Last week’s Jakota markets:

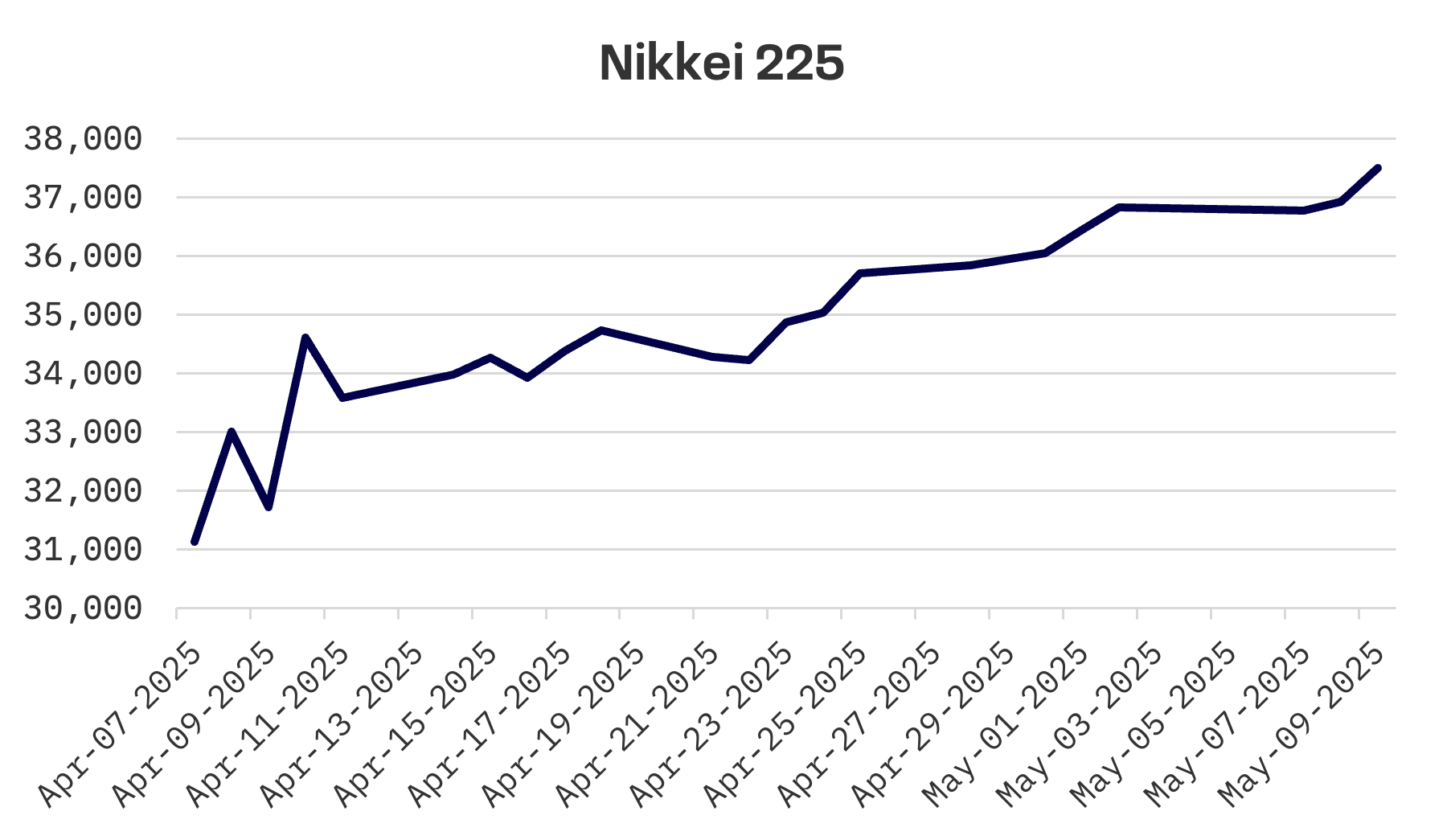

- Japan’s stock market rose 1.8% while the yen weakened past ¥145 per dollar, even as economic data showed persistent wage challenges amid trade uncertainty

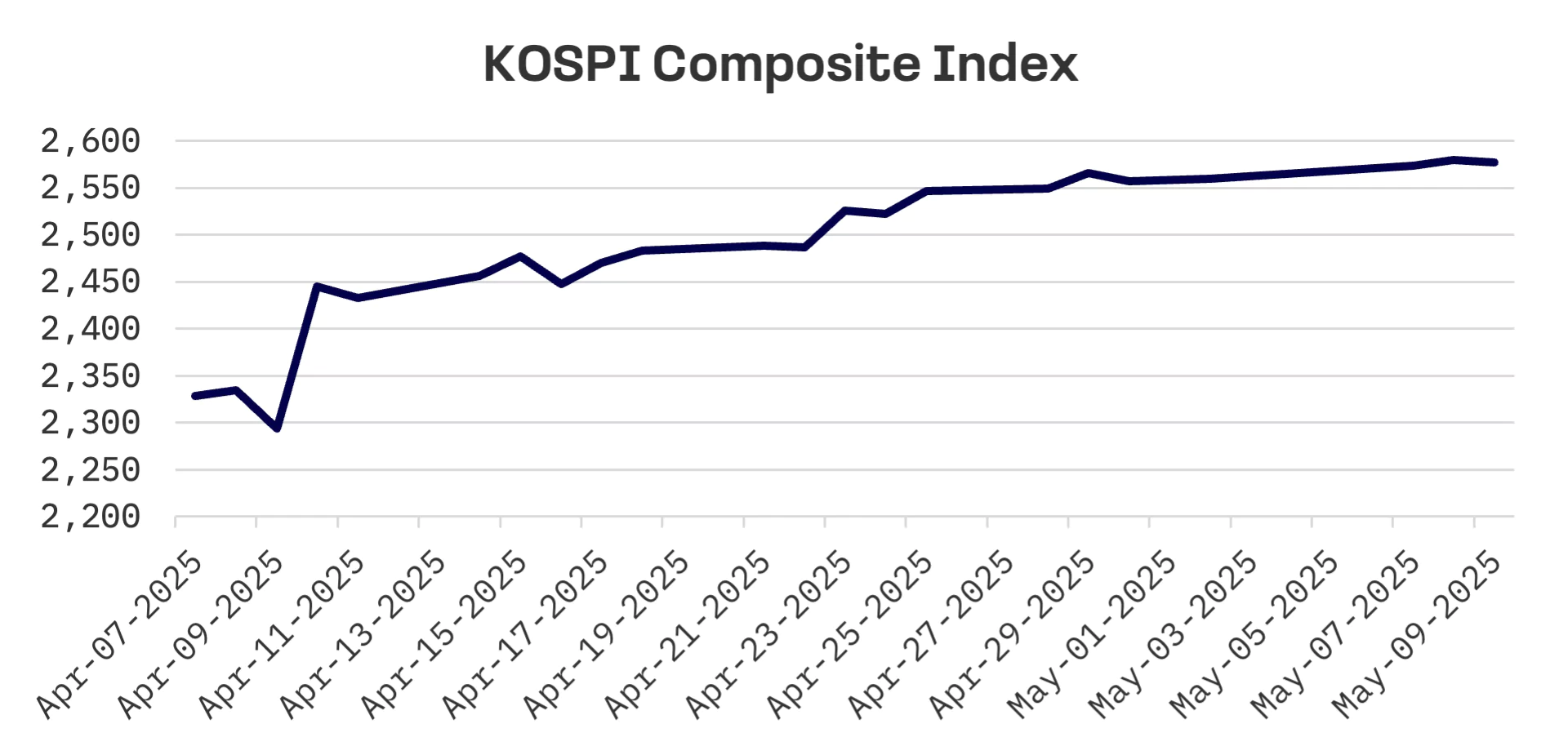

- South Korea’s KOSPI gained 0.7%, responding positively to stable U.S. monetary policy and potential easing of U.S.-China trade tensions

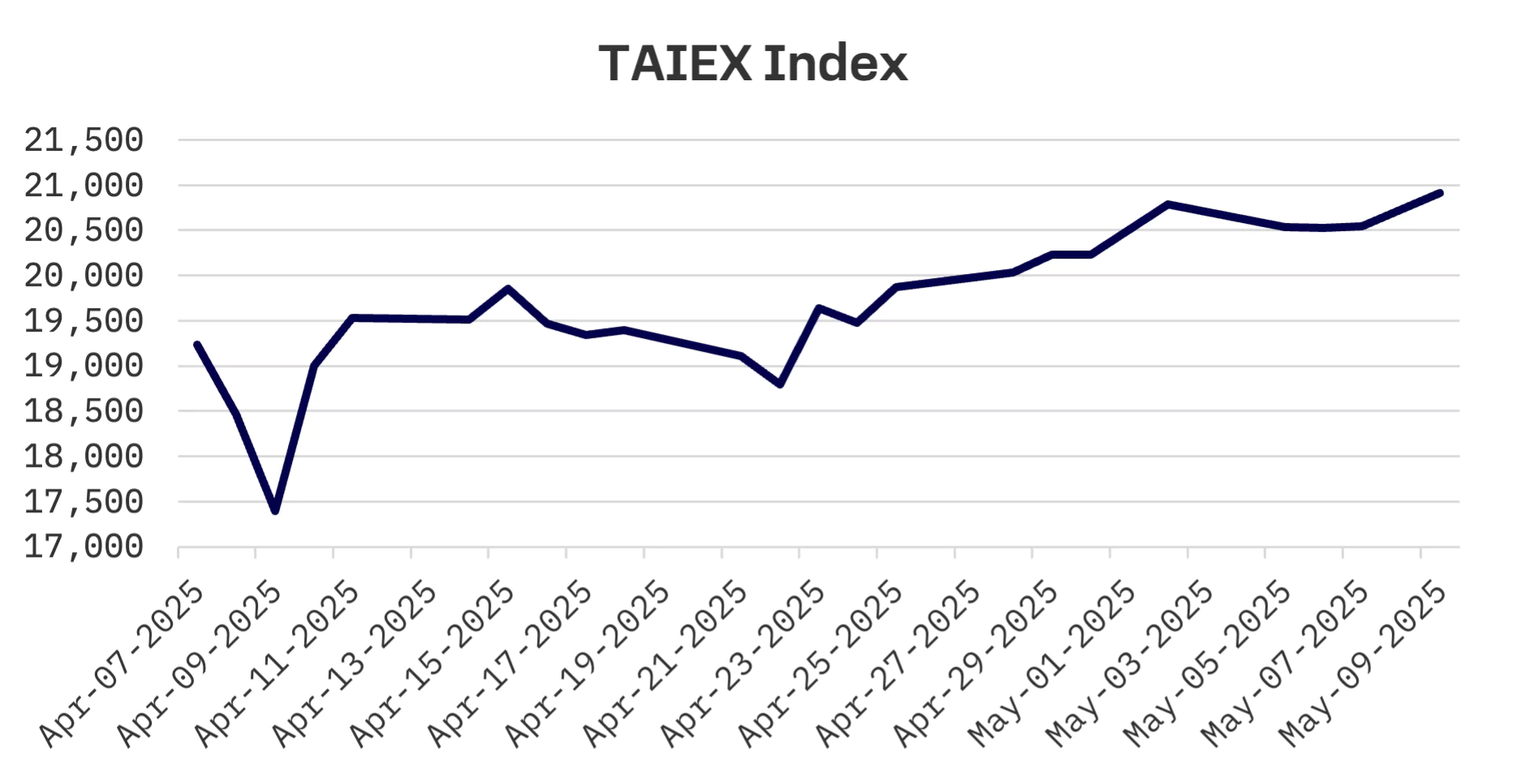

- Taiwan’s TAIEX finished up 0.6%, overcoming early currency appreciation concerns with exports jumping 30% as buyers stockpiled during the U.S. tariff reprieve

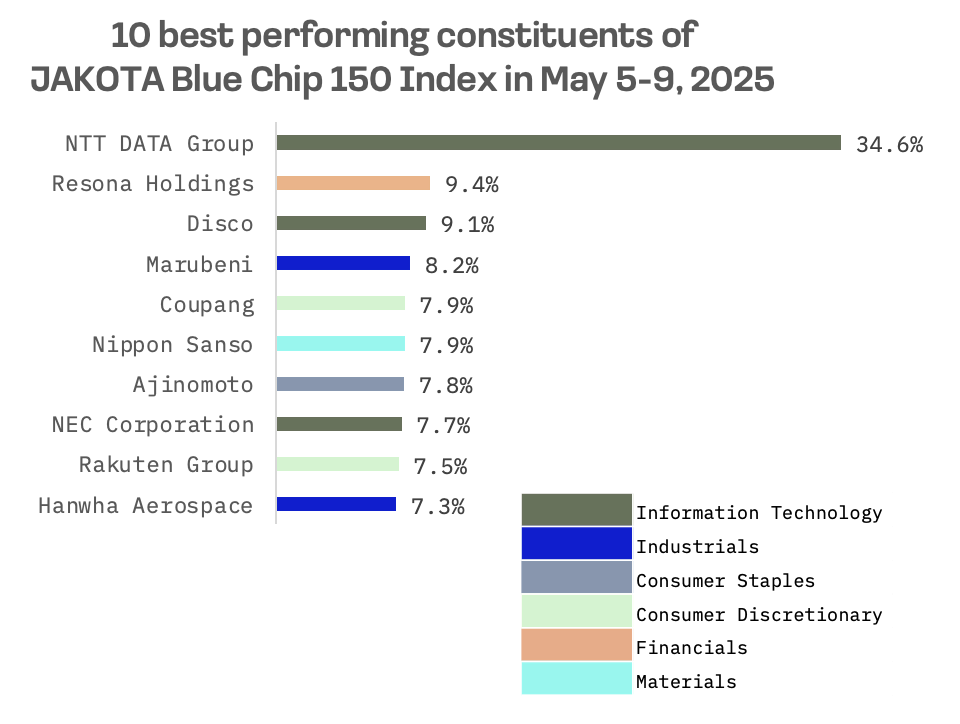

- The JAKOTA Blue Chip 150 Index climbed 1.1%, with NTT Data Group surging 34.6% on parent NTT’s $16.4 billion privatisation plan

Japan

Japan’s stock market advanced over the shortened week, with the Nikkei 225 climbing 1.8%. The yen slipped past ¥145 per dollar, touching a one month low as the U.S. currency strengthened following news of a U.S.-UK trade agreement and confirmation from Beijing that U.S.-China trade talks are set to begin.

Progress in U.S.-Japan trade talks remains limited, with Washington cautioning that a deal with Tokyo may take considerably longer to finalise than the framework agreement with the UK announced earlier in the week. Japan is pressing the U.S. to ease several tariff measures, including the removal of 24% reciprocal duties on Japanese goods (currently under suspension) and additional 25% tariffs on autos, steel and aluminium. For its part, the U.S. is expected to prioritise greater access for American agricultural exports to the Japanese market.

On the economic data front, recent statistics cast a shadow over Japan’s recovery prospects, with concerns mounting that tariff related risks could further delay the Bank of Japan’s (BoJ) efforts to normalise monetary policy. Real wages fell 2.1% year-over-year in March, marking a third straight monthly decline, while nominal pay rose 2.1%, below the 2.3% consensus and down from February’s 2.7% increase.

The BoJ continues to monitor for signs of a virtuous cycle in which rising wages and prices support broader economic growth, and recently flagged “extremely high uncertainty” (stemming from global trade and policy developments) – warning that risks to both activity and inflation remain tilted to the downside.

South Korea

South Korea’s stock market edged higher this week, with the KOSPI gaining 0.7%, driven by hopes for U.S.-China trade negotiations and the Federal Reserve’s decision to leave benchmark interest rates unchanged.

Taiwan

Taiwan’s stock market ended the week in positive territory, with the TAIEX rising 0.6%. Shares fell sharply on Monday, led by export oriented tech names, as the Taiwan dollar’s continued appreciation against the U.S. dollar fuelled concerns over potential foreign exchange losses. However, sentiment recovered by Friday, supported by renewed hopes for progress in U.S.-China trade negotiations.

Meanwhile, according to the Ministry of Finance, Taiwan’s exports surged nearly 30% year-over-year in April, marking an 18th straight month of growth, as overseas buyers accelerated inventory buildup during the 90 day tariff reprieve announced by U.S. President Donald Trump.

JAKOTA Blue Chip 150 Index

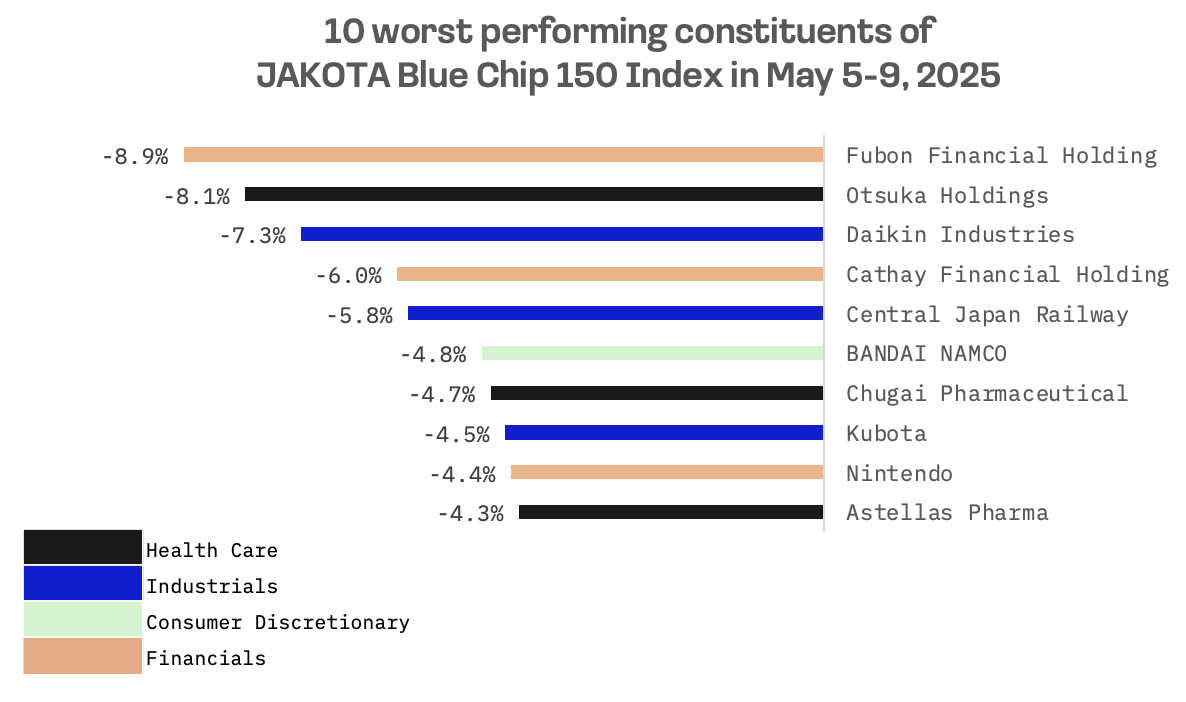

The JAKOTA Blue Chip 150 Index added 1.1% this week. Out of a pool of 150 constituents, 101 stocks posted gains.

NTT Data Group, a Japanese multinational information technology service and consulting company, surged 34.6% to lead gains on the JAKOTA Blue Chip 150 Index after parent Nippon Telegraph & Telephone Corp. said it will take the IT services firm private in a ¥2.37 trillion ($16.4 billion) deal to acquire the shares it doesn’t already own.

Nippon Telegraph & Telephone Corp. said in a statement it will launch a tender offer for NTT Data Group at ¥4,000 per share, a 34% premium to Wednesday’s close. The telecom giant currently holds a 57.7% stake in the IT services firm, which had a market capitalisation of $29.5 billion as of close of trading on Wednesday.

Fubon Financial Holding and Cathay Financial Holding, Taiwanese financial conglomerates, ranked among the worst performers on the JAKOTA Blue Chip 150 Index after the Taiwan dollar’s sharp appreciation against the greenback on Monday pressured financial firms with large foreign currency exposures.

In addition, Taiwan’s central bank said on Tuesday it will launch special inspections of the local banking sector in a bid to curb speculative activity in the foreign exchange market and help stabilise the Taiwan dollar.