Last week’s Jakota markets:

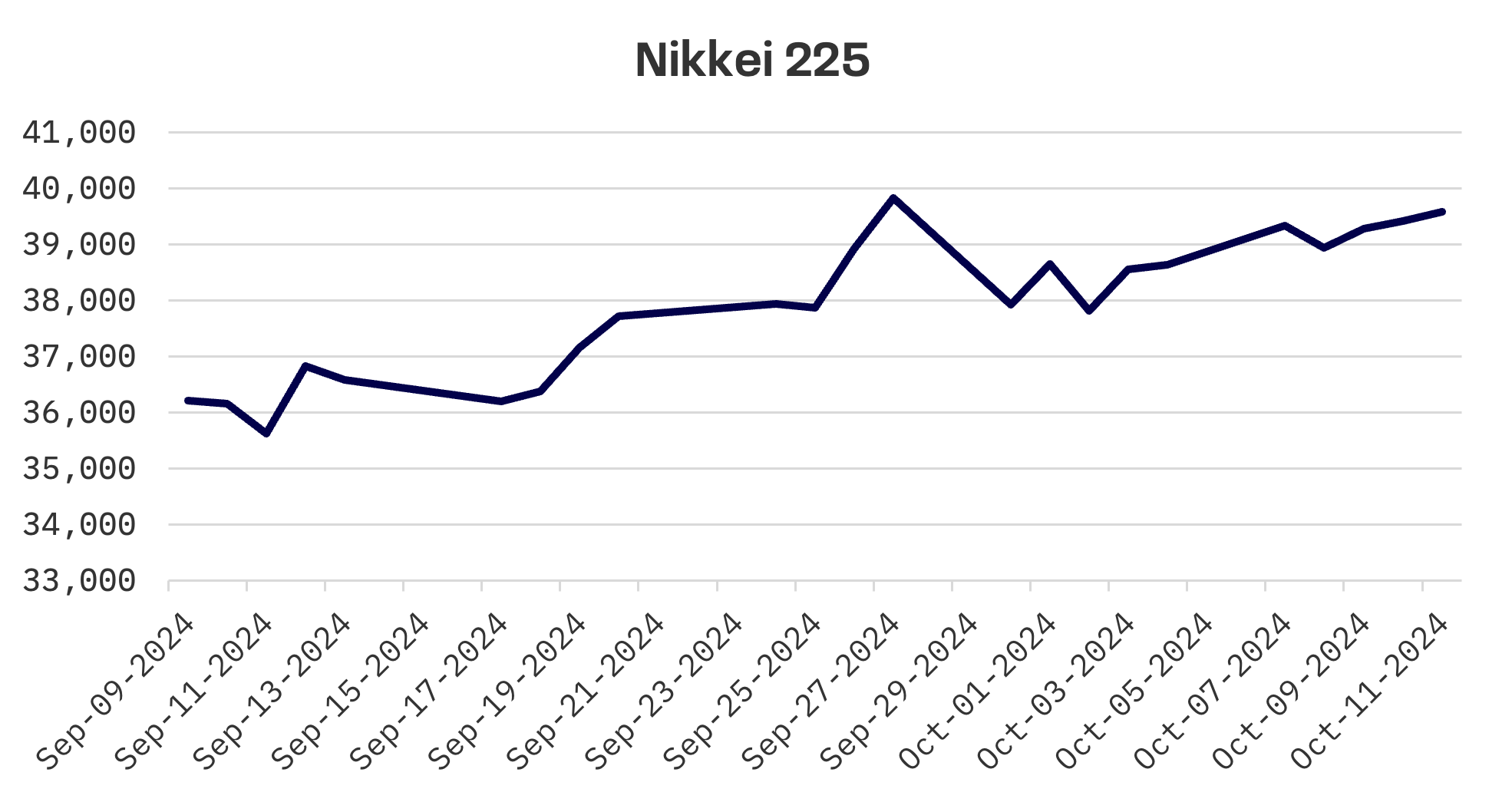

- Japan’s Nikkei 225 Index jumped 2.5%, shrugging off concerns about declining real wages and household spending

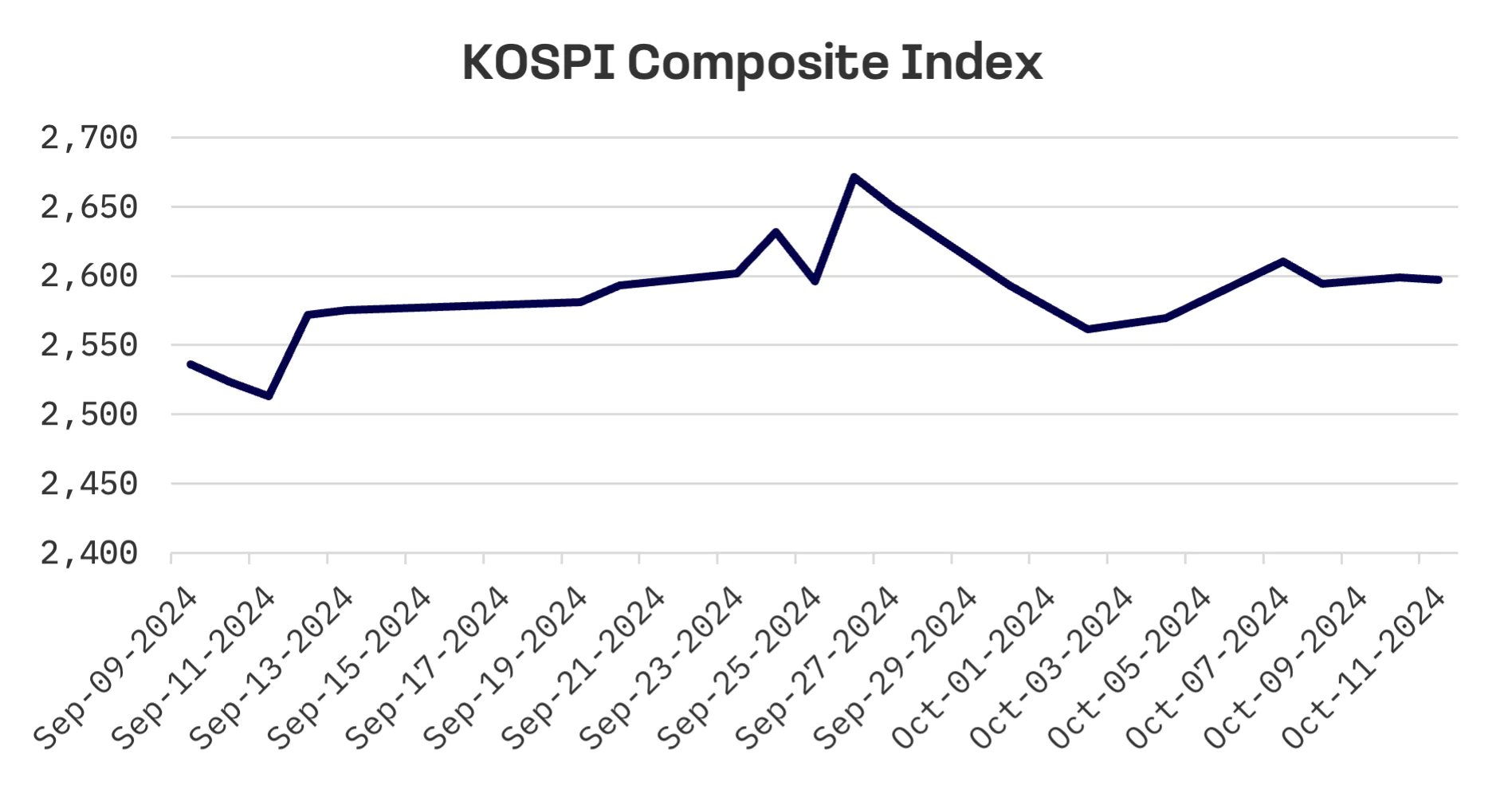

- South Korea’s KOSPI rose 1.1%, reacting positively to the central bank’s first interest rate cut since May 2020

- Taiwan’s TAIEX climbed 2.7%, buoyed by Taiwan Semiconductor’s record third quarter sales and strong export data

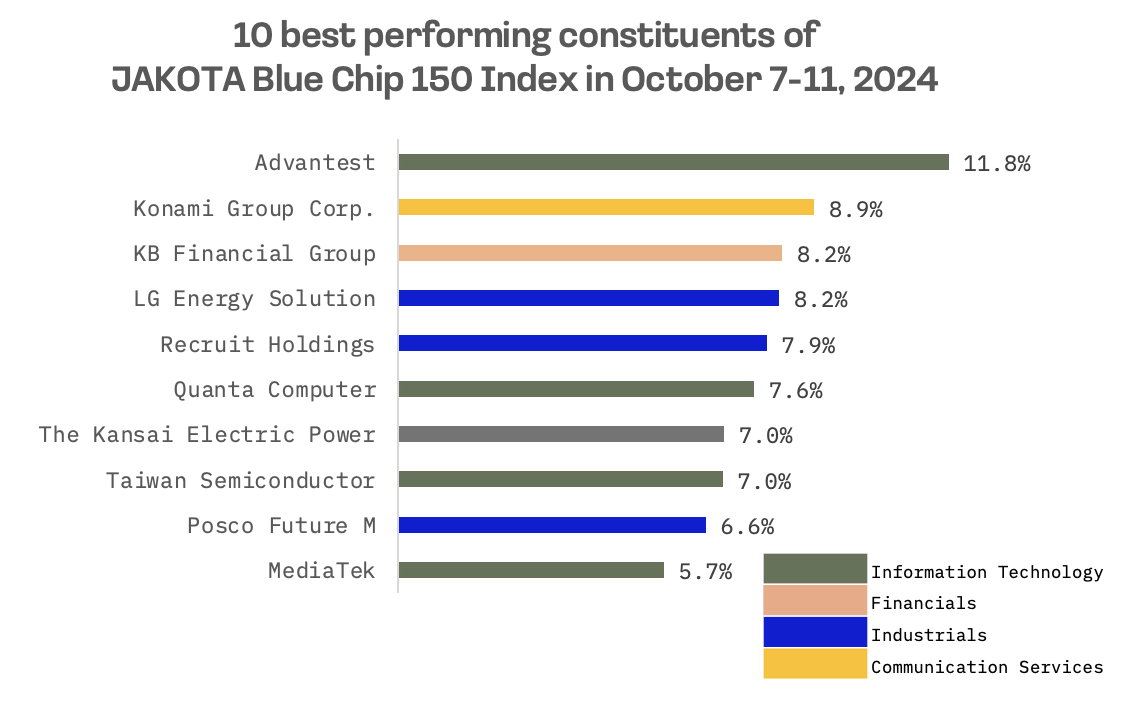

- The JAKOTA Blue Chip 150 Index inched up 0.4%, with semiconductor equipment maker Advantest soaring 11.8%

Japan

Japan’s stock markets surged last week, with the Nikkei 225 Index climbing 2.5%. The gains were driven by a weaker yen, which boosted the profit outlook for exporters. The yen traded in the upper 148 range against the U.S. dollar, near its lowest level since August. The currency has been under pressure since earlier in the month, when newly appointed Prime Minister Shigeru Ishiba signalled that conditions aren’t yet conducive to another interest rate hike.

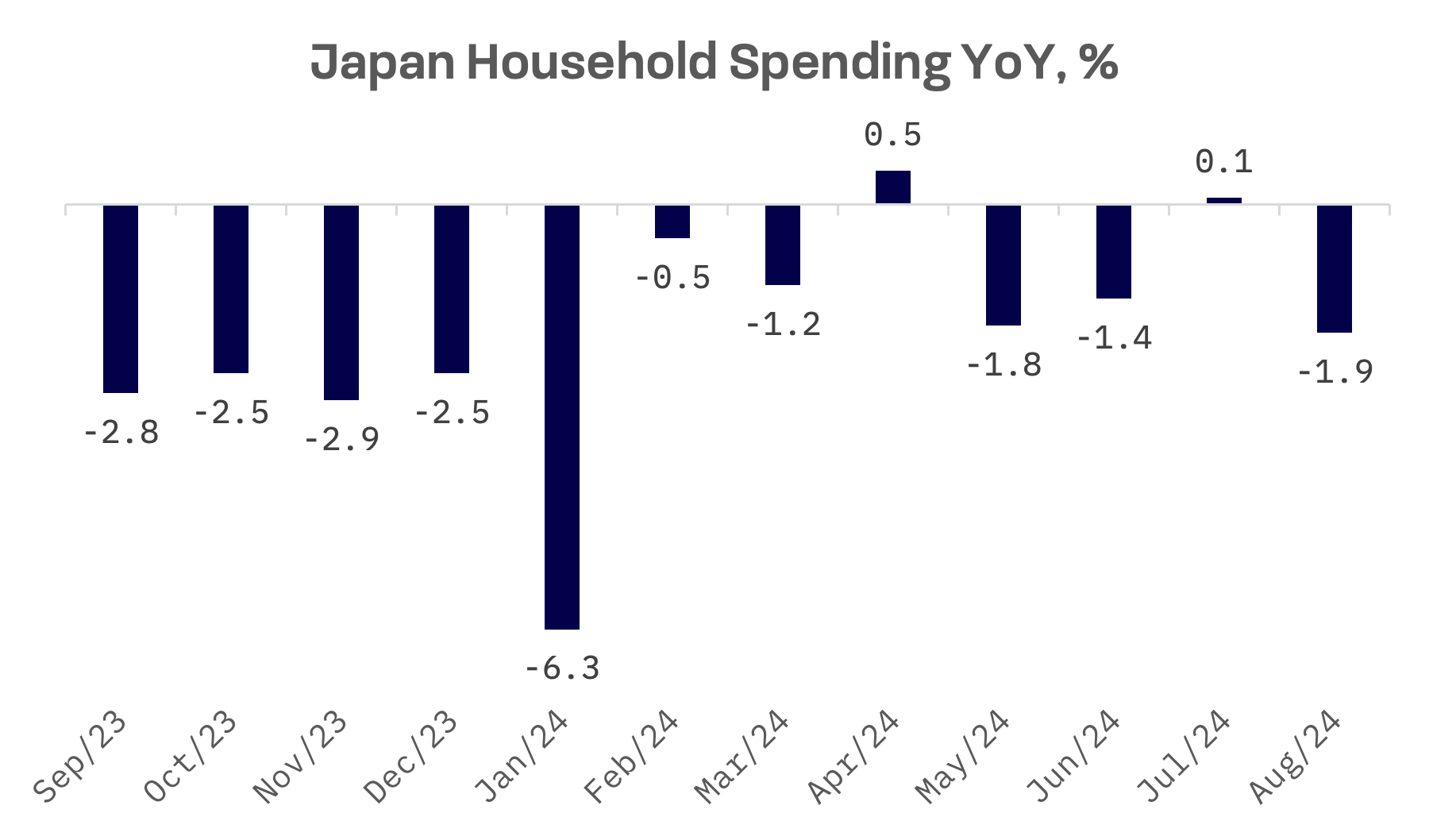

On the economic front, Japan’s inflation adjusted real wages fell 0.6% year-over-year in August, marking the first decline in three months. The drop was partly attributed to the fading impact of summer bonuses paid in the previous two months. Weak wage growth could reinforce expectations that the Bank of Japan (BoJ) may refrain from raising interest rates in the near term, as the anticipated cycle of rising wages spurring consumer spending has yet to materialise. Household spending also fell 1.9% year-over-year in August, though the decline was smaller than the 2.6% drop forecast by analysts.

Recent remarks from BoJ policymakers indicated that the central bank’s policy stance remains steady following the government transition. BoJ Deputy Governor Ryozo Himino reaffirmed the bank’s cautious approach, stating that it will continue to evaluate economic data and risks before considering further rate hikes. He emphasised that the BoJ isn’t on a predetermined path for raising interest rates, maintaining a flexible policy outlook.

South Korea

South Korea’s stock market gained ground, with the KOSPI Index rising 1.1% after the Bank of Korea (BOK) cut its key rate for the first time in more than three years.

The BOK reduced its benchmark interest rate by 25 basis points to 3.25%, signalling an end to its monetary tightening cycle that began in August 2021. However, any further rate cuts are expected to be slow and gradual due to the country’s elevated household debt levels.

Household debt remains a concern, according to BOK Governor Rhee Chang-yong. “Household debt contracted in September, but it’s still too early to confirm financial stability,” Mr. Rhee said. “The bank will closely monitor how the rate cut impacts housing transactions and the pace of rising home prices.”

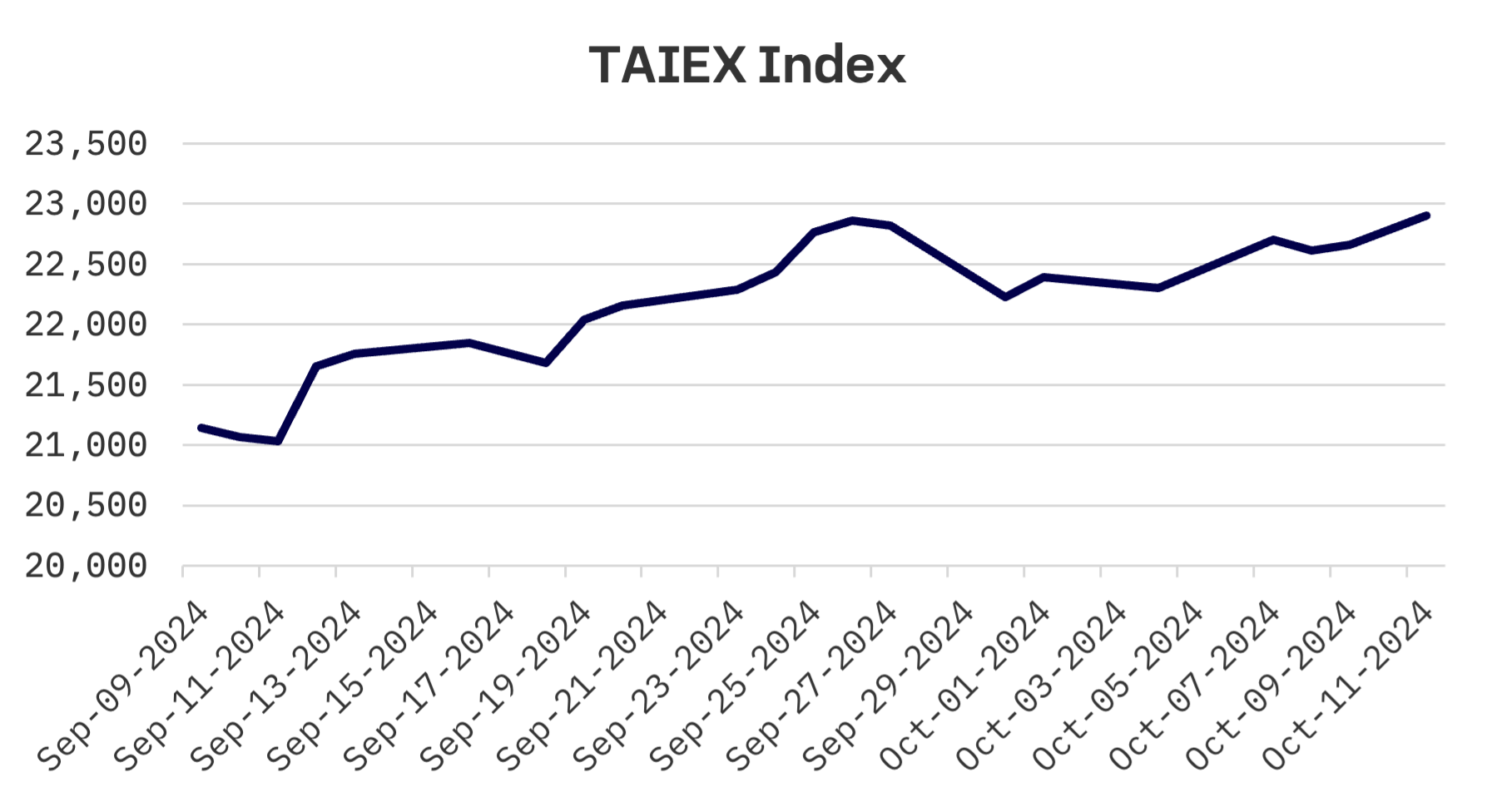

Taiwan

Taiwan’s stock market rallied, with the TAIEX adding 2.7% after Taiwan Semiconductor (TSMC) reported record third quarter sales. The chipmaker’s results surpassed earlier forecasts, with market analysts attributing the strong performance to surging demand for AI applications.

Meanwhile, Taiwan’s exports hit a record high in September, rising 4.5% from a year earlier and marking the eleventh consecutive month of year-over-year growth. The robust performance was fuelled by the expanding semiconductor industry and increased orders for advanced computing components.

JAKOTA Blue Chip 150 Index

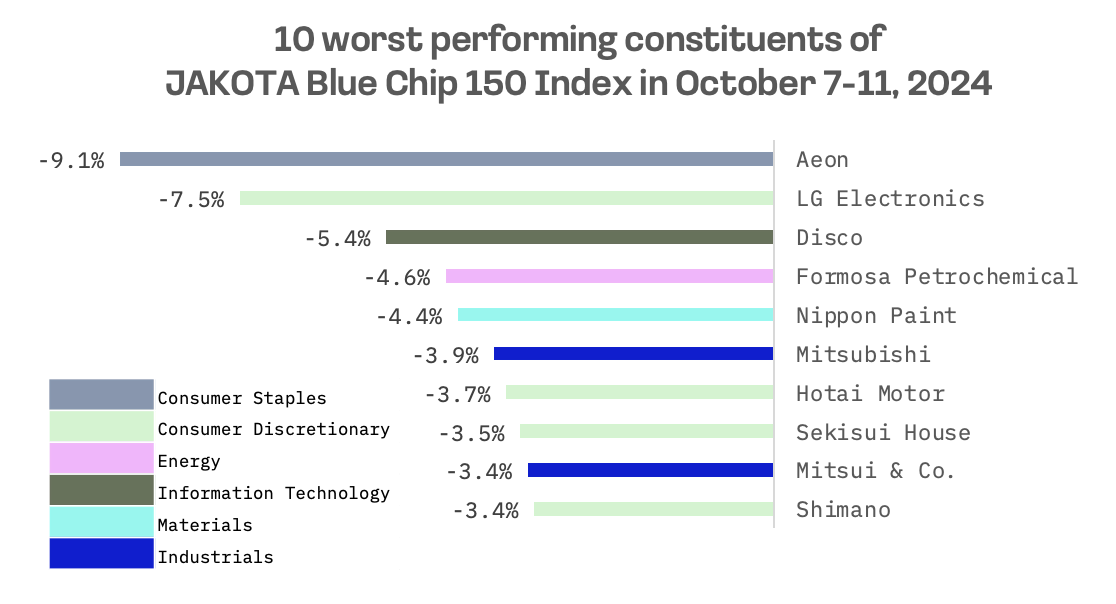

The JAKOTA Blue Chip 150 Index advanced 0.4% last week. Out of a pool of 150 constituents, only 83 stocks posted gains.

Advantest, a Japanese leading manufacturer of automatic test equipment for the semiconductor industry, emerged as the top performing stock, with a gain of 11.8%. The company is a key supplier of inspection equipment for NVIDIA’s image processing semiconductors (GPUs). Its stock price surge is driven by large purchases likely from institutional investors. As a major NVIDIA related stock, its performance continues to benefit from the booming AI market.

AEON, the Japanese diversified retail holding company, was the weakest performer on the JAKOTA Blue Chip 150 Index. The company reported second quarter operating profit of ¥50.8 billion for the June-August period, a 23.2% drop from the prior year and over ¥10 billion below market expectations. First half profit stood at ¥98.6 billion, down 16.2% year-over-year, raising doubts about the company’s ability to meet its full year forecast of ¥270 billion, a 7.6% increase from the previous fiscal year. While AEON’s finance and real estate divisions are performing well, delays in improving its core retail business have contributed to the earnings shortfall.