Last week’s JAKOTA markets:

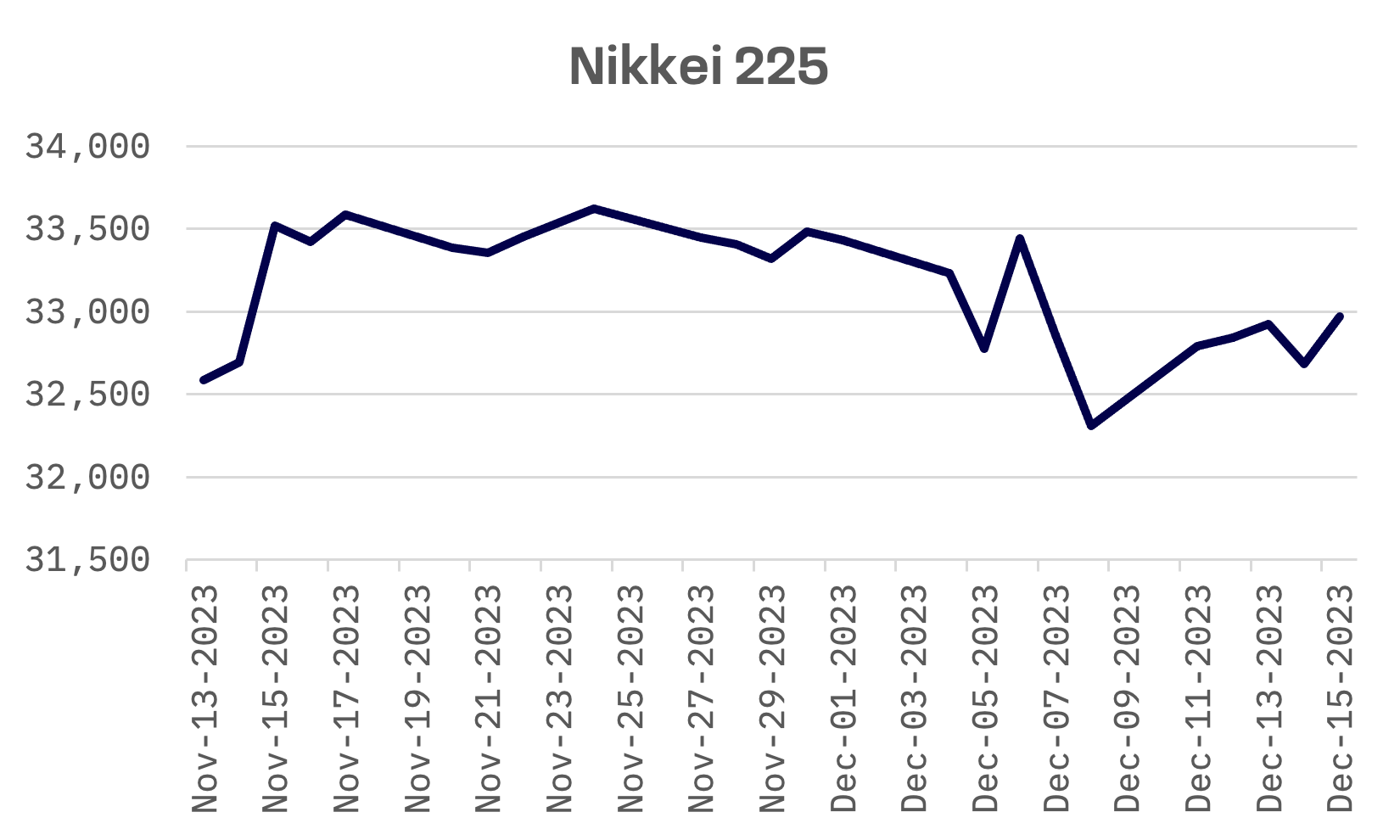

- Japan’s Nikkei 225 Index rises 2.1%, influenced by the U.S. Federal Reserve’s dovish stance.

- South Korea’s KOSPI continues its upward trajectory amid positive economic signals.

- Taiwan’s TAIEX sees gains, closing at a high not seen since March 2022.

- Key developments include shifts in bond yields, manufacturing and service sector activities, and policy adjustments from central banks – all contributing to a dynamic market environment across the region.

Japan

The Nikkei 225 Index in Japan saw a 2.1% rise this week, buoyed by the U.S. Federal Reserve’s shift from monetary tightening, stabilised interest rates and signaled rate cuts for 2024. This development was reflected in U.S. markets, with the S&P 500, Nasdaq Composite, and Dow Jones Industrial Average extending their gain streaks, with the S&P 500 achieving its longest gain streak since 2017 and the Dow reaching a record high.

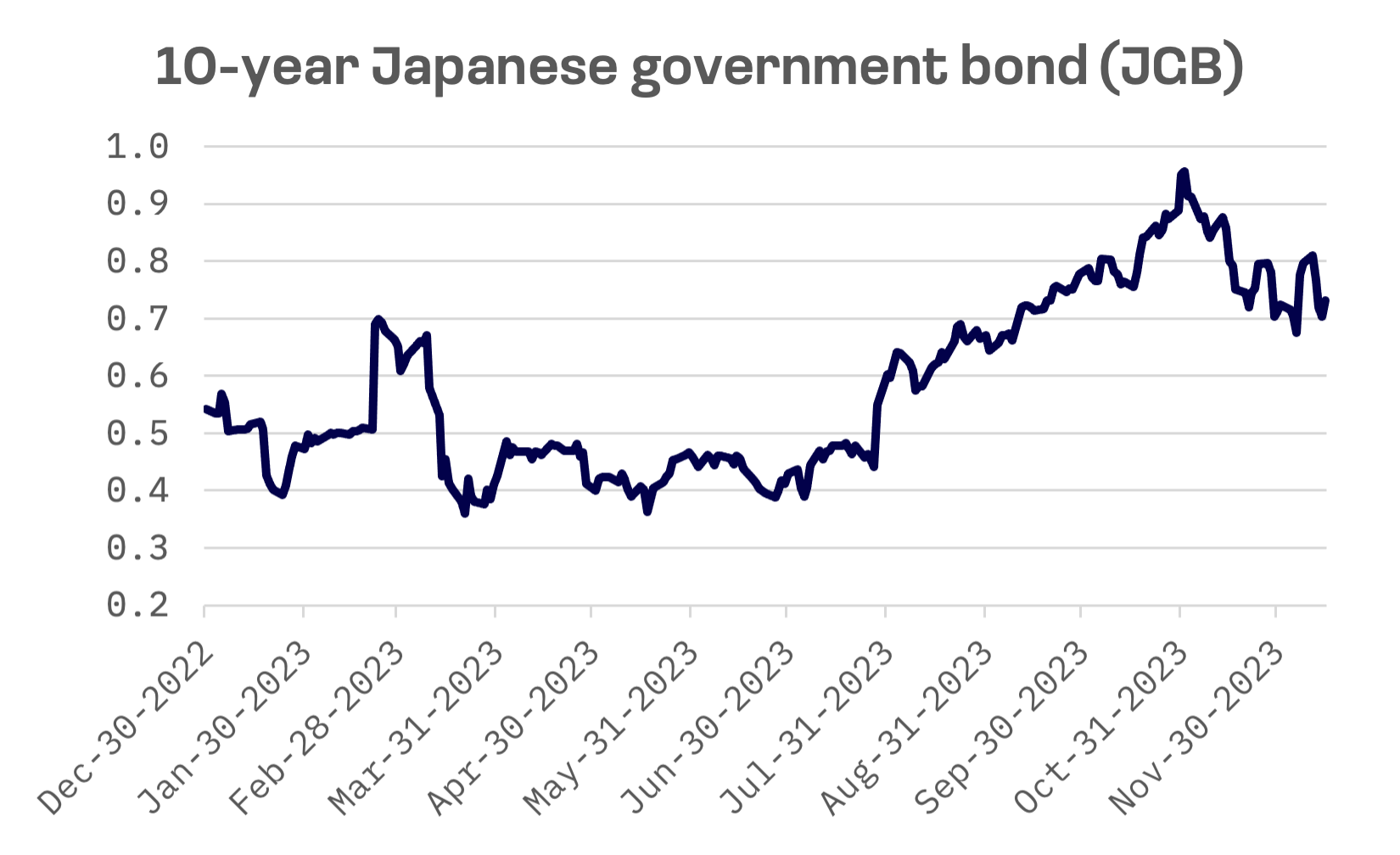

Japanese government bond yields softened, with the 10-year yield decreasing to 0.73% amid speculation about the Bank of Japan’s (BoJ) potential shift from its negative interest rate policy, largely influenced by the Fed’s policy pivot. On Wednesday, the Fed hinted at three potential rate cuts in the upcoming year.

The yen strengthened against the U.S. dollar, reaching JPY 141 – in anticipation of narrowed U.S.-Japan interest rate differentials – posing a challenge for Japan’s export-driven sectors.

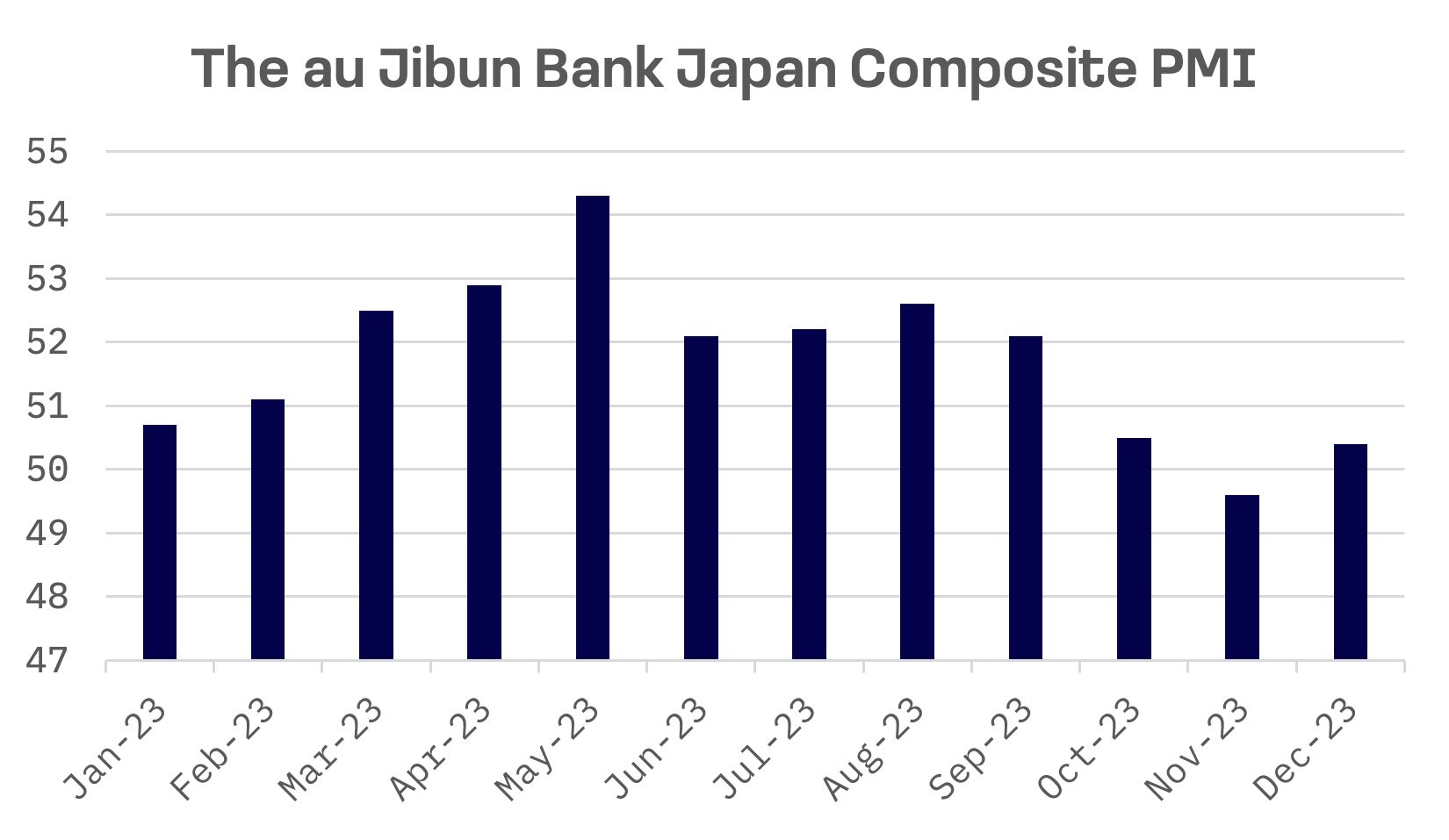

The au Jibun Bank Flash Japan composite PMI, encompassing both manufacturing and service sector activities, saw a modest increase in December, rising to 50.4 from 49.6 in November. The modest increase was primarily driven by a boost to services activity, offsetting a more pronounced contraction within the manufacturing sector.

Business sentiment among Japan’s major manufacturers has shown consistent improvement for the third consecutive quarter, indicating positive signs of recovery in both domestic and international demand. The Bank of Japan’s latest quarterly Tankan survey, released on Wednesday, revealed that the headline diffusion index (DI) for large manufacturers climbed to plus 12 in the October to December quarter, up from plus 9 in the preceding quarter. The figure not only reflects an upward trend but also exceeds the median forecast of plus 10, based on a Quick survey of economists.

The growing positive sentiment among manufacturers may pave the way for companies to consider raising wages. Such an increase could create upward movement in the price-wage spiral, a key element the Bank of Japan is monitoring as it moves towards further normalisation of its monetary policy.

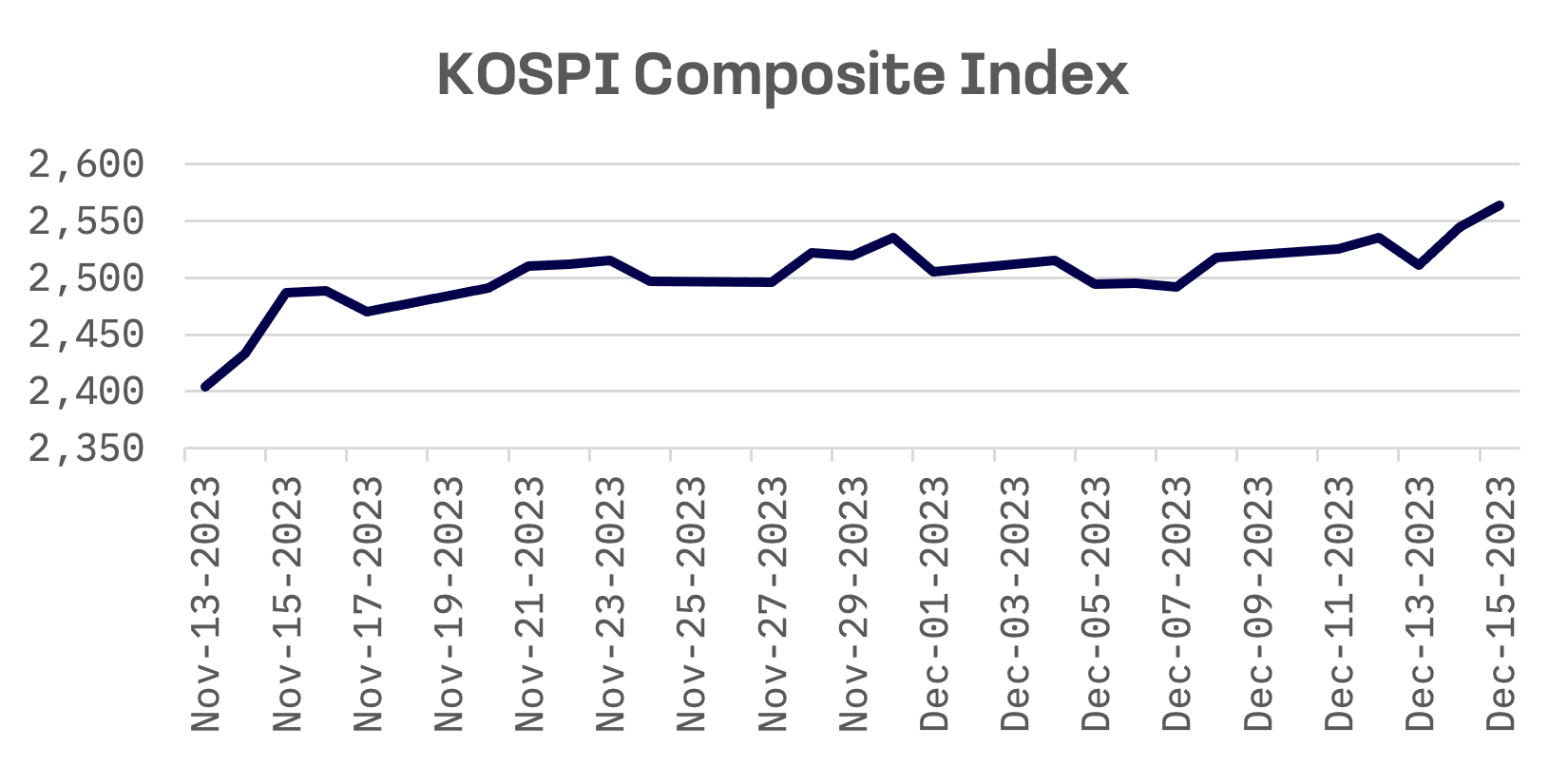

South Korea

The KOSPI Composite Index in South Korea continued its upward trend, rising 1.82% and extending its growth streak to seven weeks. The market’s resilience is partly attributed to optimism about a slowdown in U.S. inflation and anticipated Fed rate cuts, with chipmakers gaining on these expectations.

Efforts to enhance market transparency continued in South Korea, with a new mandate for major KOSPI-listed companies to provide English disclosures, as announced by Korea’s top financial regulator, the Financial Services Commission. Effective from January, companies with assets over 10 trillion won ($7.6 billion) must release English disclosures within three days of Korean submissions, focusing on dividends, capital changes, and trading status. However, companies with less than 5% foreign ownership are exempt.

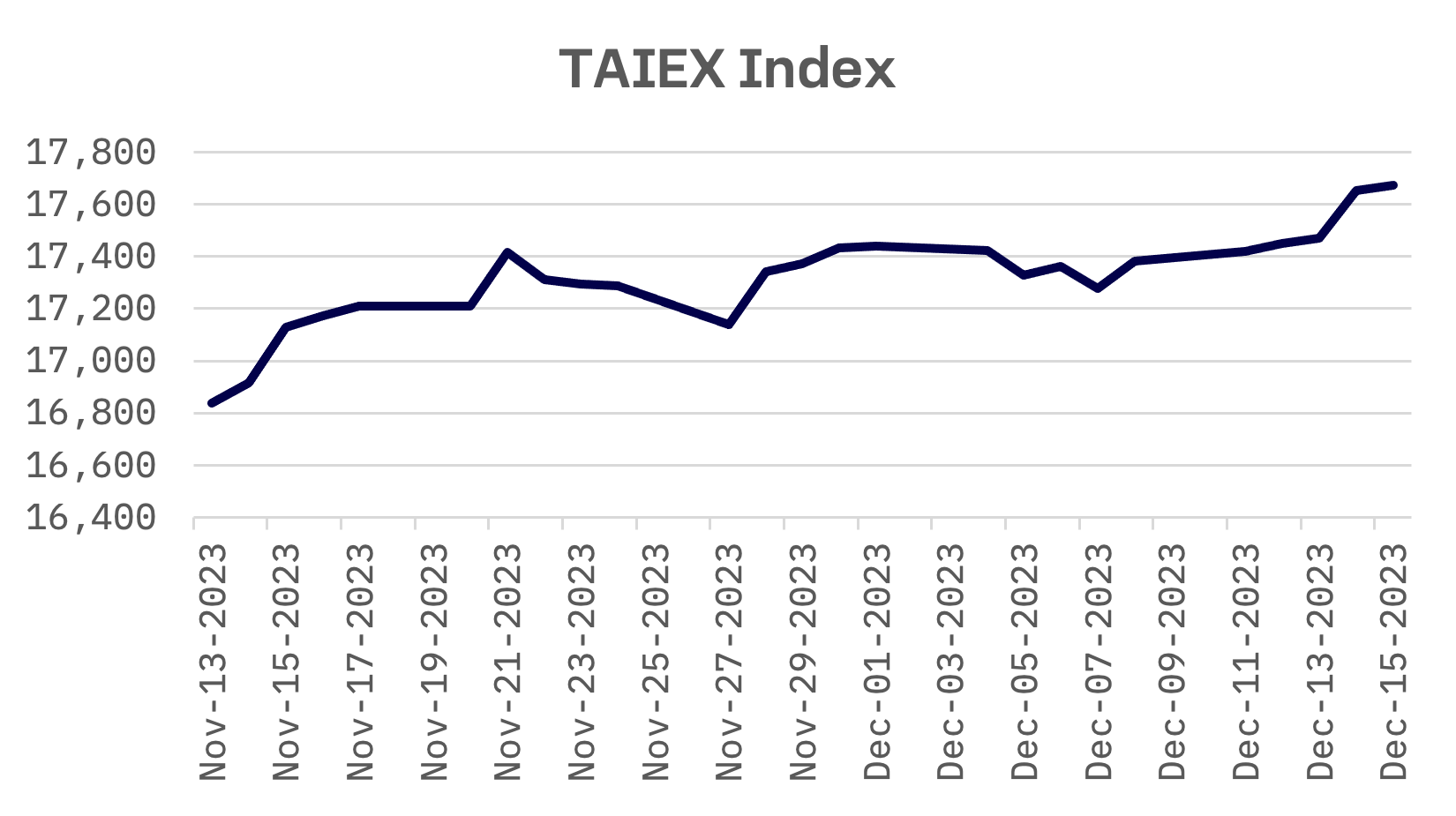

Taiwan

The TAIEX index in Taiwan increased by 2.3%, closing above 17,600 points for the first time since March 2022, following the Fed’s dovish turn and rallies in U.S. markets.

Large-cap stocks, particularly those in the influential electronics sector, spearheaded the robust performance of the main board. The uptrend was not limited to tech – buying interest notably spread into non-tech sectors, diversifying the drivers of market growth. Financial heavyweights also played a crucial role, recording substantial gains that significantly contributed to propelling the broader market forward.

The Taiwan Central Bank, following its quarterly policy-making meeting on Thursday, adjusted its projection for the country’s gross domestic product (GDP) growth in 2024. The forecast was raised to 3.12 percent, up from September’s estimate of 3.08 percent. This revision was primarily attributed to expected improvements in exports, bolstered by a recovery in global demand, and an increasing focus on emerging technologies, particularly in the development of artificial intelligence.

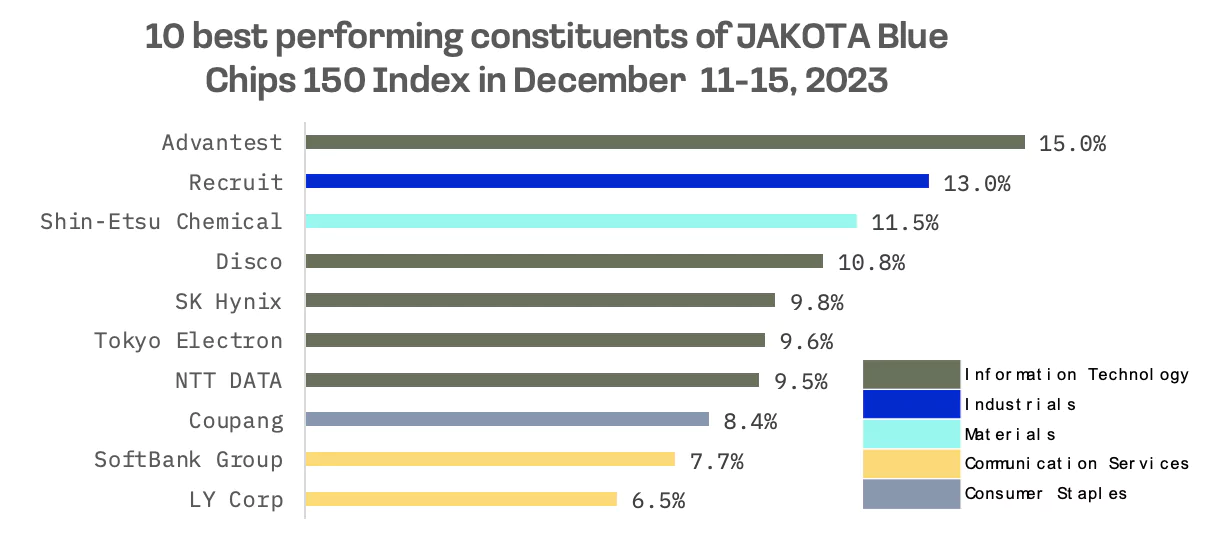

JAKOTA Blue Chip 150 Index

The JAKOTA Blue Chip 150 Index advanced 2.5%, with 80 of its 150 stocks showing positive trends.

Advantest, a leading manufacturer of automatic test equipment (ATE) for the semiconductor industry, emerged as the top performer this week. The company’s stock benefited significantly from the positive trend in semiconductor shares. Adding to its upward momentum, Advantest announced that its newly introduced ACS Real-Time Data Infrastructure has been well-received by several prominent data analytics firms. This development reflects a broader industry effort to accelerate data analytics and improve decision-making processes in artificial intelligence and machine learning, utilising a unified and integrated platform.

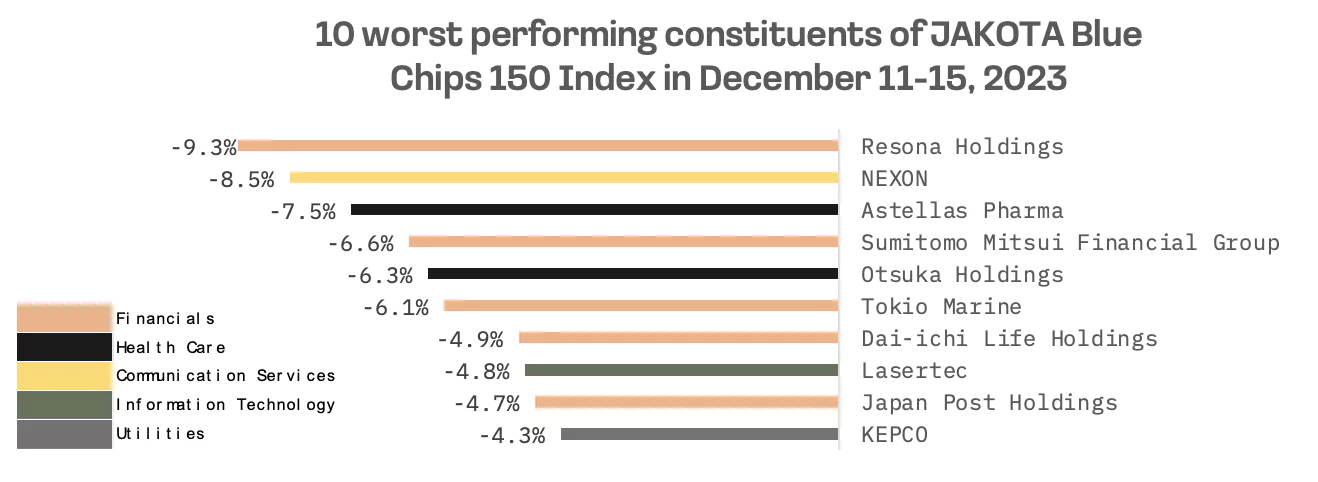

However, financial stocks underperformed, particularly impacted by speculation about the Bank of Japan’s stance on negative interest rates. Resona Holdings led this downturn with a decline exceeding 9%.