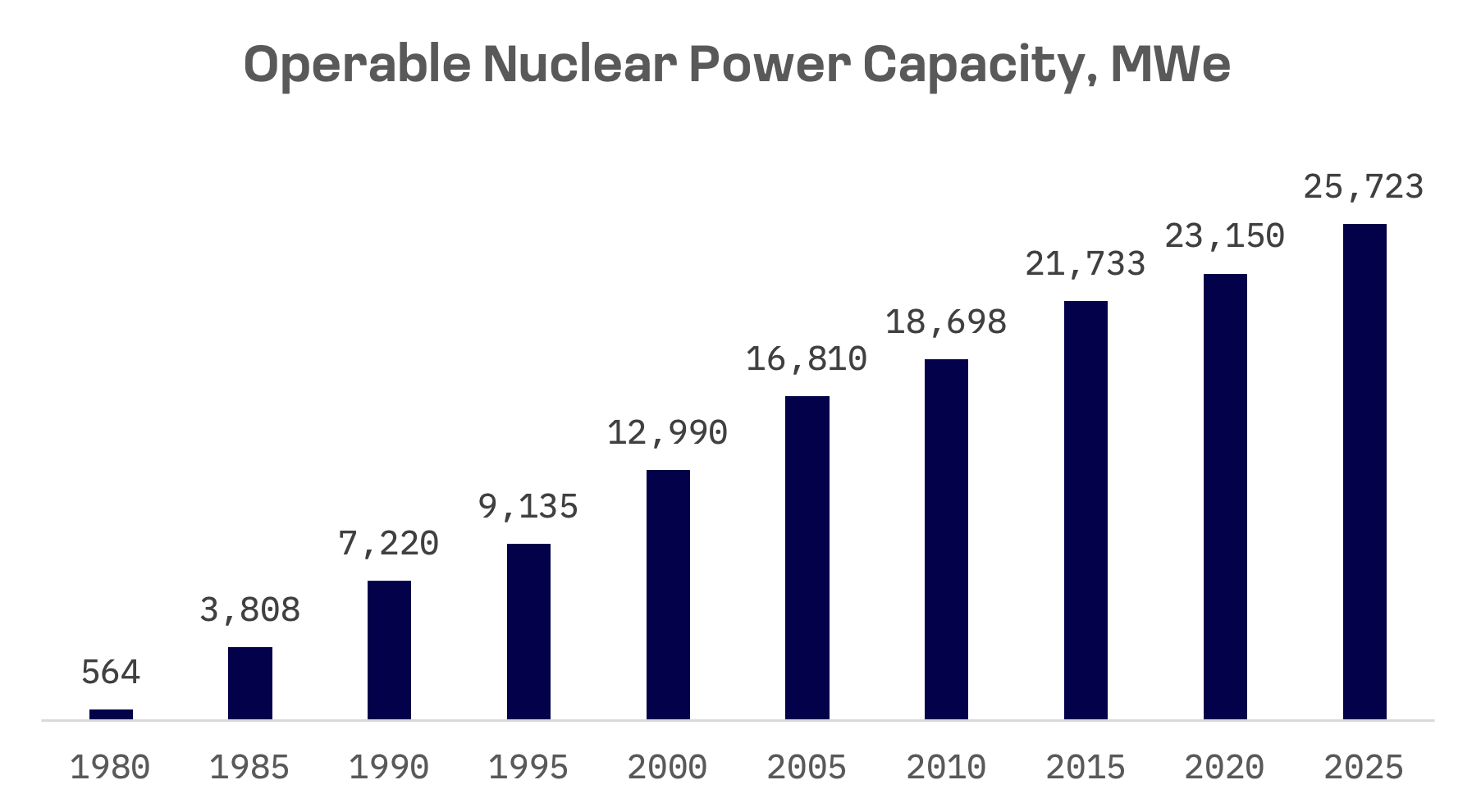

Today, South Korea operates 26 reactors with 25.8 gigawatts of electric capacity (GWe) and is building another 2.7 GWe, marking a decisive return to nuclear power after a brief phase out effort that began in 2017. This strategic reversal, initiated by the administration elected in March 2022, aims to boost nuclear’s share of the national electricity mix to at least 30% by 2030, up from slightly less than 25% currently.

Under Construction Reactors in South Korea

| Reactor Name | Model | Reactor Type | Net Capacity, MWe | Construction Start |

| Saeul 3 | APR-1400 | Pressurised Water Reactor (PWR) | 1,340 | July 2017 |

| Saeul 4 | APR-1400 | Pressurised Water Reactor (PWR) | 1,340 | September 2018 |

Source: World Nuclear Association

The APR-1400 (Advanced Pressurised Reactor-1400) is a third generation pressurised water reactor developed by South Korea, building upon the System 80+ design originally created by Combustion Engineering (CE). The basic design was completed in 1999 and design certification by the Korean Institute of Nuclear Safety (KINS) was awarded in May 2003. It offers enhanced safety with seismic design to withstand 300 Gal ground acceleration and has a 60 year design operating lifetime.

Korea Electric Power (KEPCO) is actively promoting its reactor technologies across the Middle East, North Africa and Latin America, aiming to expand its global nuclear footprint. The APR1400, selected in 2009 for the United Arab Emirates’ $20.4 billion Barakah project, marked South Korea’s first major nuclear export. All four units were initially slated to be operational by 2020, with the choice driven by competitive cost and reliable construction timelines.

That initial export success spawned ambitious government targets, with the Ministry of Trade, Industry and Energy unveiling its “Nu-Tech 2030” plan to export 80 reactors valued at $400 billion by 2030 – a strategy designed to capture 20% of the global nuclear market and position South Korea behind only the U.S. and either France or Russia. President Yoon Suk-yeol’s administration doubled down on these export aspirations in 2022, establishing a goal to secure 10 new international reactor contracts by 2030.

South Korea’s nuclear export campaign scored another major victory in July 2024 when a consortium led by Korea Hydro & Nuclear Power (KNHP) beat out France’s EDF and American rival Westinghouse to become the preferred bidder for the Czech Republic’s $17.1 billion Dukovany nuclear project. The Korean group is now finalising negotiations for the Kč400 billion contract ($17.1 billion), one of Europe’s largest nuclear infrastructure investments.

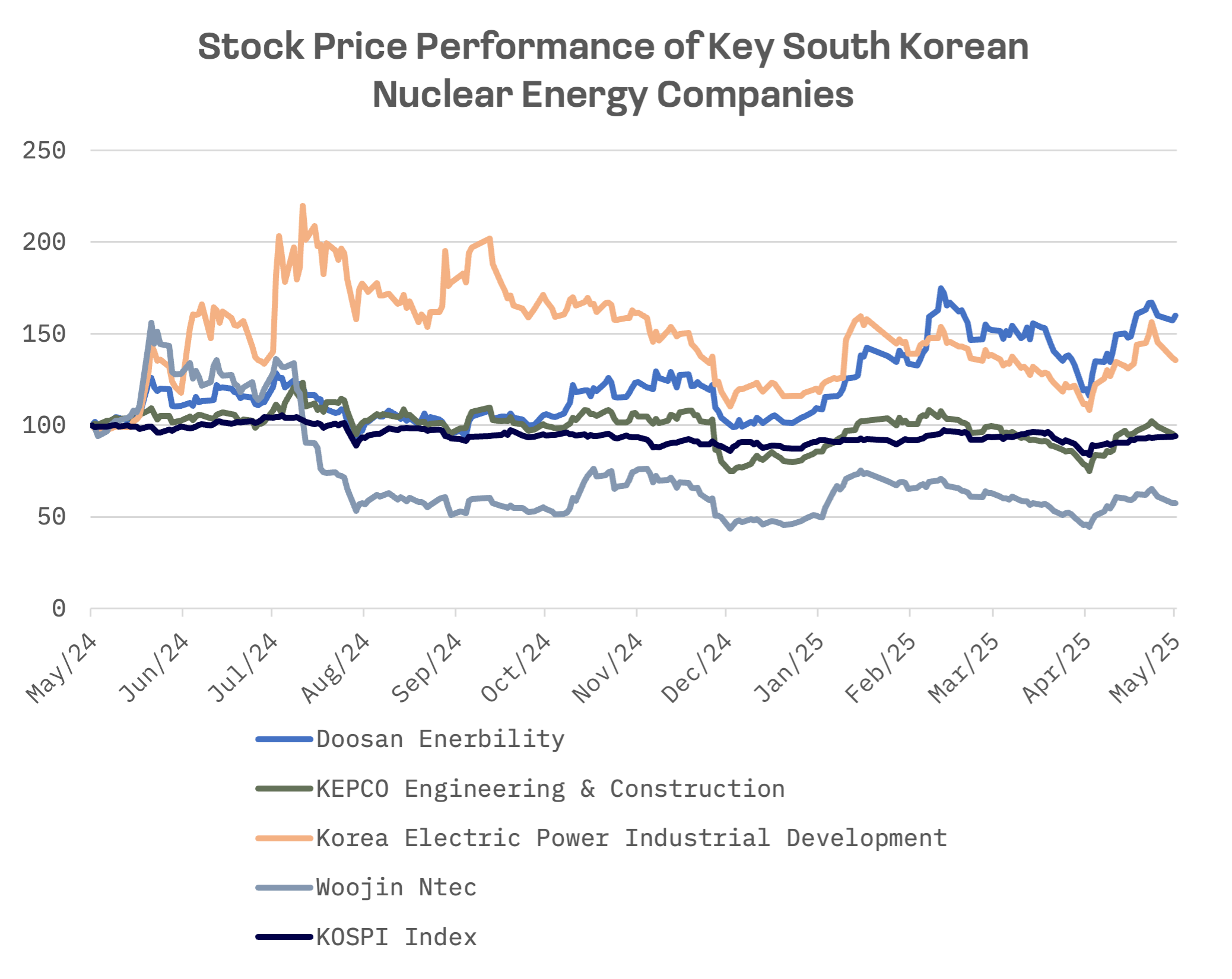

Investor enthusiasm for South Korean nuclear stocks surged in April 2025, buoyed by the country’s growing international credibility and track record of successful exports. Legal obstacles to the Czech deal evaporated when the country’s competition authority (UOHS) dismissed EDF’s appeal of the selection process, removing the final significant barrier to contract finalisation.

This report analyses four key South Korean public players in the nuclear energy and industrial engineering sectors: Doosan Enerbility, KEPCO Engineering & Construction, Woojin Ntec and Korea Electric Power Industrial Development (KEPID).

| Company Name | Ticker | Primary Segments | JAKOTA Index | Market Cap, USD |

| Doosan Enerbility | 034020.KO | Nuclear and thermal power plant equipment, turbines, Small Modular Reactors (SMRs) industrial engineering | Mid and Small Cap 2000 | 12.55B |

| KEPCO Engineering & Construction | 052690.KO | Nuclear and fossil power plant design, engineering, EPC services | Mid and Small Cap 2000 | 1.73B |

| Korea Electric Power Industrial Development (KEPID) | 130660.KQ | Thermal power O&M, metering, renewable energy, coal terminal operations | N/A | 0.26B |

| Woojin Ntec | 457550.KO | Nuclear power plant components, precision machining, industrial equipment | N/A | 0.12B |

KEPID has experienced the most pronounced market volatility within this group, peaking dramatically in August 2024 before beginning a gradual descent. Doosan Enerbility has maintained consistent upward momentum, with both it and KEPID significantly outperforming the KOSPI Index.

By contrast, KEPCO Engineering & Construction has demonstrated remarkable price stability, trading within a narrow band near its May 2024 levels. Woojin Ntec has been the sector’s clear underperformer, dropping roughly 50% in mid 2024 and failing to recover in the subsequent months.

Even though KEPCO Engineering & Construction’s current price is below its LTM peak in 2024, it remains the most expensive company in its peer group based on EV/Sales and EV/EBITDA multiples:

| Company Name | EV/Sales | EV/EBITDA |

| Doosan Enerbility | 1.30x | 14.26x |

| KEPCO Engineering & Construction | 4.25x | 23.86x |

| Korea Electric Power Industrial Development (KEPID) | 0.97x | 15.85x |

| Woojin Ntec | 3.02x | 17.86x |

| AVERAGE | 2.39x | 17.96x |

| MEDIAN | 2.16x | 16.86x |

Doosan Enerbility

Doosan Enerbility remains a key player in the global power generation equipment market, with additional strengths in plant engineering, procurement and construction (EPC) and advanced materials. The company is pivoting towards cleaner energy solutions, with strategic focus on gas turbines, wind and solar power, small modular reactors (SMRs) and hydrogen, in response to global decarbonisation trends.

The South Korean industrial giant operates through a global network radiating from its domestic headquarters to subsidiaries and sales offices throughout Asia – including India, Indonesia, Vietnam, Saudi Arabia, the UAE, China and Japan – as well as locations in Europe and the Americas.

Doosan Enerbility secured several significant commercial and strategic victories in early 2025 that demonstrate momentum across both established and emerging business lines. Key developments include:

- Expanded nuclear partnership with Candu Energy.

- A ₩130 billion fuel conversion contract in Saudi Arabia.

- A ₩320 billion agreement with Korea Western Power (KOWEPO) on March 28, 2025, covering equipment for the Yeosu Natural Gas Power Plant, including a 380MW H class gas turbine, steam turbine and Heat Recovery Steam Generator (HRSG), with project completion targeted for 2028.

The company has also initiated discussions with major technology companies about potentially deploying SMRs to power energy hungry data centres.

Despite these commercial successes in nuclear and gas turbine projects, Doosan Enerbility’s Q1 2025 earnings showed a relatively weak quarter. Revenue declined 8.5% year-over-year to ₩3.75 trillion, while EBITDA plunged 46% from the same period last year. The company expects to meet its full year guidance as growth businesses gain traction in the second half. Doosan Enerbility attributed the EBITDA decline to the conclusion of major coal and water projects, resulting in both lower sales volume and less favourable product mix.

Doosan Enerbility: Key Financial Indicators, ₩ billion

| Fiscal Q1 2025 ending 03/31/25 | Y/Y change, % | |

| Revenue | 3,749 | -8.3% |

| EBITDA | 247 | -45.6% |

| Net income | -21 | -108.0% |

KEPCO Engineering & Construction

KEPCO Engineering & Construction, founded in 1975, plays a central role in South Korea’s power plant engineering sector with specialised expertise in design, engineering and procurement for both nuclear and thermal facilities. The company possesses proprietary technologies in Architect Engineering (A/E) and Nuclear Steam Supply System (NSSS) design, and has reportedly designed approximately 60% of Korea’s power generation capacity.

KEPCO E&C operates as an integral part of the “One KEPCO Team,” a collaborative framework that includes KEPCO, Korea Hydro & Nuclear Power (KHNP), KEPCO Nuclear Fuel (KEPCO NF), KEPCO Plant Service & Engineering (KEPCO KPS), Doosan Enerbility and various construction companies.

KEPCO E&C reported mixed financial results for the first quarter of 2025. Slower project progress and various delays reduced revenue, driving down operating profit. Net income, however, increased year-over-year, boosted by asset sales including the transfer of ownership of the company’s former headquarters building.

KEPCO Engineering & Construction: Key Financial Indicators, ₩ billion

| Fiscal Q1 2025 ending 03/31/25 | Y/Y change, % | |

| Revenue | 96.4 | -24.4% |

| Operating income | 1.2 | -87.0% |

| Net income | 65.9 | 662.1% |