Last week’s Jakota markets:

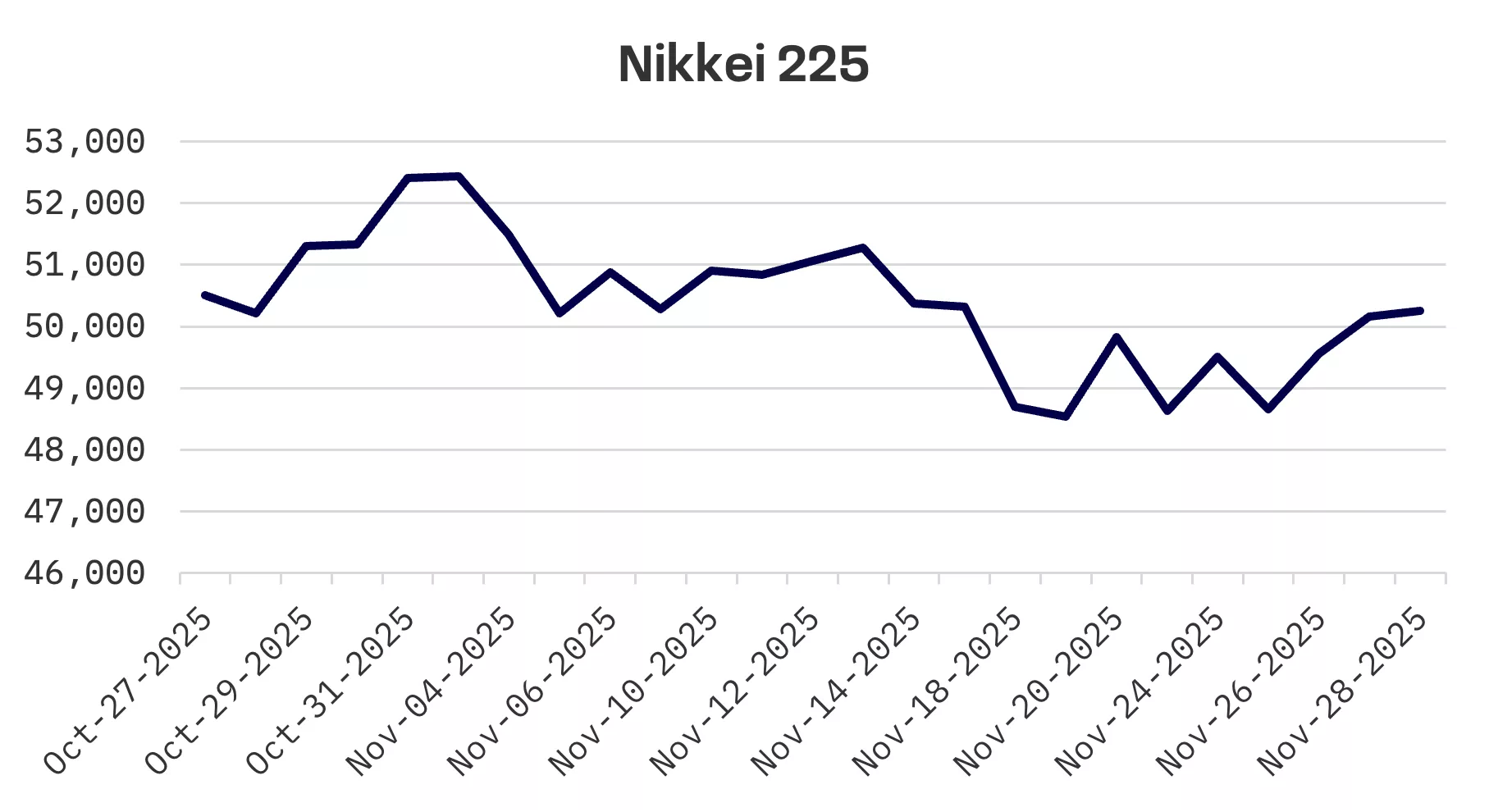

- Japan’s Nikkei 225 climbed 3.4% as dovish Fed commentary fuelled rate cut expectations and yields on 10 year government bonds approached 17 year highs amid speculation the BoJ could tighten policy as early as next month

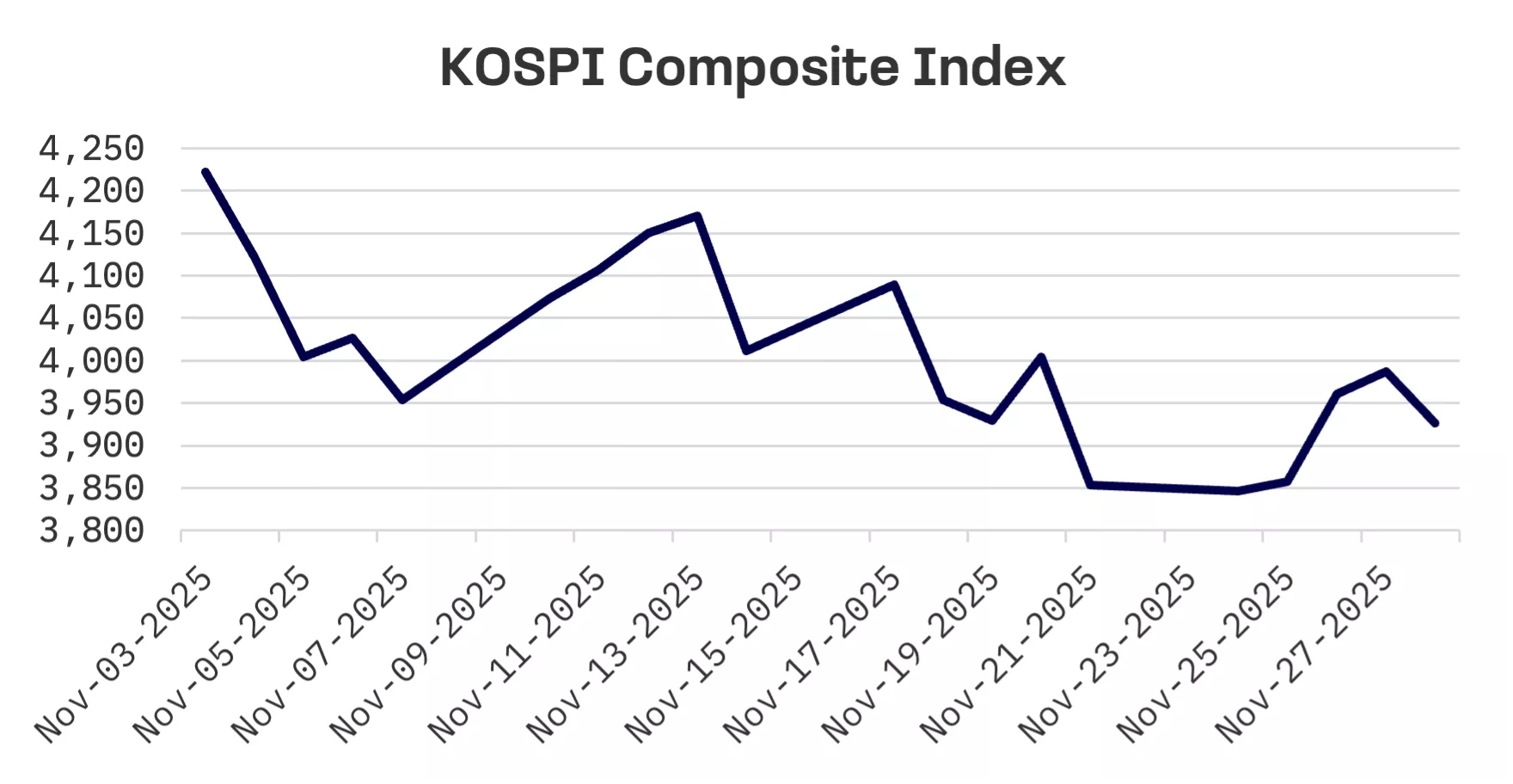

- South Korea’s KOSPI gained 1.9% on optimism over potential U.S. monetary easing, though the BOK kept rates unchanged at 2.5% and lifted its 2025 inflation forecast to 2.1% from 2%

- Taiwan’s TAIEX soared 4.5%, leading the Jakota markets, driven by semiconductor stock demand and a sharply upgraded 2025 growth projection of 7.37%, up from 4.45% three months earlier

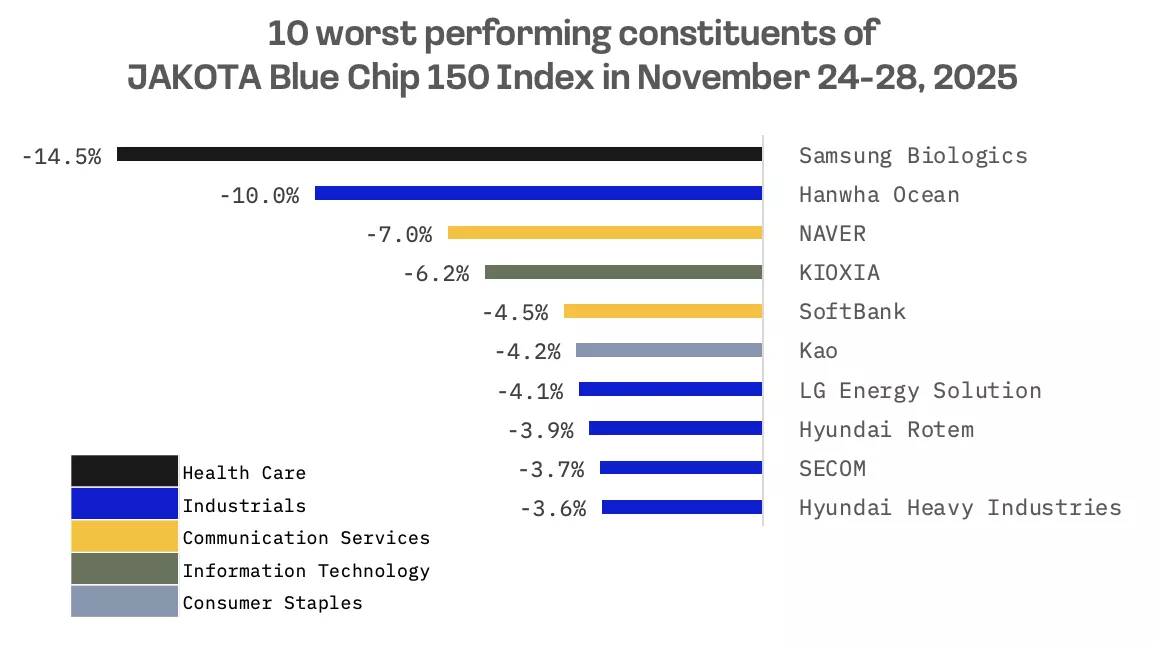

- The JAKOTA Blue Chip 150 Index advanced 2.8%, with MediaTek jumping 22% on reports of AI chip work with Google and Samsung Biologics tumbling 14.5% after relisting following its corporate restructuring

Japan

Japan’s stock market rallied this week, with the Nikkei 225 climbing 3.4% as softer U.S. economic data and dovish commentary from Federal Reserve officials stoked expectations for additional U.S. interest rate cuts. Japanese tech and AI stocks rebounded, tracking gains in U.S. peers after a steep selloff the prior week.

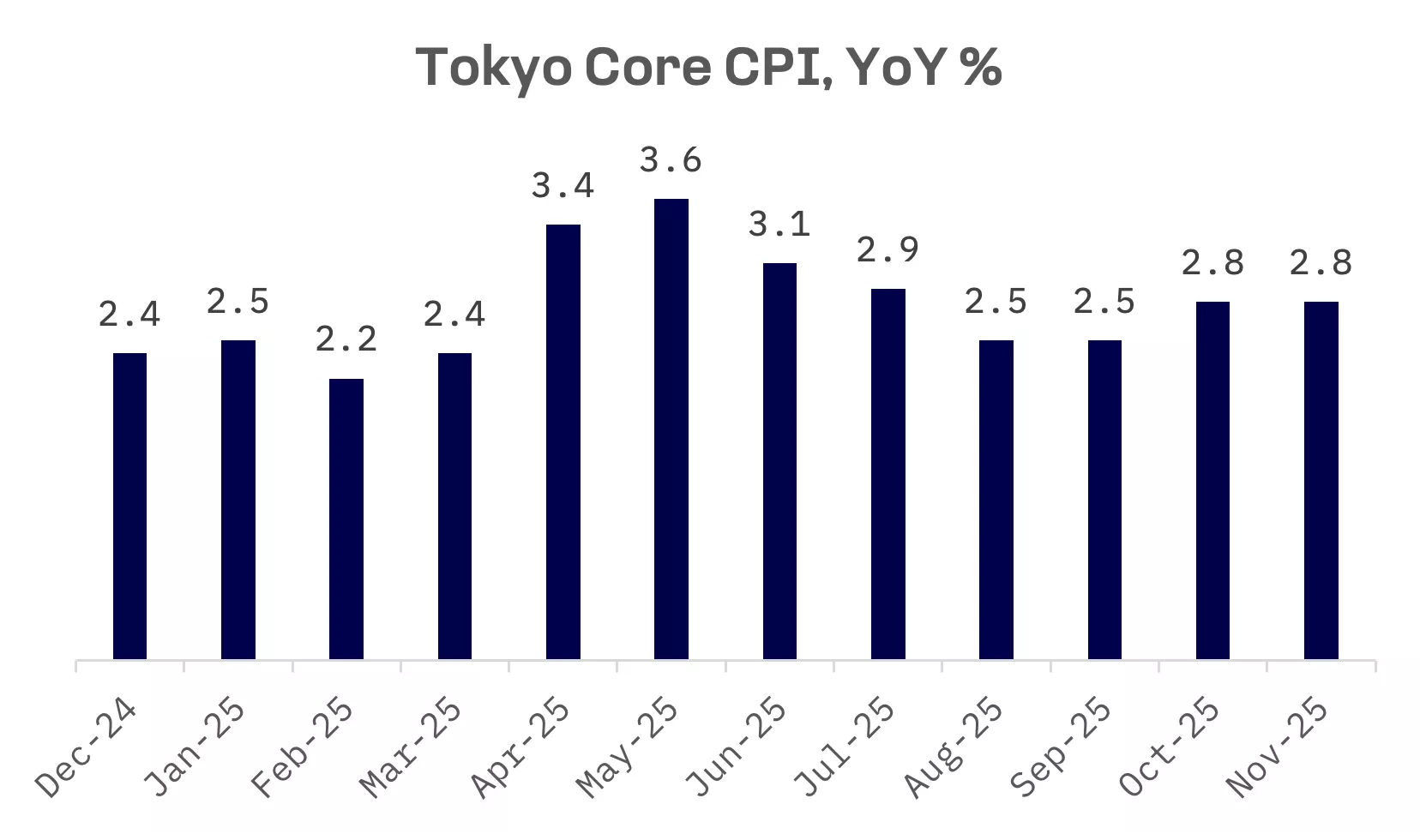

The yield on the 10 year Japanese government bond climbed to 1.82%, approaching new 17 year highs. The rise came as inflation data and improving economic indicators reinforced expectations that the Bank of Japan (BoJ) could tighten monetary policy. Speculation has intensified that policy makers could raise rates as early as next month, with persistent inflation, a still weak yen and waning political pressure to preserve ultra loose policy all contributing to the shift in market sentiment.

Tokyo’s core inflation held steady in November at about 2.8% from a year earlier, remaining above the BoJ’s 2% target and reinforcing expectations that policy makers could move towards a rate increase in coming months.

Stronger than expected October data on industrial production, retail sales and the labour market boosted optimism about the economy’s underlying strength. The data bolstered confidence that Japan is moving towards a more sustainable inflation environment.

South Korea

South Korea’s stock market rose this week, with the KOSPI adding 1.9%, buoyed by optimism over a potential U.S. rate cut.

The country’s central bank left its benchmark rate unchanged at 2.5%, with the Monetary Policy Board judging it “appropriate” to keep policy steady amid mixed signals on the outlook. Officials said inflation has “risen somewhat” and economic activity “continues to improve,” but flagged lingering uncertainty around growth and risks to financial stability.

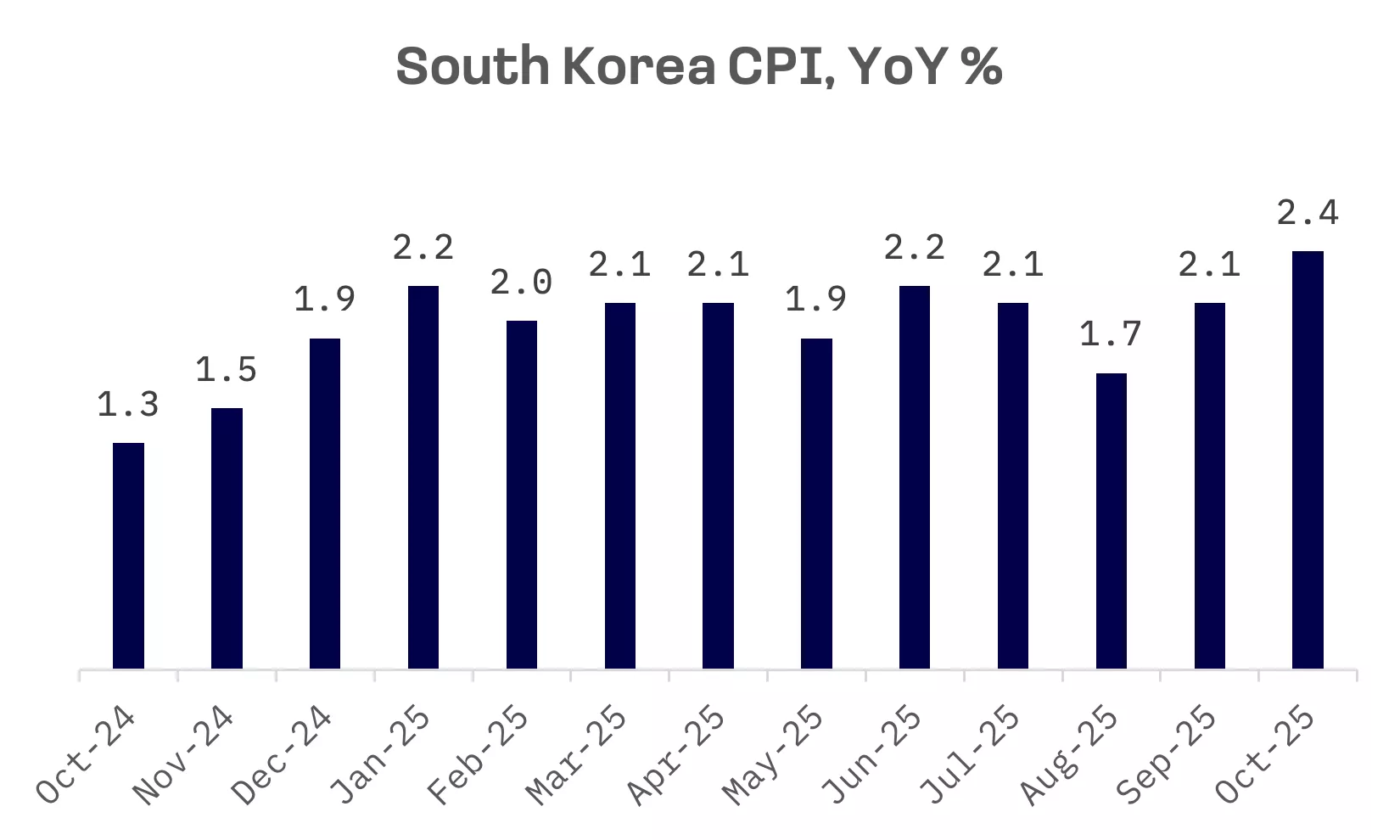

Headline consumer inflation rose to 2.4% in October, while core inflation climbed to 2.2% on higher prices for travel services, food and petroleum products.

The Bank of Korea (BOK) now expects consumer price inflation to average 2.1% this year, up from a 2% forecast in August, while maintaining a 1.9% projection for core inflation. For 2026, officials project headline and core inflation at 2.1% and 2%, respectively, compared with earlier forecasts of 1.9%.

Taiwan

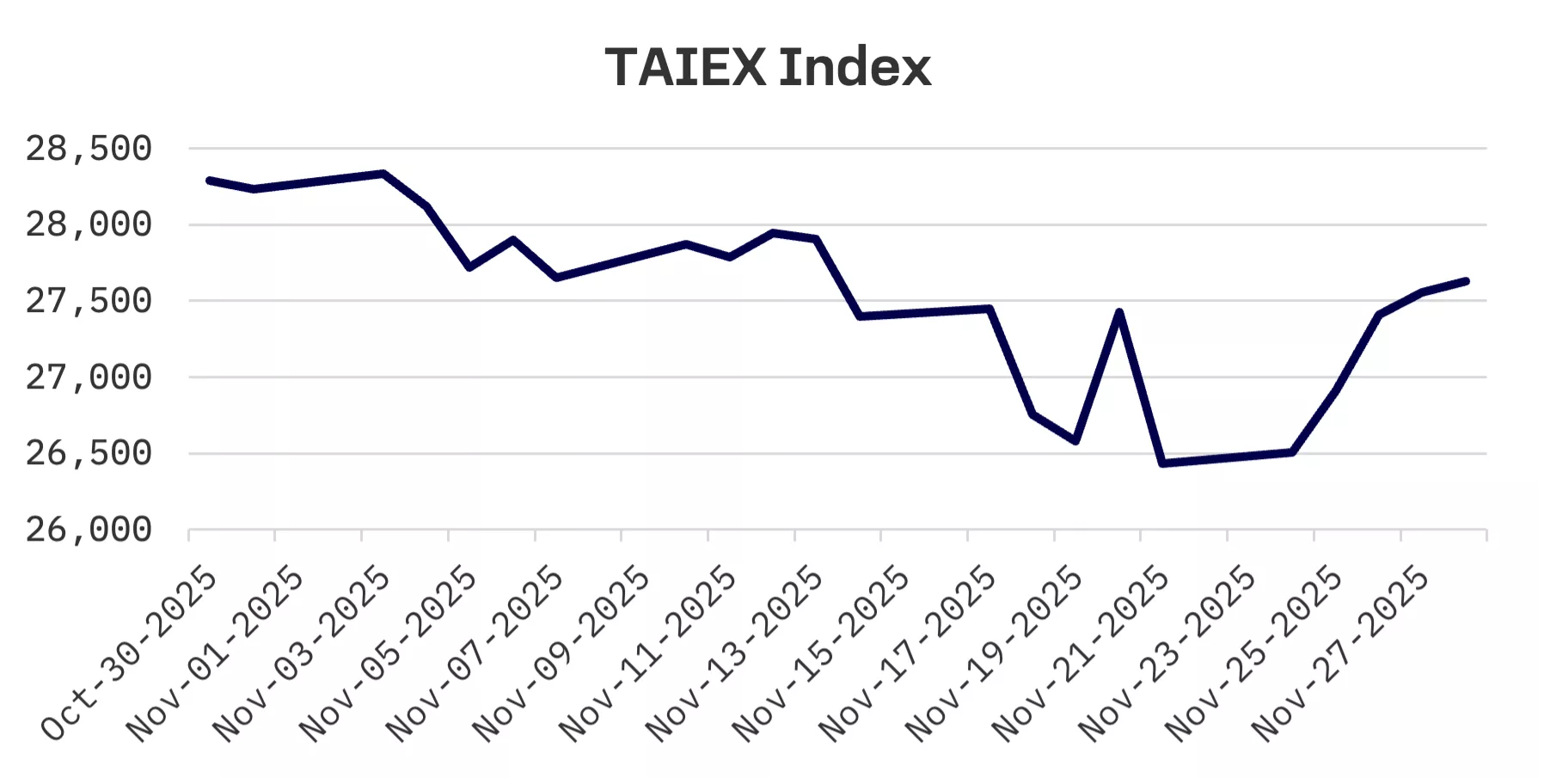

Taiwan’s stock market surged this week, with the TAIEX soaring 4.5% as growing expectations for a Federal Reserve rate cut in December drove strong demand for semiconductor stocks.

Surging demand for AI is driving gains in exports and investment, prompting Taiwan’s statistics agency to sharply raise its 2025 growth outlook. The Directorate General of Budget, Accounting and Statistics (DGBAS) now projects 7.37% growth for 2025, up sharply from a 4.45% forecast in August.

JAKOTA Blue Chip 150 Index

The JAKOTA Blue Chip 150 Index rose 2.8% this week, with 109 of its 150 constituents posting gains.

MediaTek, a Taiwanese fabless semiconductor company, was the top performer on the index this week, with shares surging around 22% amid renewed investor enthusiasm following reports that it is collaborating with Google on AI chips (tensor processing units). Google’s recent advances in AI have raised expectations that MediaTek could evolve into a major supplier of AI hardware rather than remaining primarily a smartphone chip maker.

Samsung Biologics, the world’s largest contract development and manufacturing organisation (CDMO), led declines on the index, falling 14.5% this week after its shares were relisted on November 25 following a corporate spinoff.

The restructuring divided the group’s operations into two units: Samsung Biologics, now a pure play CDMO, and Samsung Epis Holdings, which houses the biosimilar and new drug businesses. The move separates the business lines and provides investors with clearer visibility into the CDMO unit’s profitability and growth outlook, a shift analysts say should support higher valuations over time.