Last week’s Jakota markets:

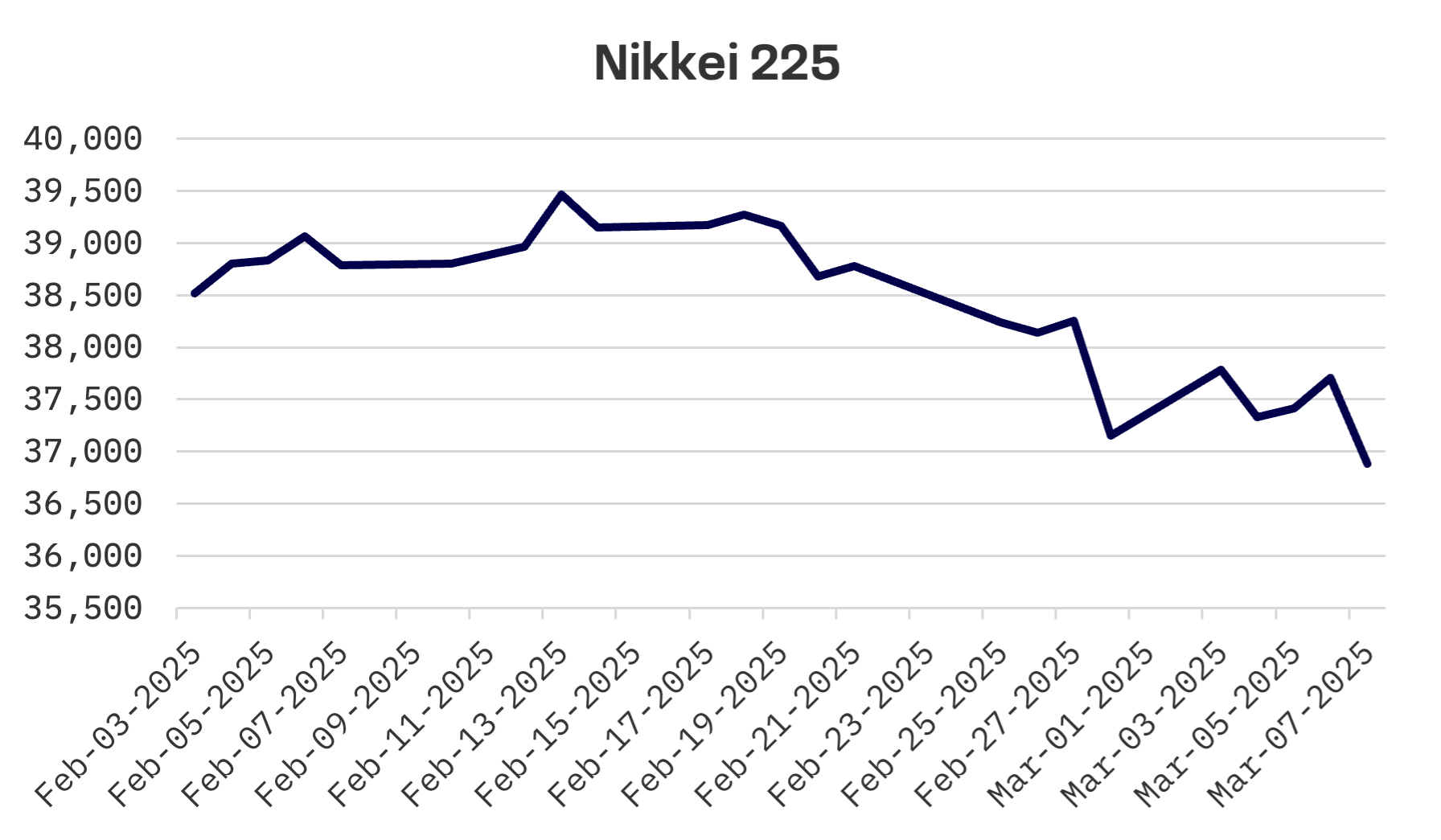

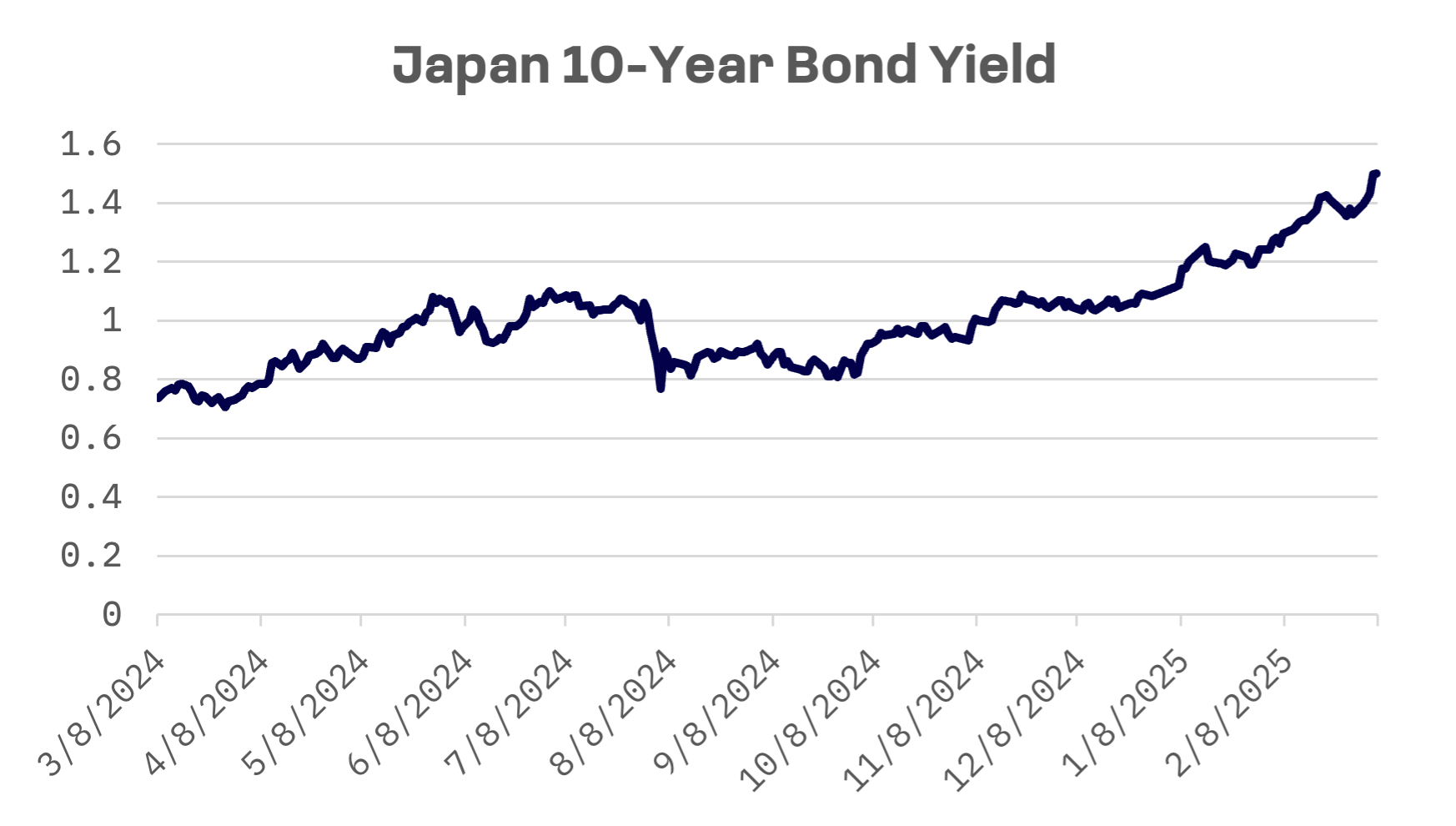

- Japan’s Nikkei 225 retreated 0.72% amid Trump tariff concerns, while 10 year JGB yields hit 1.53%, their highest since 2008, as RENGO unions demanded 6% wage increases

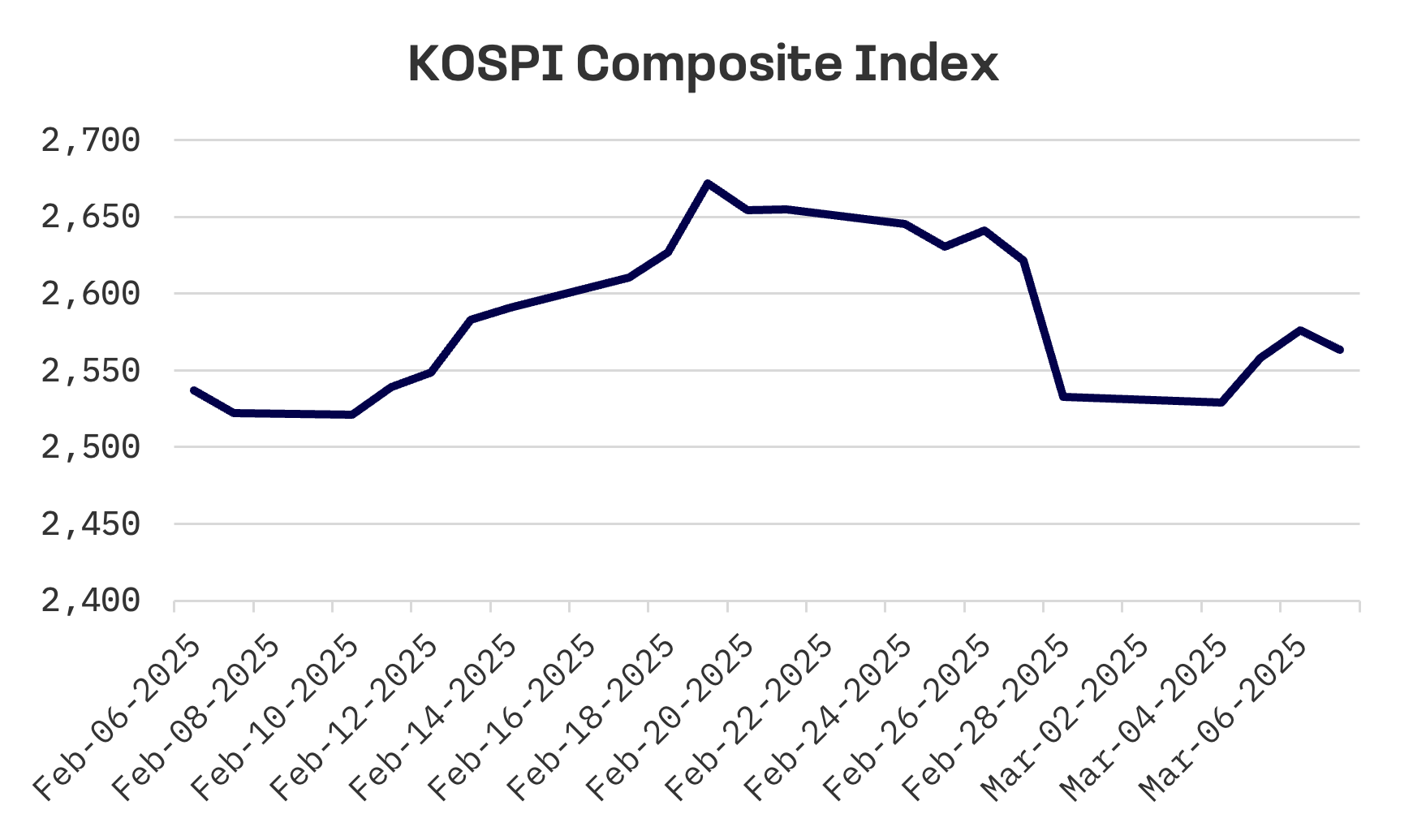

- South Korea’s KOSPI rose 1.2% despite trade war worries, with BOK Deputy Governor noting inflation holding near target at 2% in February

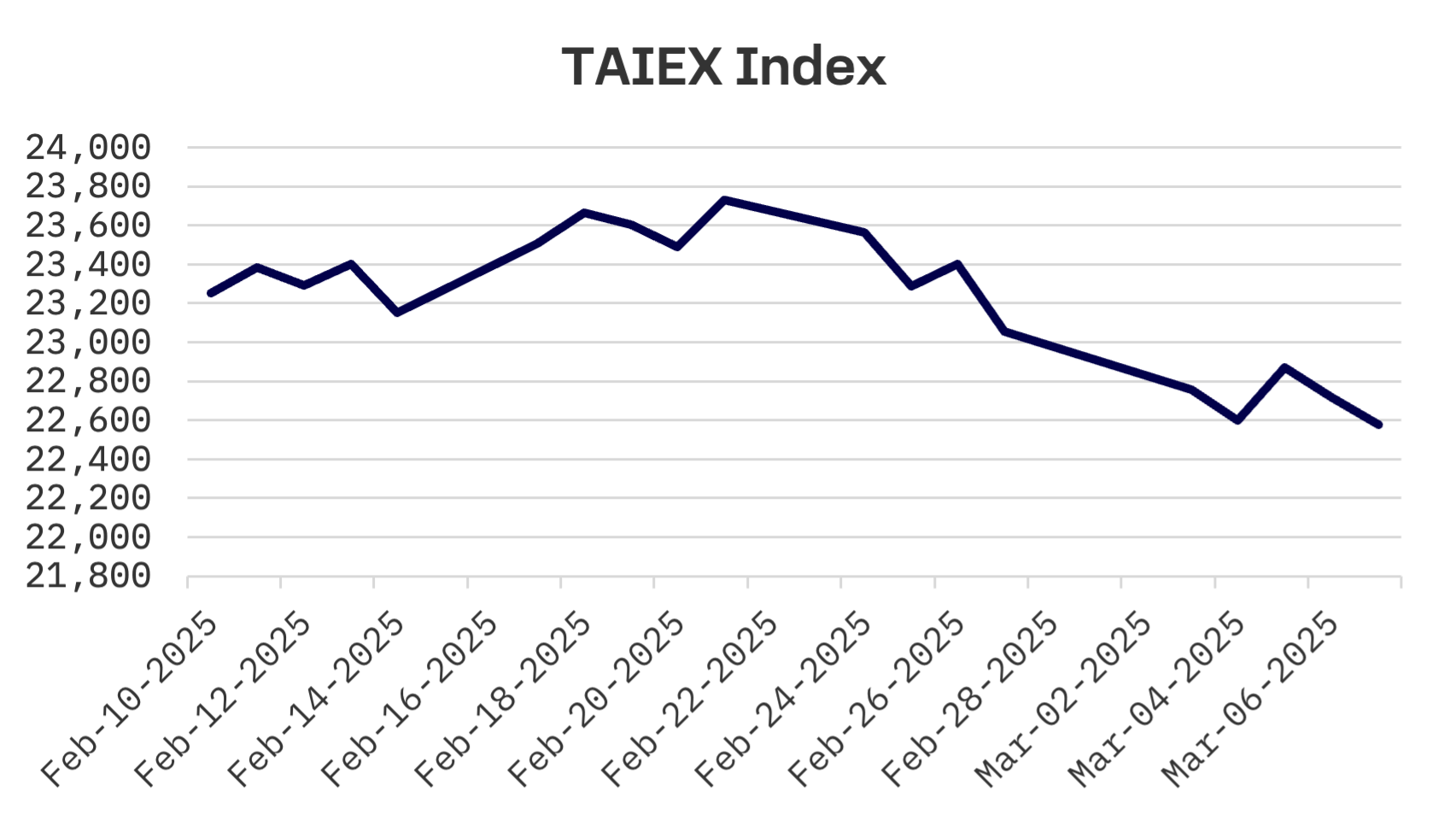

- Taiwan’s TAIEX slumped 2.1% as Trump criticised the island’s semiconductor industry, even as TSMC pledged an additional $100 billion investment in U.S. operations

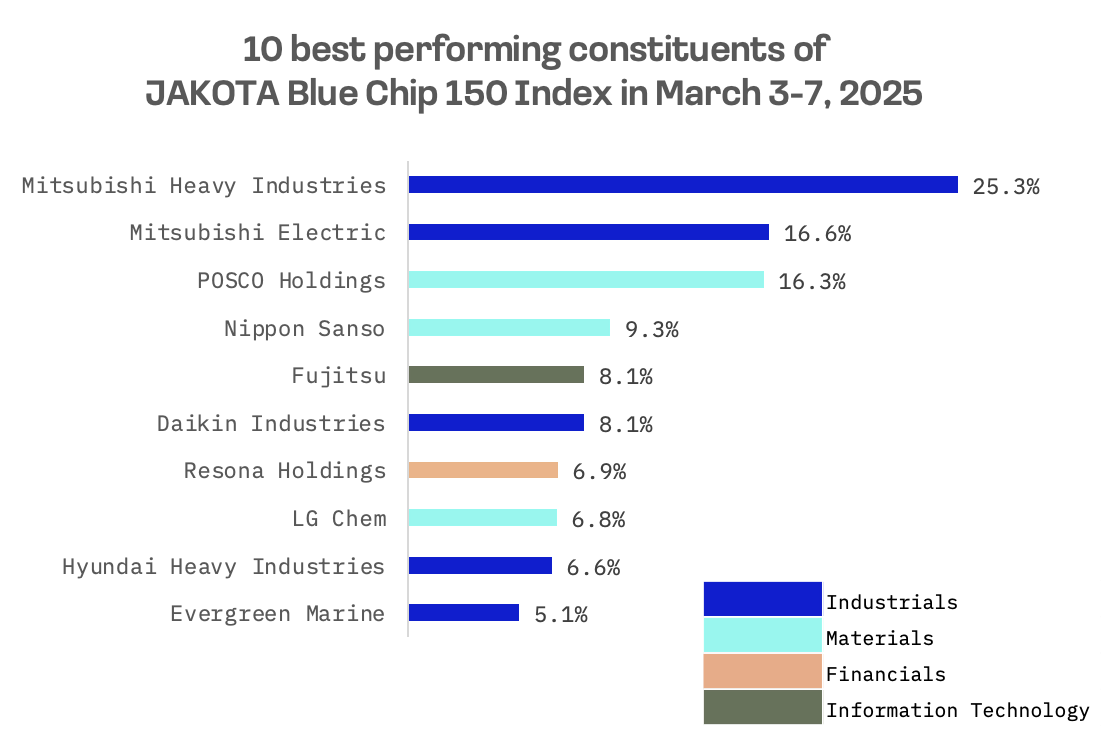

- The JAKOTA Blue Chip 150 Index gained 1.5%, with Mitsubishi Heavy Industries surging 25% following Pentagon nominee’s calls for increased Japanese defence spending

Japan

Japan’s stock market fell this week, with the Nikkei 225 slipping 0.72% as uncertainty over U.S. President Donald Trump’s tariff policies weighed on global risk appetite. The yen strengthened on safe haven demand, rising to the mid ¥147 range against the dollar from about ¥150.6 at the prior week’s close.

The yield on the benchmark 10 year Japanese government bond (JGB) rose to 1.53% from 1.37% a week earlier, reaching its highest level since 2008. The increase reflected growing expectations that the Bank of Japan (BoJ) would continue raising interest rates this year.

BoJ Deputy Governor Shinichi Uchida indicated the central bank could adjust rates in accordance with prevailing market and economic conditions, sustaining expectations of a near term rate increase.

As the government and the BoJ monitor indicators of sustainable wage growth to support the country’s economic recovery, Japan’s largest labour union group, RENGO, announced its member unions are seeking an average wage increase exceeding 6% – the highest demand in more than three decades. This follows last year’s Shunto spring wage negotiations, which resulted in companies agreeing to a 5.1% pay increase. A stronger than anticipated outcome in the 2025 talks could accelerate the timing of the BoJ’s next interest rate hike, as the central bank seeks to establish a virtuous cycle of wage and price growth to drive economic momentum.

South Korea

South Korea’s stock market advanced this week, with the KOSPI rising 1.2% despite concerns about a global trade war weighing on investor sentiment. Markets gained momentum on Wednesday and Thursday, following a recovery in major U.S. stocks after the Trump administration delayed new auto tariffs on Mexico and Canada for a month and expressed willingness for further trade negotiations. The move alleviated fears of a global trade war, boosting risk appetite.

Meanwhile, Bank of Korea (BOK) Deputy Governor Kim Woong said inflation is expected to remain around the central bank’s target, noting both upside and downside risks. His comments came during a meeting on price trends following government data that showed consumer prices – a key inflation gauge – rose 2% in February from a year earlier, compared with a 2.2% increase in January.

“Uncertainties remain high regarding geopolitical risks, trade conflicts among major economies, foreign exchange rates and domestic demand,” Kim said.

Taiwan

Taiwan’s stock market declined sharply this week, with the TAIEX index falling 2.1% as investor sentiment took a hit from U.S. President Donald Trump’s tariff policies and his remarks accusing Taiwan of “stealing” the U.S. chip industry.

In related developments, U.S. President Donald Trump and Taiwan Semiconductor Manufacturing Co. (TSMC) jointly announced that the chipmaker will invest an additional $100 billion over the coming years to expand its semiconductor manufacturing operations in the United States. Investors anticipate this move may help the company avoid potential tariffs from the Trump administration.

JAKOTA Blue Chip 150 Index

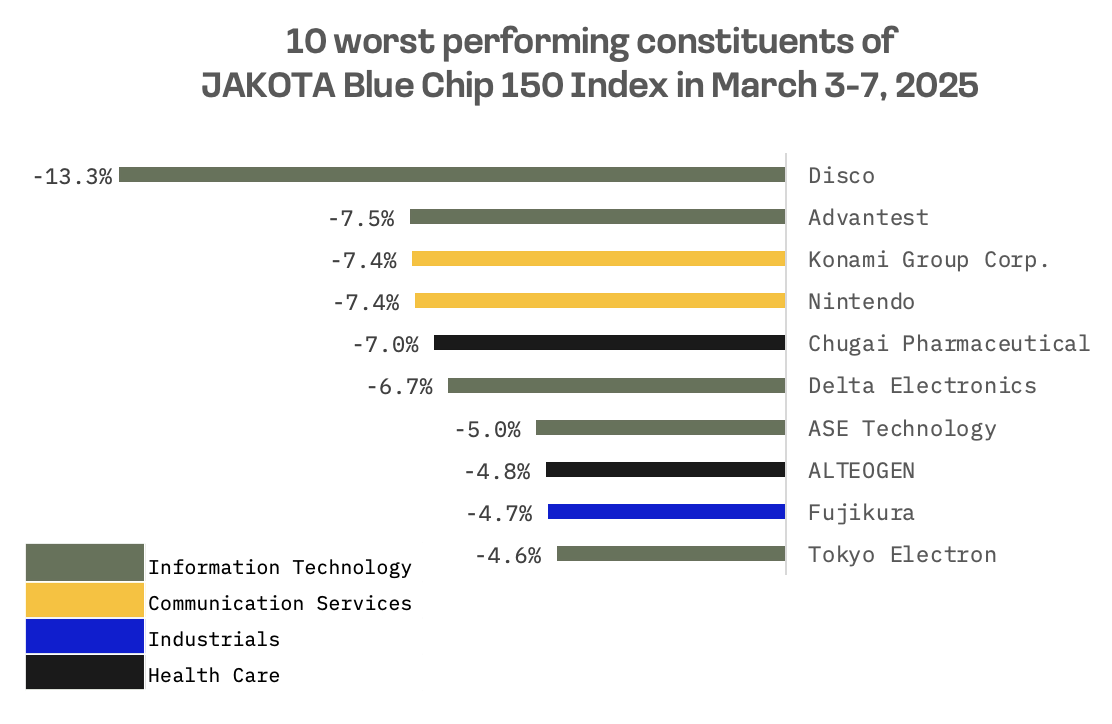

The JAKOTA Blue Chip 150 Index rose 1.5% this week. Among the index’s 150 constituents, 80 stocks registered gains.

Mitsubishi Heavy Industries, Japan’s largest defence contractor, emerged as the top performer on the JAKOTA Blue Chip 150 Index, surging 25% this week. The gains followed comments suggesting Japan and Taiwan must substantially increase defence spending to deter potential conflict with China. These remarks came from Elbridge Colby, U.S. President Donald Trump’s nominee for top policy official at the Pentagon, who testified before the Senate Armed Services Committee on Tuesday.

Colby, a prominent China hawk and former defence official in Trump’s administration, stated that Japan, which aims to allocate 2% of its GDP to defence by fiscal 2027, should increase its spending even further. “Japan should be spending at least 3% of GDP on defence as soon as possible,” Colby said, emphasising Tokyo’s need to accelerate its military restructuring to focus on “denial defence” of its territory and strengthen collective security in the Indo-Pacific region.

Japanese semiconductor industry suppliers Disco and Advantest continued to decline for the second consecutive week, leading the losses on the JAKOTA Blue Chip 150 Index. These declines followed a selloff in U.S. technology shares, with Nvidia reaching its lowest year-to-date value on Thursday.