Original article was published by Business Weekly Taiwan on November 20, 2023

https://www.businessweekly.com.tw/business/indep/1003930

Below is a translation of the original article to English.

The most significant economic trend in the 21st century is the emergence of the BRIC countries, and now JAKOTA is poised to take the lead.

JAKOTA, an acronym for the Taiwan, Japan, and Korea region, represents a current economic force. Coined by Dr. Rory Knight, Chairman of the British financial consulting company Oxford Metrica, this term signifies the collective potential for economic growth in these three Asian nations.

Dr. Knight, a former Vice President of the Swiss National Bank and twice Dean of Templeton Business School at the University of Oxford, is a seasoned professional with extensive academic and industrial experience. Having visited Asia over 150 times in the past 25 years, he points out three key reasons for his optimism regarding Taiwan, Japan, and South Korea.

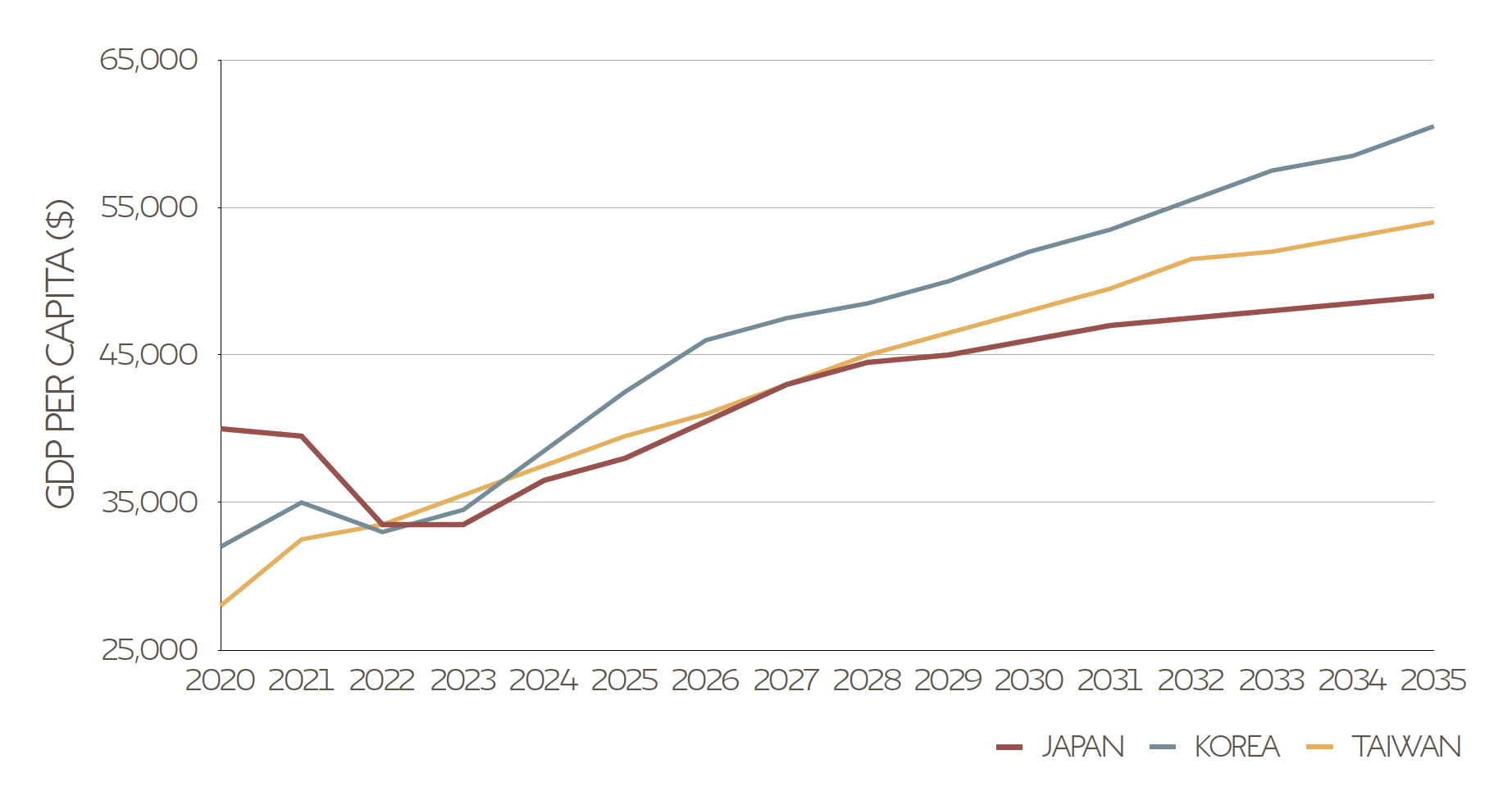

Macroeconomic Outlook for JAKOTA

Firstly, these countries boast educational standards unmatched elsewhere, with nearly 60% of individuals aged 24 to 35 holding bachelor’s degrees—a figure exceeding that of the United States and the United Kingdom. This well-educated workforce is reflected in the robust development of intellectual property rights across various industries.

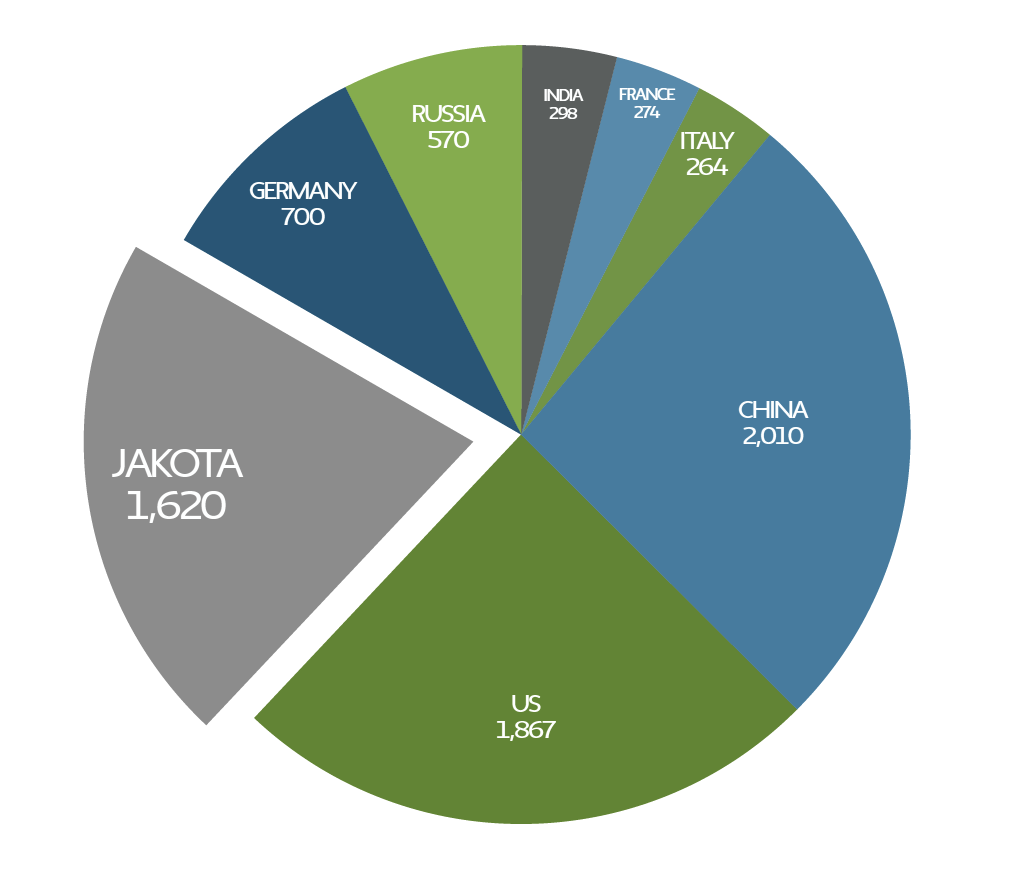

Secondly, the region ranks among the world’s top ten in terms of manufacturing output value and collectively holds a top-three position in manufacturing export scale.

Top Ten Manufacturers (USD billion)

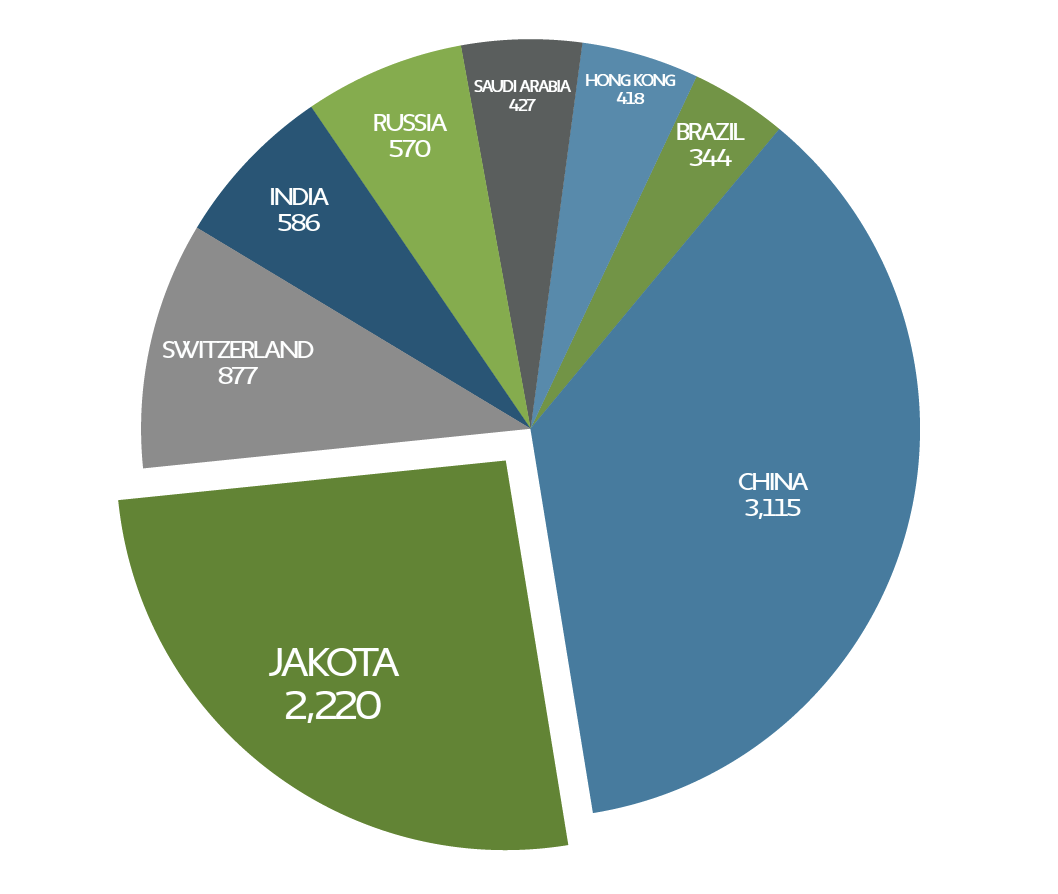

Thirdly, Taiwan, Japan, and South Korea are among the top ten global foreign exchange reserve holders, signifying their status as global creditors. Additionally, these countries exhibit high levels of freedom, democracy, political stability, and legal concepts, providing favorable conditions for economic development.

Top Ten by Foreign Reserves, October 2023 (USD billion)

Despite these opportunities, Dr. Knight identifies three major risks for JAKOTA: the risk of war, corporate governance challenges, and restrictions on foreign-owned companies due to laws and regulations. However, he remains optimistic, citing U.S. military deployment in the region for security, efforts by local leaders to avoid war, and the potential for companies to navigate governance challenges and attract foreign capital for long-term growth.

To help investors navigate these opportunities and risks, Dr. Knight has established JAKOTA Index Portfolios – jakotaindex.com. This platform conducts in-depth research on companies in Taiwan, Japan, and South Korea, compiling the JAKOTA Index, which includes companies with high-quality intellectual property rights, high liquidity, large export output, and positive cash flow.

JAKOTA Index Portfolios break away from traditional market classification methods, offering a unique approach that focuses on promising companies in the JAKOTA region. Notably, the JAKOTA Blue Chip 150 Index, one of their flagship indexes, has outperformed the S&P 500 Index in terms of return in backtesting.

In addition to overall indexes, JAKOTA Index Portfolios compile industry-specific indexes, including technology, consumer, semiconductor, and the popular K-POP index, providing investors with diverse options based on their preferences.

JAKOTA, with its robust economic strength, lower risks compared to emerging markets, and higher returns than mature economies, emerges as an ideal choice for prudent investors seeking growth.