Last week’s Jakota markets:

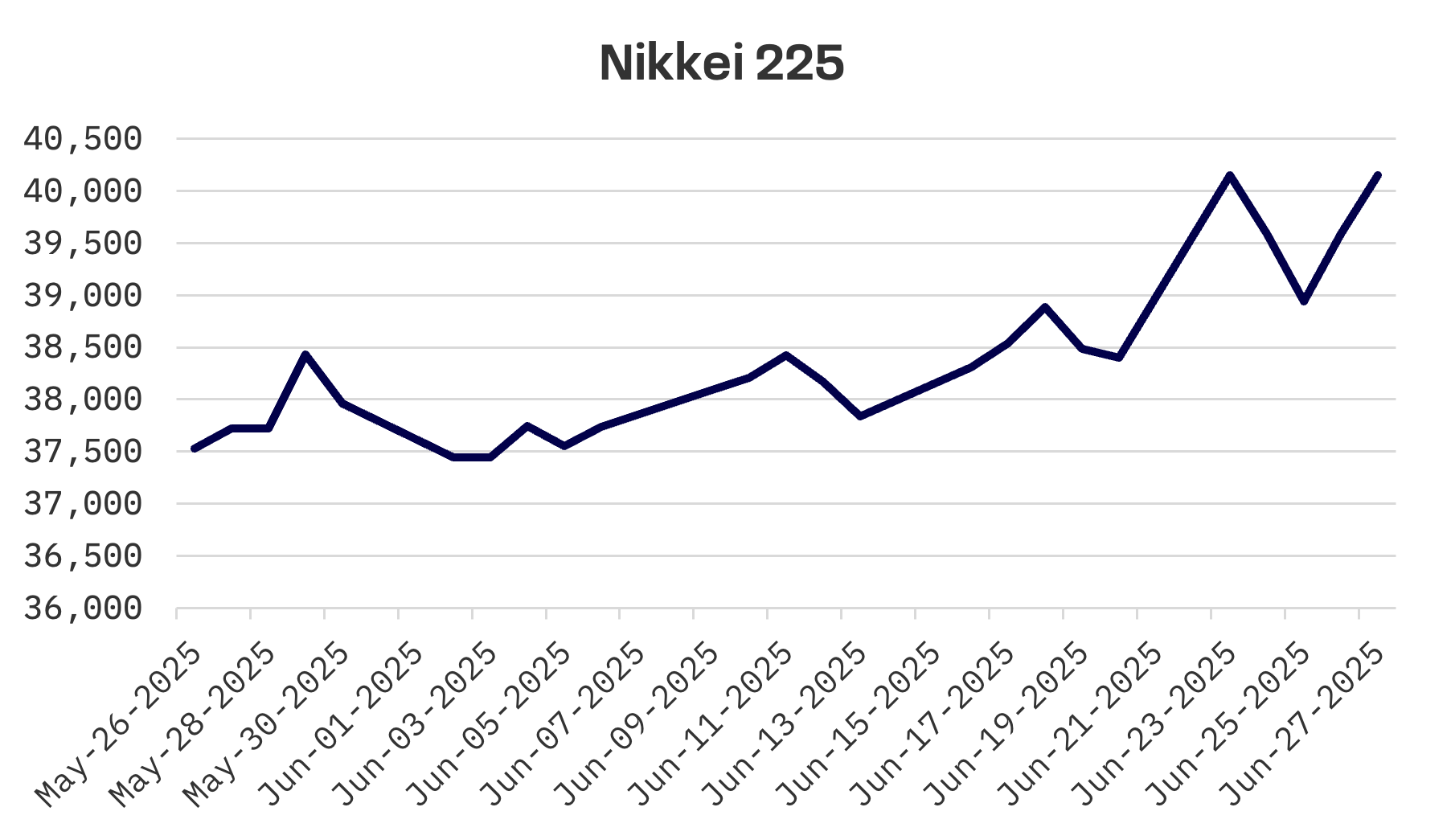

- Japan’s Nikkei 225 Index jumped 4.6% as tech stocks rallied on improved risk sentiment and signs of sustained Middle East ceasefire

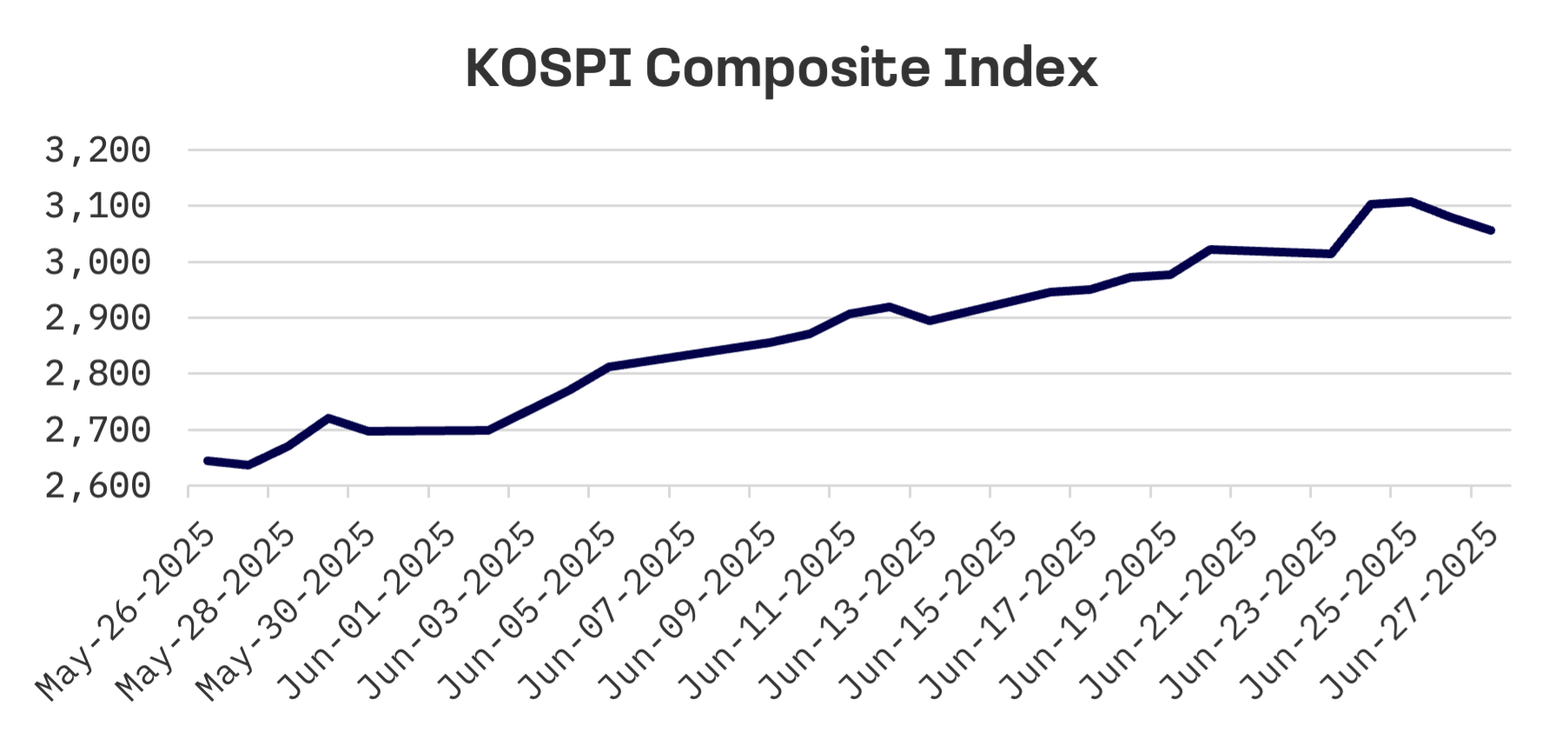

- South Korea’s KOSPI climbed 1.1% to near four year highs, marking five consecutive weeks of gains despite late week profit taking in battery and auto stocks

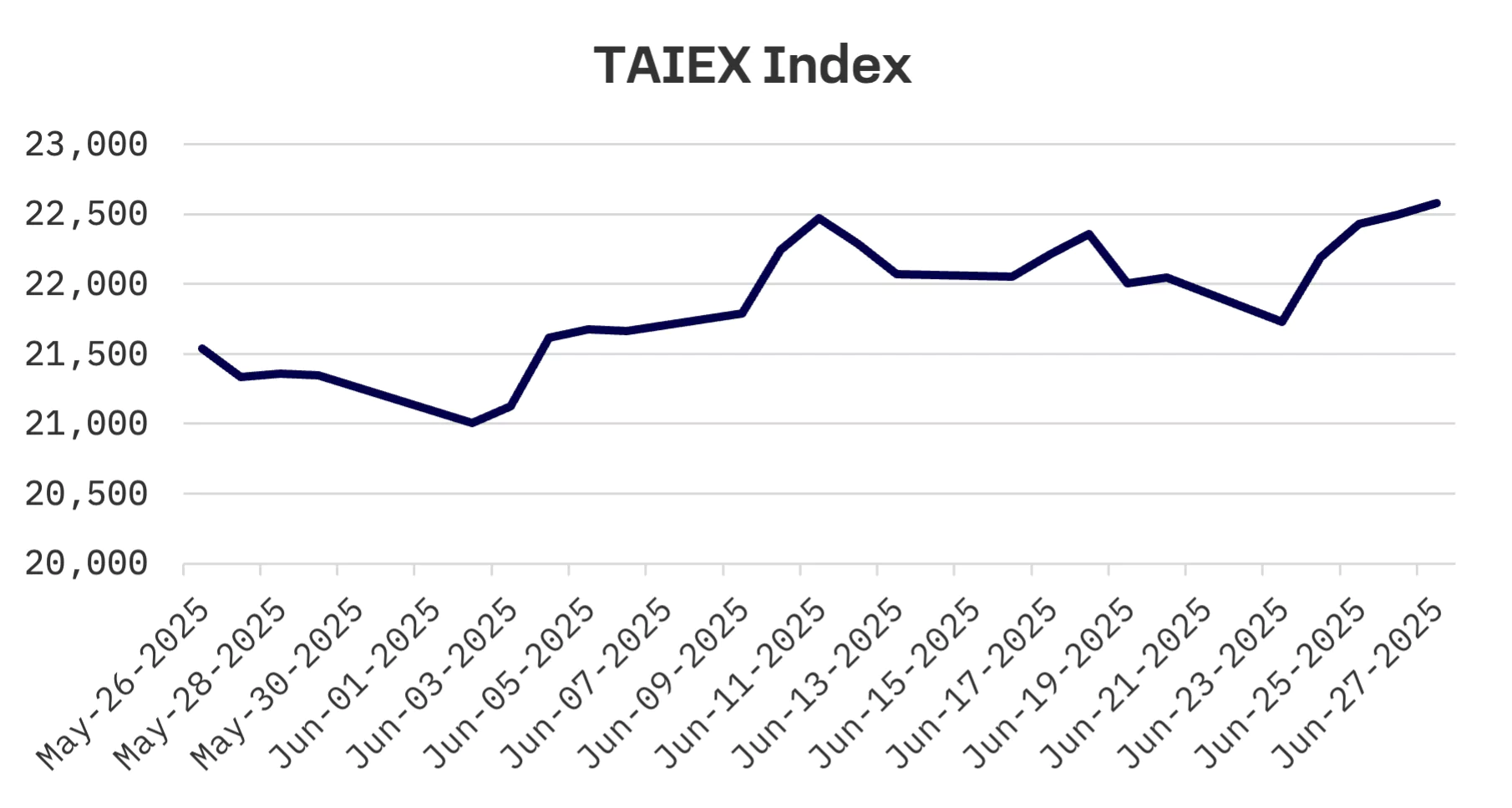

- Taiwan’s TAIEX rose 2.4%, buoyed by tech sector enthusiasm following easing geopolitical tensions

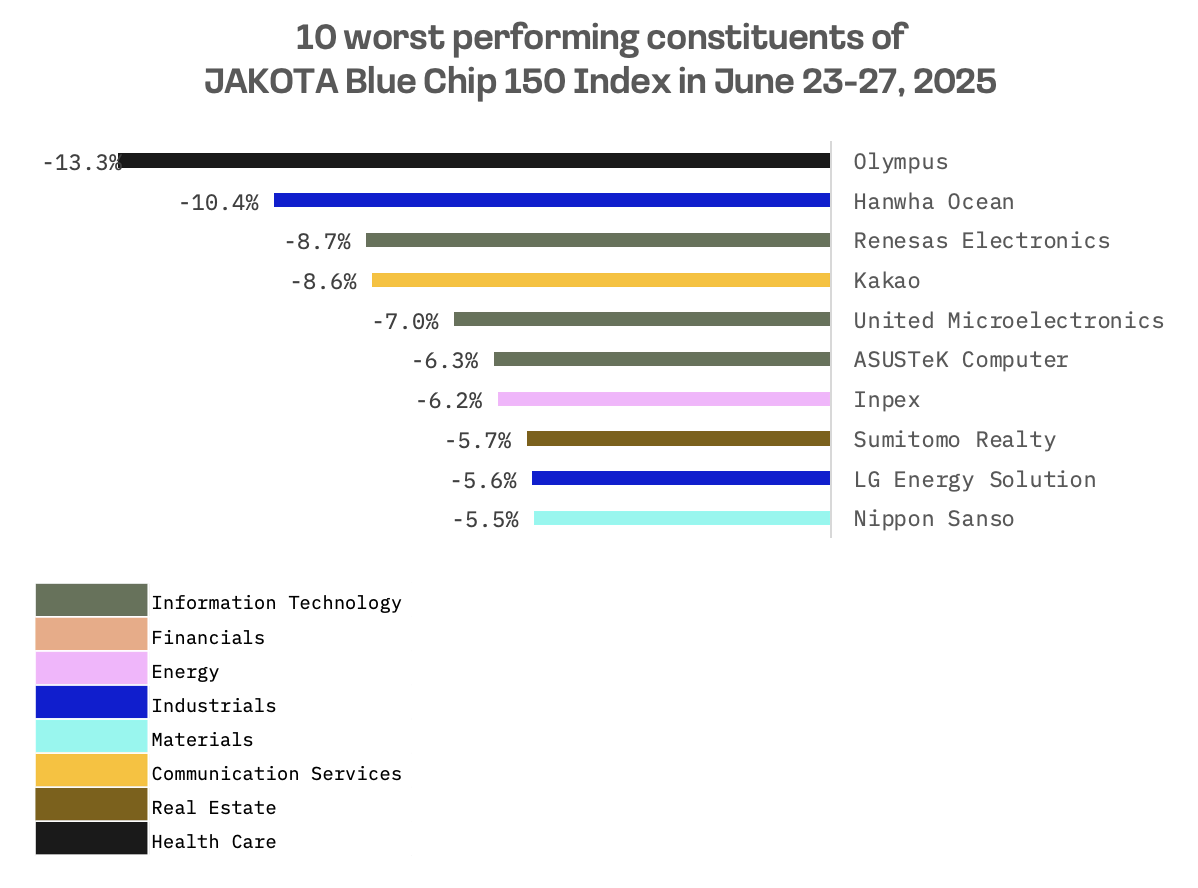

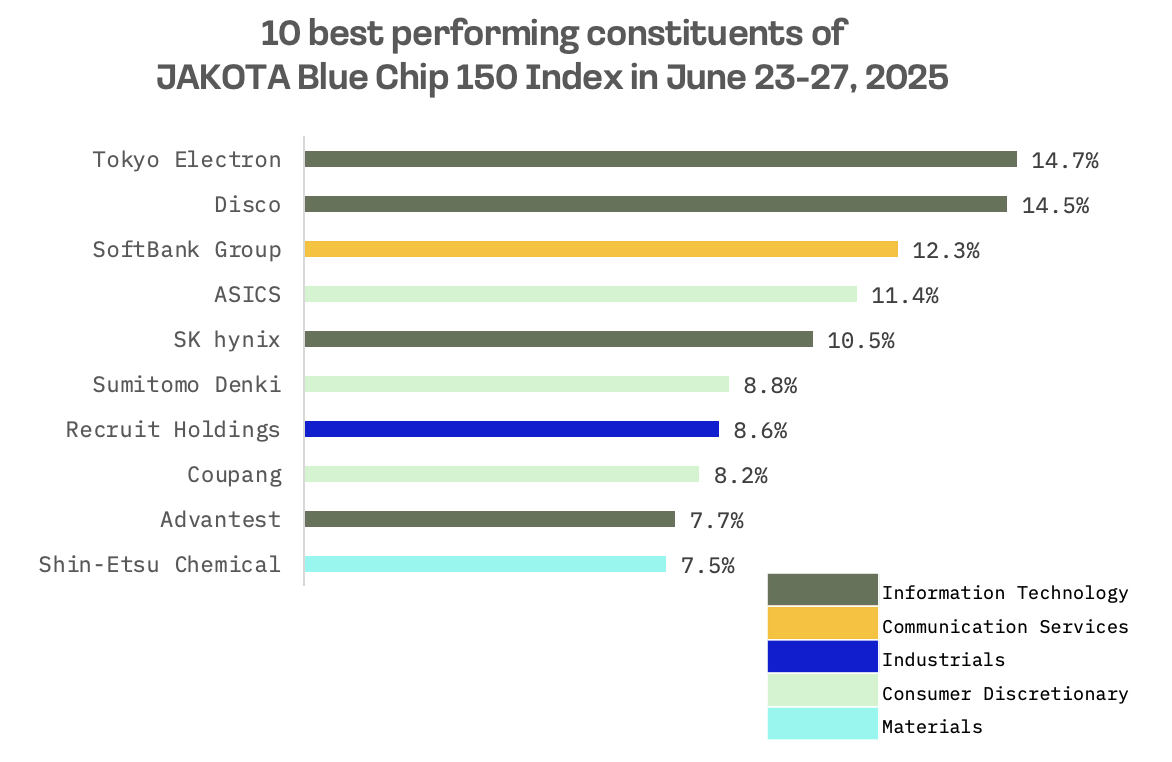

- The JAKOTA Blue Chip 150 Index gained 3.2%, led by Japanese semiconductor equipment stocks, while Olympus posted the week’s worst performance with a 13.2% drop

Japan

Japan’s stock market surged this week, with the Nikkei 225 climbing 4.6% as technology shares spearheaded a broad rally. The advance came amid improved risk sentiment following the easing of global trade war concerns and signs that the ceasefire between Iran and Israel continues to hold.

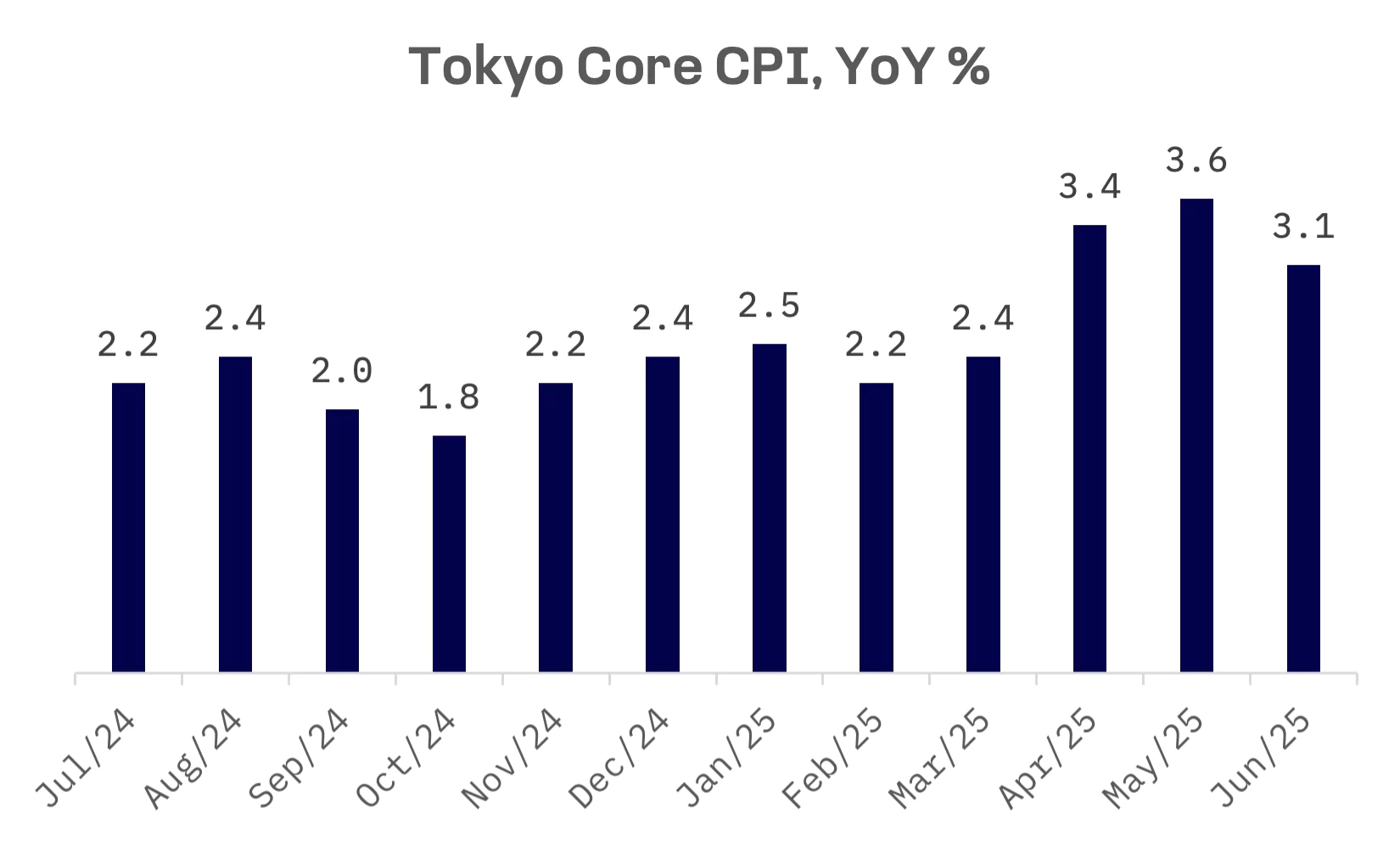

Tokyo area core inflation decelerated in June, with the index rising 3.1% year-over-year, falling short of the 3.3% consensus estimate and marking a decline from May’s 3.6% increase. The moderation was largely attributed to renewed government subsidies, though inflation remains above the Bank of Japan’s (BoJ) 2% target, supporting the case for additional rate increases.

Minutes from the BoJ’s June policy meeting highlighted the central bank’s commitment to raising rates provided its economic and inflation forecasts are realised, while acknowledging downside risks stemming from potential U.S. tariff measures and Middle East geopolitical tensions.

The Summary of Opinions disclosed internal disagreement among board members, with one hawkish member dissenting from the decision to slow the pace of Japanese Government Bond (JGB) tapering, scheduled to commence in April 2026. The member advocated for accelerated normalisation to enable markets to independently determine long term yields.

South Korea

South Korea’s stock market extended its winning streak to five consecutive weeks, with the KOSPI Index advancing 1.1%. The benchmark index hit a nearly four year high this week, propelled by diminishing Middle East tensions after President Donald Trump announced a ceasefire agreement between Israel and Iran. Gains continued on Wednesday as investors grew increasingly optimistic about a potential early Federal Reserve rate cut. However, the bullish momentum waned late in the week as profit taking emerged, with declines in battery and automotive stocks pressuring the market on Thursday and Friday.

South Korea’s pursuit of developed market status encountered another setback after MSCI declined to include the country on its watchlist for potential reclassification. In its 2025 market classification review released on Tuesday, MSCI said Korea would remain excluded from upgrade consideration, keeping Asia’s fourth largest economy in the emerging market category, where it has stayed since being removed from the watchlist in 2014.

While improvements in short selling accessibility worked in South Korea’s favour, MSCI highlighted persistent deficiencies in foreign exchange market openness, omnibus account usage, foreign investor registration, settlement systems and the availability of investable products. These shortcomings continue to fall below developed market standards, according to the index provider.

Without watchlist designation this year, Korea’s prospects for a near term upgrade are effectively postponed until at least 2028. Markets must remain on MSCI’s watchlist for a minimum of one year before formal reclassification, with annual updates announced each June.

Taiwan

Taiwanese stocks advanced this week, with the TAIEX gaining 2.4%, driven by a wave of buying in the tech sector following Trump’s announcement of the Israel-Iran ceasefire agreement.

On the economic front, Taiwan’s leading indicators shifted to “stable growth” status in May from April’s “warming” designation, as demand for traditional goods weakened, according to the National Development Council. The economy displayed a “green light” signal, with the composite index declining two points to 31 – the first green light reading since March 2024.

JAKOTA Blue Chip 150 Index

The JAKOTA Blue Chip 150 Index added 3.2% this week, with 96 of its 150 constituents posting gains.

Reports that the U.S. government is preparing new restrictions on advanced AI chip exports to China could benefit Japanese semiconductor equipment manufacturers including Tokyo Electron, Disco and Advantest. These companies face limited exposure to the restrictions and stand to benefit from a potential shift in global demand. Tokyo Electron and Disco led gains in the Blue Chip 150 Index this week as a result.

Olympus, the Japanese optics and reprography manufacturer that commands roughly 70% of the global endoscope market, tumbled 13.2% this week – the steepest decline in the JAKOTA Blue Chip 150 Index.

The selloff followed a June 25 notice from the U.S. Food and Drug Administration (FDA), which flagged several Olympus endoscope related devices – including cleaning tools and diagnostic and therapeutic instruments – for non compliance with quality system regulations, effectively halting future imports. Olympus said it is working with the FDA to resolve the issues and is evaluating the financial impact. The regulatory uncertainty, however, weighed heavily on investor sentiment, with Olympus shares plunging as much as 12% intraday, marking one of their sharpest declines in years.