Last week’s Jakota markets:

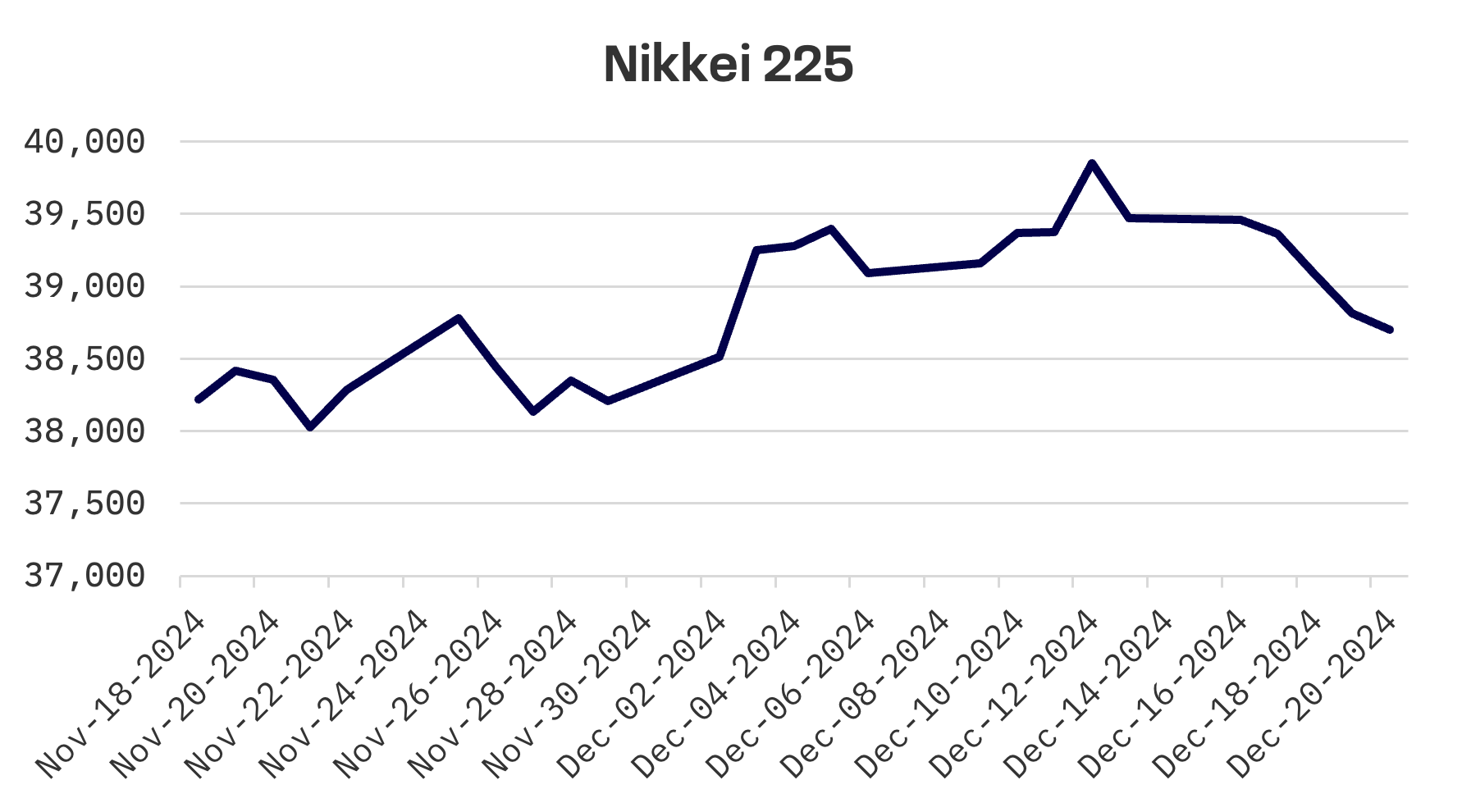

- Japan’s Nikkei 225 Index fell 2% as banking stocks weakened, while a steep yen depreciation above ¥156 benefitted exporters

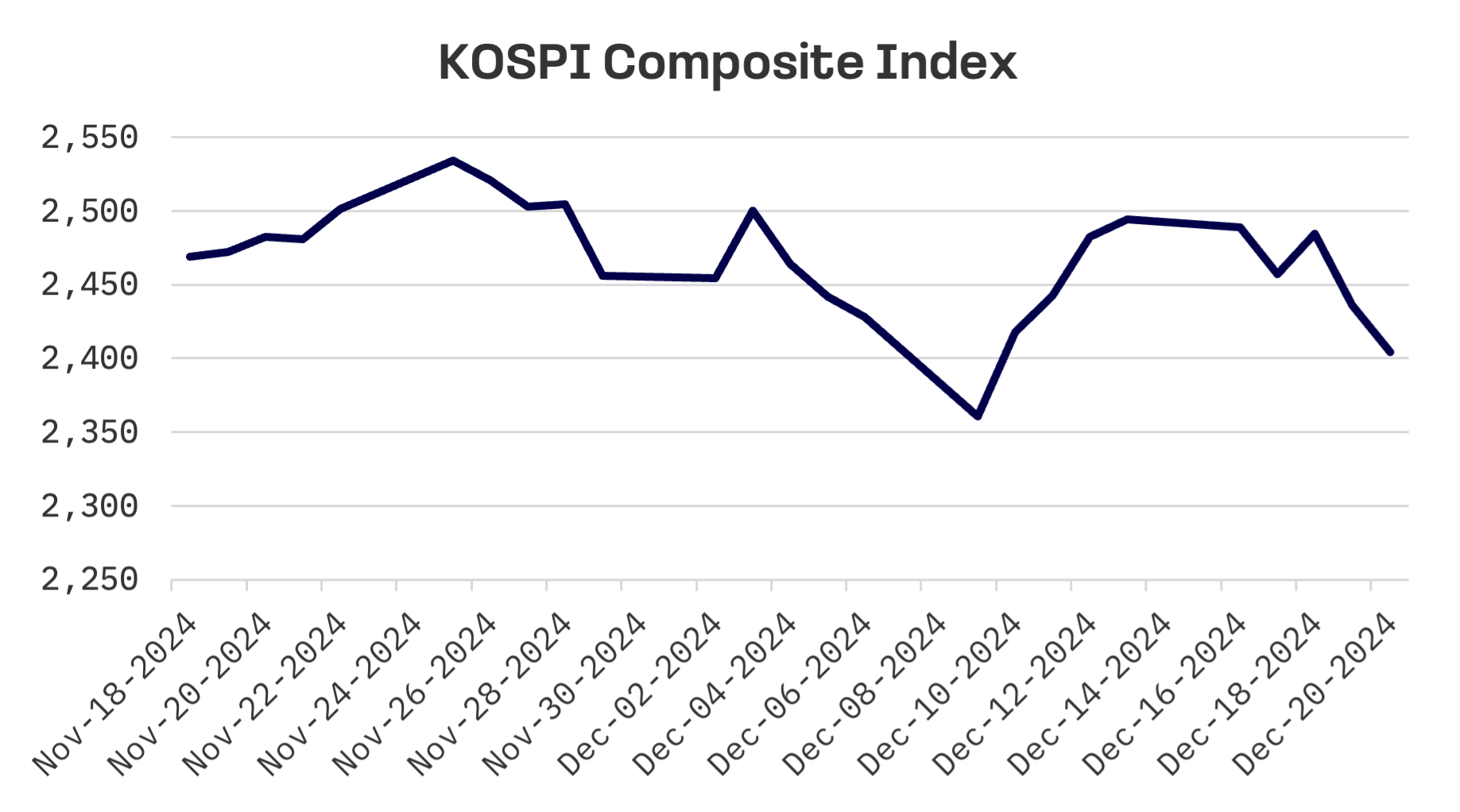

- South Korea’s KOSPI slumped 3.6%, with battery stocks leading losses on concerns over U.S. EV policy shifts under the incoming Trump administration

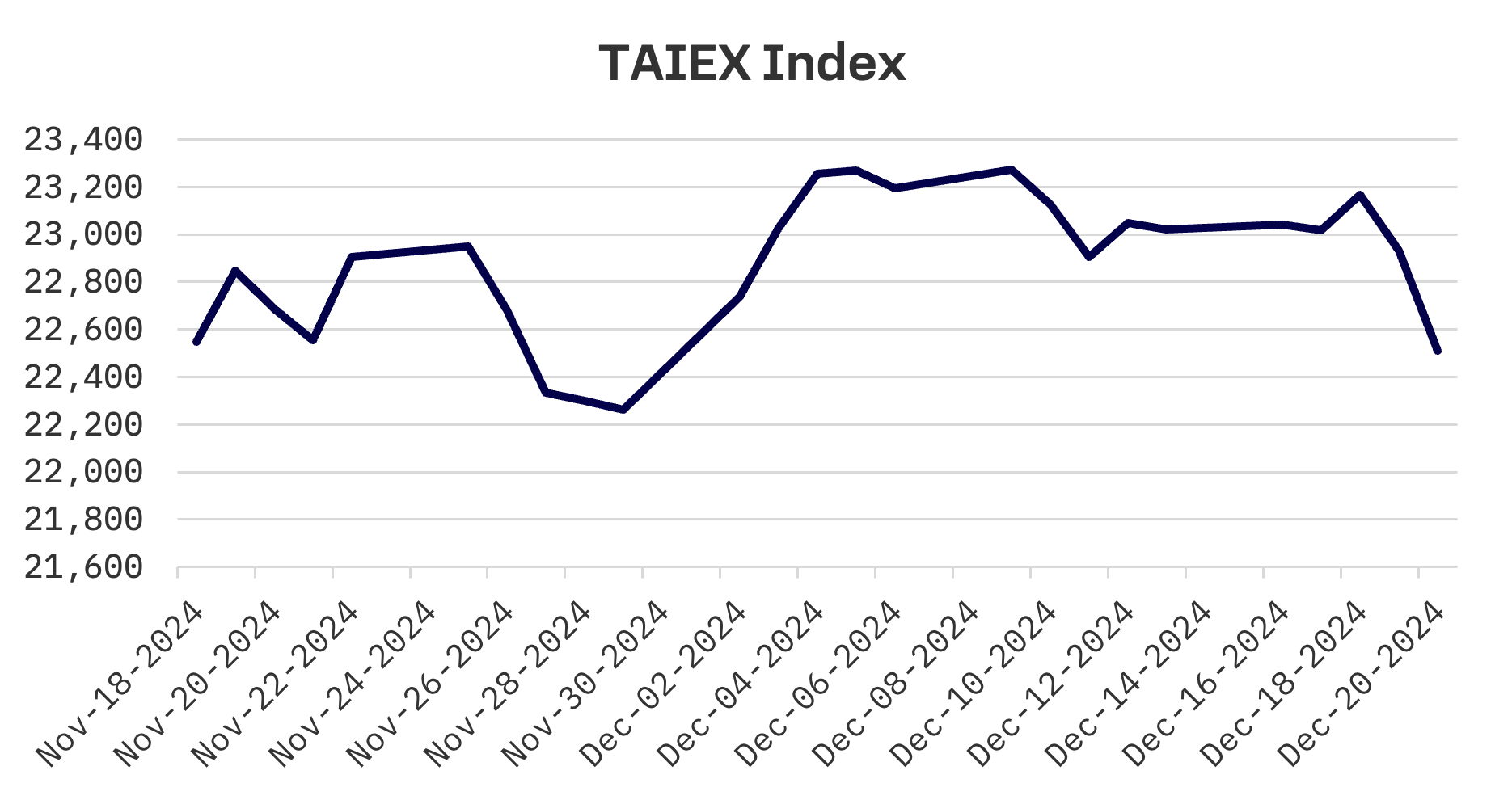

- Taiwan’s TAIEX Index decreased 2.2%, aligning with regional weakness after the Federal Reserve dampened hopes for aggressive rate cuts

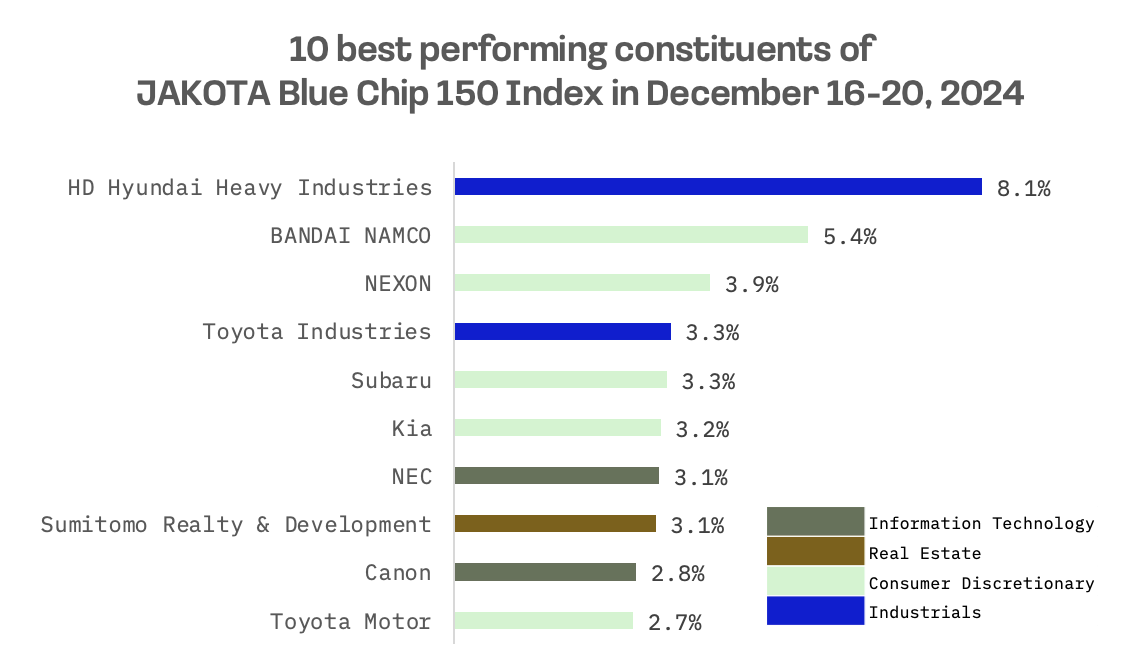

- The JAKOTA Blue Chip 150 Index dropped 3.9%, with HD Hyundai Heavy Industries emerging as a rare bright spot amid broad market weakness

Japan

The Nikkei 225 Index fell 2% this week as banking stocks declined amid speculation that the Bank of Japan (BoJ) might adopt a more gradual approach to normalising monetary policy.

A sharp depreciation in the yen benefitted exporters, particularly automakers, enhancing their profit prospects. The currency weakened to above ¥156 against the dollar from around ¥154 a week earlier, prompting Japanese officials to issue verbal warnings aimed at supporting the yen.

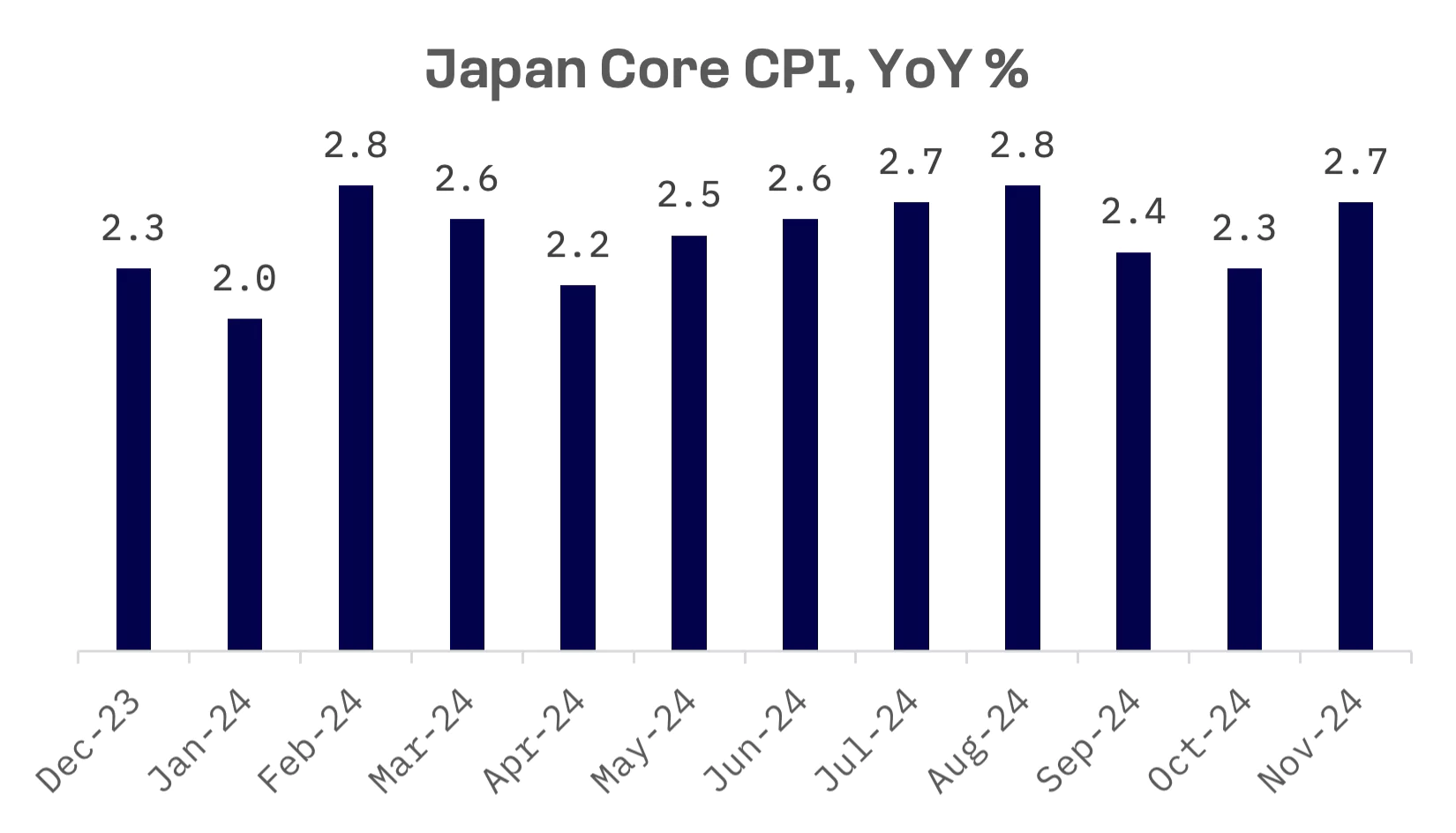

The BoJ maintained its policy rate at 0.25% at its December 18-19 meeting, with Governor Kazuo Ueda’s subsequent comments viewed as dovish by markets. The possibility of a rate increase may extend beyond January, as Ueda emphasised that clearer wage trends would emerge in March/April and cited U.S. economic policy as an ongoing concern. Before its next meeting, the central bank will receive two additional consumer price index (CPI) reports, a new outlook report and insights from a bank managers’ meeting that will include preliminary wage data for 2025 – factors likely to strengthen the case for eventual tightening.

Japan’s nationwide core CPI, which excludes fresh food, rose 2.7% in November from a year earlier, surpassing economists’ expectations of 2.6% and accelerating from October’s 2.3% increase. The upturn, marking a three month high in consumer inflation, intensified pressure on the central bank to consider raising rates.

South Korea

The KOSPI index dropped 3.6% this week, dragged down by battery and tech stocks. Battery related shares fell after reports suggested the incoming Trump administration might seek to roll back electric vehicle (EV) tax credits. Market sentiment deteriorated further on Thursday when the Federal Reserve indicated a more cautious stance towards monetary easing in 2024.

On Wednesday, South Korea’s central bank governor moved to minimise concerns about economic disruption following Parliament’s vote to impeach President Yoon Suk Yeol, stating the impact on the nation’s economy would be limited.

The Bank of Korea (BOK) said it would keep its inflation target at 2%. Governor Rhee indicated consumer inflation, which recently fell below the target, would likely stabilise around 2% next year.

Taiwan

The TAIEX Index declined 2.2% this week amid broad selling pressure, following sharp losses in U.S. markets after the Federal Reserve signalled a slower pace of potential rate cuts.

In line with other central banks in the Jakota region, the Central Bank of the Republic of China (Taiwan) kept its key interest rates steady at its quarterly policy meeting, marking three straight quarters of unchanged monetary policy.

JAKOTA Blue Chip 150 Index

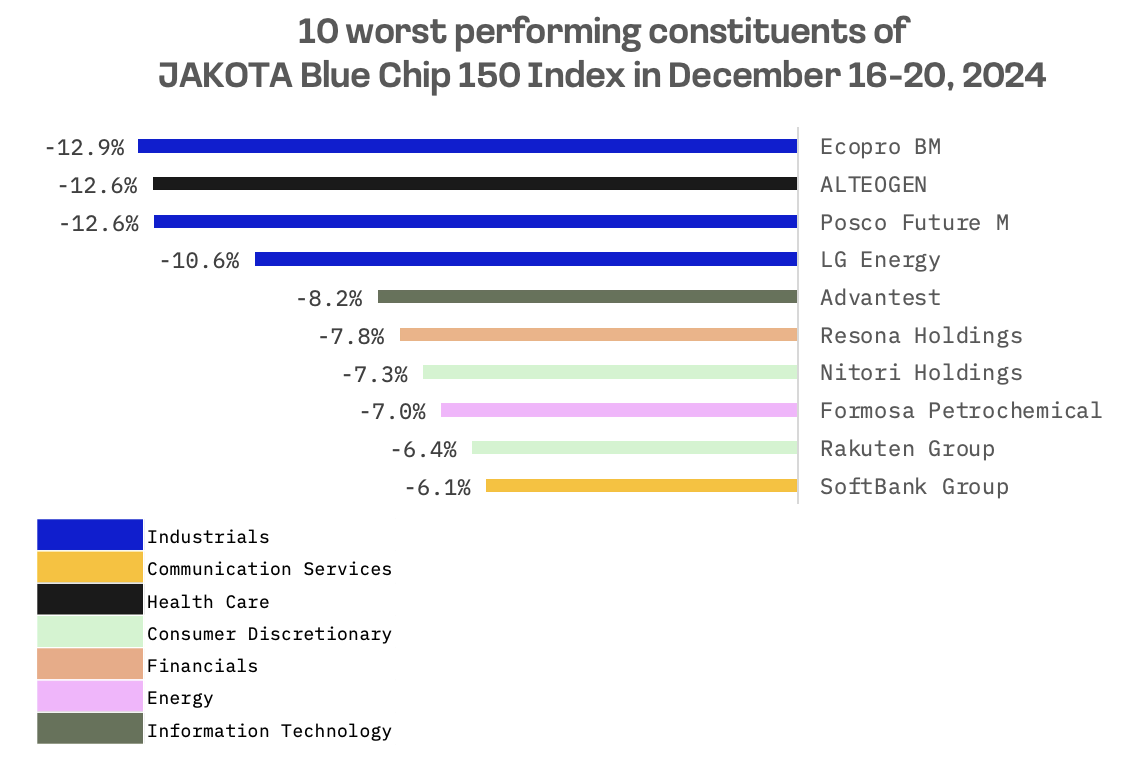

The JAKOTA Blue Chip 150 Index plummeted 3.9% this week, with only 28 of its 150 constituent stocks posting gains.

HD Hyundai Heavy Industries, the world’s largest shipbuilder, maintained its position as the index’s top performer for a second consecutive week. Shipbuilding stocks, which had been under pressure from martial law concerns, continued their recovery. Investors were encouraged by prospects of the company entering the U.S. Navy’s maintenance, repair and overhaul (MRO) business.

Korean battery manufacturers, including Ecopro BM, Posco Future M and LG Energy, ranked among the week’s worst performers amid concerns about potential rollbacks of EV tax credits under the incoming Trump administration.

Under current U.S. policy, drivers can receive up to $7,500 in federal tax credits for purchasing or leasing a new EV, with smaller credits available for used ones. The incoming administration has characterised these credits as wasteful spending, creating uncertainty about their future.