Last week’s Jakota markets:

- Japan’s Nikkei 225 Index rose to an all-time high of over 42,000 but reversed sharply on Friday due to yen intervention speculations

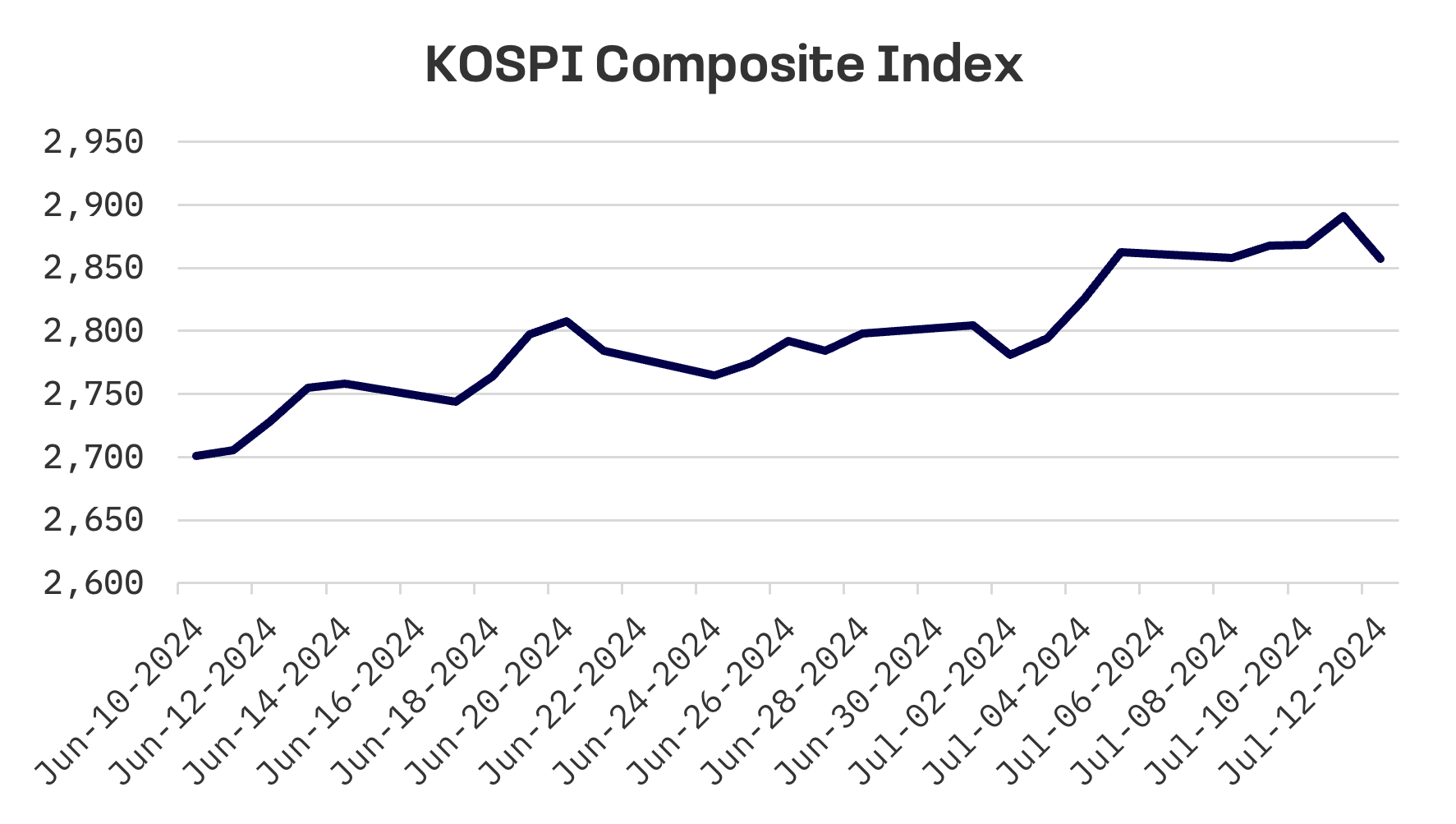

- South Korea’s KOSPI slightly declined by 0.2% as positive economic indicators were offset by profit-taking and cautious investor sentiment

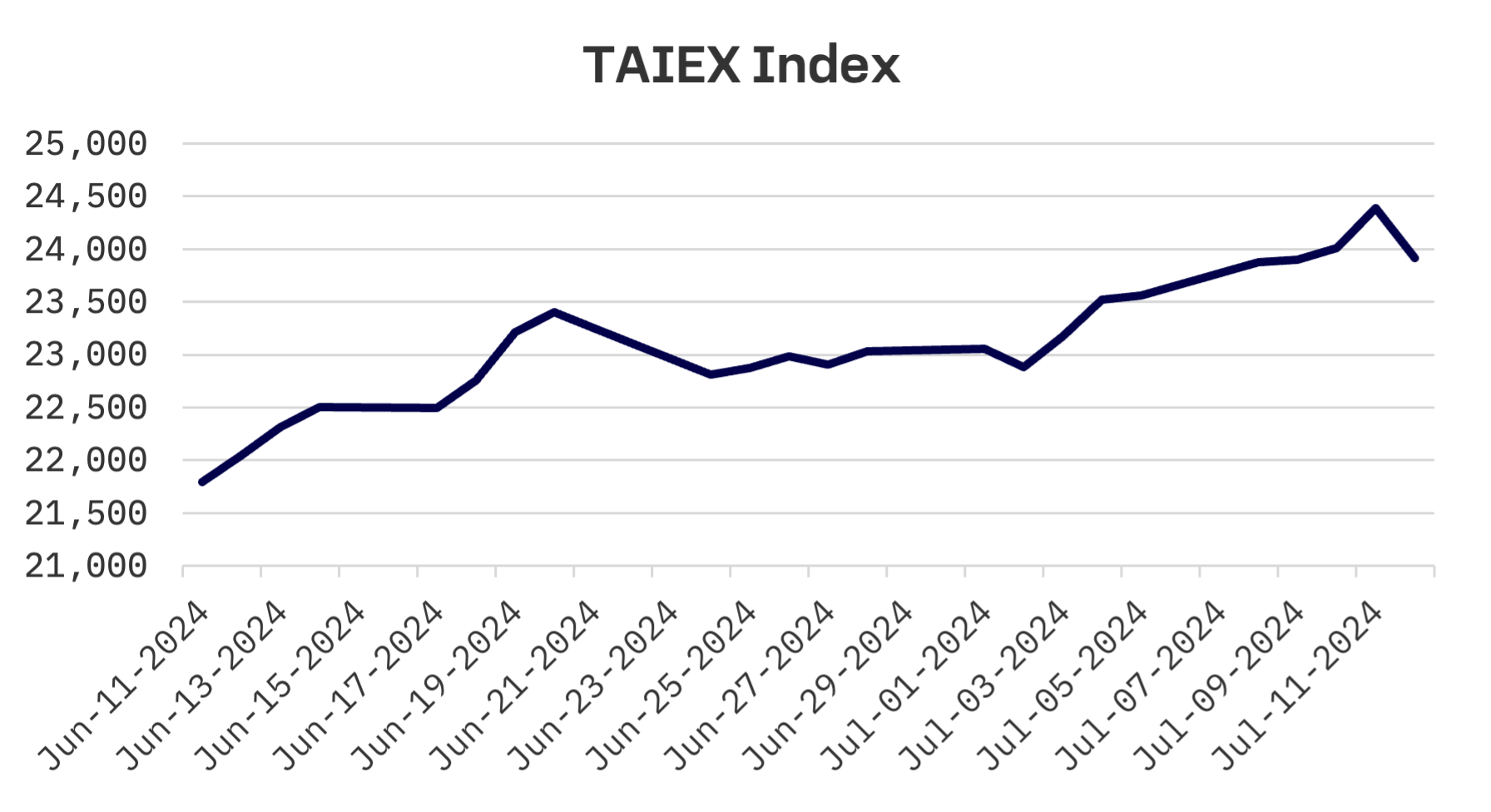

- Taiwan’s TAIEX index led the regional gains with a 1.5% increase, propelled by robust performances in semiconductors and a surge in exports

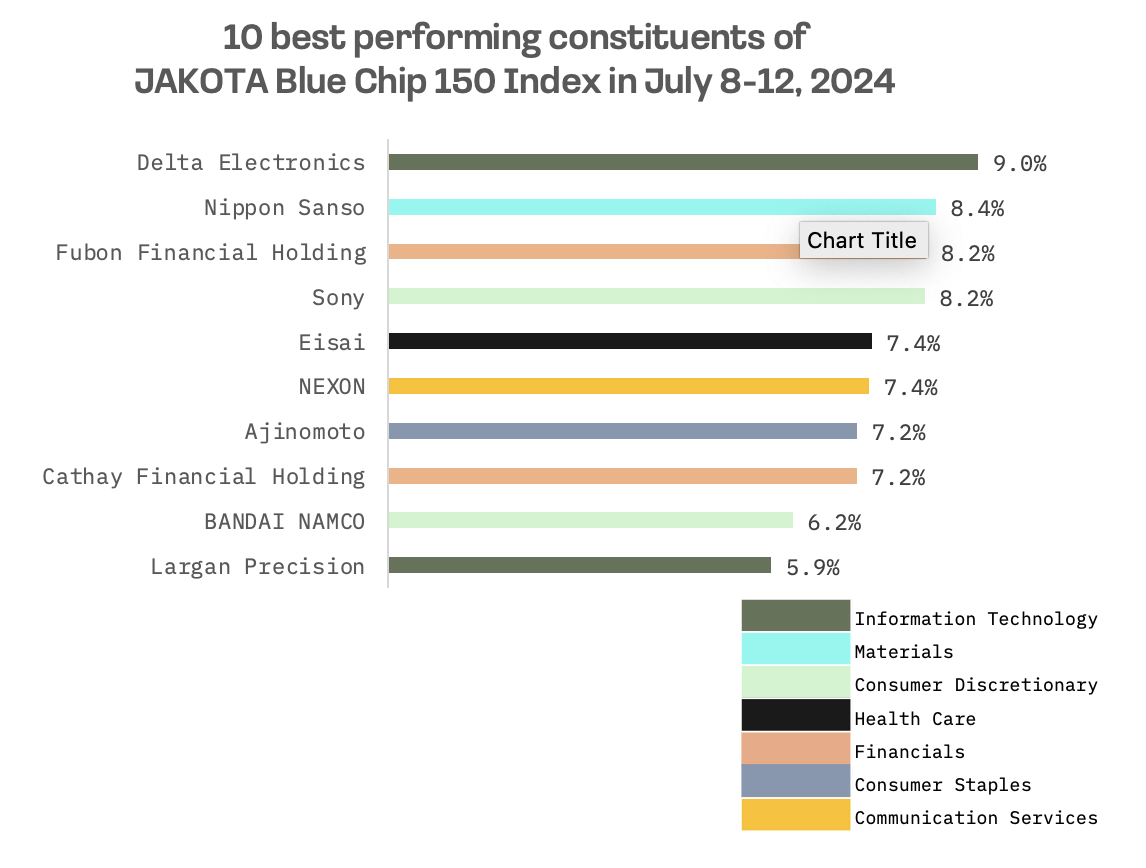

- The JAKOTA Blue Chip 150 Index increased by 1.0%, with significant gains led by Delta Electronics amid strong AI and EV market themes

Japan

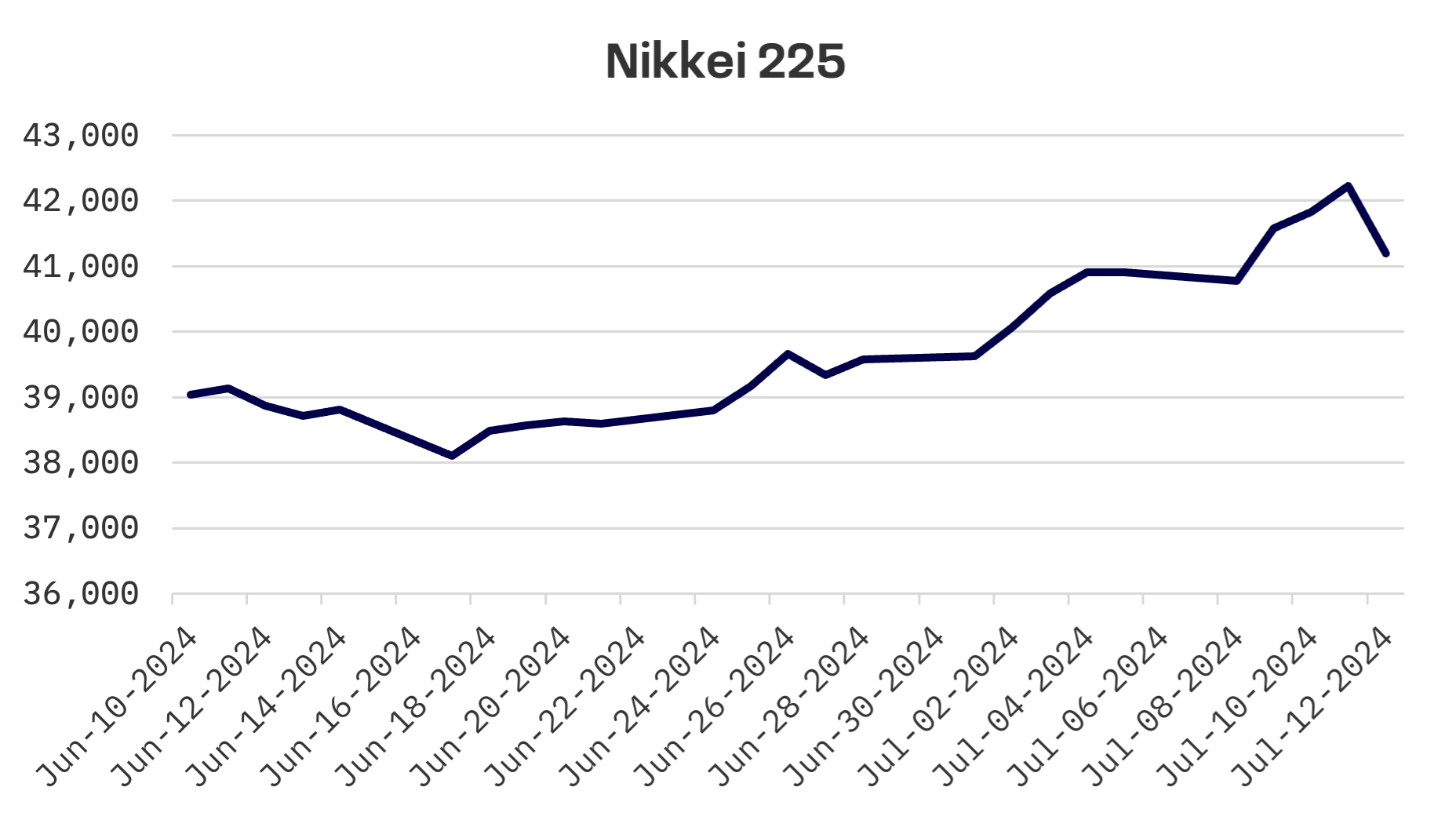

Japan’s Nikkei 225 Index extended its gains this week, rising 0.7% and hitting an all-time high above 42,000 on Thursday. However, the market reversed course sharply on Friday amid speculation of possible currency intervention to prop up the yen.

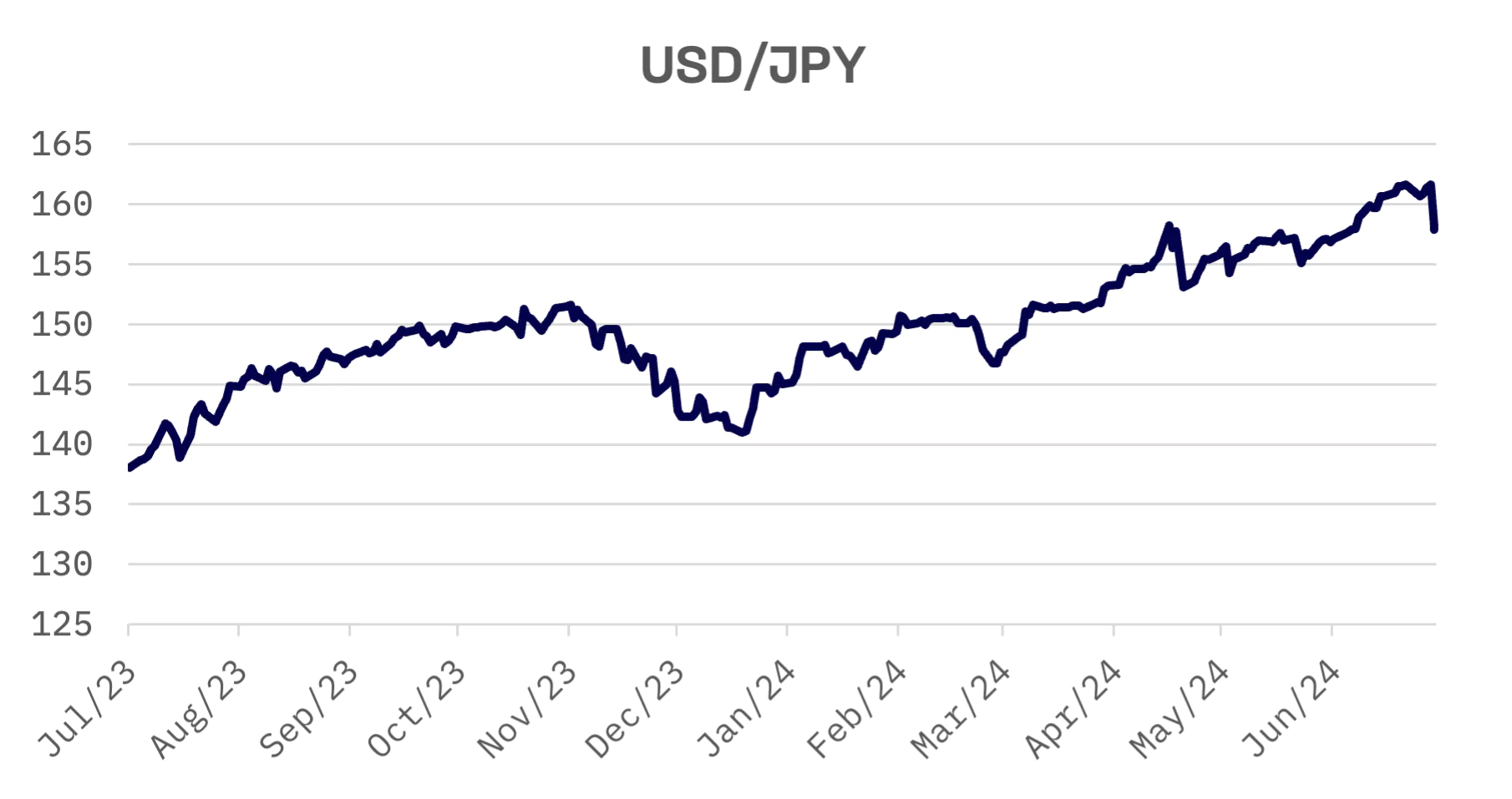

The yen’s surge against the dollar sparked the intervention rumors, which intensified after a Nikkei report that the Bank of Japan had conducted rate checks on euro-yen trades. A stronger yen typically pressures profits for Japan’s exporters and makes Japanese assets less attractive to foreign investors.

Masato Kanda, vice minister for international affairs, refrained from commenting on potential interventions, noting only that recent movements were misaligned with fundamentals. Chief Cabinet Secretary Yoshimasa Hayashi stated that authorities were prepared to take all necessary measures regarding exchange rates.

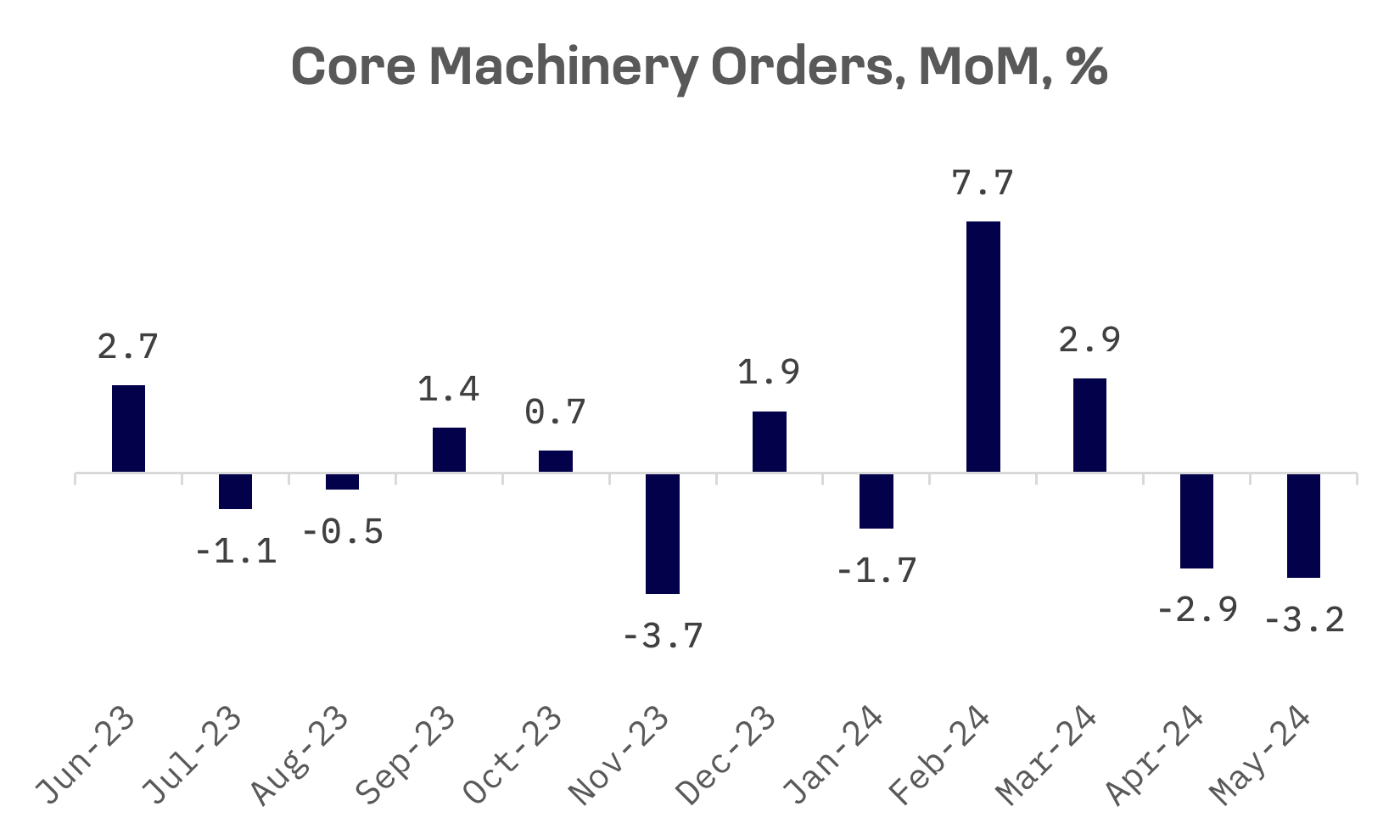

Japan’s core machinery orders, a leading indicator of capital spending over the next six to nine months, unexpectedly fell for a second straight month in May. Orders dropped 3.2% to ¥857.8 billion, following April’s 2.9% decline, primarily due to weakness in the non-manufacturing sector.

In contrast, May’s industrial production growth was revised up to 3.6% from an initial 2.8% estimate. The uptick was driven by strong rebounds in output across several sectors, including motor vehicles, electrical machinery, information and communication electronics equipment, and general-purpose and business-oriented machinery.

South Korea

South Korea’s KOSPI Composite Index edged down 0.2% this week, snapping a five-week winning streak. The market showed low volatility, with small gains most days before profit-taking on Friday. Positive drivers included the Bank of Korea holding its key rate steady and Federal Reserve Chairman Jerome Powell’s hint that rate cuts might come before inflation reaches 2%.

Bank of Korea (BOK) Governor Rhee Chang-young signalled on Thursday that the central bank is preparing for a potential interest rate cut, with consumer prices near the 2% target. However, Rhee cautioned that uncertainties remain about the timing, citing concerns over rising housing prices, growing household debt and the weakening won.

Taiwan

Taiwan’s TAIEX index outperformed other Jakota markets, rising 1.5% this week. The index hit a new high on Thursday, propelled by strong showings from Taiwan Semiconductor Manufacturing Co. (TSMC) and Hon Hai Precision Industry. However, the market retreated sharply on Friday, shedding over 470 points as investors locked in profits and reacted to U.S. tech stock losses.

Taiwan’s exports surged in June, according to Ministry of Finance data. Shipments totaled $39.90 billion, up 23.5% year-on-year, marking the eighth consecutive monthly increase and the strongest growth since February 2022. The surge was driven by robust global demand for emerging technologies, particularly AI applications.

TSMC reported record-high Q2 revenue of NT$673.51 billion ($20.6 billion), exceeding expectations. The chipmaker cited strong demand in the high-performance computing market for its 3-nanometer and 5-nanometer advanced process technologies.

JAKOTA Blue Chip 150 Index

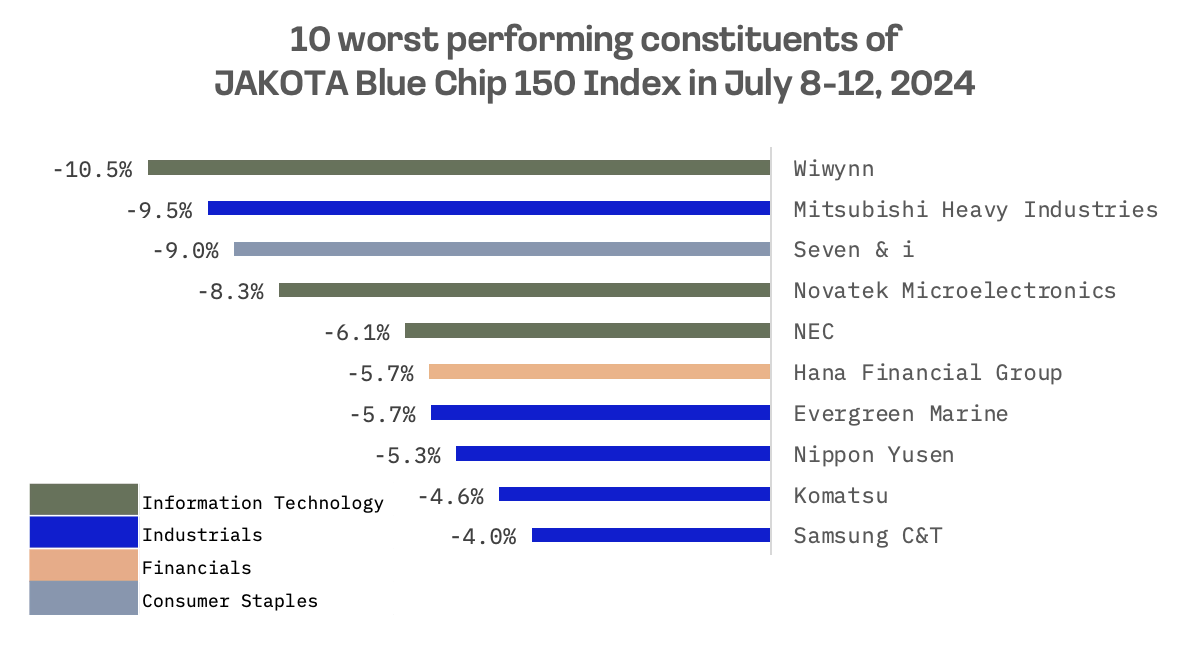

The JAKOTA Blue Chip 150 Index added 1.0% this week, with 78 of 150 constituents posting gains.

Delta Electronics, a Taiwanese electronics company and manufacturer of power and thermal management solutions, led gains with a 9.0% increase, benefiting from AI and electric vehicle themes.

Wiwynn, a major Taiwanese server OEM, led decliners in the JAKOTA Blue Chip 150 Index despite reporting June revenue at a 15-month high, up 24% from May. The stock plunged after Wiwynn announced completion of pricing for global depositary receipts (GDRs) and overseas unsecured bonds. The offerings raised NT$46.75 billion but diluted existing shareholder equity by about 9.27%. Adding to the pressure, Morgan Stanley lowered its EPS forecasts for Wiwynn, citing the expanded equity capital.