Last week’s JAKOTA markets:

- Japan’s Nikkei 225 Index surges to a historic peak, underpinned by a robust economic recovery and strong corporate earnings, despite mixed economic indicators

- South Korea’s KOSPI index soars, driven by reform optimism and tech sector strength, marking its best week since November 2022

- Taiwan’s TAIEX index hits a record high, fuelled by the semiconductor industry’s growth, with TSMC leading the charge amid booming AI demand

Japan

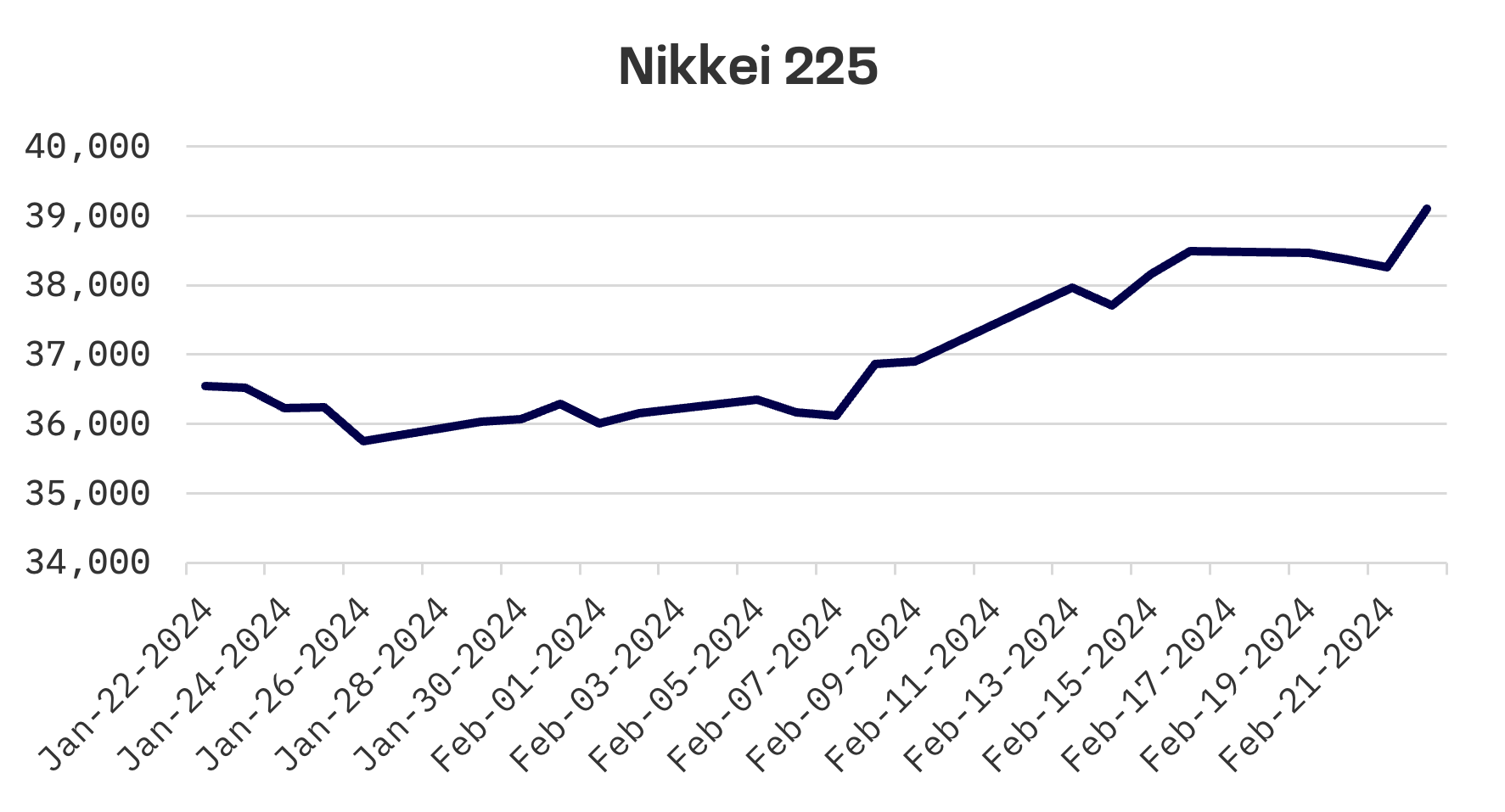

The Japanese stock market reached a historic milestone on Thursday, with the Nikkei 225 Index breaking past its previous high from December 1989.

This achievement reflects Japan’s solid economic recovery and corporate earnings strength, instilling investor confidence. Despite a challenging week marked by a losing streak, the market rallied impressively on Thursday, ahead of the Emperor’s Birthday holiday, closing the week with a 1.6% gain.

On the economic data front, Japan began the week on a strong note with core machinery orders for December rising by a seasonally adjusted 2.7%, marking a sharp recovery from a 4.9% contraction in November. This turnaround resulted in a less than anticipated annual decline of 0.7% in machine orders, underscoring the manufacturing sector’s durability.

Japan’s export figures for January were notably robust, achieving a record high and marking the second consecutive month of expansion at an 11.9% increase. This growth alleviates concerns around diminishing global demand. Contributing to the optimistic outlook, a decrease in energy imports has substantially narrowed Japan’s trade deficit, cutting it down to roughly half its size from the previous year.

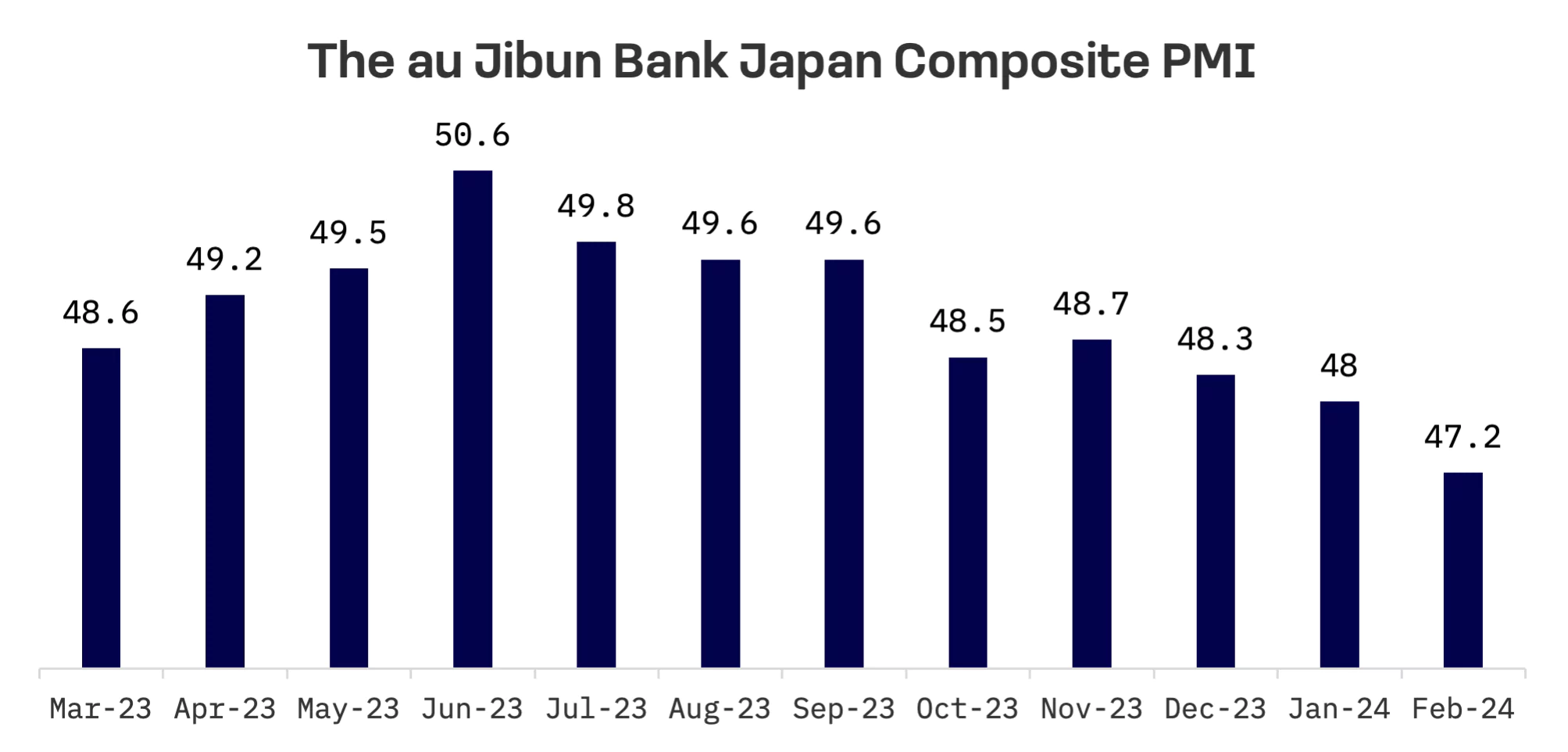

Later in the week, Japan’s manufacturing sector presented a bleaker outlook, with the Purchasing Managers’ Index (PMI) slipping to 47.2 from January’s 48.0, signaling persistent contraction. Conversely, the services sector’s PMI, despite a slight decrease from 53.1 in January to 52.5 in February, continues to reflect growth, albeit at a reduced pace.

Compounding the market’s dynamics, comments from Bank of Japan Governor Kazuo Ueda sparked optimism. He conveyed confidence in the nation’s path toward moderate inflation paired with wage increases. The financial community remains keenly observant of the central bank’s next move to end its negative interest rate policy and pivot from its longstanding expansive monetary strategy.

South Korea

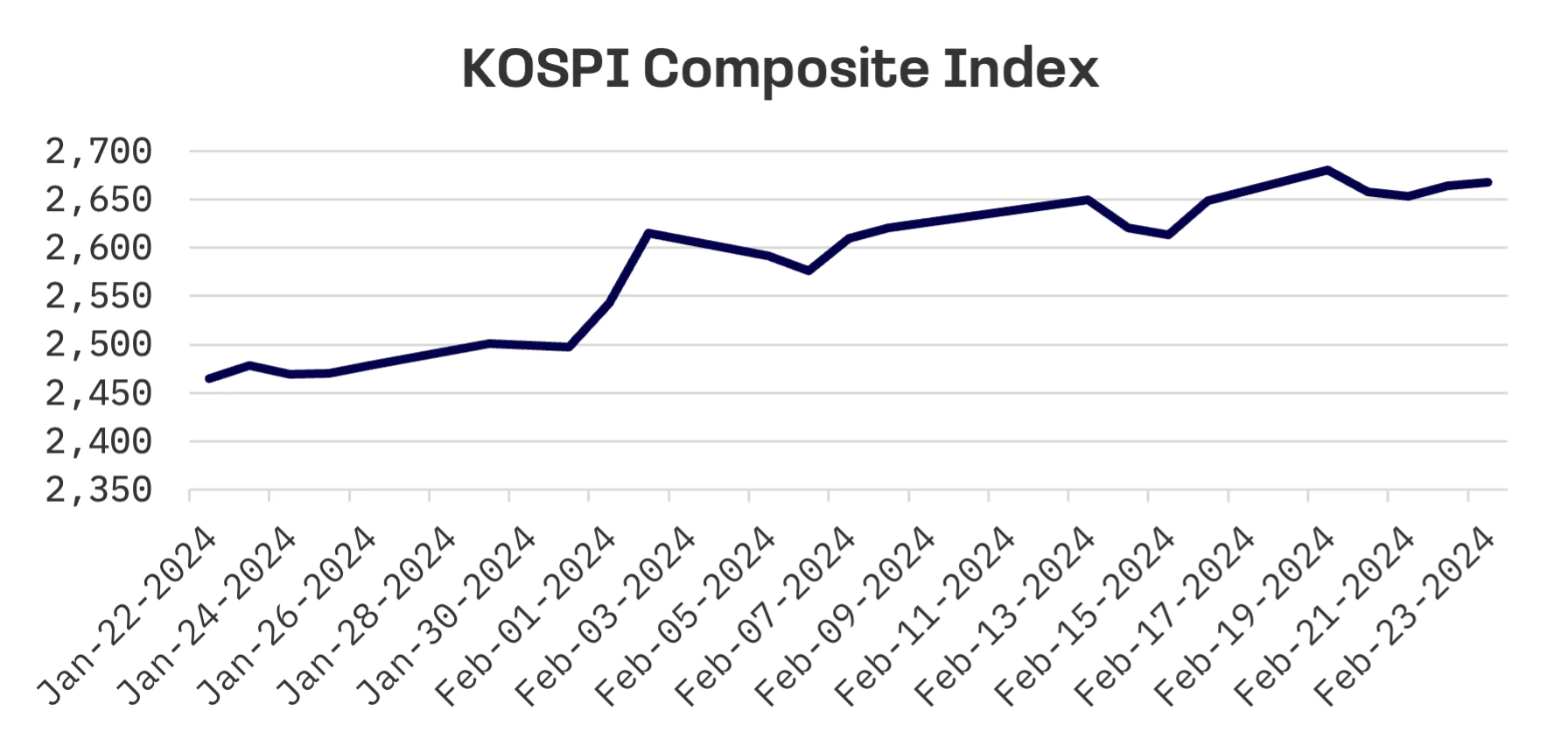

The KOSPI index in South Korea leaped by 5.5% over the week, the largest one-week percentage gain since the week ending November 11, 2022, buoyed by optimism surrounding the upcoming “Corporate Value-up Program.” These reforms, aimed at improving corporate governance and enhancing shareholder value, are crucial for unlocking the potential of South Korean companies, long constrained by the opaque practices of chaebol conglomerates.

The reform package includes measures to encourage undervalued companies to reveal value enhancement plans and to introduce an index of firms showing strong shareholder value. The finance minister last week highlighted considerations for tax incentives designed to motivate companies to increase shareholder returns. Additionally, plans are underway to create individual savings accounts that offer tax breaks on dividends and interest income from local stocks.

Korean stocks received an additional boost from investor confidence in local technology shares, spurred by Nvidia’s strong earnings report and upward revision of its full-year guidance, reflecting high demand for its chips, particularly in AI applications. Despite a 7.8% year-on-year decline in Korea’s exports for the first 20 days of the current month, primarily due to weakened demand from China and fewer working days, semiconductor sales witnessed a nearly 40% increase during the same period, highlighting the sector’s strong performance.

The Bank of Korea (BOK) has opted to keep its policy rate steady at 3.5% for the ninth consecutive session, citing the slower than expected easing of inflation as a reason for caution against rate cuts. Governor Rhee Chang-yong further emphasised the difficulty of reducing the key rate by the end of the first half of this year, reaffirming the central bank’s cautious stance on monetary easing.

Taiwan

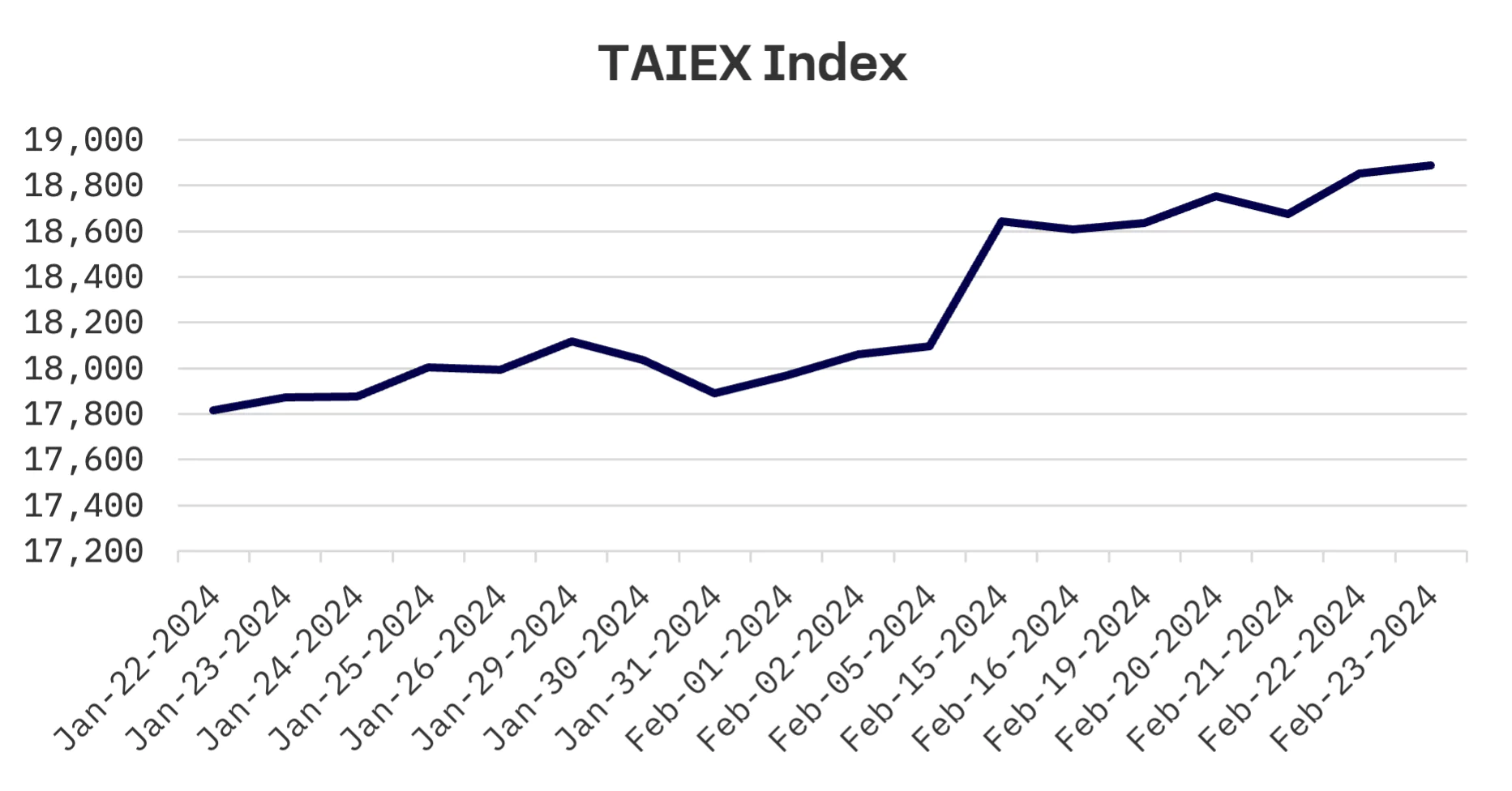

The Taiwanese stock market continued its ascent, with the TAIEX index climbing 1.5% over the week to reach an all-time high. A significant driver of this growth was Taiwan Semiconductor Manufacturing (TSMC), a pivotal foundry service provider for Nvidia’s AI chips, alongside other AI-related stocks.

The production value of Taiwan’s semiconductor sector is on track to set a new record in 2024, with a forecasted increase of over 15% from the previous year. This optimistic projection is supported by strong demand for AI applications and the waning effects of inventory adjustments. The Industrial Technology Research Institute (ITRI) announced on Monday that the sector’s output is expected to achieve NT$5.01 trillion (approximately US$160 billion) in 2024.

JAKOTA Blue Chip 150 Index

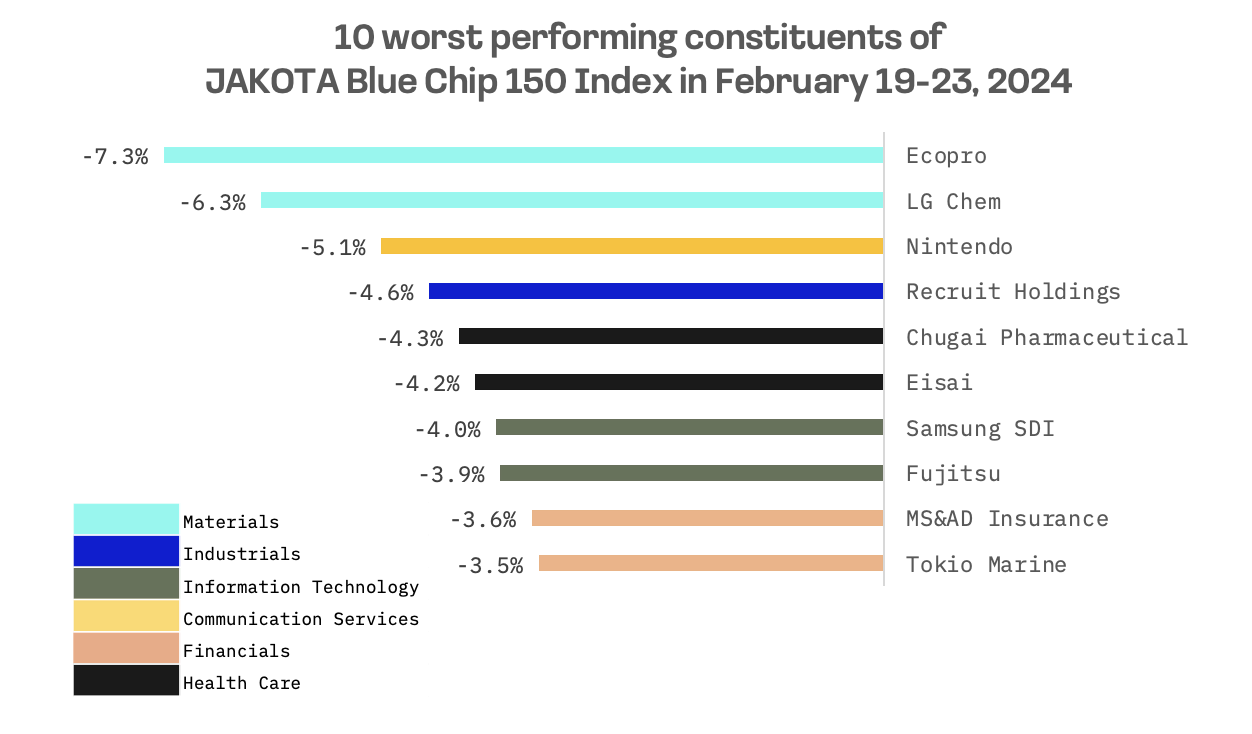

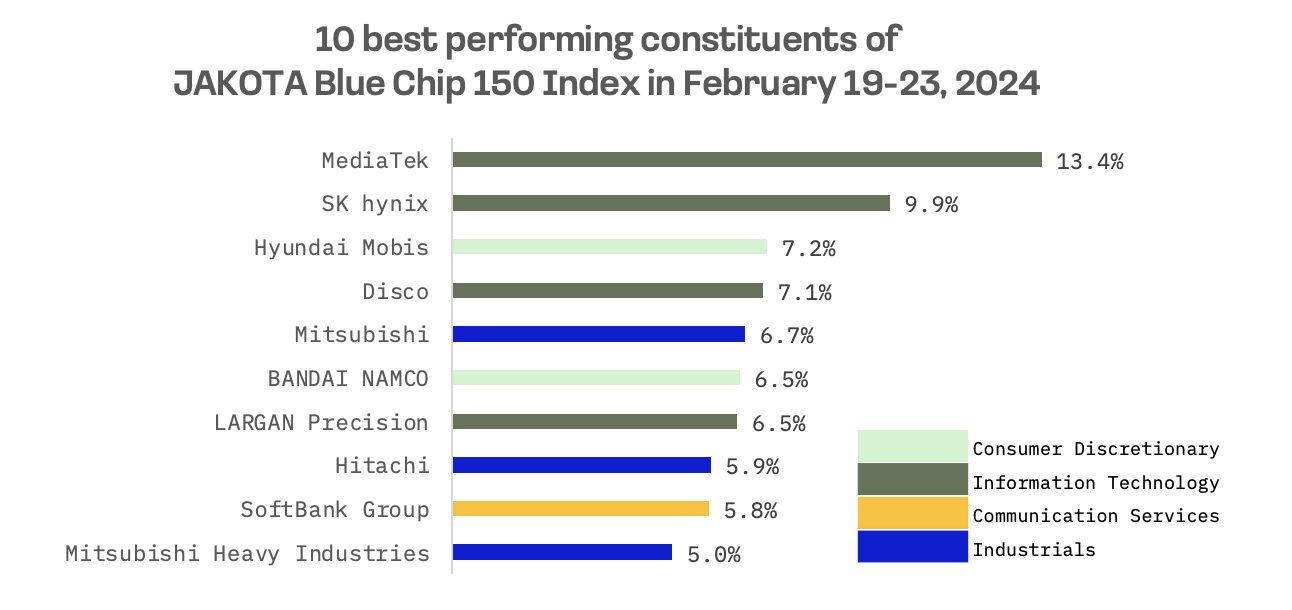

The JAKOTA Blue Chip 150 Index saw a modest increase of 0.9%, with 98 of its 150 constituents posting gains.

Heading up the curve, MediaTek, a Taiwanese fabless semiconductor company, enjoyed a notable boost, buoyed by Nvidia’s robust earnings report. MediaTek captivated attention at the World Communications Conference with its pioneering advancements in 6G technology. MediaTek’s flagship mobile chip Dimensity 9300 AI processor led the demonstration of generative AI applications, significantly bolstering the company’s market performance.

Conversely, EcoPro, a South Korean producer of secondary battery materials, faced a sharp downturn, dropping 7.3% and marking it as the index’s laggard for the week. The dip was largely attributed to profit-taking maneuvers and growing skepticism over the stock’s lofty valuation.