Last week’s Jakota markets:

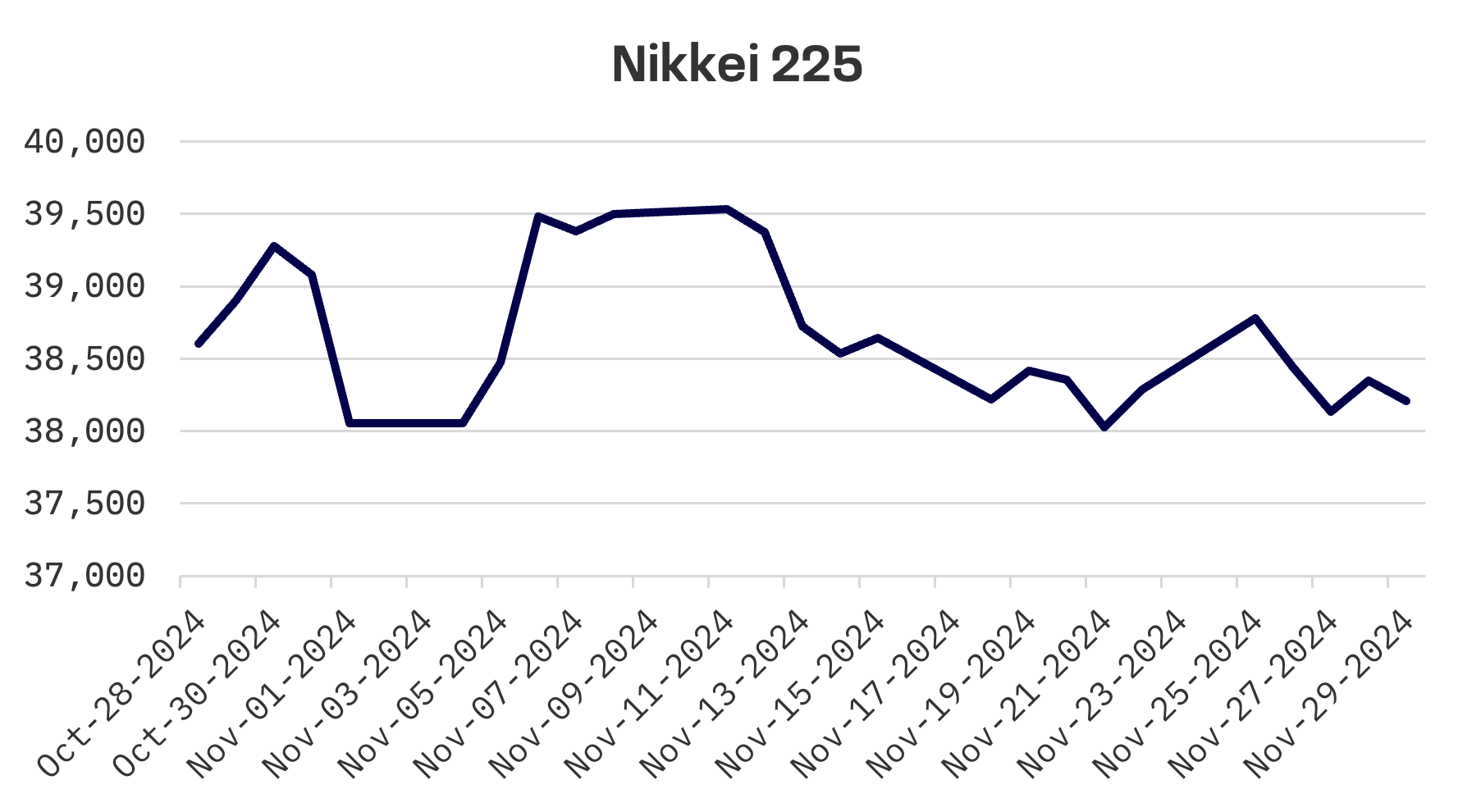

- Japan’s Nikkei 225 edged down 0.2% as geopolitical tensions and a stronger yen pressured export sectors

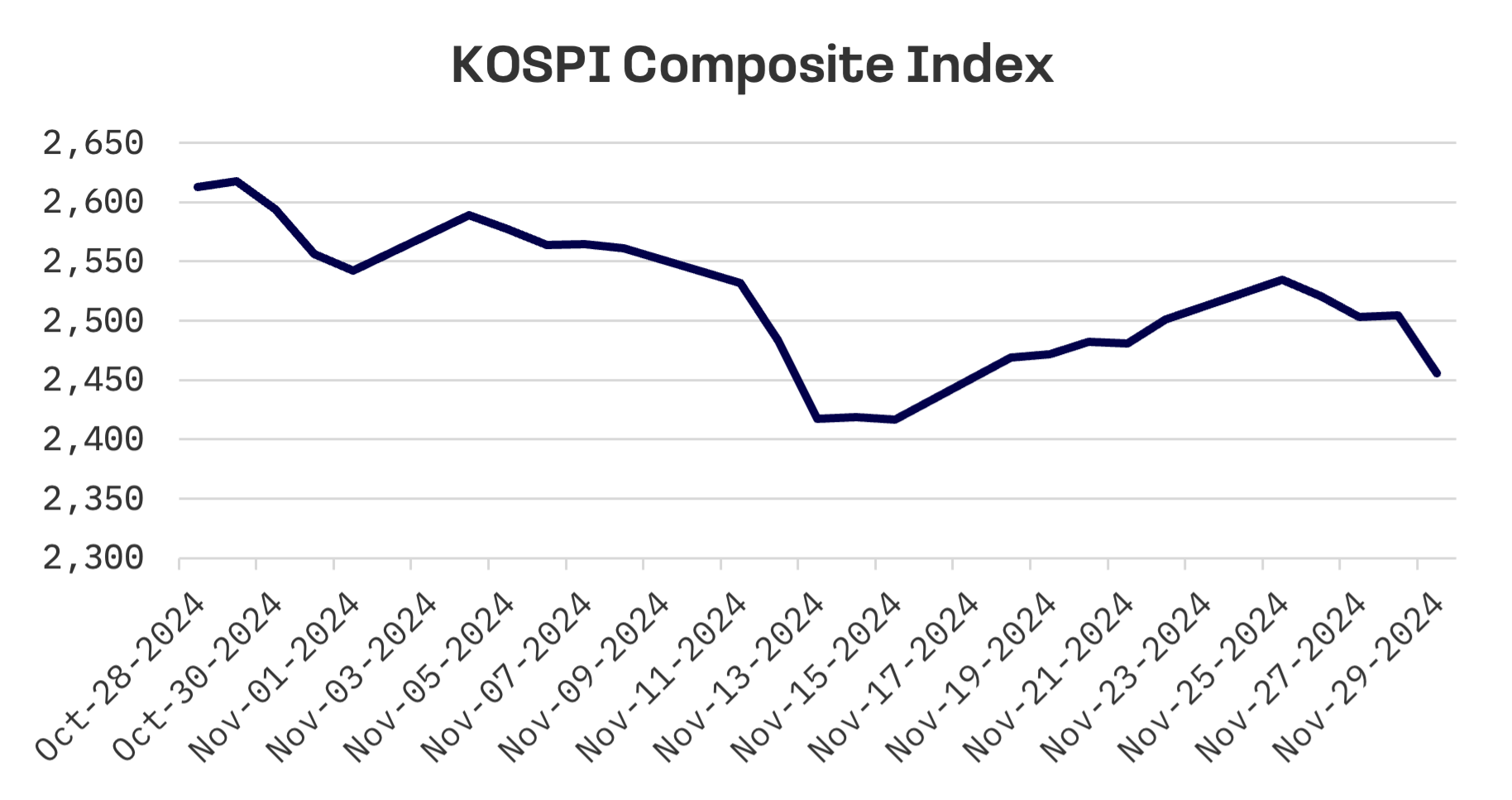

- South Korea’s KOSPI fell 1.8%, dragged lower by BOK’s surprise rate cut to 3.00% and deteriorating business sentiment

- Taiwan’s TAIEX dropped 2.8%, hit by Trump’s tariff threats and increased foreign institutional hedging

- The JAKOTA Blue Chip 150 Index rose 0.9%, with only one third of constituents posting gains amid market volatility

Japan

Japanese stocks finished the week slightly lower, with the Nikkei 225 dropping 0.2%, as heightened geopolitical tensions dampened risk appetite globally. The yen’s appreciation against the dollar pressured Japan’s export oriented sectors, contributing to the market’s decline.

The Japanese currency strengthened to around ¥150 against the dollar, climbing from above ¥154 the previous week, as investors sought safe haven assets. Better than expected inflation data bolstered the currency further, intensifying speculation about the Bank of Japan (BoJ)’s next policy move. BoJ Governor Kazuo Ueda maintained that future rate increases would depend on economic conditions and price trends meeting the central bank’s projections.

In parliament, Prime Minister Shigeru Ishiba presented his policy agenda while seeking approval for supplementary budget funding to support a new stimulus package. The proposed measures focus on economic revitalisation in rural areas and addressing inflation’s effects on households and businesses. The plan encompasses energy subsidies, direct payments to low income households and an increased tax free salary threshold. Ishiba, echoing his predecessor Fumio Kishida’s policies, stressed the importance of wage growth outpacing inflation and investment driven economic expansion.

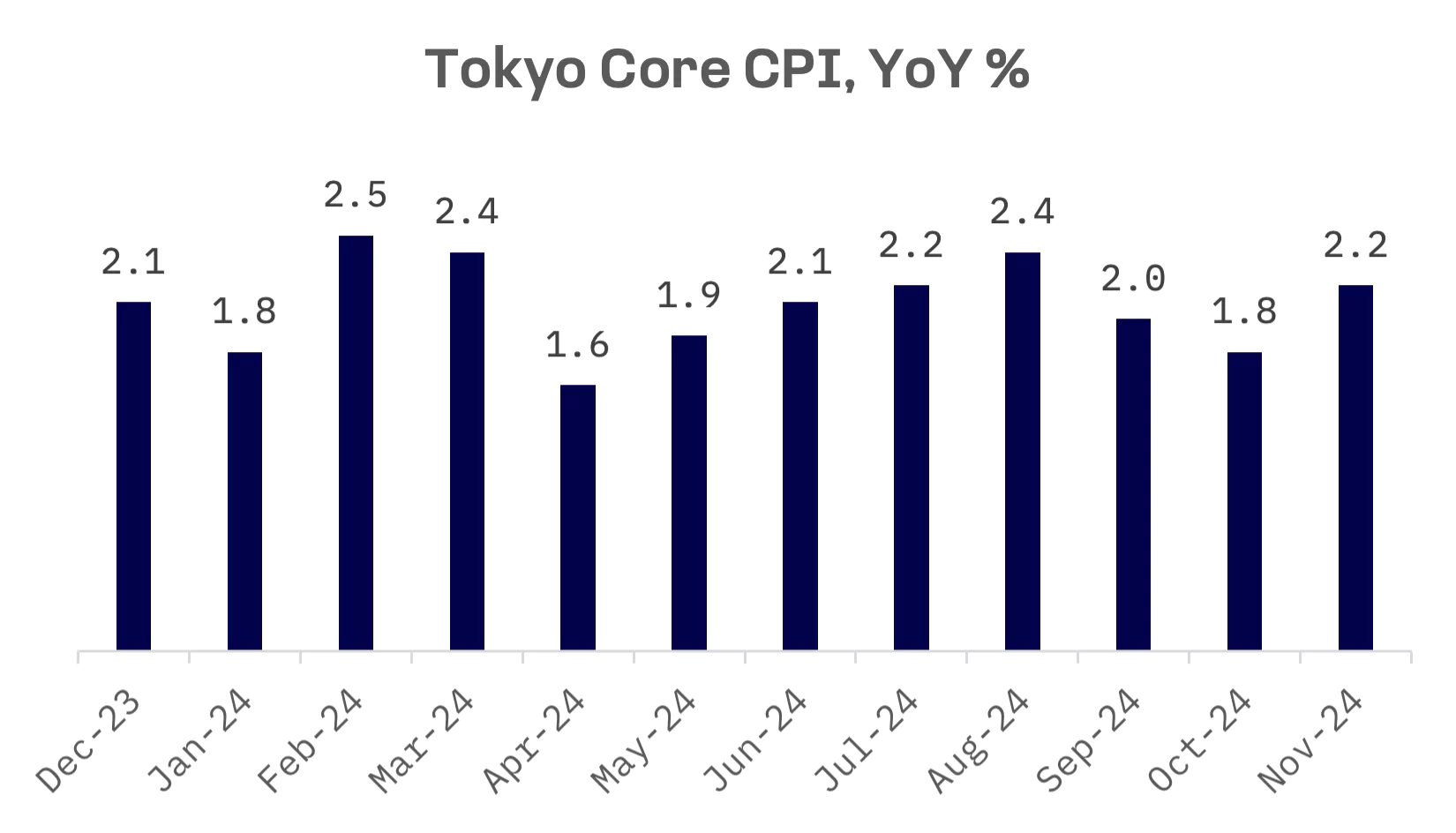

November’s Tokyo area core consumer price index (CPI), which often predicts national inflation trends, rose 2.2% from a year earlier, exceeding market forecasts and accelerating from October’s 1.8% increase.

South Korea

South Korea’s KOSPI Index declined 1.8% for the week, with most losses concentrated on Friday after an unexpected interest rate reduction and downbeat economic outlook from the central bank.

The Bank of Korea (BOK) cut its benchmark rate by 25 basis points to 3.00% on Friday, contrary to widespread expectations for no change, according to The Korea Economic Daily’s survey. The decision marks the first back-to-back rate reductions since the 2009 global financial crisis. The move comes amid concerns about trade uncertainties, particularly regarding potential protectionist policies under U.S. President-elect Donald Trump.

The central bank indicated possible further easing within three months as it aims to support Asia’s fourth largest economy.

Meanwhile, business sentiment deteriorated in November, reflecting mounting concerns over sluggish growth momentum, driven in part by weakening domestic demand. The Composite Business Sentiment Index (CBSI) for all industries slipped to 91.5, a 0.6 point decline from the previous month, according to BOK data.

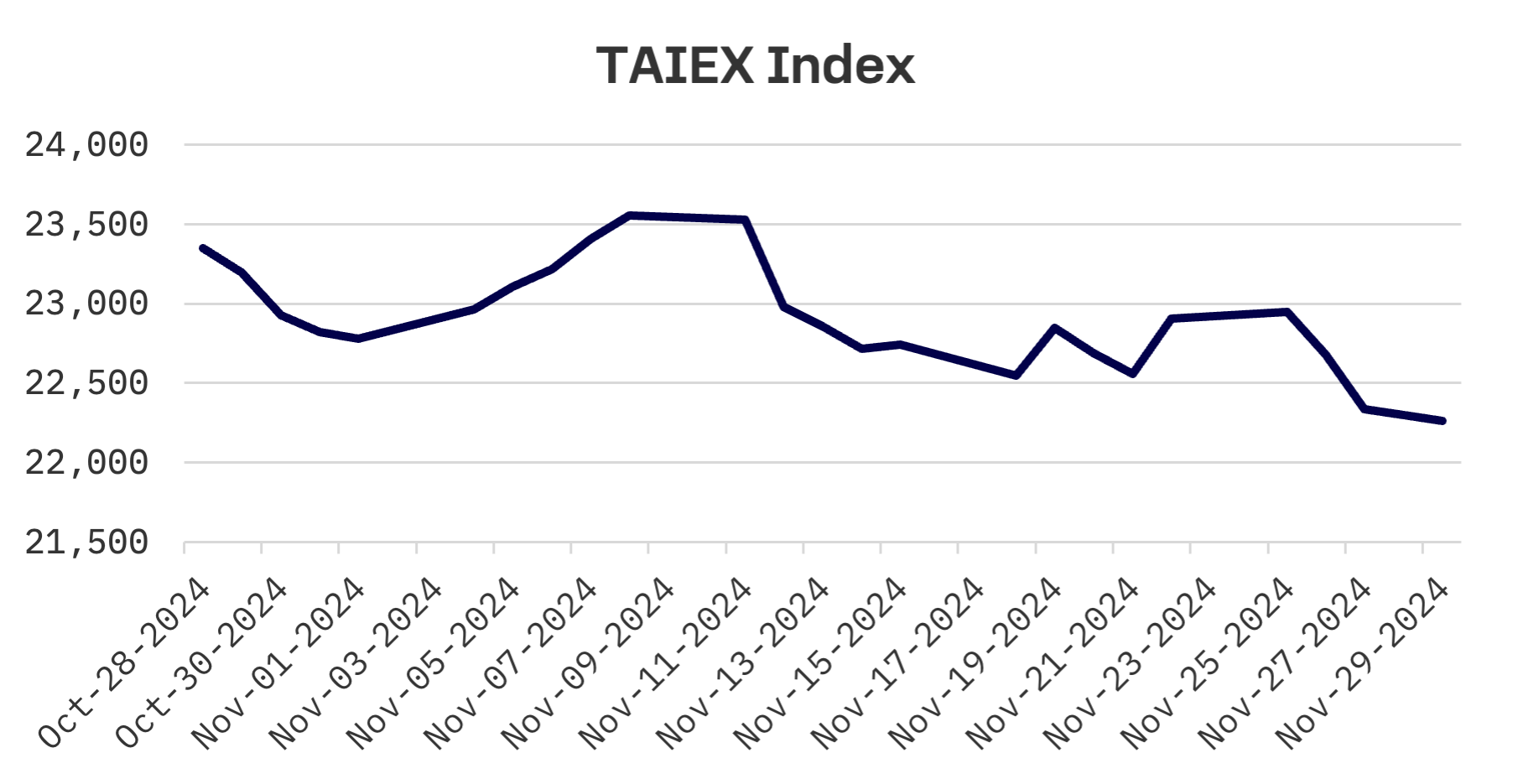

Taiwan

Taiwan’s TAIEX Index fell 2.8% for the week as President-elect Trump’s threats of tariffs on Chinese, Canadian and Mexican goods weighed on large technology stocks. Foreign institutional investors increased short futures positions to hedge market risks, adding to the downward pressure.

Taiwan’s economy is projected to grow 4.27% in 2024, up from an earlier estimate of 3.9%, according to the Directorate General of Budget, Accounting and Statistics (DGBAS). The revised forecast, potentially marking the fastest growth in three years, reflects stronger than expected export performance and steady domestic investment, the DGBAS noted in its Friday release.

JAKOTA Blue Chip Index

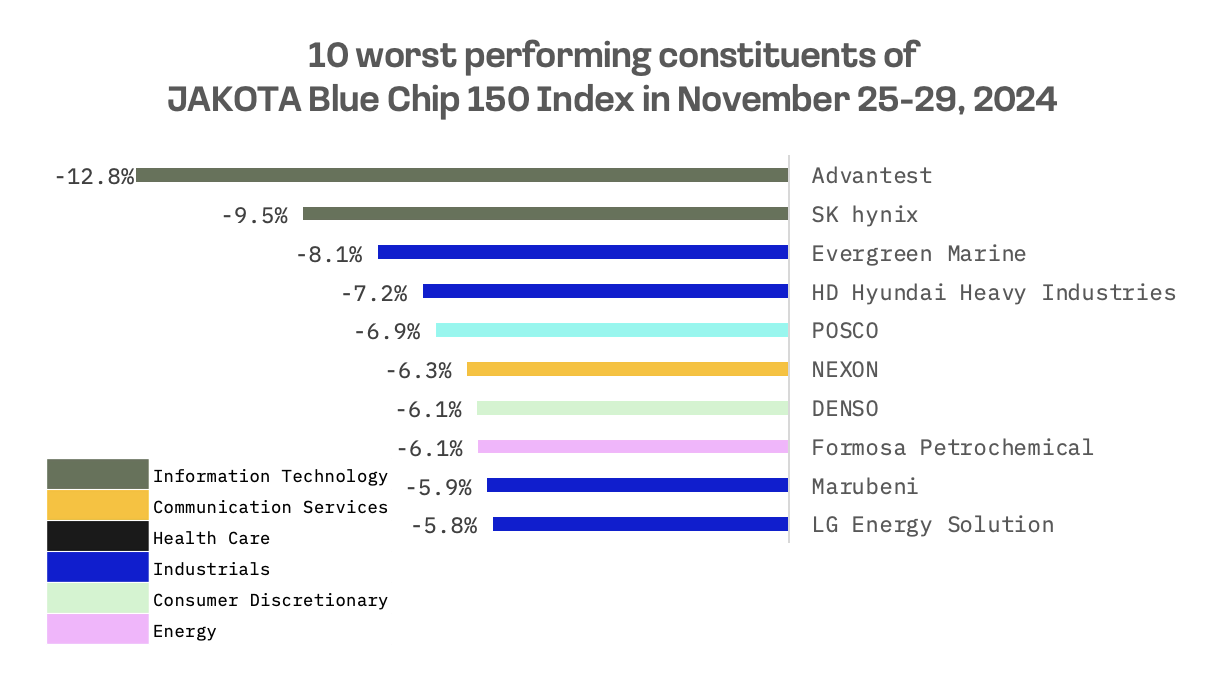

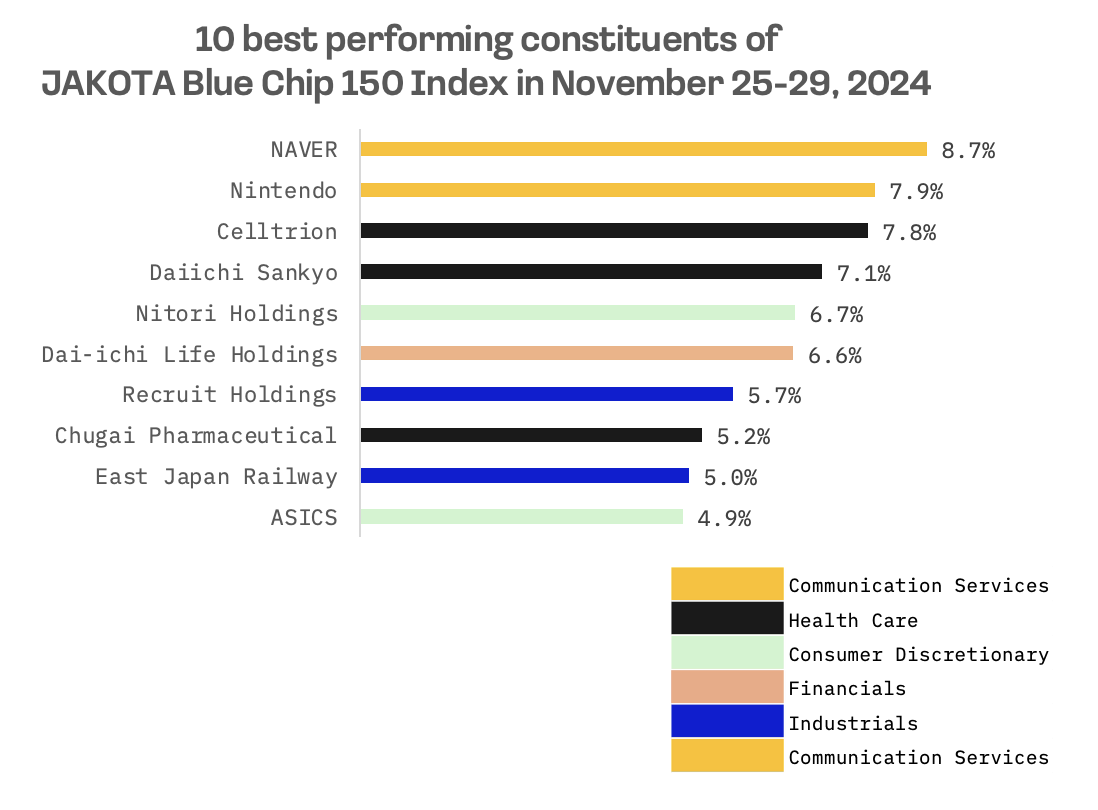

The JAKOTA Blue Chip 150 Index rose 0.9% this week, boosted by yen appreciation, with one third of its constituents advancing.

South Korean internet conglomerate Naver emerged as the index’s top performer after adding Netflix’s ad supported standard plan to its Naver Plus membership at no extra cost. The addition of the streaming service, valued at ₩5,500 monthly, aims to attract both existing Netflix subscribers and new users to Naver’s platform. Industry analysts view the move as a direct challenge to Coupang, South Korea’s largest subscription based service provider. While Naver’s exact subscriber count remains undisclosed, estimates place it at around 10 million compared with Coupang’s 14 million Wow members.

Advantest, a leading manufacturer of automatic test equipment (ATE) for the semiconductor industry, ranked as the index’s worst performer. The Japanese company’s shares extended their decline, falling below their 25 day moving average amid profit taking following volatility in U.S. semiconductor stocks.