Despite having a history of low stock investment levels, there’s a growing trend of increased engagement in the stock market by Japanese households. According to the Bank of Japan’s 2022 report, Japanese families have historically invested a mere 11.0% of their financial assets in stocks, significantly less than their counterparts in the United States and Europe, who allocate 39.2% and 20.0%, respectively.

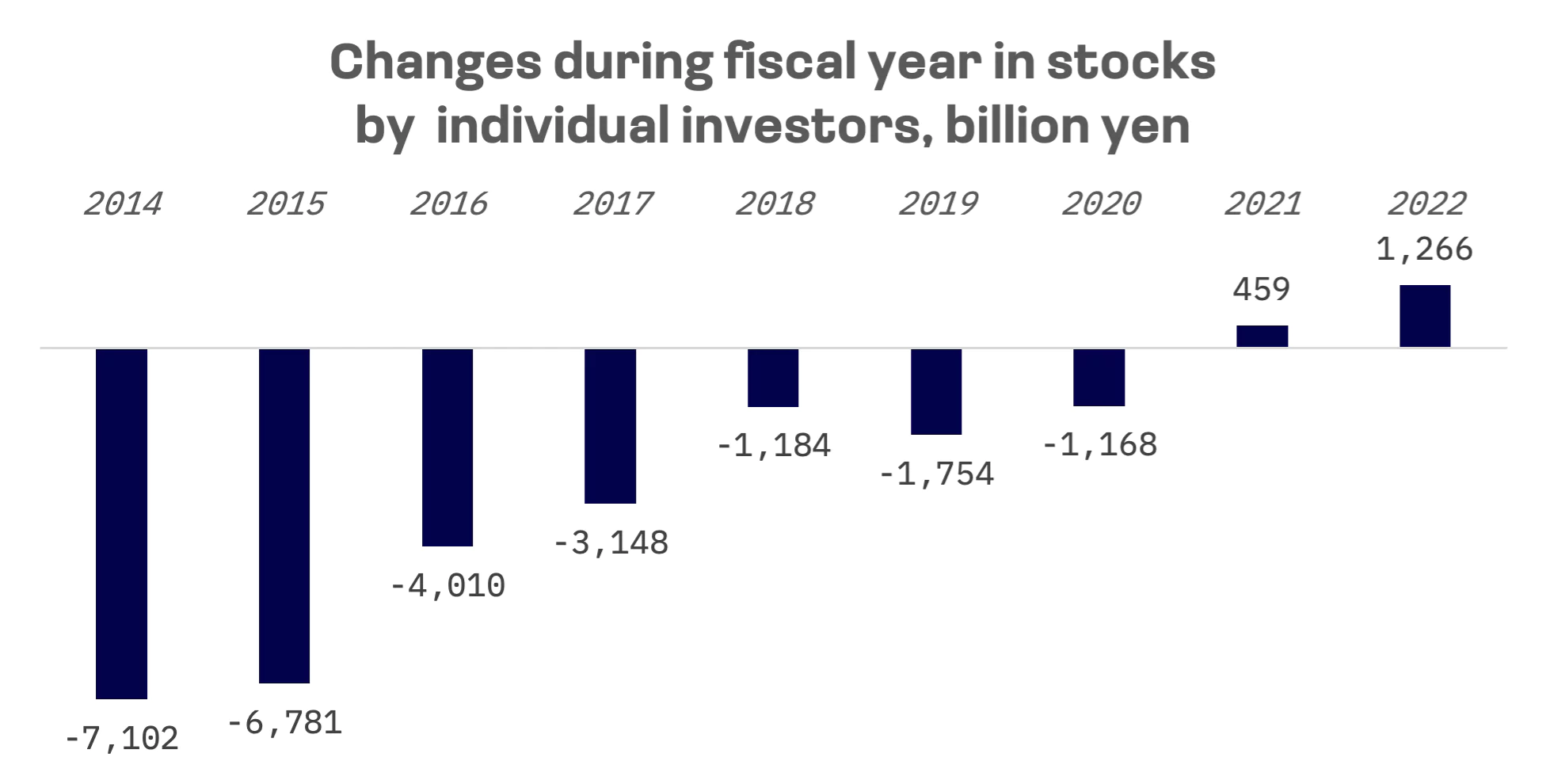

However, this trend is changing as individual investors have begun to exert a greater influence on the Japanese stock market. This shift is attributed to several key factors: the enduring low interest rates on traditional savings, the enhanced accessibility of online trading platforms and a rising interest in stock investment amongst young people. Consequently, individual investors have transitioned to net buyers in the market as of 2021, a momentum that has continued into 2022.

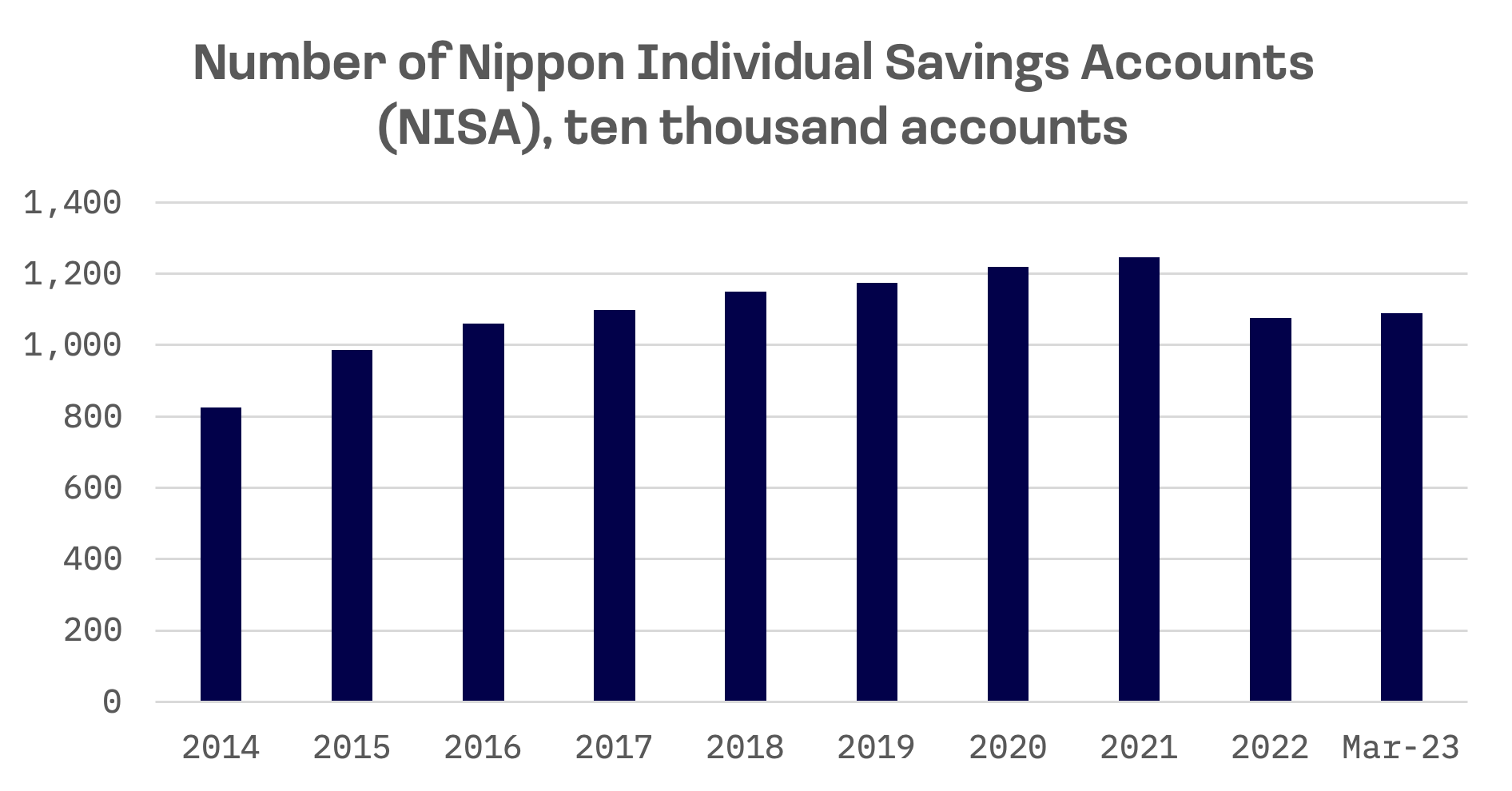

Yet, over half of Japan’s household financial assets, which amount to more than $15 trillion, are still held in cash and deposits. In an effort to mobilize these savings towards more productive avenues, the government has implemented reforms aimed at fostering a healthy investment ecosystem. Central to these reforms is the revitalization and permanence of the Nippon Individual Savings Account (NISA) program, which has been expanded and established as a permanent feature as of this January. This tax exemption scheme for retail investors is designed to stimulate a migration of household financial assets from mere savings to investments, thereby bolstering national income and corporate profitability.

Originally introduced in 2014 and modeled after the UK’s Individual Savings Account (ISA) system, the NISA program offers two types of accounts: a general NISA for a wide array of investment products, and a Tsumitate NISA, tailored for long-term investments in mutual funds. Before the 2024 enhancements, individuals were allowed to invest up to ¥1.2 million (~$8,000) annually in general NISA accounts and up to ¥400,000 in Tsumitate accounts, with these investments enjoying a five-year (general NISA) and twenty-year (Tsumitate NISA) exemption from Japan’s 20% capital gains tax.

The program’s recent overhaul significantly increases the annual investment limit for individuals to ¥3.6 million, effectively doubling the cap for general NISA accounts to ¥2.4 million. Additionally, it introduces a cumulative total balance limit of ¥18 million across all NISA accounts, with permanent tax-exemption status.

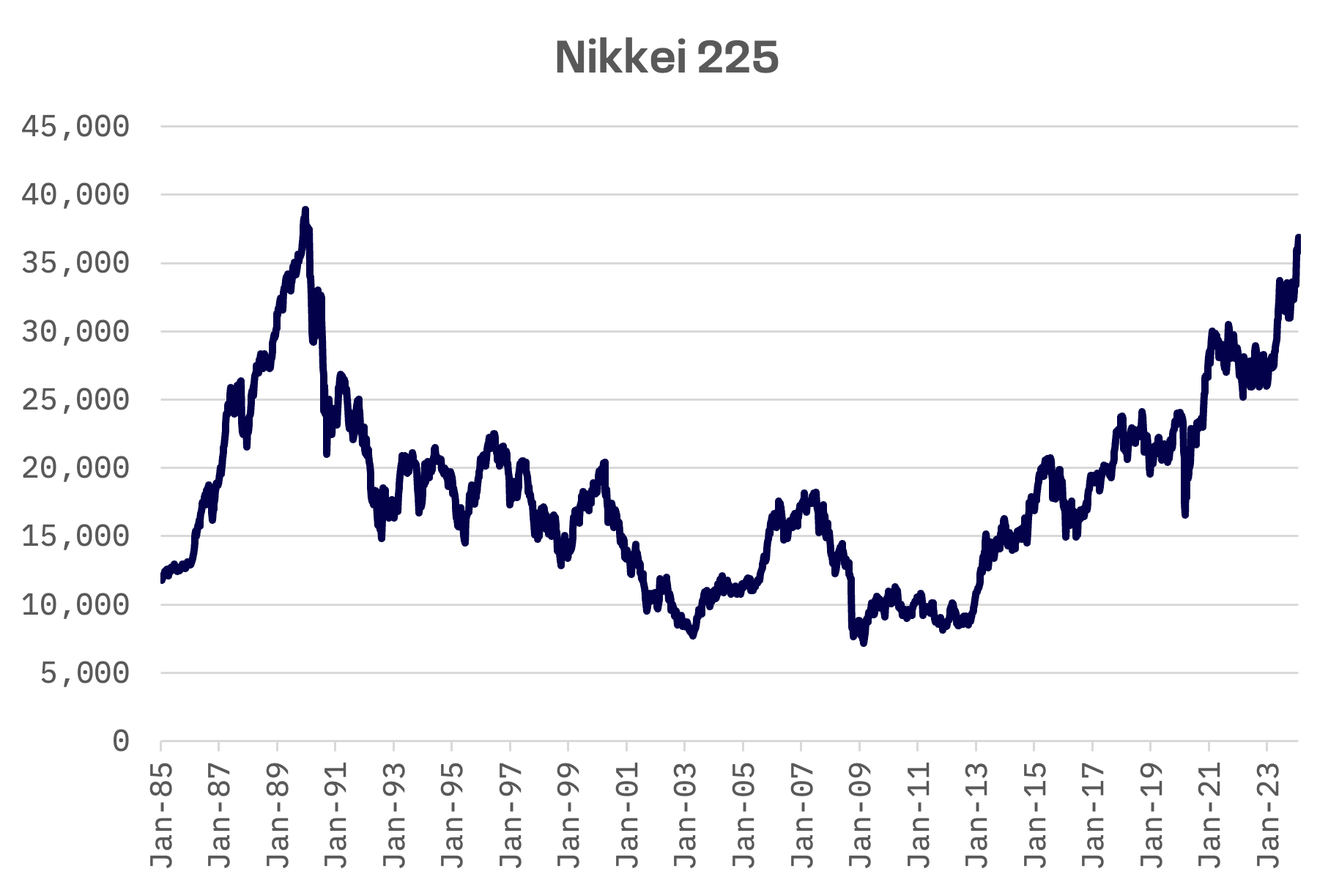

Coinciding with the Nikkei 225 index reaching its highest point in approximately 33 years, Japan’s retail investors have shown heightened interest in the NISA program, particularly following its recent enhancements. Records indicate an unprecedented surge in stock purchases through NISA accounts, with high-dividend stocks such as Japan Tobacco attracting notable attention. In the two weeks leading up to January 19, stock purchases via tax-exempt NISA accounts reached a new high of ¥464.9 billion ($3.1 billion), as reported by leading online brokerages.

Investment behaviors among Japanese retail investors show a clear generational divide. Older investors, often wary of prolonged market uptrends, tend to adopt contrarian strategies, especially during rallies driven by foreign investment. This cohort also includes those holding stocks that plummeted after Japan’s asset price bubble burst in the early 1990s, prompting them to sell during rallies to cut losses.

In contrast, the younger generation, particularly those in their 20s and 30s, displays a more bullish outlook on the stock market, largely due to their formative years coinciding with its growth. Many in this demographic are leveraging NISA accounts among other investment avenues to accumulate wealth.

While January’s investment surge in NISA accounts is partly attributed to seasonal factors such as winter bonuses and early-year contribution maximization, it’s imperative to monitor whether this upturn represents a sustained change in investment patterns or a temporary fluctuation.