Last week’s Jakota markets:

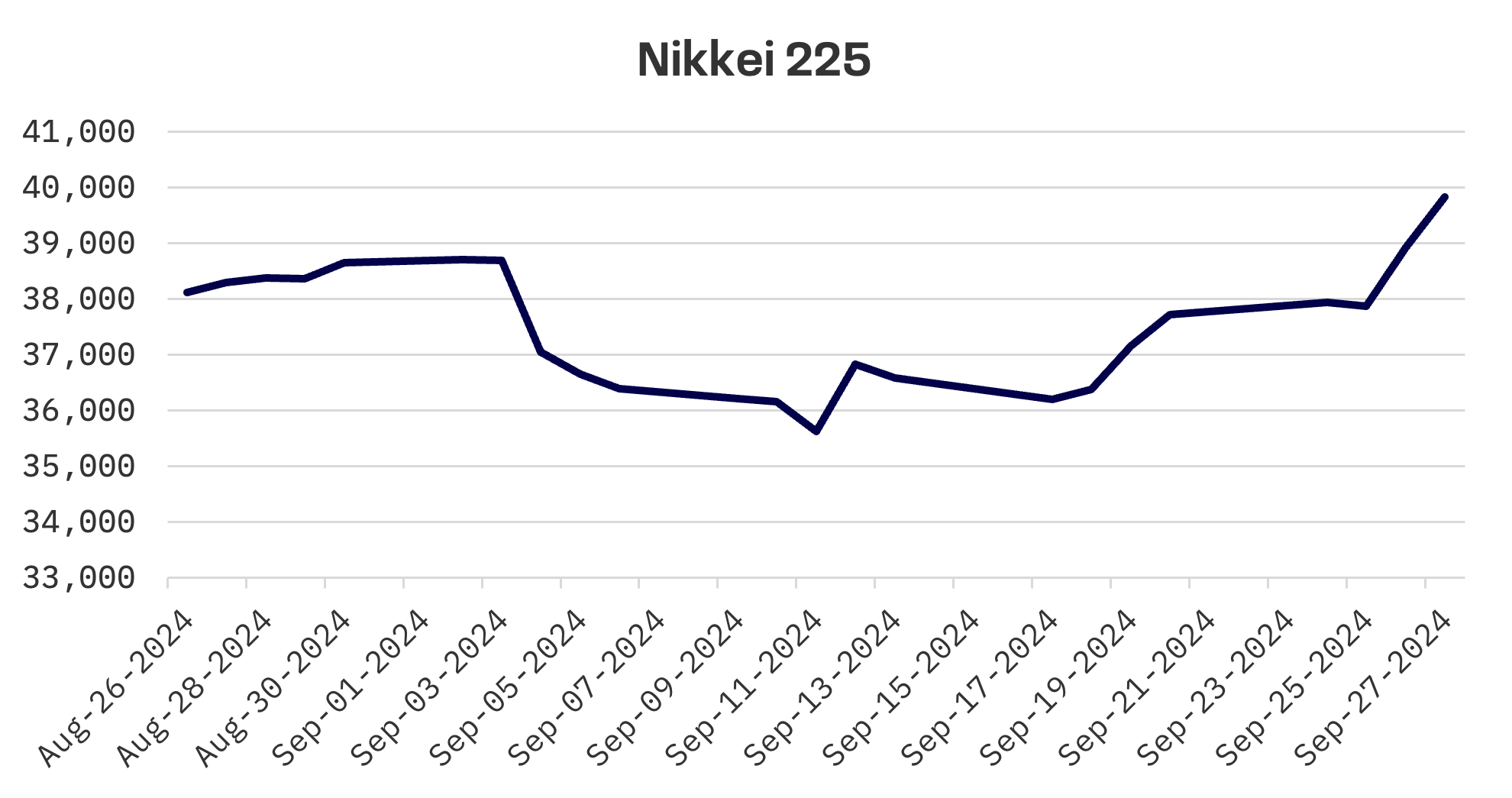

- Japan’s Nikkei 225 Index leapt 5.6%, buoyed by a weaker yen and potential benefits from China’s economic stimulus

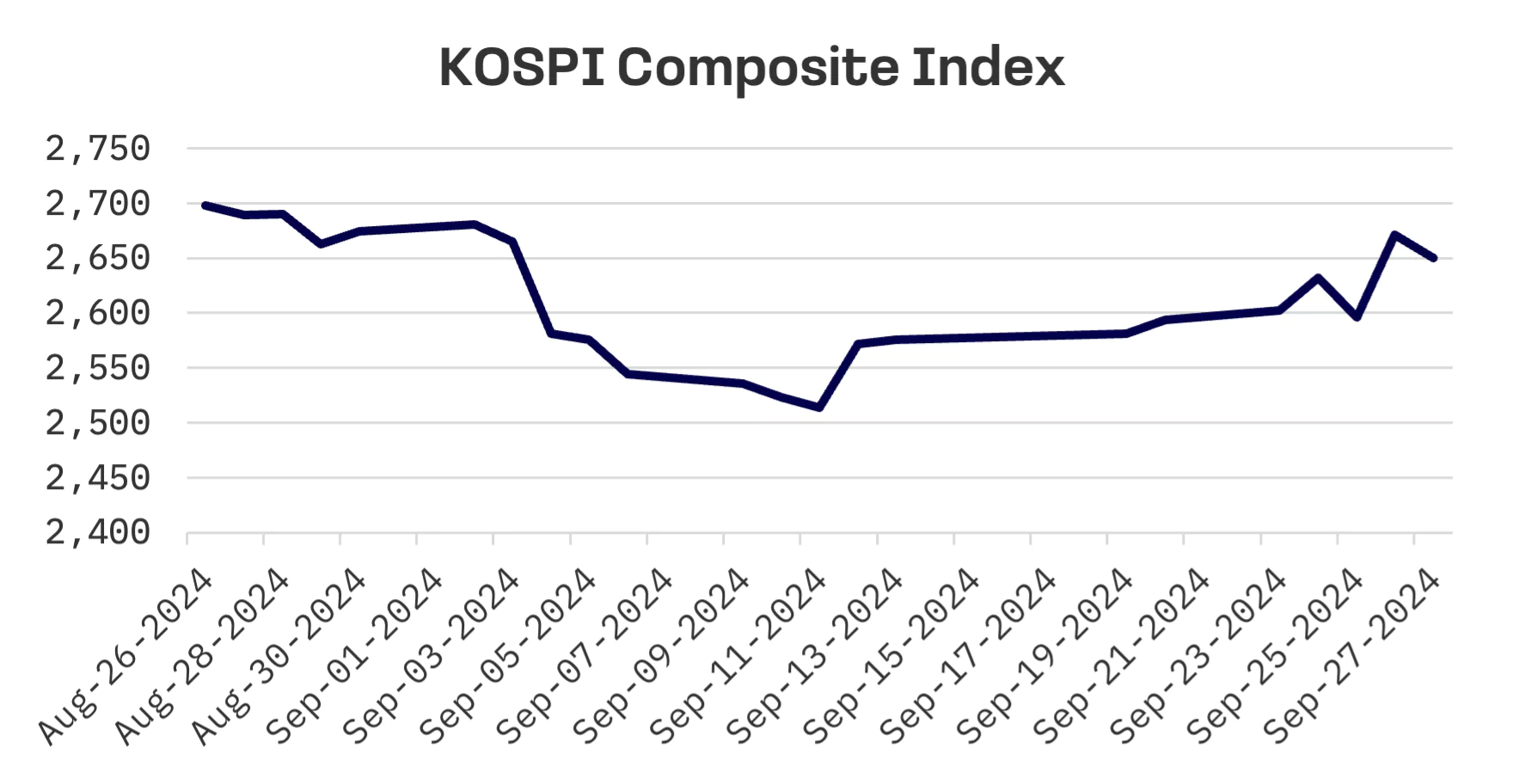

- South Korea’s KOSPI rose 2.2%, weathering criticism of the new Corporate Value-up Index and mixed signals on monetary policy

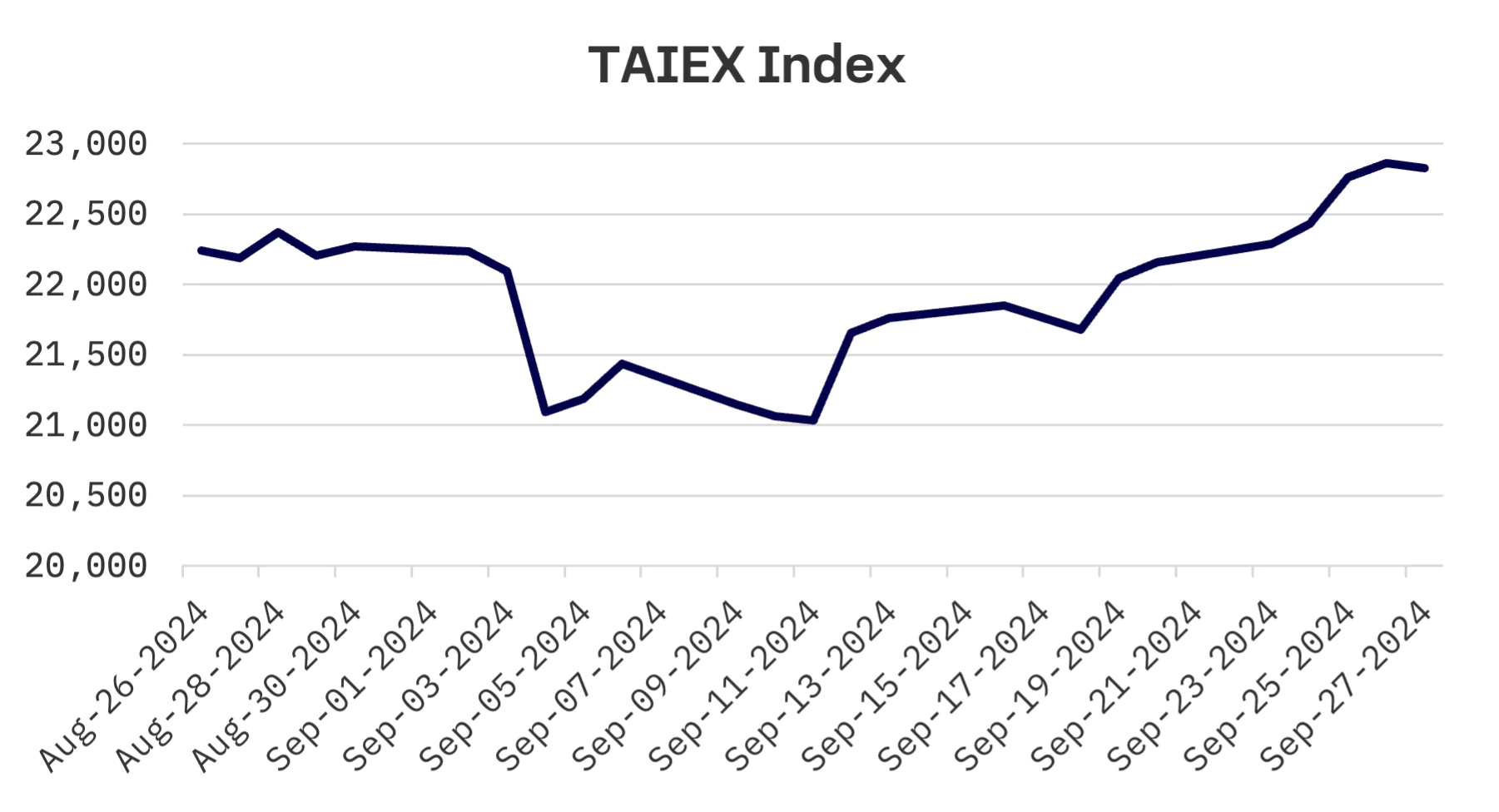

- Taiwan’s TAIEX index gained 3.0%, riding the coattails of Nvidia’s robust performance in the U.S. tech sector

- The JAKOTA Blue Chip 150 Index jumped 5.4%, with Japanese semiconductor and industrial companies leading the rally

Japan

Japan’s Nikkei 225 Index advanced 5.6% last week, driven by a dovish tone from the Bank of Japan and China’s fresh stimulus measures. The yen weakened, providing a tailwind for equities. Investor sentiment got a lift from China’s support measures in response to the country’s sluggish economic growth and struggling housing market. As a significant portion of Japan’s exports head to China, the stimulus buoys Japanese companies that stand to benefit from improved Chinese demand.

Bank of Japan (BoJ) Governor Kazuo Ueda indicated the central bank has ample time to monitor market and economic conditions before making any further policy adjustments, following the decision to keep interest rates unchanged at its September 19-20 meeting. His comments suggest the BoJ is in no hurry to raise rates.

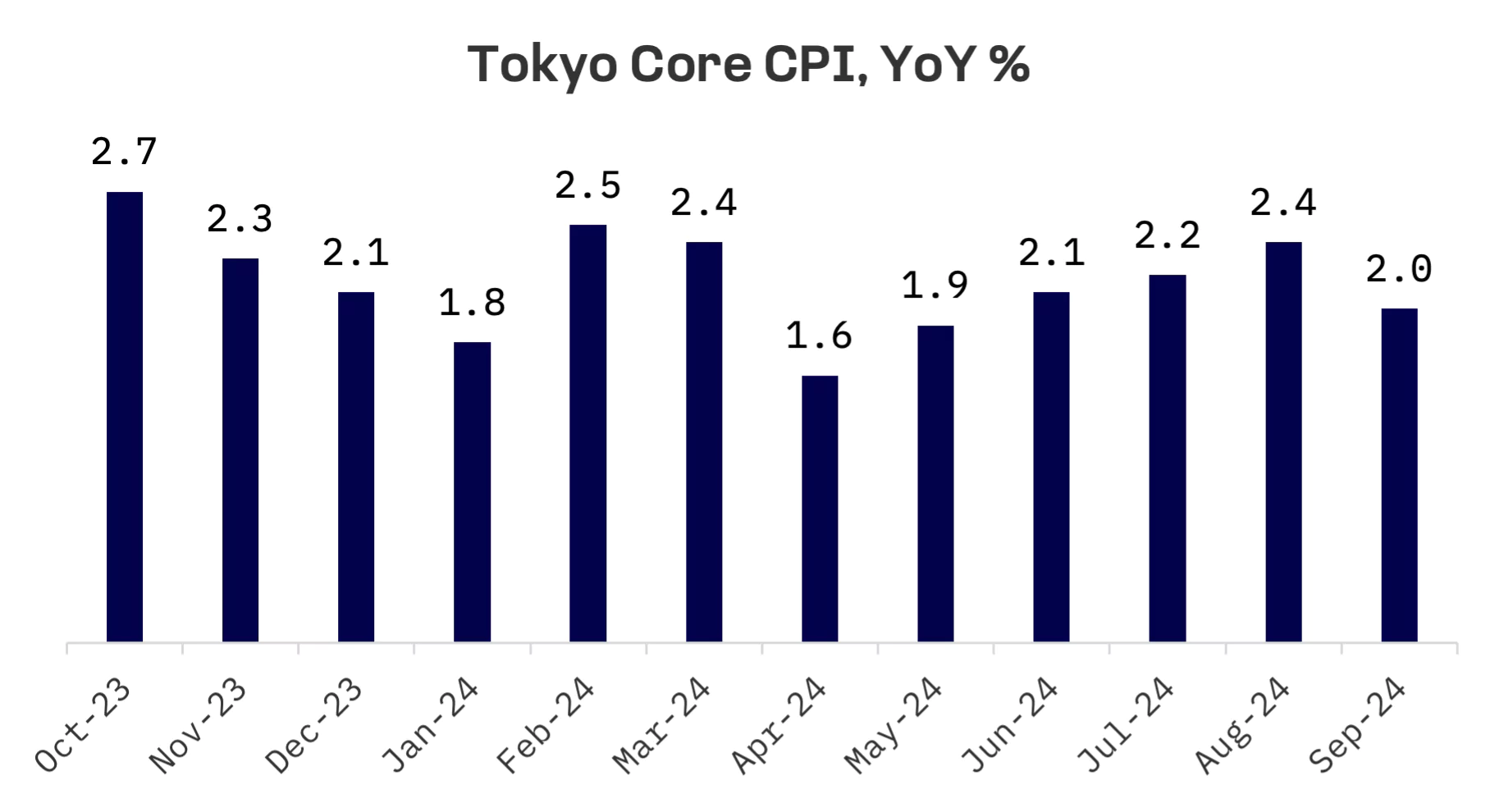

Tokyo’s core consumer price index (CPI), a key indicator of national trends, rose 2.0% year-over-year in September, down from 2.4% in August. The slowdown was largely attributed to renewed energy subsidies.

Au Jibun Bank’s flash PMI data showed Japan’s private sector continued to expand in September, albeit at a slightly slower pace than in August. The services sector drove the expansion, while manufacturing output contracted marginally.

South Korea

South Korea’s KOSPI Index gained 2.2%, led by tech stocks. Optimism surrounding potential further rate cuts by the Federal Reserve helped bolster investor sentiment.

However, the market experienced a midweek reversal, with Seoul shares falling more than 1% on Wednesday, ending a six day winning streak. Investors were disappointed by the upcoming launch of the Corporate Value-up Index, which has faced ongoing criticism from the securities industry both domestically and internationally.

The Corporate Value-up Index is a part of the Corporate Value-up Program launched by South Korea’s Financial Services Commission (FSC) earlier. Critics argue the index has deviated from its original intent, excluding many undervalued high dividend stocks while including those with low dividend yields and limited shareholder returns.

Shin Seong-hwan, a Bank of Korea board member, suggested the bank might cut its key interest rate before a significant slowdown in rising home prices occurs. However, he noted that the timing of any monetary easing remains uncertain.

Finance Minister Choi Sang-mok stated that the government is prioritising boosting domestic demand over addressing household debt. He expressed full support for the Bank of Korea’s decision to hold rates steady amid rising debt levels and surging home prices.

Taiwan

Taiwan’s TAIEX Index climbed 3.0%, driven by strong performances from Taiwan Semiconductor and other tech stocks, which followed robust dynamics in Nvidia shares.

JAKOTA Blue Chip 150 Index

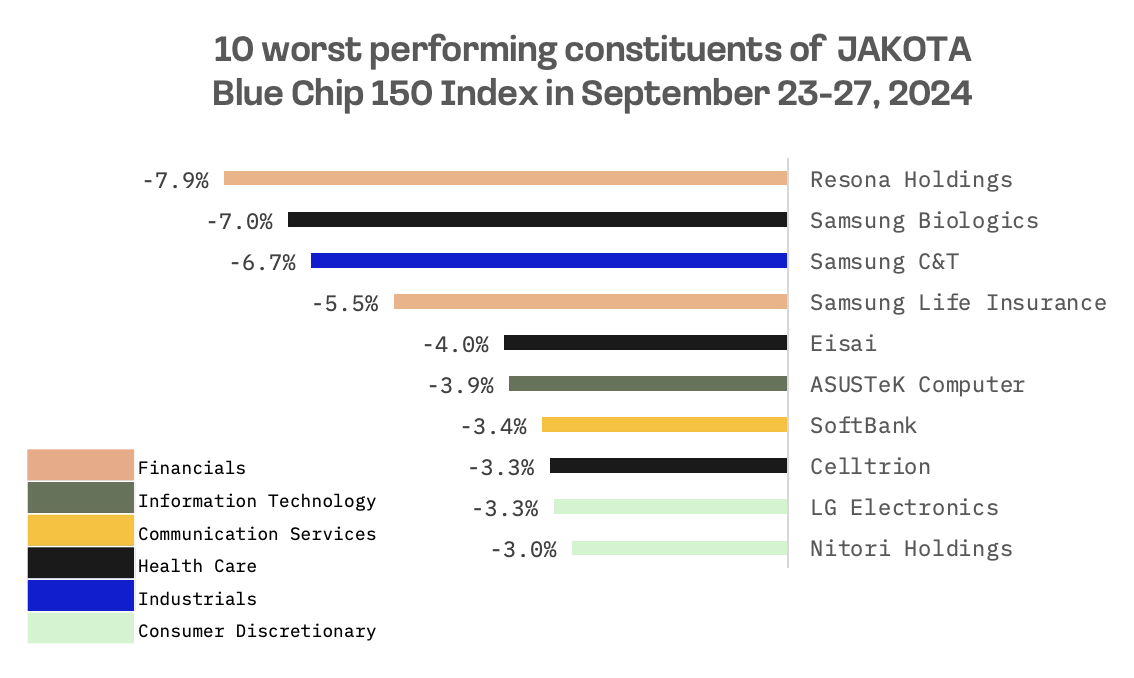

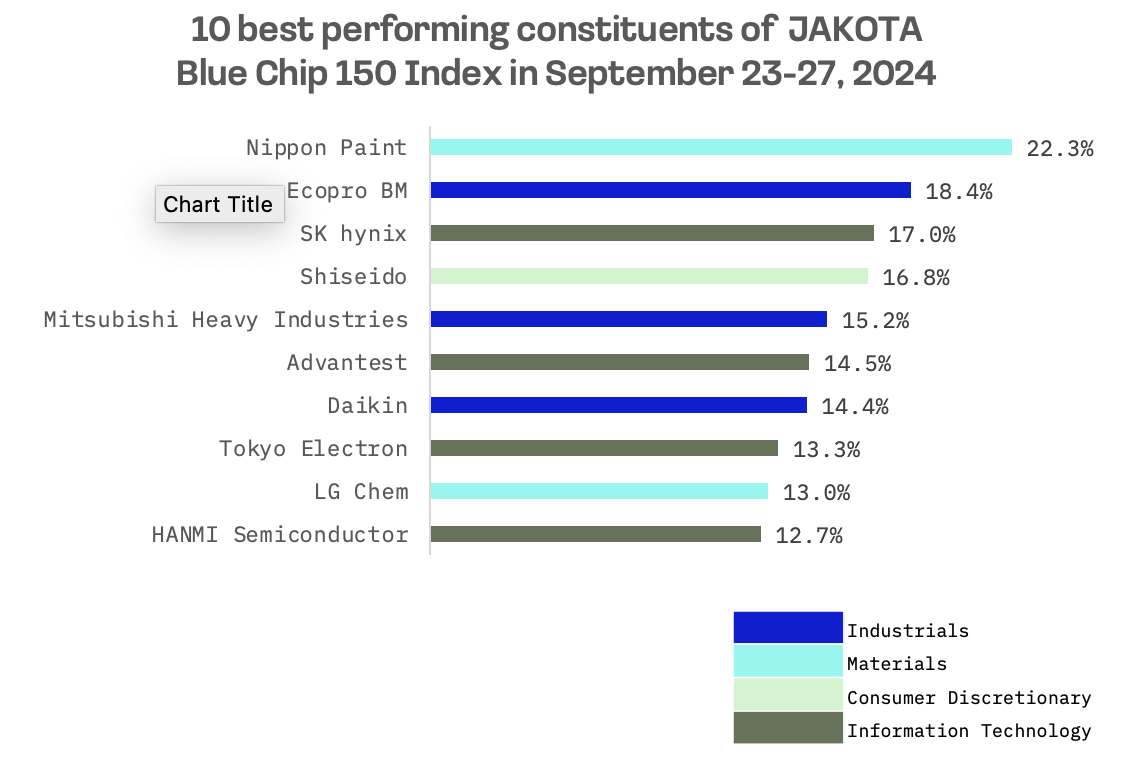

The JAKOTA Blue Chip 150 Index surged 5.4%, with 122 out of 150 constituents posting gains.

Japanese semiconductor and industrial companies led the best performing stocks.

In addition, shares of EcoPro BM, a South Korean cathode materials producer, rose 18% following news of its collaboration with Hyundai Motor to develop precursor free lithium iron phosphate cathodes. The company announced plans to work with Hyundai Motor Group and Hyundai Steel on this initiative.

Resona Holdings, one of Japan’s largest banking groups, was the worst performer on the JAKOTA Blue Chip 150 Index after BofA Securities downgraded its rating on the stock to Neutral from Buy. The price target was lowered to ¥1,150 from ¥1,320, reflecting a reassessment of the stock’s value amid current market conditions.