South Korea’s life sciences industry is experiencing robust growth, fuelled by advanced research capabilities, a highly skilled workforce, strong intellectual property protections and a solid regulatory framework. The sector has attracted significant domestic and foreign investments across biotechnology, pharmaceuticals, medical devices and healthcare services.

The country’s strategic location and global partnerships make it an attractive hub for life sciences companies expanding into Asia, with easy access to major markets like China and Japan.

Government support plays a crucial role. The Ministry of Science and ICT’s Bio Venture Support Program offers funding and resources to early stage startups, fostering innovation and commercialisation.

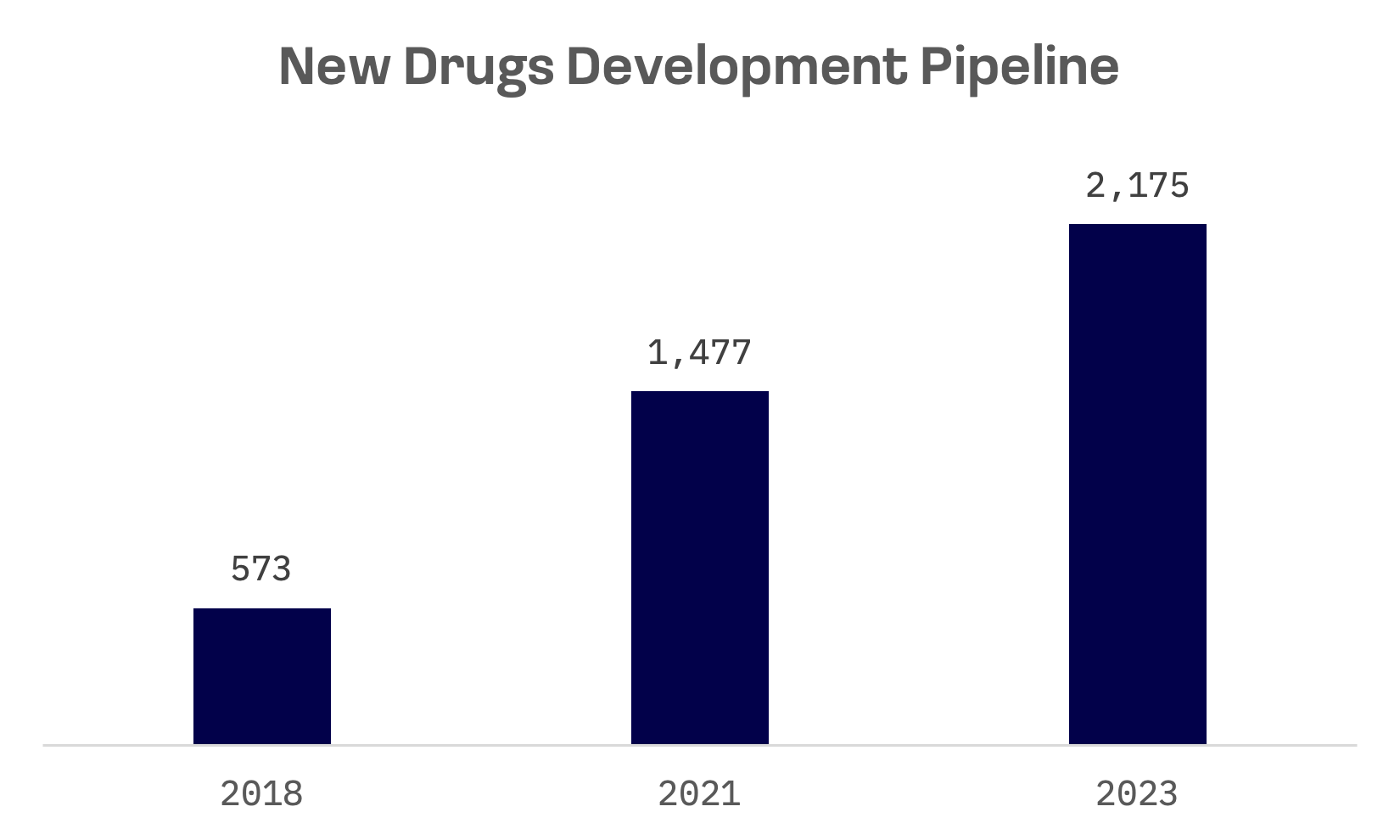

The drug development pipeline has achieved a compound annual growth rate (CAGR) of 31% from 2018 to 2023.

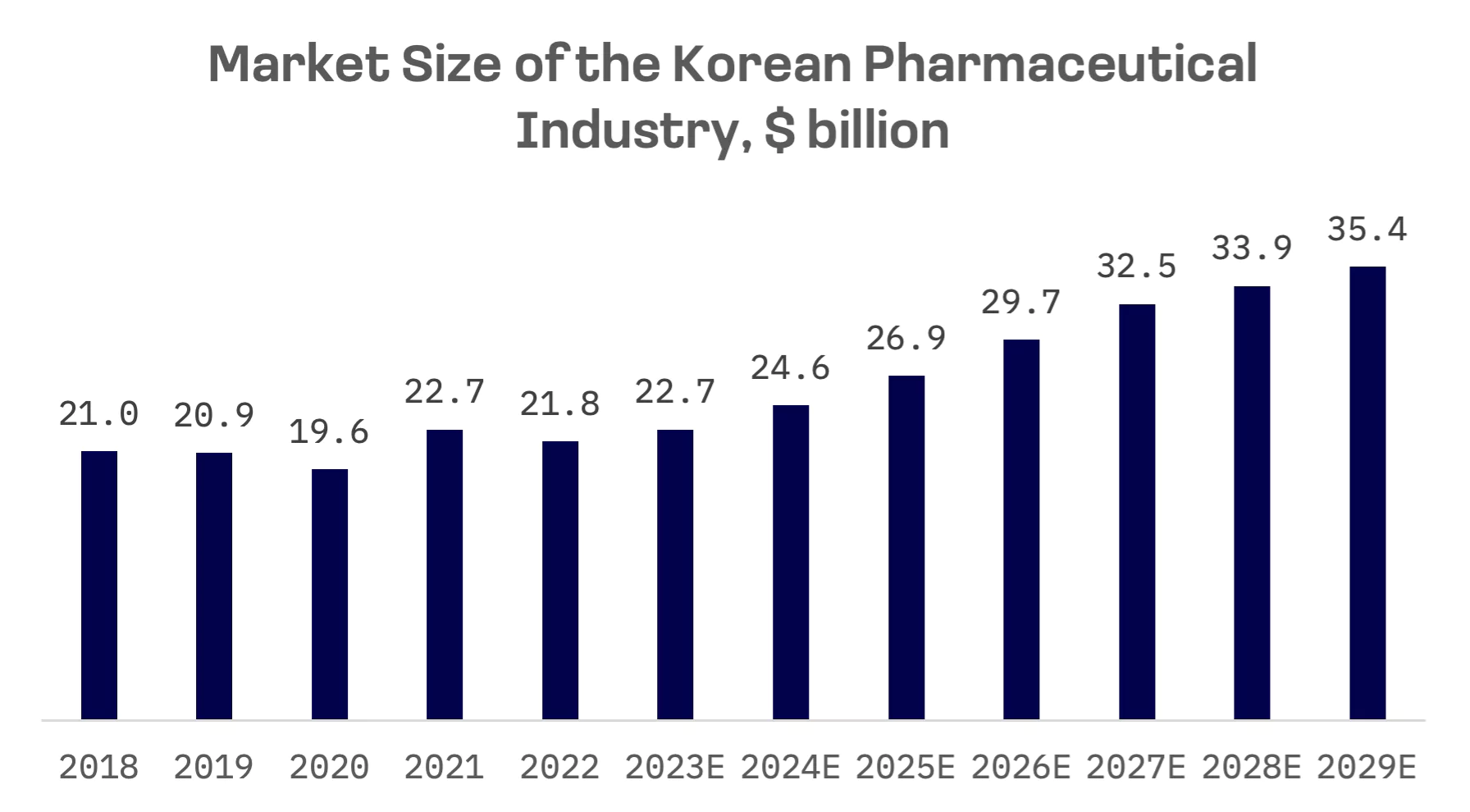

In 2022, South Korea’s healthcare industry ranked 11th globally, with a market size of $203 billion. The pharmaceutical market, ranked 13th globally, is expected to grow at CAGR of 8.9% between 2023 and 2029.

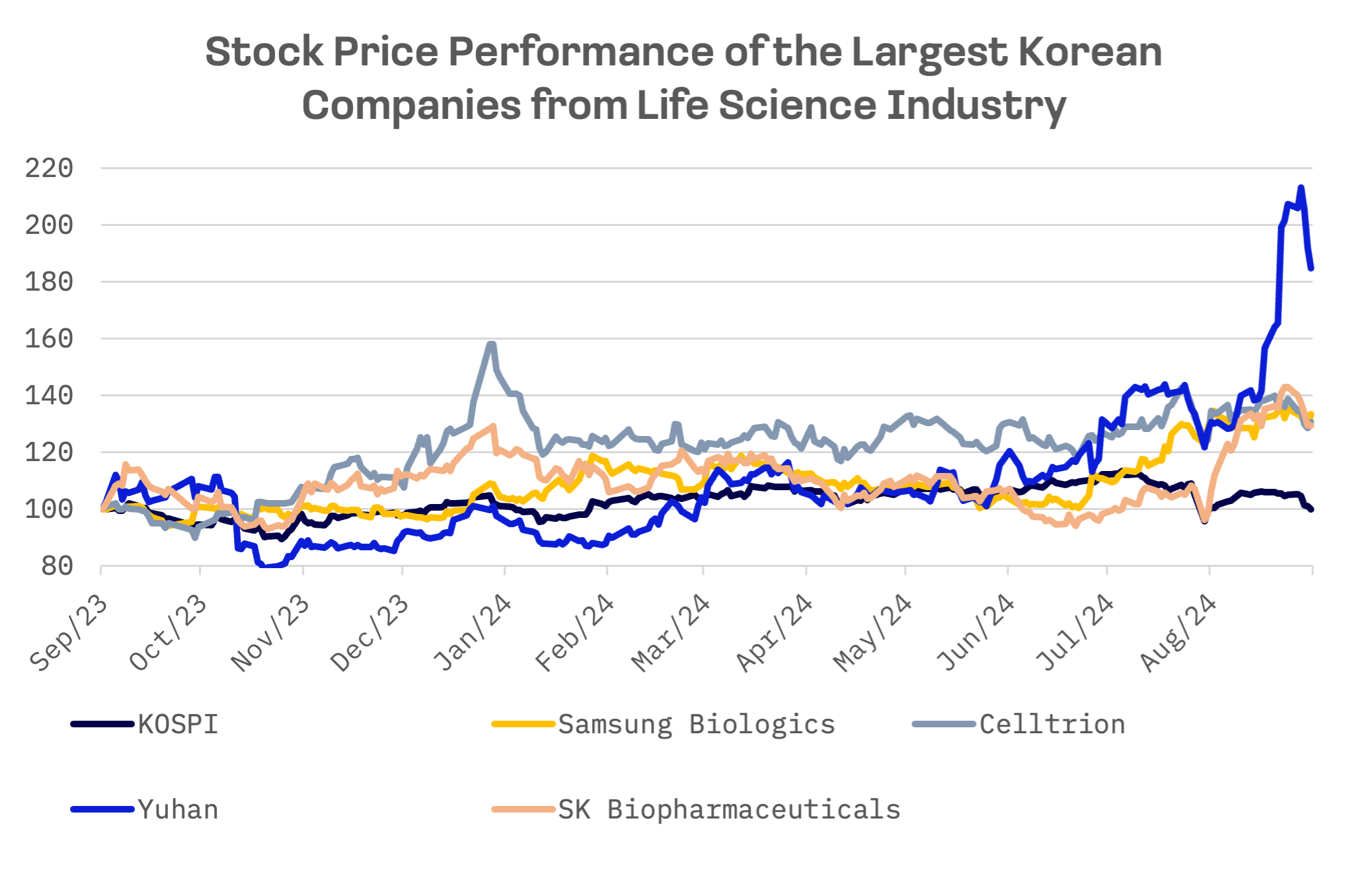

South Korea boasts a dynamic life sciences ecosystem, featuring a mix of prominent pharmaceutical companies, research institutes and innovative startups. Key players by market capitalisation include Samsung Biologics, Celltrion, SK Biopharmaceuticals and Yuhan.

Samsung Biologics, a Samsung Group affiliate, is among the world’s largest contract manufacturing organisations (CMOs) for biopharmaceuticals, providing services from cell line development to clinical and commercial manufacturing.

Celltrion is renowned for its biosimilar products, particularly those used in treating autoimmune diseases and cancer.

SK Biopharmaceuticals focuses on developing innovative treatments for neurological and psychiatric disorders. As a subsidiary of SK Group, the company is dedicated to advancing its research in novel drug development, leveraging its expertise to create therapies that address unmet medical needs.

Yuhan is another top Korean pharmaceutical company with a strong emphasis on research and development across various therapeutic areas. With a broad portfolio of innovative drugs, the company is actively advancing new drug development in oncology, cardiovascular diseases and other vital therapeutic fields.

As of September 6, 2024, all four companies had market capitalisations exceeding $5 billion:

| Company Name | Ticker | Subsector | JAKOTA Index | Market Cap, USD |

| Samsung Biologics | 207940.KO | CDMO | Blue Chip 150 | 51.0B |

| Celltrion | 068270.KO | Biotechnology | Blue Chip 150 | 29.6B |

| Yuhan | 000100.KO | Pharmaceuticals | Mid and Small Cap 2000 | 6.6B |

| SK Biopharmaceuticals | 326030.KO | Pharmaceuticals | Mid and Small Cap 2000 | 6.1B |

Over the past 12 months, they have outperformed the KOSPI Index, with Samsung Biologics, Celltrion, and SK Biopharmaceuticals seeing their stock prices rise by approximately 30% compared to a year ago.

Yuhan’s stock price surged to an all time high following the FDA’s approval of its non-small cell lung cancer treatment, Reclaza. On August 20, Yuhan announced that the FDA had approved the combination therapy of Reclaza and Johnson & Johnson’s anticancer drug, Librilant, as a first line treatment. This marks the first FDA approval for an anticancer drug developed in South Korea.

SK Biopharmaceuticals, the only Korean company to win FDA approval for two new drugs, commands the highest valuation multiples among its peers:

| Company Name | EV/Sales | EV/EBITDA | Forward P/E |

| Samsung Biologics | 16.34x | 34.15x | 55.25x |

| Celltrion | 15.35x | 48.92x | 24.63x |

| Yuhan | 4.63x | 43.19x | 31.55x |

| SK Biopharmaceuticals | 17.41x | 191.08x | 81.30x |

| AVERAGE | 13.43x | 79.35x | 48.18x |

| MEDIAN | 15.85x | 46.06x | 43.40x |

Rising demand for biologic drugs is driving Samsung Biologics’ continued investment in large scale biomanufacturing, including a new plant in South Korea. The company is constructing a fifth plant and expanding its Bio Campus II in Songdo, which will include a dedicated antibody drug conjugate facility. Plant 5, with a 180,000 litre capacity, is set for completion by April 2025, boosting the company’s total capacity to 784,000 litres.

Samsung is investing ₩1.9 trillion ($1.46 billion) in Plant 5 and allocating ₩7.5 trillion ($6 billion) for Bio Campus II, which will house four plants. Combined with Bio Campus I, the company’s total capacity is expected to surpass 1.3 million litres by 2032.

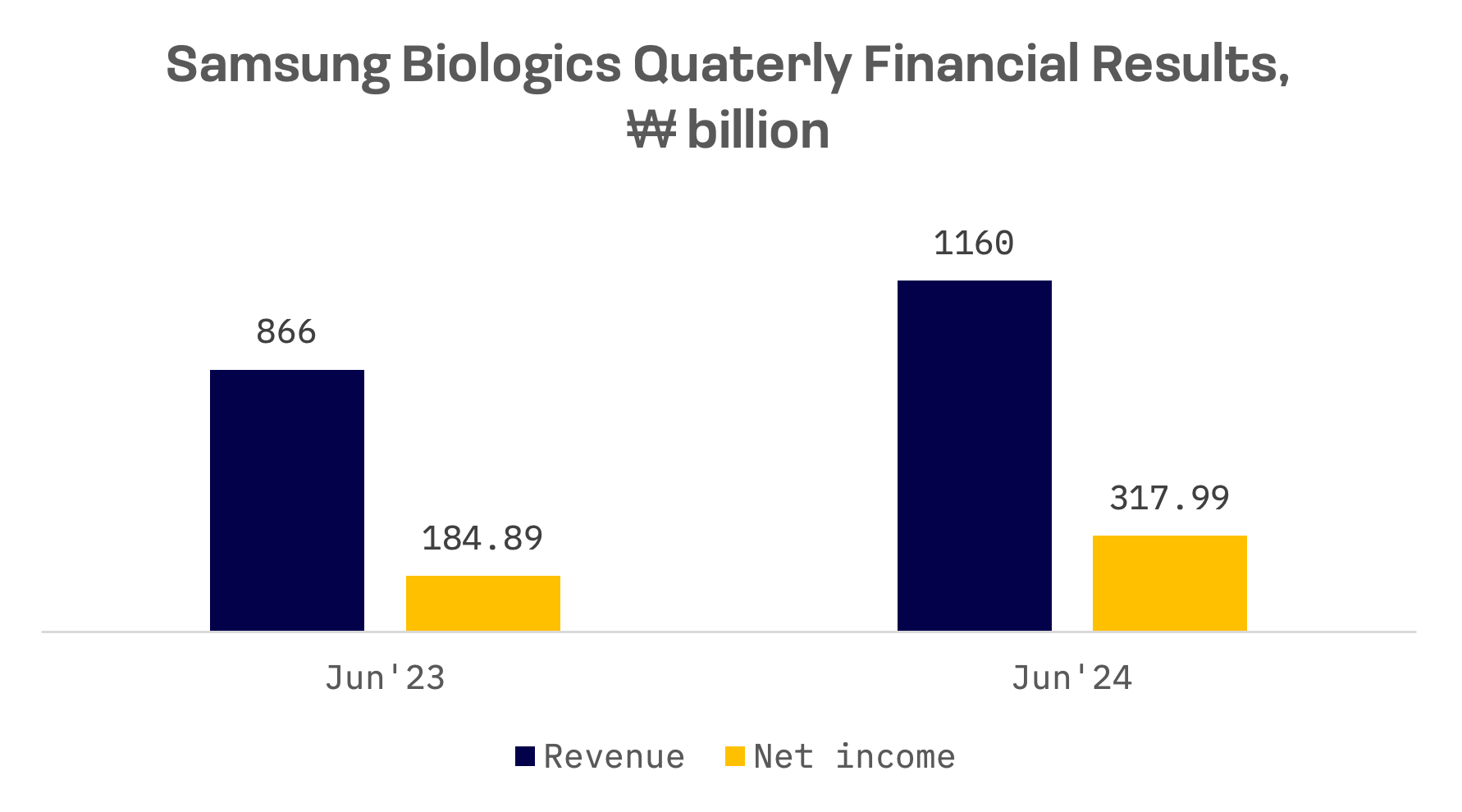

Samsung Biologics posted strong financial performance, reporting record second quarter consolidated sales of ₩1.16 trillion, up from ₩866 billion in the same period last year.

In July, Samsung Biologics secured a new manufacturing deal worth ₩1.46 trillion ($1.05 billion) with a large, unnamed U.S. drugmaker. The agreement represents over 39% of Samsung Biologics’ total sales from last year, which reached ₩3.7 trillion ($2.7 billion).

The companies signed a letter of intent on June 5, with the production deal set to run through 2030, though the final timeline may vary based on mutual agreement, according to the public disclosure.

Celltrion is also making significant moves. Founder and Chairman Seo Jung-jin announced plans to invest several billion dollars to build a new plant, aiming to establish a wholly owned contract development and manufacturing organisation (CDMO) subsidiary this year, with plans to construct a 180,000 litre capacity facility starting next year.

The plant, Celltrion’s fourth production site, is expected to be fully operational within four years. The move comes as Celltrion seeks to tap into the growing CDMO market, currently led by Swiss pharmaceutical giant Lonza.

South Korean CDMOs stand to benefit from the U.S.’s introduction of the Biosecure Act, a bill aimed at tightening regulations on Chinese biotech companies. The legislation could shift biomanufacturing demand away from China, creating new opportunities for South Korean firms in the sector.

Additionally, CEO Seo Jin-seok, the eldest son of Chairman Seo, announced that Celltrion will launch five new products next year, expanding on the six biosimilars it has introduced since 2002.

The company has also submitted investigational new drug (IND) applications for clinical trials of three antibody drug conjugates (ADC) and one antibody in the coming year. Celltrion aims to build a portfolio of 22 biosimilar candidates by 2030.