Last week’s Jakota markets:

- Japan’s Nikkei 225 leapt 8.7% as Japan’s GDP grew 0.8%, beating forecasts and reversing Q1 contraction

- South Korea’s KOSPI rebounded 4.2%, snapping a losing streak on cooler U.S. inflation data and robust local job numbers

- Taiwan’s TAIEX jumped 4.1%, mirroring gains across the region as U.S. market optimism spilled over

- The JAKOTA Blue Chip 150 Index jumped 6.9%, led by Mitsubishi Electric’s 20% gain

Japan

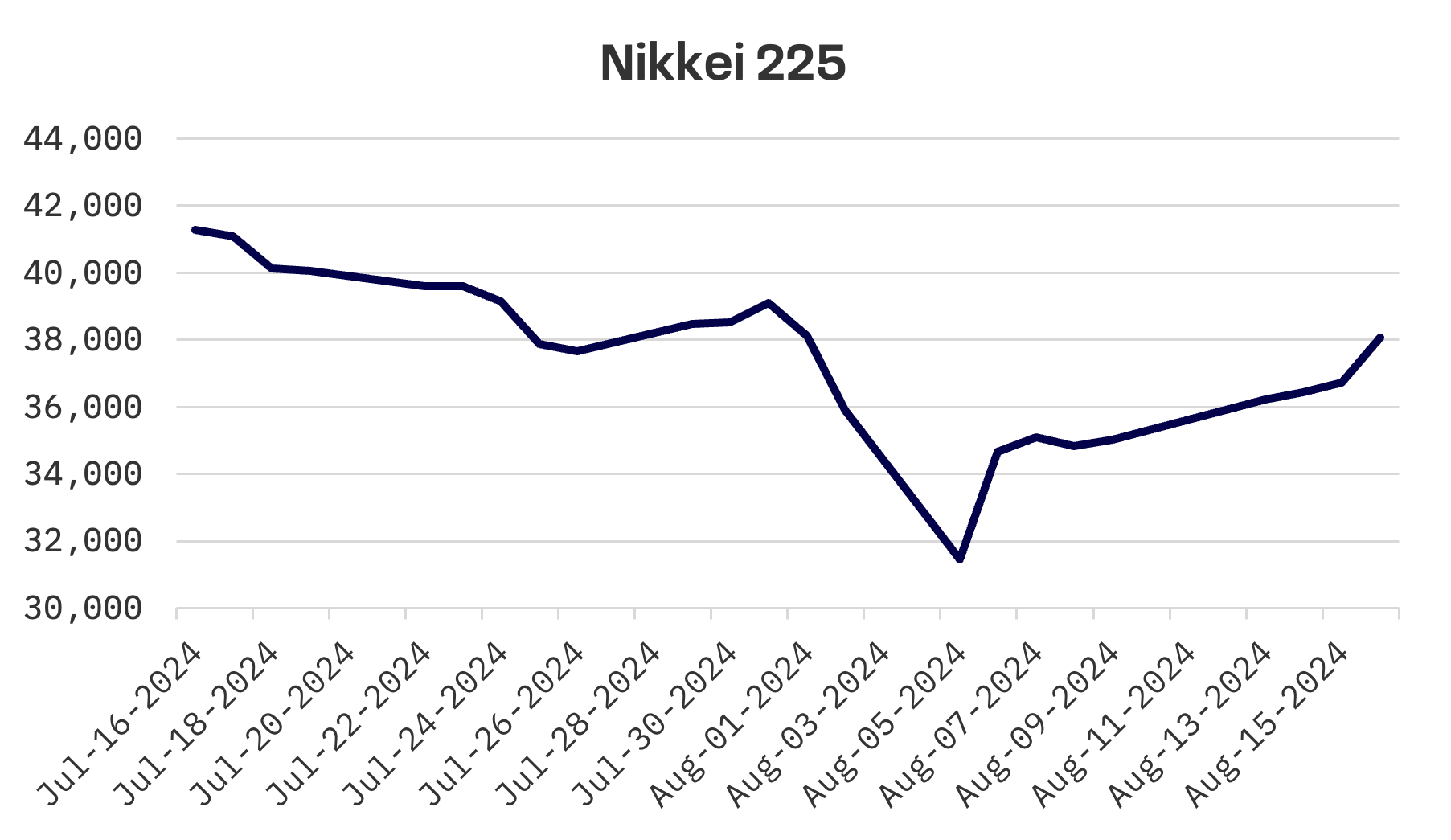

The Japanese stock market staged a robust recovery during a holiday shortened week, with the Nikkei 225 Index surging 8.7%. Investor sentiment improved on the back of stronger than expected U.S. economic data, which alleviated fears of a looming recession in the world’s largest economy. This positive outlook was further reinforced by Japan’s gross domestic product, which grew at a faster pace than anticipated in the second quarter. Adding to the market’s momentum, the yen weakened to the high 148 range against the U.S. dollar (from last week’s 147 range), offering a boost to the country’s exporters.

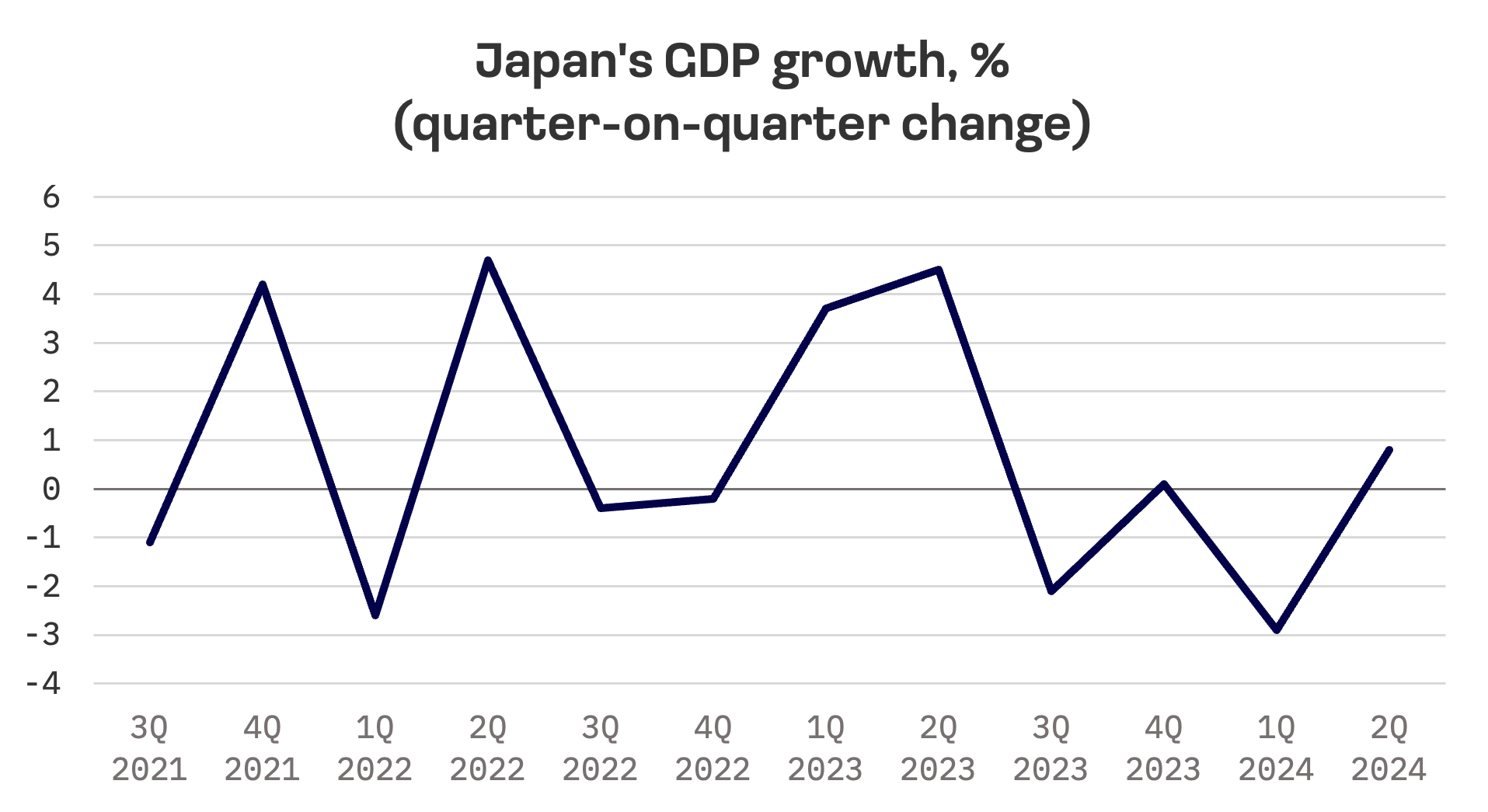

Japan’s economy posted a strong rebound in the second quarter, growing 0.8% quarter-on-quarter, surpassing expectations of a 0.5% increase and reversing the previous quarter’s 0.6% contraction. On an annualised basis, the economy expanded by 3.1%, well above the consensus estimate of 2.1% and following a 2.3% decline in the first quarter. The recovery was fuelled by a significant rise in private consumption and a resurgence in business investment.

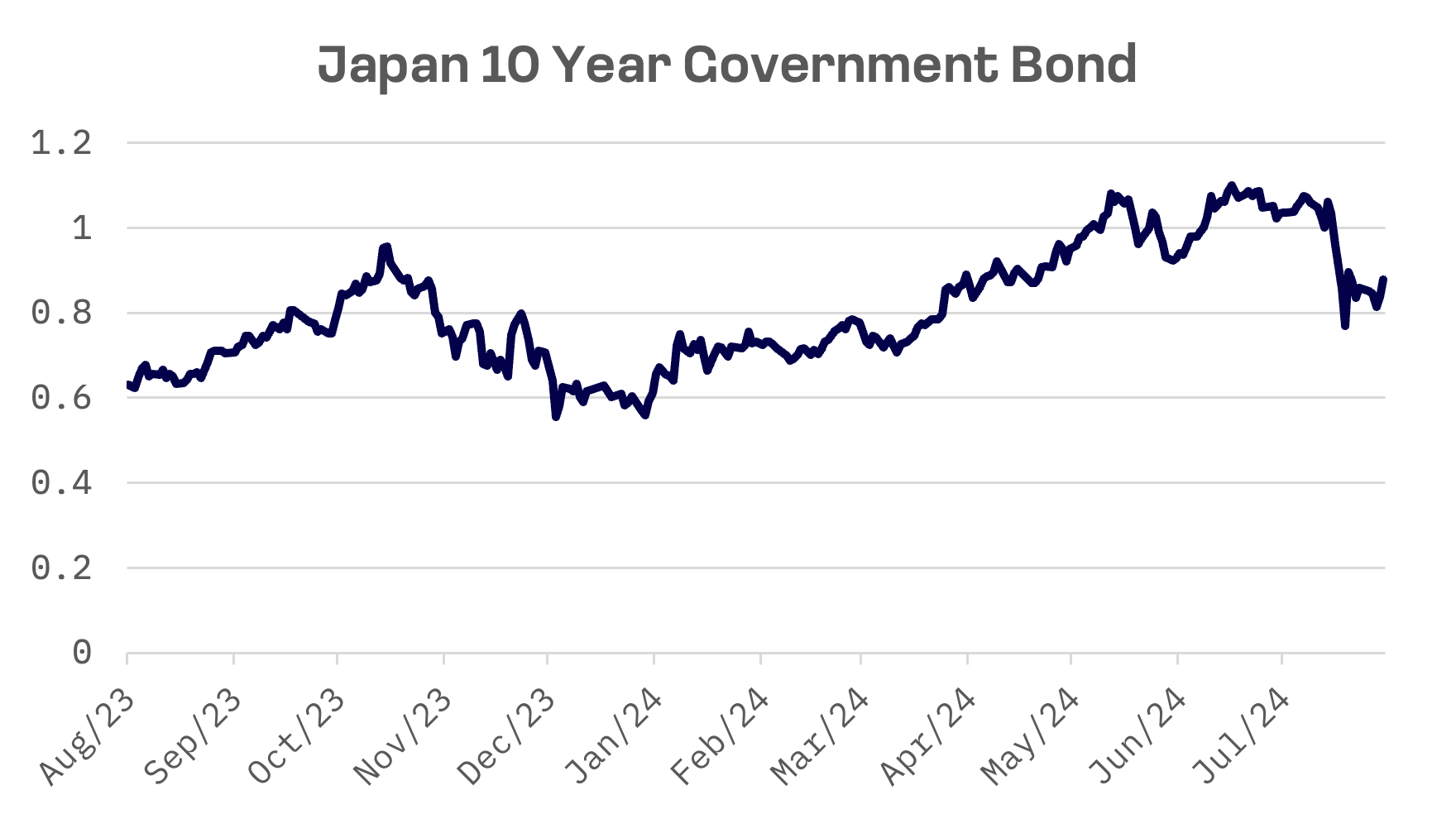

In the fixed income markets, the yield on the 10-year Japanese government bond edged up to 0.88%, from 0.86% at the previous week’s close. Speculation persists regarding the Bank of Japan’s (BoJ) monetary policy outlook. The central bank’s deputy governor recently emphasized that rate hikes would be avoided during periods of market instability, tempering expectations for further increases this year following July’s controversial hike.

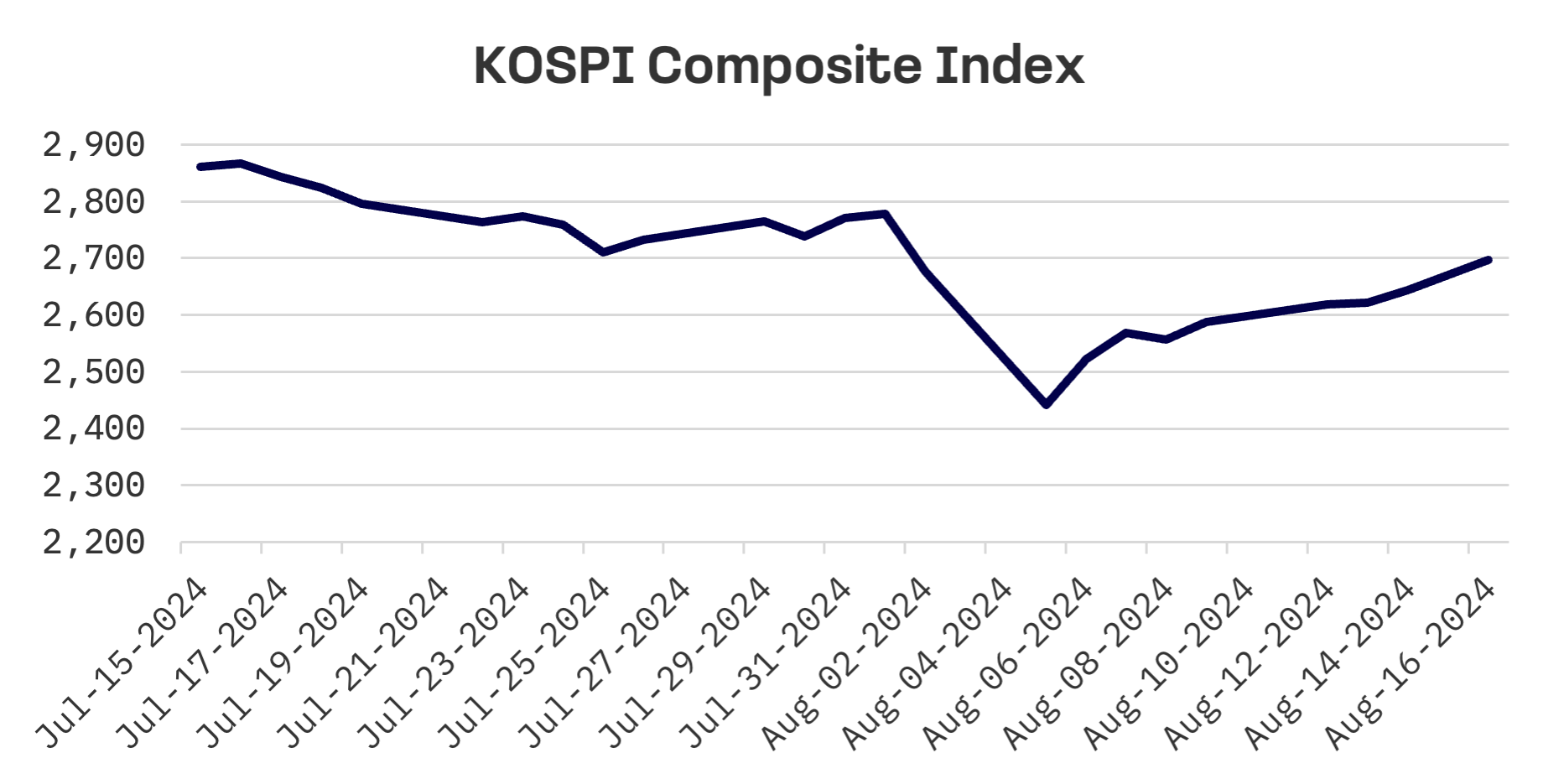

South Korea

The Korean stock market experienced a significant recovery this week, with the KOSPI Composite Index rising by 4.2%. The surge marks a reversal in the recent downward trend following weeks of consistent losses, as South Korea’s market rebounded from last week’s rout amid easing concerns over a U.S. economic recession. The turnaround was driven by cooler than expected U.S. producer price data and strong performances from major U.S. tech stocks, known as the “Magnificent Seven.” The softer Producer Price Index (PPI) bolstered expectations that the Federal Reserve could soon cut interest rates. The latest PPI also calmed fears that the world’s largest economy might struggle to achieve a soft landing.

The market posted gains every trading day, with Thursday closed for National Liberation Day. Friday saw a robust 2% jump following encouraging U.S. retail sales figures. The U.S. consumer price index for July, released during Korea’s market holiday, further reinforced expectations of potential Federal Reserve rate cuts.

Strong domestic jobs data provided additional support. South Korea added over 100,000 jobs in July for the first time in three months, with total employment reaching 28.85 million, up 172,000 year-over-year, according to Statistics Korea.

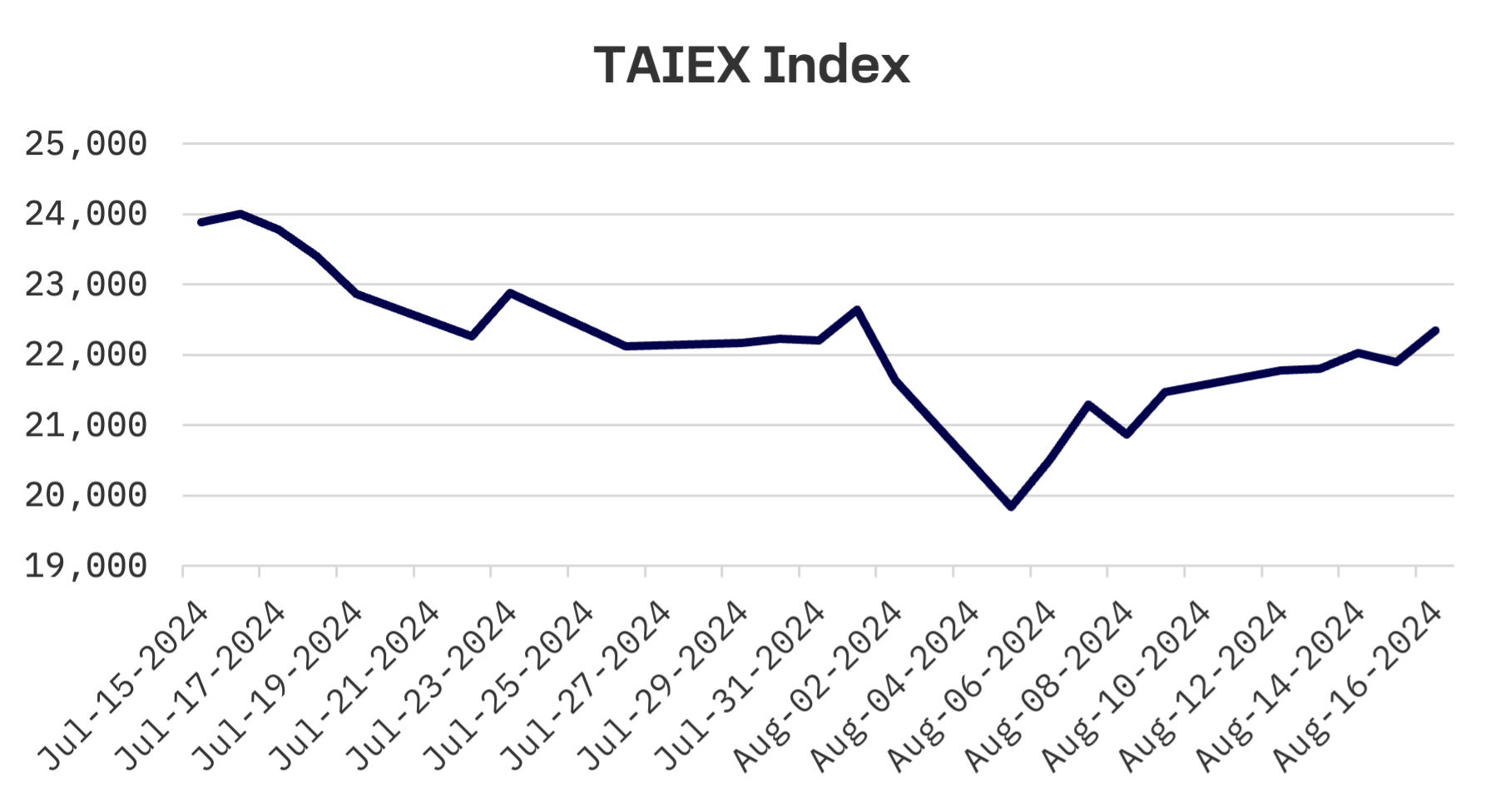

Taiwan

Taiwan’s TAIEX index jumped 4.1%, mirroring gains across the Jakota region. The surge was sparked by the U.S. market rally, driven by softer than expected July PPI growth and positive economic data on retail sales and jobless claims.

Market analysts noted that the strong rebound in Taiwan and the United States reflected that markets were oversold amid worries about a possible hard landing of the U.S. economy.

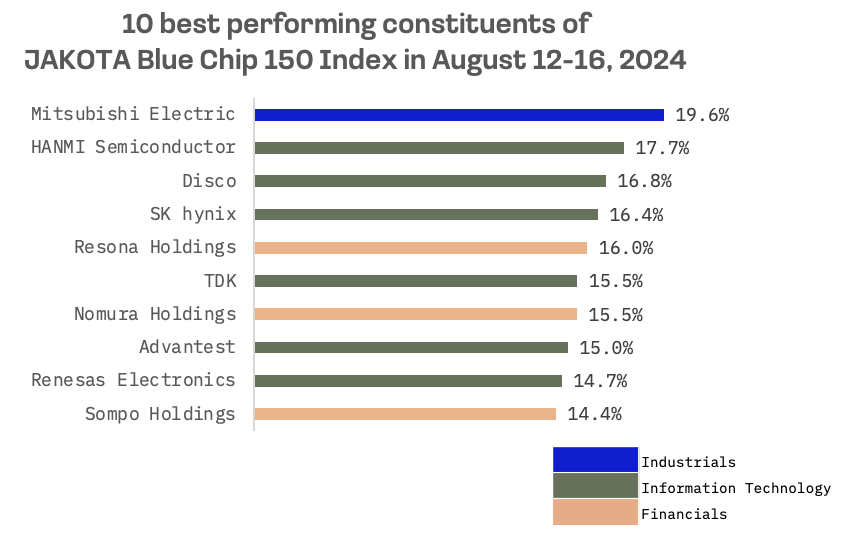

JAKOTA Blue Chip 150 Index

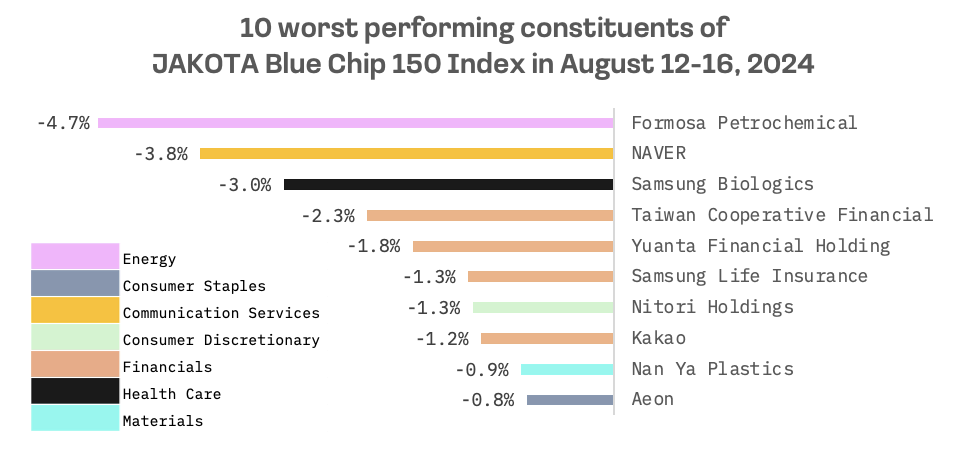

The JAKOTA Blue Chip 150 Index soared 6.9% this week, with only 13 of its 150 constituents posting losses.

The top-performing stock this week was Mitsubishi Electric, a Japanese multinational electronics and electrical equipment manufacturing company, which surged nearly 20%. Mitsubishi Electric’s shares had been under significant pressure following the release of its quarterly financial results on July 31, compounded by heightened market volatility in recent weeks. However, the stock rebounded sharply this week, buoyed by a broader rally in the Japanese market and a newly published report in which analysts maintained a bullish outlook on the company’s prospects.

Formosa Petrochemical, a Taiwanese energy company specializing in crude oil refining and the marketing of petroleum and petrochemical products, led the decline among JAKOTA Blue Chip 150 constituents this week, posting a 4.7% drop. The decline followed MSCI’s decision to remove the company from its Global Standard Indexes.