Japan

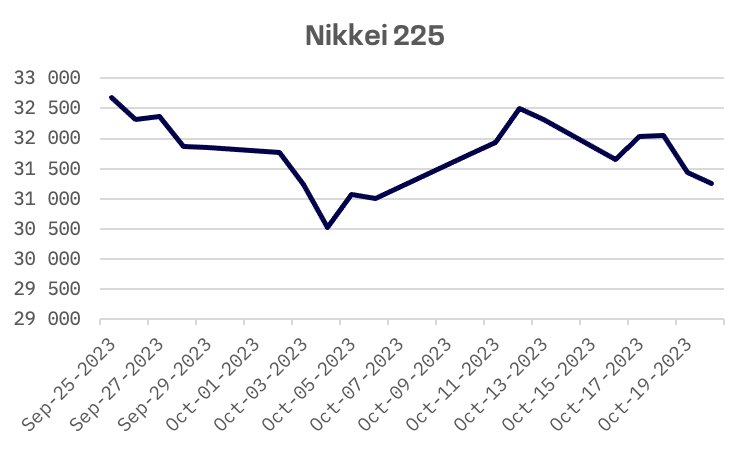

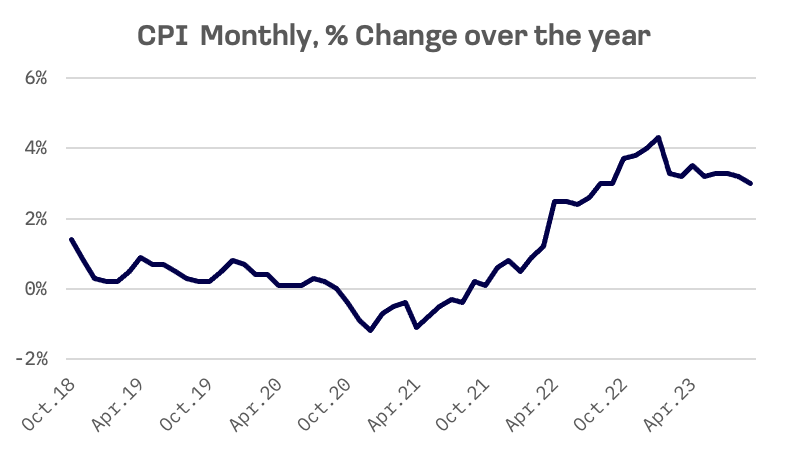

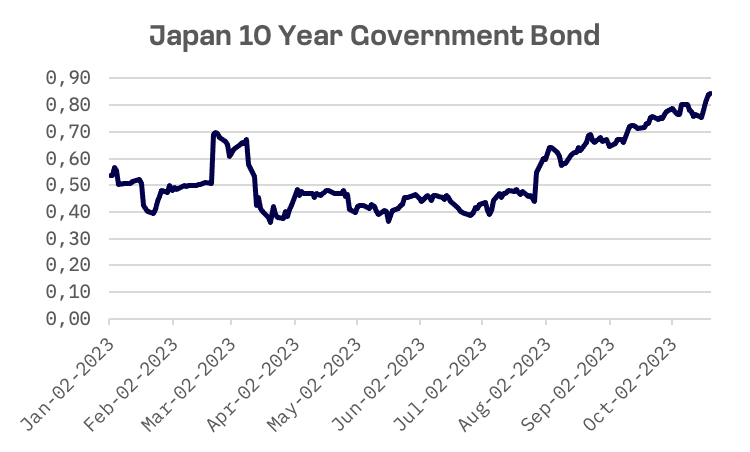

Japan’s stock markets faced a downturn throughout the week, with the Nikkei 225 Index registering a 3.3% decline. This decline occurred amidst a modest easing of inflationary pressures, yet Japan’s overall inflation rate remains above the Bank of Japan’s 2% target for the 18th consecutive month. Additionally, Japan’s 10-year government bond rate reached its highest point in nearly a decade.

In September, Japan’s inflation rate showed signs of slowing down, as the core consumer price index (CPI) recorded a year-on-year increase of 2.8%, down from August’s 3.1%. However, prices continued to exceed the Bank of Japan’s 2% target for the 18th consecutive month. It is widely anticipated that the Bank of Japan will revise its inflation forecasts upward during its meeting on October 30-31.

Apart from the modest easing of inflationary pressures, there was a particular focus on wage growth. Asahi Noguchi, a member of the BOJ board, assumes that policymakers must concentrate on improving wage growth to pave the way for sustainable inflation before adjusting the easing policy. Japan’s wage trend, which has remained relatively stagnant during the last three decades, is under close scrutiny by global financial markets. This is due to the Bank of Japan’s emphasis on sustainable wage increases as a crucial condition for gradually phasing out its extensive monetary stimulus measures.

The yield on the 10-year Japanese government bond (JGB) saw a notable surge, climbing from 0.76% at the close of the previous week to 0.83%. During the week, the Bank of Japan conducted an unscheduled bond-purchase operation to moderate the pace of this upward movement. This action signals that the central bank’s preference is for a gradual increase in yields rather than abrupt moves toward a yield cap at 1%.

South Korea

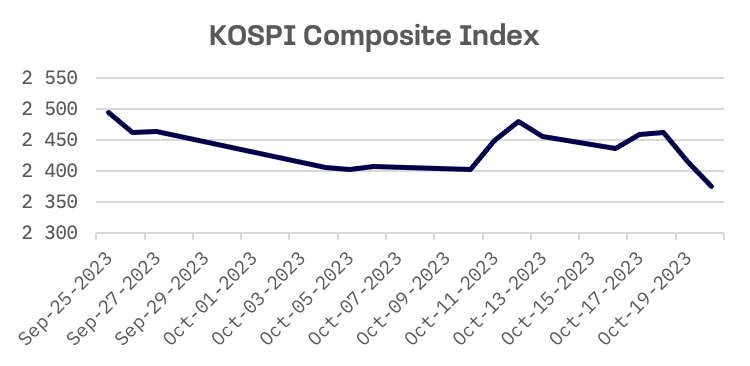

The KOSPI Composite Index experienced a significant decline of 81.15 points, or 3.30%, during the week, closing at 2,375.00. This marked its lowest closing value since March 14, 2023. The stock markets faced substantial pressure due to concerns about the U.S. Federal Reserve’s plans for additional monetary tightening. Federal Reserve Chairman Jerome Powell’s statement that inflation remains “too high,” coupled with a surge in longer-term bond yields, significantly impacted investor confidence.

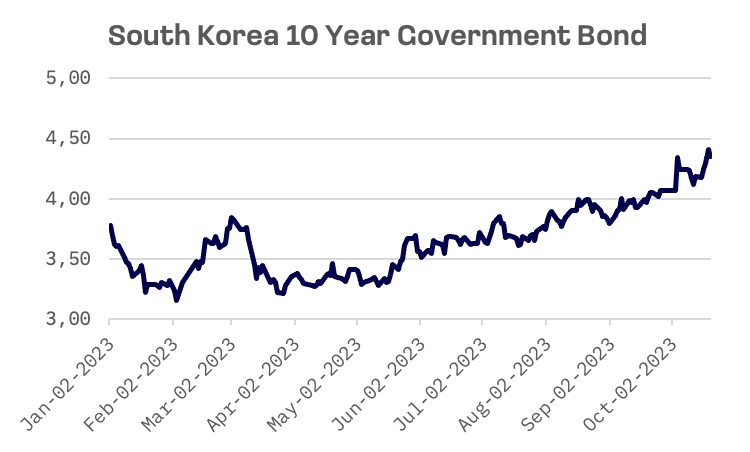

Furthermore, Bank of Korea Governor Rhee Chang-yong, during an interest rate policy meeting on October 19, 2023, stated that inflationary pressures in South Korea may alleviate more slowly than previously anticipated. This is attributed to rising uncertainties stemming from the conflict between Israel and Hamas. Consequently, the central bank is considering the possibility of raising its policy interest rate. Meanwhile, the yield on 10-year government bonds hovers at approximately 4.3%, marking the highest level since October of the previous year.

Taiwan

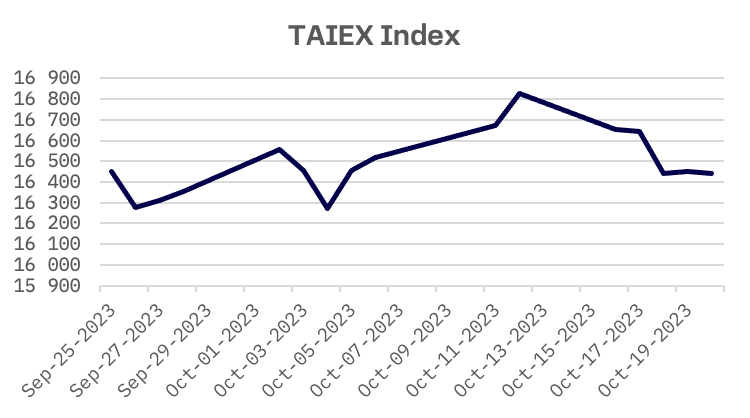

In line with other Asian stock markets, Taiwanese stock markets saw a decline over the week, with the TAIEX index down 2.0%.

The most significant decline occurred on Wednesday when the TAIEX index dropped by 200 points, primarily driven by losses in the electronics sector. This drop was triggered by the Biden administration’s decision to halt shipments of chips developed by companies such as Nvidia Corp. and other American semiconductor designers to China.

On a positive note, Taiwan Semiconductor Manufacturing Co. (JAKOTA Blue Chip 150 Index, JAKOTA Tech 350 Index) reported on Thursday that its net profit for the third quarter surged by over 16% compared to the previous quarter. Additionally, the company’s gross margin exceeded its earlier projection, contributing to a slight uptick in the TAIEX index on October 19.

During a press conference on Friday, the Chung-Hua Institution for Economic Research (CIER), a prominent think tank for economic and industry-related research, revised down its projection for Taiwan’s gross domestic product (GDP) growth in 2023 to 1.38%, down from its previous estimate of 1.60% made in July. This adjustment is attributed to a decline in global demand.

JAKOTA Blue Chip 150 Index

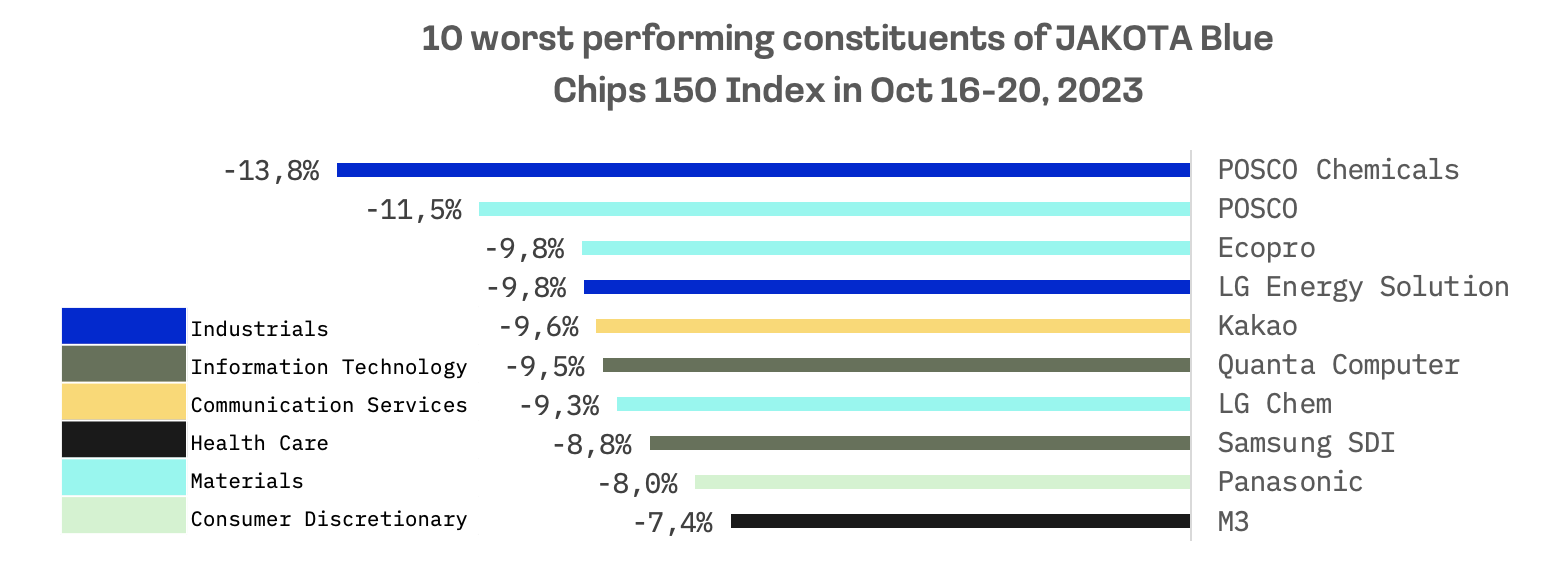

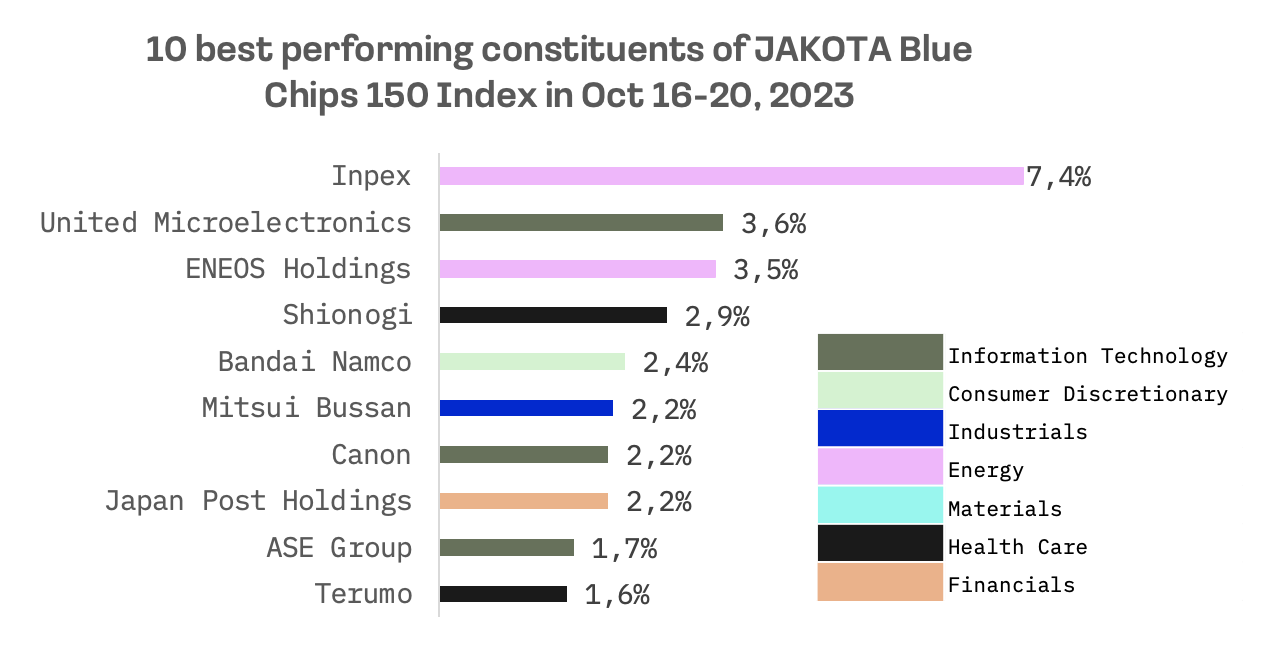

Out of a pool of 150 constituents, only 29 shares demonstrated positive price trends during the week.

Among the top-performing stocks, two entities from the Energy sector, Inpex and ENEOS Holdings, benefited from the recent surge in oil prices.

POSCO witnessed a significant downturn in its shares, coinciding with the company’s third-quarter operating earnings estimate of 1.2 trillion won (approximately US$884 million), reflecting a robust 33.3% increase from the preceding year. Meanwhile, sales experienced a decline of 10.4%, amounting to 19 trillion won.