Last week’s Jakota markets:

- Japan’s Nikkei 225 Index plunged 2.5%, marked by historic one-day losses amid yen volatility, with partial recovery spurred by BoJ reassurances

- South Korea’s KOSPI dropped 3.3%, its fifth straight weekly loss, despite governmental efforts to curb excessive market movements

- Taiwan’s TAIEX slid 0.8%, driven by sector-specific weakness, yet rebounded with a surge in TSMC shares after strong earnings

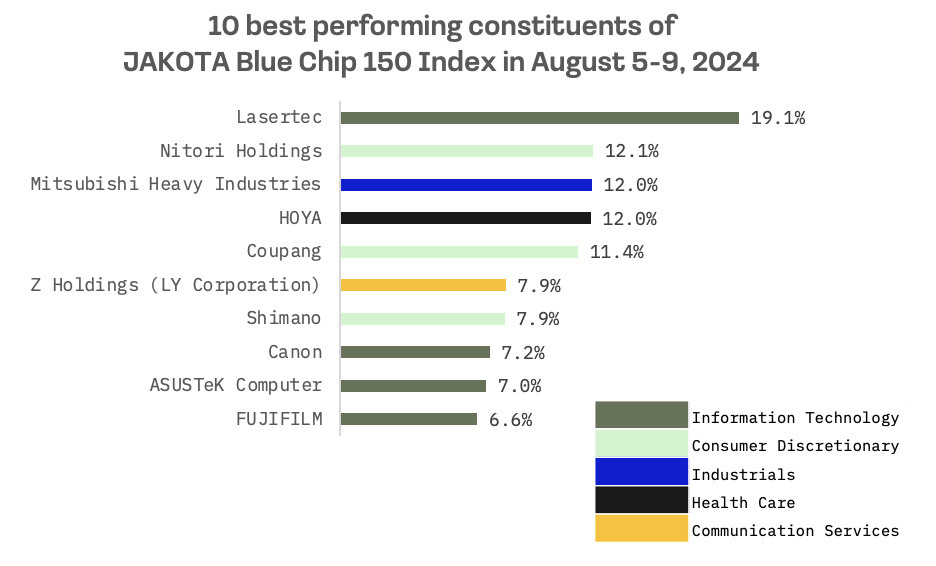

- The JAKOTA Blue Chip 150 Index decreased 0.9%, with Lasertec’s gains contrasting with significant declines across other constituents

Japan

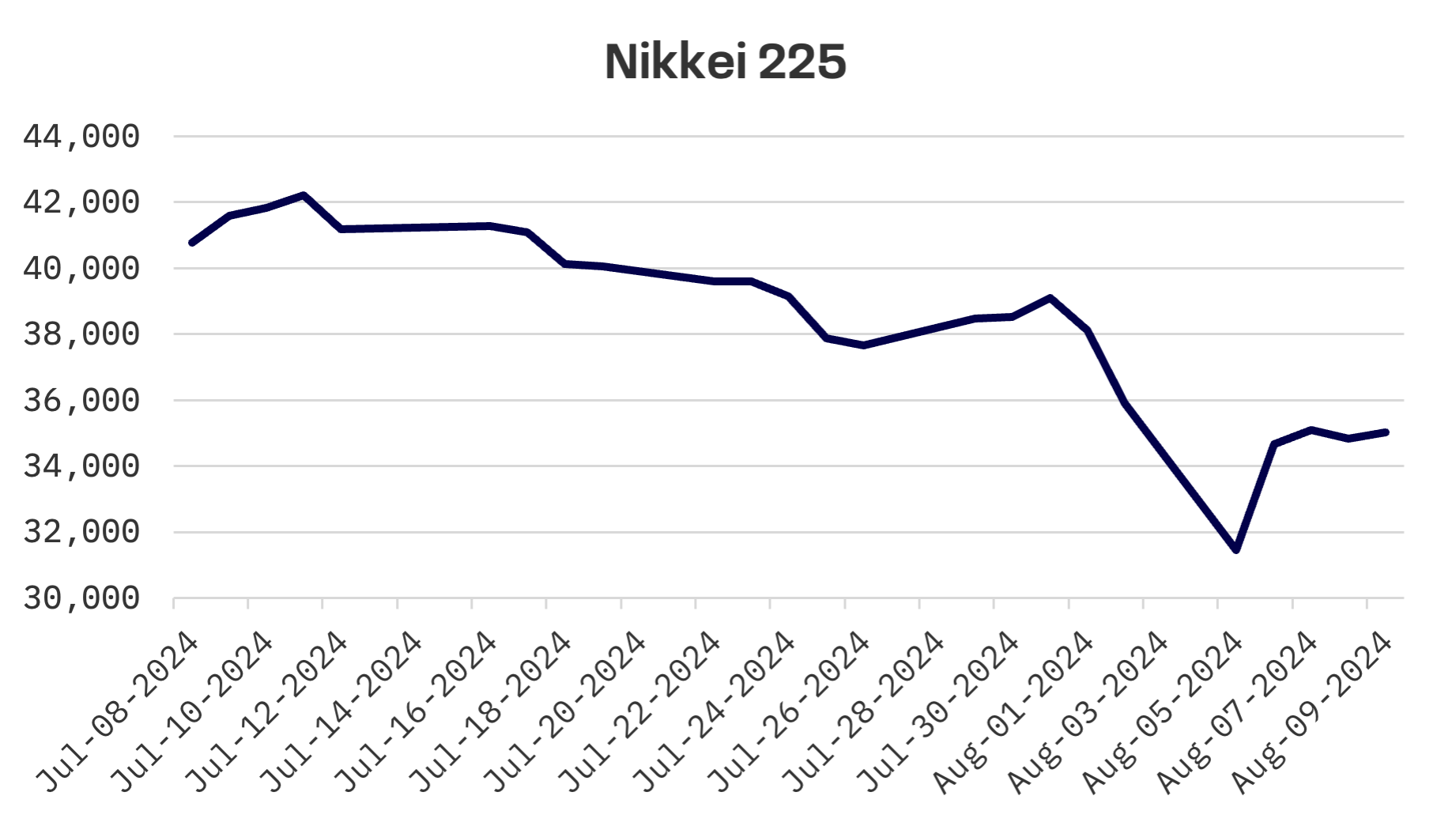

The Japanese stock market experienced considerable volatility last week, culminating in a 2.5% decline in the Nikkei 225 Index. The week began with Japan’s most severe one day selloff since 1987, as the Nikkei 225 plummeted 12.4%. This plunge was triggered by a surging yen following the Bank of Japan’s hawkish stance in its July meeting, where it raised interest rates and outlined plans to taper bond purchases.

Fears of slowing global growth weighed on risk sentiment, leading investors to unwind the yen carry trade amid expectations of narrowing U.S.-Japan rate differentials. However, over subsequent trading sessions, Japan’s markets managed to recoup much of the lost ground.

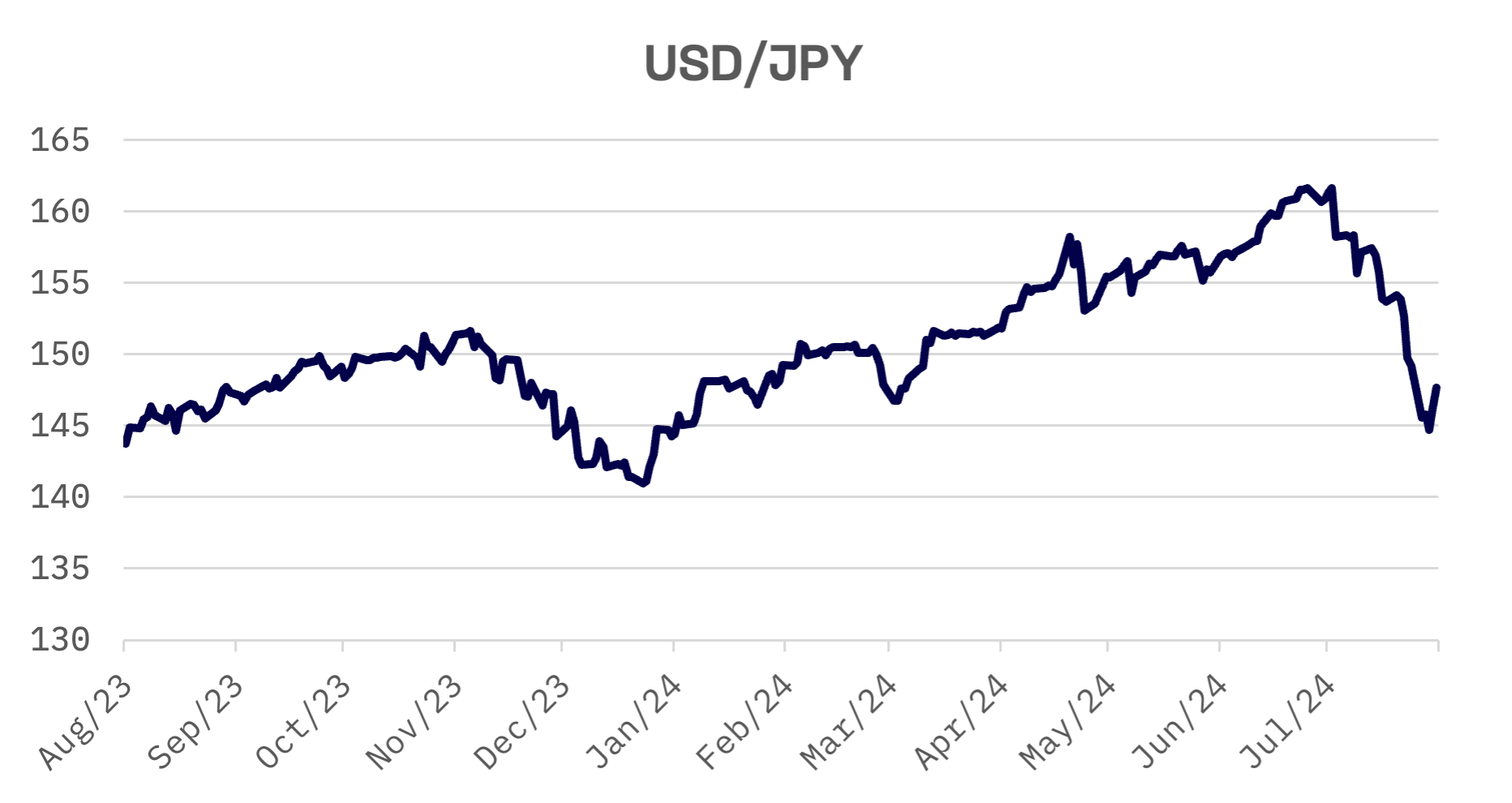

The yen’s rapid appreciation, which undermines the export competitiveness of Japanese manufacturers, initially saw the currency surge to a seven month high against the U.S. dollar, reaching around 143 on Monday. However, it pulled back on Tuesday, declining by about 1.2% to 146. By week’s end, the yen had settled in the lower end of the 147 range against the dollar, reflecting continued volatility in the currency market.

Market volatility eased following dovish remarks from Bank of Japan Deputy Governor Shinichi Uchida, who reassured that the central bank would refrain from raising interest rates during periods of market instability. Following Uchida’s comments, the yen weakened, ending the week in the lower end of the 147 range against the dollar.

On the economic data front, June wage growth surpassed expectations, with headline wages climbing 4.5% year-over-year — the fastest pace since January 1997 — compared to a projected 2.4% increase. This surge was largely attributed to a sharp rise in the volatile special payments component, reflecting summertime bonuses. Real wages in Japan increased by 1.1% in June, marking the first rise in 27 months, following a revised 1.3% decline in May.

South Korea

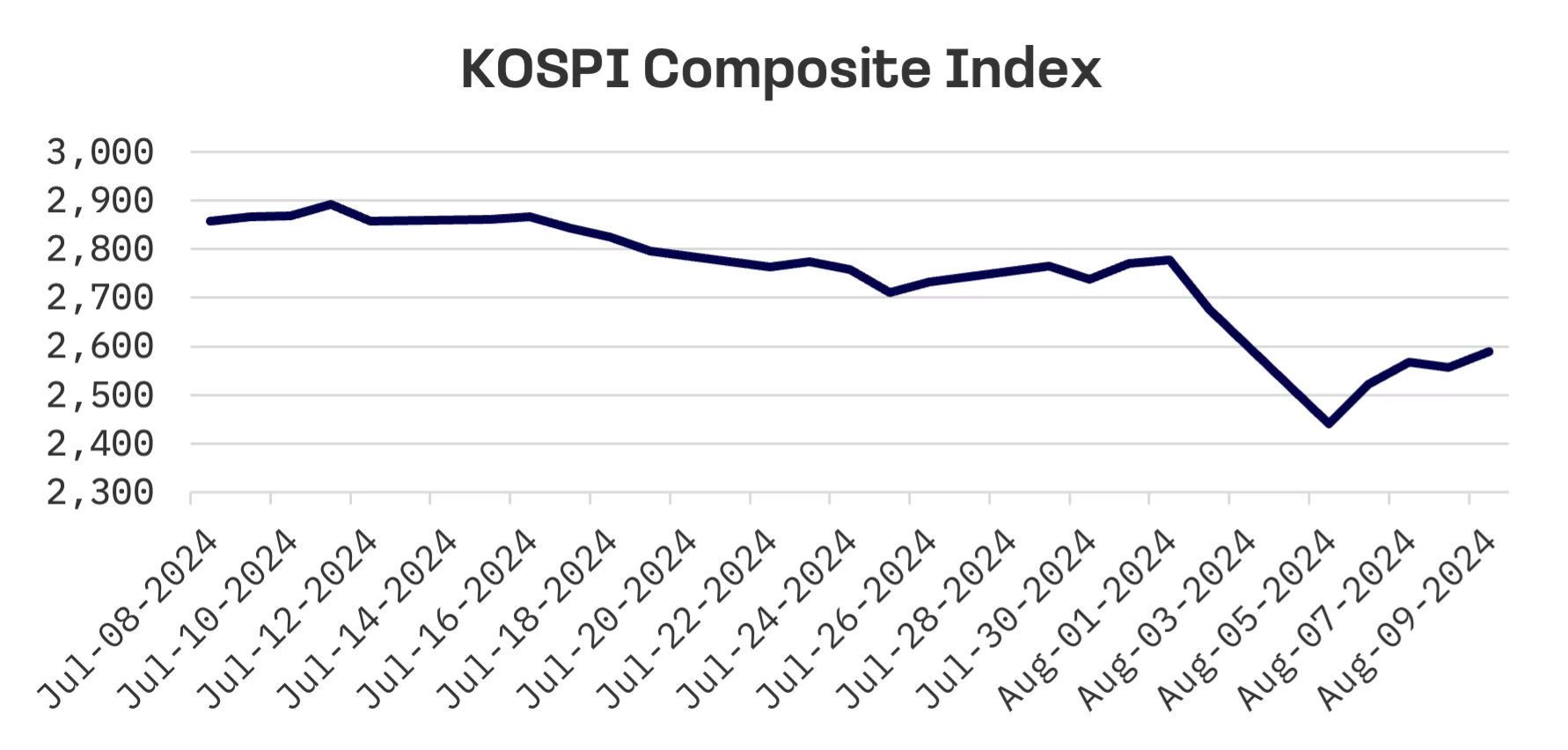

The Korean stock market weakened last week, with the KOSPI Composite Index shedding 3.3%, marking its fifth consecutive weekly loss. South Korea’s market was among the hardest hit by Monday’s panic selling, as the KOSPI index plunged nearly 9%, breaking below the 2,500 mark.

In the late afternoon, the Korea Exchange triggered a circuit breaker, halting trading on both the KOSDAQ and KOSPI for 20 minutes after they each fell more than 8%. This marked the eighth circuit breaker in the KOSPI’s history and the first time both indexes were suspended since March 2020, during the peak of the COVID-19 pandemic. Nearly 99% of stocks listed on the KOSPI declined on Monday, with losses extending across almost all blue chip stocks.

On Tuesday, South Korean stocks regained some ground following stern verbal warnings from financial authorities against excessive market movements. Earlier in the day, the Korean government and financial regulators convened an emergency meeting to address the previous day’s market turmoil. Finance Minister Choi Sang-mok highlighted that the stock market was disproportionately affected by external shocks, stating, “This was an unusual instance where only the stock market suffered corrections.” He assured that both the government and the Bank of Korea are prepared to implement necessary measures to counteract external shocks and stabilize market volatility.

On Thursday, the Korea Development Institute (KDI) trimmed its economic growth forecast for South Korea to 2.5% for the year, down 0.1 percentage point from its May projection. The institute cited weak domestic demand as a constraint on an export led recovery.

Taiwan

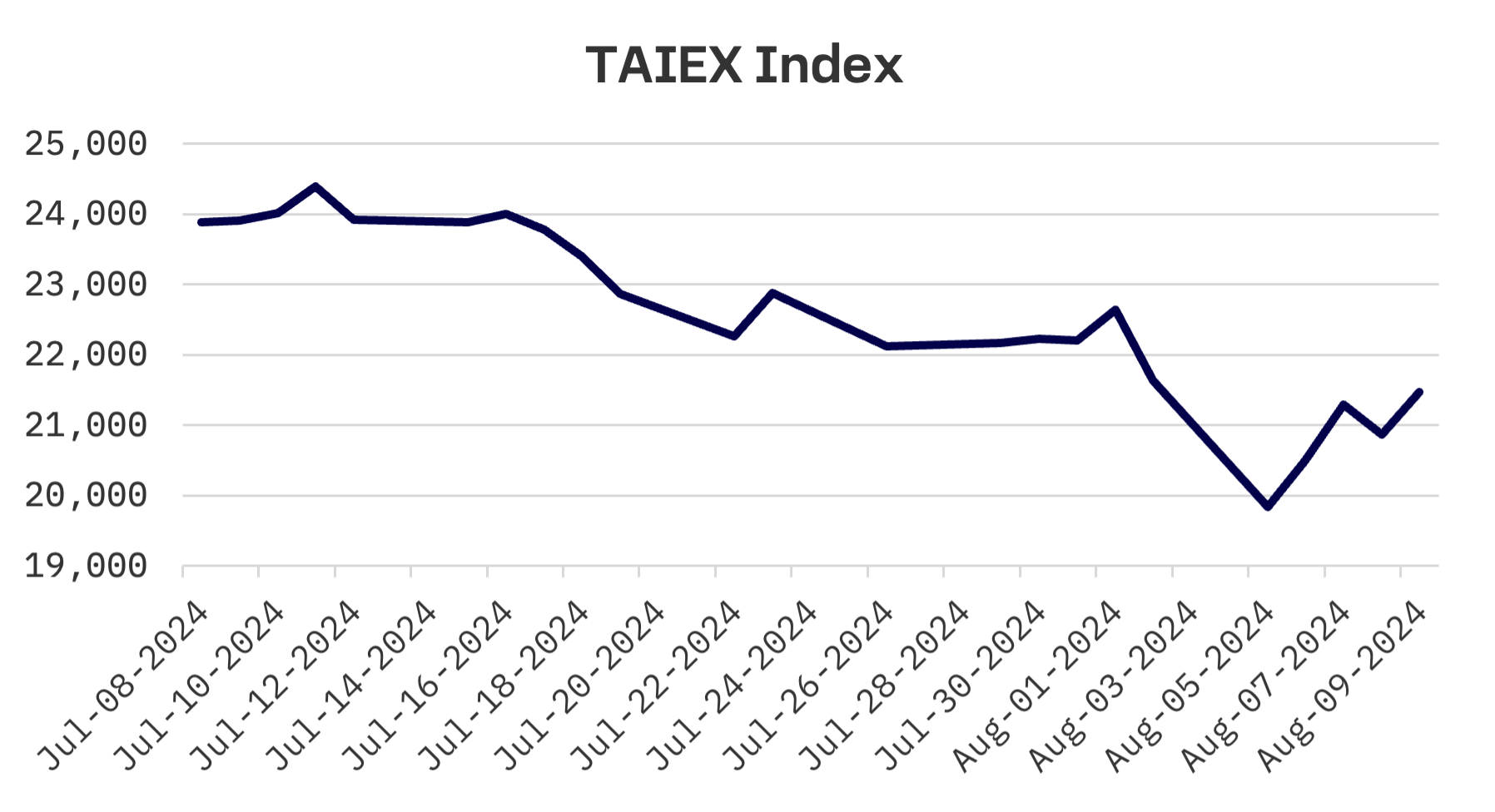

Taiwan’s shares dipped last week, with the TAIEX index dropping modestly by 0.8%. On Monday, the benchmark index faced significant pressure, largely driven by weakness in the key electronics sector, causing the TAIEX to fall below the 20,000-point mark, ending down 8.35%. Taiwan Semiconductor (TSMC), the largest stock on Taiwan’s market by weight, closed down 9.75%.

However, shares in Taiwan experienced a technical rebound midweek, driven by a recovery in the tech sector. On Friday, the market surged by 2.9%, fuelled by a rally in TSMC. The contract chipmaker reported record July net revenue of NT$2,567 billion ($7.93 billion), a 23.6% increase from the previous month and a 44.7% rise year-over-year.

Taiwan’s exports increased by 3.1% year-over-year in July, marking the ninth consecutive month of growth, driven by robust global demand for AI applications, according to the Ministry of Finance (MOF). The MOF reported that Taiwan’s exports amounted to $39.94 billion for the month.

JAKOTA Blue Chip 150 Index

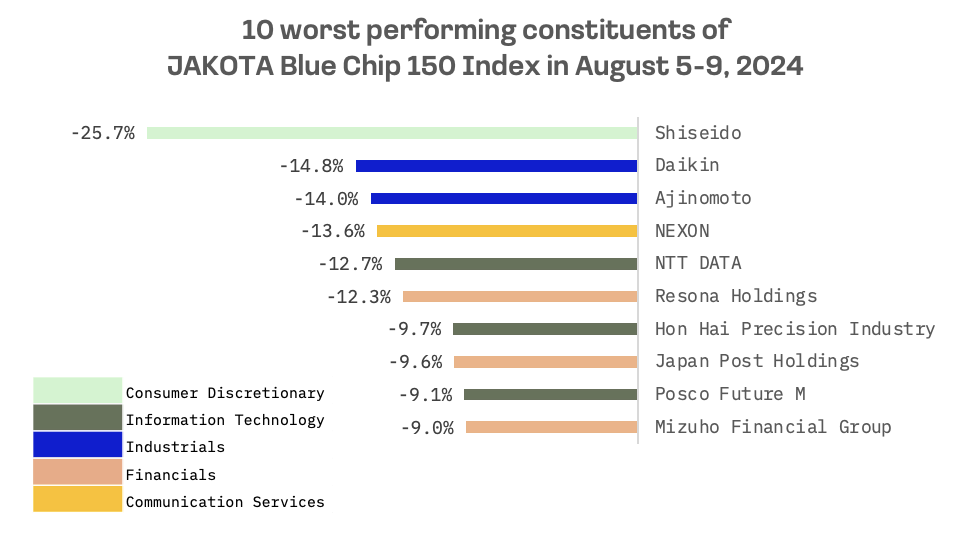

The JAKOTA Blue Chip 150 Index saw a turbulent week, ultimately finishing down 0.9%. Monday’s session was particularly severe, with the Index plunging 8.3% — the sharpest drop in its history. Out of 150 constituents, only 45 managed to post gains.

Lasertec, a Japanese company mainly engaged in the design, manufacture and sale of the inspection and measurement equipment, emerged as the top performer among JAKOTA Blue Chip 150 constituents. The company’s stock surged after reporting a 39.7% increase in sales to ¥213.56 billion and a 28% rise in net profits to ¥59.08 billion for the fiscal year ending June 2024.

Looking ahead, Lasertec projects a 12.4% rise in sales to ¥240 billion and a 25.3% increase in net profit to ¥74 billion for fiscal 2025, marking a second consecutive year of record profitability. The firm raised its annual dividend to ¥288, up ¥58 from the previous year, citing sustained growth in the semiconductor market driven by demand from generative AI and data centers.

At the other end of the spectrum, Shiseido, the Japanese cosmetics giant, led the decline. Its shares plummeted on Thursday, suffering their steepest slide in nearly 37 years and prompting a trading halt. The selloff followed Shiseido’s report of a ¥2.7 billion operating loss for the January-June period, compared with a ¥13.6 billion profit a year earlier. The company attributed the loss to weak demand in China and production issues in the U.S.