Last week’s Jakota markets:

- Japan’s Nikkei 225 Index struggled against the backdrop of strong U.S. economic data, closing the week lower by 0.41%

- South Korea’s KOSPI experienced its third consecutive weekly decline, influenced by cautious investor sentiment ahead of U.S. PCE data

- Taiwan’s TAIEX index saw a decline of 1.8% after weeks of gains, despite a positive revision in GDP growth forecasts due to robust tech sector activity

- The JAKOTA Blue Chip 150 Index registered a 1% drop, with mixed performances across its constituents

Japan

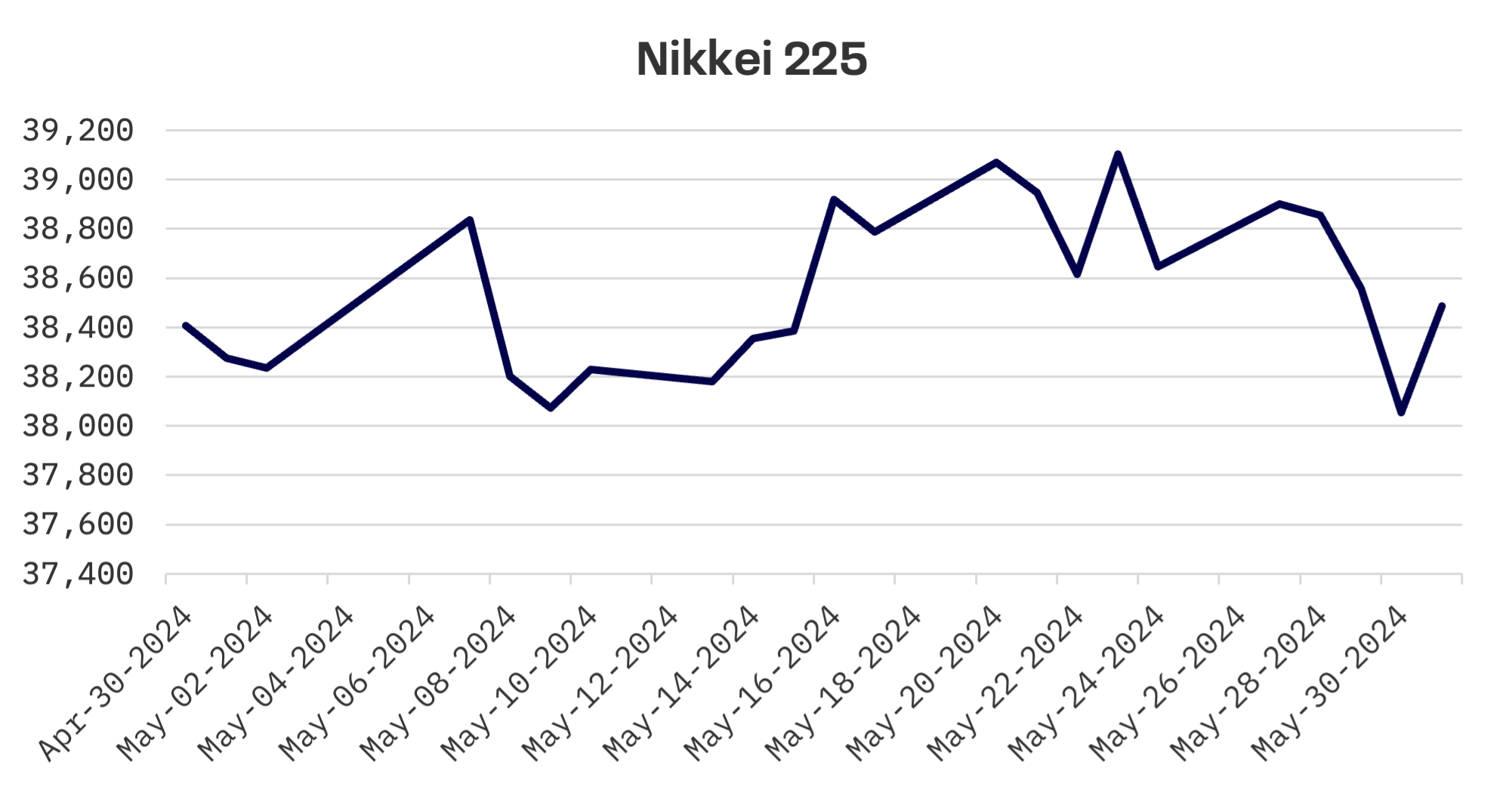

The Japanese stock market has recorded declines over the past two weeks, with the Nikkei 225 Index dropping 0.41% this week alone. On Thursday, the index touched a one-month low, spurred by stronger than expected U.S. consumer confidence data, which sent U.S. government bond yields to near a four-week high. Although higher U.S. long-term yields have raised concerns about the American economic outlook, the Nikkei 225 rebounded on Friday after U.S. bond yields softened, suggesting that the Federal Reserve may have the leeway to reduce rates later this year.

Investor attention remains sharply focused on the Bank of Japan’s (BoJ) policy trajectory, particularly concerning further monetary normalization. This week, the yield on the 10-year Japanese government bond rose to 1.07% from 1.00%, amid ongoing speculation about the BoJ’s short-term interest rate decisions. Despite abandoning its negative interest rate policy in March, Japan’s monetary policy remains one of the most accommodative globally.

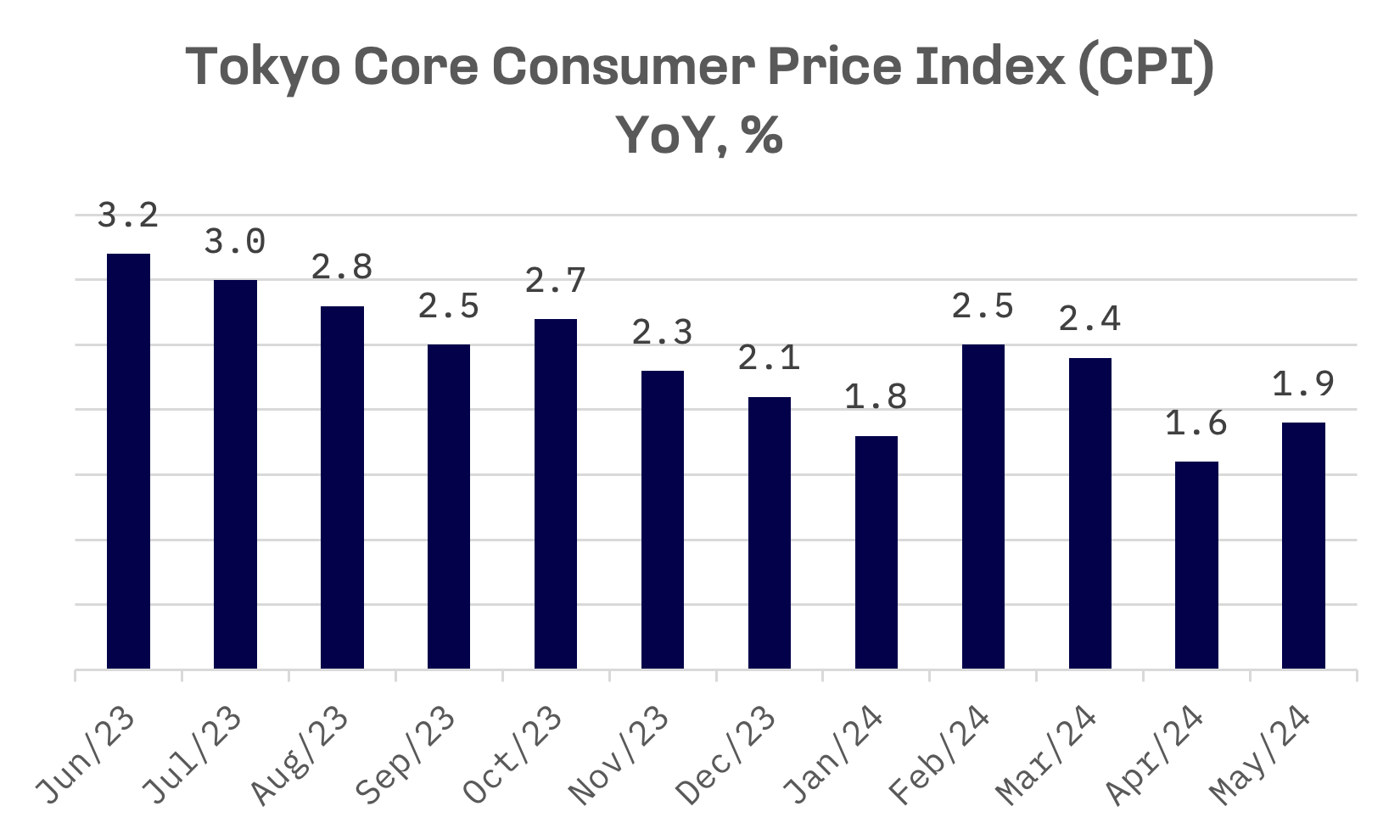

Economic indicators show that the Tokyo-area core consumer price index, a key indicator of nationwide trends, rose year-on-year to 1.9% in May, a slight uptick from April’s 1.6%, driven primarily by higher electricity costs. This increase still falls short of the BoJ’s 2% inflation target, reducing the urgency for imminent interest rate hikes.

Meanwhile, retail sales in April exceeded expectations, driven by rising wages, though industrial production saw an unexpected drop, adding complexity to the economic outlook.

South Korea

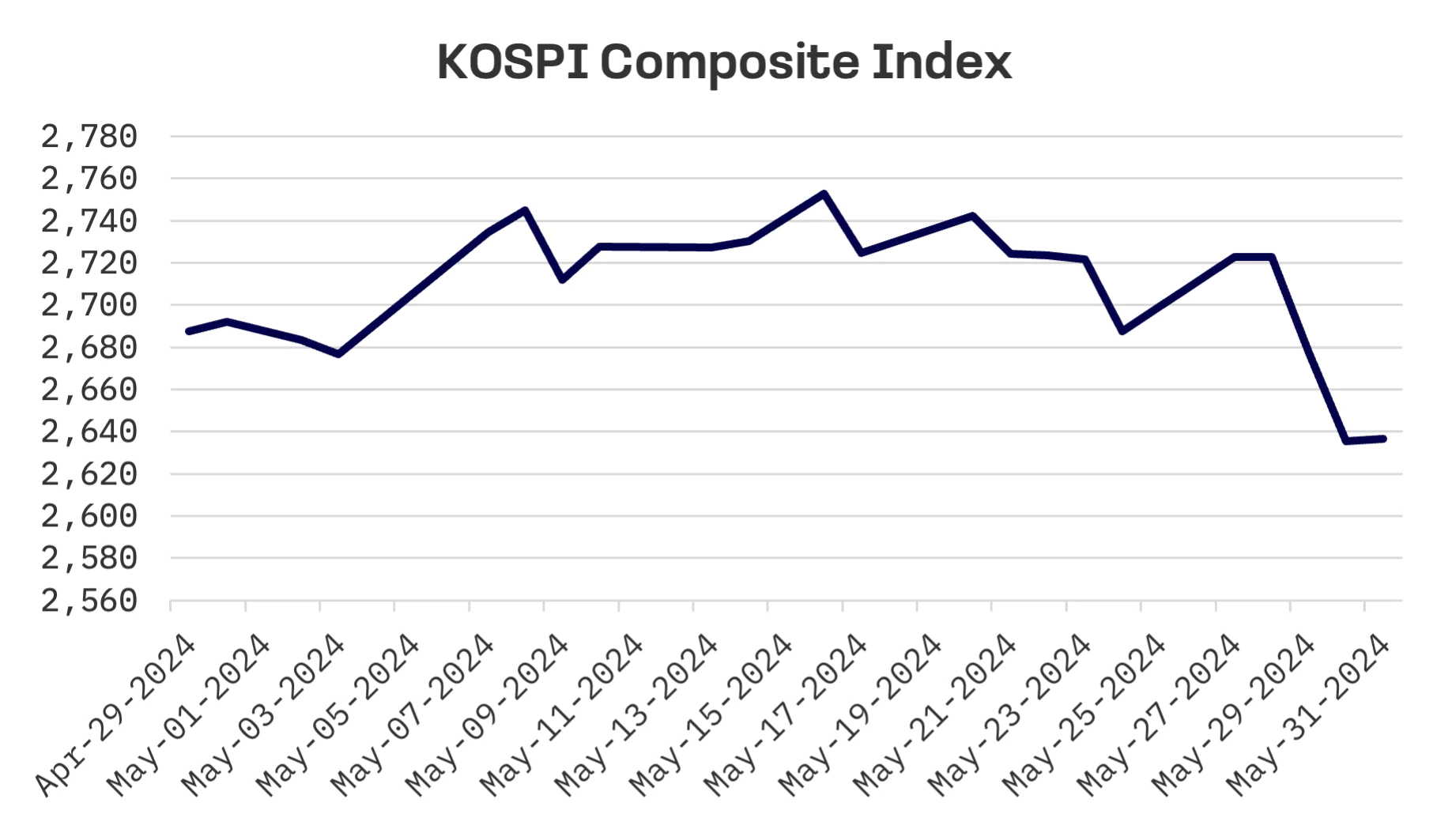

The Korean stock market declined for the third consecutive week, with the KOSPI falling by 1.9%. Starting Wednesday, the market faced downward pressure as investors awaited the release of the U.S. April core Personal Consumption Expenditures (PCE) price index. Preliminary data suggested that the U.S. economy has been expanding at a modest pace since April, reducing the likelihood of an imminent rate cut.

Exports from South Korea continued to grow for the eighth consecutive month in May, driven by strong semiconductor shipments. According to the Ministry of Trade, Industry and Energy, outbound shipments surged by 11.7% year-on-year to US$58.1 billion last month. However, imports decreased by 2% year-on-year to $53.1 billion during the same period.

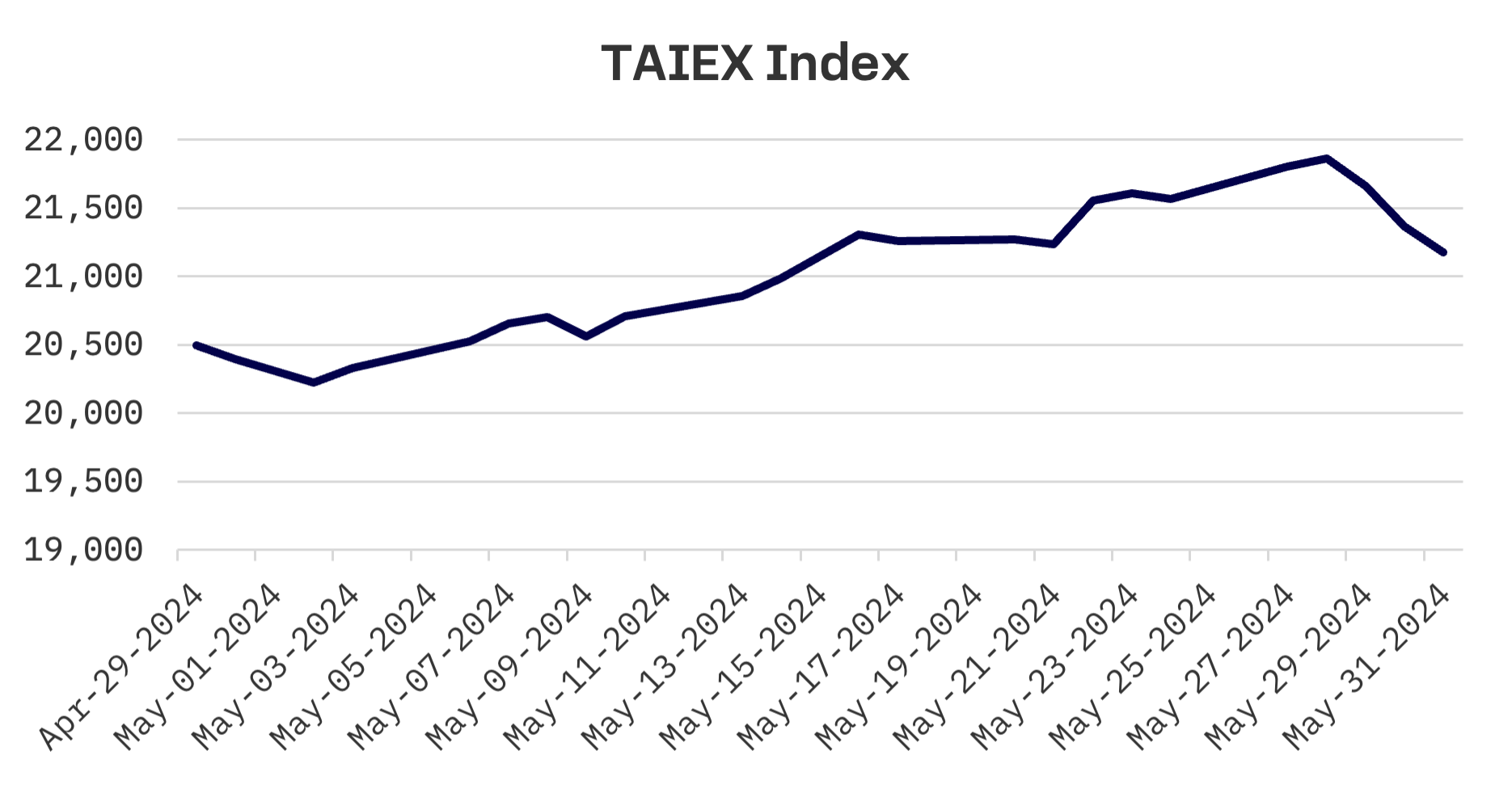

Taiwan

After five weeks of consecutive growth, reaching a new high on Tuesday, Taiwan’s stock market ended the week with a 1.8% decline.

The TAIEX index surpassed the 21,850-point level on Tuesday, supported by strong performances in the electronics and shipping sectors. However, the market receded starting Wednesday, as investors awaited key U.S. inflation data that could influence the Federal Reserve’s rate decisions.

The Directorate General of Budget, Accounting and Statistics (DGBA) recently upgraded its 2024 GDP growth forecast for Taiwan to 3.94%, marking the highest prediction in three years. This adjustment represents a 0.51% increase from earlier estimates in February. According to the DGBAS, exports have significantly benefitted from high demand for AI, while the production capacity of Taiwan’s high-end semiconductor and information and communication technology (ICT) sectors has also seen substantial growth in recent years.

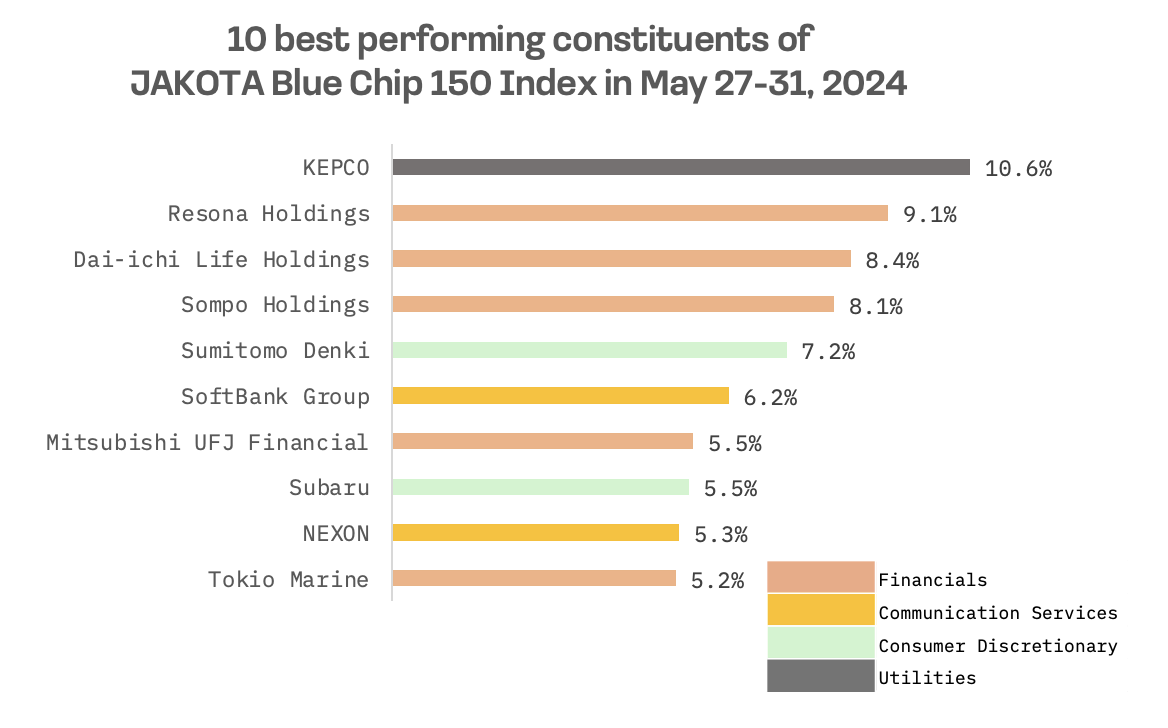

JAKOTA Blue Chip 150 Index

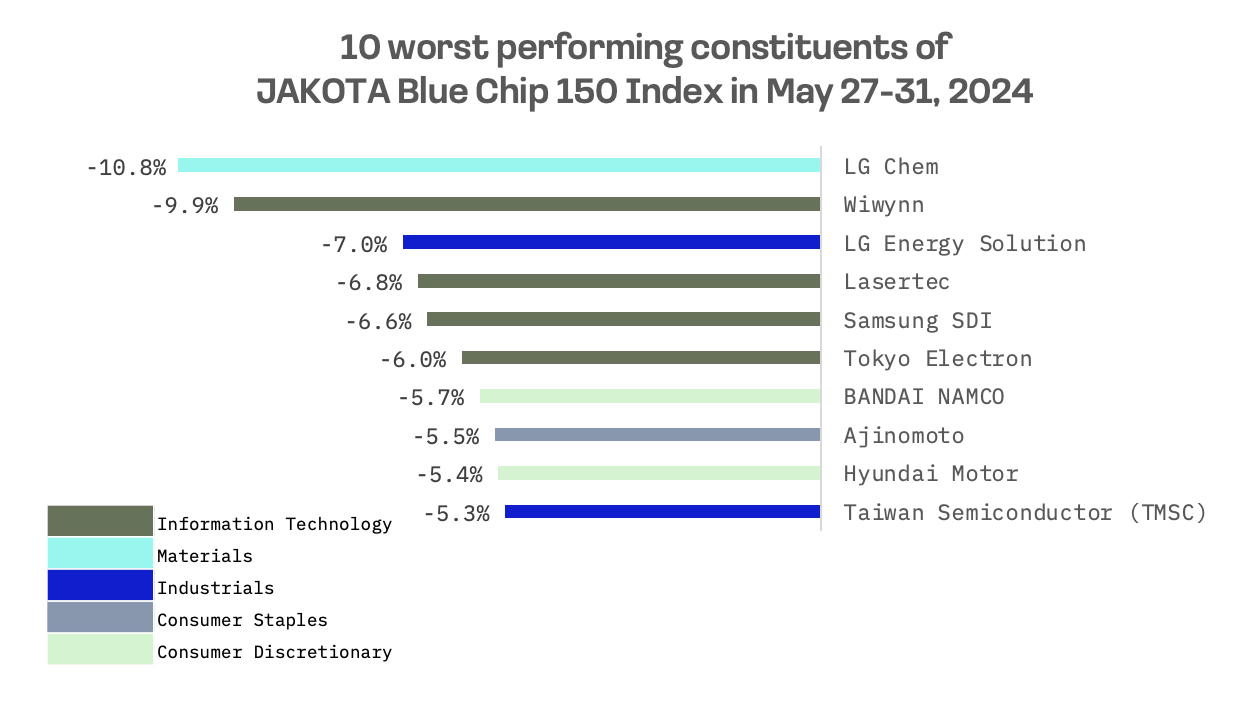

The JAKOTA Blue Chip 150 Index experienced a 1% decline this week. Among the 150 stocks, 78 showed positive price movements.

KEPCO (the Kansai Electric Power Company), a Japanese electric utility company, stood out with a 10.6% gain. The company benefits from expectations that electricity demand will increase due to the AI adoption. Morgan Stanley MUFG Securities recently elevated KEPCO’s target share price from ¥2,770 to ¥3,330. The firm believes that the stock price has not sufficiently factored in the relatively high ROE level and takes a positive view of the company’s decision to raise its medium-term management plan targets. With the expansion of its energy business, KEPCO has revised its operating profit forecast for the fiscal year ending March 2025 upward from the previous ¥308 billion to ¥360 billion.

On the downside, LG Chem, the largest Korean chemical company, was among the week’s losers, following a downgrade in its credit rating outlook from ‘stable’ to ‘negative’ by S&P Global. The downgrade was based on concerns over LG Chem’s aggressive facility investments. The agency stated, ”Due to LG Chem’s aggressive investment in electric vehicle battery-related businesses, the ratio of borrowings to EBITDA is expected to increase from 1.5x in 2022 and 2.4x in 2023 to 2.6x to 2.8x in 2024-2025.”