Last week’s Jakota markets:

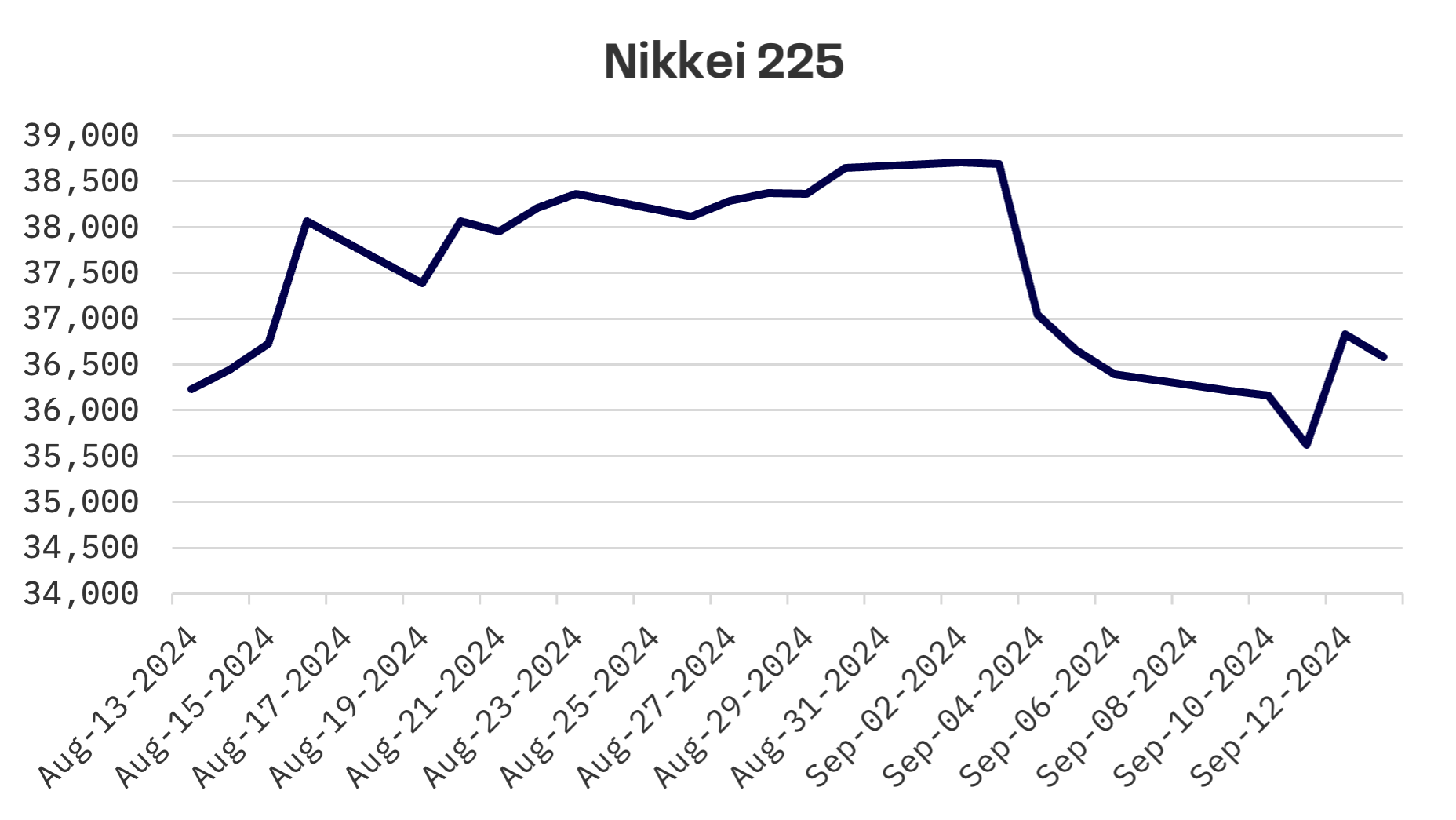

- Japan’s stock market gained 0.5% as the Nikkei 225 rose, shrugging off yen strength and downward GDP revision amid speculation of both BoJ tightening and Fed easing

- South Korean shares climbed 1.2%, with the KOSPI recovering from early pressure to post gains on tech sector strength and rate cut hopes, despite the Bank of Korea’s cautious stance

- Taiwan’s TAIEX outperformed other JAKOTA markets, advancing 1.5% on the back of a late week rally led by TSMC and other tech heavyweights

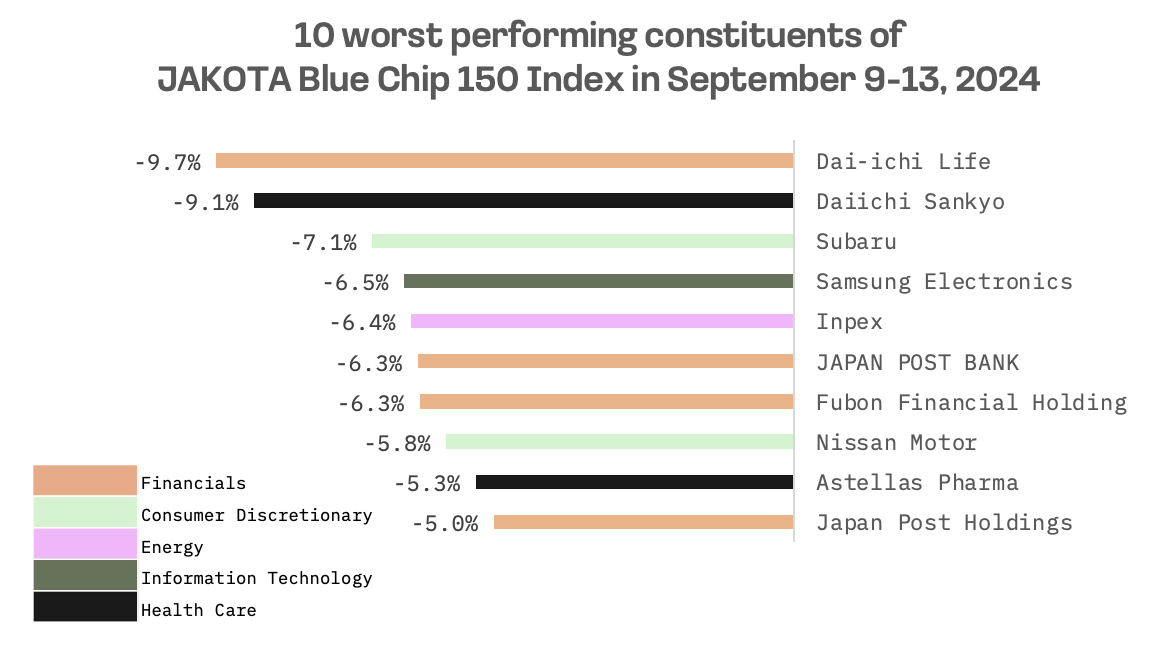

- The JAKOTA Blue Chip 150 Index rose 0.5%, with POSCO Group affiliates showing strength while Japanese financials and Daiichi Sankyo underperformed

Japan

Japan’s stock market edged up this week, with the Nikkei 225 gaining 0.5%. Exporters faced headwinds as the yen strengthened to the upper JPY 140 range against the U.S. dollar, compared with JPY 142 the previous week. The currency’s rise followed a hawkish outlook for the Bank of Japan (BoJ)’s monetary policy.

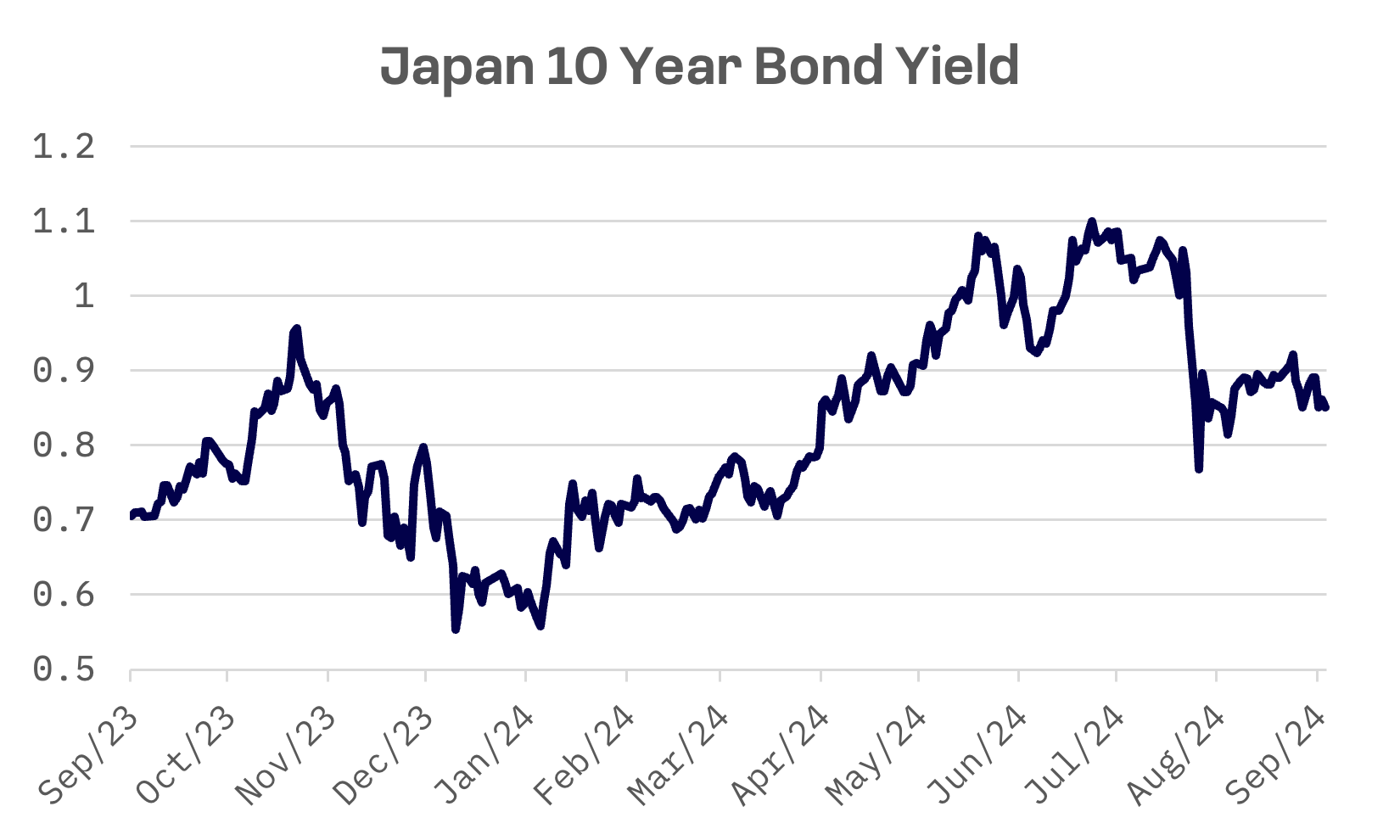

Expectations for another interest rate hike by the BoJ this year gained momentum after recent comments from board members. Junko Nakagawa reiterated that monetary easing will be adjusted if Japan’s economic and inflation outlook materialises, noting that real rates remain exceptionally low. Naoki Tamura suggested that the short term rate may need to rise to around 1% in the second half of the BoJ’s projection period through fiscal 2026 to manage inflation risks and ensure price stability.

Despite the hawkish signals, the yield on the 10 year Japanese government bond dipped to 0.84% from 0.86% the previous week. The decline mirrored U.S. bond yields, amid speculation that the Federal Reserve could implement a more aggressive 50 basis point rate cut at its upcoming September meeting.

Japan’s second quarter GDP growth was revised downward, with the economy expanding at an annualised rate of 2.9% quarter-on-quarter, below the preliminary estimate of 3.1% and market expectations of 3.2%. Weaker contributions from private consumption and capital expenditure drove the revision.

South Korea

The Korean stock market ended the week on a positive note, with the KOSPI Index rising 1.2%. Gains were concentrated in the last two trading sessions after initial pressure from investor apprehension over potential U.S. Federal Reserve rate cuts, exacerbated by foreign selloff and cautious sentiment ahead of critical U.S. inflation data.

Seoul shares rebounded on Thursday, driven by gains in the technology sector and buoyed by expectations of a forthcoming rate cut. Investors remain hopeful for at least a 25 basis point rate reduction by the Fed, despite inflation data diminishing prospects for a more substantial cut.

The Bank of Korea (BOK) signalled that the timing and pace of any cuts will depend on financial stability, stressing that no reductions will occur while household debt remains elevated. With two policy meetings remaining this year, in October and November, a rate cut decision is likely in November, contingent on signs of cooling in home prices and debt levels.

Taiwan

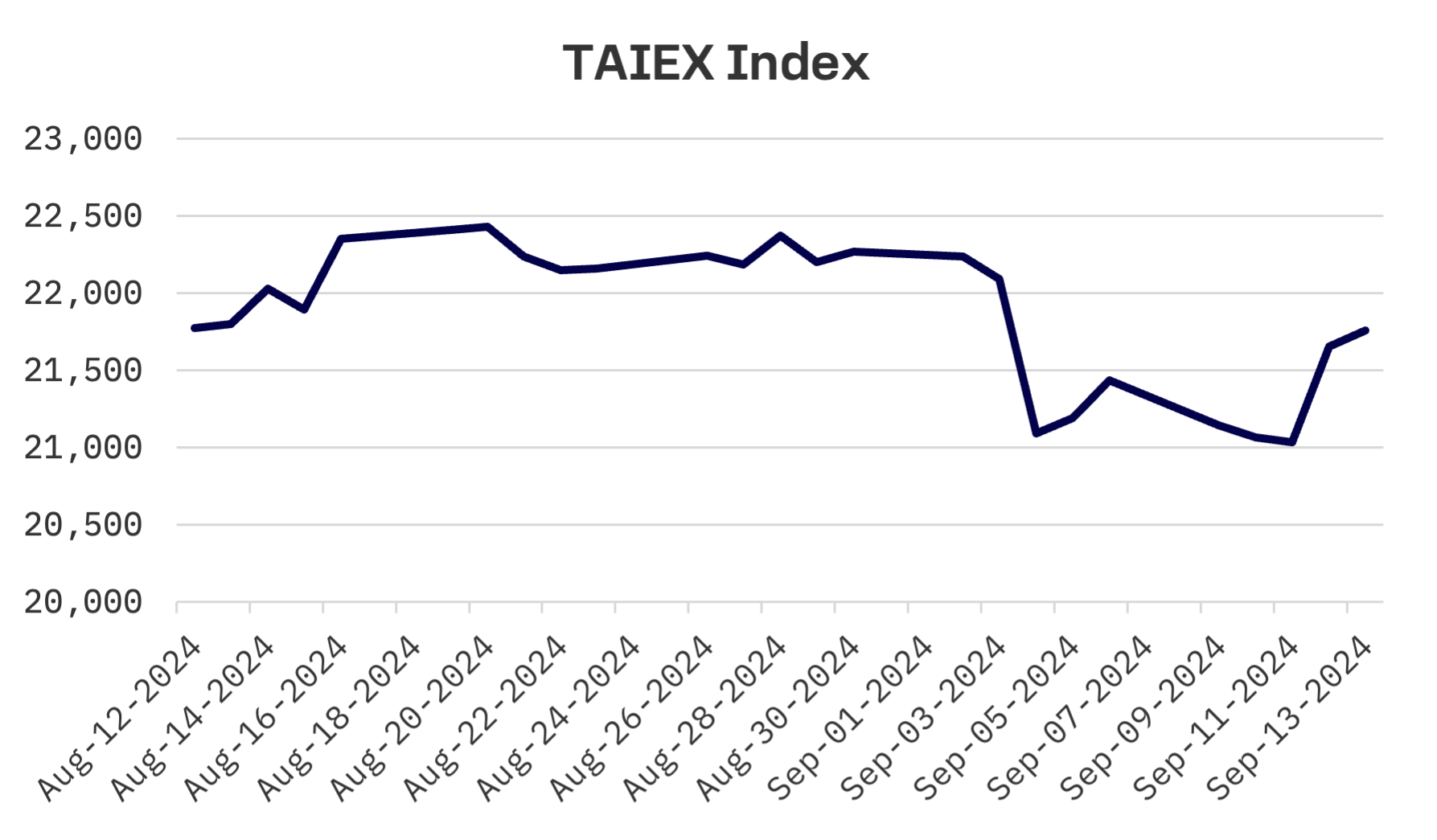

Taiwanese shares saw the largest gain among Jakota markets this week, with the TAIEX Index advancing 1.5%.

The market experienced volatility early in the week due to concerns over potential U.S. market fluctuations. Wednesday saw a slight decline with market consolidation and cautious sentiment ahead of the August CPI release, leading to the second lowest turnover of the year.

Thursday marked a strong rebound, with the market soaring over 600 points, driven by significant gains from chipmaker Taiwan Semiconductor Manufacturing Co. (TSMC) and other large cap tech stocks. The week ended on a positive note Friday, with shares closing moderately higher, although turnover remained thin as investors awaited the upcoming U.S. Federal Reserve policymaking meeting.

JAKOTA Blue Chip 150 Index

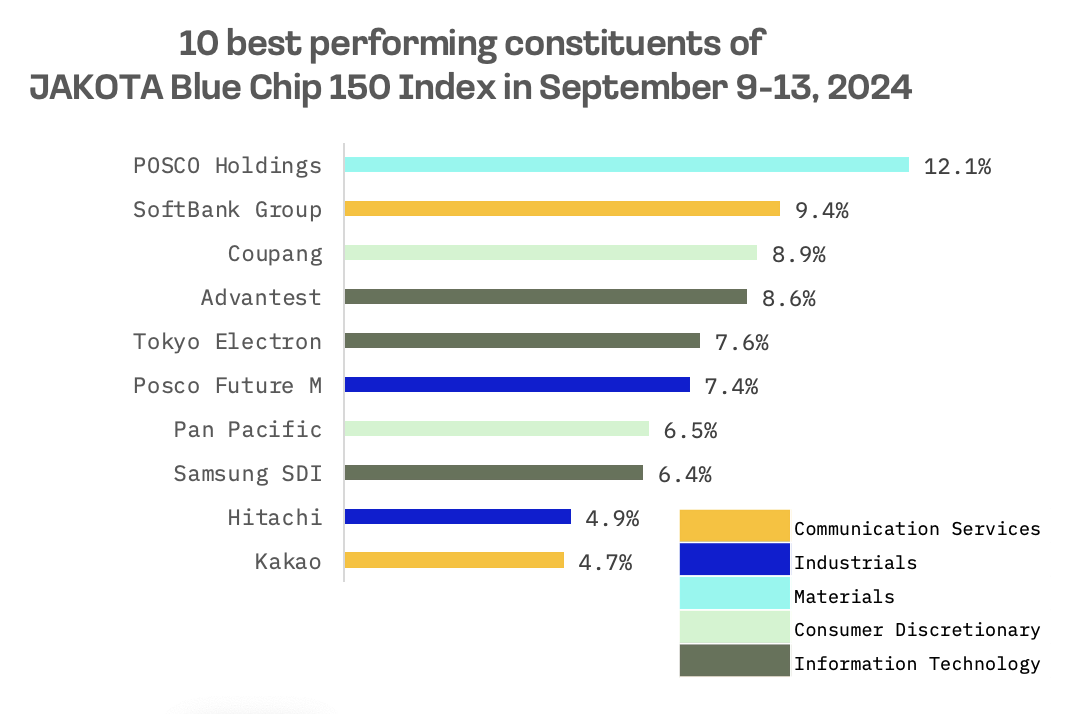

The JAKOTA Blue Chip 150 Index added 0.5% this week, with 59 out of 150 constituents posting gains.

Affiliates of POSCO Group, the South Korean conglomerate with interests spanning steel, rechargeable battery materials, lithium and nickel, hydrogen, energy, construction and infrastructure and agri-bio, made a strong showing. POSCO Holdings, an integrated steel manufacturer, added 12.1%, while POSCO Future M, a battery material & chemical company, gained 7.4%.

POSCO Holdings is garnering significant market attention following recent developments. China’s CLTL’s reduction in lithium production and the subsequent rebound in lithium carbonate prices have contributed to a notable increase in POSCO Holdings’ stock price. This uptick is also benefitting other lithium related stocks, with POSCO Holdings particularly well positioned as it adapts to shifts in the raw materials market.

In the U.S. stock market, lithium stocks have recently surged, exemplified by Albemarle’s 13% gain. Despite ongoing volatility in raw materials, POSCO Holdings appears well prepared to navigate fluctuations in lithium prices, potentially enhancing its appeal as an investment opportunity amid the price recovery.

Japanese insurance and financial companies, including Dai-ichi Life, Japan Post Bank and Fubon Financial Holding, were among the weakest performers on the JAKOTA Blue Chip 150 Index, following reductions in their target prices.

Daiichi Sankyo, Japan’s second largest pharmaceutical company, saw its shares drop over 9% following disappointing trial results for Dato-DXd, its lung cancer treatment.