Last week’s Jakota markets:

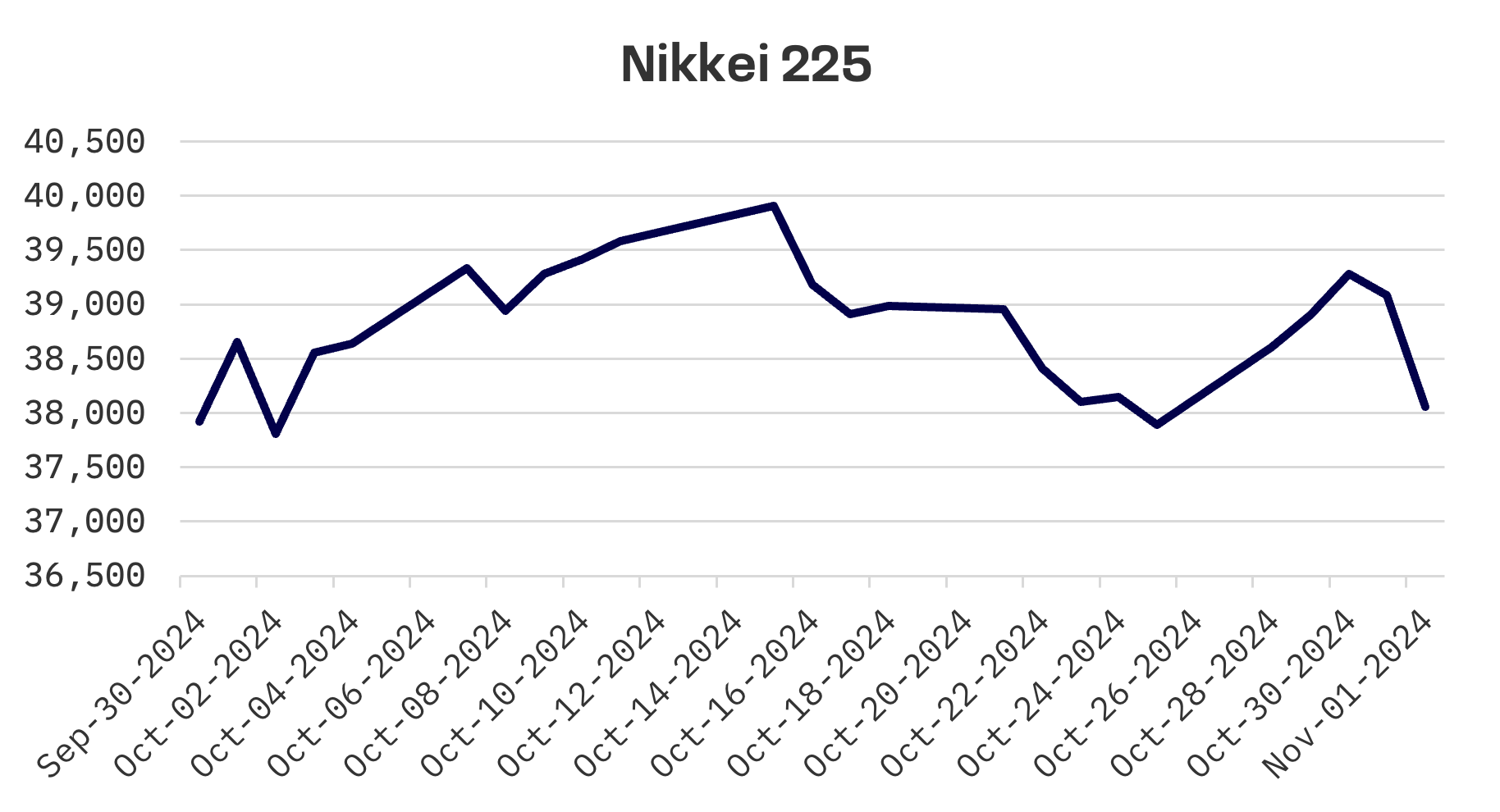

- Japan’s Nikkei 225 Index gained 0.4% as the BoJ held rates at 0.25%, with Governor Ueda signalling a potential shift from ultra loose monetary policy

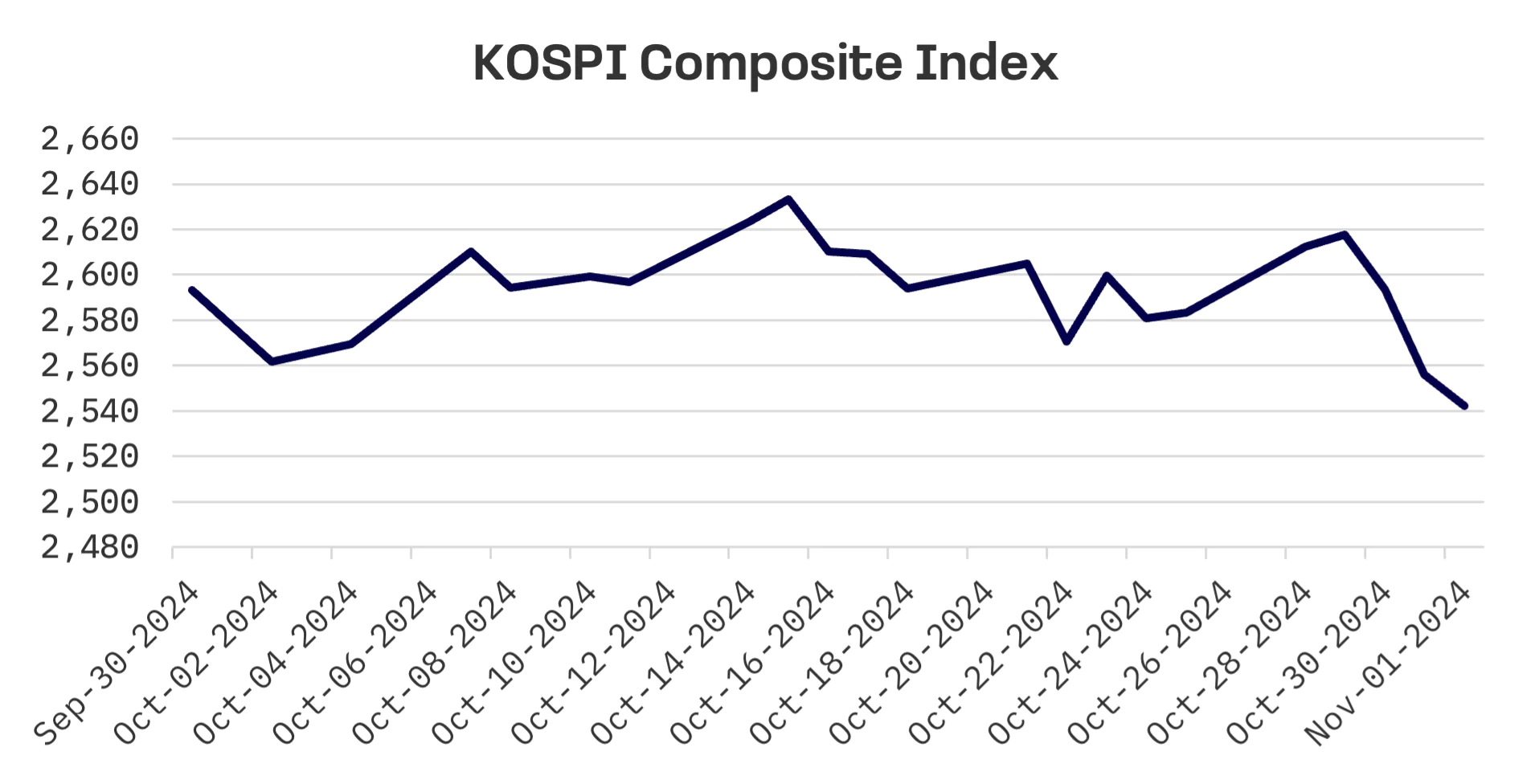

- South Korea’s KOSPI retreated 1.6%, hit by three consecutive sessions of losses in tech shares following weak U.S. earnings

- Taiwan’s TAIEX suffered the Jakota region’s biggest decline, falling 2.4% as technology stocks faced sustained pressure

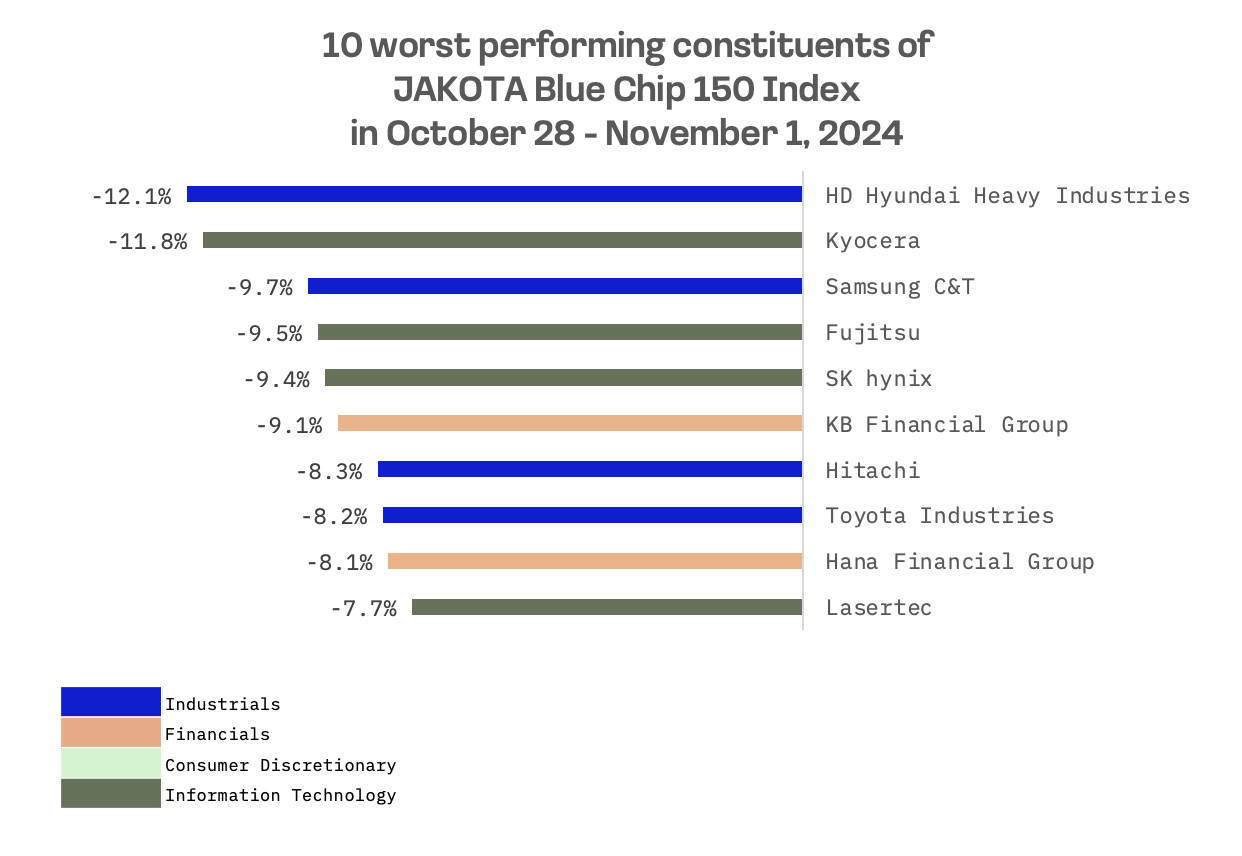

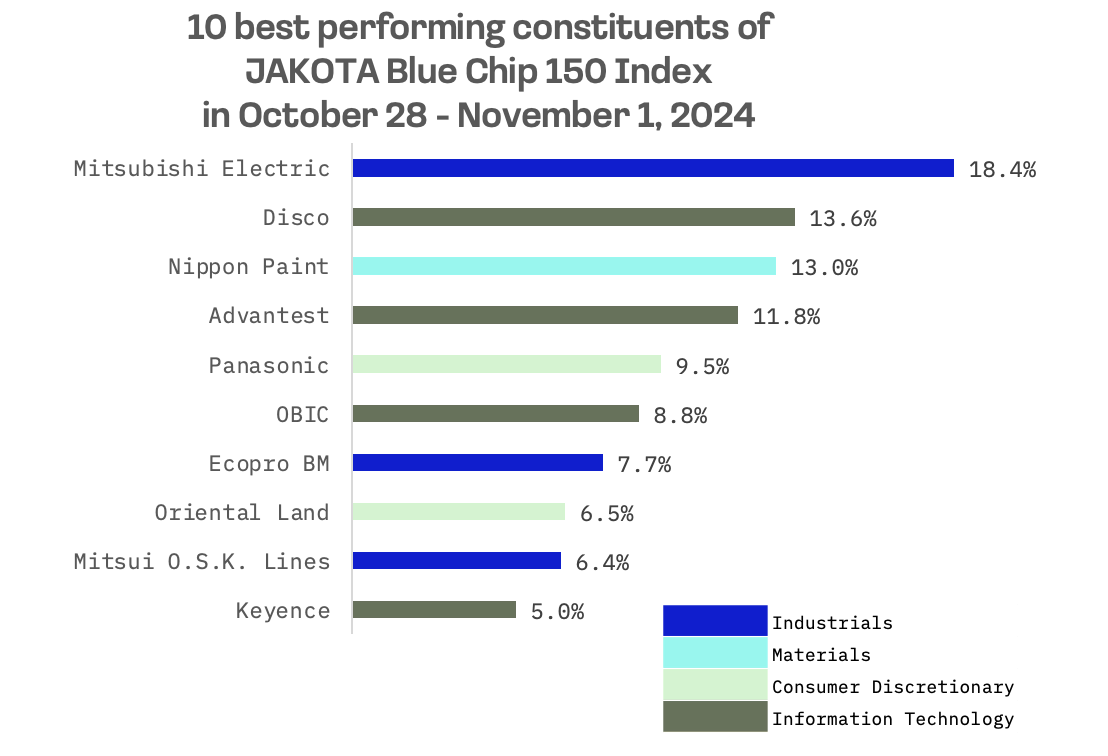

- JAKOTA Blue Chip 150 Index fell 0.4%, with Mitsubishi Electric surging 18.4% on strong earnings while HD Hyundai Heavy Industries led declines

Japan

Japan’s stock market advanced modestly this week, with the Nikkei 225 Index rising 0.4%, as the Bank of Japan maintained its interest rate stance amid political turmoil. The ruling Liberal Democratic Party (LDP)-Komeito coalition failed to secure a majority in Sunday’s parliamentary election, as opposition parties capitalised on voter discontent over an LDP corruption scandal and rising consumer prices. Prime Minister Shigeru Ishiba’s LDP now faces the challenge of forming a minority government while seeking support from smaller parties to maintain control of the lower house.

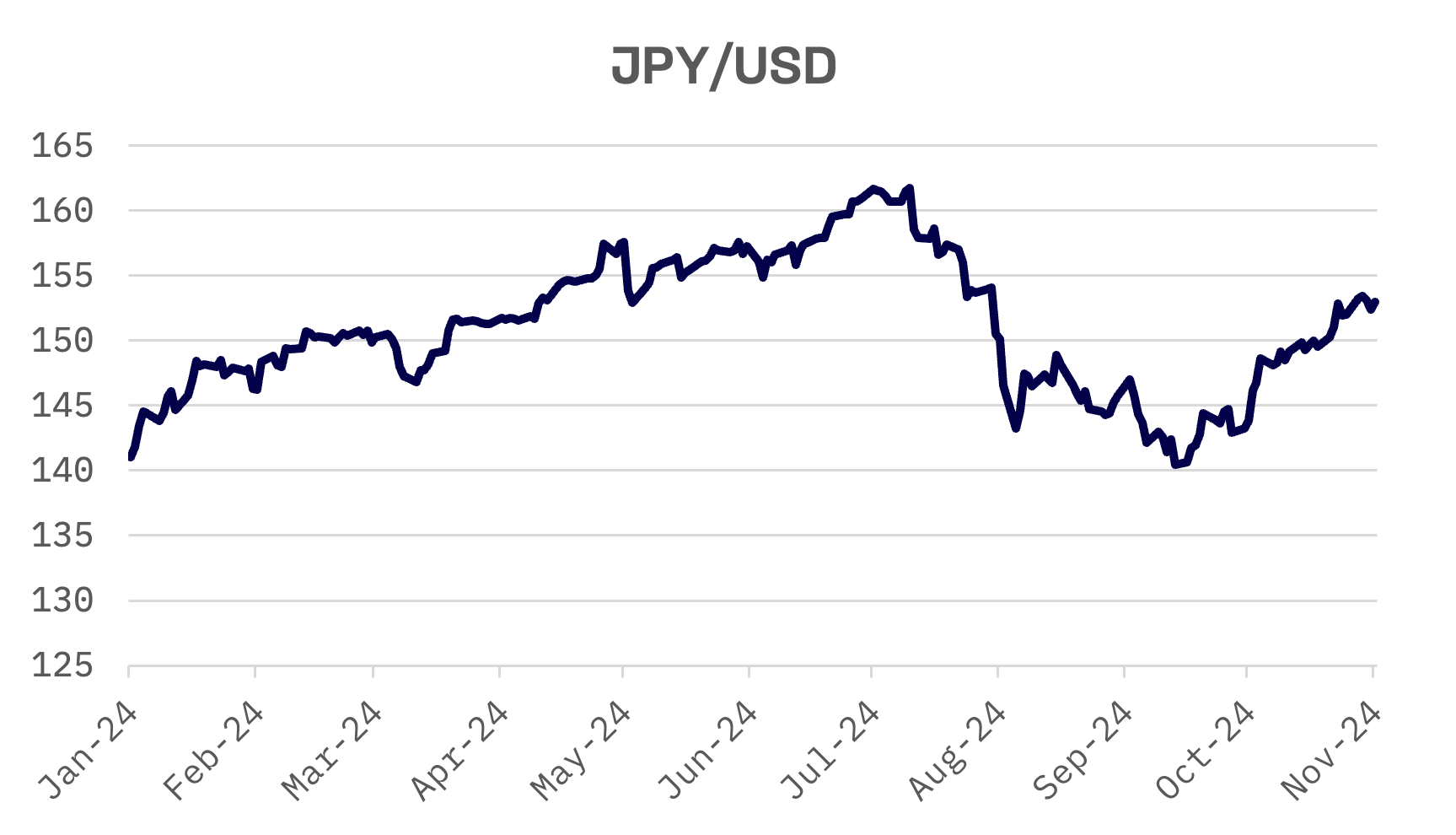

The election results initially pressured the yen, which weakened against the dollar as investors weighed the implications of political uncertainty on fiscal policy and central bank decisions. The Bank of Japan (BoJ) kept its policy rate at 0.25% at its October meeting, as widely anticipated. The currency found support in less dovish comments from BoJ Governor Kazuo Ueda, ending the week near ¥152 to the dollar, largely unchanged.

Ueda reinforced the central bank’s position on potential rate increases should economic and inflation projections materialise. In a notable shift, the governor departed from previous rhetoric by omitting references to “ample time” regarding rate hike timing, suggesting a less accommodative stance. The BOJ’s assessment that U.S. economic risks have largely dissipated has led some analysts to anticipate monetary tightening, with market expectations split between December and January for the timing of a possible rate increase.

South Korea

South Korea’s KOSPI Index fell 1.6% this week, marking its third consecutive weekly decline. The market’s early week momentum, driven by strong performances in large cap stocks, reversed sharply mid week. Technology and financial shares led Thursday’s 1.5% drop, with the downward trend continuing into Friday following disappointing earnings from major U.S. technology companies.

Economic data showed South Korean export growth decelerated to a seven month low in October, despite sustained demand for semiconductors and automobiles. The slowdown has intensified concerns about economic headwinds amid U.S. electoral uncertainty and geopolitical tensions.

The Ministry of Trade reported on Friday that exports increased 4.6% year-over-year to $57.5 billion in October, marking the slowest pace since March while extending the growth streak to 13 months.

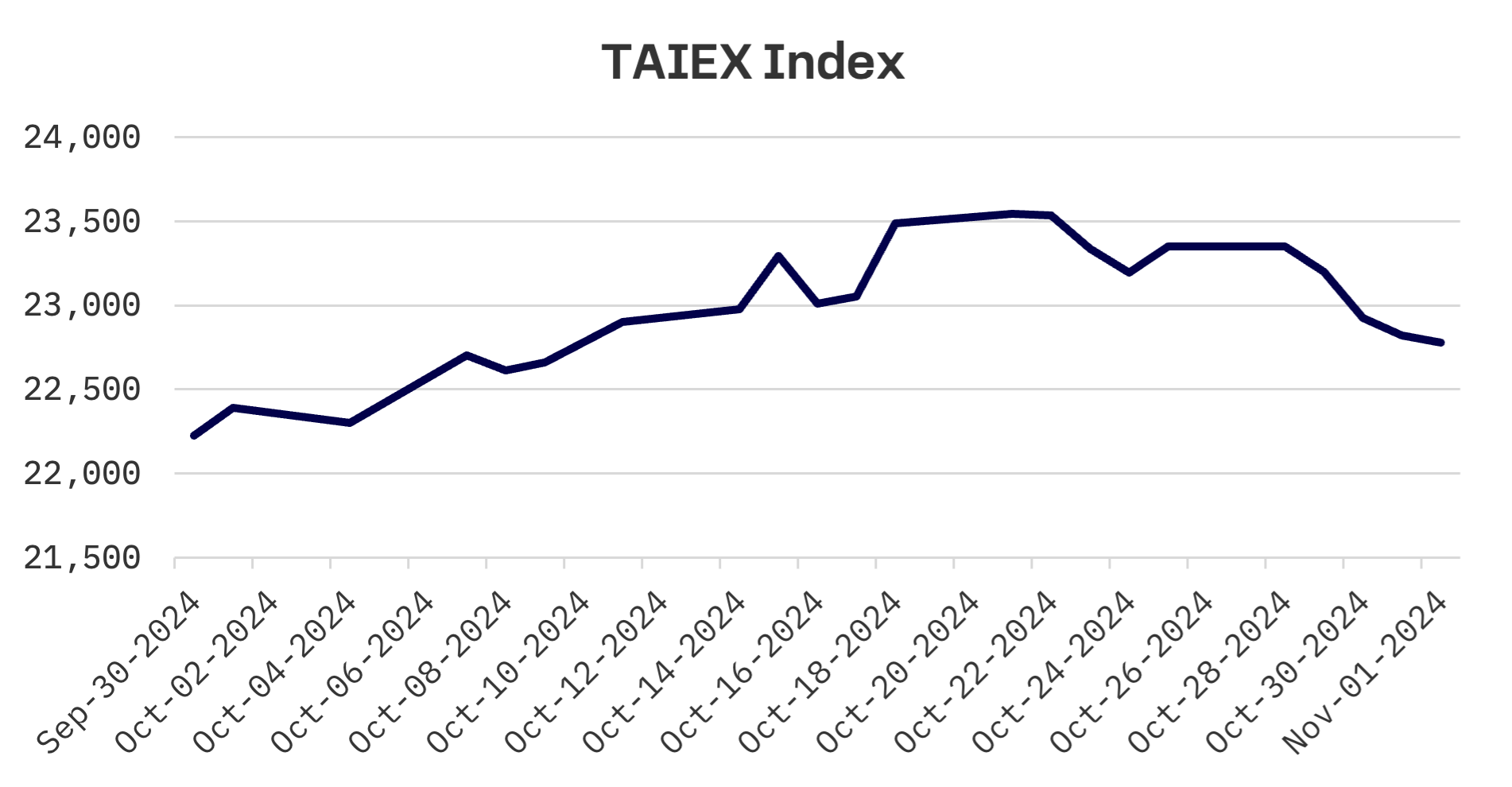

Taiwan

Taiwan’s stock market posted the steepest decline among the Jakota markets this week, with the TAIEX index dropping 2.4% under pressure from technology shares.

The economy showed resilience, however, as third quarter GDP growth reached 3.97% year-over-year, exceeding August’s projection of 3.21%, according to preliminary government data. The Directorate General of Budget, Accounting and Statistics attributed the stronger performance to robust export demand, particularly from AI related industries.

JAKOTA Blue Chip Index

The JAKOTA Blue Chip 150 Index retreated 0.4% this week, with 73 of its 150 constituents advancing.

Mitsubishi Electric, a Japanese multinational electronics and electrical equipment manufacturing company, emerged as the top performer, surging 18.4% after reporting record first half revenue and operating profit for fiscal 2025, ending March 31. The Japanese multinational’s results benefitted from yen weakness and strong growth in its Infrastructure and Life segments.

HD Hyundai Heavy Industries, the world’s largest shipbuilding company from South Korea, ranked as the index’s worst performer. The company’s shares declined despite returning to profitability in the third quarter with a 27% revenue increase, as profit margins fell short of market expectations.