Last week’s JAKOTA markets:

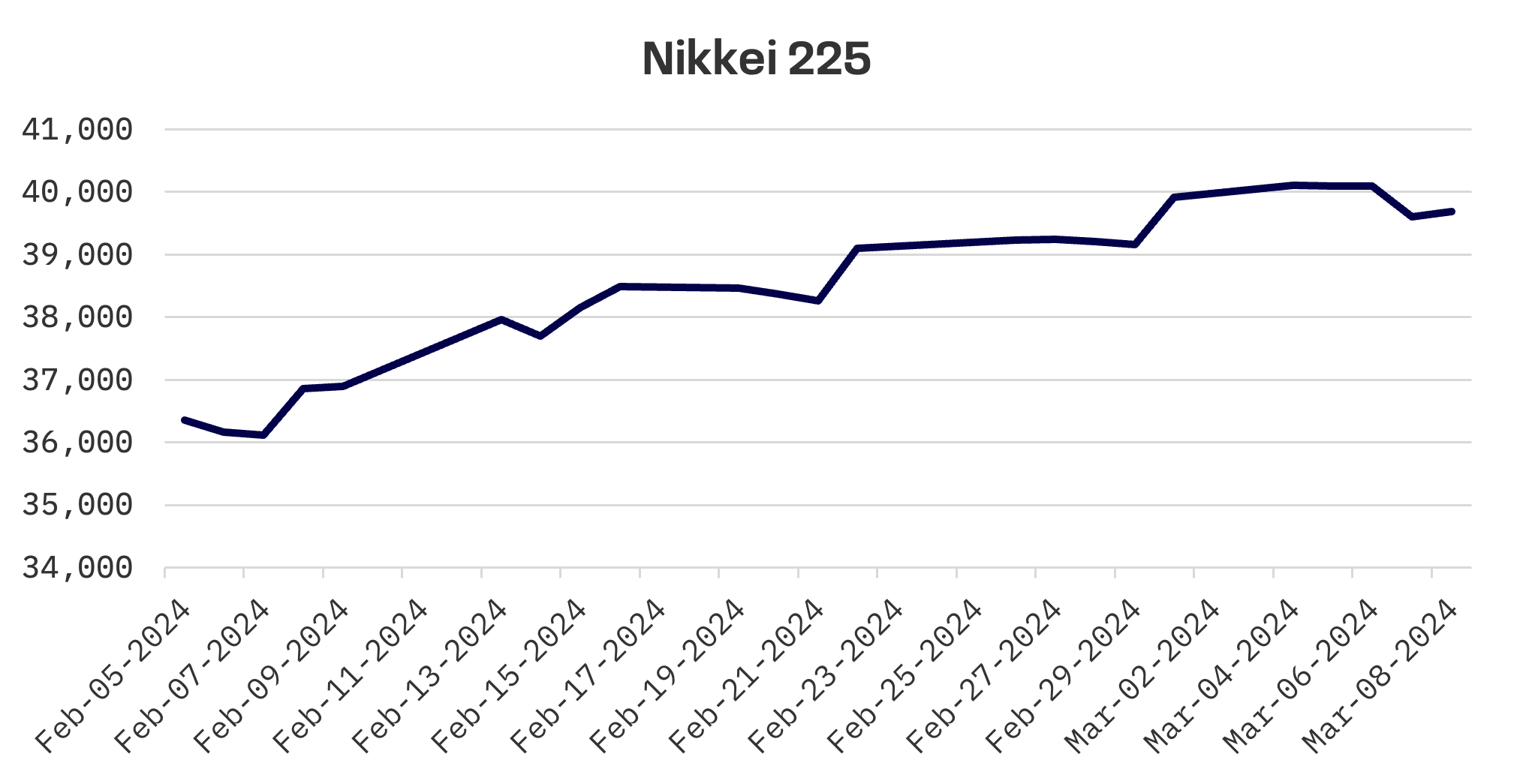

- The Nikkei 225 Index in Japan dipped slightly by 0.56% as discussions around the Bank of Japan’s monetary policy direction influences investor sentiment

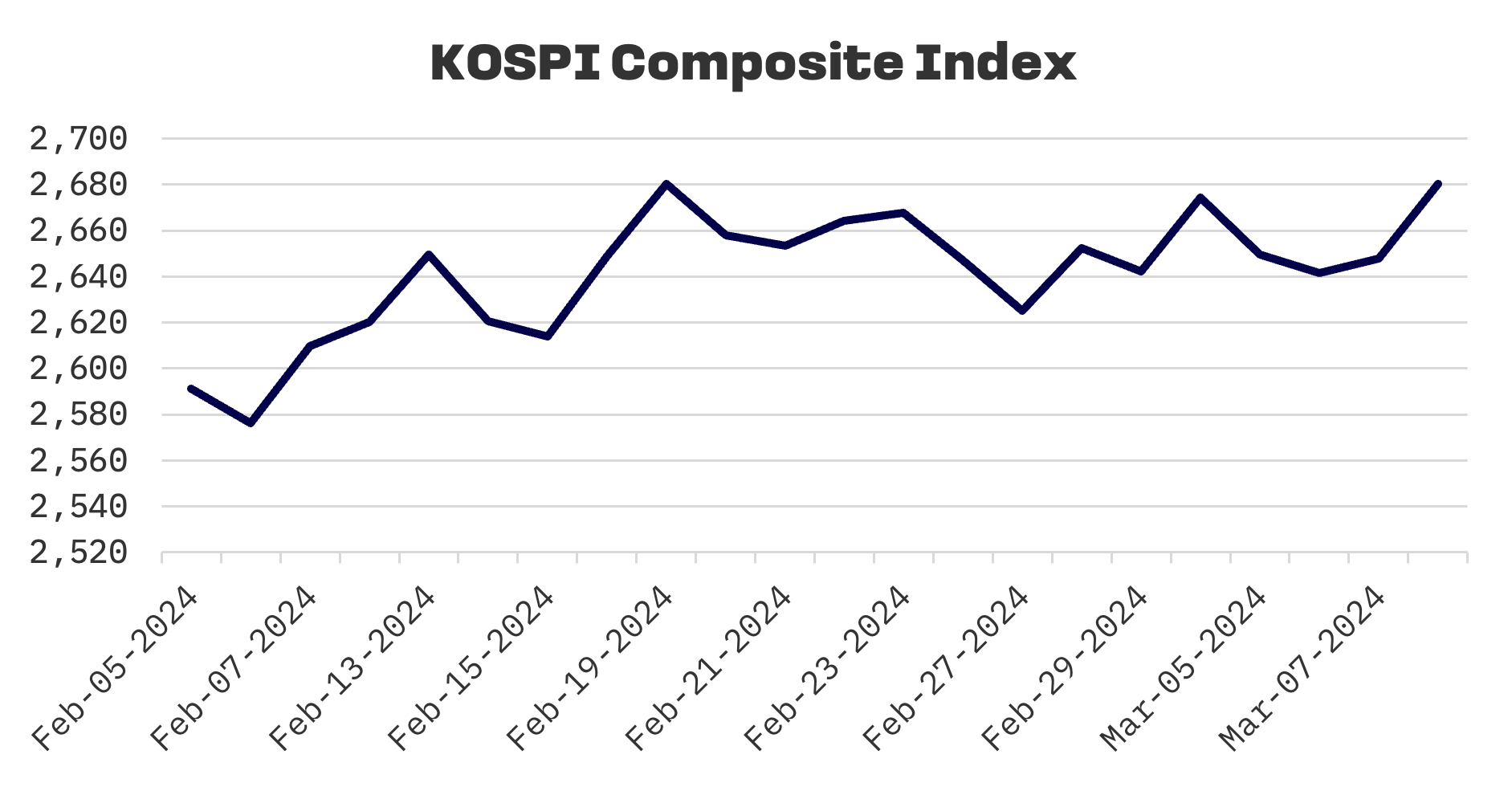

- Optimism about easing monetary policies in the U.S. contributed to a 1.4% increase in South Korea’s stock market, despite internal economic concerns

- Taiwan led the JAKOTA markets with a 4.5% surge in the TAIEX index, driven by significant sales announcements from TSMC and a robust interest in AI-related stocks

- Strong performances from Taiwanese constituents pushed the JAKOTA Blue Chip 150 Index up by 3.7%, highlighting the influence of AI technology on market trends

Japan

The Japanese stock market experienced a slight downturn this week, with the Nikkei 225 Index closing down 0.56%. Investor sentiment was significantly shaped by ongoing discussions about the Bank of Japan’s (BoJ) future monetary policy, with growing speculation that the central bank might be considering a move to increase short-term interest rates from their current negative levels. This shift in expectation was further fuelled by a BoJ board member’s comments suggesting that a virtuous cycle of rising prices and wages — a prerequisite for policy tightening — might be on the horizon.

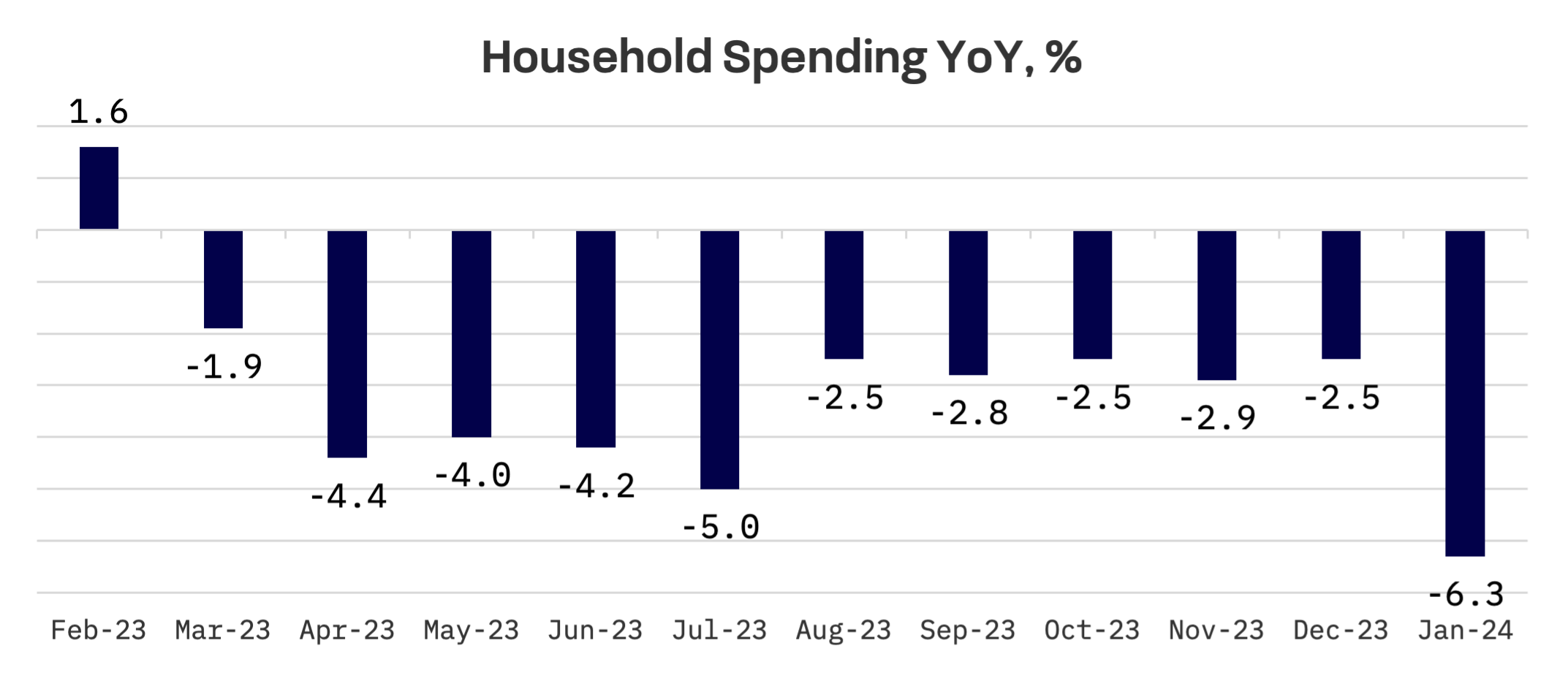

Economic data revealed a stark 6.3% year-on-year drop in household spending for January, marking the steepest fall in almost three years, with automobile sales notably impacted.

In contrast, nominal wage growth in January exceeded expectations, rising 2.0% year-on-year against an anticipated 1.2%. This has led Japanese unions to push for the most significant wage increases in over three decades during this year’s spring shunto negotiations, amidst ongoing inflationary pressures.

South Korea

South Korea’s stock market concluded the week with a 1.4% gain, buoyed by a strong Friday performance. The market’s optimism was lifted by U.S. Federal Reserve Chair Jerome Powell’s testimony, suggesting that the Fed is nearing a point where it might consider rate cuts later this year as confidence grows in inflation moving towards the 2% target rate.

The Korea Development Institute (KDI), in its latest economic assessment, cautioned about persistent domestic demand risks and noted that delinquency rates on household and personal business loans remain high. Inflationary pressures on certain goods, including agricultural products, are intensifying due to supply-side constraints.

Taiwan

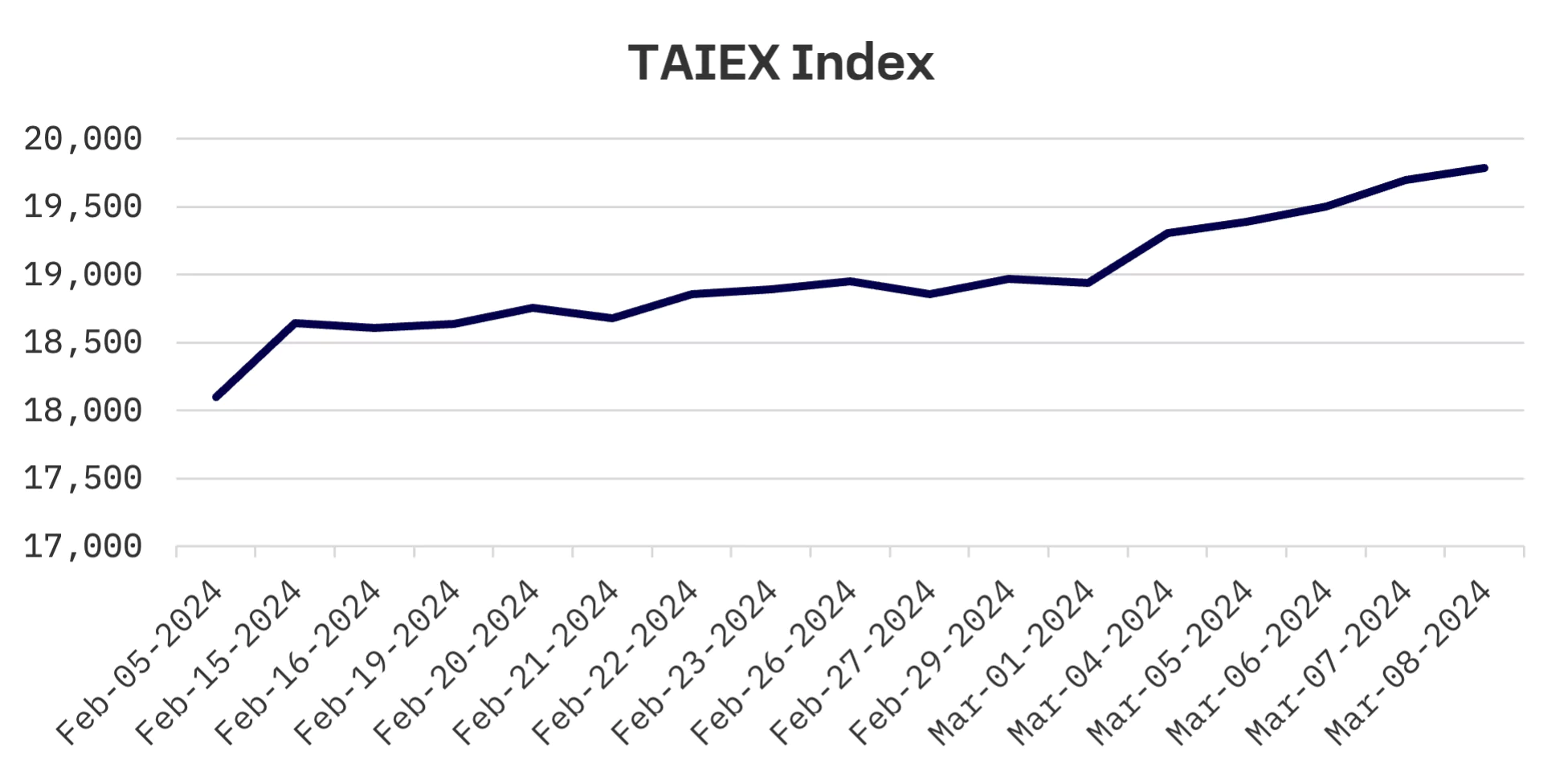

Taiwan’s stock market surged by 4.5% this week, with the TAIEX index briefly surpassing the 20,000-point mark, primarily driven by a rally in AI-related stocks, notably Taiwan Semiconductor (TSMC).

TSMC announced its highest-ever sales for February, attributed to the strong demand for AI applications, with the company projecting a more than 20% sales increase in 2024 compared to the previous year.

Further bolstering the market, the Taiwan Institute of Economic Research (TIER) reported rapid growth in the manufacturing sector in January, driven by global interest in AI development. This growth was especially evident in the electronics industry.

The Ministry of Finance’s (MOF) latest report also lifted investor spirits. Taiwan celebrated a fourth successive month of year-on-year export growth in February, with outbound sales climbing 1.3% from the previous year to $31.43 billion. This achievement signifies the second-highest export value for February on record. A notable contributor to this surge was the robust demand for information technology and audio-visual products. In February alone, these sectors generated $8.51 billion in exports, effectively doubling the figure from the previous year and establishing a new monthly high.

JAKOTA Blue Chip 150 Index

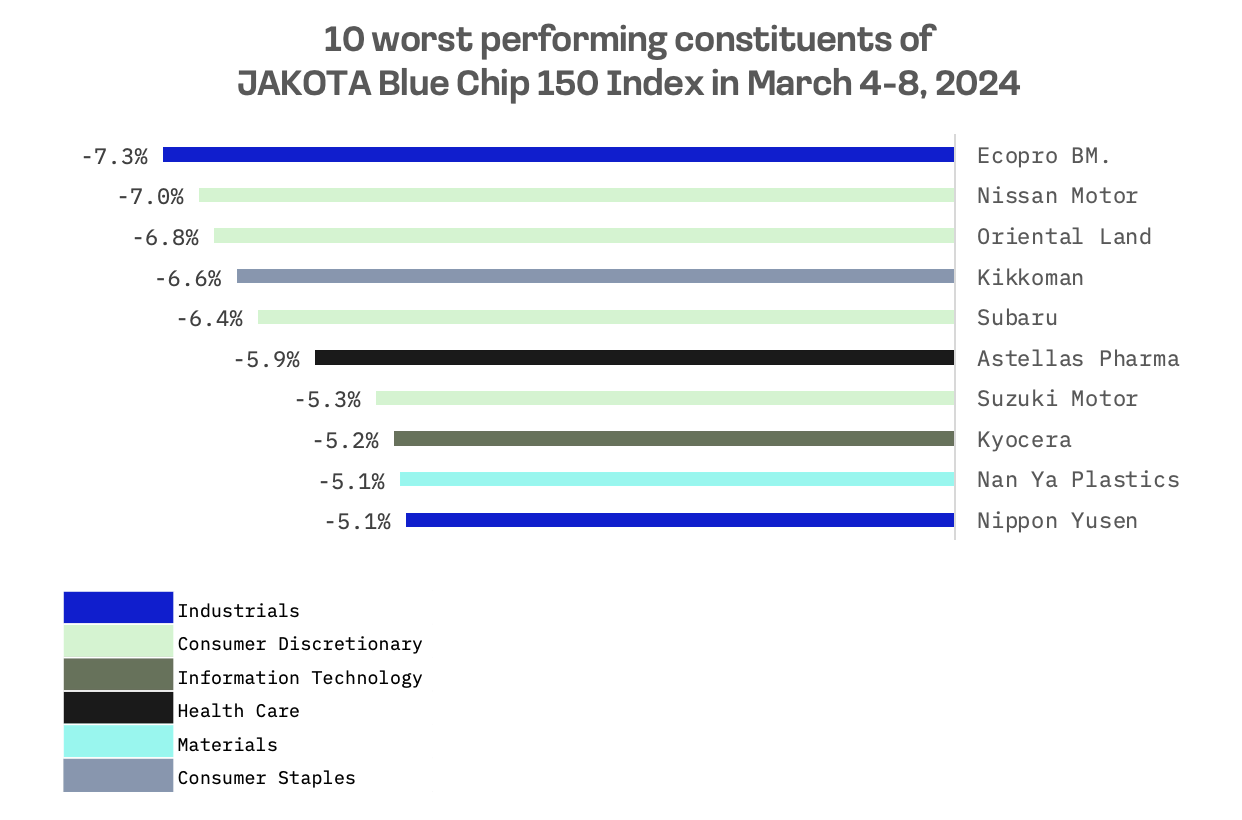

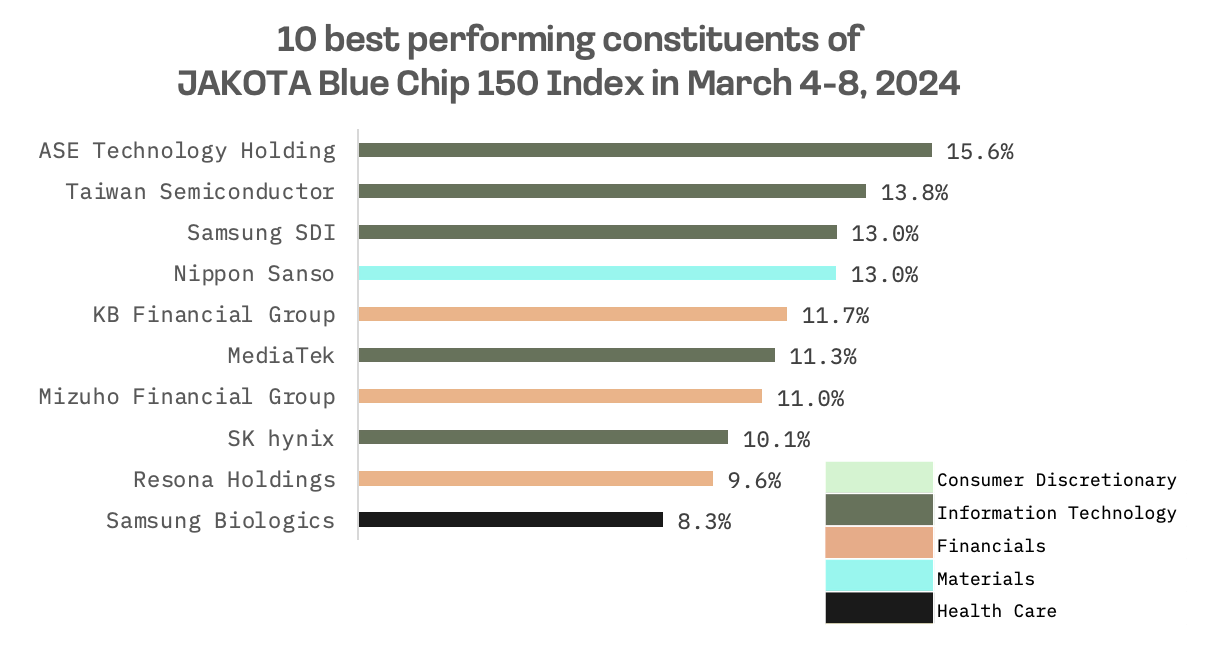

The JAKOTA Blue Chip 150 Index enjoyed a 3.7% increase this week, led by the stellar performance of Taiwanese AI-related firms. Among the index’s 150 constituents, 86 stocks trended upwards.

ASE Technology Holding, an integrated circuit packaging and testing services provider, topped the list of gainers, riding the wave of optimism surrounding the impact of AI applications on semiconductor firms.

On the other end, Ecopro BM, a Korean secondary battery materials producer, was the week’s laggard, reflecting its volatility within the index after a previous surge related to its anticipated listing transfer to the KOSPI.