Last week’s JAKOTA markets:

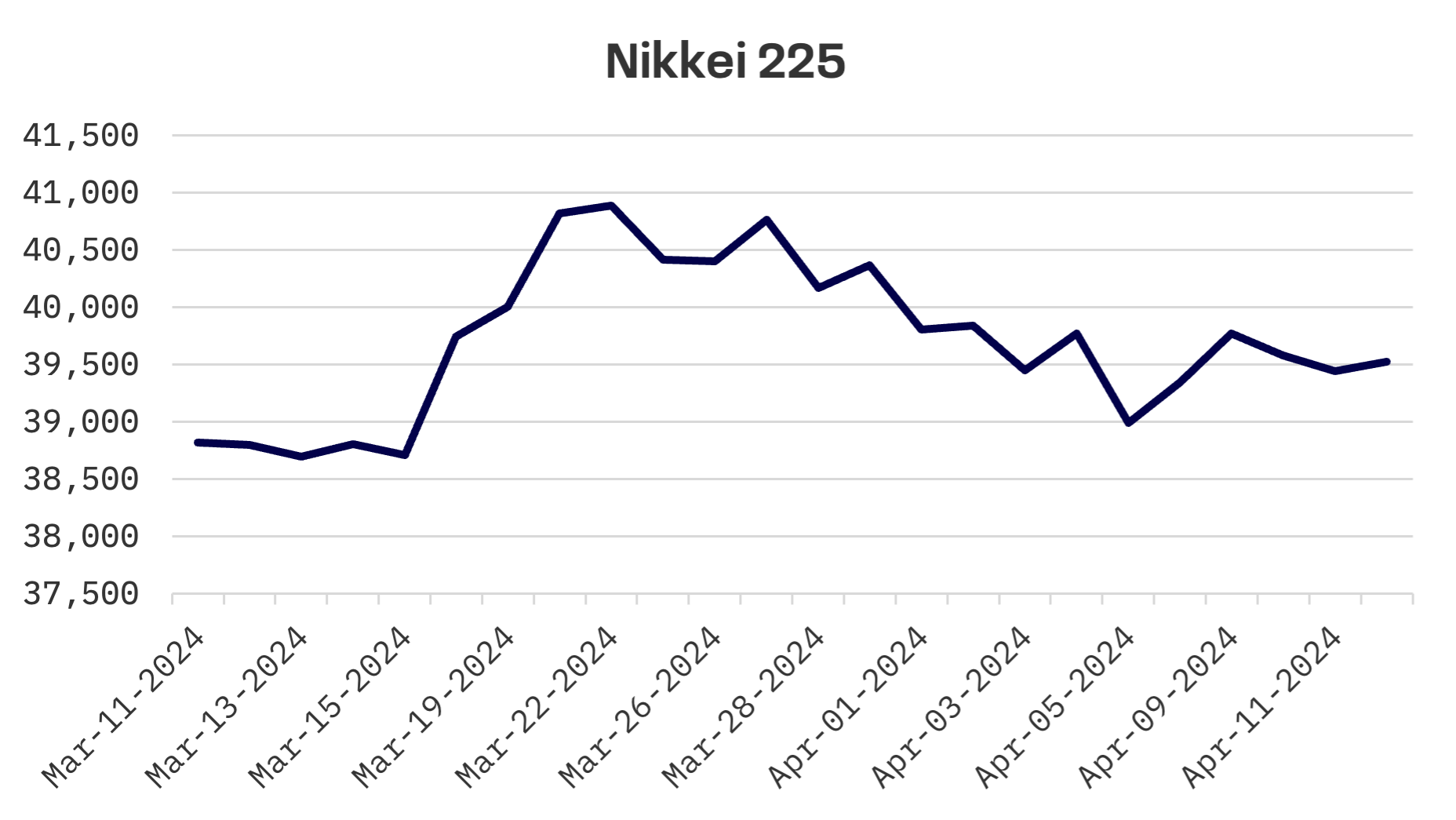

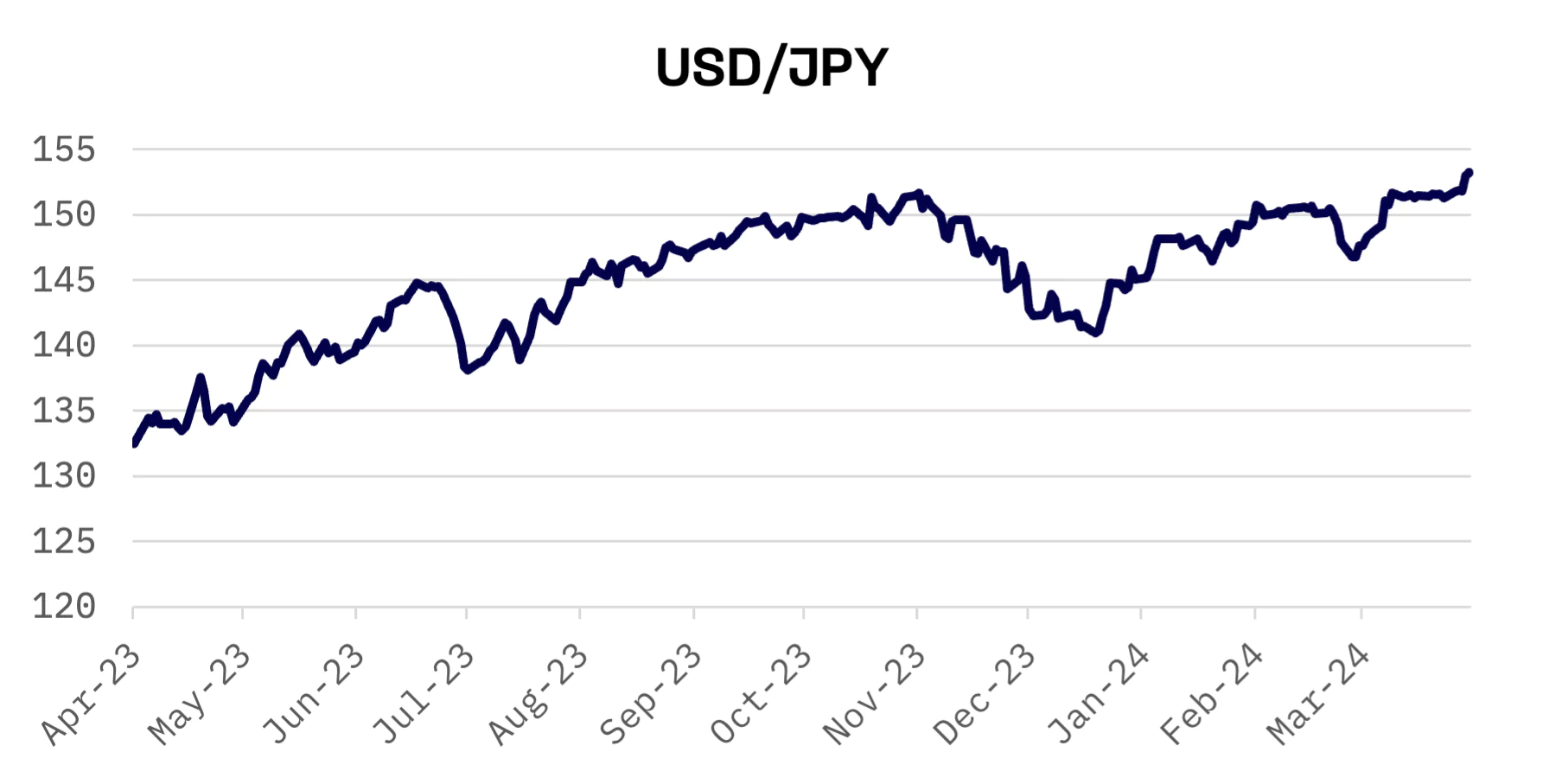

- Japan: The Nikkei 225 Index increased by 1.4%, as the yen’s continued depreciation raises alarms but fails to prompt governmental intervention

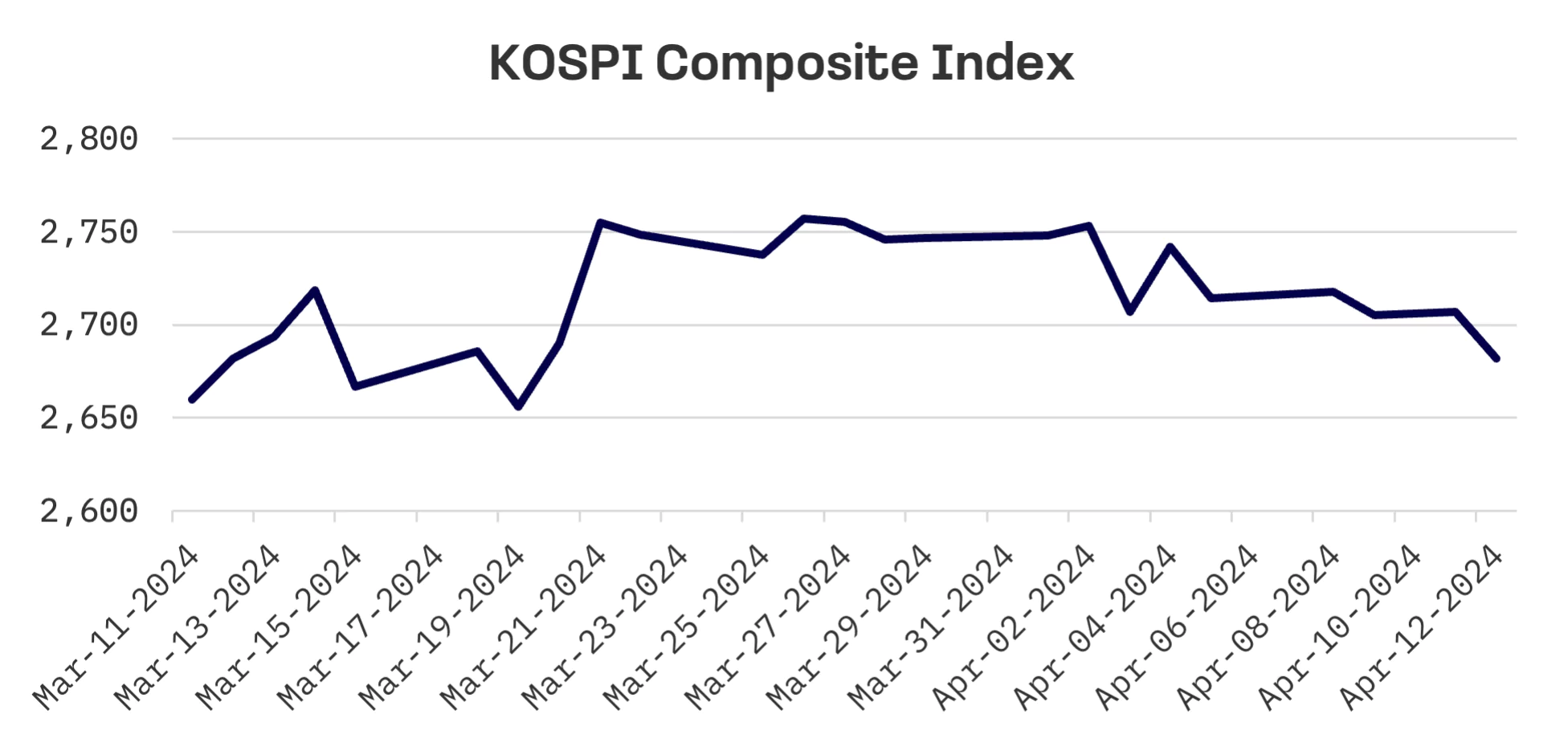

- South Korea: Challenges persisted for the KOSPI, which declined by 1.2% amid ongoing restrictive policies from the Bank of Korea, defying market expectations for easing

- Taiwan: A strong rebound for the TAIEX index, up 2% due to a spike in Taiwan Semiconductor shares after expansion announcements and a record sales report

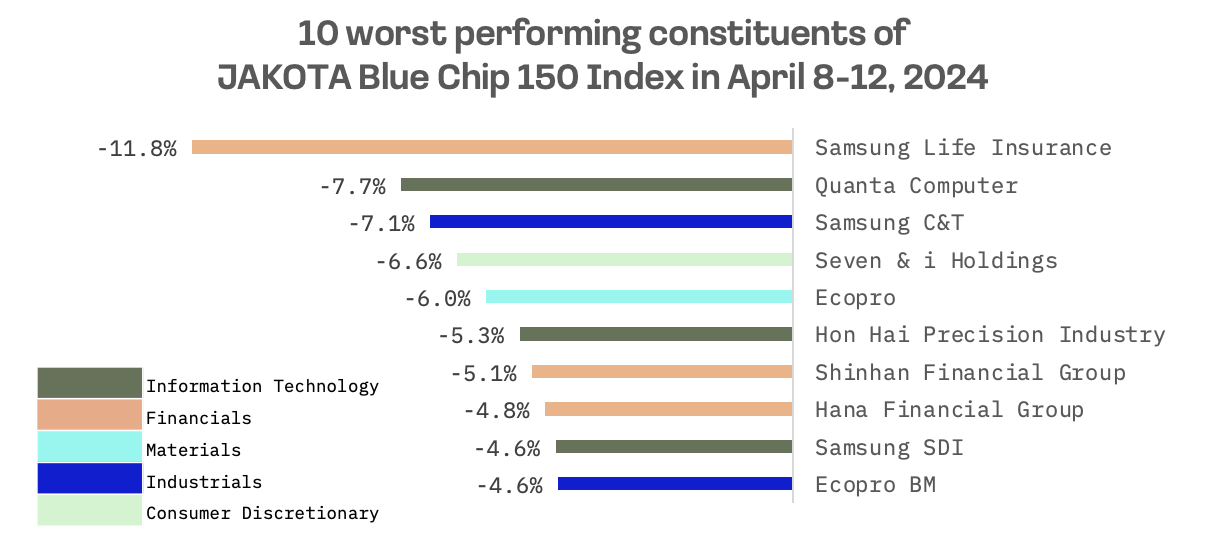

- JAKOTA Blue Chip 150 Index: Modestly up by 0.2%, with Coupang leading the gains after a major pricing strategy revision, while Samsung Life faced headwinds

Japan

The Japanese stock market ended the week positively, with the Nikkei 225 Index registering a significant gain of 1.4%. This occurred against the backdrop of the yen hovering near a 34-year low, which has kept investors on alert for potential interventions by Japanese financial institutions to support the currency.

The yen’s depreciation — from the high-JPY 151 range to surpassing the critical JPY 152 level — did not trigger intervention during the week. However, finance ministry officials underscored their vigilance and readiness to act against any undue weakness in the currency.

Bank of Japan (BoJ) Governor Kazuo Ueda refuted the idea of using interest rate hikes to counter a weakened yen, emphasizing the central bank’s commitment to maintaining its monetary policy independently of exchange rate fluctuations. This stance follows the recent conclusion of its negative interest rate policy and the phasing out of its yield curve control program, with market sentiment now anticipating two additional rate hikes over the next year, reflecting a coordinated increase in prices and wages.

Despite these policy shifts, Japan’s monetary strategy remains among the most accommodative globally, with the ongoing weak yen and supportive financial conditions continuing to benefit exporters significantly. This juxtaposition sets a favorable stage for Japan’s stock indices.

Global inflationary pressures, particularly from the United States, have influenced the Japanese bond market. Following a notable increase in U.S. inflation figures and a consequent rise in U.S. Treasury yields, the benchmark 10 year Japanese government bond yield escalated to 0.84% from the previous week’s 0.77%, reaching heights not seen since November 2023.

South Korea

The South Korean stock market saw a decline of 1.2% this week, marking its third consecutive week of losses. The market maintained stability until Friday when an unexpected announcement from Governor Rhee Chang-yong regarding the Bank of Korea’s ongoing restrictive monetary policy led to a 1% fall in the KOSPI index.

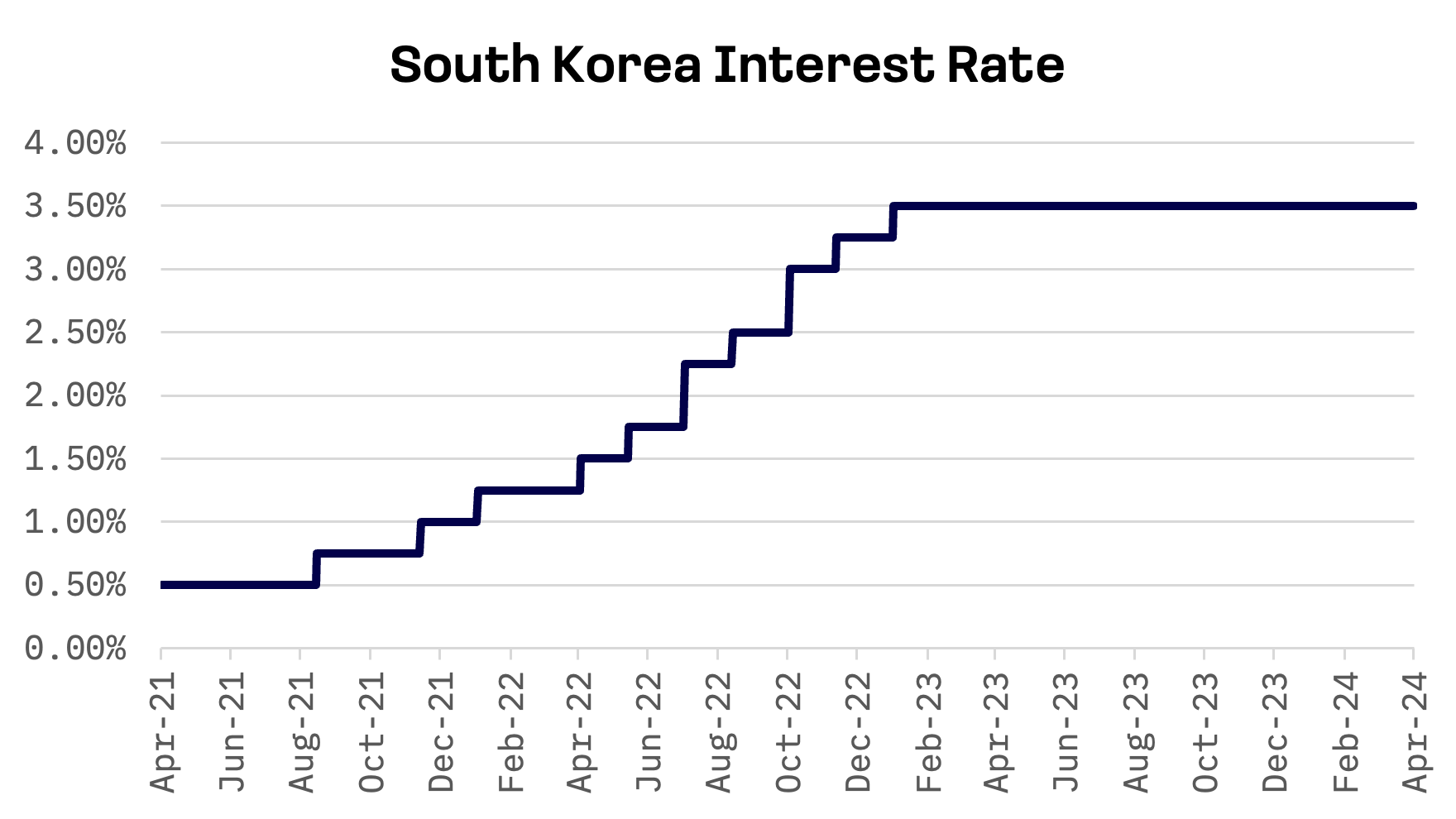

Governor Rhee’s statement came after the central bank decided to keep its benchmark interest rate steady at 3.5%, a rate that has been maintained since January 2023, despite ongoing consumer price increases above 3%, surpassing the BOK’s target range of 2%. During a post meeting press conference, Governor Rhee highlighted the unanimous consensus among monetary policy board members against considering a rate cut in the latter half of the year.

The prevailing policy rate in South Korea now stands at its highest level in over 15 years, adding a layer of complexity to future monetary policy decisions. This heightened interest rate has stirred speculation about whether the Bank of Korea might lower the base rate later this year. This prospect is particularly noteworthy against the backdrop of the U.S. Federal Reserve’s recent shift towards a dovish monetary stance, which was announced in December 2023. The Fed has hinted at the possibility of implementing three rate cuts in 2024, with market observers anticipating that the first adjustment could occur as early as June.

Taiwan

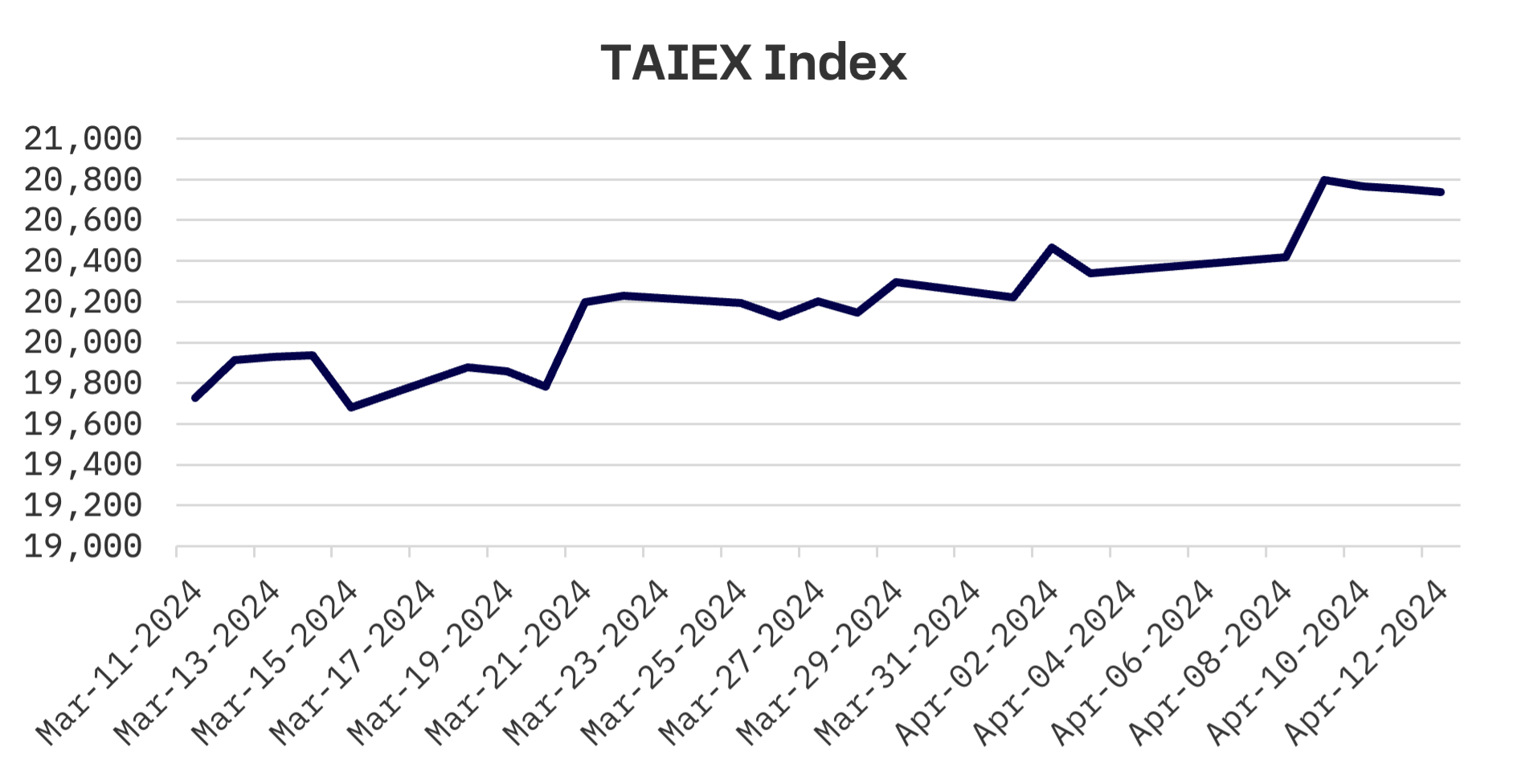

Taiwanese shares displayed strong performance this week, with the TAIEX index gaining 2% after resuming trading post the four-day Tomb Sweeping Festival holiday.

A significant factor was the surge in Taiwan Semiconductor shares following news of its expansion plans with a third wafer fab in Arizona, a development expected to significantly bolster long term sales and enhance the company’s competitive edge in the semiconductor industry. Furthermore, Taiwan Semiconductor announced record breaking sales for the first quarter on Wednesday, driven by strong demand for emerging technologies.

Taiwan’s economic data for March also reflected this strength, with exports surging over 18% year-over-year, exceeding initial projections and highlighting robust opportunities in the country’s thriving tech sector.

JAKOTA Blue Chip 150 Index

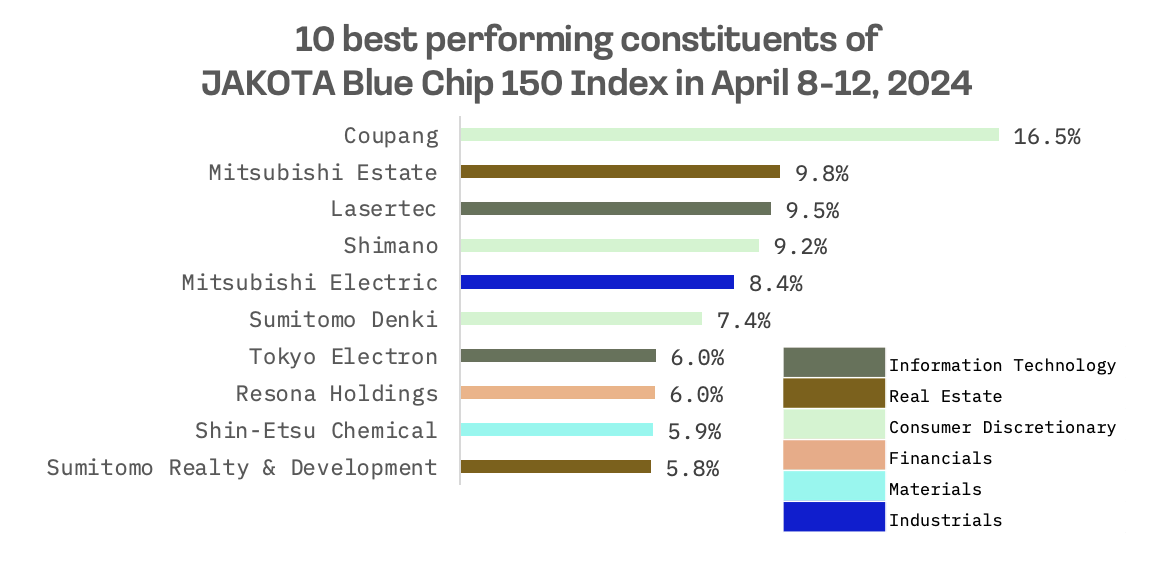

The JAKOTA Blue Chip 150 Index experienced a modest increase of 0.2% this week. Of the 150 constituents, 102 stocks demonstrated positive price trends.

Leading the gains was Coupang, a South Korean e-commerce company, which saw its shares climb by 16.5% after announcing a significant price hike for its Wow membership service. The new price of 7,890 won per month marks a substantial 58% increase from the current rate of 4,990 won. This strategic move is aimed at enhancing the company’s profitability.

Conversely, Samsung Life Insurance ranked among the week’s worst performers, struggling due to increased competition in the South Korean insurance market and subdued expectations from the country’s value-up program.