South Korea lifted its short selling ban on March 31, ending restrictions imposed in November 2023 after authorities uncovered several naked short selling violations by global investment banks.

The move reinstated short selling for all listed firms for the first time since March 2020, when authorities implemented a blanket ban amid market turmoil triggered by the COVID-19 pandemic. The ban was partially lifted in May 2021 before being reintroduced in 2023.

To address previous concerns, the bourse operator has implemented a new system to detect illegal practices, while the Financial Supervisory Commission, South Korea’s financial regulator, introduced updated regulatory measures.

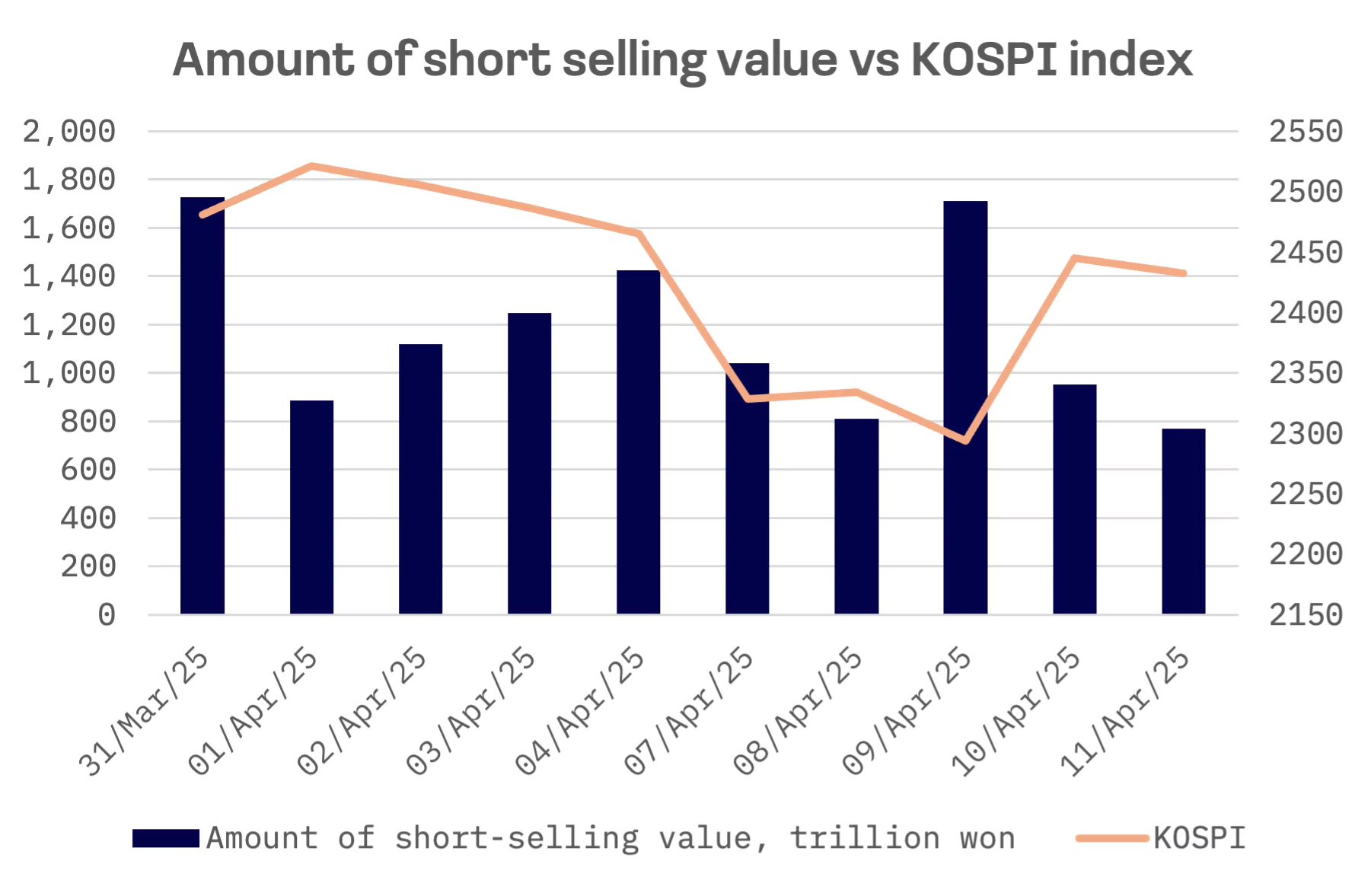

The decision came during a period of heightened market volatility, as mounting fears of a global trade war followed aggressive U.S. reciprocal tariffs – measures that were subsequently paused for 90 days.

According to the Korea Exchange, short selling on the main KOSPI and secondary KOSDAQ boards has averaged ₩1.17 trillion ($940 million) daily during the first two weeks since the practice resumed.

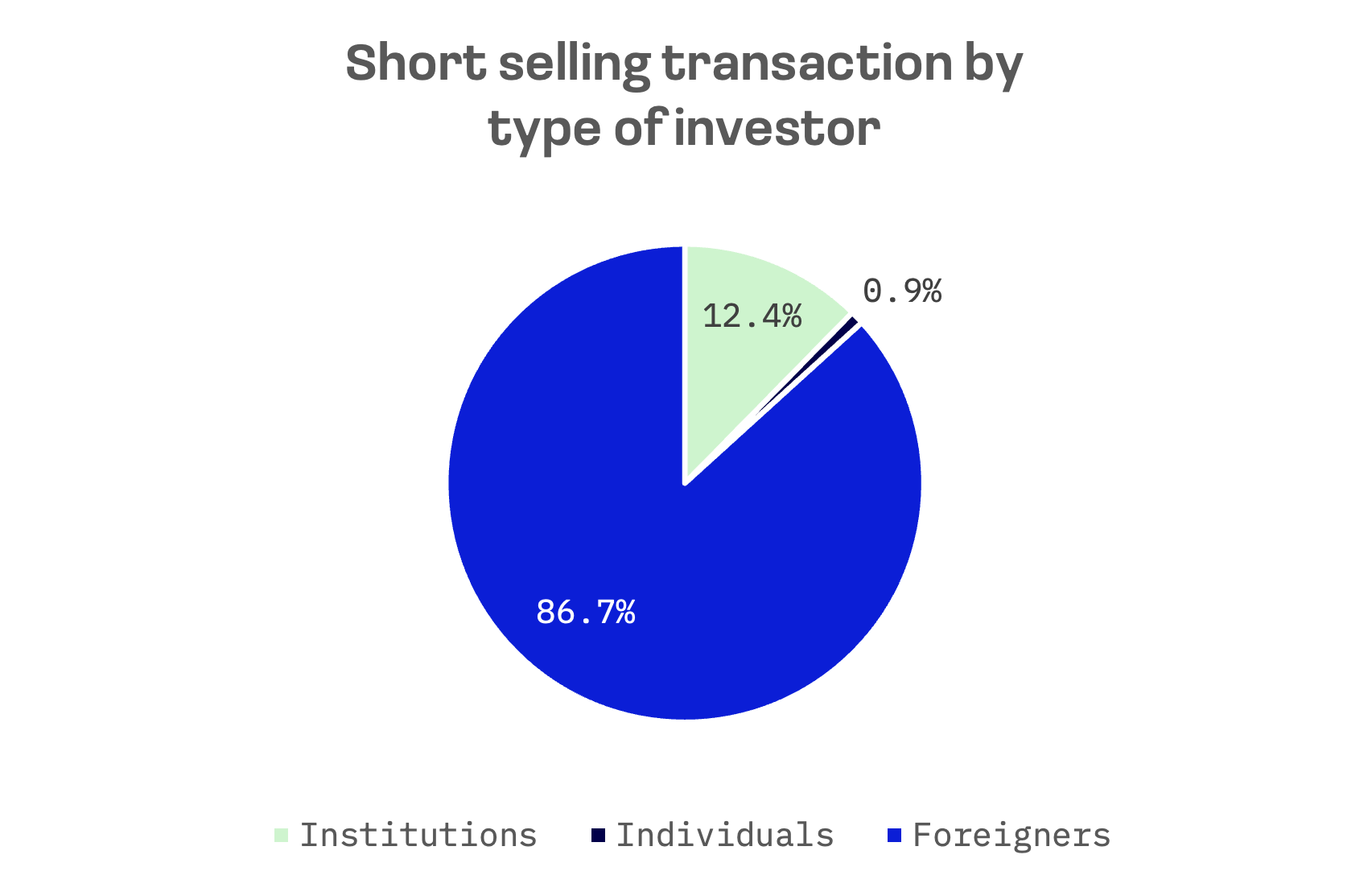

Foreign investors dominated the activity, accounting for approximately 90% of short selling on the KOSPI, while individual investors contributed less than 1%.

Regulators view the policy change as an attempt to restore confidence among global investors, some of whom withdrew following political unrest late last year. The Financial Supervisory Service announced it would strengthen market monitoring and introduce measures to limit excessive volatility in certain stocks for up to two months following the ban’s removal.

The Korean stock market permits short selling under specific standards to capitalise on its benefits while implementing market management measures to minimise risks. To prevent payment defaults, naked short selling remains prohibited and members must confirm when accepting sell orders. To maintain market stability and balanced price formation, financial authorities enforce regulations including restrictions on asking prices, public announcement requirements, reporting systems for net short positions and designations for overheated short selling issues.

The reinstatement of short selling – a strategy favoured by hedge funds and global investment banks – could enhance liquidity on the benchmark KOSPI index and support South Korea’s long standing goal to achieve developed market status in MSCI’s global classification.

MSCI had previously warned that the ban introduced “market accessibility restrictions,” noting that while temporary, abrupt changes in trading rules “are not desirable.”