Last week’s Jakota markets:

- Japan’s stock market climbed 3.1% as the yen weakened to ¥143.8 per dollar, influenced by divergent Fed and BOJ policies

- South Korean shares rose 0.7% during a shortened trading week, reacting positively to the Fed’s first rate cut in four years

- Taiwan’s benchmark index jumped 1.8%, driven by optimism following the Fed’s rate cut and strong performance in the electronics sector

- The JAKOTA Blue Chip 150 Index increased 0.7%, with Samsung Biologics reclaiming “emperor stock” status while Apple suppliers struggled

Japan

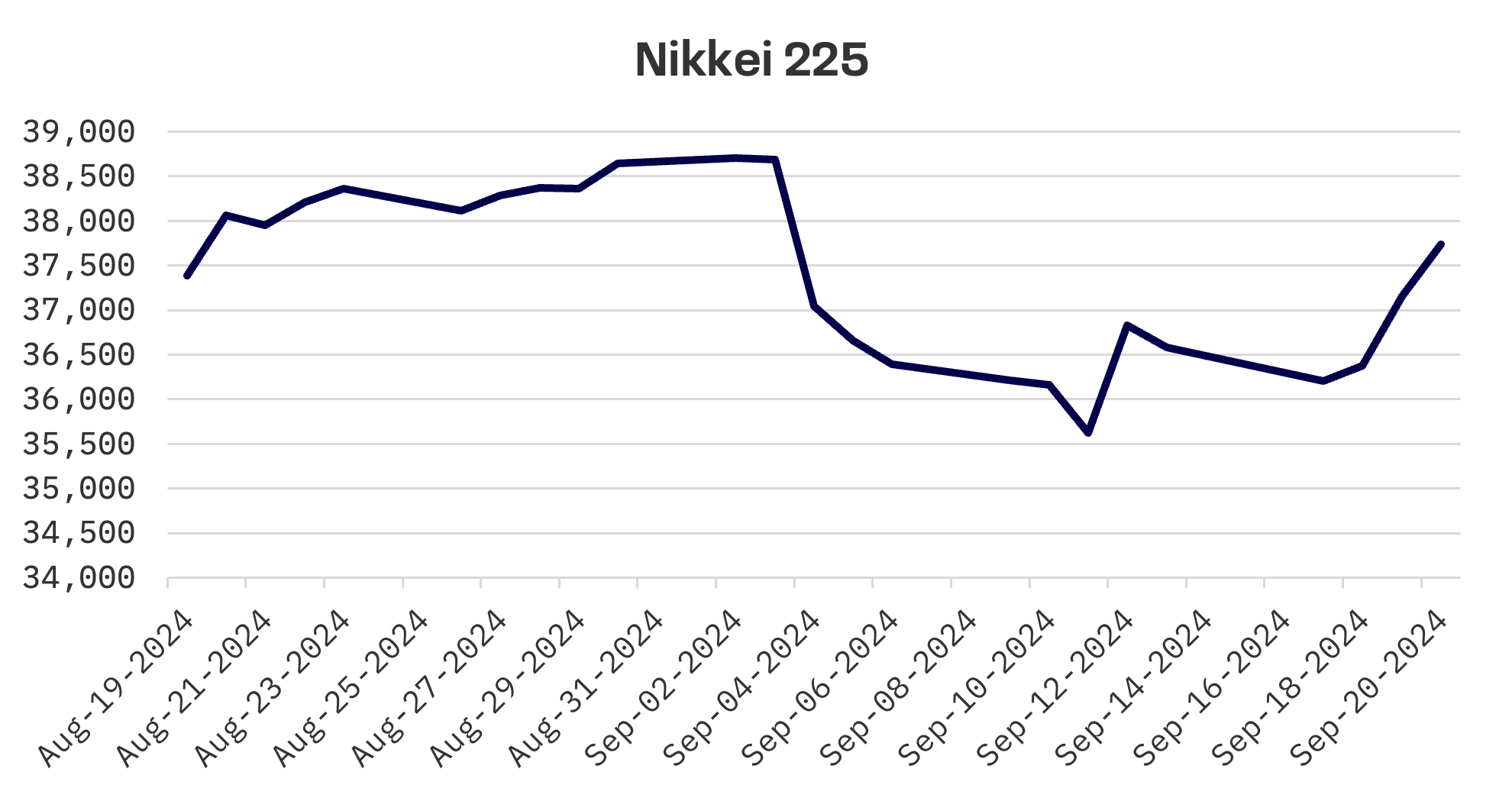

Japan’s Nikkei 225 rose 3.1% over the week, buoyed by a weakening yen. The currency’s decline followed the U.S. Federal Reserve’s larger than expected 50 basis point rate cut midweek and the Bank of Japan’s decision to maintain steady rates on Friday. By week’s end, the yen had weakened to approximately 143.8 per U.S. dollar, down from 140.8 the previous week.

The Bank of Japan (BOJ), as widely anticipated, held its key short term interest rate at around 0.25% during its September 19-20 meeting. This decision follows two rate hikes earlier in 2024, in March and July. The central bank noted a moderate increase in inflation expectations and projected continued economic growth above the potential rate, supported by a strengthening cycle of income driving spending.

BOJ Governor Kazuo Ueda reaffirmed the bank’s data driven approach to policy decisions in the post meeting press conference, emphasising that any future rate hikes will depend on economic, price and financial conditions. He expressed confidence in the economy’s progress, citing recent consumption data. When questioned about a potential rate increase by year end, Mr. Ueda reiterated the BOJ’s focus on both domestic trends and U.S. economic developments.

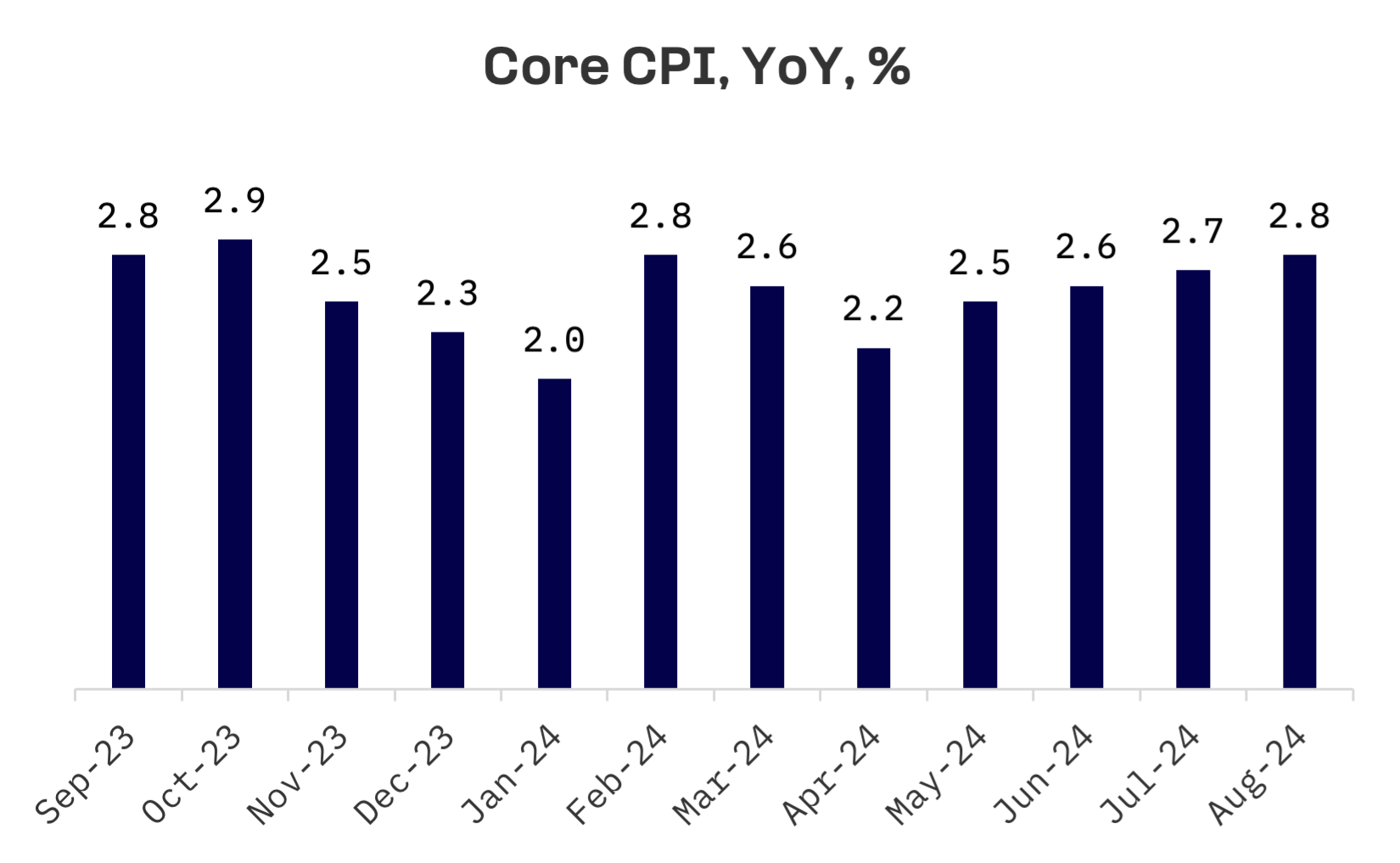

Japan’s core consumer price index (CPI) rose 2.8% year-over-year in August, slightly up from July’s 2.7% and in line with expectations. The overall CPI climbed to 3.0% from 2.8% the previous month, meeting consensus forecasts.

South Korea

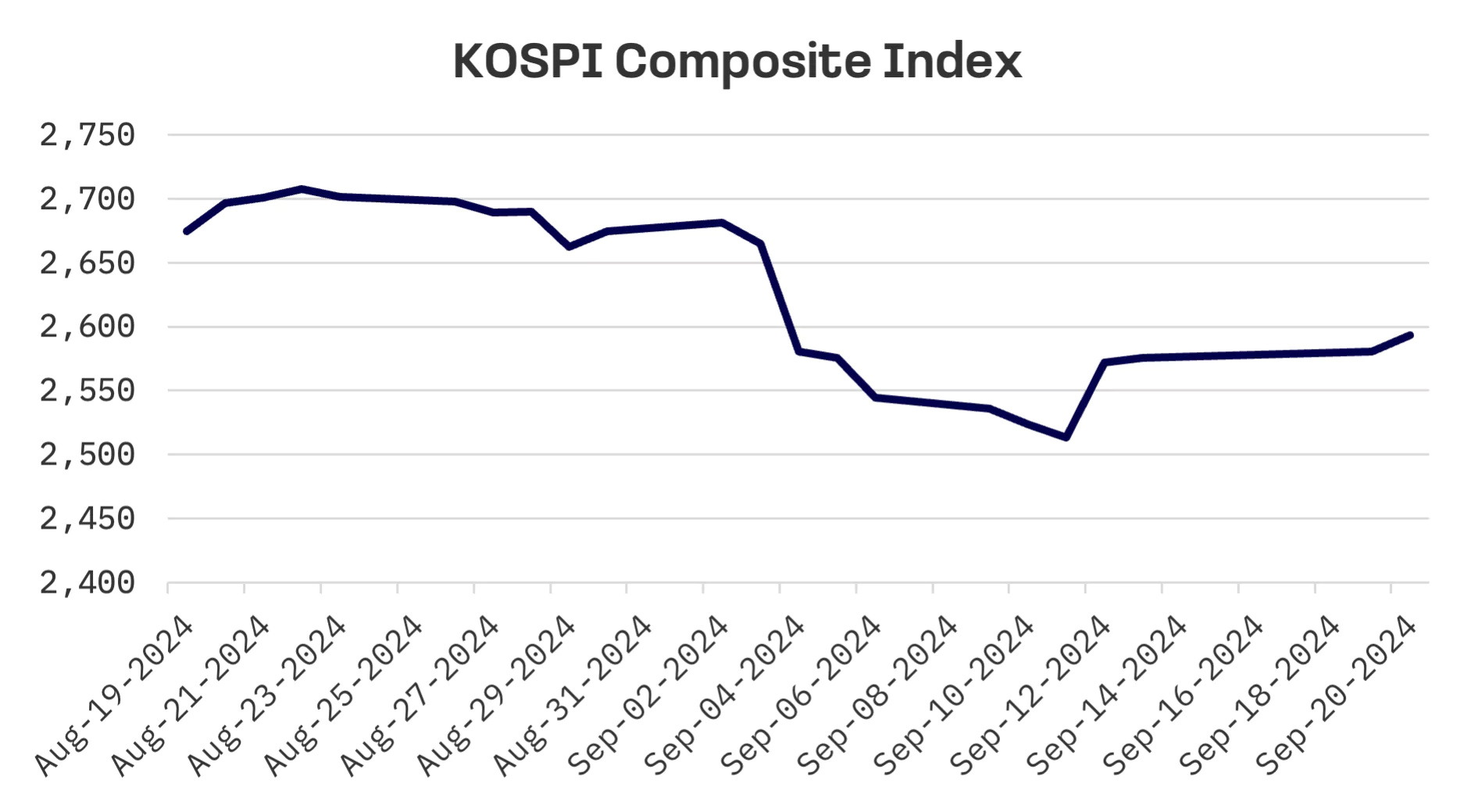

South Korea’s KOSPI Index gained 0.7% for the week, despite the market being closed from Monday through Wednesday for Chuseok, the mid-autumn harvest festival. The rise, driven by institutional buying, followed the Federal Reserve’s first interest rate cut in over four years.

Taiwan

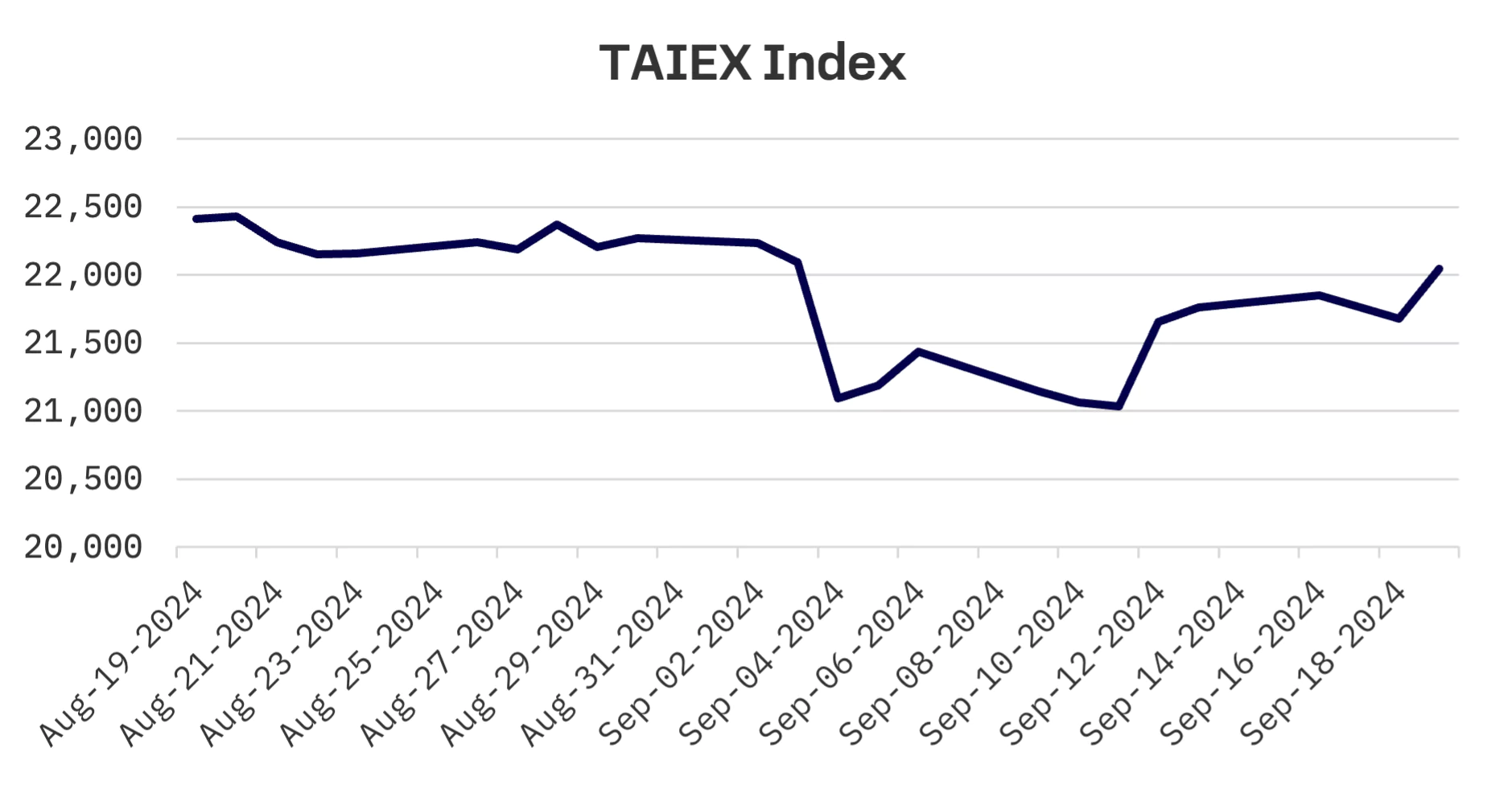

Taiwan’s TAIEX Index advanced 1.8% during the shortened week, with markets closed Tuesday for the Mid-Autumn Festival.

On Monday, shares closed moderately higher, though trading volume hit a seven month low. The market turned cautious on Wednesday, closing lower as investors awaited the U.S. Federal Reserve’s policy decision. However, stocks surged on Thursday, pushing the index above the 22,000 mark after the Fed cut interest rates. This move sparked optimism for increased liquidity, prompting investors to buy large cap stocks, particularly in the electronics sector. The upward momentum continued Friday, further extending gains.

Taiwan’s central bank maintained its key interest rates but raised the required reserve ratio – the portion of deposits banks must hold and not lend – by 25 basis points, mirroring a similar increase in June. This move aims to curb rising housing prices. The central bank cited inflation concerns, noting that the local CPI continues to exceed the 2% threshold.

JAKOTA Blue Chip 150 Index

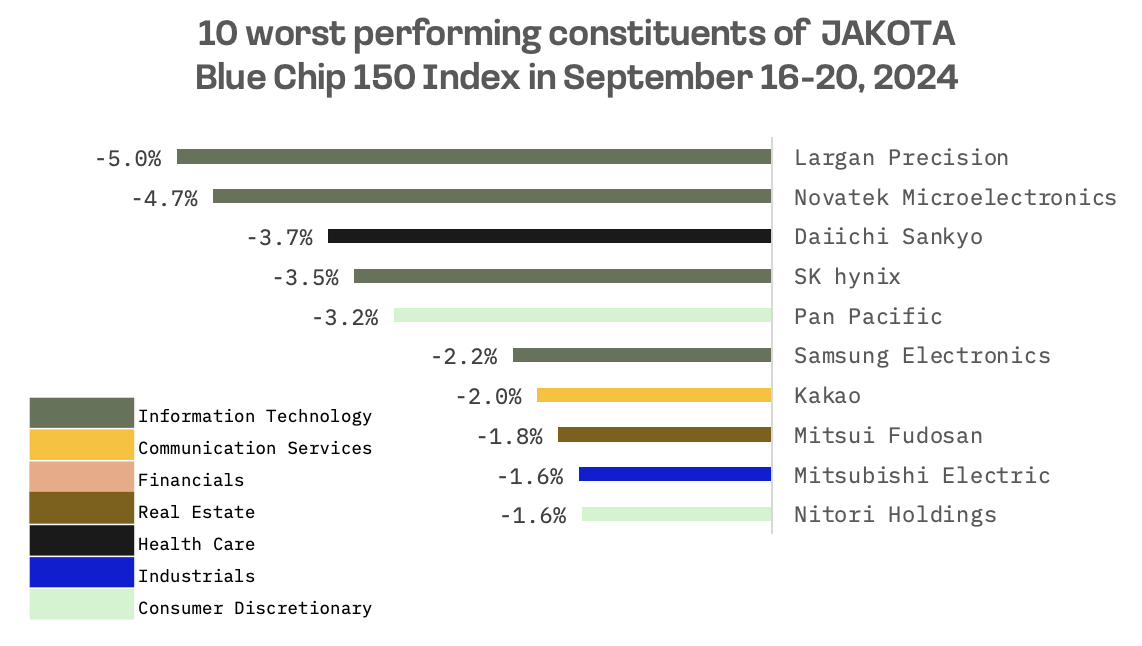

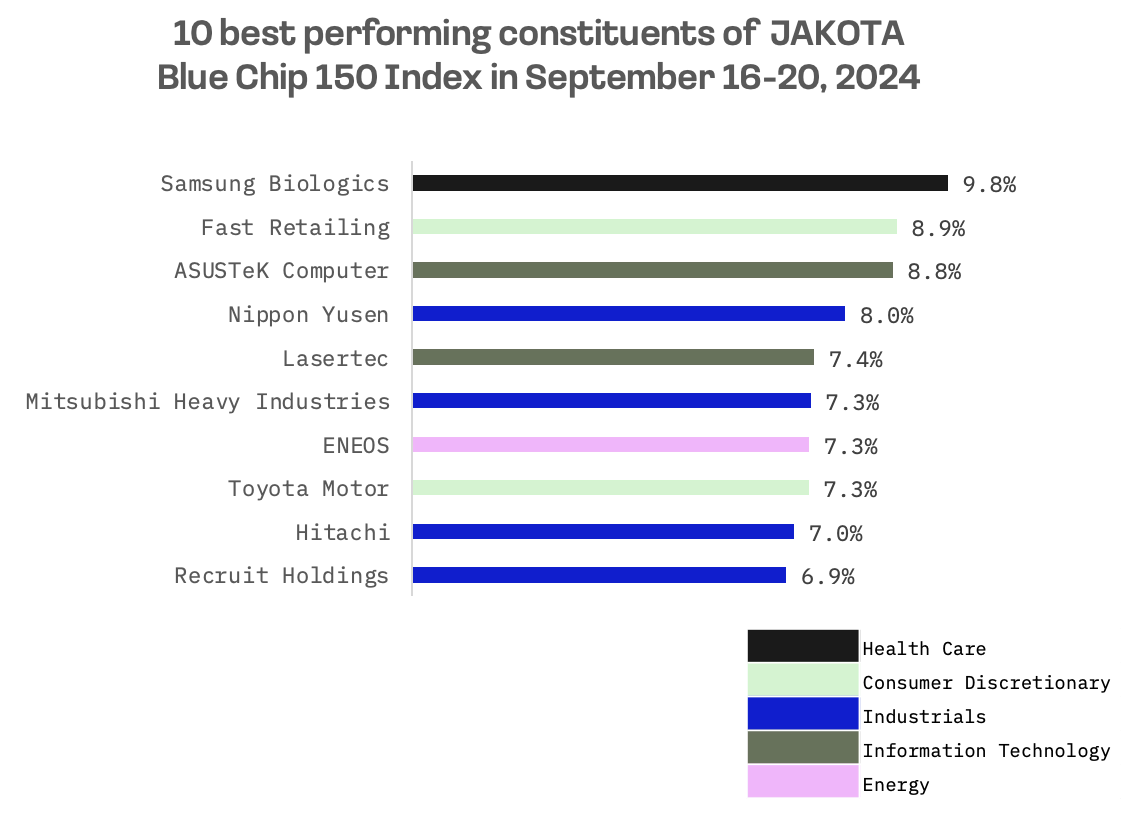

The JAKOTA Blue Chip 150 Index added 0.7% this week, with 117 out of 150 constituents posting gains.

Samsung Biologics, one of the world’s largest contract manufacturing organisations (CMOs), surged 9.8%, making it the index’s top performer. The company reclaimed its “emperor stock” status, with its closing price surpassing ₩1 million for the first time in three years.

The surge in Samsung Biologics was fuelled by strong foreign investor interest, driven by U.S. sanctions on Chinese biotech firms and Morgan Stanley’s recommendation to buy domestic bio stocks. On September 9, the U.S. House Standing Committee passed a biosecurity law restricting transactions with five Chinese biotech firms, including Wuxi Biologics and Wuxi Apptech. Subsequently, on September 18, Morgan Stanley issued a report setting a target price of ₩35,000 for domestic biotech firm Binex, spurring a rise in related stocks.

Two of Apple’s Taiwanese suppliers, Largan Precision and Novatek Microelectronics, emerged as the worst performers on the JAKOTA Blue Chip 150 Index this week. Their shares were weighed down by concerns over waning demand for the iPhone 16. Analysts from Barclays, JPMorgan and Bank of America have pointed to shipping delays as a possible signal of weaker demand for Apple’s latest iPhone Pro models.