Last week’s Jakota markets:

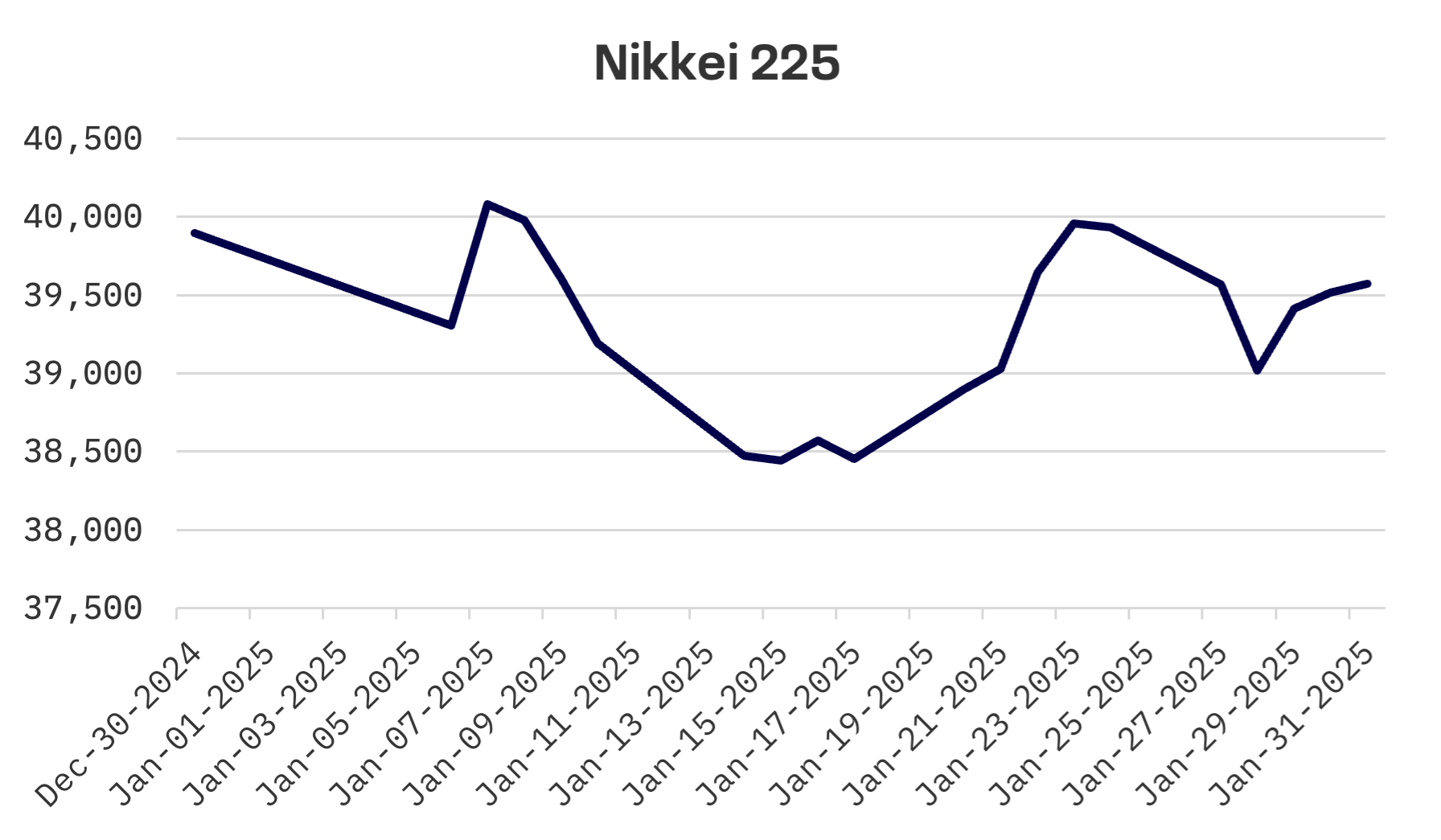

- Japan’s Nikkei 225 fell 0.9% as Chinese AI firm DeepSeek’s emergence sparked a tech selloff and BoJ maintained its hawkish stance

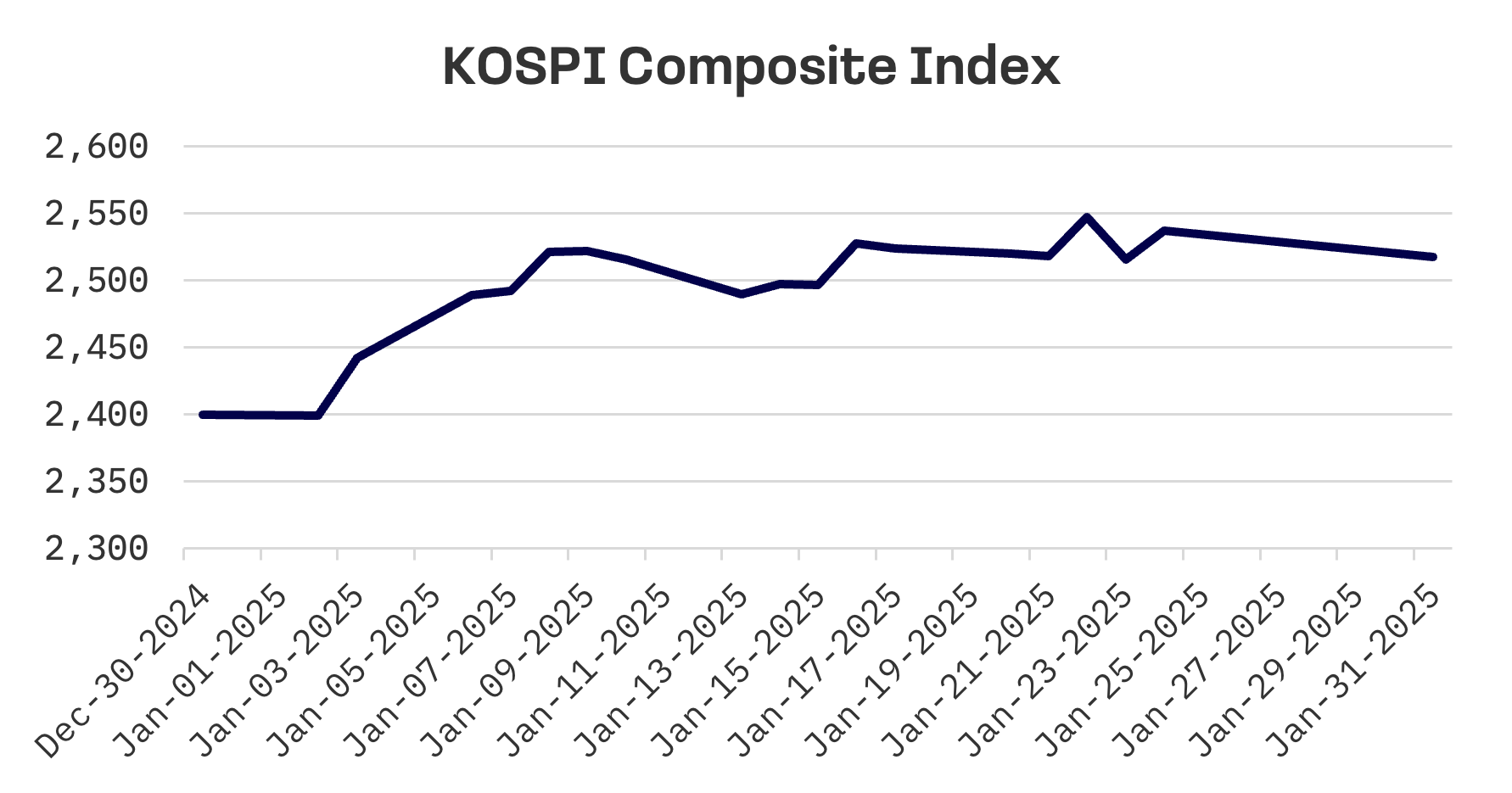

- South Korea’s KOSPI dropped 0.8% in a single trading session amid the Lunar New Year holiday, pressured by DeepSeek related concerns

- Taiwan’s market remained closed for Chinese New Year celebrations

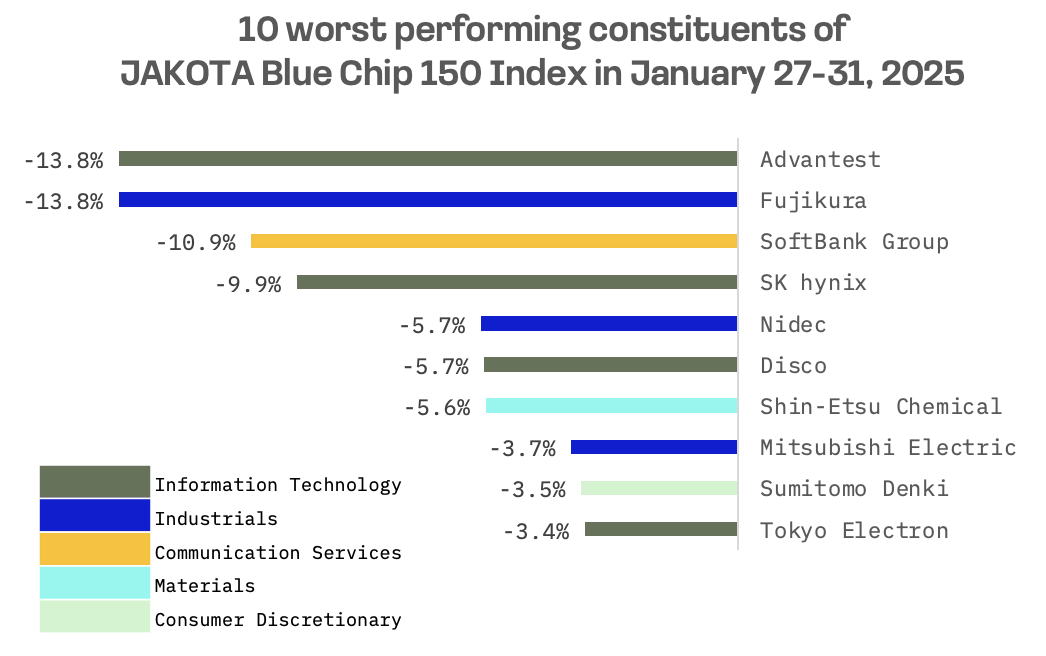

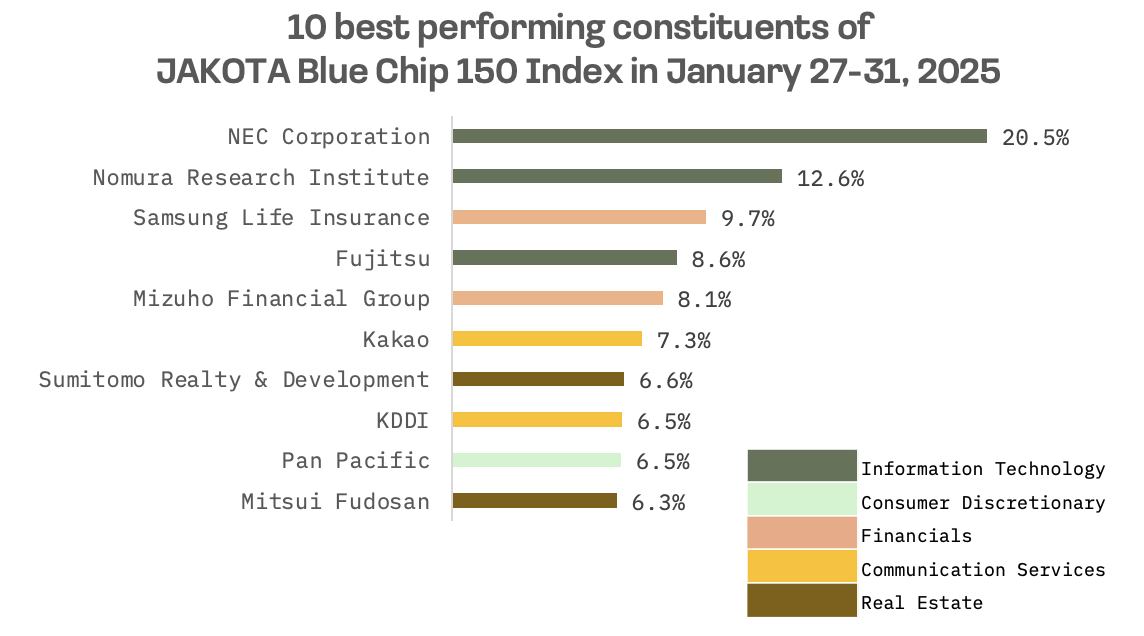

- The JAKOTA Blue Chip 150 Index gained 0.8%, led by NEC’s record rally while semiconductor stocks Advantest and Fujikura each lost 13.8%

Japan

Japanese stocks declined this week, with the Nikkei 225 dropping 0.9% after the emergence of China’s DeepSeek – viewed as a potential challenger to U.S. AI dominance – sparked a selloff in major U.S. technology stocks that pressured Japanese chipmakers. The market faced additional headwinds from the Bank of Japan (BoJ)’s hawkish stance after the central bank raised interest rates for the third time in a year and lifted its inflation outlook at its January 23-24 policy meeting.

BoJ Deputy Governor Ryozo Himino indicated further rate increases remain possible if economic conditions align with forecasts, while Governor Kazuo Ueda said markets have clearly understood the central bank’s messaging on gradual tightening.

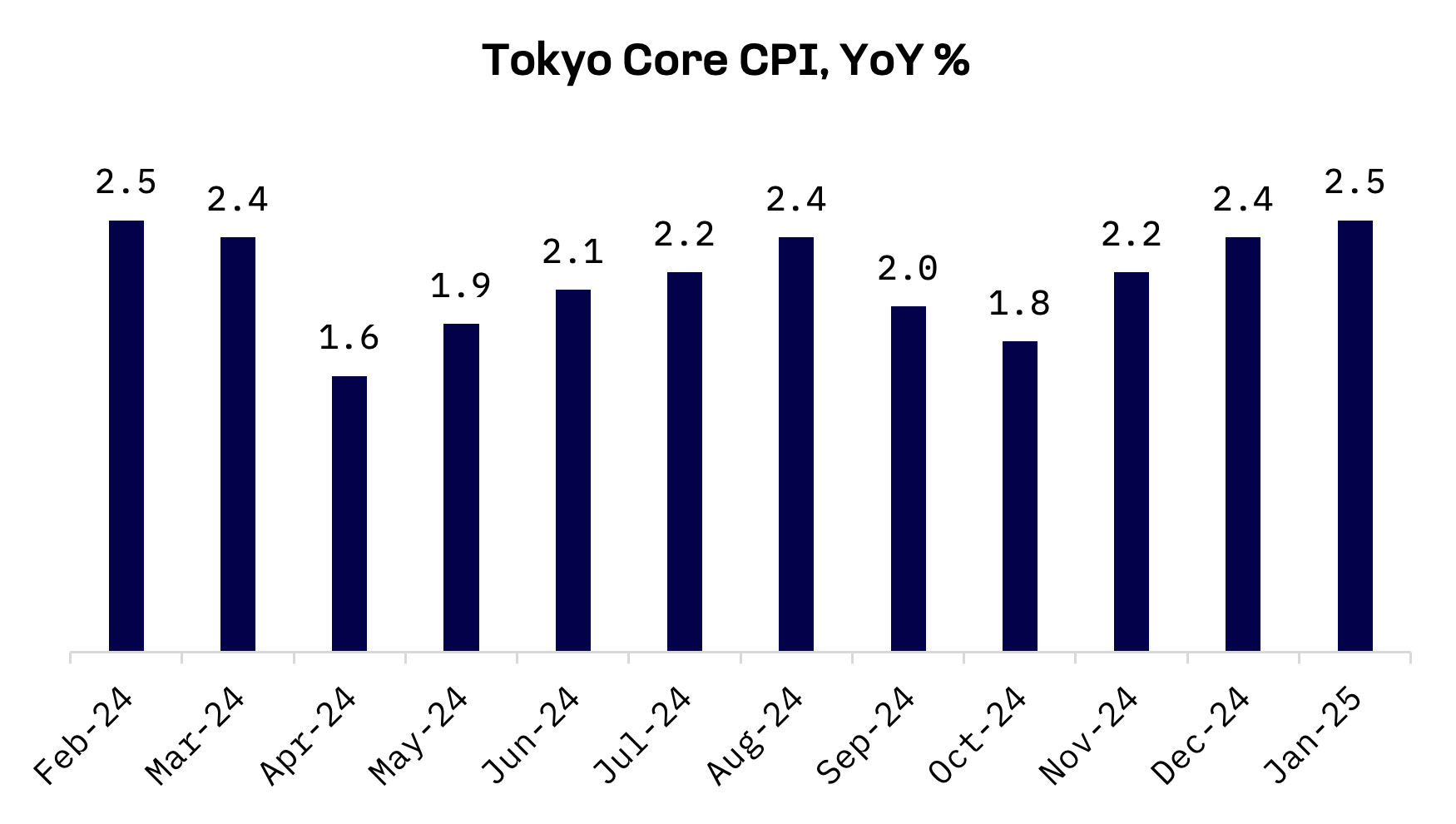

Tokyo’s core consumer price index (CPI), a key indicator of nationwide trends, rose 2.5% from a year earlier in January, matching expectations and climbing from December’s 2.4% increase.

The data bolstered the case for the BoJ’s hawkish stance, though sluggish growth remains a headwind, highlighting the need for measured rate increases.

South Korea

South Korean markets were closed Monday through Thursday for the Lunar New Year holiday. In Friday’s sole trading session, the KOSPI index fell 0.8% as technology shares tumbled following the DeepSeek developments. The index saw significant volatility in semiconductor and electronics stocks as the DeepSeek news roiled global markets during the Korean holiday.

Taiwan

Taiwan’s stock market remained closed this week for Chinese New Year holidays.

JAKOTA Blue Chip 150 Index

The JAKOTA Blue Chip 150 Index rose 0.8% this week, with 83 of 150 constituents advancing.

NEC Corporation, a Japanese producer of telecommunications equipment and related software and services, led gains on the index, surging 20.5% to a record after raising its earnings outlook.

The company lifted its consolidated earnings forecast for the fiscal year ending March 2025 to ¥3.41 trillion from ¥3.37 trillion — despite projecting a 1.9% year-over-year decline. It raised its non GAAP operating profit forecast 23% to ¥280 billion from ¥255 billion and increased its net profit outlook to ¥182 billion from ¥165 billion.

The revised guidance came on the back of stronger than expected third quarter performance, with domestic IT services bolstered by robust orders for government cloud support amid local government standardisation efforts and increased defence spending lifting the aerospace segment. The guidance also reflects steady momentum in the company’s overseas digital government and digital finance initiatives.

NEC also announced a 5-for-1 stock split effective March 31, aimed at improving share liquidity and broadening its investor base.

Advantest and Fujikura, key players in Japan’s semiconductor supply chain, were the index’s worst performers, each dropping 13.8%. Fujikura, a specialist in electrical and optical cable production including optical fibre cables and components for AI-driven data centres, and Advantest, a leading manufacturer of automated test equipment for semiconductors, fell amid a broader technology selloff.

The decline followed Chinese AI developer DeepSeek’s unveiling of an open source large language model (LLM) that requires significantly less energy and processing power than current industry standards. The model’s efficiency and performance have raised competitive concerns that could dampen investments in advanced chips, data centres and critical electrical infrastructure.