Last week’s Jakota markets:

- Japan’s Nikkei 225 tumbled 3% following Shigeru Ishiba’s surprise victory in the LDP leadership race, despite his later dovish tone on monetary policy

- South Korea’s KOSPI dropped 3% during a shortened trading week, reacting to Middle East tensions and domestic inflation falling below 2%

- Taiwan’s TAIEX lost 2.3% over three trading days, with large cap tech stocks driving market fluctuations

- The JAKOTA Blue Chip 150 Index sank 4.1%, reflecting broad market declines across the region, with only 31 of 150 constituents posting gains

Japan

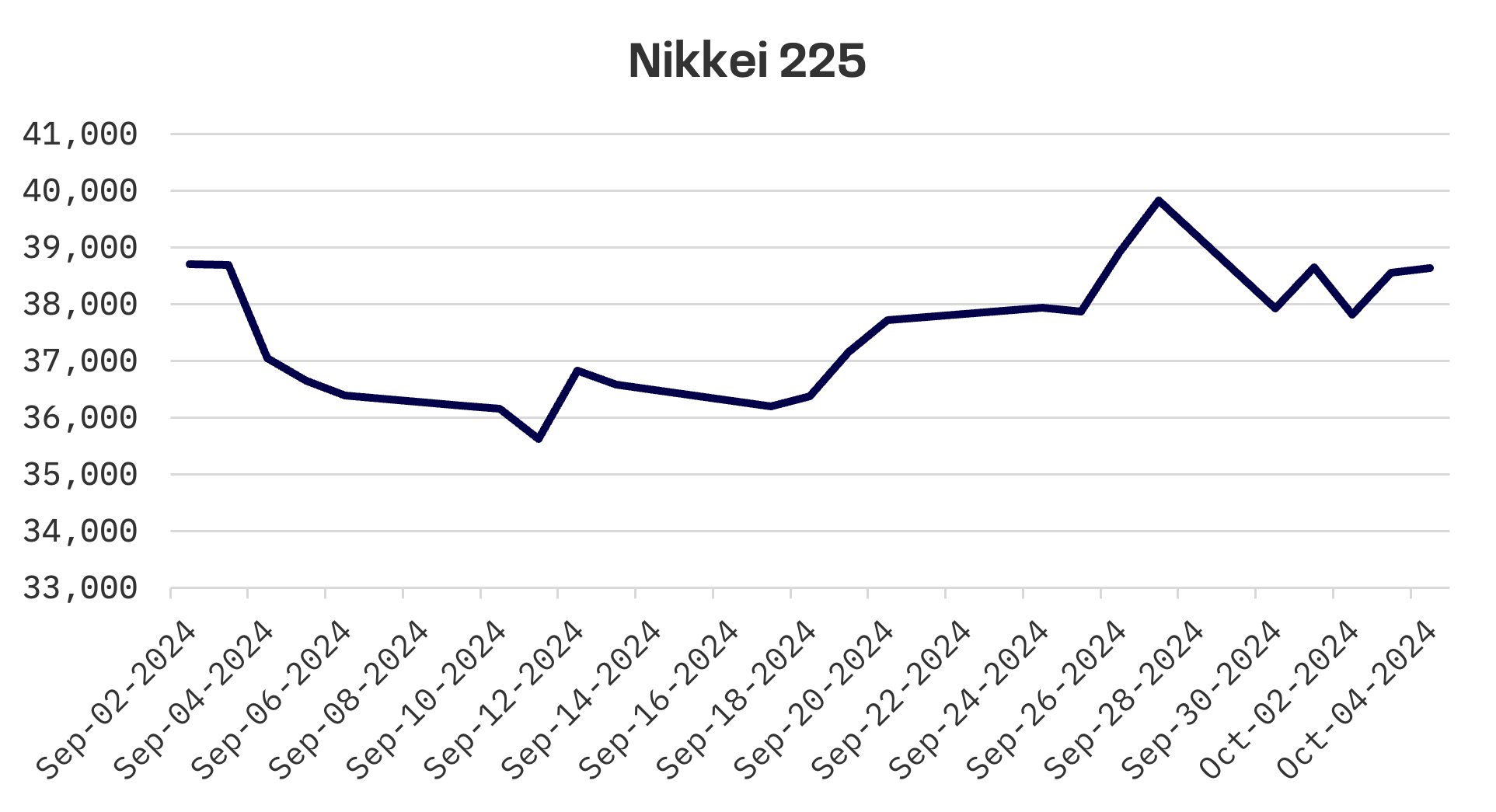

Japan’s stock market tumbled this week, with the Nikkei 225 falling 3% as investors reacted to recent political developments. On Friday September 27, Shigeru Ishiba secured a surprise victory in the Liberal Democratic Party (LDP)’s leadership race, defeating Sanae Takaichi in a runoff to become Japan’s new prime minister. Ishiba’s hawkish stance on monetary policy initially strengthened the yen and weighed on stocks. However, by midweek, markets recovered some ground after Ishiba struck a more dovish tone than expected, pushing the yen down to around 146 per dollar from 142 the previous week.

On the first full day of Ishiba’s new government, the prime minister commented on monetary policy. While careful not to encroach on the Bank of Japan’s independence, he said that the environment is not ready for an additional interest rate hike and stressed his hope that the economy will make progress in a sustainable manner towards the end of deflation with the monetary easing trend in place.

Regarding economic policy, Ishiba pledged to maintain continuity with his predecessor, Fumio Kishida, calling for intensive efforts to overcome deflation without risking a reversal of the virtuous cycle. Ishiba also instructed his cabinet to draw up a stimulus package to support households struggling with inflation and to boost regional economies. This comes ahead of a snap election called for October 27, where the LDP’s dominance is likely to remain strong.

Bank of Japan board member Asahi Noguchi, speaking a day after Ishiba’s appointment, echoed the prime minister’s sentiment, stating that the economy is not yet ready for additional interest rate hikes.

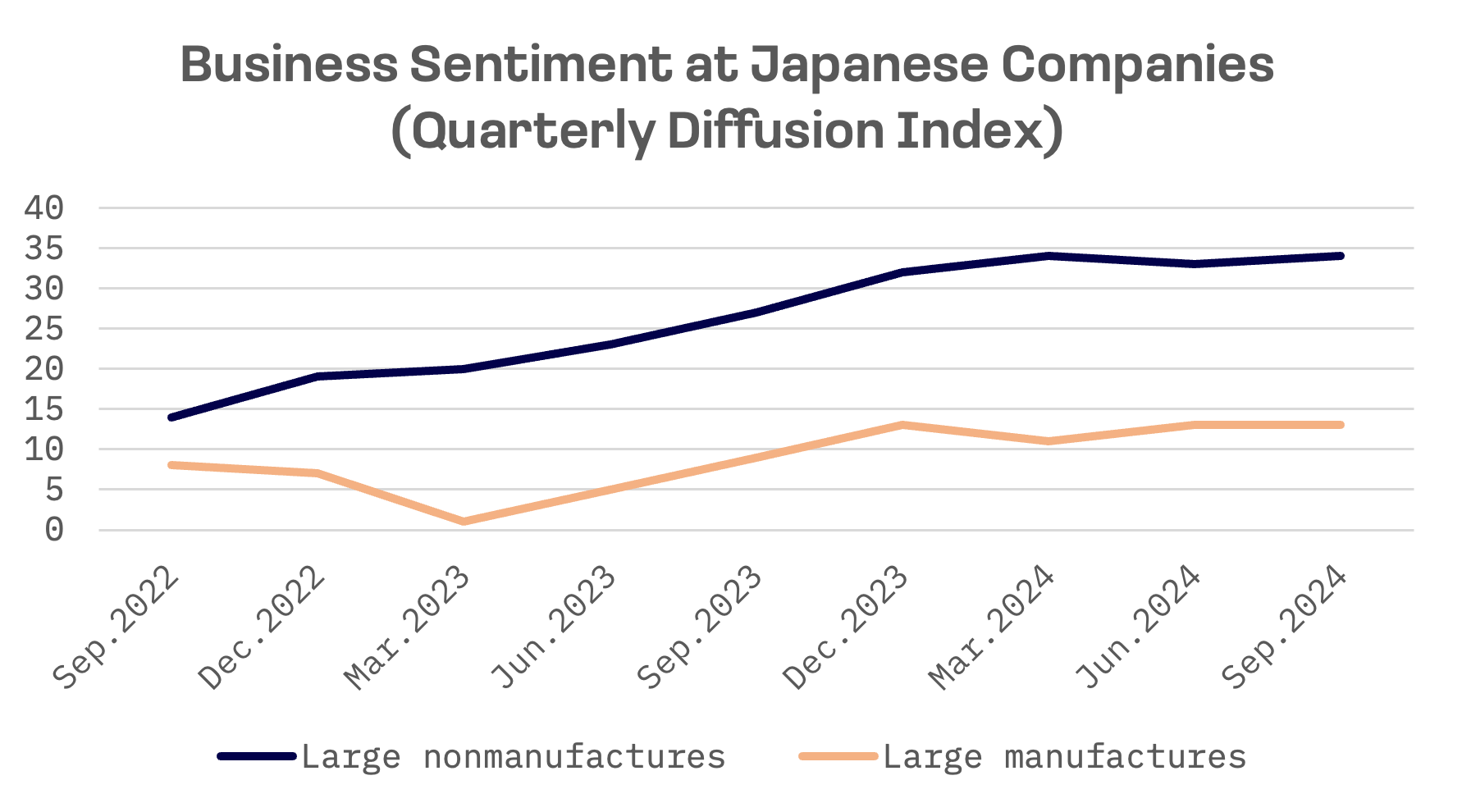

On the economic data front, business sentiment among Japan’s large manufacturers remained unchanged from the previous quarter, according to the Bank of Japan’s latest Tankan survey.

The headline diffusion index (DI) for large manufacturers stood at plus 13 for the July–September period, matching the plus 13 recorded in the April–June quarter. This result aligned with the median forecast from a QUICK survey of economists.

South Korea

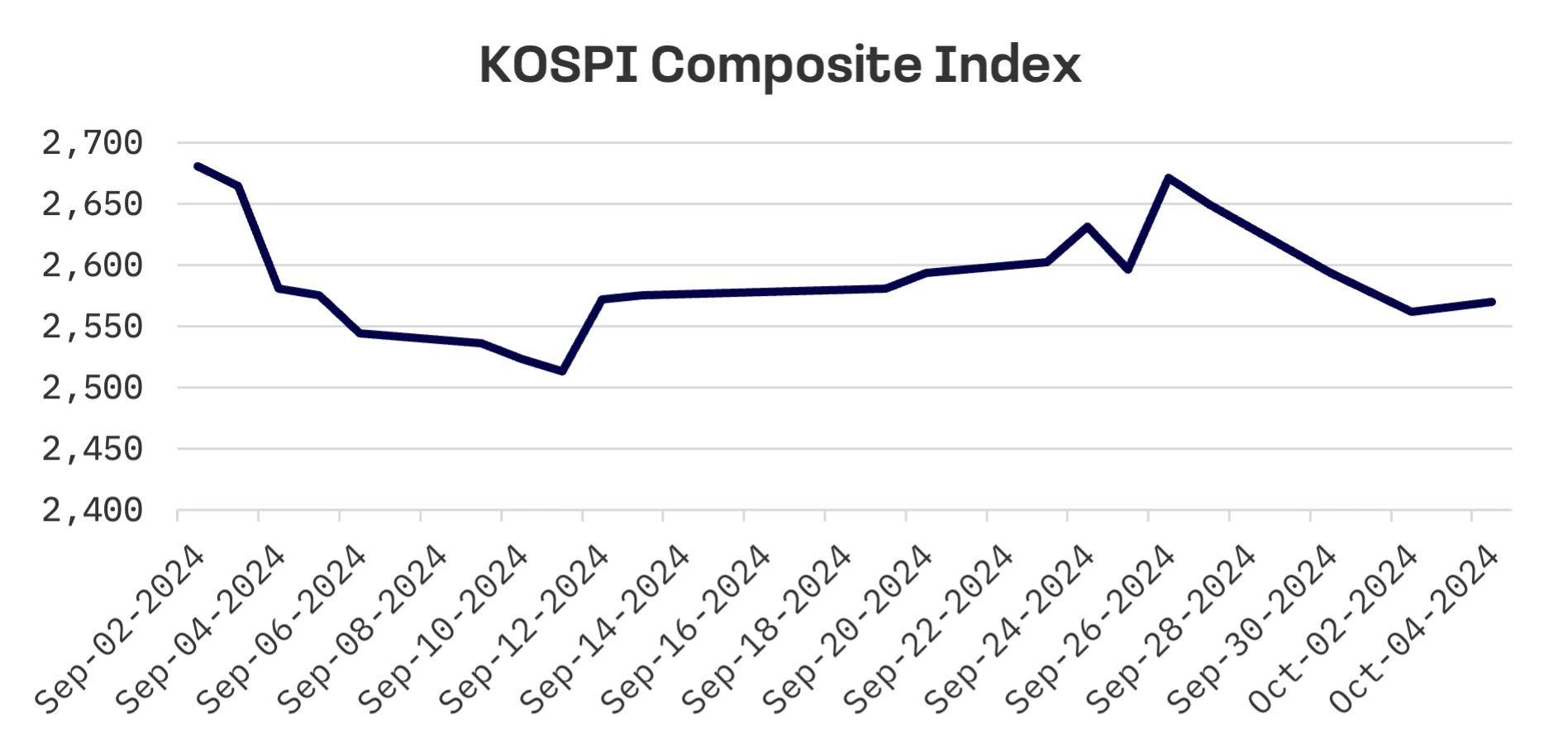

South Korea’s stock market posted losses during a shortened trading week, with the market closed on October 1 for Armed Forces Day and October 3 for National Foundation Day. The KOSPI Index fell 3% amid escalating tension in the Middle East following Iran’s massive missile attack against Israel.

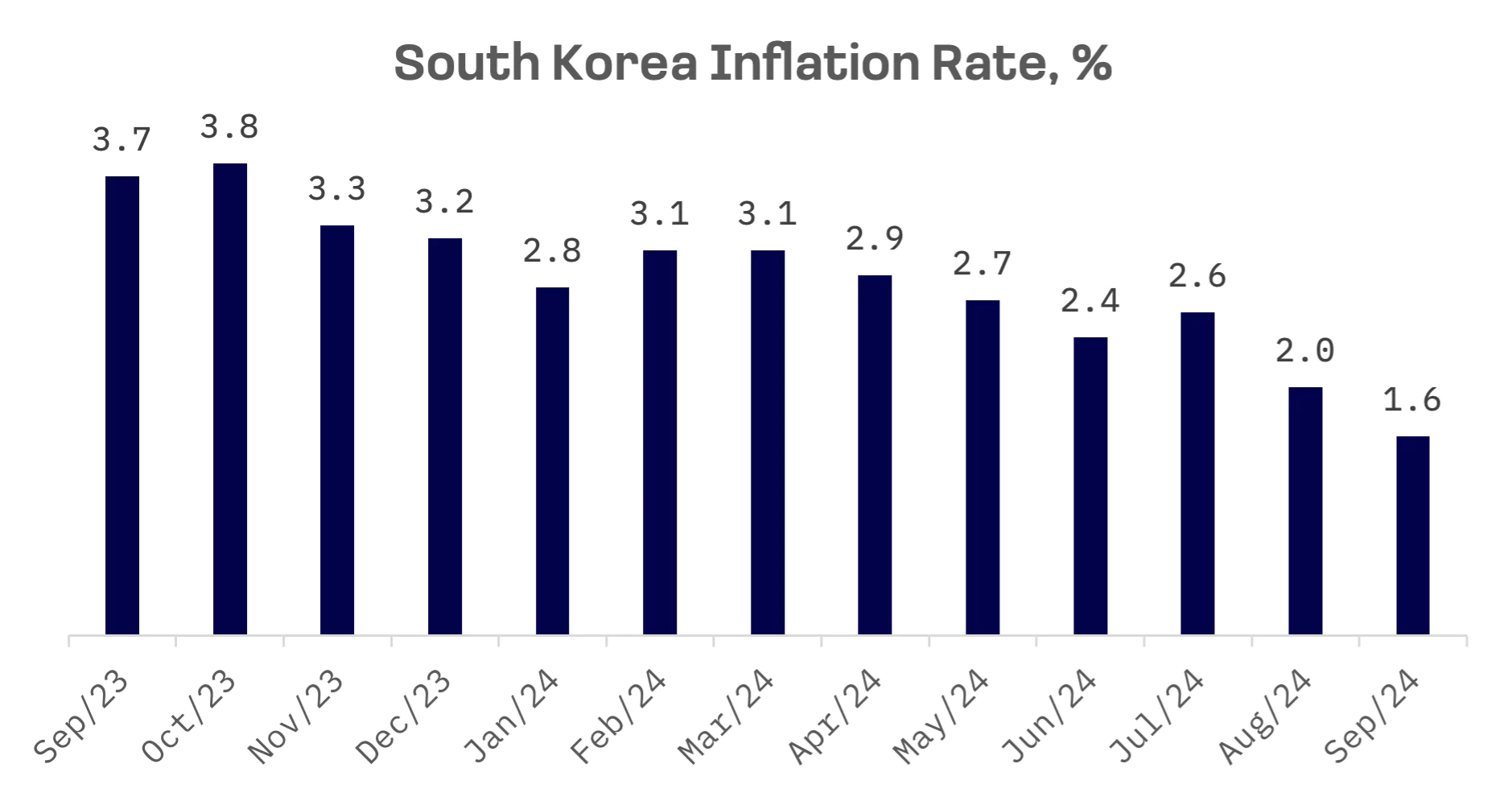

South Korea’s headline inflation fell below 2% in September for the first time in three and a half years, driven by lower international oil prices. The decline bolsters expectations that the country’s central bank may cut its policy rate for the first time in four and a half years.

Consumer prices in September rose 1.6% year-over-year, falling short of the Bank of Korea’s 2% inflation target, according to data released on Wednesday by Statistics Korea.

Meanwhile, South Korea’s exports rose 7.5% in September from a year earlier to $58.77 billion, marking the twelfth consecutive month of growth, following an 11.4% gain in August. The rise was fuelled by record high semiconductor shipments, strong demand for ships and a recovery in car sales, boosting the country’s export outlook for the remainder of the year.

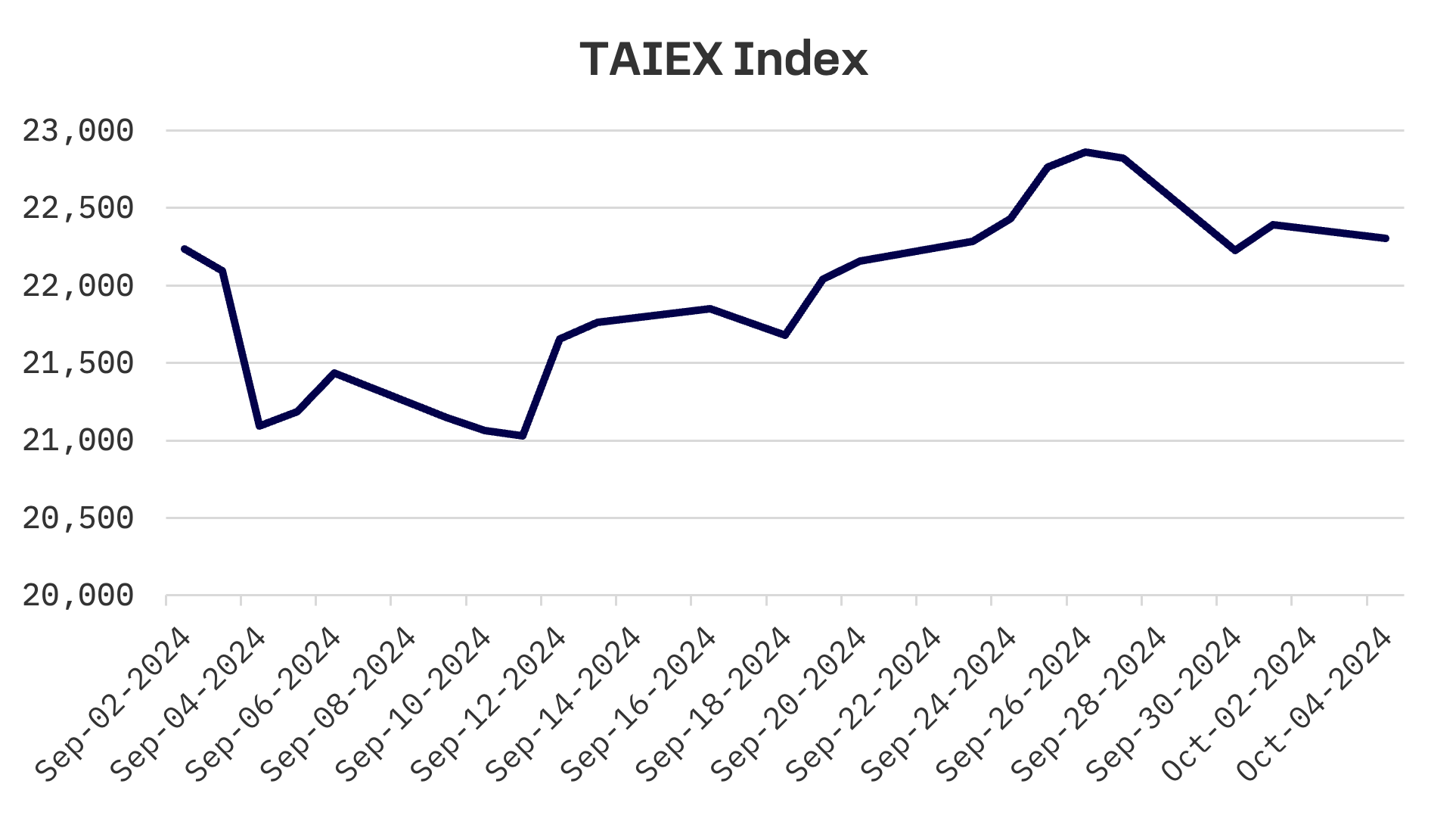

Taiwan

Taiwan’s stock market was also closed for two trading days, Wednesday and Thursday, due to market holidays. During the shortened week, the TAIEX declined 2.3%. On Monday, shares plunged, led by steep declines in Taiwan Semiconductor (TSMC) and other major tech stocks. However, losses were partially recovered on Tuesday following a technical rebound in large cap tech stocks. On Friday, the market declined again as investor sentiment turned cautious amid escalating tensions in the Middle East.

JAKOTA Blue Chip 150 Index

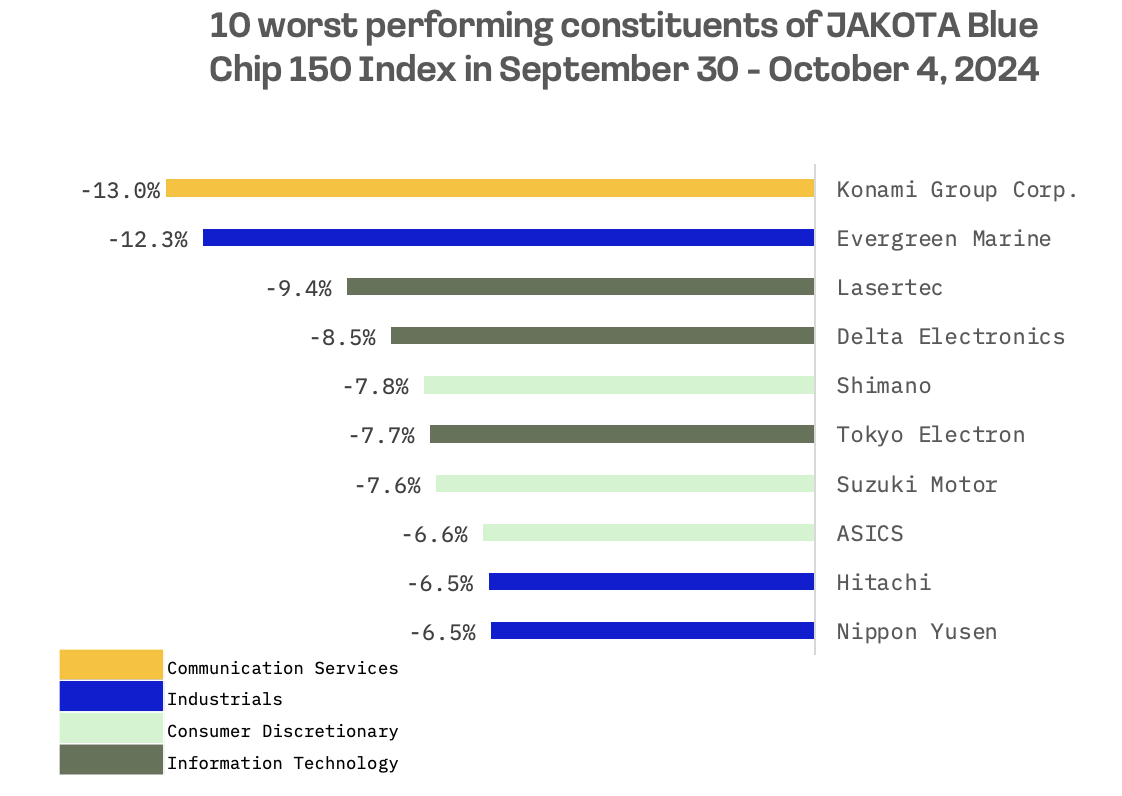

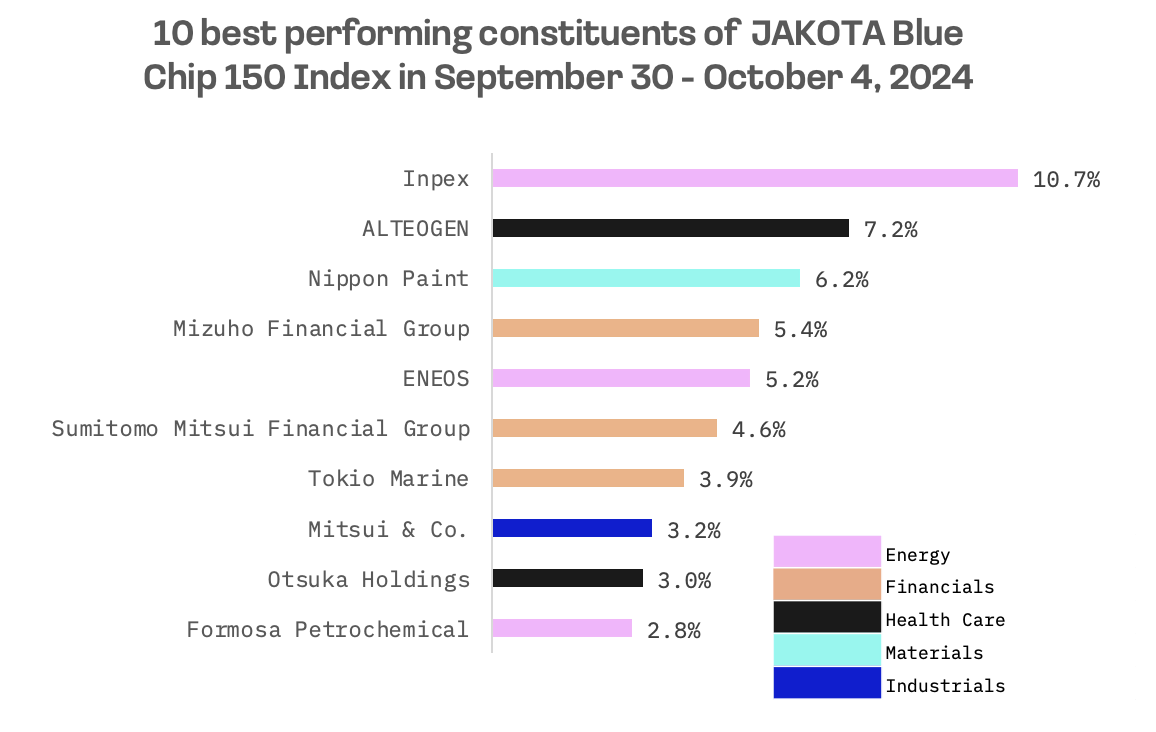

The JAKOTA Blue Chip 150 Index plunged 4.1% this week. Out of a pool of 150 constituents, only 31 stocks posted gains.

Japanese energy and financial firms dominated the best performing stocks this week, with Inpex, Japan’s largest oil and gas exploration company, emerging as the top performer. Inpex surged as oil prices spiked on heightened concerns that Israel might retaliate against Iran, potentially targeting key crude oil infrastructure.

Konami Group Corp., a Japanese multinational entertainment company and video game developer and publisher, was the worst performer on the JAKOTA Blue Chip 150 Index this week. After the stock recently hit a new high, profit taking likely drove the selloff.