South Korea’s defence industry has undergone a dramatic transformation, evolving from a recipient of foreign military aid into a major global player and one of the world’s leading arms exporters. The domestic defence production has been propelled by persistent geopolitical tensions, primarily with North Korea, and reinforced by strong government backing through sustained investment and strategic initiatives such as “Defence Innovation 4.0.” The country’s 2024 defence budget stands at approximately $45.2 billion, with a substantial portion allocated to the Force Improvement Plan (FIP). The program channels funding into research, development and procurement, fuelling the expansion of the country’s domestic defence industry.

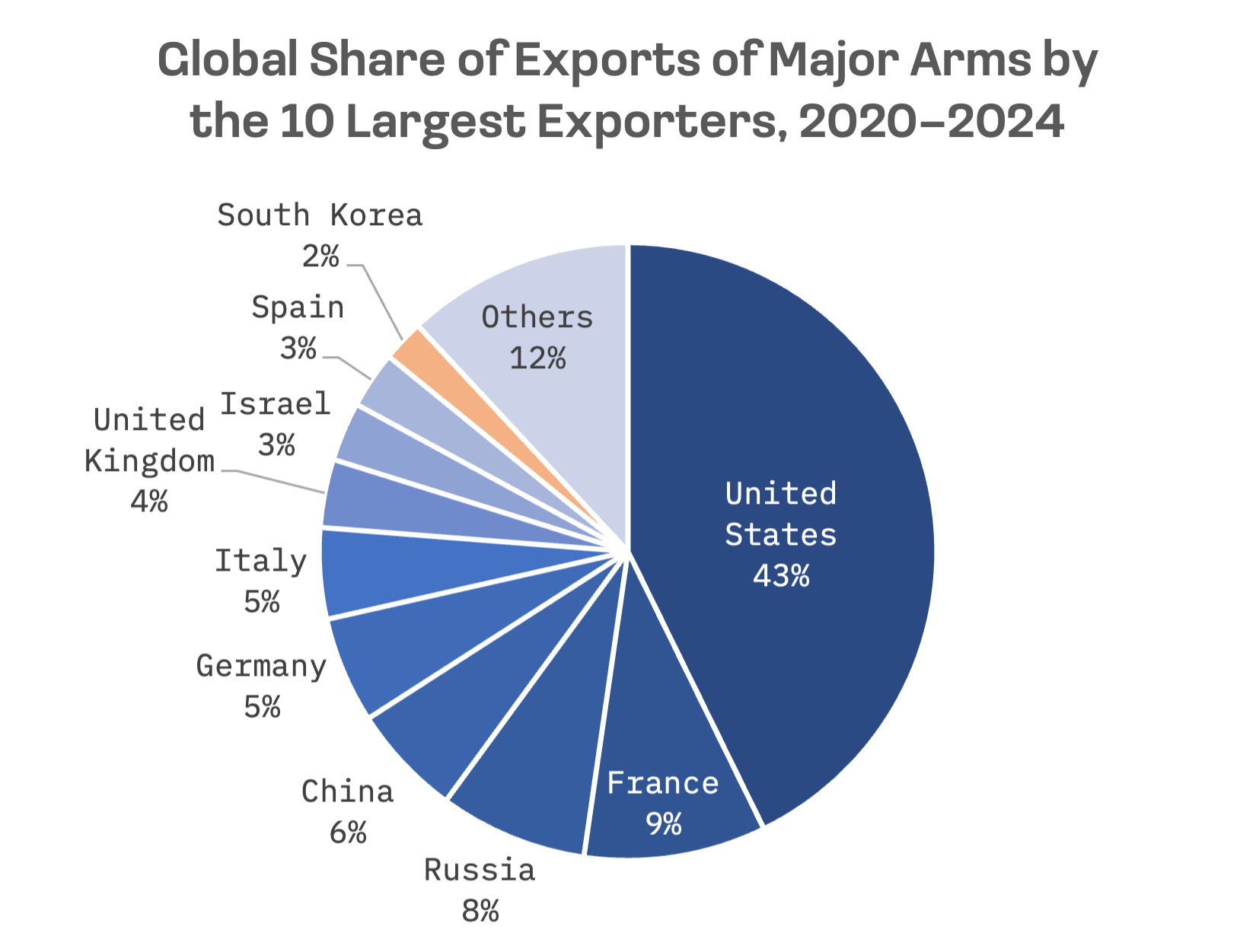

The country has secured its position as the world’s 10th largest arms exporter – and Asia’s second highest after China – capturing 2.2% of the global market from 2020 to 2024. That marks a 0.1 percentage point increase from the 2015-2019 period. Poland, the Philippines and India are among the nation’s top three arms importers.

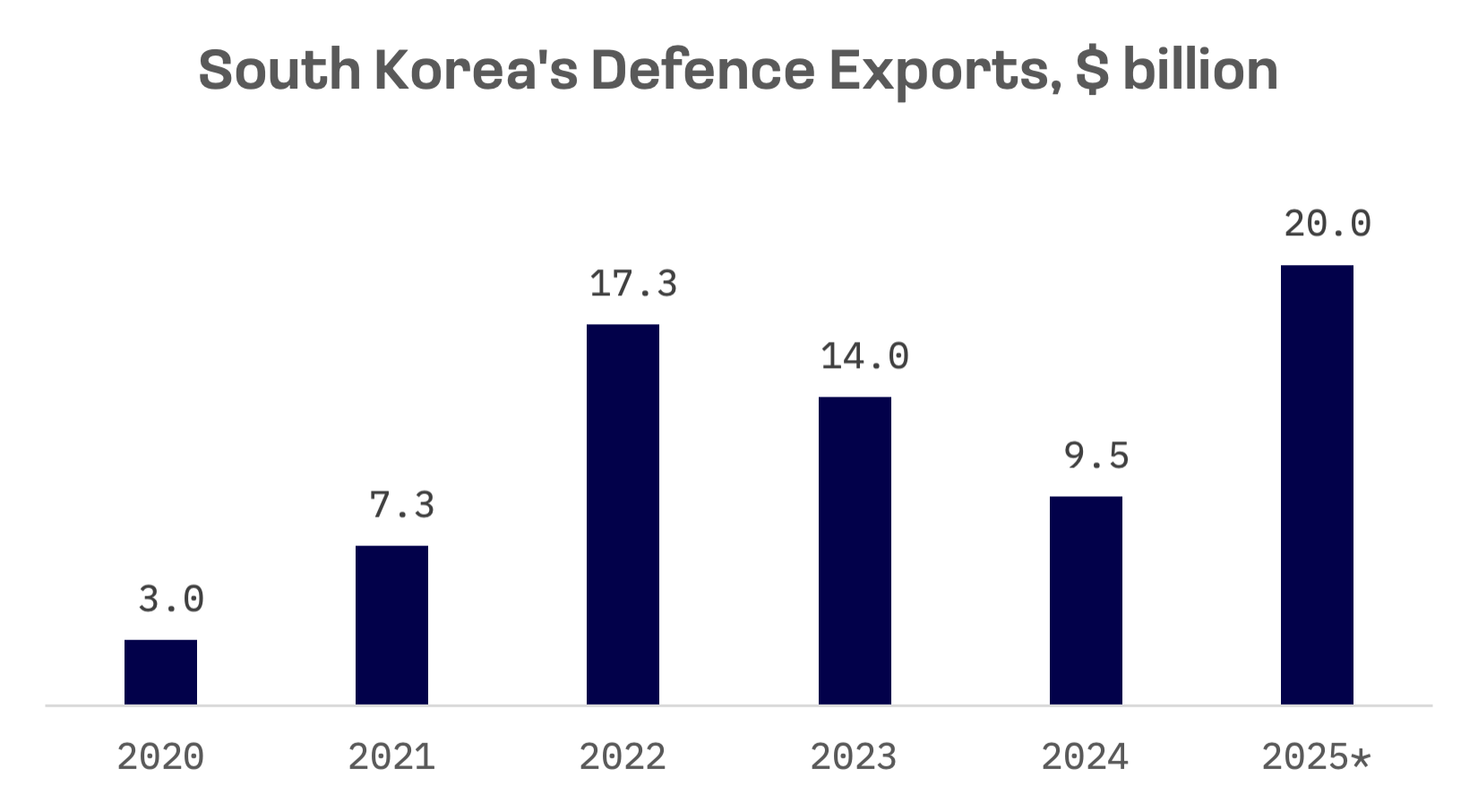

South Korea’s defence exports have seen a sharp upswing in recent years, more than doubling from $3 billion in 2020 to $7.25 billion in 2021, before surging to a record $17.3 billion in 2022. Sales moderated to $14 billion in 2023, reflecting a slowdown following blockbuster deals with Poland that made up roughly 72% of 2022’s total.

The cooling trend continued in 2024, with exports falling to $9.5 billion, well below the government’s ambitious targets. Despite the shortfall, combined operating profits for major domestic defence firms are projected to rise, driven by a growing backlog of export contracts signed over the past two years. For 2025, Seoul is again targeting a $20 billion export goal, with expectations of landing additional deals.

South Korea’s rise in the global arms market is fuelled by a strong value proposition: technologically advanced and reliable systems, often NATO interoperable, delivered swiftly via active domestic production lines; competitively priced and paired with flexible industrial cooperation packages. This is all underpinned by active government backing through the Defence Acquisition Program Administration (DAPA).

South Korea’s defence industry is structured around the dominance of major conglomerates, or chaebols, such as Hanwha and Hyundai, which serve as system integrators across key domains including land systems, naval shipbuilding, aerospace and defence electronics. Leading publicly listed firms driving the sector’s growth include Hanwha Aerospace (engines, land systems, space), Korea Aerospace Industries (KAI) (aircraft, satellites, MRO), LIG Nex1 (guided missiles, radar, C4I), Hyundai Rotem (tanks, land vehicles), Hanwha Systems (defence electronics, C5I, naval systems), Hanwha Ocean (naval vessels, submarines) and HD Hyundai Heavy Industries (naval vessels, Aegis destroyers).

This report will focus on all the companies mentioned above, excluding Hanwha Ocean and HD Hyundai Heavy Industries, as they were previously covered in the South Korea Shipbuilding Industry Report. The table below summarises the major players in the South Korea defence industry:

| Company Name | Ticker | Primary Segments | JAKOTA Index | Market Cap, USD |

| Hanwha Aerospace | 012450.KO | Land Systems, Aerospace Engines, Space Launch Systems, Marine Propulsion/ESS | Blue Chip 150 | 26.45B |

| Hyundai Rotem | 064350.KO | Land Systems (MBT, APC) | Mid and Small Cap 2000 | 8.80B |

| Korea Aerospace Industries | 047810.KO | Military Aircraft, Military Helicopter, Unmanned Aerial Vehicle | Mid and Small Cap 2000 | 5.51B |

| Hanwha Systems | 272210.KO | Defence Electronics (Radar, EO/IR), C5I, Naval Combat Systems, Avionics, Satellite Payloads, ICT | Mid and Small Cap 2000 | 5.08B |

| LIG Nex1 | 079550.KO | Guided Missiles, Radar Systems, C4I, Electronic Warfare, Torpedoes | Mid and Small Cap 2000 | 4.40B |

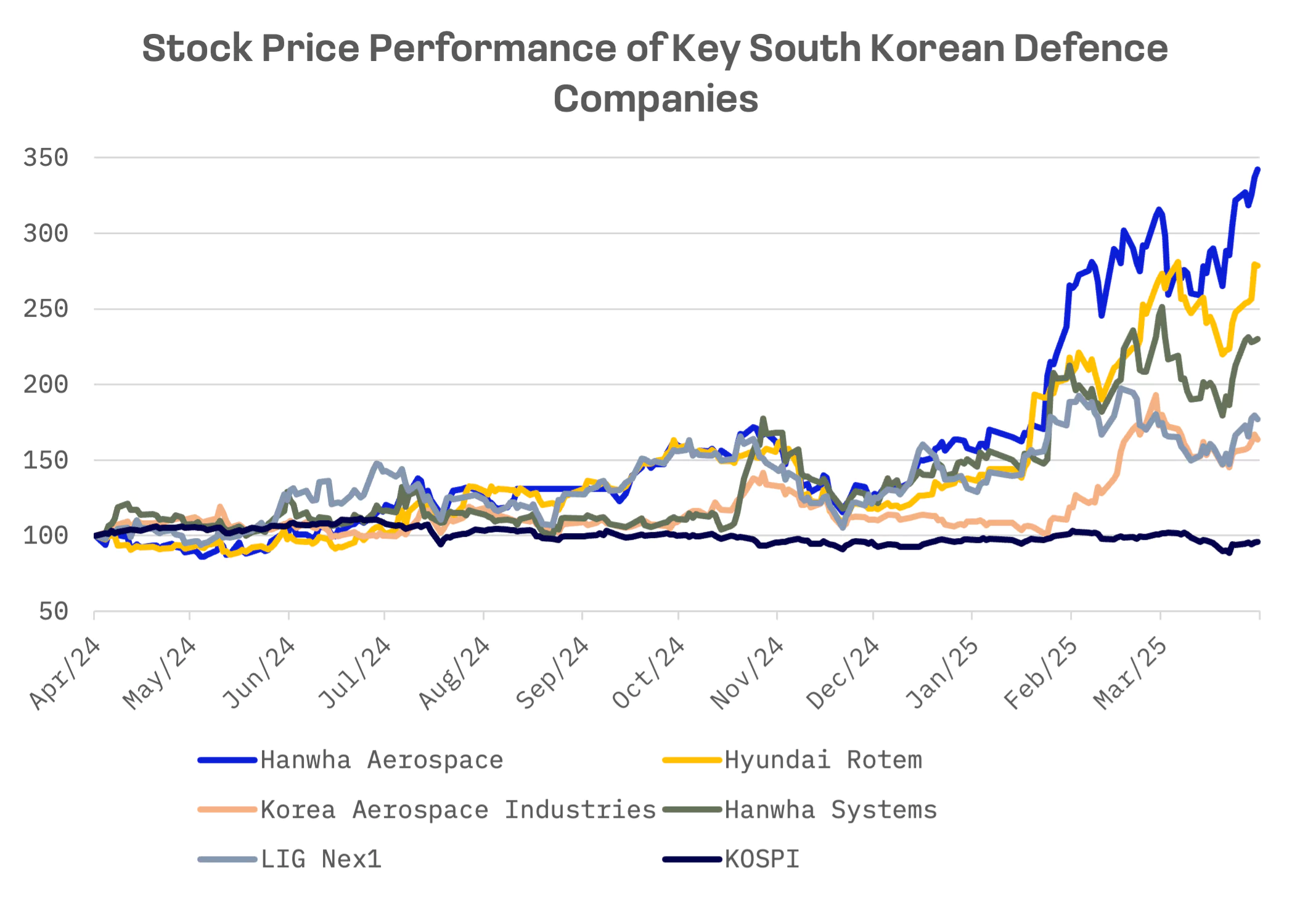

Over the past year, South Korean defence stocks have substantially outperformed the KOSPI index, with Hanwha Aerospace showing especially outstanding performance – its shares increasing nearly 3.5 times. Hyundai Rotem and Hanwha Systems also surged, with shares more than doubling in value.

Hanwha Aerospace is the most expensive company among its peers in terms of EV/Sales. However, based on the EV/EBITDA multiple, it is below the peer group average:

| Company Name | EV/Sales | EV/EBITDA |

| Hanwha Aerospace | 4.00x | 13.97x |

| Hyundai Rotem | 2.77x | 21.15x |

| Korea Aerospace Industries | 2.41x | 26.21x |

| Hanwha Systems | 2.20x | 8.57x |

| LIG Nex1 | 1.87x | 20.39x |

| AVERAGE | 2.65x | 18.06x |

| MEDIAN | 2.41x | 20.39x |

Hanwha Aerospace

As a flagship entity within the Hanwha Group, Hanwha Aerospace has strategically positioned itself as a total solutions provider in the aerospace, defence and marine sectors since its founding in 1977. It plays a major role in South Korea’s defence exports, and its substantial market capitalisation reflects its leadership in the industry. The company aims to become a global top tier player, leveraging strategic acquisitions such as its stake in satellite company Satrec Initiative and the integration of Hanwha Ocean into the broader Hanwha defence ecosystem.

Over the past year, Hanwha Aerospace has secured a series of major international defence deals, including a $1.6 billion contract with Poland for 72 Chunmoo multiple launch rocket systems in 2024, alongside several recently announced contracts:

| Country | Date | Products | Description |

| Poland | April 2025 | Krab Howitzer Components | Hanwha Aerospace signed a $280 million deal with Poland’s Huta Stalowa Wola (HSW) to supply chassis components and powerpacks for 87 Krab 155mm/52-calibre self propelled howitzers. Deliveries are slated for 2026–2028. The agreement reinforces a decade long collaboration, with the Krab platform built on South Korean K9 Thunder technology. |

| India | April 2025 | K9 Vajra-T Howitzers | Hanwha Aerospace secured a $253 million follow-on contract from Larsen & Toubro (L&T) to supply components for 100 additional K9 Vajra-T howitzers. The deal builds on a 2017 order and targets 60% domestic production under India’s defence localisation push. |

In October 2024, Hanwha entered a strategic partnership with U.S.-based General Atomics to co-develop unmanned aircraft systems (UAS), targeting growth in the global UAS market and bolstering South Korea’s defence capabilities.

The company also deepened its shipbuilding footprint with a ₩1.3 trillion share purchase in Hanwha Ocean in February 2025. As part of a broader restructuring, Hanwha spun off its industrial solutions division (Hanwha Vision and Hanwha Precision Machinery) in August 2024, sharpening its focus on core aerospace and defence businesses.

In February 2025, Hanwha Aerospace reported strong fourth quarter 2024 results, fuelled by a sharp increase in global defence orders, with revenue jumping 55.8% year-over-year.

Hanwha Aerospace: Key financial indicators, ₩

| Fiscal 4Q 2024 ending on 12/31/24 | Y/Y change, % | |

| Revenue | 4.83T | 55.8% |

| EBITDA | 0.99T | 164.3% |

| Net income | 1.85B | 1,048.7% |

Additionally, in April 2025, Hanwha Aerospace scaled back its planned rights offering to ₩2.3 trillion ($1.6 billion), down from the previously announced ₩3.6 trillion. The remaining ₩1.3 trillion will be raised through a third party allotment involving group affiliates, as the company adjusts its capital raising strategy while maintaining funding for facility investments and acquisitions.

Hyundai Rotem

Hyundai Rotem, part of Hyundai Motor Group, has diversified operations spanning Rail Solutions, Defence Solutions and Plant & Machinery segments. Its Defence Solutions unit specialises in land systems, led by the K2 Black Panther main battle tank and the K808 White Tiger armoured personnel carrier. The company is strategically focused on leveraging K2’s export momentum to broaden its presence in the global armoured vehicle market.

Among recent deal wins of Hyundai Rotem:

- K2 Tank and K808 APC for Peru: Hyundai Rotem expanded its defence footprint in Latin America with a strategic agreement signed in November 2024 with Peru’s state owned FAME S.A.C. The deal builds on an initial $60.9 million contract from May 2024 for 30 K808 wheeled armoured personnel carriers, with an option for 120 more. The broader agreement includes the planned supply of approximately 100 K2 main battle tanks and additional K808 vehicles, alongside commitments to local assembly and production.

- K2PL Tank Program for Poland: Negotiations for a second tranche of 180 K2PL main battle tanks – estimated at $6.2 billion – are expected to be finalised in April 2025. The tanks under this contract are slated for local assembly, aligning with Poland’s broader plan to acquire up to 1,000 K2 units in successive batches with increasing domestic content.

Hyundai Rotem posted a strong performance in the fourth quarter of 2024, with revenue surging 45.7% year-over-year and net income skyrocketing 209.4%.

Hyundai Rotem: Key financial indicators, ₩

| Fiscal 4Q 2024 ending on 12/31/24 | Y/Y change, % | |

| Revenue | 1.44T | 45.7% |

| EBITDA | 175.1B | 117.5% |

| Net income | 145.2B | 209.4% |

Hanwha Systems

Hanwha Systems, the defence electronics and ICT arm of South Korea’s Hanwha Group, specialises in advanced technologies including radar systems (Multi-Function Radar – MFR for the Cheongung-II air defence system, Active Electronically Scanned Array – AESA radar for the KF-21 fighter), command, control, communications, computers, and intelligence (C4I) systems like the Tactical Information Communication Network (TICN), electro optical sensors, naval combat management systems and satellite technology, particularly Synthetic Aperture Radar (SAR) satellites.

Hanwha Systems’ recent financial results received a notable lift from participation in high profile export deals spearheaded by other South Korean defence majors. In 2024, the company delivered MFR systems for the Cheongung-II air defence platform to the UAE and secured an $867 million share in a $3.2 billion Saudi Arabia contract signed in February, led by an LIG Nex1 consortium. Hanwha also supplied fire control systems for K2 tanks exported to Poland under Hyundai Rotem’s deal. Domestically, Hanwha Systems commenced mass production of the fourth batch of the TICN system and the second batch of the next generation military tactical multi band multirole radio (TMMR) in 2024.

Hanwha Systems: Key financial indicators, ₩

| Fiscal 4Q 2024 ending on 12/31/24 | Y/Y change, % | |

| Revenue | 932.8B | 19.4% |

| EBITDA | 87.3B | 5.0% |

| Net income | 364.8B | 734.8% |

This performance highlights Hanwha Systems’ symbiotic relationship with South Korea’s primary weapons platform developers – Hanwha Aerospace, Hyundai Rotem, Korea Aerospace Industries (KAI) and LIG Nex1. As a key supplier of advanced electronic subsystems, the company plays a critical role in flagship platforms such as the K9 howitzer, K2 tank, FA-50 light combat aircraft, Cheongung-II missile system and the next generation KF-21 fighter jet.

Large scale defence exports by these prime contractors translate into significant downstream gains for Hanwha Systems, reinforcing synergistic growth across the broader “K-Defence” industrial ecosystem. The company’s performance has become a bellwether for the strength and trajectory of South Korea’s defence export push.

Another key milestone for Hanwha Group came with its $100 million acquisition of Philly Shipyard in December 2024. The deal gives the conglomerate its first overseas shipbuilding facility and a strategic entry point into the U.S. defence industrial base, bolstering its ambitions in naval defence contracting.

Rising defence budgets worldwide and persistent geopolitical tensions continue to provide fertile ground for South Korea’s defence sector. The nation’s leading contractors have successfully translated international demand into robust order backlogs and strengthened financial positions. This industrial momentum enjoys consistent reinforcement through substantial government backing. The Defence Acquisition Program Administration (DAPA) serves as a crucial facilitator for international sales, crafting government-to-government frameworks such as the recent K2/K808 arrangement between Hyundai Rotem and Peru’s FAME S.A.C.

High level diplomacy is also central to this push, with Defence Minister Seok Jong-gun’s visits to Saudi Arabia and Norway in January 2025 underscoring Seoul’s strategic engagement abroad. With strong demand expected across key markets, South Korea’s defence industry is poised to sustain its upward trajectory.