Japan

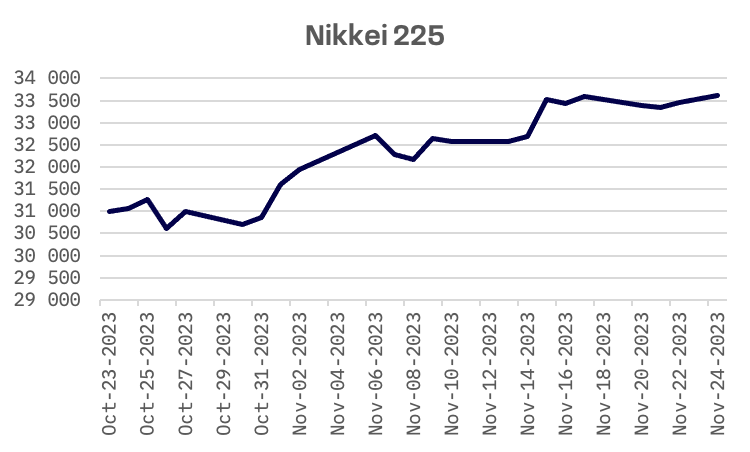

Japan’s stock market witnessed modest gains this week, with the Nikkei 225 Index inching up by 0.1%. Earlier, robust domestic corporate earnings pushed the Nikkei to 33,817 — its highest since 1990. Manufacturers capitalized on the yen’s depreciation and easing supply chain issues. Market optimism was further fueled by expectations that U.S. interest rates might have peaked.

The 10-year Japanese government bond (JGB) yield rose from 0.72% to 0.77%, as the Bank of Japan (BoJ) continued to pare back JGB purchases for the second consecutive week.

Currency markets saw the yen initially strengthen to a two-month high amid a weakening U.S. dollar. However, it ended the week with marginal changes, trading around JPY 149 against the USD.

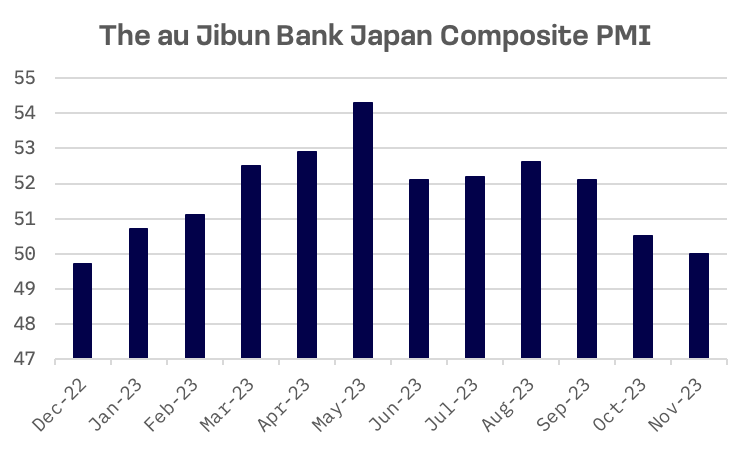

Japan’s economic landscape in October 2023 offered a nuanced view. The au Jibun Bank Japan Composite PMI edged down to 50.0 from September’s 50.5, the lowest since December 2022, highlighting a persistent contraction in factory activity for the sixth straight month, alongside modest growth in the service sector.

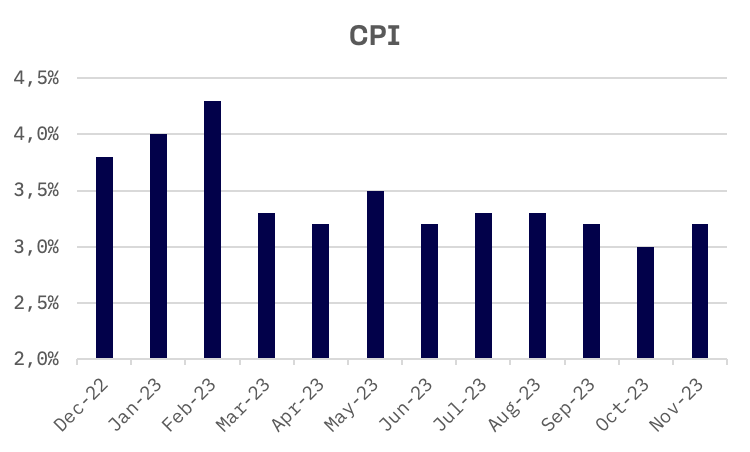

In the same month, Japan’s core consumer price index (CPI) recorded a year-on-year increase of 2.9%, marking its first rise in four months and slightly trailing expectations of a 3.0% uptick. Despite falling short of forecasts, the CPI continued to exceed the Bank of Japan’s (BoJ) 2% inflation target for the 19th consecutive month. This persistent trend above the target rate has sparked speculation about a potential shift towards tighter monetary policy in Japan.

South Korea

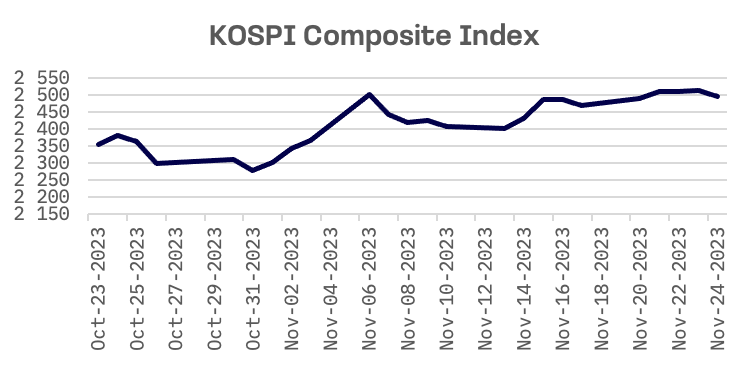

South Korea’s KOSPI Composite Index climbed 1.1% this week, achieving its longest winning streak since the week ending June 9, 2023. This upward trend in the market was buoyed by speculation of potential Federal Reserve rate cuts in the upcoming year and strong figures in semiconductor exports. Market expectations were notably high for robust earnings from US-based Nvidia, which indeed surpassed forecasts in both revenue and earnings. However, despite these impressive figures, Nvidia’s stock price experienced a sharp decline post-announcement, reflecting even higher investor expectations.

In terms of industrial sentiment, manufacturing confidence in Korea, as reported by the Korea Institute for Industrial Economics & Trade (KIET), rose for the first time in four months. This upturn is attributed to signs of recovery in global demand for semiconductors. The Professional Survey Index (PSI) for December reached 100, an increase from November’s reading of 97, signifying a balanced outlook among industry professionals. This positive sentiment in the manufacturing sector is further corroborated by customs office data, which reveals a 2.4% year-on-year increase in semiconductor exports in the first 20 days of November. This surge has contributed to a 2.2% growth in South Korea’s total overseas sales, amounting to $33.8 billion during this period.

Taiwan

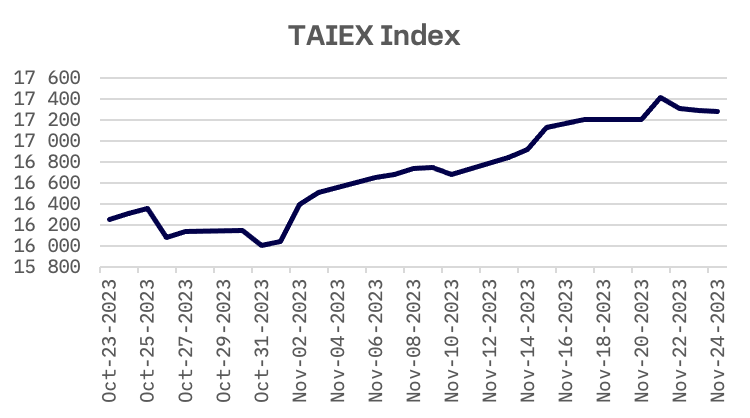

Taiwan’s TAIEX index saw a modest 0.5% gain this week. The index showed notable strength early in the week, surpassing the 17,400-point mark on Tuesday, buoyed by strong liquidity and a robust Taiwan dollar. The electronics sector, especially stocks linked to artificial intelligence, was central to this upward trend. However, the market faced a downturn in AI-related stocks mid-week following a cautionary statement from Nvidia concerning the U.S. government’s ban on chip sales to China, which impacted investor sentiment.

Nvidia, which played a key role in market dynamics, reported impressive earnings for its fiscal third quarter ending in October, with earnings per share reaching US$4.02, exceeding expectations. However, the company issued a cautionary note about potential sales impacts due to U.S. restrictions on high-performance AI chip sales to China. This announcement, coupled with evolving market conditions, led to a more neutral market sentiment by the end of the week.

Taiwan’s industrial sector showed mixed signals in recent data. The Ministry of Economic Affairs (MOEA) reported that the industrial production index in October fell by 2.32% year-on-year to 92.29, marking the 17th consecutive month of decline — the longest year-on-year falling streak in the nation’s history. However, this rate of contraction showed signs of moderation compared to September’s 6.72% fall, partially attributed to robust demand for AI chips.

In terms of business sentiment, the Taiwan Institute of Economic Research (TIER) noted minimal changes among manufacturers in October. Their data revealed a slight decline in the composite index of business sentiment in the manufacturing sector, dropping by 0.38 points to 93.71, compared to the previous month. TIER President Chang Chien-yi, speaking at a news conference, interpreted this minor month-on-month decrease as indicative of a stabilization in the manufacturing sector, suggesting that the export-oriented manufacturers might be overcoming their most challenging phase.

JAKOTA Blue Chip 150 Index

The JAKOTA Blue Chip 150 Index exhibited stability this week, with little overall change. Out of its 150 constituents, 85 shares demonstrated positive price trends, indicating a balanced market movement.

Nitori Holdings, a furniture and home accessories retailer, stood out as the top performer of the week. The company’s shares soared following the announcement of its plans to expand into Vietnam, highlighting investor optimism about its growth prospects.

On the other side, major Japanese automotive companies like Honda, Nissan, and Toyota were among the laggards in the index. Notably, Suzuki Motor emerged as the worst-performing constituent of the JAKOTA Blue Chip 150 Index this week, reflecting challenges faced by the automotive sector.