Last week’s JAKOTA markets:

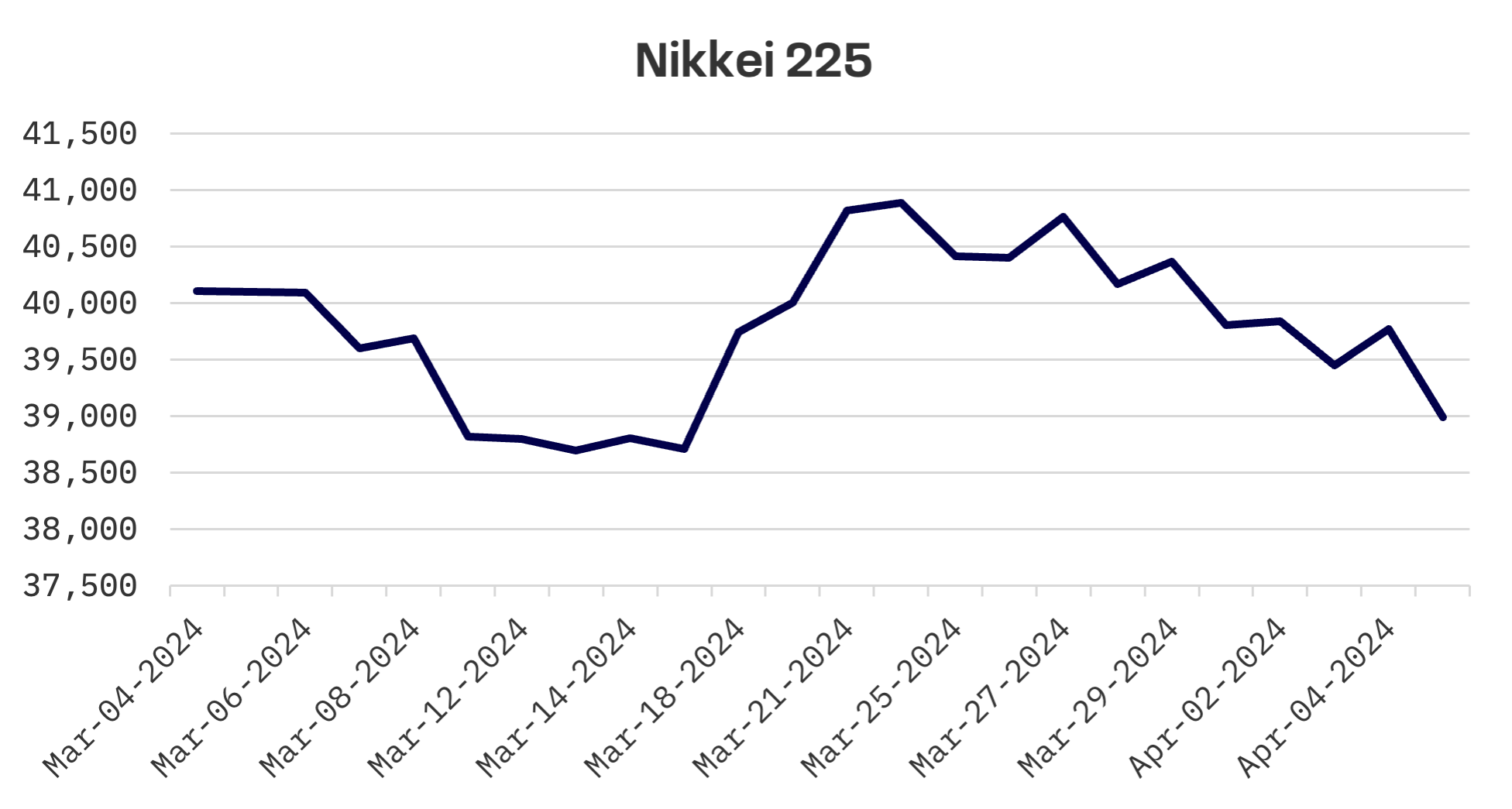

- In Japan, the Nikkei 225 Index saw a 3.4% fall, amid speculations of government interventions to support the weakening yen and BoJ’s potential policy shifts

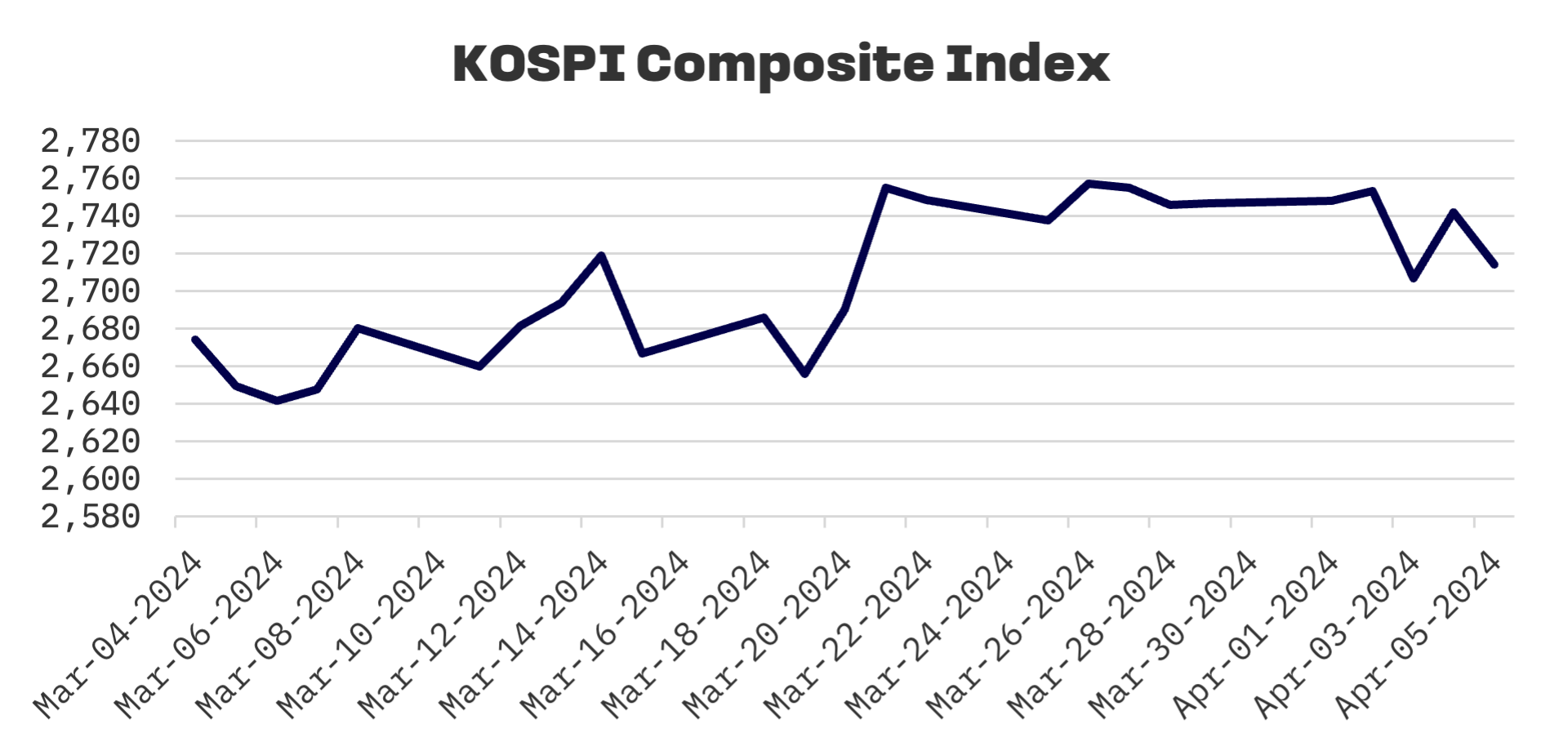

- South Korea’s KOSPI index experienced a 1.2% decline, reflecting market volatility and mixed signals from the U.S. about future interest rate directions

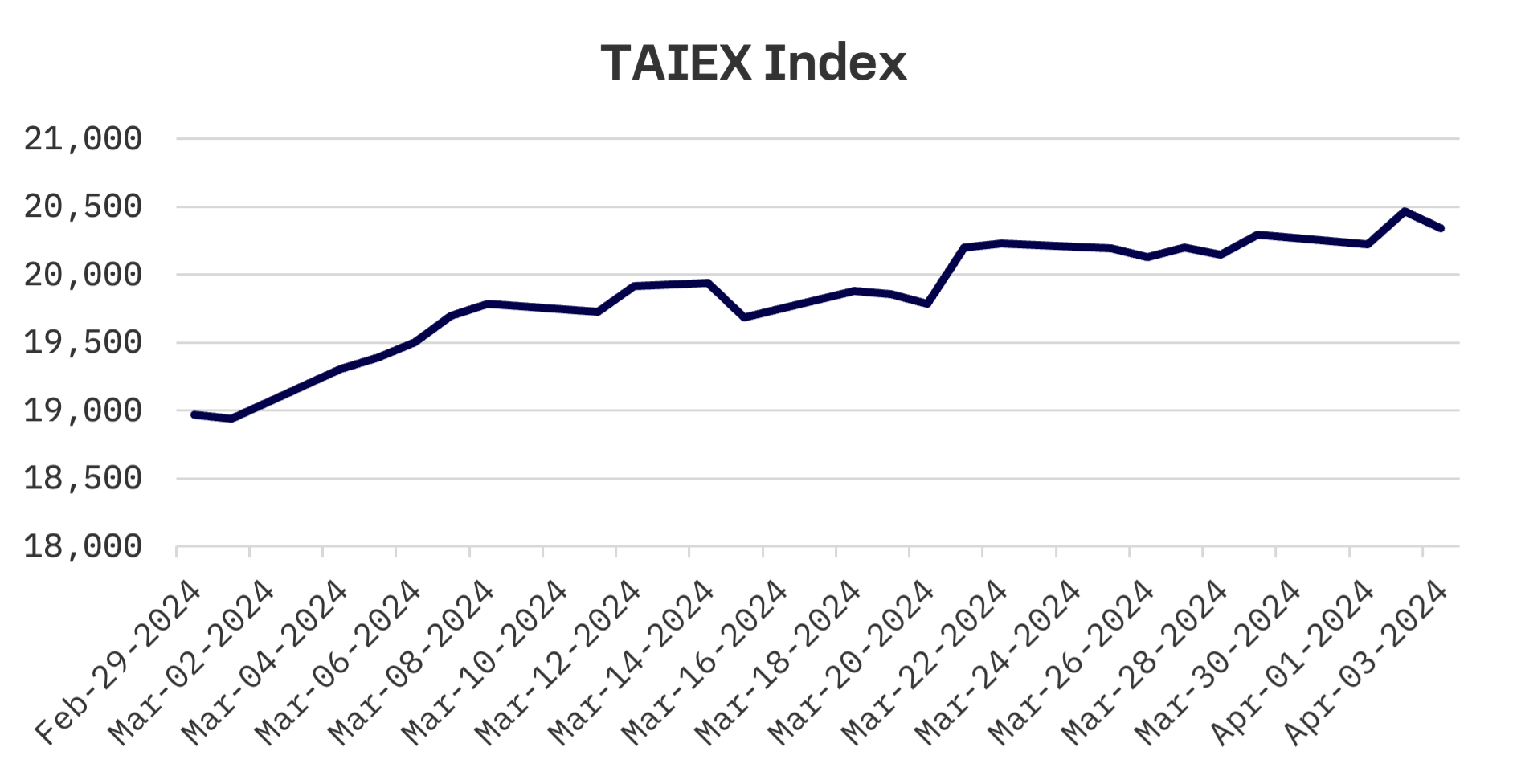

- Taiwan’s TAIEX demonstrated resilience with a slight 0.2% increase, overcoming challenges from a major earthquake and global market downturns

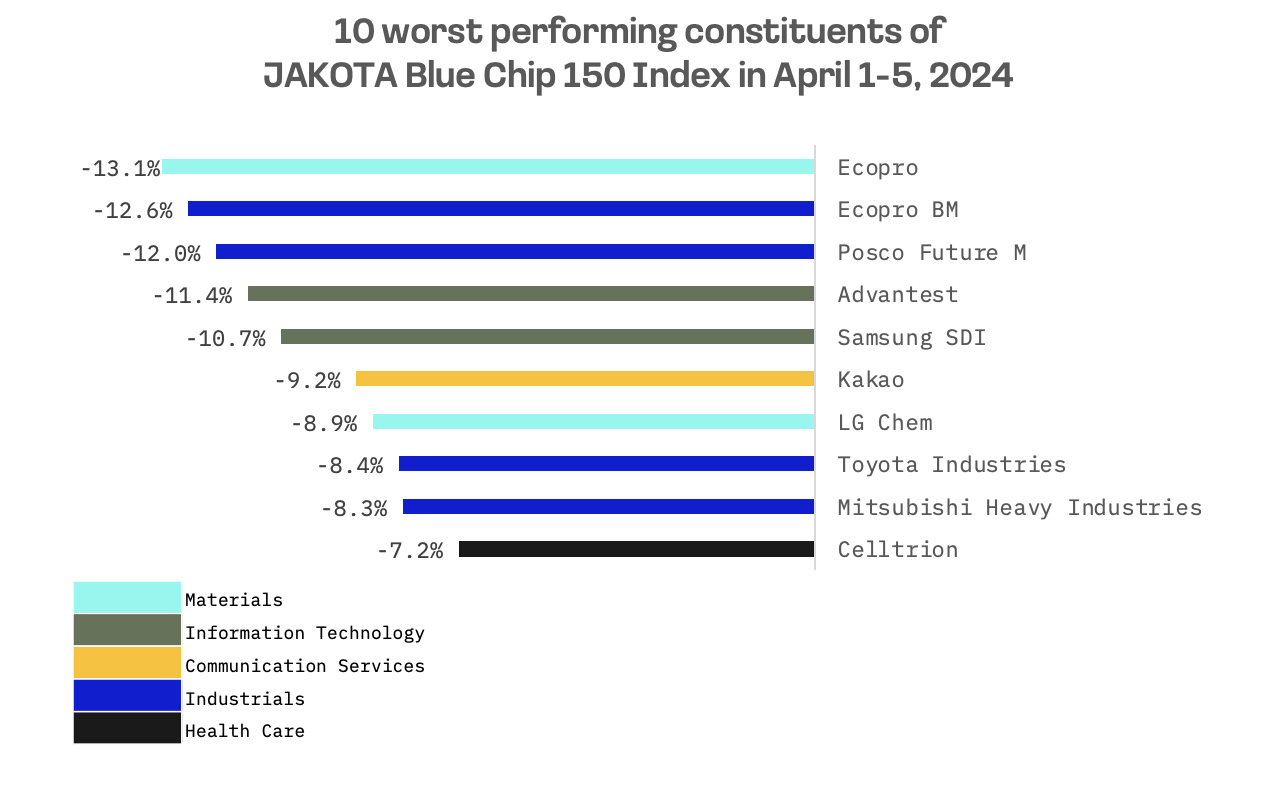

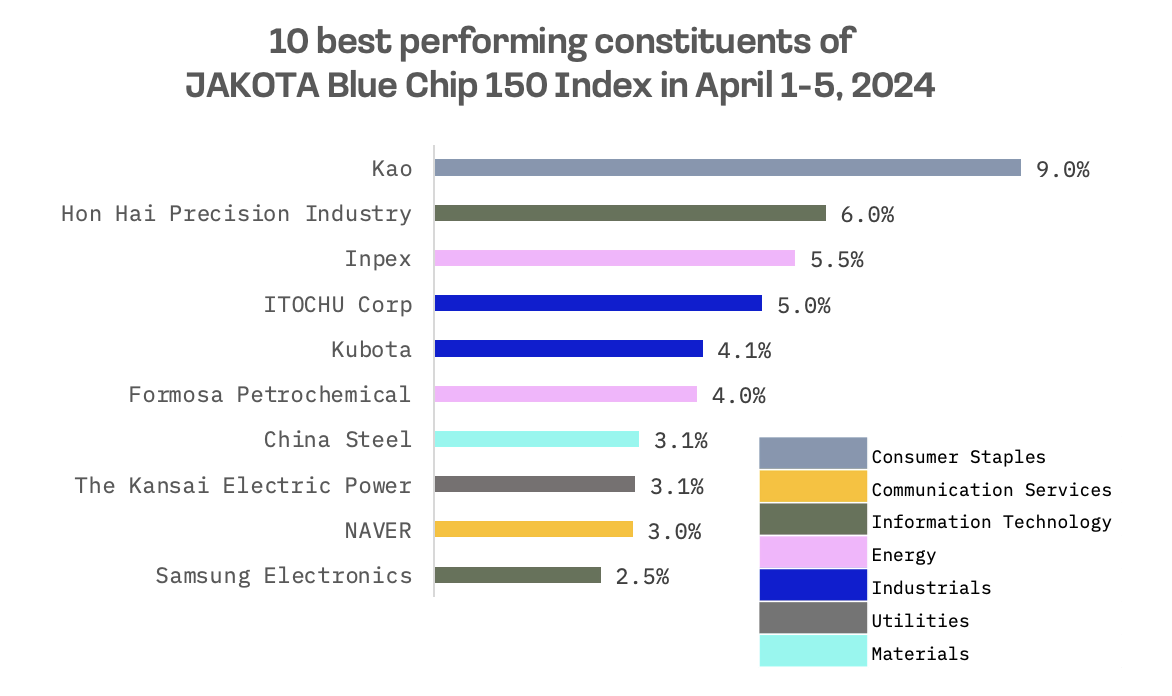

- With a 2% drop, the JAKOTA Blue Chip 150 Index mirrored the mixed fortunes of its constituents, from Kao Corporation’s surge to Ecopro’s decline following Tesla’s delivery report

Japan

This week, the Japanese stock market faced a notable downturn, with the Nikkei 225 Index dropping by 3.4%. The decline was largely driven by geopolitical tensions and uncertainty over the future direction of the U.S. Federal Reserve’s monetary policy, which exerted pressure on global equities. Domestically, there was ongoing speculation about possible interventions by Japanese authorities to support the yen as it flirted with the high-JPY 151 mark against the U.S. dollar, its weakest position in roughly 34 years. Despite this, the Ministry of Finance has been vocal about its readiness to counteract excessive volatility in the forex market. The yen’s depreciation over the last three years has been a boon for Japan’s exporters, enhancing their overseas earnings.

Signals from the Bank of Japan (BoJ) about a potential interest rate hike led to an increase in the yield on the 10-year Japanese government bond, moving to 0.77% from 0.72% a week earlier.

BoJ Governor Kazuo Ueda hinted that the central bank might leverage monetary policy tools to combat the yen’s significant weakness. The BoJ is closely monitoring the impact of the yen’s depreciation on inflation and wage growth, both of which are on a reflationary path. The central bank’s goal is to reach a sustainable 2% inflation rate alongside wage increases, with any policy normalization contingent upon these outcomes.

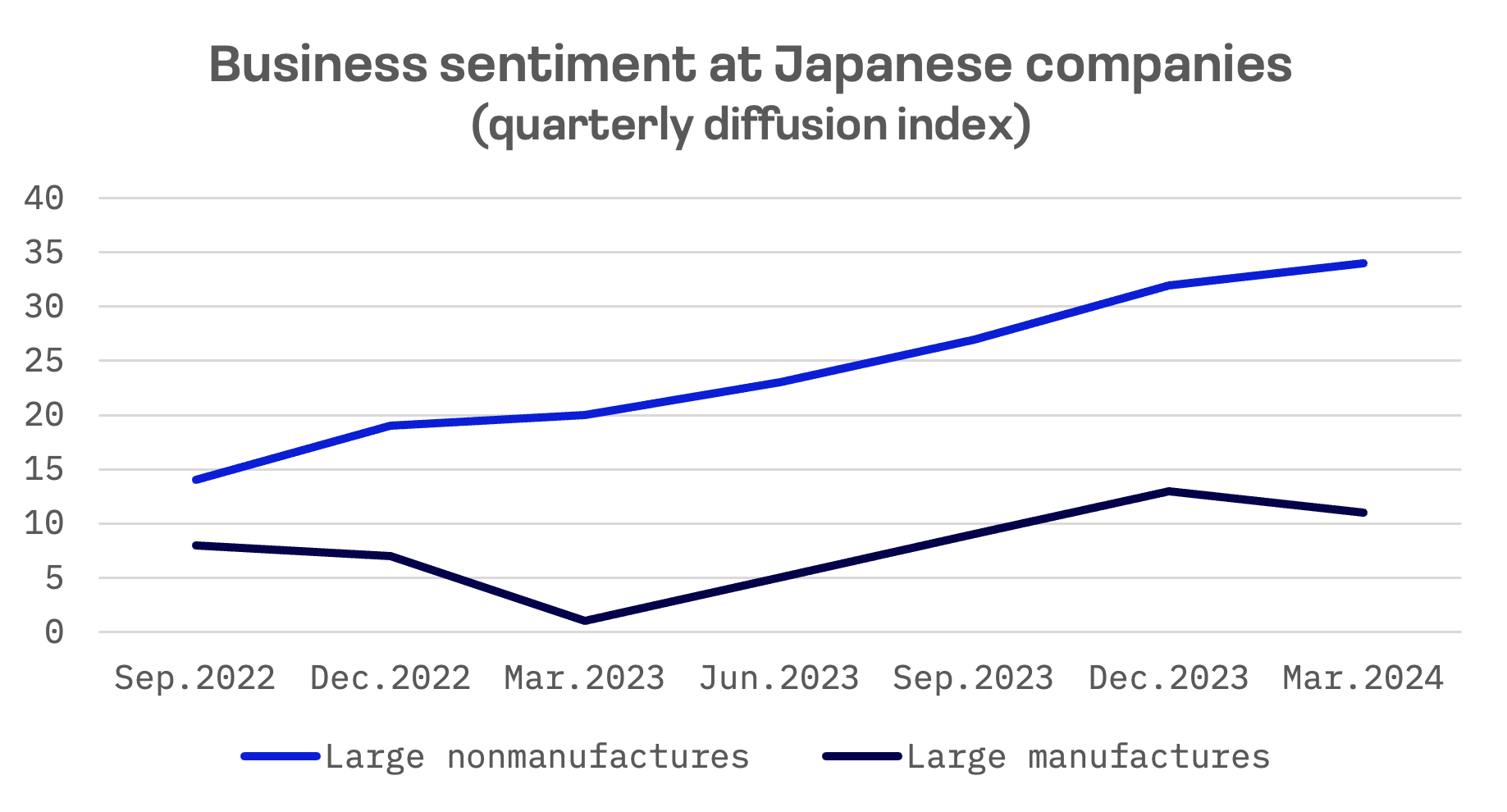

Recent economic data showed a dip in business sentiment among Japan’s large manufacturers for the first time in a year, influenced by car plant shutdowns due to acknowledged quality issues.

The Bank of Japan’s quarterly Tankan survey for the January-to-March quarter reported a headline diffusion index among large manufacturers at plus 11, a decrease from plus 13 in the previous quarter.

South Korea

The KOSPI index in South Korea fell by 1.2% this week, reflecting significant market volatility. The index ended its three-day winning streak on Wednesday, influenced by robust economic indicators from the United States that suggested the Federal Reserve might maintain elevated interest rates longer than anticipated. Nonetheless, a rebound occurred on Thursday, fuelled by the technology and automotive sectors’ gains and renewed optimism for potential Federal Reserve rate cuts later in the year. However, investor sentiment turned negative on Friday following hawkish statements from Federal Reserve officials.

Statistics Korea announced that March’s consumer prices rose by 3.1% year-over-year, maintaining the previous month’s inflation rate and marking the second consecutive month of inflation above 3%. This persistent inflation, spurred by sharp increases in fruit and vegetable prices and high international oil prices, underscores the Bank of Korea’s intention to continue its monetary tightening cycle.

Taiwan

Taiwan’s stock market had a shortened trading week due to the Children’s Day and Tomb-Sweeping Day holidays. Shares reached a new high on Tuesday, driven predominantly by buying activity in Taiwan Semiconductor (TSMC). However, the market’s bullish momentum was halted on Wednesday, closing lower after a 7.2 magnitude earthquake earlier in the day, coupled with overnight losses in U.S. markets. As a result, the TAIEX index registered a modest gain of 0.2% for the week.

The electronics sector, particularly concerned about potential production disruptions following the earthquake, led the downturn. Additionally, the financial sector saw declines amid fears that insurance companies could face significant claims due to the earthquake’s aftermath.

JAKOTA Blue Chip 150 Index

The JAKOTA Blue Chip 150 Index experienced a 2% decline this week, with only 30 of its 150 constituents showing positive performance.

Kao Corporation, a Japanese global chemical and cosmetics company, emerged as the top performer, with shares jumping 9% following activist investor calls for strategic actions to unlock value. The company reaffirmed its commitment to global growth, focusing on its strongest brands.

On the other end, Ecopro, a Korean secondary battery materials producer, and its subsidiary, Ecopro BM, were among the week’s biggest losers, affected by Tesla’s disappointing quarterly delivery report. This marked Tesla’s first year-over-year delivery decline since 2020, with global deliveries hitting a nearly two-year low amid a slowdown in electric vehicle demand.