Last week’s JAKOTA markets:

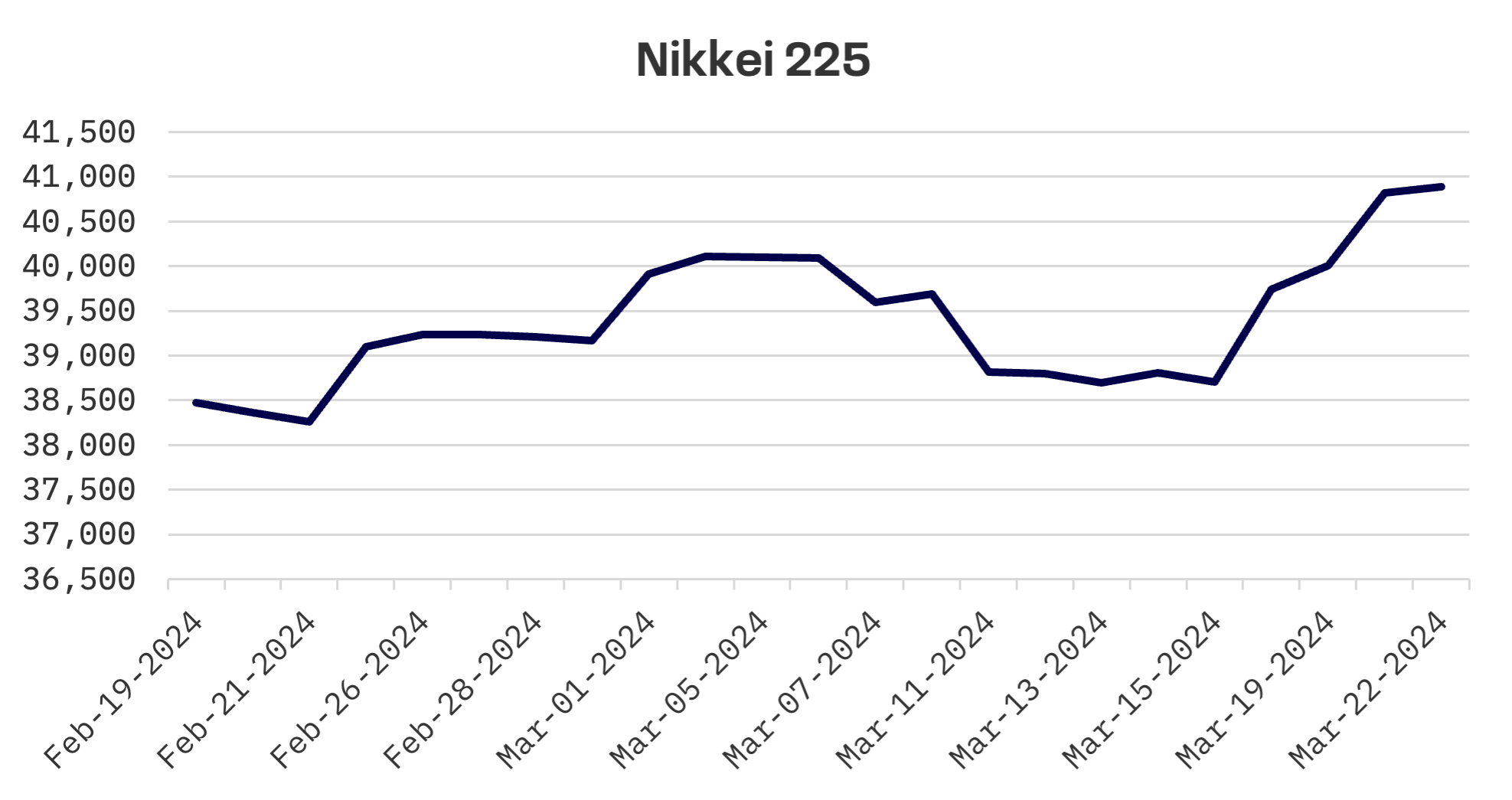

- In Japan, the Nikkei 225 Index’s climb of 5.6% highlighted the market’s positive reaction to the Bank of Japan’s surprising interest rate adjustments and a weaker yen

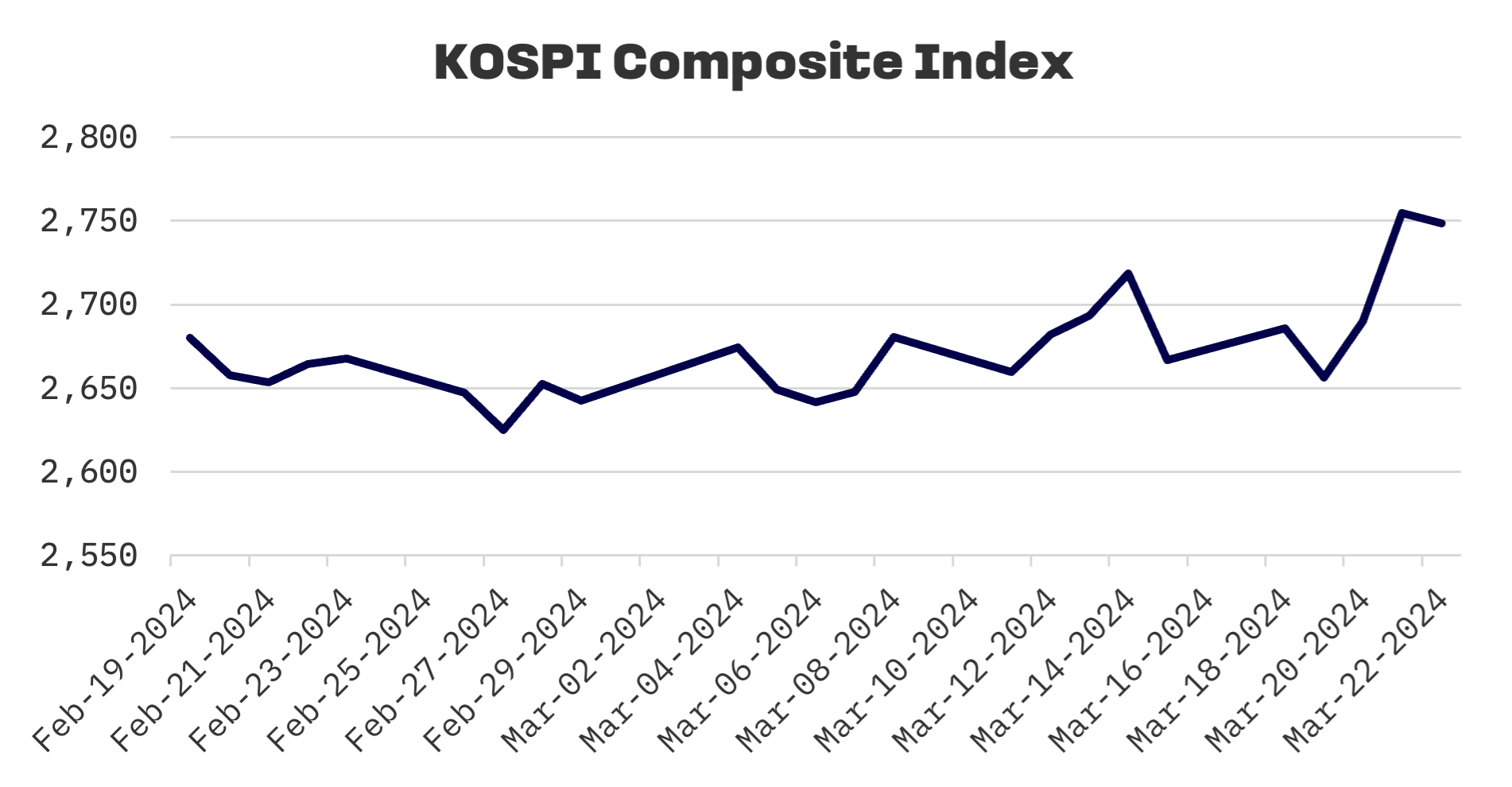

- The KOSPI index in South Korea gained 3.1%, reflecting optimism after the Federal Reserve’s latest policy meeting and a bullish trend in the technology sector

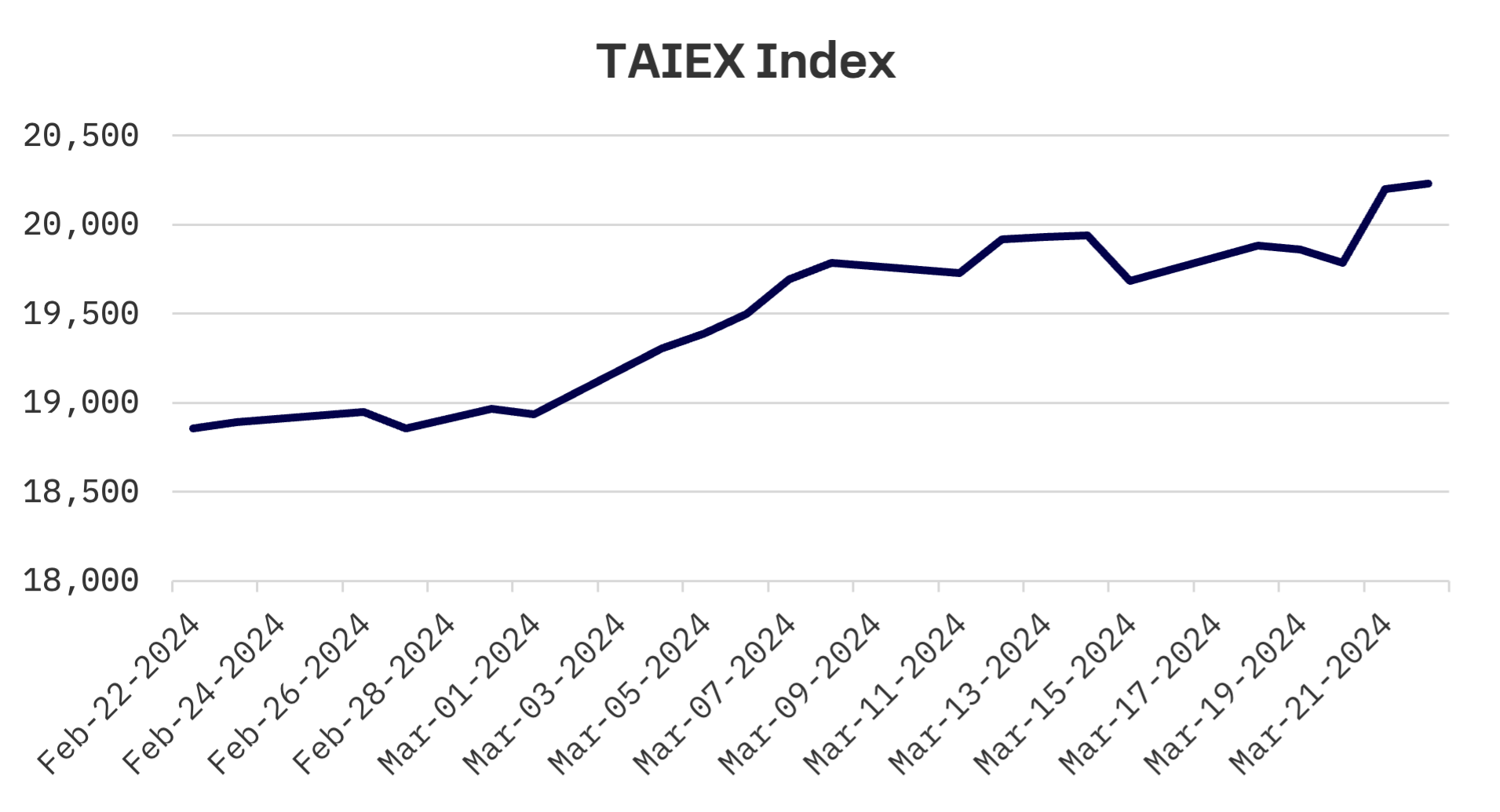

- Taiwan’s stock market, with the TAIEX index up by 2.8%, benefited from a global economic recovery outlook and strong demand for emerging tech, particularly in AI technologies

Japan

Japan’s stock markets rallied impressively this week, with the Nikkei 225 Index climbing 5.6% to unprecedented levels. These gains were primarily driven by the depreciation of the yen, triggered by the Bank of Japan’s (BoJ) unexpected decision to raise interest rates earlier than most had anticipated — the first hike since 2007. This move, combined with the anticipation of the U.S. Federal Reserve potentially lowering interest rates in 2024, significantly buoyed market sentiment.

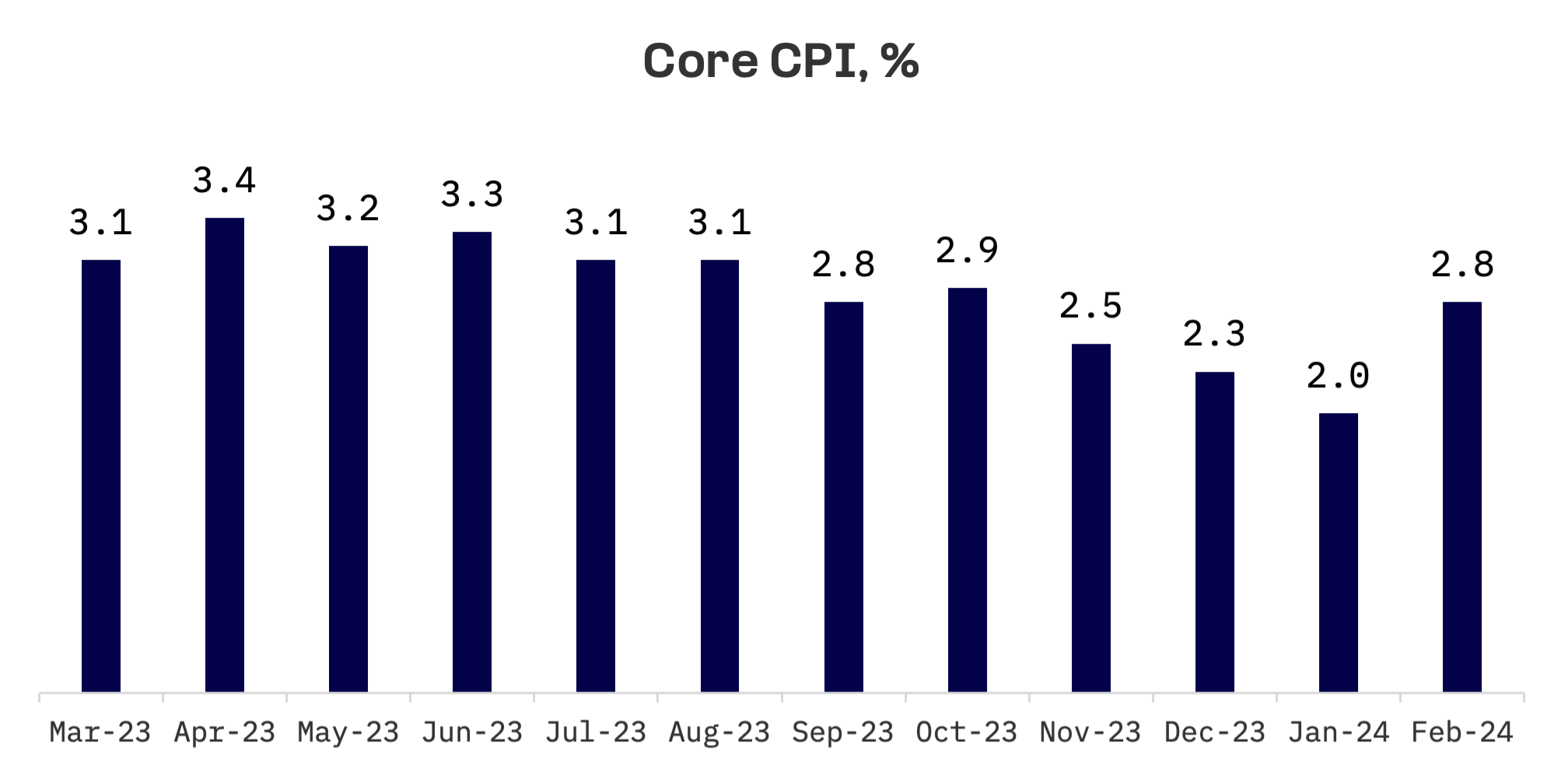

Japanese government bond yields declined following the Bank of Japan’s (BoJ) long-awaited policy shift, which involved exiting its negative interest rate policy. The central bank announced a policy rate target of 0 to 0.1%, up from the previous -0.1%, alongside reports of major companies agreeing to substantial pay increases in annual wage talks from the previous week. Additionally, the BoJ terminated its yield curve control program. Despite these changes, Governor Kazuo Ueda affirmed that financial conditions would remain accommodative, citing inflation expectations that remained below the 2% target.

Japan’s consumer price inflation surged to a 2.8% annualized rate in February, marking a notable rise from January’s 2.0% and eclipsing the Bank of Japan’s inflation benchmark.

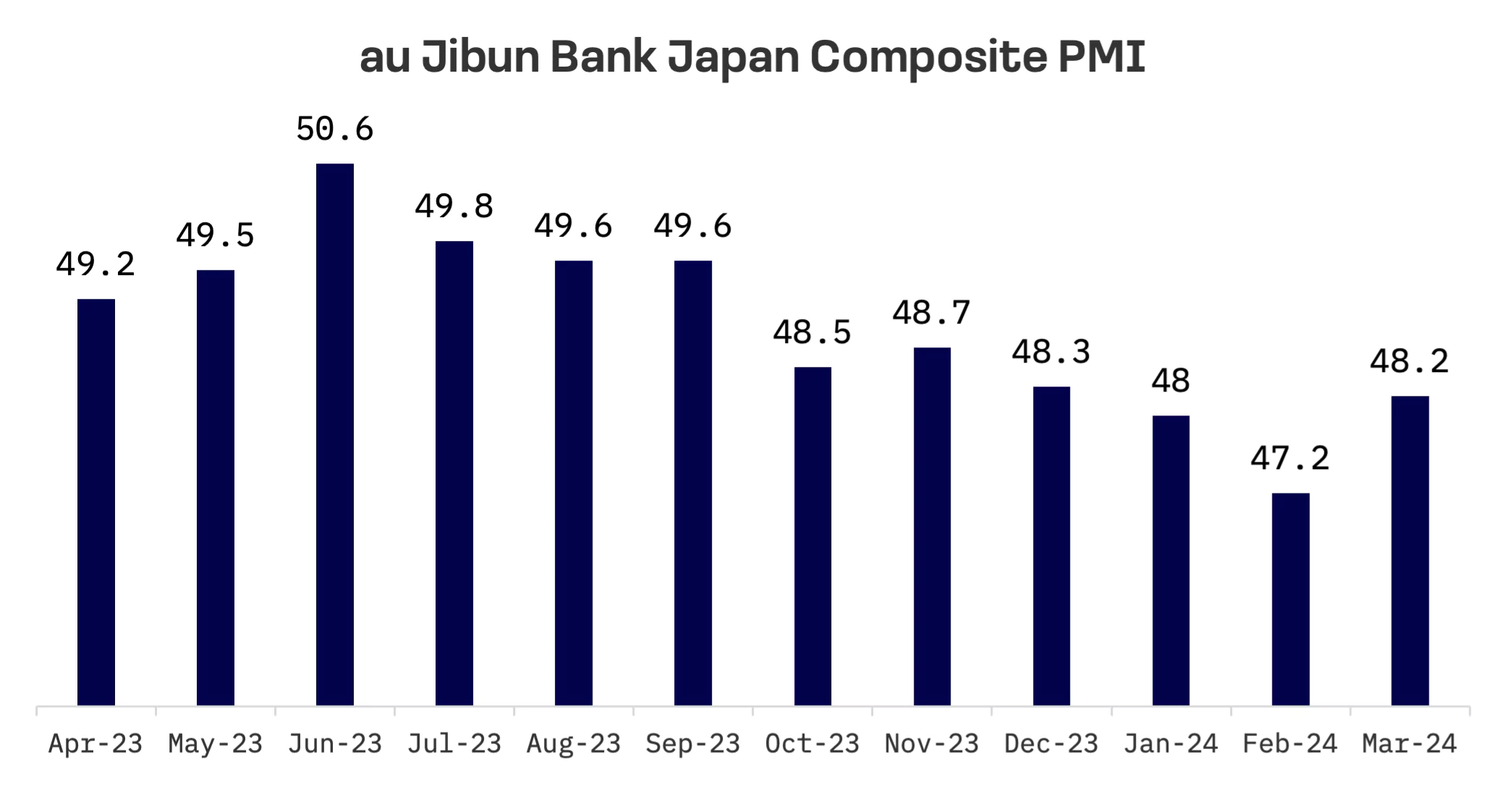

Furthermore, the most recent Purchasing Managers’ Index (PMI) data underscored a significant upturn in economic activity, with Japan’s private sector expanding at its fastest rate in seven months during March.

This acceleration was largely fuelled by a robust performance in the service sector, which saw the fastest expansion in new business activity in nine months. Meanwhile, the manufacturing sector also showed signs of resilience, with a deceleration in output decline, contributing further to the overall economic momentum.

South Korea

The South Korean KOSPI index enjoyed a 3.1% rise this week, marking its seventh increase in the last nine weeks. The main driver of sentiment for the week seemed to be news from the U.S.: the conclusion of the Fed’s policy meeting on Wednesday. As widely anticipated, policymakers opted to leave the federal funds rate unchanged and signalled their anticipation of three rate cuts later in the year. Additionally, investors were encouraged by Fed Chair Jerome Powell’s post-meeting press conference, where he expressed limited concern about the rise in inflation data in January and February, attributing it to seasonal factors.

According to market observers, the Bank of Korea (BOK) is anticipated to have the opportunity to lower the key rate after June. This sentiment is bolstered by the announcement of the BOK’s plans for three rate cuts throughout the year. It is widely expected that Korea’s central bank will maintain the key rate steady at the current 3.5% level until June, when the Fed is expected to begin a monetary easing cycle. Korea is expected to refrain from adopting a dovish stance before the Fed does so.

Taiwan

Along with other JAKOTA markets, the Taiwanese stock market experienced a 2.8% surge this week, buoyed by a dovish Federal Reserve and a rally in U.S. technology stocks. Reflecting on the positive global economic outlook and stable domestic consumption trends, the Central Bank of the Republic of China (Taiwan) has upgraded its GDP and CPI growth forecasts for 2024. Following a quarterly policymaking meeting, the central bank stated that it has raised the GDP growth forecast to 3.22% and the CPI growth forecast to 2.16%.

In its statement, the central bank highlighted Taiwan’s expected benefits from the recovery in the global economy and stable private consumption within the country. Specifically, the GDP growth forecast for the year has been adjusted to 3.22%, a notable increase from the 3.12% projection made in December. This optimistic adjustment is underpinned by the expected surge in demand for emerging technologies, including AI, which is likely to catalyse a significant rebound in Taiwan’s export sales. Additionally, an improvement in consumer confidence domestically has been identified as a key contributor to this positive economic outlook.

On the unemployment front, Taiwan reported a slight increase to 3.39% in February, halting a five-month trend of consecutive declines. This increase of 0.08 percentage points, as detailed by the Directorate General of Budget, Accounting, and Statistics (DGBAS), is attributed to the seasonal conclusion of temporary jobs following the Lunar New Year and the common trend of post-holiday job transitions.

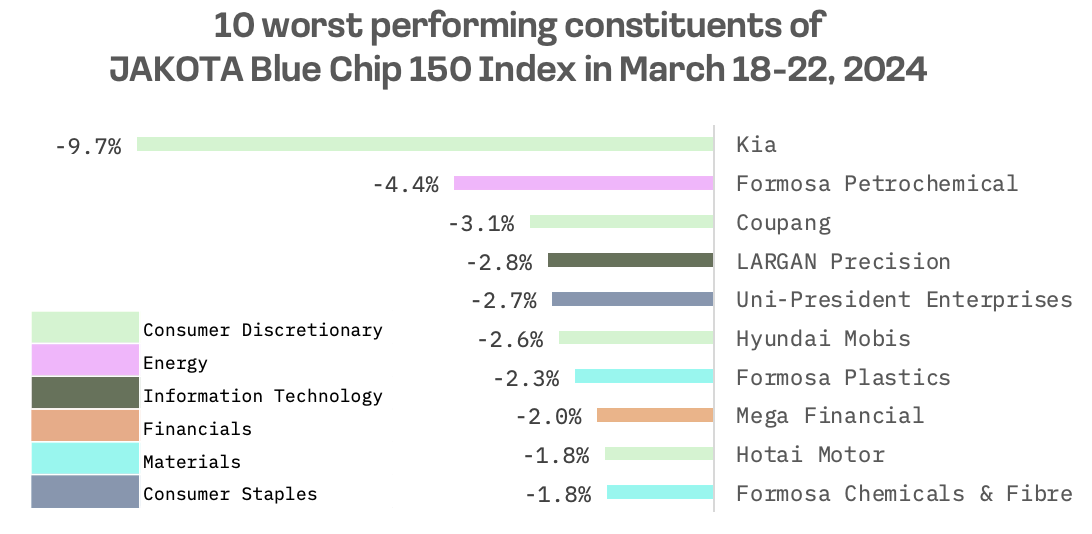

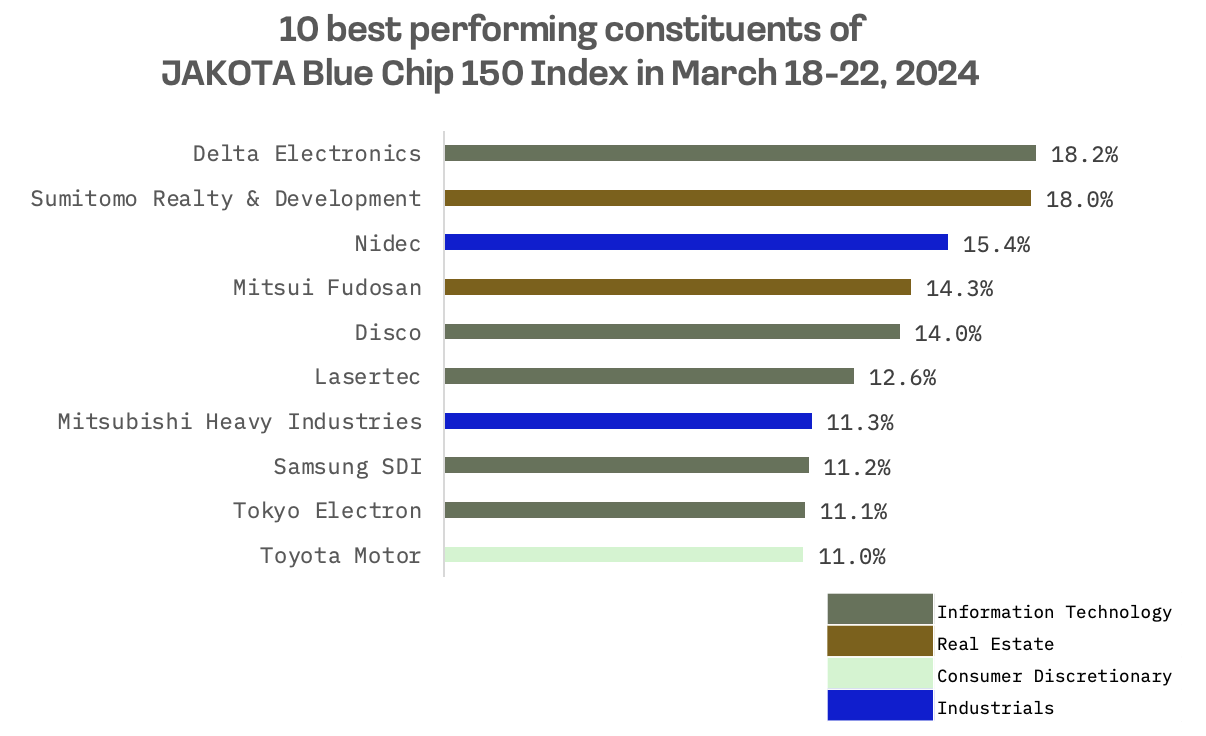

JAKOTA Blue Chip 150 Index

The JAKOTA Blue Chip 150 Index witnessed a 3.2% increase this week, with 125 of its 150 constituents posting gains.

The shares of Delta Electronics, a Taiwanese leader in power management and provider of IoT-based smart green solutions, jumped by more than 18% – driven by technology stock rally, especially AI related stocks, and the company’s announcement regarding the launch of its 500kW DC Ultra-fast EV Charger UFC 500. Amidst the increasing demand for high-power charging solutions and the challenges associated with land acquisition for EV charging operators, the UFC 500 stands out as an ideal solution due to its remarkable power versus footprint ratio. The UFC 500 can charge one heavy-duty electric vehicle (e-truck/e-Bus) with a large battery capacity at 460 kW power within 2 hours.

Kia, a prominent player in the Korean automotive industry, found itself at the bottom of the JAKOTA Blue Chip 150 index this week, highlighting the sector’s struggles. The downturn was significantly influenced by a 7.8% year-over-year decrease in Korea’s auto exports in February. Compounding the sector’s woes, Kia, along with Hyundai, faced challenges in the U.S. market, particularly with the announcement of a substantial recall involving 48,232 units of its EV6 model due to potential charging unit defects that could cause a loss of power during operation.