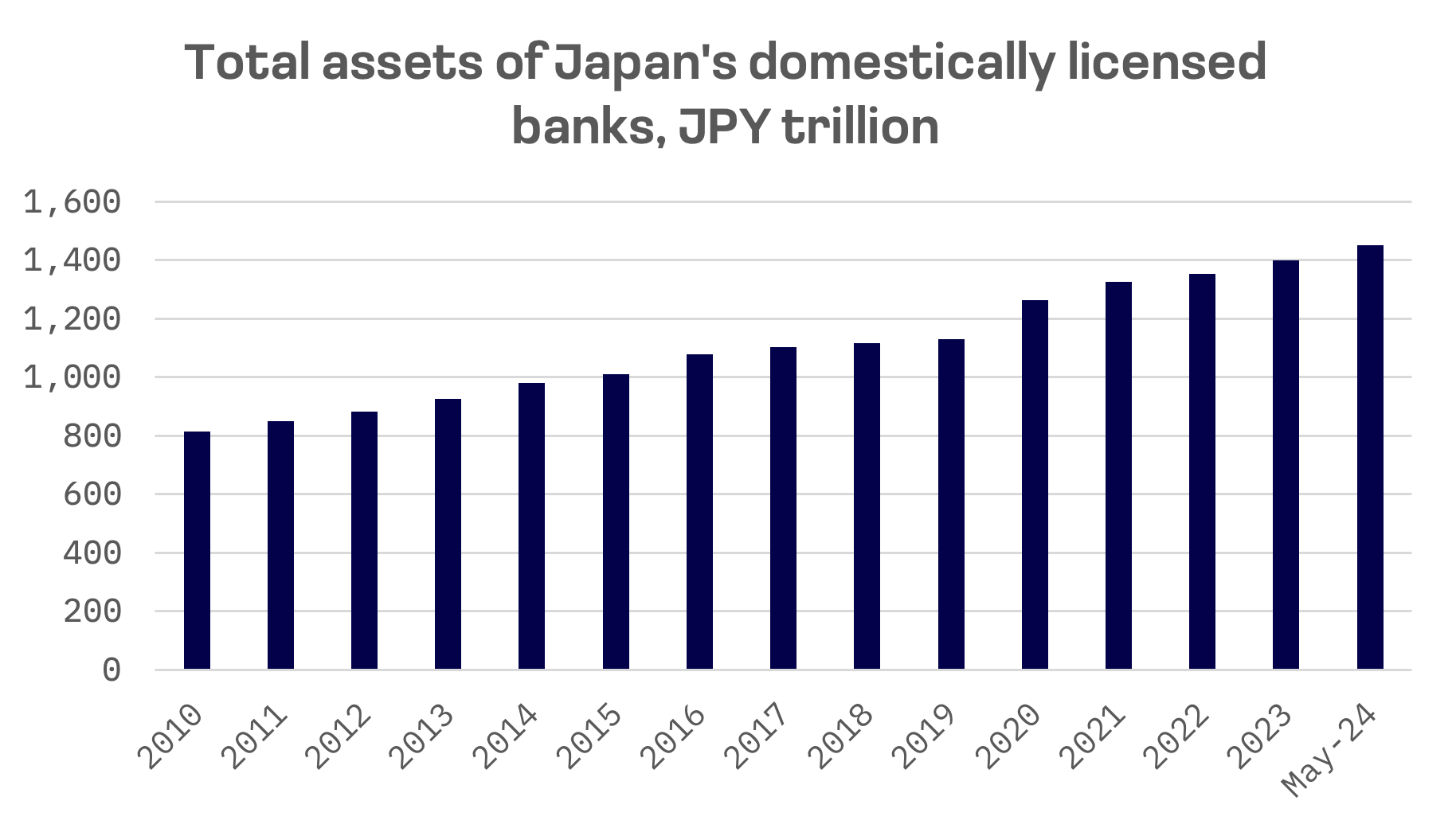

Japan’s banking industry, one of the world’s largest and most complex, boasts combined assets of ¥1,450.7 trillion ($9.24 trillion) among domestically licensed banks as of May 2024, according to Bank of Japan (BoJ) figures.

The landscape comprises major banks, regional banks and shinkin banks. Ten major banks lead the sector:

- Mizuho Bank

- MUFG Bank

- Sumitomo Mitsui Banking Corporation

- Resona Bank

- Saitama Resona Bank

- Mitsubishi UFJ Trust and Banking Corporation

- Mizuho Trust and Banking Company

- Sumitomo Mitsui Trust Bank

- SBI Shinsei Bank

- Aozora Bank

Regional banks consist of 62 members in the Regional Banks Association of Japan (Regional banks I) and 37 in the Second Association of Regional Banks (Regional banks II).

Additionally, 247 shinkin banks hold current accounts at the Bank of Japan. These cooperative financial institutions play a vital role in Japan’s banking sector, providing essential services to small and medium sized enterprises and individuals, particularly in local communities. Their focus on community development and support for financial inclusion cements their position as a crucial pillar of the Japanese economy.

Despite a nearly 50% surge in total assets over the past decade, Japan’s persistent low-interest-rate policy and aging population have created challenges for banks. Recent deregulatory measures aim to improve earnings, particularly for struggling regional banks, with further amendments anticipated.

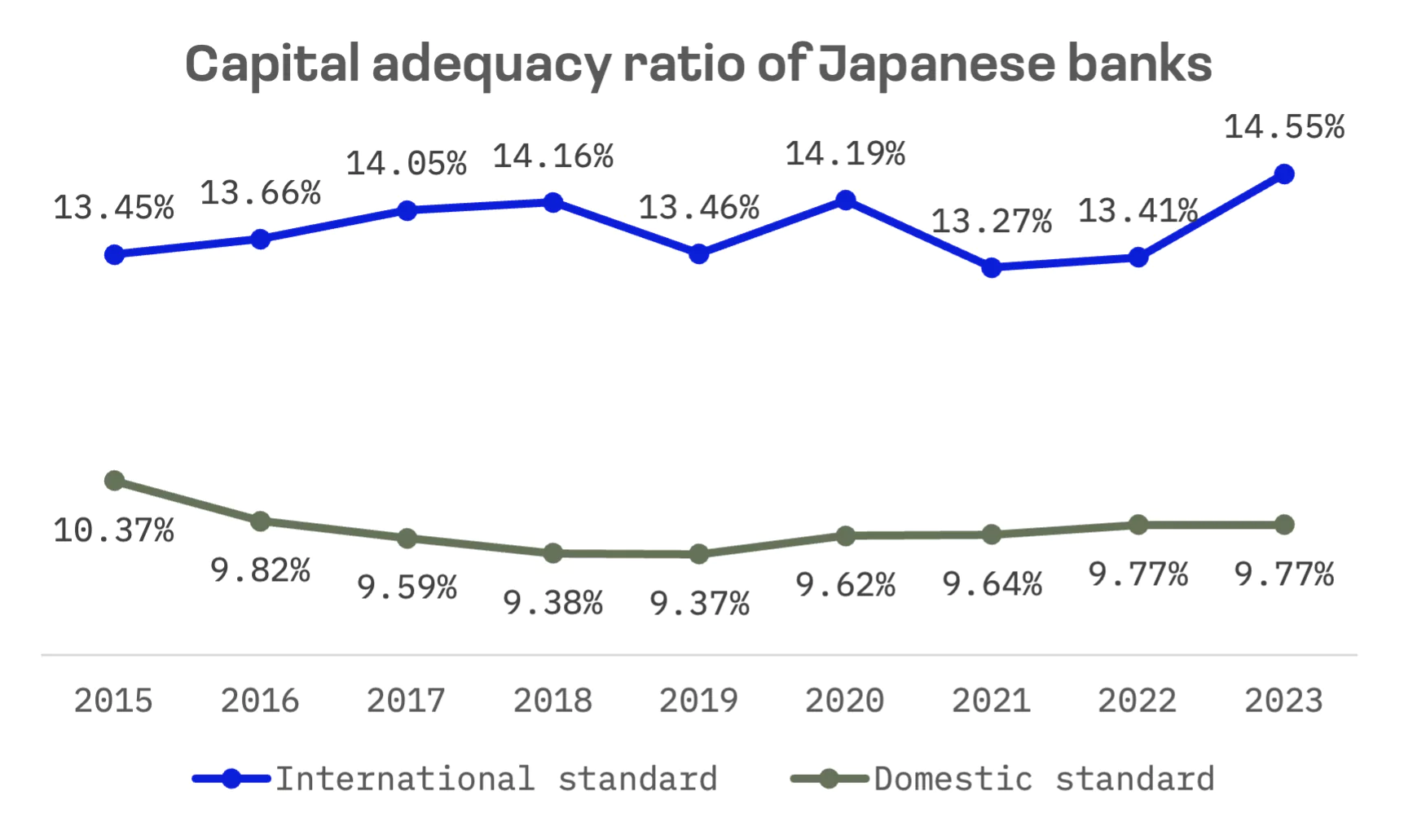

The Banking Act, cornerstone of Japan’s financial regulatory framework, has undergone numerous amendments in recent years. These changes, aimed at deregulation, enable Japanese banks to better navigate significant shifts in their external landscape, including persistently low interest rates and the rise of FinTech innovations. Recent revisions primarily impact the scope of business for banks and bank groups. Concurrently, prudential regulations, including the capital adequacy ratio, are being progressively strengthened to align with the Basel III Regime.

The Capital Adequacy Ratio Regulation requires banks to maintain a ratio above a specified threshold. This threshold varies significantly based on the bank’s operational scope, with higher requirements for internationally active banks compared to domestic ones.

In fiscal year 2023, Japanese banks adhering to the international regulatory framework reported a capital adequacy ratio of 14.55%, while those following the domestic standard averaged 9.77%. The domestic standard sets lower minimum requirements.

Under the Banking Act, Japanese banks must be structured as stock companies (“Kabushiki Kaisha”). They are required to have: (a) a board of directors; (b) a board of company auditors, an audit and supervisory committee, or nominating, compensating, and auditing committees; and (c) an accounting auditor.

Banks listed on the Japanese stock market must disclose their governance status according to Japan’s Corporate Governance Code. This code follows a “comply or explain” approach, mandating that banks provide explanations for any non compliance with the Code’s recommendations.

This report will further focus exclusively on the largest banks by market capitalisation that are part of the JAKOTA Blue Chip Index:

| Company Name | Ticker | Market Cap, USD |

| Mitsubishi UFJ Financial | 8306.TSE | 129.7B |

| Sumitomo Mitsui Financial Group | 8316.TSE | 90.1B |

| Mizuho Financial Group | 8411.TSE | 54.1B |

| Japan Post Bank | 7182.TSE | 34.3B |

| Sumitomo Mitsui Trust Holdings | 8309.TSE | 16.9B |

| Resona Holdings | 8308.TSE | 15.3B |

Mitsubishi UFJ Financial Group (MUFG) stands as Japan’s largest banking group in terms of domestic loans, deposits and market capitalisation. It’s also the most globally oriented among Japanese banks, with overseas operations significantly contributing to both profits and balance sheet.

Two companies in the peer group belong to The Sumitomo Group: Sumitomo Mitsui Financial Group (SMFG) and Sumitomo Mitsui Trust Holdings (SMTH). SMFG offers a wide range of financial services including banking, leasing, securities, credit cards and consumer finance both domestically and internationally. SMTH operates primarily as a trust bank, providing trust and related services in Japan and globally.

Mizuho Financial Group, Japan’s third largest financial services company, is involved in banking, trust, securities and various other financial services both domestically and internationally.

Japan Post Bank offers a range of banking products and services to retail and corporate clients, primarily through contracted post offices that are officially part of Japan Post Service.

Resona Holdings provides retail and commercial banking products and services in Japan and internationally.

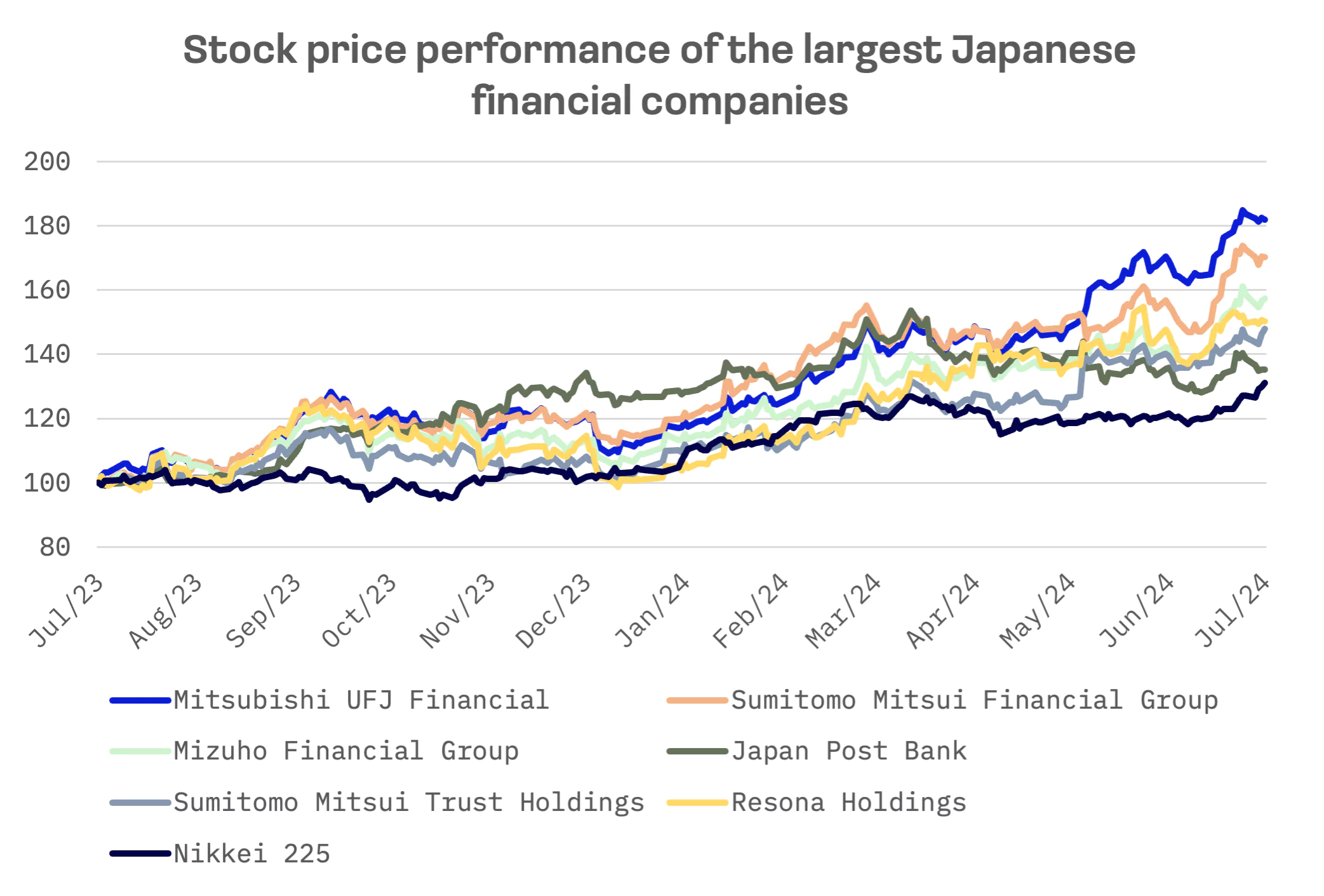

Over the past 12 months, shares of Japan’s six largest banks have all posted positive returns, outperforming the Nikkei 225 index. This strong performance in the banking sector is primarily attributed to the Bank of Japan’s decision to end its negative interest rate and yield curve control policies. The move, aimed at restoring greater monetary policy flexibility, has significantly boosted Japanese banks’ net interest margins.

Mitsubishi UFJ Financial Group (MUFG) has been the standout performer, with its shares surging 82% over the last 12 months. Unsurprisingly, this remarkable gain has made MUFG the most expensive among its peers across most valuation multiples:

| Company Name | Price/Sales | Price/Book Value | P/E | Forward P/E |

| Mitsubishi UFJ Financial | 4.47x | 0.96x | 14.42x | 11.26x |

| Sumitomo Mitsui Financial Group | 3.04x | 0.86x | 15.31x | 11.26x |

| Mizuho Financial Group | 2.65x | 0.78x | 12.92x | 10.19x |

| Japan Post Bank | 3.61x | 0.60x | 15.55x | 13.16x |

| Sumitomo Mitsui Trust Holdings | 2.32x | 0.80x | 34.94x | 9.57x |

| Resona Holdings | 3.07x | 0.90x | 15.80x | 13.89x |

| AVERAGE | 3.19x | 0.82x | 18.16x | 11.56x |

| MEDIAN | 3.06x | 0.83x | 15.43x | 11.26x |

Japan’s largest banks are forecasting record profits for the coming year, signalling increased optimism about an economy emerging from years of negative interest rates. Mitsubishi UFJ Financial Group (MUFG) expects a net profit of ¥1.5 trillion ($9.6 billion) for the current year, a slight increase over last year’s record jump up by a third.

“We are entering a world with interest rates, which is a plus for us,” said MUFG’s group chief executive, Hironori Kamezawa.

Results from MUFG, Sumitomo Mitsui Financial Group (SMFG) and Mizuho Financial Group underscore how Japanese banks are benefiting from higher overseas interest rates and a weaker yen, which boosts repatriated earnings.

MUFG and SMFG each announced plans to repurchase up to ¥100 billion in shares. SMFG also plans a 3 for 1 stock split for shareholders as of September 30. MUFG raised its fiscal 2024 dividend forecast to ¥50 per common stock from ¥41 in fiscal 2023, targeting a 39.1% payout ratio.

Despite the positive momentum, questions linger about potential benefits from increased deal demand and higher domestic interest rates. Years of deflation have fostered a cash hoarding tendency among Japanese businesses and households.

Despite the positive momentum in Japan’s banking sector, a central question persists: how much can banks benefit from potentially heightened deal demand and higher domestic interest rates? The cautious mindset of Japanese businesses and households, shaped by years of deflation, has fostered a tendency to hoard cash.

SMFG CEO Toru Nakashima noted a shift towards optimism among Japanese corporate managers, a positive economic indicator. However, he acknowledged that these economic advantages have yet to translate into widespread benefits for average citizen.