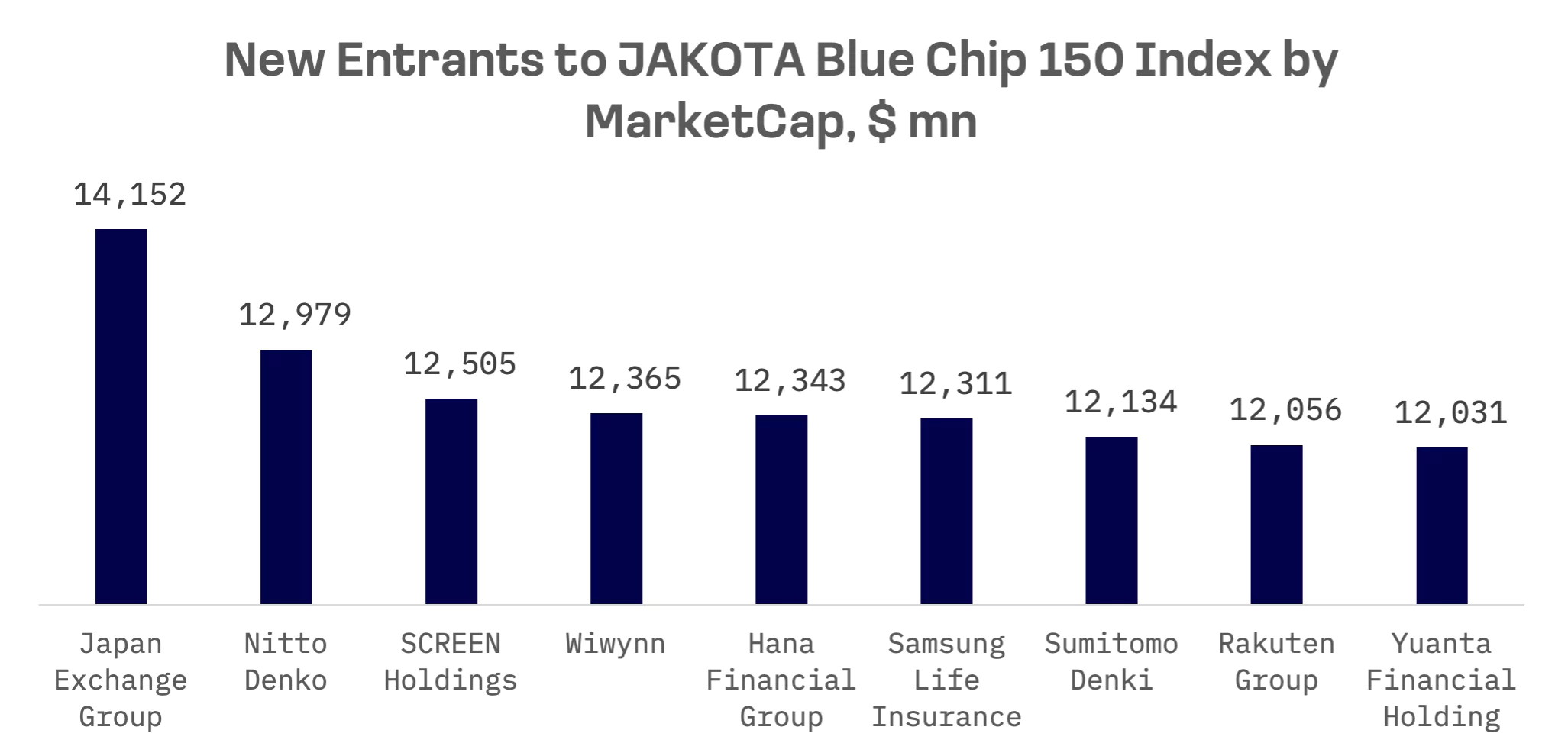

The new entrants and the companies they replace are as follows:

| Entrants | Leavers | ||

| Japan Exchange Group | Eisai | ||

| Nitto Denko | Hotai Motor | ||

| SCREEN Holdings | LG Electronics | ||

| Wiwynn | Largan Precision | ||

| Hana Financial Group | Shiseido | ||

| Samsung Life Insurance | Formosa Chemicals & Fibre | ||

| Sumitomo Denki | ASUSTeK Computer | ||

| Rakuten Group | First Financial Holding | ||

| Yuanta Financial Holding | Sysmex |

Japan Exchange Group (8697.TSE) operates as a financial instruments exchange holding company, owning the Tokyo Stock Exchange (TSE), Osaka Exchange (OSE) and Tokyo Commodity Exchange (TOCOM).

Nitto Denko (6988.TSE), a Japanese company, specialises in the production and distribution of adhesives, optical films, semiconductors, electronic devices and consumer products.

SCREEN Holdings (7735.TSE), a Japanese semiconductor and electronics company, engages in the manufacture and sale of equipment for semiconductors, flat panel displays, storage media and precision technology.

Wiwynn (6669.TW), based in Taiwan, focuses on the research, development, design, manufacture and distribution of servers for cloud services and Hyperscale Data Centers.

Hana Financial Group (086790.KO), a South Korean financial group, offers integrated financial services through its subsidiaries, including KEB Hana Bank, Hana Daetoo Securities, KEB Hana Card and Hana Life.

Samsung Life Insurance (032830.KO) is South Korea’s largest life insurer.

Sumitomo Denki (5802.TSE) is a Japanese manufacturer of electric wire and optical fibre cables.

Rakuten Group (4755.TSE) ranks as Japan’s largest ecommerce company and the third largest globally.

Yuanta Financial Holding (2885.TW) offers brokerage and investment banking services in Taiwan.

In terms of geographic distribution, Japan leads with five companies among the new entrants, followed by South Korea and Taiwan with two each.

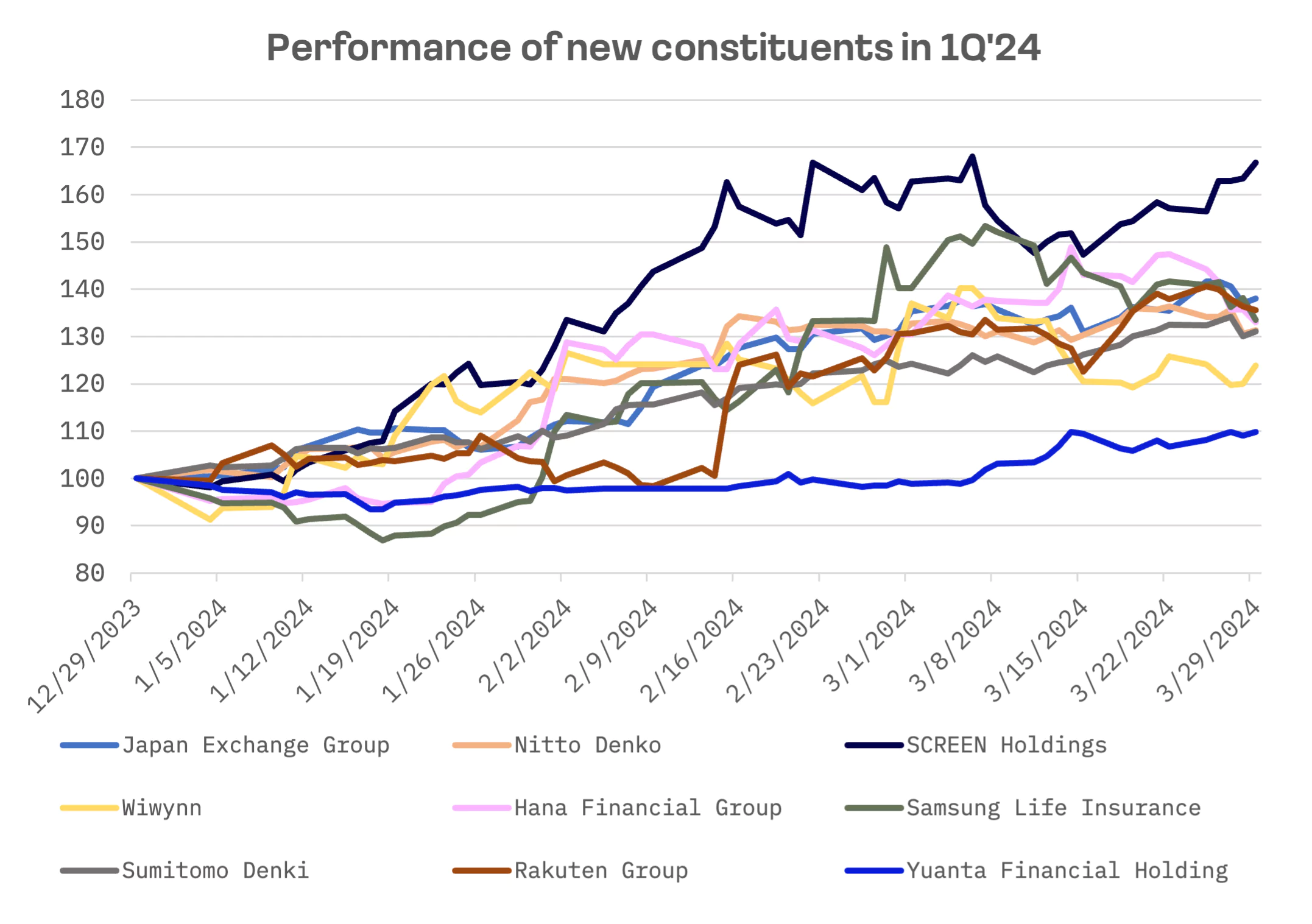

In the first quarter of 2024, these new entrants experienced an average growth of 33%. SCREEN Holdings notably stood out, benefitting from increased spending by memory chip producers, particularly during the September 2023 to March 2024 period. This growth is part of a broader uptrend in the semiconductor equipment sector driven by robust demand from China.

In terms of valuation metrics, Japan Exchange Group and SCREEN Holdings are highlighted for their substantial valuations relative to their peers, indicating elevated investor expectations for their future growth and profitability.

| Company | EV/Total Revenues | EV/EBITDA | P/E |

| Japan Exchange Group | 12.5x | 18.6x | 35.3x |

| Nitto Denko | 1.9x | 9.2x | 21.6x |

| SCREEN Holdings | 3.1x | 16.0x | 29.0x |

| Wiwynn | 1.6x | 21.8x | 33.6x |

| Hana Financial Group | NA | NA | 4.7x |

| Samsung Life Insurance | 1.1x | NA | 7.5x |

| Sumitomo Denki | 0.6x | 9.7x | 14.0x |

| Rakuten Group | 0.7x | 9.6x | 56.2x |

| Yuanta Financial Holding | 1.7x | 4.4x | 14.3x |

| MEAN | 2.9x | 12.8x | 24.0x |

| MEDIAN | 1.6x | 9.7x | 21.6x |