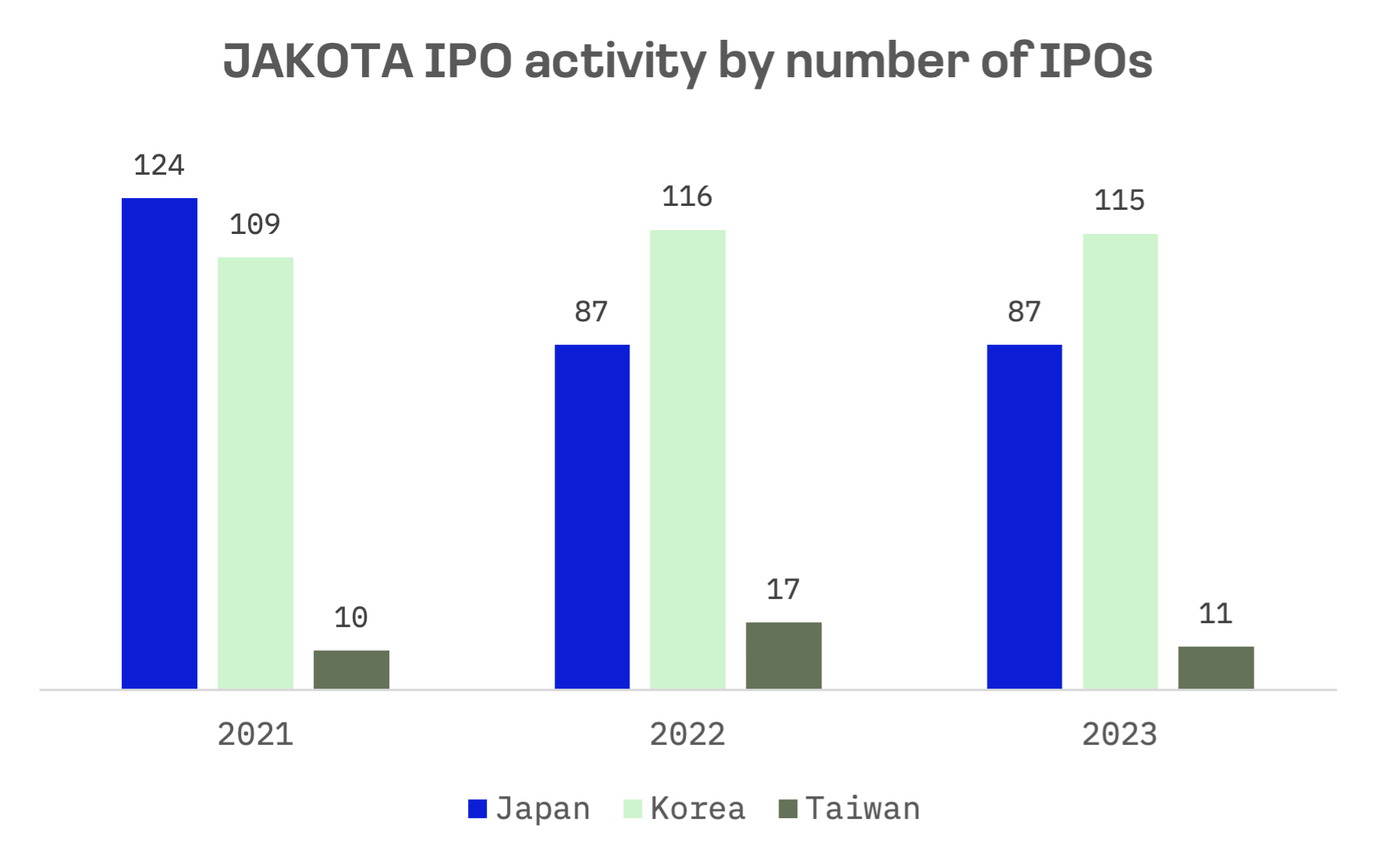

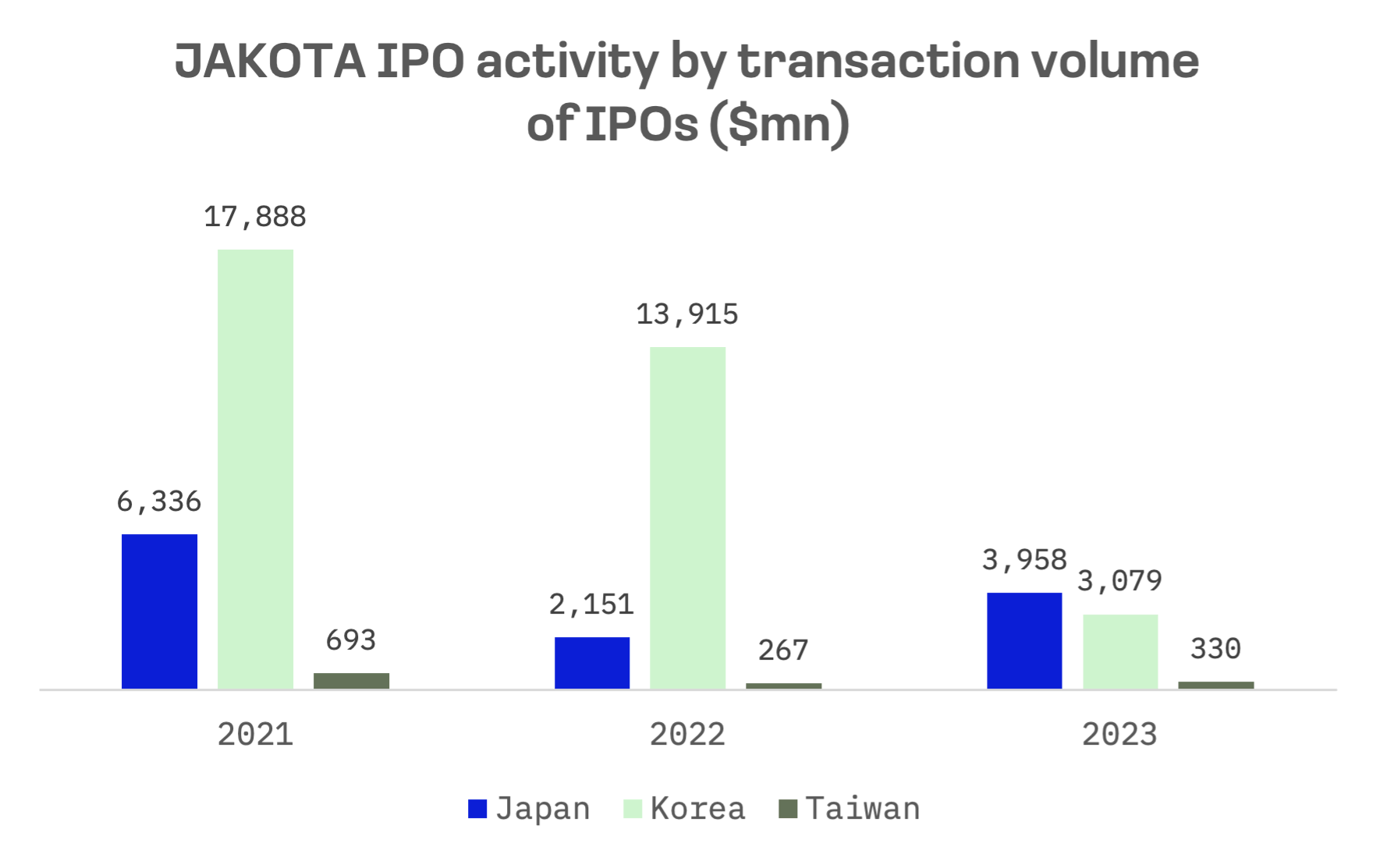

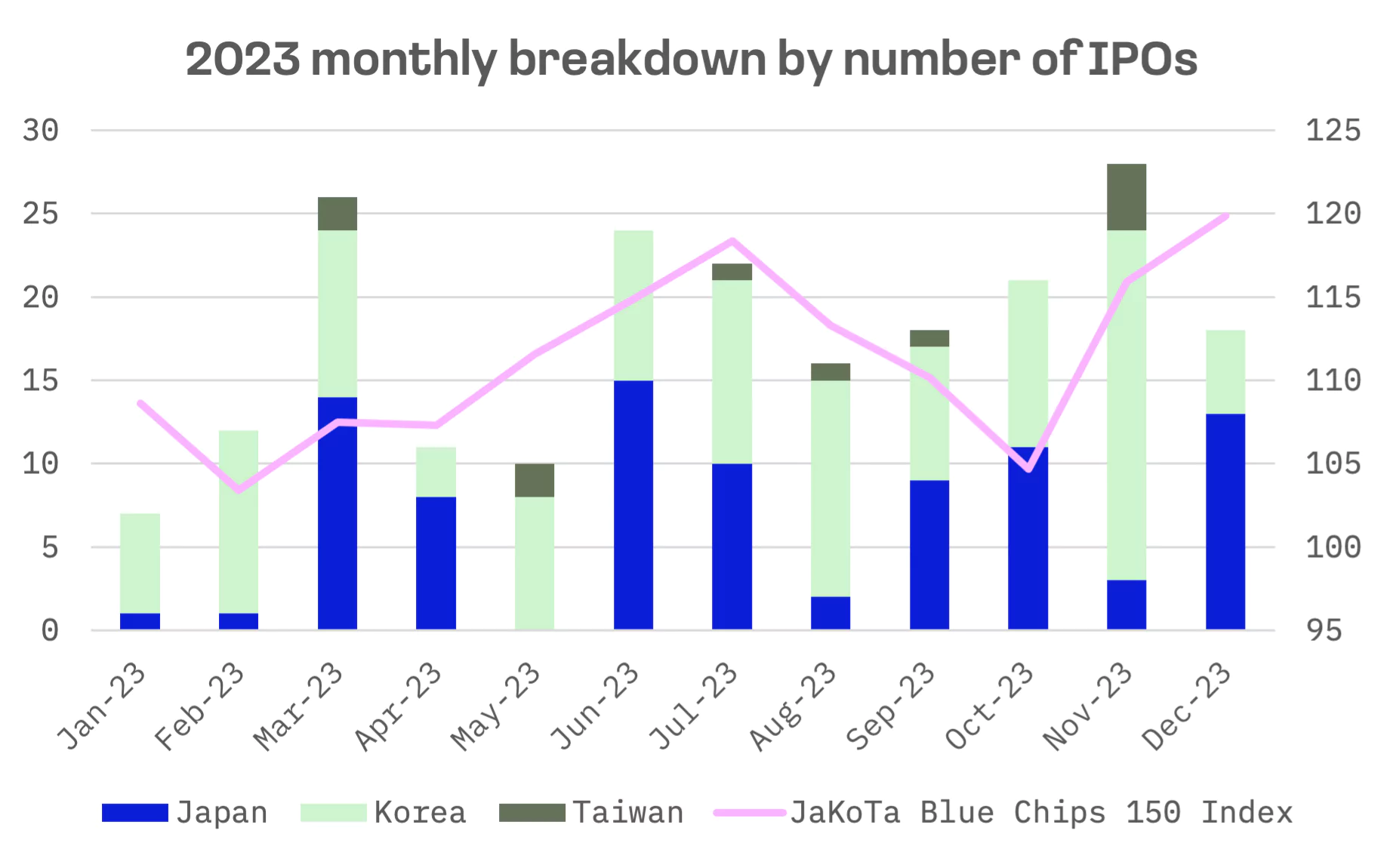

In 2023, the JAKOTA IPO market experienced a dichotomy, with small-cap deals thriving while larger offerings, particularly in South Korea, faltered. The year wrapped up with 213 IPOs, collectively raising $7.37 billion. While the number of IPOs remained robust, this fundraising figure marks a significant downturn in terms of IPO proceeds, declining to nearly half of 2022’s already modest levels. Japan, however, bucked this trend, exhibiting significant growth in transaction volumes.

Korea’s diminished transaction volume can be largely attributed to the absence of mega IPOs like that of LG Energy in 2022, which alone raised about $10.7 billion — a figure approximately 2.5 times larger than Korea’s previous record, set by Samsung Life Insurance Co.

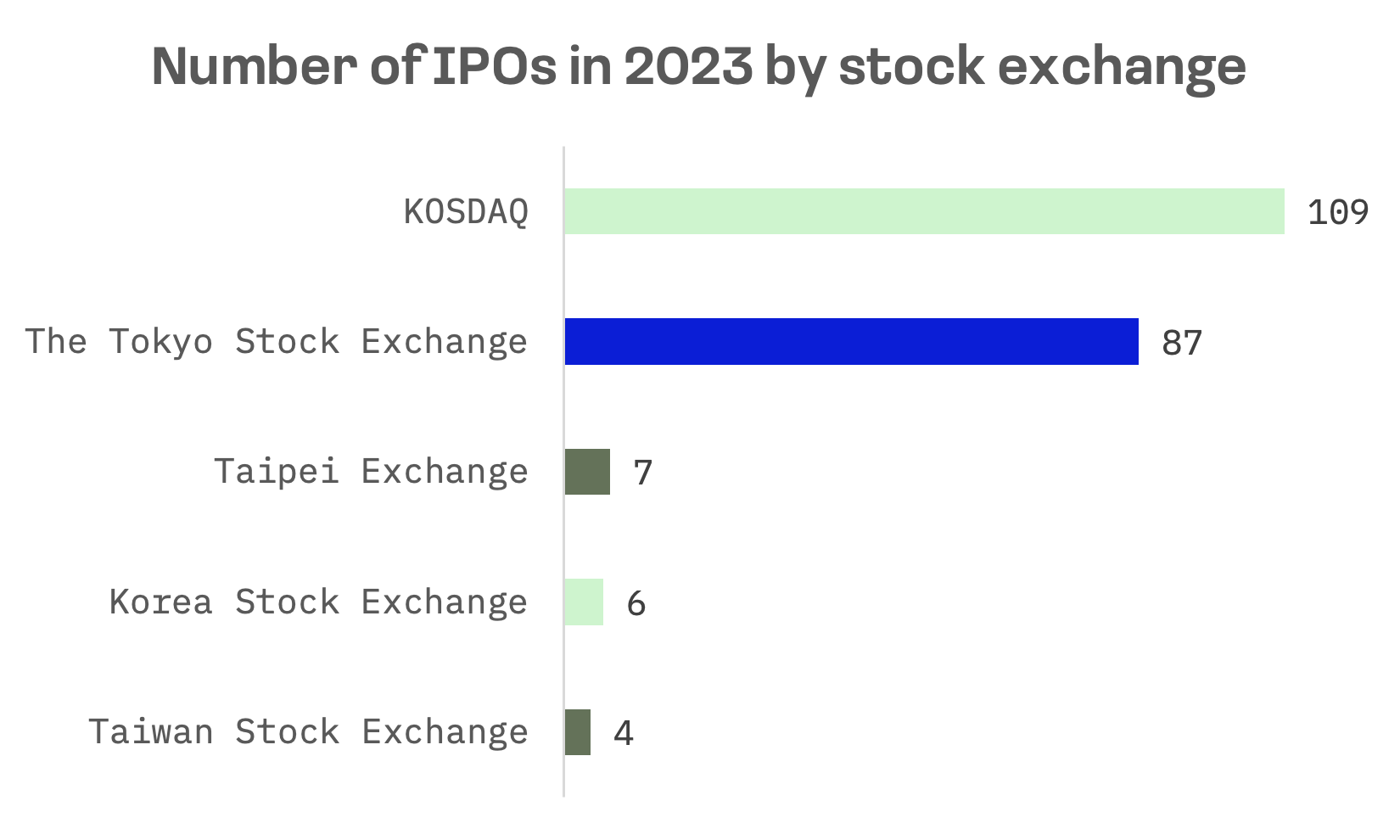

The JAKOTA IPO universe encompasses exchanges in Tokyo (Tokyo Stock Exchange), two in South Korea (Korea Stock Exchange and KOSDAQ) and two in Taiwan (Taipei Exchange and Taiwan Stock Exchange). While KOSDAQ led in terms of the sheer number of IPOs, the Tokyo Stock Exchange outstripped others in transaction volume, its average deal size being more than double that of KOSDAQ.

Despite a strong equity market rally, IPOs remained subdued, primarily due to the influence of aggressive global monetary policies, which have significantly overshadowed the traditional impact of stock market performance. This year’s notable decrease in global inflation, coupled with the anticipation of interest rate reductions, may offer investors a more predictable return on investment in IPOs, potentially stimulating activity in this market.

The IPO sector’s optimism is palpable. According to the EY CEO Outlook Pulse survey in October 2023, 40% of private company CEOs with imminent transactions in the following 12 months are actively considering IPOs, spin-offs, and divestments, hoping to leverage the anticipated market upswing.

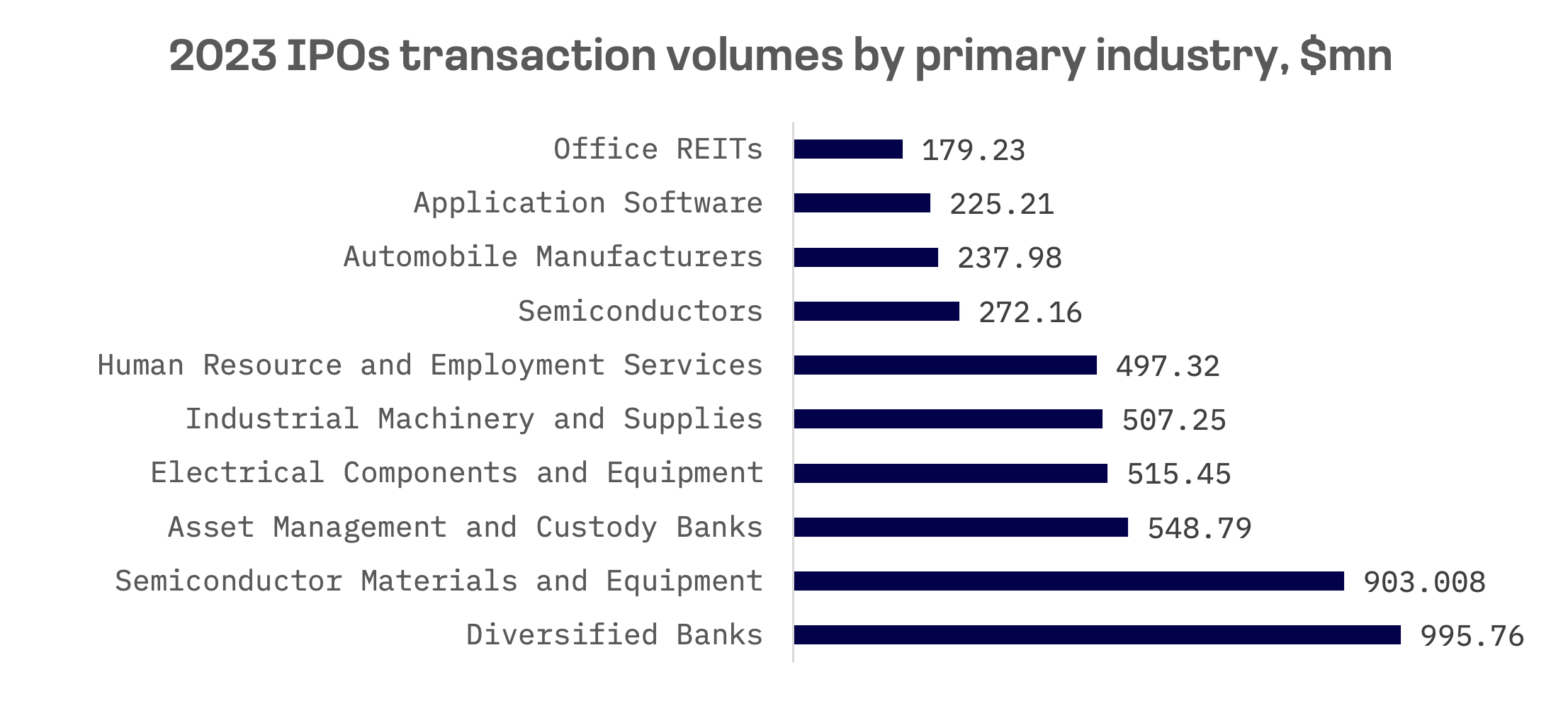

In 2023, the JAKOTA IPO market saw Diversified Banks and Semiconductor Materials and Equipment emerge as the top industries by transaction volumes, reflecting a significant shift in the sectorial landscape. This change is highlighted by the entrance of industries such as Diversified Banks, Human Resource and Employment Services, and Automobile Manufacturers into the top 10 list for 2023, which were absent in the previous year’s ranking.

While many industries experienced declines or only modest growth in transaction volumes compared to 2022, the Semiconductor Materials and Equipment sector, in particular, stood out as a remarkable exception, showcasing an increase in transaction volumes by more than fivefold, highlighting the dynamic and ever-changing nature of market trends in the IPO landscape.

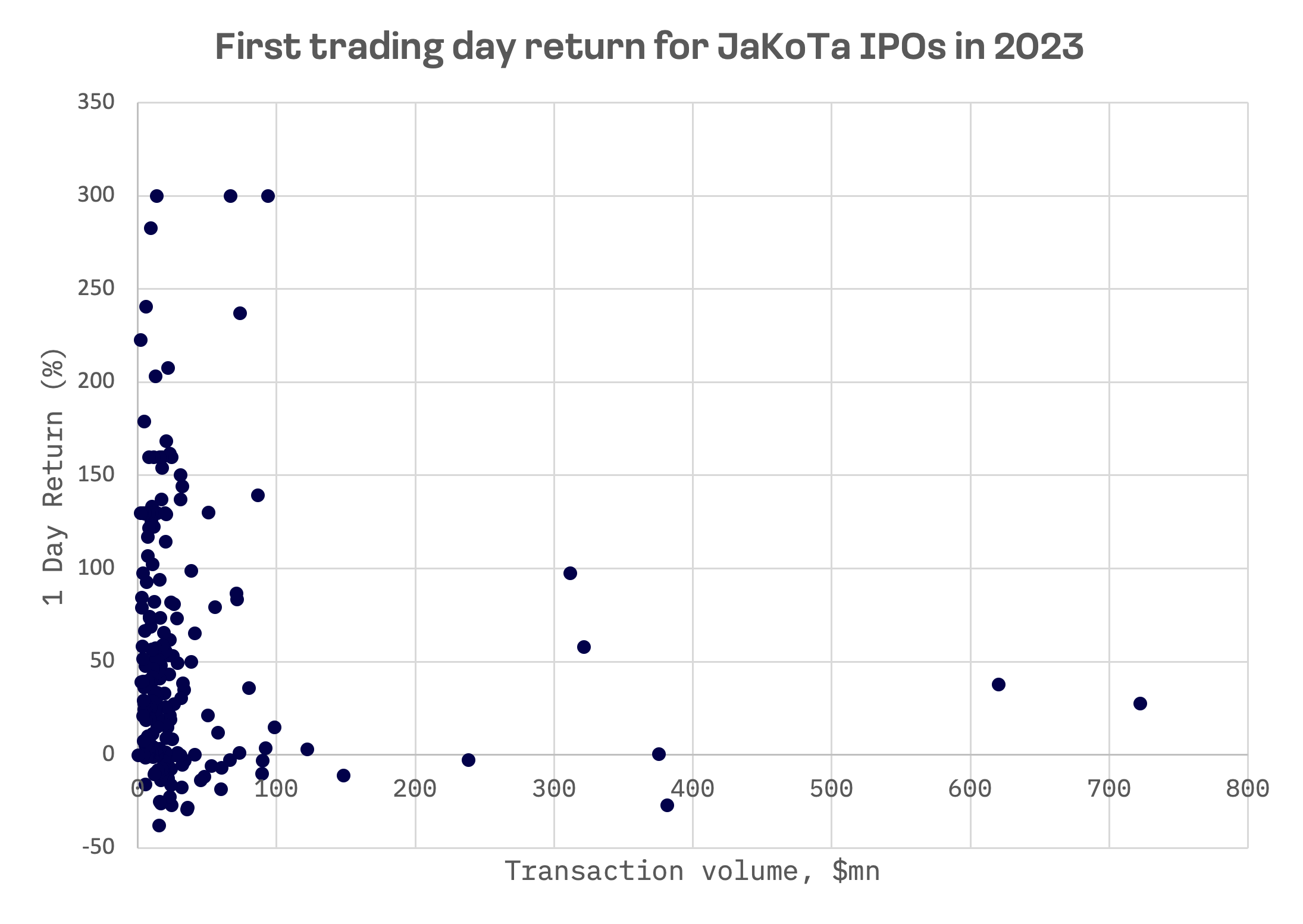

Four of the five largest IPOs in 2023, by transaction volume, took place on the Tokyo Stock Exchange.

| Target/Issuer | Ticker | Exchange | Total Transaction Value ($mn, Historical rate) | 1 Day Return (%) | Public Offerings Offer Date | Primary Industry |

| Kokusai Electric | 6525.TSE | Tokyo Stock Exchange | 722.16 | 27.72 | 10/25/2023 | Semiconductor Materials and Equipment |

| Rakuten Bank | 5838.TSE | Tokyo Stock Exchange | 620.31 | 37.86 | 04/21/2023 | Diversified Banks |

| TRYT | 9164.TSE | Tokyo Stock Exchange | 381.38 | (27.0) | 07/20/2023 | Human Resource and Employment Services |

| SBI Sumishin Net Bank | 7163.TSE | Tokyo Stock Exchange | 375.45 | 0.417 | 03/29/2023 | Diversified Banks |

| Ecopro Materials | A450080.KO | Korea Stock Exchange | 321.32 | 58.01 | 11/14/2023 | Electrical Components and Equipment |

Kokusai Electric, a chip equipment maker owned by U.S. private equity firm KKR, successfully raised $722 million in Japan’s largest initial public offering (IPO) in five years. The company set its IPO price at 1,840 yen per share, pricing its shares at the upper end of the marketed range. This pricing strategy resulted in a valuation of Kokusai at 423.9 billion yen (approximately $2.8 billion), with the foreign investor segment of the IPO attracting overwhelming demand, being oversubscribed by more than ten times. The listing of Kokusai Electric comes at a time of intense debate regarding the demand strength in the chip industry, characterised by growing enthusiasm for artificial intelligence yet tempered by a slowdown in the broader electronics market, including smartphones and personal computers.

Similarly, Rakuten Bank, the banking arm of the Japanese e-commerce behemoth Rakuten Group Inc (4755.TSE), achieved a successful IPO. The bank priced its shares at 1,400 yen each, the top of its initially proposed range of 1,300 yen to 1,400 yen. This pricing placed the value of the offering at roughly 83.3 billion yen ($620 million) and the bank’s overall valuation at around 238 billion yen ($1.8 billion). This offering provided a substantial cash injection for its parent company, which has been navigating financial challenges stemming from the extensive expansion of its mobile phone business.

These IPO trends mirror global economic and supply chain shifts, impacting various industries differently.

Over 77% of IPOs in JAKOTA markets in 2023 yielded positive returns on their first trading day.

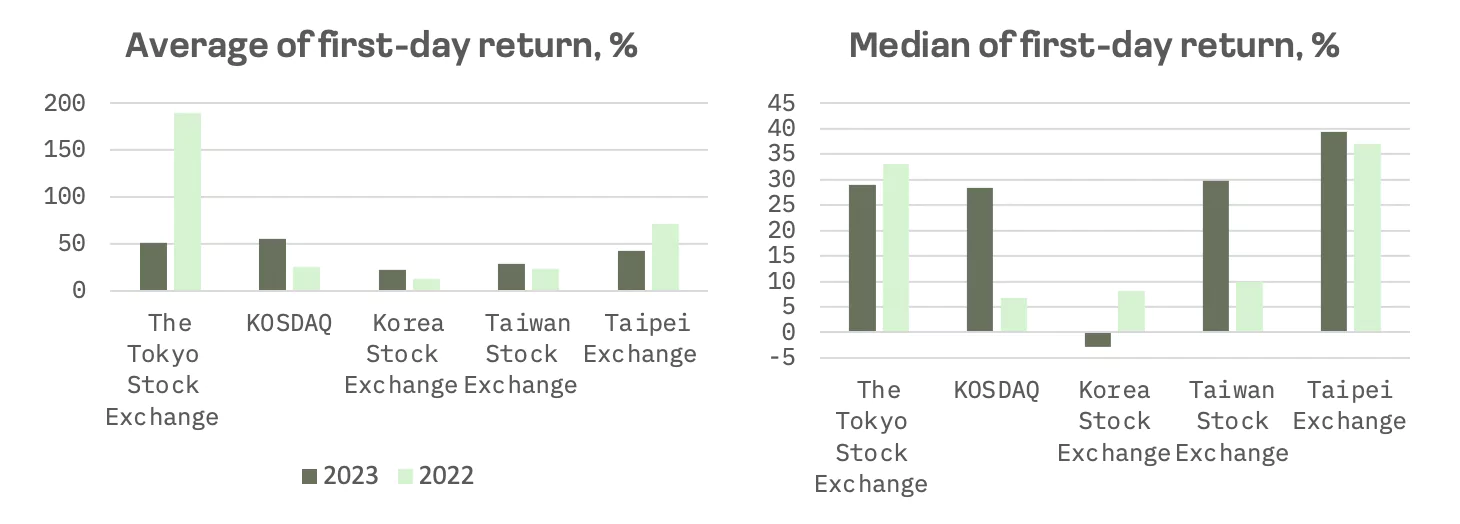

However, the Tokyo Stock Exchange saw a decline in both average and median first-day returns for IPOs, while KOSDAQ and the Taiwan Stock Exchange exhibited significant growth in these metrics. This underscores the continued importance of solid fundamentals in determining the success of IPOs in an evolving market landscape.