Japan stands as the world’s third-largest steel producer, dedicating a substantial portion of its output to key domestic sectors including construction and automotive manufacturing. However, the country faces a challenge due to the scarcity of natural resources crucial for steel production, leading to a heavy reliance on imports of raw materials. Despite this challenge, Japan’s role as the second-largest global steel exporter underscores its critical importance in the international steel market.

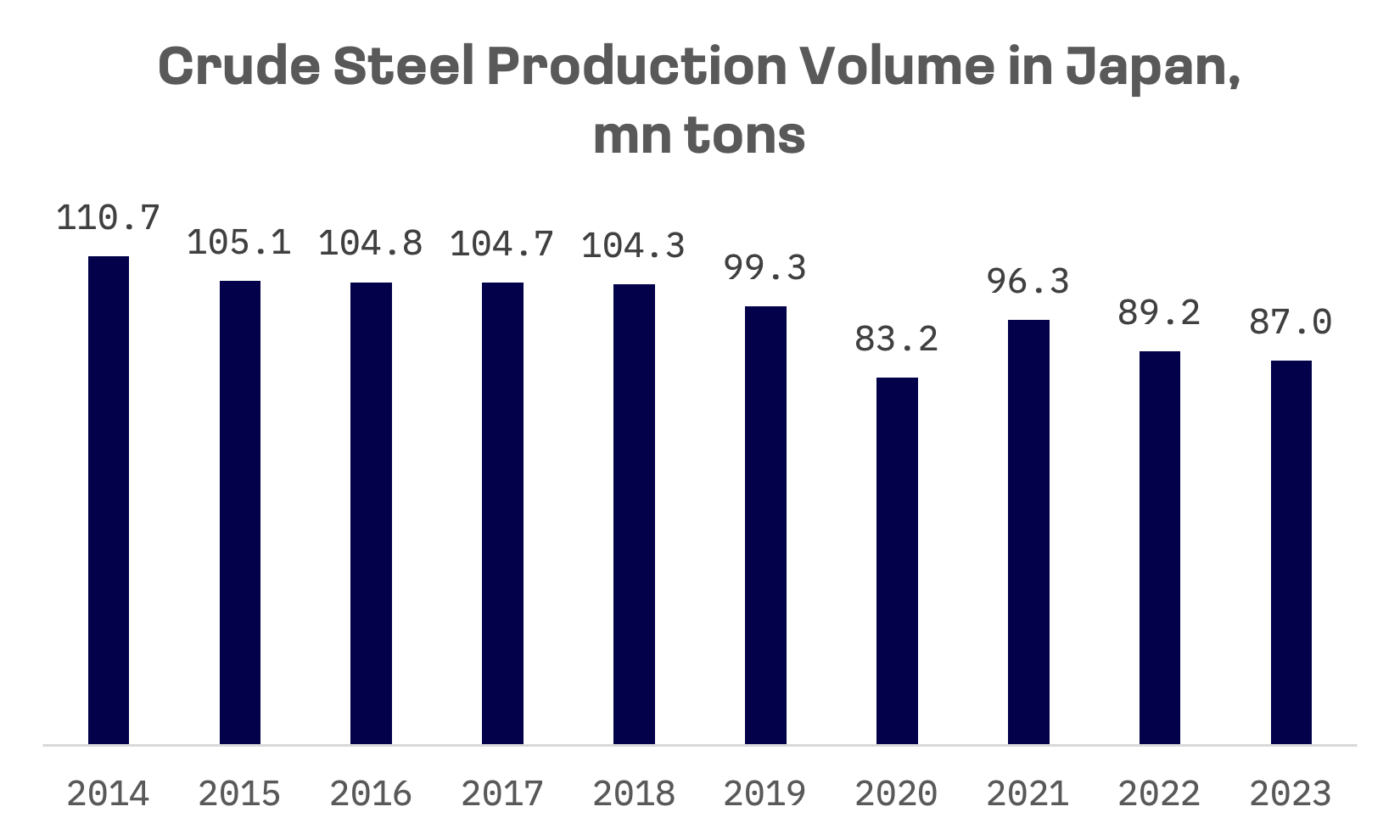

The Japan Iron and Steel Federation reported a 2.5% decrease in Japan’s crude steel production in 2023, dropping to 87 million metric tons — the lowest since the demand downturn in 2020 due to the COVID-19 pandemic. This downturn is attributed to reduced demand from manufacturing and construction sectors, coupled with declining exports amid China’s increasing steel exports.

In 2023, Japan’s automobile production showed signs of rebounding from the previous year’s challenges, notably the prolonged chip shortage and other component deficits that led to repeated reductions in production targets. However, this recovery contrasted with the continued sluggishness in other manufacturing sectors. The construction sector, in particular, saw persistently soft demand, attributed to delays in project timelines driven by labor shortages and the burden of high material costs.

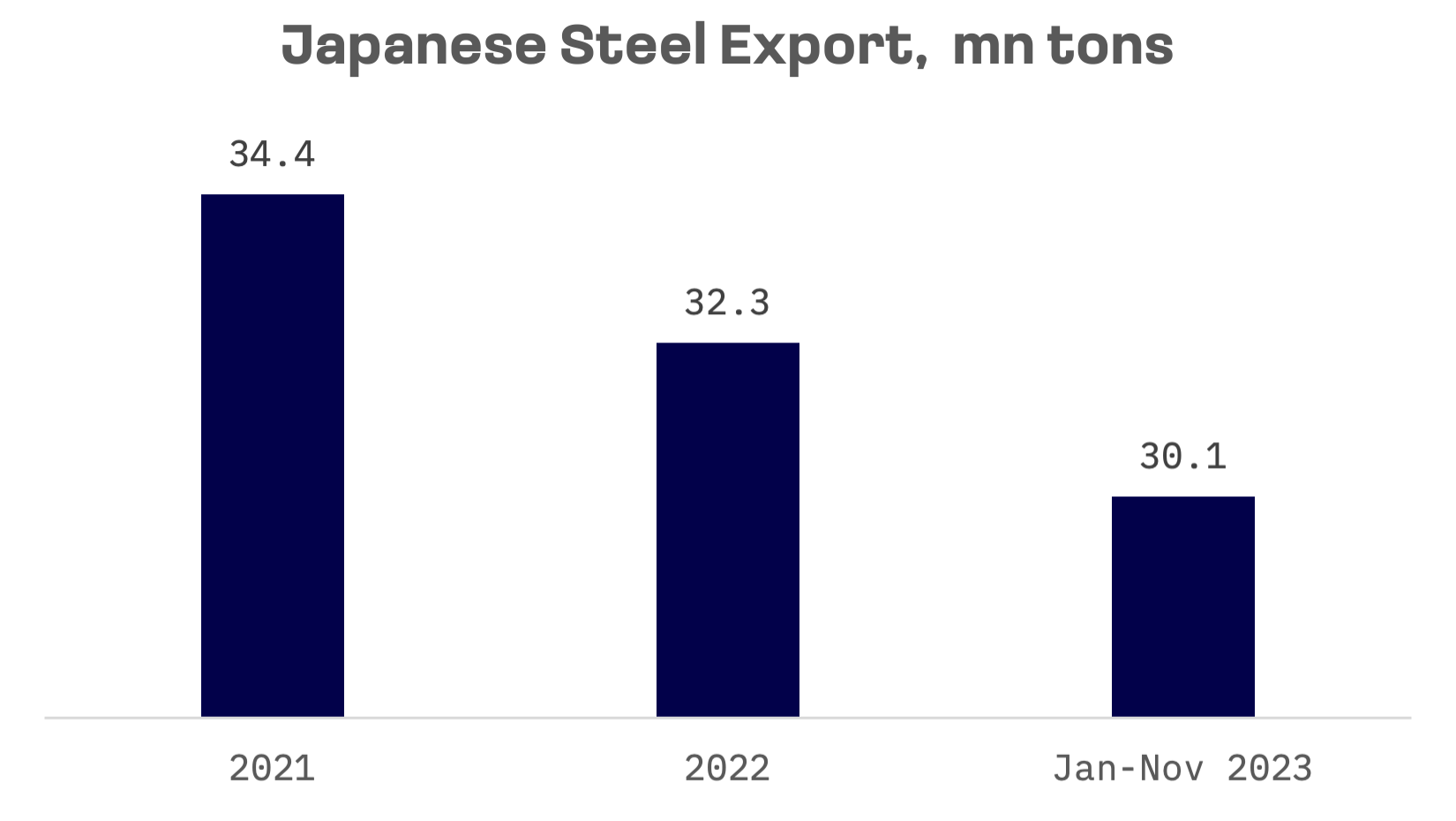

Despite recording a 1.7% growth in steel exports from January to November 2023, compared to the same period in 2022, Japanese steelmakers were unable to capitalize on a weaker yen against the U.S. dollar. This difficulty was compounded as Chinese steel mills ramped up their exports to Southeast Asia — a key market traditionally dominated by Japanese steel exports.

On the supply side, Japanese steelmakers have been reducing the number of blast furnaces in recent years, shifting their focus from sheer production volume to value-added products, aimed at securing higher profits. Experts remain cautious about the industry’s capacity to elevate steel output to the 100 million tons threshold given current supply constraints.

Among the numerous public companies representing Japan’s iron and steel landscape, we would like to focus on the four largest by market capitalisation and assets.

| Company Name | Ticker | JAKOTA Index | Market Cap as of Jan 26, 2024, USD | Total Assets as of Sep 30, 2023, USD |

| Nippon Steel | 5401.TSE | Blue Chip 150 | 22.24B | 71.51B |

| JFE Holdings | 5411.TSE | Mid and Small Cap 2000 | 9.48B | 38.03B |

| Kobe Steel | 5406.TSE | Mid and Small Cap 2000 | 5.21B | 19.69B |

| Daido Steel | 5471.TSE | Mid and Small Cap 2000 | 2.15B | 5.32B |

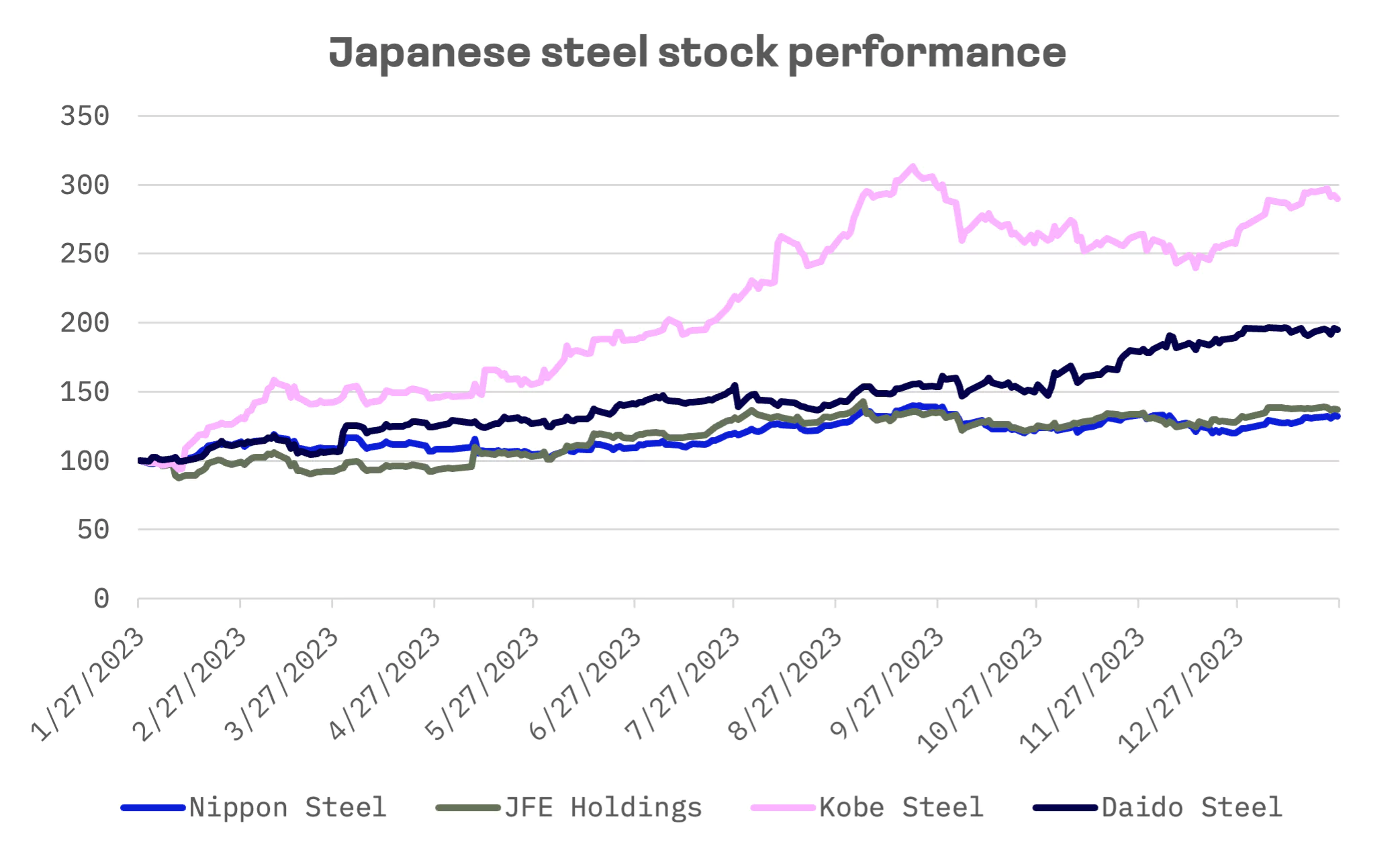

Thanks to the strong dynamics of the entire Japan stock market, all Japanese steel stocks have shown robust growth. Among these, Kobe Steel stands out, with its shares nearly tripling in value over the past year.

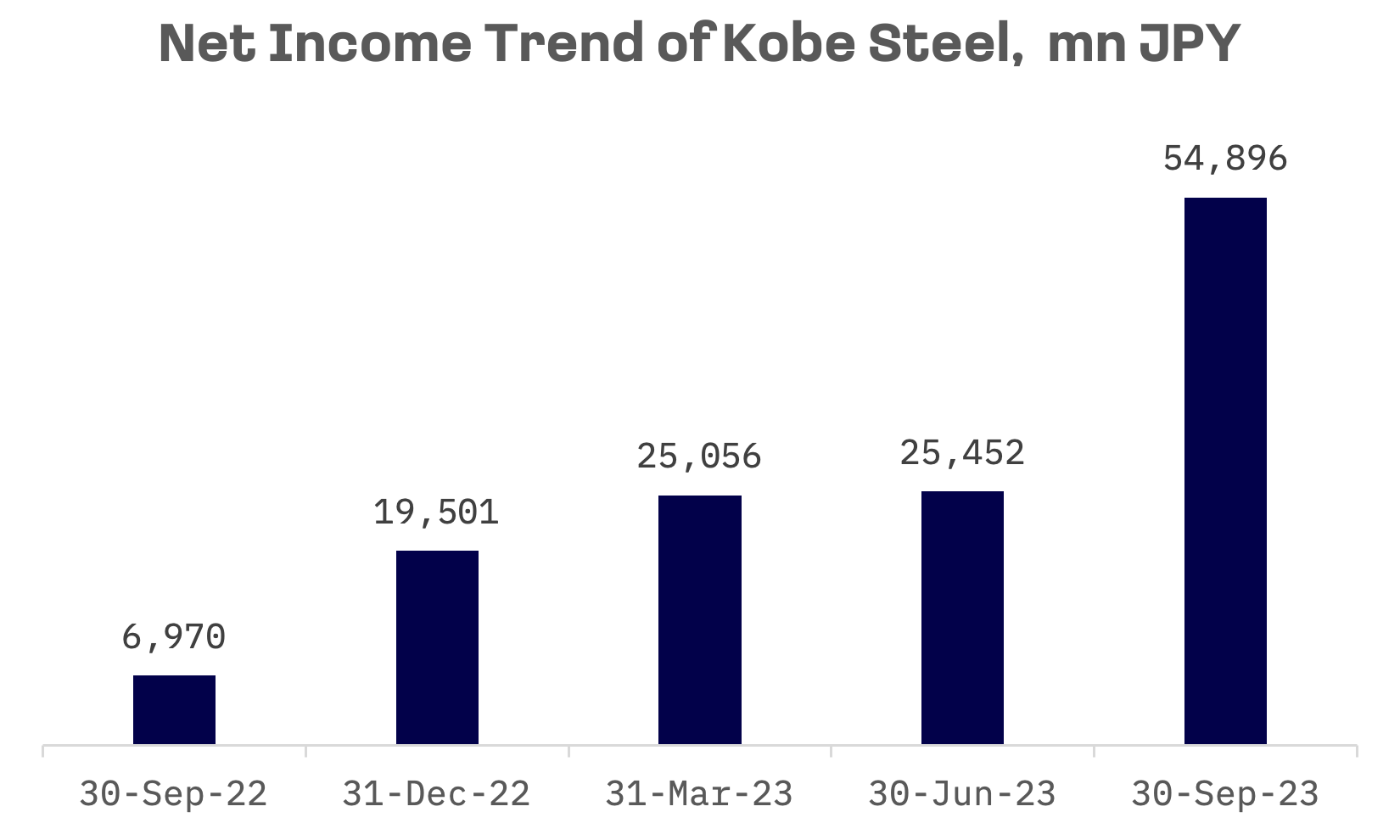

In April-September 2023, Kobe Steel’s net income witnessed a remarkable surge, increasing by ¥52.3 billion from the previous year to reach a record ¥80.3 billion. This substantial growth was fuelled by improved steel metal spreads and strong earnings from the electric power segment. Additionally, the positive impact of delayed fuel cost adjustments and temporary gains from changes in electricity prices played crucial roles in this achievement.

In terms of ratios such as EV/Sales, EV/EBITDA and P/E, Kobe Steel remains relatively cheap compared to its peer group.

| Company Name | TEV/Total Revenues LTM | TEV/EBITDA LTM | P/Diluted EPS LTM |

| Nippon Steel | 0.66x | 4.92x | 5.80x |

| JFE Holdings | 0.57x | 6.10x | 9.07x |

| Kobe Steel | 0.53x | 4.36x | 6.24x |

| Daido Steel | 0.84x | 6.88x | 10.8x |

| MEAN | 0.65x | 5.57x | 7.98x |

| MEDIAN | 0.62x | 5.51x | 7.66x |

The Japan Iron and Steel Federation projects that crude steel production in 2024 will level with 2023 figures. The federation cites high material costs and labor shortages, particularly within the construction industry, as factors likely to quell demand for construction steel in 2024. Similarly, labor shortages are expected to dampen manufacturing activity. Despite a steady backlog of orders in shipbuilding, a decline in demand for steel in the machinery sector is anticipated, following a surge in machine tool demand in 2023. Conversely, the automotive industry is poised for a boost in steel demand as it works through existing order backlogs. The Japanese Ministry of Trade (METI) anticipates a 1.7% increase in steel production in the first quarter of 2024, driven by robust demand from the automotive sector, which may counterbalance weaker demand from other sectors and construction. However, concerns linger about how a weakening European economy and China’s stalled recovery might affect demand for industrial machinery steel.

In this context, where production volume growth is not expected, stringent cost management emerges as critical for the stable growth of Japanese steel companies.

Another factor driving interest in Japanese steel companies is the unfolding potential acquisition of the United States Steel by Nippon Steel.

Nippon Steel’s bid for U.S. Steel

Nippon Steel, Japan’s largest steelmaker, announced on December 18 its intention to acquire all of U.S. Steel’s steelmaking and iron ore assets in the United States, as well as its operations in Slovakia, for a purchase price exceeding $14.1 billion. This strategic acquisition is designed to diversify Nippon Steel’s global operations significantly, boosting its production capacity towards a strategic goal of achieving 100 million metric tons of global crude steel capacity annually.

The offer of $55 per share represents a substantial premium, nearly 60% over the previous offer made by Cleveland-Cliffs Inc. in late July, which U.S. Steel’s leadership declined, leading to the historic manufacturer being put up for sale.

Nippon Steel’s bid has drawn significant attention from U.S. legislators and the White House. On December 19, Republican Senators JD Vance, Marco Rubio and Josh Hawley wrote to US Treasury Secretary Janet Yellen, urging the Committee on Foreign Investments in the United States (CFIUS), chaired by Yellen, to block the acquisition of US Steel by Nippon Steel. The Senators argued that the transaction was “not entered into with US national security in mind” and highlighted the Section 232 tariffs on foreign steel — enacted as a national security measure by former President Donald Trump in March 2018 and still in effect today — as a reason for scrutinising the move. Jon Fetterman, a Democratic senator from Pennsylvania, has also expressed his determination to halt the sale.

President Joe Biden has supported a thorough investigation into the acquisition’s implications on national security and supply chain reliability, reflecting the deal’s high-profile nature and its potential impact. Lael Brainard, President Biden’s national economic adviser, expressed on December 21, that the U.S. President believes that “the purchase of this iconic American-owned company by a foreign entity — even one from a close ally — appears to deserve serious scrutiny in terms of its potential impact on national security and supply chain reliability.”

Nippon Steel has sought to alleviate concerns by committing to honoring collective bargaining agreements and preserving U.S. Steel’s Pittsburgh headquarters. Additionally, it has stated that it does not anticipate any job losses resulting from the deal.

Furthermore, in a recent development on January 24, U.S. Steel made a significant disclosure regarding the ongoing auction process. A bidder referred to as “Company D,” later identified as Cleveland-Cliffs, raised its cash-and-stock offer to $54 per share. Additionally, it projected that synergies between the two companies would deliver an additional $6.50 per share in value to U.S. Steel shareholders. Nippon Steel initially made a $48-a-share cash proposal on December 15 but swiftly increased its offer by almost 15% within 24 hours (the final offer is at $55 per share). Cleveland-Cliffs indicated it had accepted the outcome of the sale process, wishing U.S. Steel “luck” in completing the deal with Nippon Steel.

This strategic acquisition, if completed, would position the combined entity of Nippon Steel and US Steel as the world’s third-largest steel producer, boasting an annual crude steel production capacity of 86 million metric tons.