Last week’s Jakota markets:

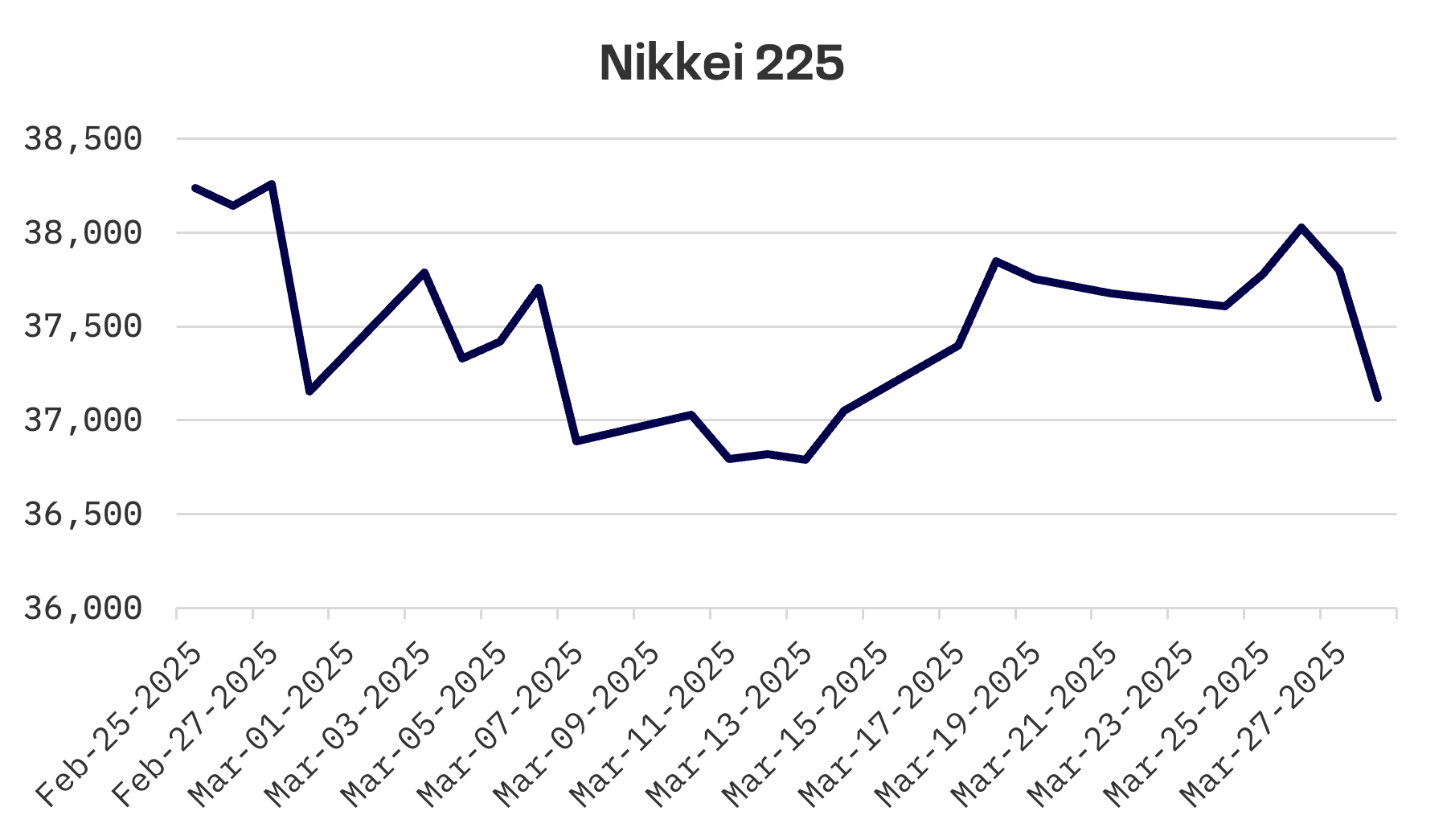

- Japan’s Nikkei 225 fell 1.5% as Prime Minister Ishiba warned of a “very big” impact from new U.S. auto tariffs, while BoJ’s Ueda signaled readiness for further rate hikes

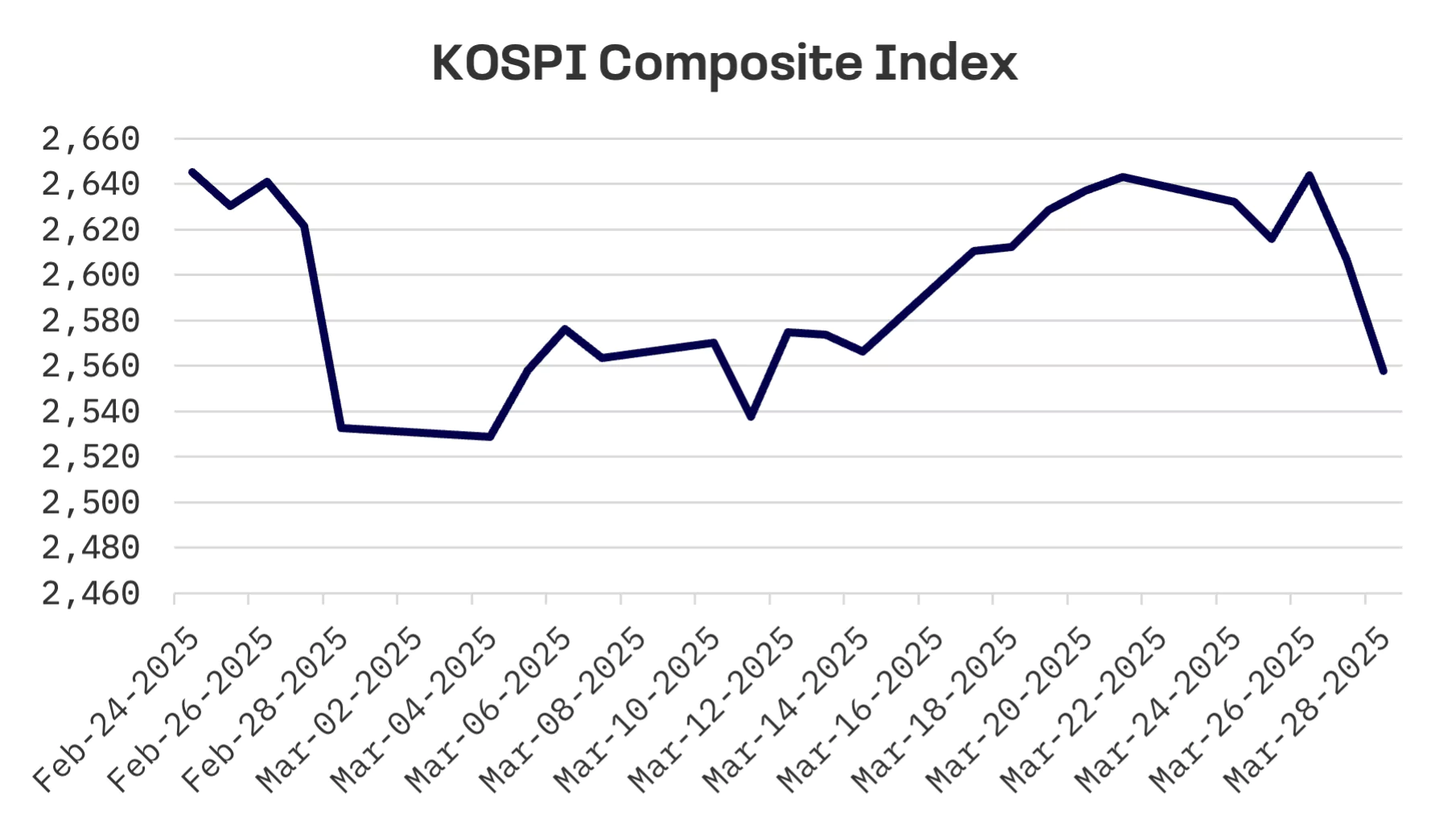

- South Korea’s KOSPI tumbled 3.2% as investors fled positions amid mounting trade war concerns, exacerbated by a surge in foreign selling

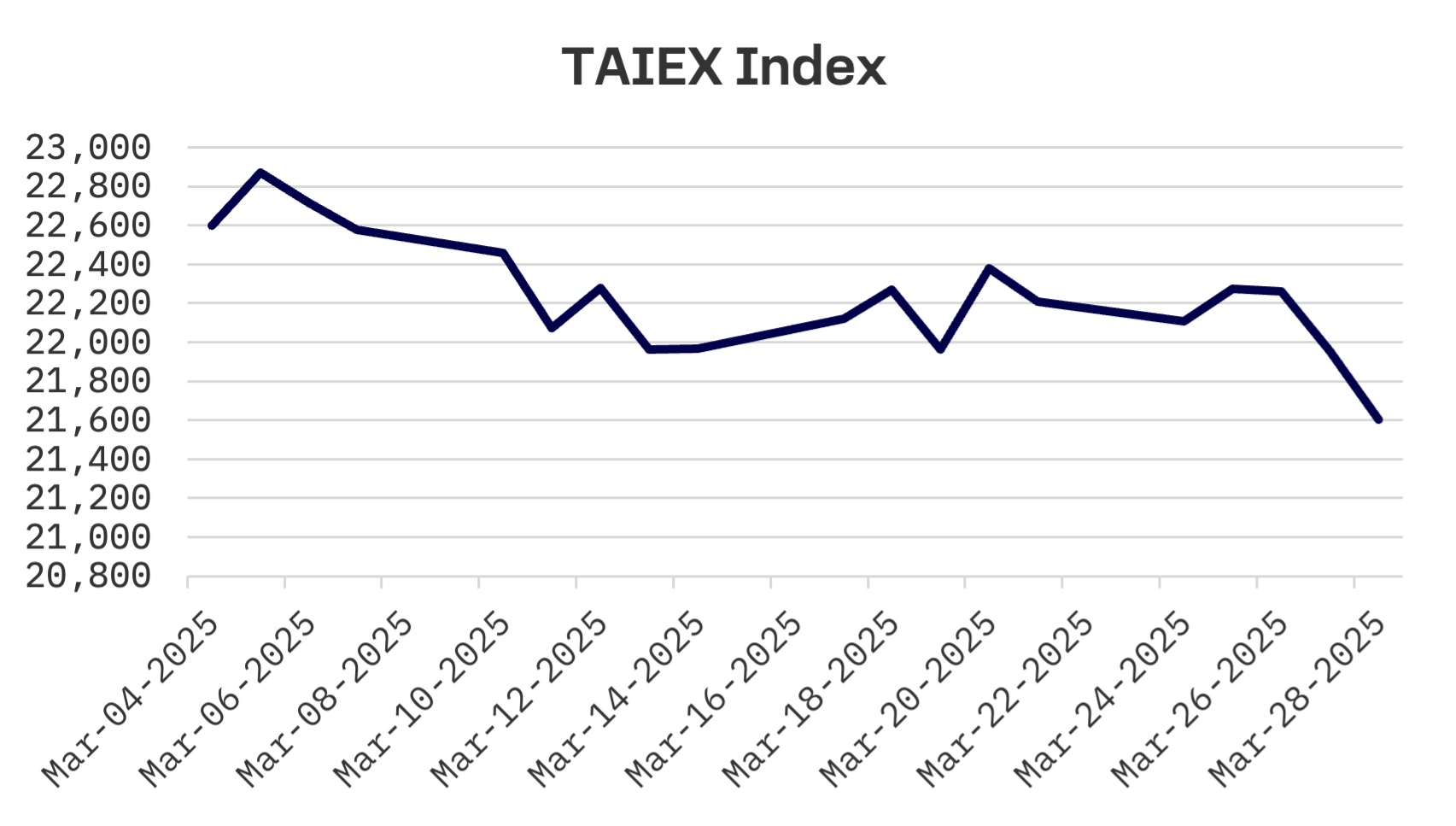

- Taiwan’s TAIEX index dropped 3% in sympathy with the Jakota markets, with investors on edge following U.S. trade policy announcements

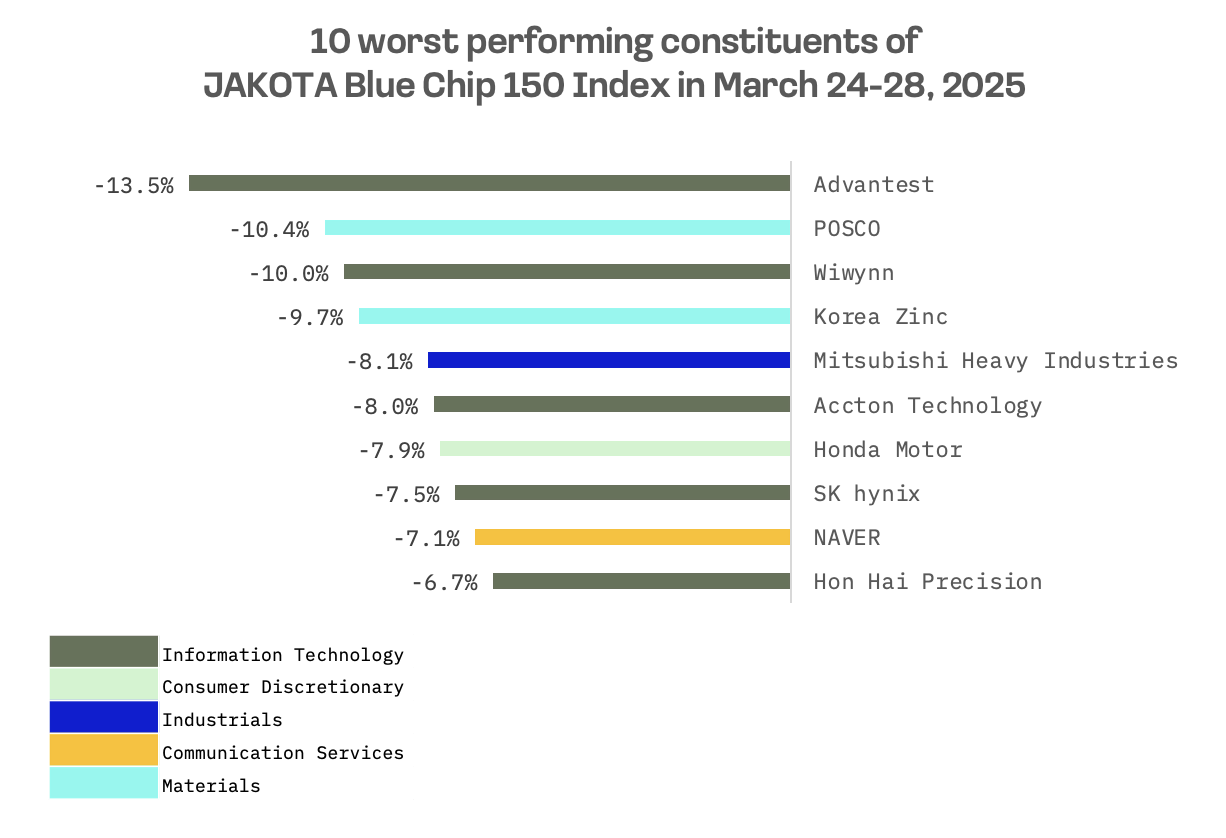

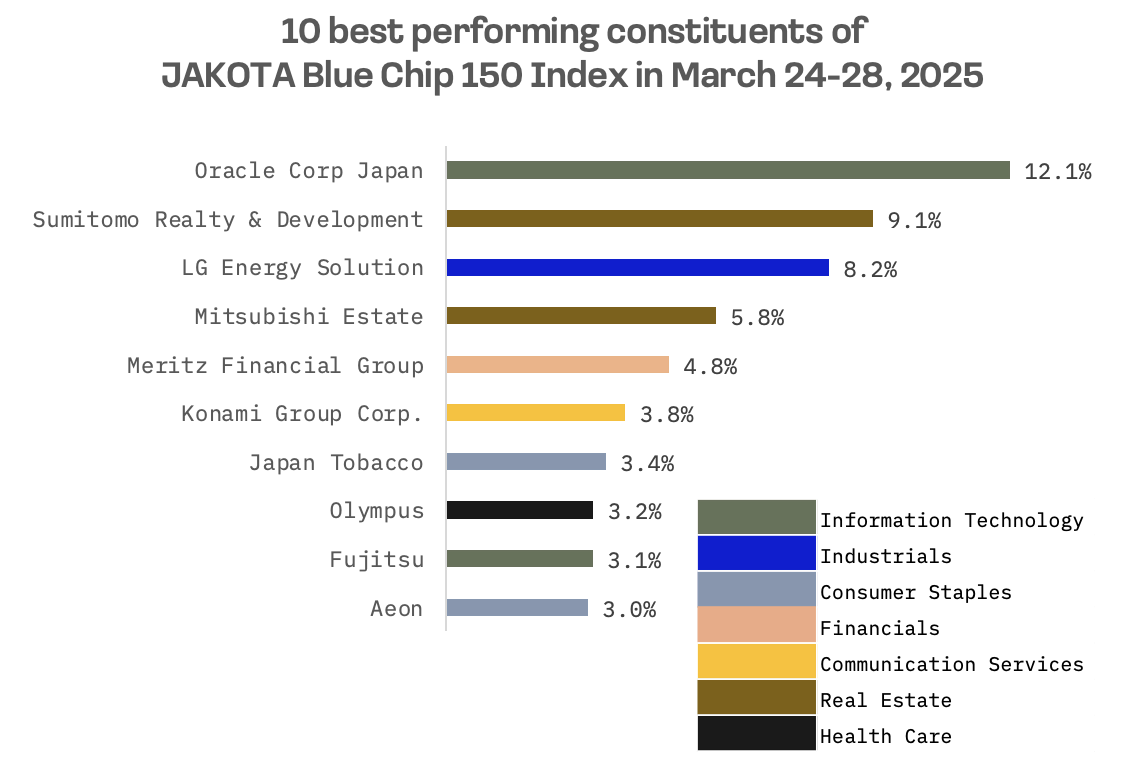

- The JAKOTA Blue Chip 150 Index posted a 1.9% weekly loss, with Oracle Japan emerging as a standout performer while semiconductor stocks, led by Advantest, faced significant pressure

Japan

Japan’s stock market retreated over the week, with the Nikkei 225 shedding 1.5%. The decline came after the Trump administration unveiled plans to impose a 25% tariff on U.S. auto imports beginning April 3, a move that battered shares of Japanese automakers and exporters. Intensifying fears of a widening trade conflict, coupled with the prospect of retaliatory measures from U.S. trading partners, cast a pall over market sentiment.

Japanese Prime Minister Shigeru Ishiba warned that the latest U.S. auto tariff announcement would have a “very big” impact on the country’s vital auto industry and broader economy. With automobiles constituting roughly a third of Japan’s exports to the U.S., Mr. Ishiba indicated his government is weighing all available options in formulating a response. Tokyo has redoubled diplomatic efforts to secure an exemption from the tariffs, including promises to boost investments and energy purchases from the U.S.

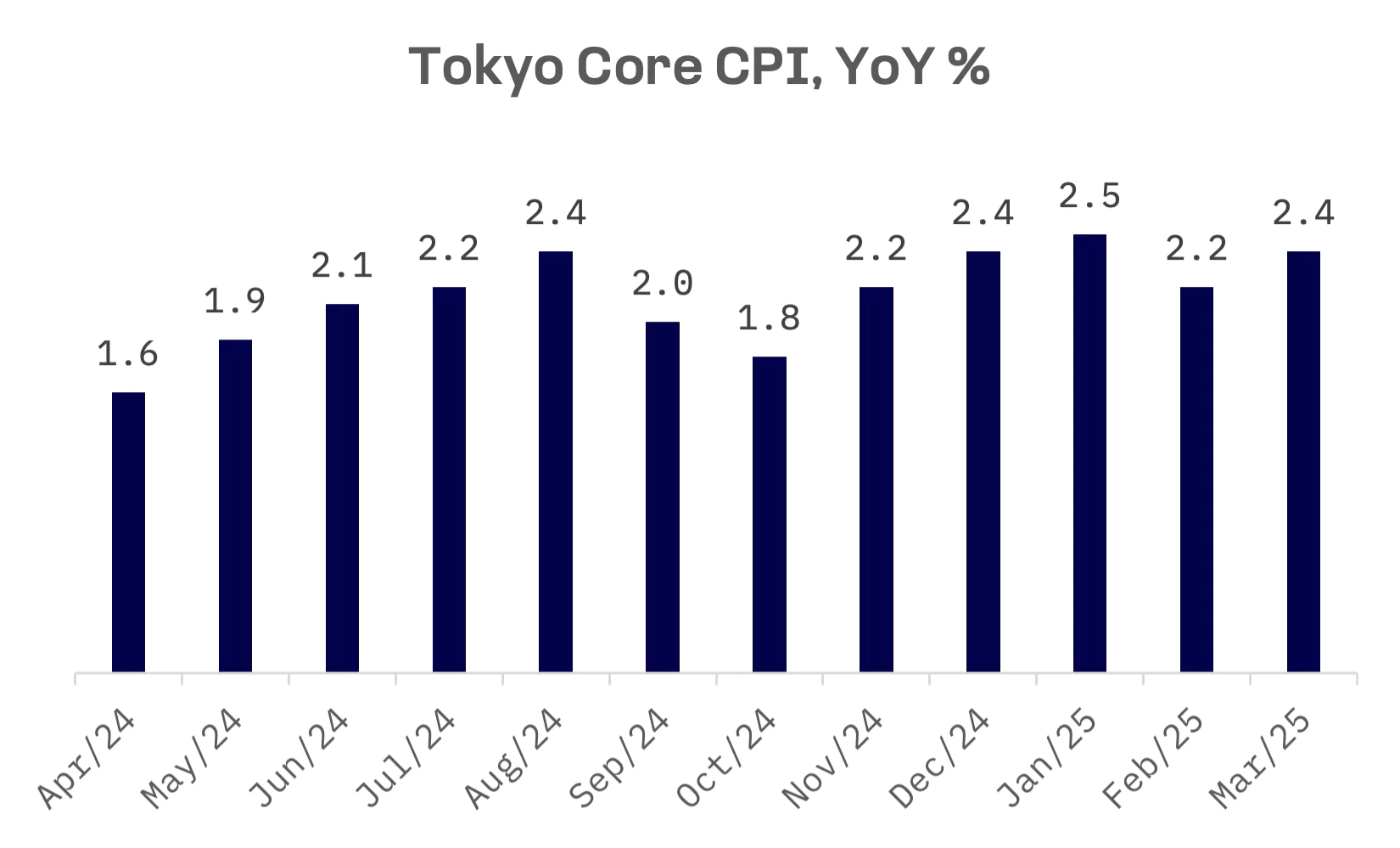

In monetary policy developments, Bank of Japan (BoJ) Governor Kazuo Ueda affirmed the central bank’s readiness to implement further rate increases should economic and price trends align with its forecasts. Mr. Ueda specifically highlighted the risk that persistent food price increases could fuel broader inflationary pressures, potentially triggering additional monetary tightening.

Recent economic data showed Tokyo area consumer prices climbing 2.4% in March from a year earlier, surpassing analyst expectations and accelerating from February’s 2.2% rise. The increase was largely driven by surging rice prices.

South Korea

South Korea’s equity market took a substantial hit this week, with the KOSPI index plunging 3.2%. Investors fled positions amid mounting concerns over a global trade war, triggered by the U.S. administration’s broad tariffs on all imported vehicles. The market decline was exacerbated by a surge in foreign selling.

Against this backdrop, South Korea’s auto industry representatives convened on Friday to urge government intervention to buffer the anticipated impact of U.S. auto tariffs set to take effect next week, officials reported. Industry leaders called for sustained negotiations with the Trump administration to ensure Korean automakers don’t face competitive disadvantages compared to global rivals under the new tariff structure.

The industry also advocated for support measures targeting auto parts suppliers, who are expected to shoulder the heaviest burden from Washington’s trade initiatives. Proposed interventions include emergency liquidity facilities and programs to help manufacturers diversify their export markets. The industry ministry is preparing to unveil a comprehensive package of emergency response measures next month, designed to enhance the investment climate and mitigate fallout from the U.S. tariffs.

On the economic data front, South Korea’s sentiment indicators deteriorated in March amid intensifying concerns over economic deceleration. The Bank of Korea’s (BOK) composite consumer sentiment index registered at 93.4 this month, dropping 1.8 points from February, according to the central bank’s latest survey. Weak domestic demand and sluggish exports were cited as primary factors weighing on consumer confidence.

Taiwan

Taiwan’s stock market declined in tandem with its Jakota peers, with the TAIEX benchmark retreating 3%. Market sentiment soured following the U.S. announcement of new tariffs targeting imported automobiles and components, further unsettling investors already on edge.

Taiwan’s consumer confidence metric fell to an 11 month low in March, primarily due to growing apprehension regarding a potential electricity rate increase slated for April, according to data from National Central University (NCU).

JAKOTA Blue Chip 150 Index

The JAKOTA Blue Chip 150 Index declined 1.9% for the week. The selloff was broad based, with only 42 of the 150 constituent stocks managing to post gains.

Oracle Corporation Japan emerged as the index’s standout performer this week following robust financial results for the third quarter of fiscal 2025. The software giant, which provides integrated cloud applications and platform services, reported particular strength in its cloud services segment.

The company recorded total revenue of $14.1 billion, representing a 6% increase year-over-year. Cloud revenue surged 23% to reach $6.2 billion, while GAAP earnings per share jumped 20%. Looking ahead, Oracle’s management projected 15% revenue growth for the coming fiscal year, citing a substantial sales backlog and expanding cloud service agreements with major tech firms.

At the opposite end of the performance spectrum, Advantest, Japan’s leading manufacturer of automatic test equipment (ATE) for the semiconductor industry, led decliners among the JAKOTA Blue Chip 150 Index constituents. The selloff occurred amid a broader retreat in semiconductor stocks, with industry bellwether Nvidia dropping 5.7%.

Advantest, a key supplier of semiconductor testers for Nvidia’s graphics processing units (GPUs), suffered collateral damage from the downturn. Nvidia’s share price decline followed the U.S. government’s decision to place several Chinese companies on a national security export restriction list, requiring U.S. companies to secure government authorisation before selling chips to these entities.