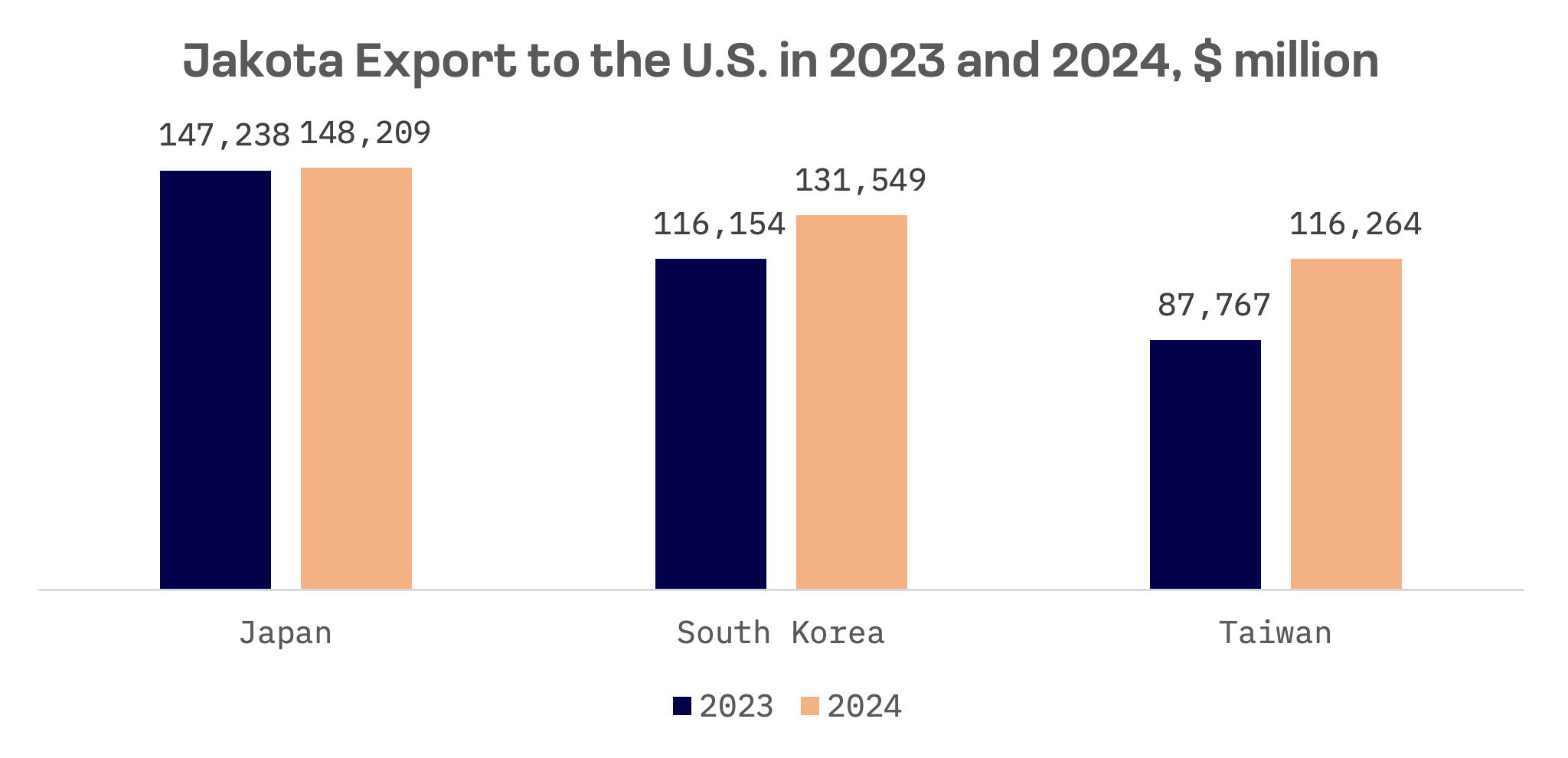

U.S. bound exports from Japan, South Korea and Taiwan surged to nearly $400 billion in 2024, climbing 13% from the previous year on robust American demand for semiconductors, automobiles and electronic components.

This export boom now faces a significant challenge, as President Donald Trump revived a long standing pledge to impose higher duties on trading partners in an effort to bolster American industry. On April 2, 2025, Mr. Trump formally announced the new tariff plan, setting rates at 24% for Japan, 25% for South Korea and 32% for Taiwan.

The tariff plan carves out notable exceptions. Pharmaceuticals, semiconductors, copper, lumber, energy products and certain critical minerals won’t face the new duties. Products already subject to Section 232 tariffs – including steel, aluminum and automobiles – also remain exempt. This approach suggests the administration is pursuing a strategy of layering trade barriers rather than replacing existing ones, reflecting a more aggressive and targeted approach to trade protection.

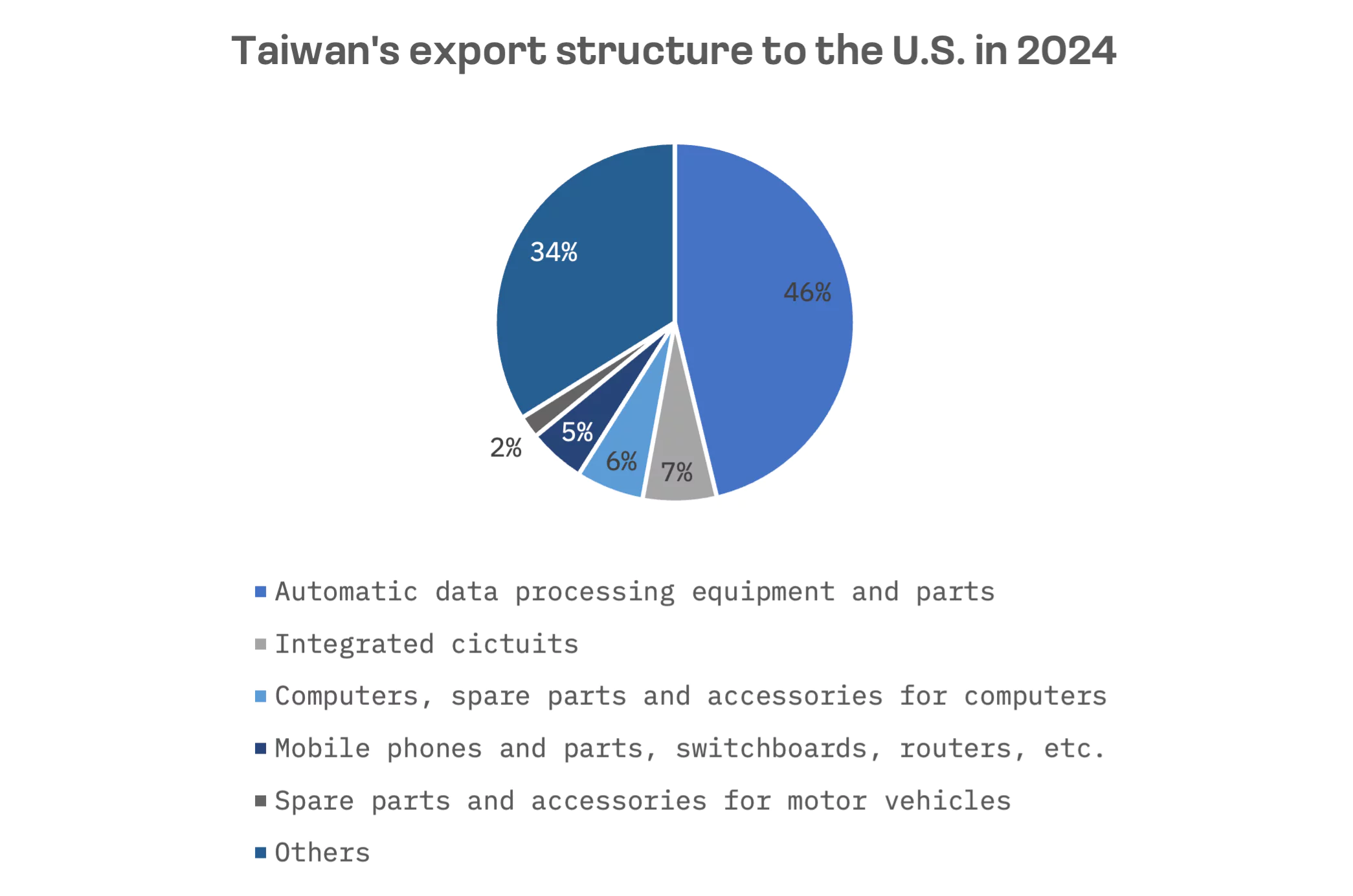

The exclusion of semiconductors is particularly significant for Taiwan, given the dominant role the chip sector plays in its export structure to the U.S.. Taiwan’s semiconductor industry has been granted a temporary reprieve, mitigating some of the immediate impact of the new tariffs.

Japan reacted swiftly and forcefully to the tariff announcement. Prime Minister Shigeru Ishiba didn’t mince words, labelling the duties a “national crisis” while expressing deep regret and advocating for a “calm-headed” approach to negotiations with Washington.

South Korea had braced itself for potential U.S. trade action, given its considerable trade surplus with America. The 25% tariff immediately set off alarm bells in Seoul, particularly regarding key export sectors like semiconductors, automobiles and consumer electronics. While existing tariffs already cover South Korean automotive exports, Mr. Trump specifically highlighted the country’s high proportion of domestically produced vehicles, signalling that auto trade imbalances remain a central concern in his broader trade agenda.

Taiwan delivered perhaps the sharpest rebuke, condemning the 32% tariff as “deeply unreasonable” and “highly regrettable.” The Taiwanese government announced plans to lodge a formal protest with the U.S. Trade Representative while pursuing diplomatic channels to protect its national and industrial interests. Despite the semiconductor exemption, trade associations warn that Taiwan’s machine tool and information and communications technology (ICT) sectors face significant disruption.

Taiwanese officials argue the steep tariff rate fails to reflect the true nature of the bilateral trade relationship. They point to soaring U.S. demand for Taiwanese semiconductors and AI related products, along with Taiwan’s efforts to shift manufacturing away from China in response to earlier U.S. tariffs on Chinese goods. Taiwan emphasised its strategic importance to U.S. economic and national security interests, maintaining that such punitive measures lack justification. Unlike Tokyo, Taipei hasn’t telegraphed retaliatory measures, focusing instead on diplomatic resolution.

The tariff announcement triggered immediate market turbulence and heightened scrutiny of vulnerable industries. While short term disruptions dominate current concerns, longer term structural consequences loom on the horizon. These could include strategic shifts towards export market diversification, reassessment of domestic manufacturing capacity and intensified efforts to develop trade relationships beyond the United States.