Last week’s JAKOTA markets:

- Japan’s Nikkei 225 Index recorded gains amidst a positive market reaction to the BoJ’s interest rate policy, rounding off a robust annual performance.

- The KOSPI in South Korea ascended to a significant high, with investor optimism overriding concerns indicated in manufacturing sector surveys.

- Taiwan’s TAIEX index surged, fueled by strong sectoral performances and anticipation of easing U.S. interest rates.

- Notable developments involved economic data releases, central bank policy statements, and movements in leading stocks, reflecting the dynamic economic landscape of the region.

Japan

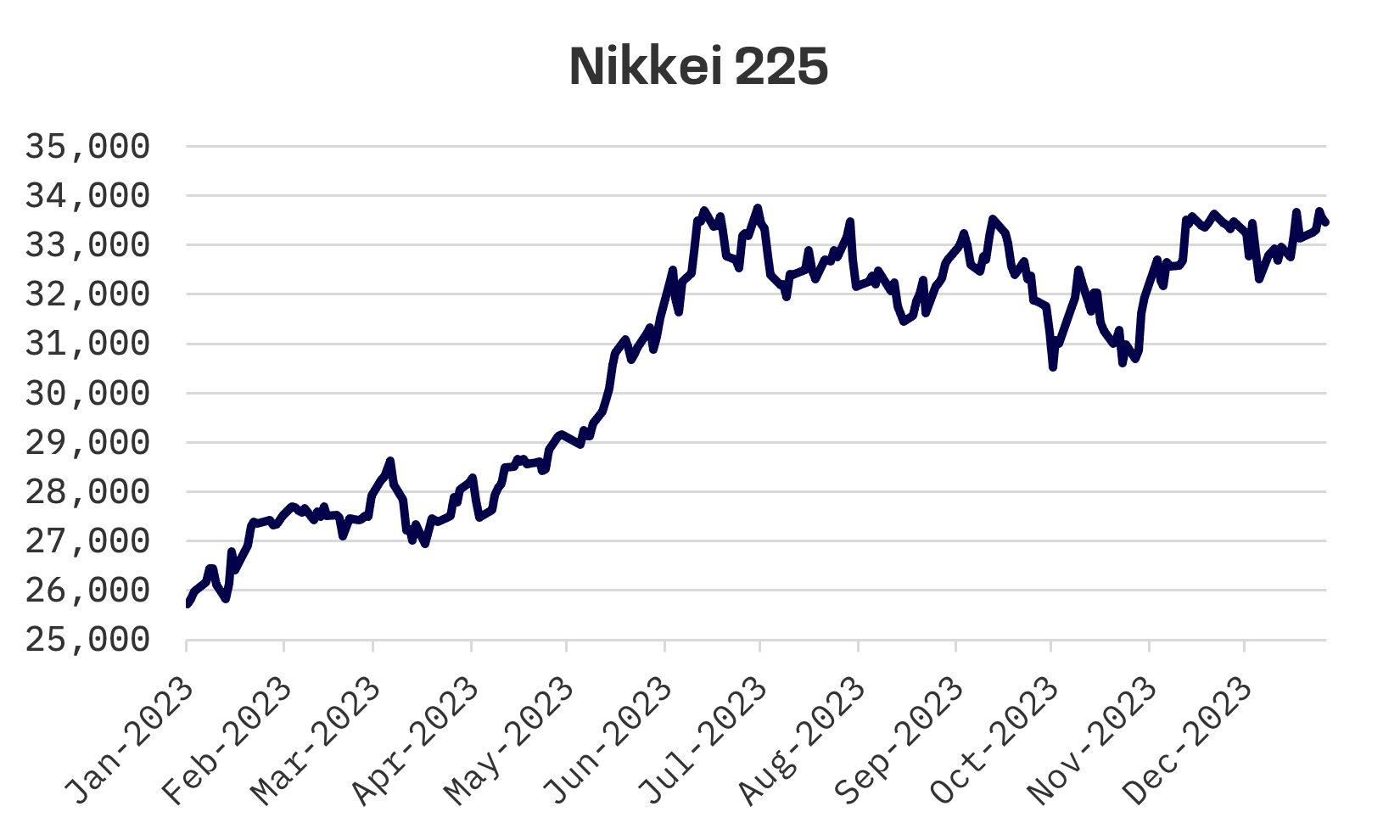

The Nikkei 225 Index in Japan concluded the week with a 0.89% gain amid muted trading before the New Year’s holiday. This rise in the Japanese stock market was fueled by investor optimism, driven by expectations that the Bank of Japan (BoJ) would persist with its ultralow interest rate policy. Remarkably, the Nikkei achieved a 28% annual surge in 2023, its most significant since 2013, positioning it as Asia’s top-performing index.

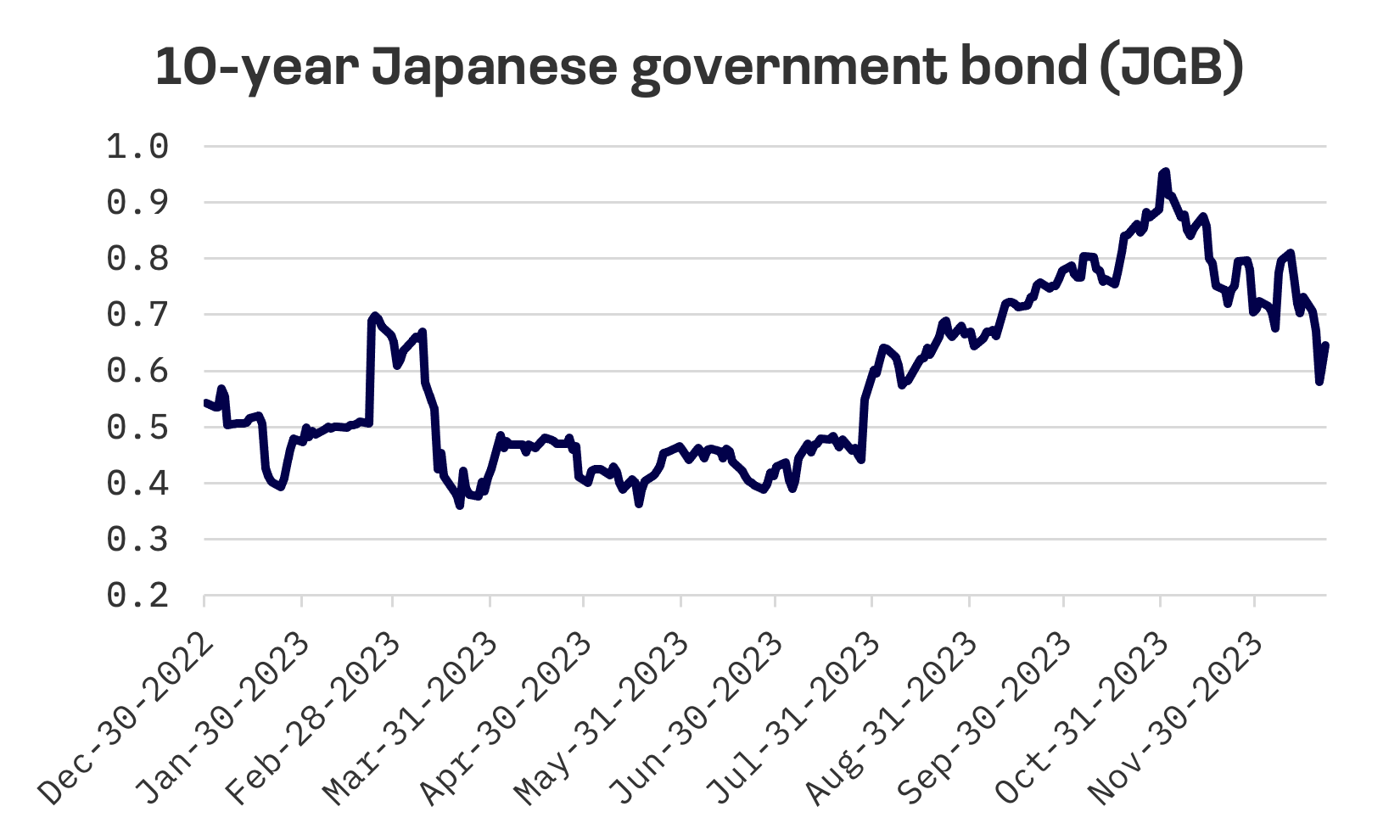

The yield on 10-year Japanese government bonds dipped to 0.64%, reflecting the market’s response to the BoJ’s December meeting, where discussions hinted at a potential exit from the stimulus program.

Economic indicators in Japan painted a mixed picture, though with limited impact on the market. In November, the unemployment rate remained constant at 2.5%. Industrial output saw its first decline in three months, but the decrease was less pronounced than anticipated, suggesting resilience in the sector. On the other hand, retail sales exhibited robust year-over-year growth, signaling a sustained recovery from the downturn caused by the pandemic.

Bank of Japan (BoJ) Governor Kazuo Ueda stated that the likelihood of achieving the central bank’s 2% inflation target is “gradually rising.” Ueda hinted that the BoJ might consider a policy shift if the probability of sustainably reaching this inflation target increases “sufficiently.” He particularly emphasized the importance of the forthcoming wage negotiations in the spring, highlighting the critical role that ongoing wage increases play in driving service prices higher.

However, despite Ueda’s remarks, a summary of opinions from the BoJ’s December policy meeting portrayed a more cautious approach among the central bank members regarding exiting the economic stimulus program. The summary revealed that members are not feeling pressed to rush their exit strategy, asserting that the BoJ has “sufficient leeway” to wait for more comprehensive wage data before making any decisive policy changes.

South Korea

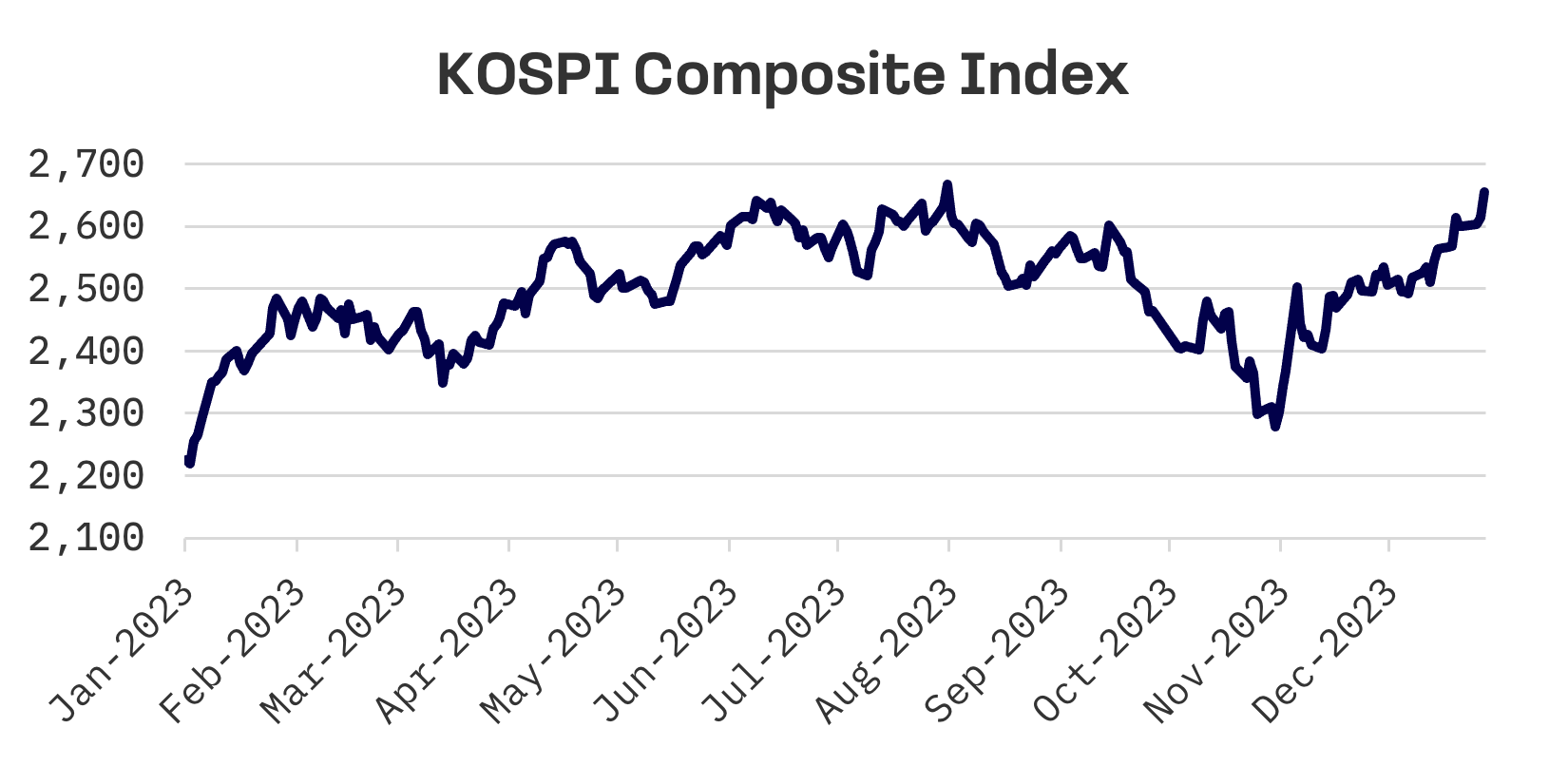

The KOSPI Composite Index in South Korea climbed 2.1% in a shortened trading week, hitting 2,655 points on December 28, its highest since early August, buoyed by robust foreign and institutional buying.

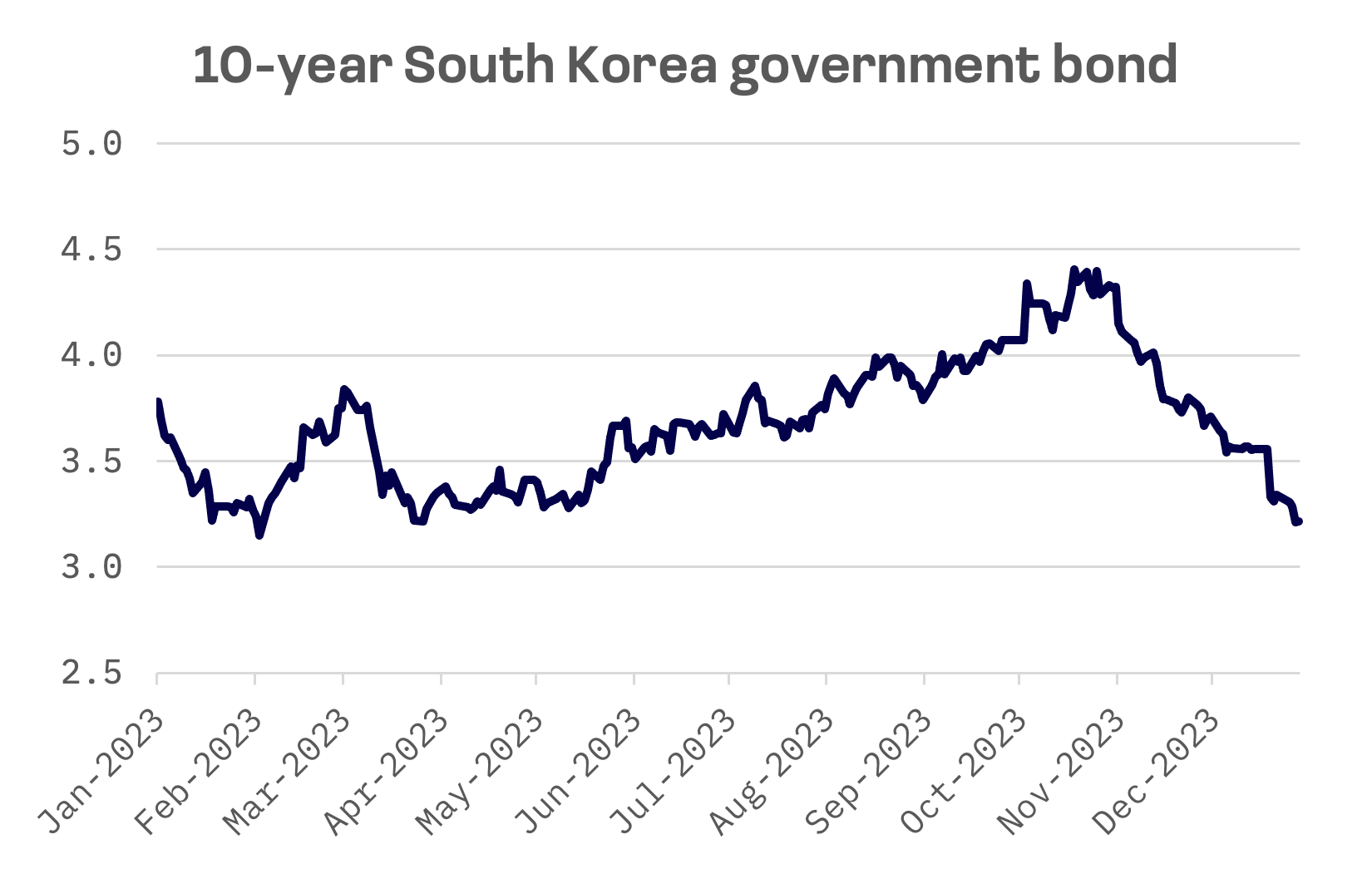

This increase occurred despite the 10-year government bond yield falling to 3.22%, its lowest since February, amid expectations of a more dovish monetary policy in the upcoming year.

In the midst of the market’s upward trend, there was notable hesitancy among investors, reflected in their reluctance to react strongly to negative lagging indicators. The Korea Chamber of Commerce and Industry (KCCI) conducted a comprehensive survey covering 2,156 manufacturing firms across South Korea. The survey results pointed towards a challenging first quarter in 2024 for these manufacturers, driven by concerns about weakening domestic demand and rising costs of materials.

The Business Sentiment Index (BSI) for the January-March period fell to 83, a decrease of 1 point from the current quarter, marking this as the third consecutive quarterly decline. This BSI score, which sits below the 100 threshold, signals a growing pessimism among businesses, indicating a general expectation of deteriorating business conditions. The survey thus highlights the economic challenges confronting South Korean manufacturers, particularly the impact of sluggish local demand and increased material costs on their operations.

Taiwan

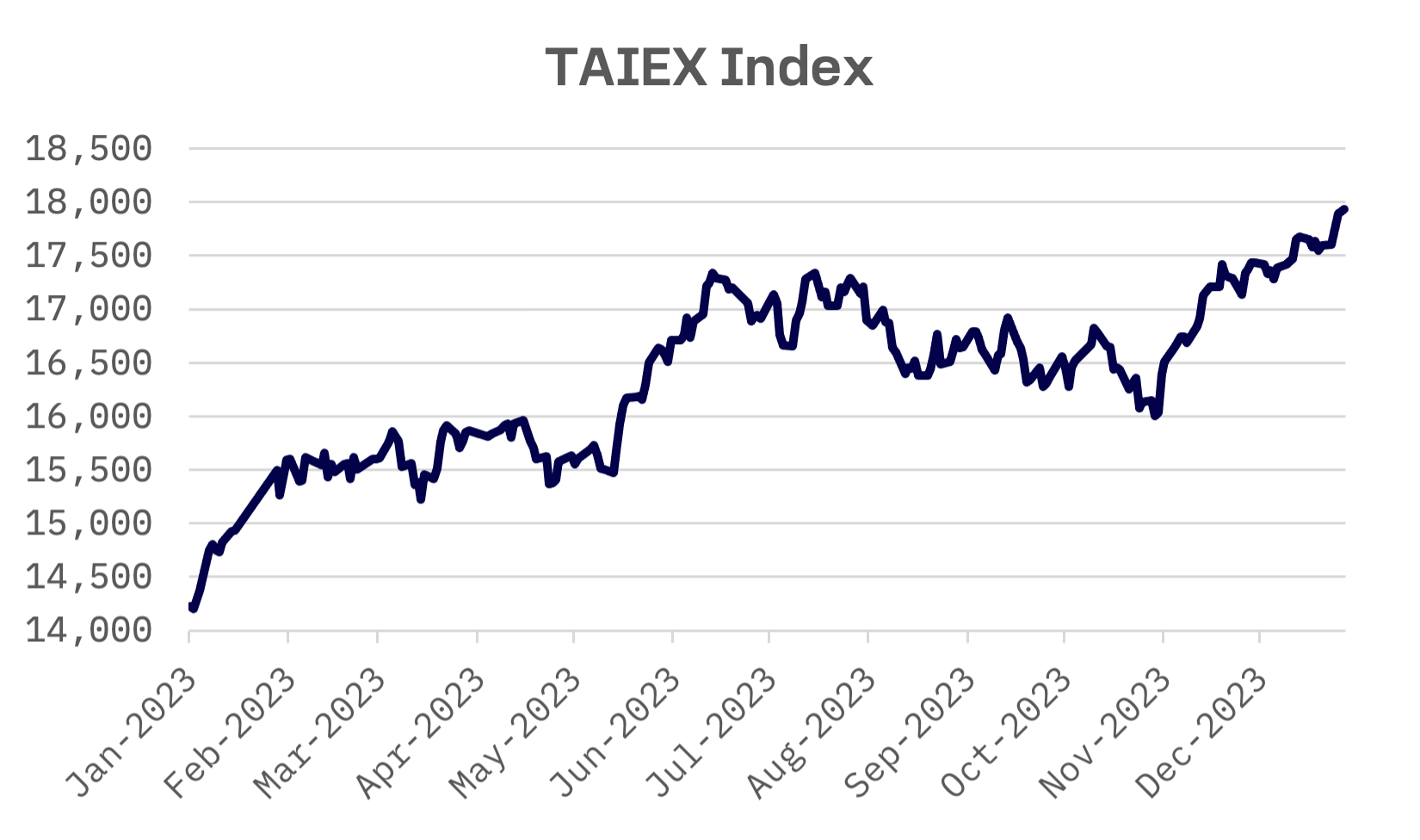

Taiwan’s stock market trended positively, with the TAIEX index gaining 1.9%, buoyed by expectations of the U.S. Federal Reserve cutting interest rates amid weakening inflation.

On the final trading day of 2023, Taiwan’s TAIEX index achieved a significant milestone, climbing to 17,930.81. This marked an impressive surge of 3,793 points, or 26.7 percent, compared to its closing figures in 2022. The remarkable rise in the index was primarily driven by the performance of Taiwan Semiconductor Manufacturing.

In terms of economic data, Taiwan’s manufacturing sector continued to show signs of a slowdown, extending its sluggish performance into the fifth consecutive month in November. This was highlighted in a report by the Taiwan Institute of Economic Research (TIER) released on Friday. TIER’s data indicated that the composite index for the manufacturing sector fell by 0.69 points compared to the previous month, settling at 10.71 in November.

Conversely, Taiwan’s local economy showed signs of improvement in November. The National Development Council (NDC) reported on Wednesday that its index for assessing economic fundamentals had surged to its highest level in over a year, indicating a move away from contraction.

JAKOTA Blue Chip 150 Index

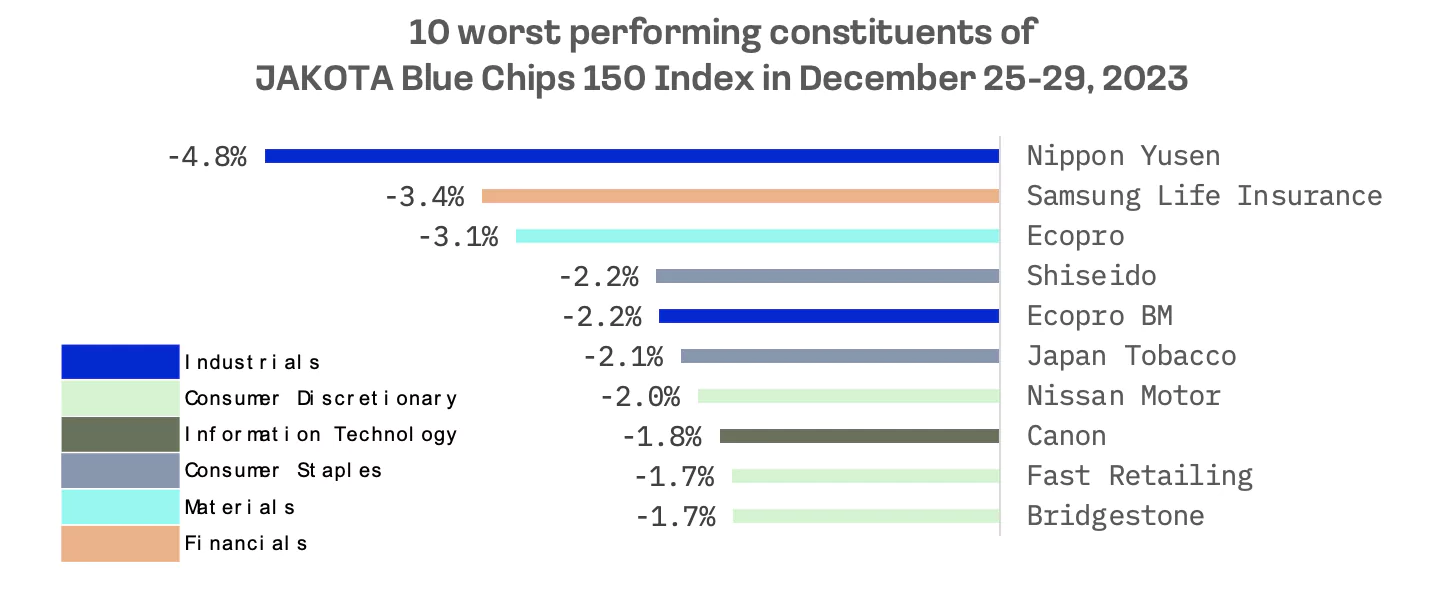

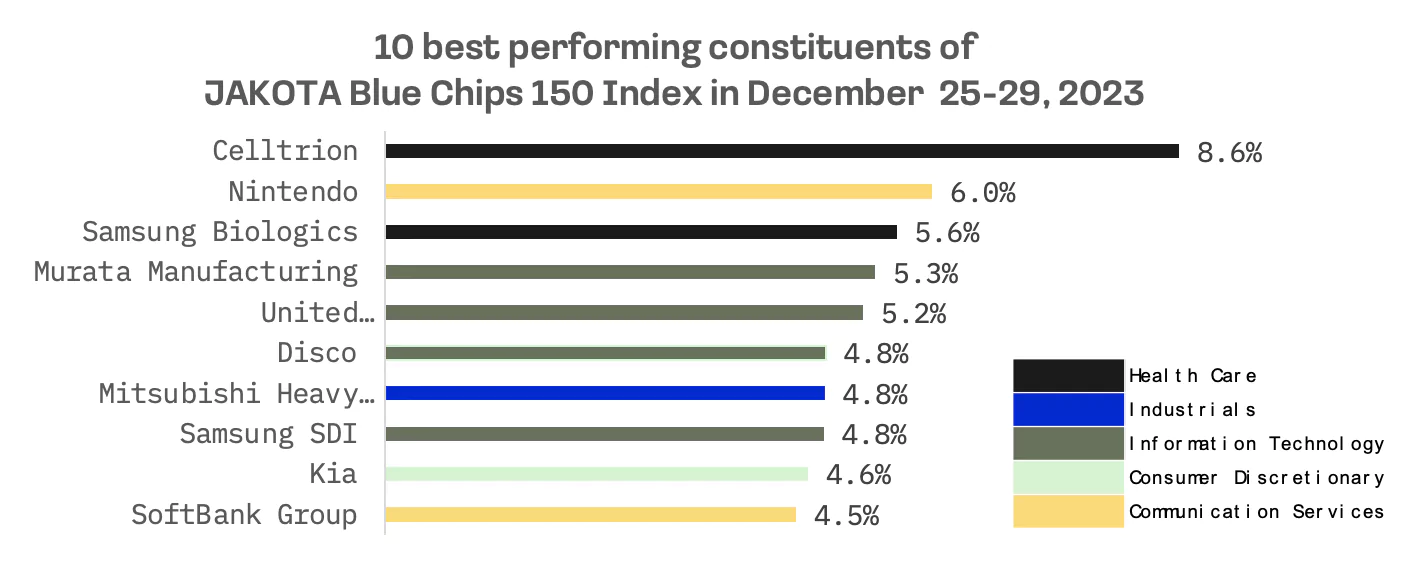

The JAKOTA Blue Chip 150 Index advanced 2.63% in the final week of 2023, closing at 119.98. Of its 149 constituents, 118 stocks showed positive movements.

Celltrion, a biopharmaceutical company, emerged as the strongest performer in the JAKOTA Blue Chip 150 Index this week, registering an impressive surge of 8.6%. This notable increase was primarily driven by the culmination of Celltrion’s long-awaited merger with Celltrion Healthcare, a plan initially proposed three years ago. The company announced that its board had approved the merger on Thursday.

In contrast, Nippon Yusen, a shipping and logistics company, which had topped the JAKOTA Blue Chip 150 Index in the preceding week, saw its stock price decline by 4.8% this week. This correction is attributed mainly to technical factors, as the shares were considered overbought.